Professional Documents

Culture Documents

Your Vehicle Details: Additional Cover

Uploaded by

chetanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your Vehicle Details: Additional Cover

Uploaded by

chetanCopyright:

Available Formats

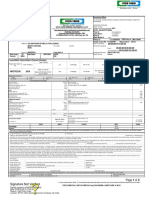

Smart Drive Private Car Insurance Policy

CERTIFICATE OF INSURANCE CUM SCHEDULE

Name of the Policy : Chetan Gopinath Policy No : S7078954

Holder Policy Type : Private Car-Comprehensive Insurance Policy

Communication : Suchetan , No.33, 4th Main, Behind Syndicate Bank, Konena Total Premium : 4558.00

Address Agrahara, Hal , Policy Start Date : 12/02/2019 00:00 hrs

Bangalore Karnataka Policy End Date : 11/02/2020 Midnight

560017 Agent No : 2C000047

Contact No : 9916132305 Agent Name : Coverfox Insurance Broking Pvt Ltd

Email ID : chetang135@gmail.com

Your Vehicle Details

Vehicle Reg.no. : KA03MR6173 Year of Manufacture : 2012 Make / Model : MARUTI/RITZ Fuel Type : Petrol

Insured Declared Value of the : 195671 Seating Capacity(Including Driver) : 5 Chassis / Engine No : 411934 / 034793 Cubic Capacity : 1197

Vehicle(IDV)

Your Premium Details(in Rs)

Own Damage Premium(A)

Vehicle 6744.78 Additional Cover

CNG/LPG (IMT 25) ( NA ) NA Depreciation Cover (100%) NA

Accessory (IMT 24) ( NA ) NA Roadside Assistance Cover NA

Basic Own Damage Premium 6744.78 Consumable Cover NA

No Claim Bonus ( 50%) -674.48 Invoice Price Cover NA

Load / Discount - 5395.82 Key Replacement Cover NA

Engine and GearBox Protection Cover NA

No Claim Bonus Same Slab Cover NA

Total Own Damage Premium 674.48

Liability Premium (B)

Basic TP Premium (Including TPPD) 2863.00

PA to Owner Driver 325.00

Unnamed PA Cover to Passengers (IMT 16) NA

Legal Liability to Paid Driver (IMT 28) NA

Bi-Fuel Kit NA

Total Liability Premium 3188.00

Net Premium (A+B) 3862.48

Goods and Services Tax @ 18% 695.25

Total Premium(In Rs) 4558.00

Limitations as to use: The Policy covers use of the vehicle for any purpose other than: (a) Hire or Reward (b) Carriage of goods (other than samples of personal luggage) (c) Organized

Racing (d) Pace Making (e) Speed Testing (f) Reliability Trial (g) Any purpose in connection with Motor Trade. Driver's Clause: Persons or Classes of person entitled to drive: Any person

including the insured, provided that a person driving holds an effective driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided

also that the person holding an effective Learner's License may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules,

1989. Limits of Liability: Under Section II-1 (i) of the policy (Death of or bodily injury): Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. Under

Section II-1 (ii) of the policy (Damage to Third Party Property) Rs. 7.5 lakhs. Under Section III: P.A cover to owner driver (CSI): 1500000. PA cover to unnamed passenger Rs. 100000.

Deductible under Section-I: Compulsory Deductible IMT 22: Rs. 1000 . Subject to Indian Motor Tariff Endorsement (nos.) IMT22-IMT15

I/We hereby certify that the Policy to which this Certificate relates as well as this Certificate of Insurance are issued in accordance with the provisions of Chapter X and XI of Motor Vehicles

Act, 1988. In witness of this Policy has been signed at _________________ Receipt no. : GSBI4609292063 Service Tax Registration no.:AA290417044859K For Bharti AXA General

Insurance Co. Ltd

Stamp duty paid to the account of The District Registrar of Stamps (Acc Head 0030-02-103-0-01), Bangalore Karnataka.

Important Notice: The insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this schedule. Any payment made by the company by reason of wider terms appearing in

the certificate in order to comply with the Motor Vehicle's Act, 1988 is recoverable from the insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY".The

Schedule, the attached Policy and Endorsements mentioned herein above shall read together and word or expression to which a specific meaning has been attached in any part of this Policy or of the

Schedule shall bear the same meaning wherever it may appear. Any amendments/modifications/alterations made on this system generated policy document is not valid and Company shall not be liable for

any liability whatsoever arising from such changes. Any changes required to be made in the policy once issued, would be valid and effective, only after written request is made to the company and Company

accepts the requested amendments/ modifications/alterations and records the same through separate endorsement to be issued by the Company.Insurance is the subject matter of solicitation. For redressal

of your grievance, if any, you may approach any one of the offices- 1.Policy issuing office 2.Corporate Office. In case, you are not satisfied with our own grievance redressal mechanism; you may also

approach Insurance Ombudsman. Details of Insurance Ombudsman offices are available at IRDA website: www.irda.gov.in , or on the website of General Insurance Council: www.gicouncil.in or on the

company website www.bharti-axagi.co.in Bharti AXA General Insurance Company Limited, First Floor, Ferns Icon, Survey No. 28, Next to Akme Ballet, Doddanekundi, Off Outer Ring Road, Bangalore - 560

037.

