Professional Documents

Culture Documents

Cash F Practise Ch13

Cash F Practise Ch13

Uploaded by

masroor umair0 ratings0% found this document useful (0 votes)

7 views7 pagesCash

Original Title

Cash f Practise Ch13

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views7 pagesCash F Practise Ch13

Cash F Practise Ch13

Uploaded by

masroor umairCash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

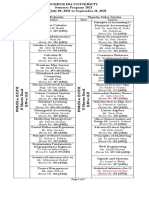

Chapter 13 Statement of Cash Flows

C

ws BRIEF

EXERCISE 13.1

Gash Flows from

Operations (Direct),

7 BRIEF

EXERCISE 13.2

Cash Flows from

Operations (Indirect)

us BRIEF

EXERCISE 13.3

Gash Flows trom

Operations (Direct)

7 BRIEF

EXERCISE 13.4

Cash Flows from

Operations (Indirect)

ls BRIEF

EXERCISE 13.5

Cash Flows from

Investing

ls BRIEF

EXERCISE 13.6

Gash Flows trom

Financing Activities

ls BRIEF

EXERCISE 13.7

Cash Payment for

Merchandise

Brief Exercises ® connec

‘Olympic, Inc, had the following positive and negative cash flows during the current year:

Positive cash flows:

Received from customers... 240,000,

Interest and dividends 50,000

Sale of plant assets 330,000

Negative cash flows:

Paid to suppliers and omployees ........cscsseseeesevsvsesesseeseveee $127,000

Purchase of investments 45,000

Purchase of treasury SIOSK eee eee vevseeeetetseseseseeeseeses 96,000

Determine the amount of cash provided by or used for operating activities by the direct method

Garagiola Company had net income inthe current year of $430,000. Depreciation expense for the

year totaled $67,000. During the year the company experienced an increase in accounts receivable

{all from sales to customers) of $35,000 and an inerease in accounts payable (all to suppliers) of

'$56,000, Compute the amount of cash provided by or used for operating activities hy the indirect

‘method.

Georgia Products Co. had the following positive cash flows during the current year: received cash

from customers of $750,000; received bank loans of $35,000; and received cash from the sale of

common stock of $145,000. During the same year, cash was paid out to purchase inventory for

'$335,000, co employees for $230,000, and for the purchase of plant assets of $190,000, Calculate

the amount of cash provided by or used for operating activities by the direct method,

Patterson Company reported net income for the current year of $666,000. During the year the

company’s accounts receivable increased by $50,000, inventory decreased by $23,000, accounts

payable decreased by $55,000, and accrued expenses payable increased by $14,000. Determine the

amount of cash provided by or used for operating activities by the indirect method,

(Old Alabama Company purchased investments for $45,000 and plant assets for $127,000 dur

ing the current year, during which it also sold plant assets for $66,000, at a gain of $6,000. The

company also purchased treasury stock for $78,000 and sold a new issue of common stock for

'$523,000, Determine the amount of cash provided by or used for investing activites for the year

‘Texas, Inc., sold common stock for $560,000 and preferred stock for $36,000 during the cur-

rent year. In addition, the company purchased treasury stock for $35,000 and paid dividends on

common and preferred stock for $24,000, Determine the amount of cash provided by or used for

financing activities dusing the yea

Dane, Inc. reported cost of goods sold of $100,100 during the current year. Following are the

‘beginning and ending balances of merchandise inventory and accounts payable forthe year:

Beginning Ending

Merchandise inventory... Coccsssssrerisessersss $85,000 $43,000

Accounts payable. . . ce 23,000 30,000

Determine the amount of cash payments for purchases dusing the yeas

Exercises

(2 BRIEF

EXERCISE 13.8

Determining Beginning

Cash Balance

(08 BRIEF

EXERCISE 13.9

Reconciling Net

Income to Cash trom

Operations.

2 BRIEF

EXERCISE 13.10

Preparing Statement

of Cash Flows

597

‘Tyler, Inc’s cash balance at Devember 31, 2011, the end of its financial reporting year, was

$155,000. During 2011, cash provided by operations was $145,000, cash used in investing activi

ties was $67,000, and cash provided by financing activities was $10,000. Calculate the amount of

‘Tyler's beginning cash balance at January 1, 2011

Zephre Company reported net income forthe year of $56,000. Depreciation expense forthe year

‘was $12,000, During the year, accounts receivable increased by $4,000, inventory decreased by

'$6,000, accounts payable increased by $3,000, and accrued expenses payable decreased by $2,000.

Reconcile the amount of net income (o the amount of cash provided by or used for operating

activites.

‘Watson, Inc. had a cash balance at the beginning of the year of $89,000. During the year, the

following cash flows occurted

From operating activites $136,000

From investing activities... cevecteeeee (66,000)

From financing activities (4,000)

Prepare an abbreviated statement of cash flows, including a reconciliation of the beginning and

ending cash balances for the yeas,

C

toy EXERCISE 13.1

Using a Statement

of Cash lows

Wl EXERCISE 13.2

Using a Statement

ton of Cash Flows

Exercises connect’

Wallace Company's statement of cash flows for the current year is summarized as follows:

‘Cash provided by operating activi cos eeeetesseseeeeseeeeses $200,000

‘Cash used in investing activities (120,000)

‘Cash provided by financing activities

Inrease in cash during the year

Cash balance, beginning ofthe year .

Cash balance, end of the year

‘a. Briefly explain whet is inchuded in each of the first three categories listed (ie. the cash from

‘operating, investing, and financing activities categories).

. On the basis ofthe limited information presented above. describe the company’s change in

ceash position during the year and your interpretation of the strength ofthe company’s current

(end-of-year) cash position,

Auto Supply Company's 2011 statement of cash flows appears in Exhibit 13-8. Study the state-

‘ment and respond to the Following questions:

‘a. What was the company’s free cash flow in 20117

1b. What were the major sources and uses of cash from financing activities during 2011? Did the

net effect of financing activities result in an increase or a decrease in cash during the year?

What happened to the total amount of cash and cash equivalents during the year? Assuming

2011 was a typical year, is the firm in a position to continue its dividend payments in the

future? Explain

(0 EXERCISE 13.3,

‘Computing Cash

Flows

ls EXERCISE 13.4

Comparing Net Sales

tog and Cash Reocints

U3 EXERCISE 13.5

Computing Cash

Paid tor Purchases.

of Merchandise

\03 EXERCISE 12.6

Reporting Lending

tog Activities and Interest

Revenue

\2 EXERCISE 13.7

Format of a Statoment

of Gash Flows

Chapter 13 Statement of Cash Flows

4. Look at the reconciliation of net income to net cash provided by operating activities, and

explain the following:

1. Net Joss (gain) from the sale of marketable securities,

2, Increase in accounts reveivable,

‘An analysis of the Masketable Securities control account of Prosper Products, Inc, shows the

following entries during the year:

Balance, Jan. too. .ce es ceceecseeesessseeessesesessssseseseeesssess $280,000

Debit entries........ . . seseees 128,000

Crodit ontios (140,000)

Balance, Dec. 31 $275,000,

In addition, the company's income statement includes 2 $35,000 loss on sales of marketable

securities. None of the company’s masketable securities is considered a cash equivalent,

‘Compute the amounts that should appear in the statement of cash flows as:

a, Purchases of marketable securities

1b. Proceeds from sales of marketable securities.

During the current year, Tachnic, Inc., made cash sales of $285,000 and credit sales of $460,000.

During the year, accounts receivable decreased by $32,000,

‘4. Compute for the current year the amounts o:

A, Net sales reported as revenue in the income statement.

2. Cash received from collecting accounts receivable,

3. Cash received from customers.

1D. Write a brief statement explaining why cash received from customers differs from the amount

of net sales,

‘The general ledger of MPX, Inc., provides the following information relating to purchases of

merchandise:

Endof Beginning

Year of Year

'$820,000 $780,000

430,000 500,000

inventory coe

‘Accounts payable to merchandise suppliers

‘The company’s cost of goods sold during the year was 2,975,000. Compute the amount of cash

payments made during the year to suppliers of merchandise.

During the current year, Maine Savings and Loan Association made new loans of $15 millon. In

addition, the company collected $36 million from borrowers, of which $30 million was interest

revenve. Explain how these cash flows will appear inthe company’s statement of cash flows, indi-

cating the classification and the dollar amount of each cash flow.

‘The accounting staff of Wyoming Outfitters, Inc, has assembled the following information for the

year ended December 31, 2011

Exercises

(08 EXERCISE 13.8

Effects of Business

Strategies

WS EXERCISE 13.9

An Analysis of

tay Possoi Reconcling

‘Cash and cash equivalents, Jan. tee... cece eeeeeeceteseseceeeeseees $95,800

‘Cash and cash equivalents, Dec. 31 74,800

‘Cash paid to acquire plant assets 21,000

Proceeds trom shorterm borrowing 10,000

Loans made to borrowers o 5,000

Collections on loans (excluding interest) 4,000

Interest and dividends received . 27,000

‘Cash received from customers. 795,000

Proceeds from sales of plant assets «2.2... .6seeeeeeseseeesceeseesesses 8,000

Dividends paid 155,000

‘Cash paid to suppliers and employees 35,000

Interest paid : ses 19,000

Income taxes paid 71,000

Using this information, prepare a statement of cash flows. Include a proper heading for the finan-

cial statement, and classify the given information into the categories of operating activites, nvest-

ing activities, and financing activities, Determine net cash flows from operating activities by the

direct method. Place brackets around the dollar amounts ofall cash disbursements.

Indicate how you would expect the following strategies to affect the company’s net cash flows

from operating activities (1) in the near future and (2) in later periods (after the strategy’s long-

term effects have “taken hold”), Fully explain your reasoning,

‘a, A successful pharmaceutical company substantially reduces its expenditures for research and

development

1. A restaurant that previously sold only for cash adopts a policy of accepting bank credit cards,

‘such as Visa and MasterCard.

© A manufacturing company reduces by $0 percent the size ofits inventories of raw materials

(assume no change in inventory storage costs)

Through tax planning, a rapidly growing real estate developer is able to defer significant

amounts of income taxes.

fe. Arapidly growing software company announces that it will stop paying cash dividends for the

Toreseeable future and will instead distribute stock dividends,

‘An analysis ofthe annual financial statements of Conner Corporation reveals the following:

‘a, ‘The company had a $5 million extraordinary loss from insurance proceeds received duc to a

tornado that destroyed a factory building,

Depreciation forthe year amounted to $8 million.

uring the year, $2 million in cash was transferred from the company’s checking account into

‘a money market fund,

Accounts receivable from customers increased by $4 million over the year

‘Cash received from customers during the year amounted to $167 million,

Prepaid expenses decreased by $1 million aver the year.

Dividends declared during the year amounted to $7 million; dividends paid during the year

amounted co $6 million,

‘Accounts payable (to suppliers of merchandise) increased by $2.5 million during the year.

4, The liability for accrued income taxes payable amounted to $5 million atthe beginning of the

year and $3 million at year-end,

In the computation of net cash flows from operating activities by the indirect method, explain

whether each of the above items should be added to net income, deducted from net income, of

‘omitted from the computation. Briefly explain your reasons for each answer.

\07 EXERCISE 13.10

‘Computation of Net

Cash Flows trom

Operating Actvitios—

Indirest Metnod

(2 EXERCISE 13.11

Glassitying Cash

Flows

(2 EXERCISE 13.12

Glassitying Cash

Flows

Chapter 13 Statement of Cash Flows

‘The following data ae taken from the income statement and balance sheet of Keaner Machinery, In.

Dec.31, Jan. 1,

2011 2011

income statement

Net income .. $985,000,

Depreciation Expense . 125,000

‘Amortization of Intangible Assets 40,000

Gain on Sale of Plant Assets . 190,000

Loss on Salo of Investments 35,000

nce sheet:

‘Accounts Receivable. $835,000 $380,000

Inventory 503,000 575,000,

Prepaid Expenses. . . . 22,000 10,000,

‘Accounts Payable (to merchandise suppliers) 379,000 410,000

‘Accrued Expenses Payable .. 180,000 185,000

Using this information, prepare a partial statement of cash flows for the year ended December 31,

2011, showing the computation of net cash flows from aperating activities by the indirect method,

Among the transactions of Beeler, Ine., were the following:

‘a, Made payments on accounts payable to merchandise suppliers

Paid the principal amount of a note payable to Fist Bank

PPaid interest charges relating to a note payable to First Bank,

Issued bonds payable for cash; management plans to use this cash in the near future to expand

‘manufacturing and warehouse capabilities.

Paid salaries to employees inthe finance department,

Collected an account zeceivable from a customer,

‘Transferred cash from the general bank account into a money market fund.

‘Used the cash received in above, to purchase land and a building suitable for a manufactur

ing facility

Made a yearend adjusting entry to recognize depreciation expense

At year-end, purchased for cash an insurance policy covering the next 12 months.

Paid the quarterly dividend on preferred stock.

Paid the semiannual interest on bonds payable.

Received a quarterly dividend from an investment in the preferred stock of another corporation,

Sold for eash an investment in the preferred stock of another corporation,

Received cash upon the maturity of an investment in cash equivalents. (Ignore interest.)

aoe

rune

erg tree

Instructions

‘Most of the preceding cancactions should be included among the activities summarized ina statement

‘of cash flows, For each transaction that should be included in this statement, indicate whether the

transaction should be classified as an operating activity, an investing activity, or a financing activity,

Ifthe transaction should not be included inthe current year’s statement of cash flows, briefly explain

‘why not, (Assume that net cash flows from operating activities ate determined by the direct method.)

‘Among the transactions of Marvel Manufacturing were the following:

1L. Made payments on accounts payable to office suppliers.

2. Paid the principal amount of a mortgage to Seventh Bank.

3. Paid interest charges relating to a mortgage to Seventh Bank.

4

Issued preferred stock for cash; management plans to use this cash in the near future to pur-

chase another company.

Exercises

'S. Paid salaries to employees in the finance department.

6, Collected an account receivable from a customer.

7. Transferred cash from the general bank account into a money market fund,

‘8, Used the cash received in 4, above, to purchase Moran Manufacturing Co,

9. Made a yearend adjusting entry to recognize amortization expense,

10. At year-end, purchased for cash an advertising spot on a local radio station forthe next eight

months,

11. Paid the annual dividend on preferred stock,

12. Paid the semiannual interest on bonds payable

43, Received a semiannual dividend from an investment inthe common stock of another corporation,

4M, Sold for cash an investment inthe common stock of another corporation.

15, Received cash upon the maturity ofan investment in cash equivalents, (Ignore interest.)

Instructions,

‘Most of the preceding transactions should be included among the activities summarized ina statement

‘of cash flows. For each transaction that should be included inthis statement, indicate whether the

‘tansaction should be classified as an operating activity, an investing activity, or a financing activity.

the transaction should not be included inthe current year’s statement of cash flows, briefly explain

‘why not, (Assume that net cash flows from operating activites are determined by the direct method.)

WS EXERCISE 13.13 Wotford Company provides the following information related to its investing and financing activi

Gash Flows trom ties for the current year:

Investing Activities

Cash receipts:

‘Sale of common stock : $250,000,

Sale of equioment (at $34,000 loss) cette 186,000

‘Salo of land (at $50,000 gain 160,000

‘Cash payments:

Purchase of equipment cise $178,000

Purchase of treasury stock cites 45,000

Retirement of debt coccetetetierersetiserensitesererssress 98,600

Dividends on preferred and comman stock 75,000

a. Calculate the net amount of cash provided by or used for investing activities forthe year,

'b, What impact, if any, do the folowing facts have on your calculation? (4) Equipment was sold

ata loss, and (2) land was sold ata gain.

© Briefly explain your decision to exclude any of the items listed above if they were not included

in your calculation in pasta

WS EXERCISE 13.14 Shepherd Industries had the following cash flows by major categories during the current year:

Gash Flows trom

Financing Activities ‘Cash provided by:

Feceipts from customers $560,000

Sale of bonds... 400,000

Salo of treasury stock ........ 34,000,

Interest and dividends received 56,000

Sale of equipment (at a $56,000 loss)... 236,000

Cash used fo

Payments to mployees «....e.cesseresseseevsessserseeveresserseress $135,000

Payments to purchase inventory 180,000

Dividends on common stock... 60,000

Purchase of treasury S10cK vs... sessessssesesvsessevsesissessersesees 20,000

Interest expense - "78,000

602

Wl EXERCISE 13.15,

Home Depot, Inc.

te Using a Statement

‘of Cash Flows

Chapter 13 Statement of Cash Flows

Calculate the net amount of eash provided by or use for financing activites for the yea.

’._Brietly jusity why you excluded any ofthe above items in your calculation in part a

‘© Briefly explain your treatment of interest expense in your calculation in par.

‘Statements of cash flow for Home Depot, Inc., for 2009, 2008, and 2007 are included in Appendix

‘Ao this text,

‘a, Focus on the information for 2009 (year ending January 31, 2010). How does net earnings

‘compare with net cash provided by or used in operations, and what accounts for the primary

sifference between the two amounts?

1b. What are the major uses of cash, other than operations, and how have these varied over the

three-year period presented?

‘Cash flows from both investing and financing activities have been mostly negative for all

tree years presented, Considering Home Depot's overall cash flows, including its cash flows

from operations, would you say that ths leads to a negative interpretation of Home Depot's

‘cash position a January 31, 2010 Why or why not?

4. Calculate the amount of fre cash flow for each of 2007, 2008, and 2009, and comment briefly

‘on your conclusion concerning this information.

luz PROBLEM 13.14

Problem Set A connect,

‘The accounting staff of Harris Company has assembled the following information for the year

Format of a Statement ended December 31, 2011:

woth or Cash Flows.

Lo

(04 PROBLEM 13.20

Reporting Investing

Activities

Cash sales $800,000

Credit sales. cottttetteees oe 2,500,000,

Collections on accounis receivable 2,200,000,

‘Cash transferred from the money market fund to the seer bank

account. cess 250,000

Interest and dividends received... we 100,000

Purchases (all on account) a : sees 1,800,000

Payments on accounts payable to marchandse suppers 1,800,000,

‘Cash payments for operating expenses. 1,050,000,

Interest paid . 180,000

Income taxes paid oes bese 98,000

Loans made to borrowers 500,000

Collections on loans (excluding receipts of intorest) 260,000

Cash paid to acquire plant assets 3,100,000,

Book value of plant assets sold 860,000

Loss on sales of plant assets 180,000

Proceeds trom issuing bonds payable . 2,800,000,

Dividends paid . 120,000

‘Cash and cash equivalents, Jan. 1... 488,000

Instructions.

Prepare a statement of cash flows in the format illustrated in Exhibit 13-1. Place brackets around

amounts representing cash outflows. Use the direct method of reporting cash flows from operating

activities

‘Some of the items above willbe listed in your statement without change, However, you will have

{o combine certain given information to compute the amounts of (1) collections from customers,

(2) cash paid to suppliers and employees, and (3) proceeds from sales of plant assets. (Hint: Nat

every item listed is used in preparing a statement of cash flows.)

‘An analysis of the income statement and the balance shect accounts of Headrick, Inc, at December 31,

201, provides the following information:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hair CaseDocument8 pagesHair Casemasroor umairNo ratings yet

- Module Code: Bso208Sl: Module Title: International Business Title of Paper: Referred ExaminationDocument3 pagesModule Code: Bso208Sl: Module Title: International Business Title of Paper: Referred Examinationmasroor umairNo ratings yet

- Module Code: Bso208Sl: Module Title: International Business Title of Paper: Referred ExaminationDocument3 pagesModule Code: Bso208Sl: Module Title: International Business Title of Paper: Referred Examinationmasroor umairNo ratings yet

- Summer Class Time Table Updated July 11 2021 v4Document3 pagesSummer Class Time Table Updated July 11 2021 v4masroor umairNo ratings yet

- Ogdcl Internship Program 2021Document1 pageOgdcl Internship Program 2021masroor umairNo ratings yet