You might also like

- HDFC ERGO General Insurance Two Wheeler Comprehensive Policy CertificateDocument3 pagesHDFC ERGO General Insurance Two Wheeler Comprehensive Policy CertificateLaxman AngaraNo ratings yet

- Shamse Alam PDFDocument4 pagesShamse Alam PDFaxis motorsNo ratings yet

- Smart Drive Two Wheeler Insurance Policy SummaryDocument1 pageSmart Drive Two Wheeler Insurance Policy SummaryVaishnavi HallikarNo ratings yet

- Two Wheeler Insurance SummaryDocument1 pageTwo Wheeler Insurance SummaryAyaz SayedNo ratings yet

- SmartDrive Motor Insurance Policy SummaryDocument2 pagesSmartDrive Motor Insurance Policy Summarysunil dhanjuNo ratings yet

- Bike Insurance - 2013 PDFDocument3 pagesBike Insurance - 2013 PDFRupinder SinghNo ratings yet

- Pulsar 150 InsuranceDocument2 pagesPulsar 150 Insurancesunny rocky100% (1)

- HDFC Two Wheeler PolicyDocument3 pagesHDFC Two Wheeler PolicybalaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument11 pagesBajaj Allianz General Insurance Company LTDmahesh jhaNo ratings yet

- Motor Insurance Policy - OICLDocument3 pagesMotor Insurance Policy - OICLAman DeepNo ratings yet

- v3624773 ScheduleDocument1 pagev3624773 ScheduleHrishikesh BasakNo ratings yet

- Insured Motor Vehicle Details Insured Declared Value (Idv) (In RS.)Document2 pagesInsured Motor Vehicle Details Insured Declared Value (Idv) (In RS.)Zakir SzaNo ratings yet

- GJ16CH1531Document3 pagesGJ16CH1531Chandan KumarNo ratings yet

- Shishpal PDFDocument1 pageShishpal PDFManphool JangidNo ratings yet

- 2 Wheeler PolicyDocument3 pages2 Wheeler PolicyKiran Deshmukh100% (1)

- Comprehensive Two-Wheeler Policy DetailsDocument4 pagesComprehensive Two-Wheeler Policy DetailsSoftway GoaNo ratings yet

- Createds PDFDocument1 pageCreateds PDFROHIT KUMARNo ratings yet

- Smart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleDocument2 pagesSmart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleSHILADITYA DEYNo ratings yet

- Comprehensive Bike Insurance CoverageDocument1 pageComprehensive Bike Insurance CoverageMrajyalakshmi RajyalskshmiNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDrandhirrajputNo ratings yet

- Og 20 3820 1803 00000045 PDFDocument5 pagesOg 20 3820 1803 00000045 PDFShaikh AsifNo ratings yet

- Policy ScheduleDocument1 pagePolicy ScheduleShankar Nath100% (1)

- PolicySoftCopy 509109346Document1 pagePolicySoftCopy 509109346Zishan100% (2)

- Digit Two-Wheeler Liability Only Policy: IRDAN158P0003V01201718Document2 pagesDigit Two-Wheeler Liability Only Policy: IRDAN158P0003V01201718PiyushNo ratings yet

- Vehicle Insurance Certificate in IndiaDocument3 pagesVehicle Insurance Certificate in IndiaMukulNo ratings yet

- Smart Drive Private Car Insurance Policy SummaryDocument2 pagesSmart Drive Private Car Insurance Policy Summaryvishal sharmaNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - Scheduleraj2364uNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Manohar BidwaikNo ratings yet

- Pulsar Bike Insurence - FileDocument2 pagesPulsar Bike Insurence - FileishanNo ratings yet

- United India Insurance Motorcycle Insurance ScheduleDocument2 pagesUnited India Insurance Motorcycle Insurance SchedulepmukundaNo ratings yet

- Policy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerDocument2 pagesPolicy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerSanjay SharmaNo ratings yet

- ActivaDocument1 pageActivaFaraz KhanNo ratings yet

- 2320100231958600000Document2 pages2320100231958600000vikas100% (2)

- Comprehensive Two-Wheeler Insurance Policy DetailsDocument3 pagesComprehensive Two-Wheeler Insurance Policy DetailsMANTEL TELECOMNo ratings yet

- Liability Only Policy - Private Car: Policy Details Vehicle DetailsDocument1 pageLiability Only Policy - Private Car: Policy Details Vehicle DetailsSmarttNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleArora ParasNo ratings yet

- Smart Drive Two Wheeler Insurance Policy DetailsDocument1 pageSmart Drive Two Wheeler Insurance Policy Detailshaja immranNo ratings yet

- Insurance Copy Activa 1255 PDFDocument4 pagesInsurance Copy Activa 1255 PDFDivya SuvarnaNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEIshan BakshiNo ratings yet

- Policy Copy (5) - UnlockedDocument6 pagesPolicy Copy (5) - UnlockedVignesh PNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDsarthakNo ratings yet

- TW Niapolicyschedulecirtificatetw 26204148Document3 pagesTW Niapolicyschedulecirtificatetw 26204148harinadh birudukota0% (2)

- Smart Two Wheeler InsuranceDocument1 pageSmart Two Wheeler InsuranceanshumanshrivastavaNo ratings yet

- PDFDocument4 pagesPDFJwalant J AntaniNo ratings yet

- Royal Sundaram vehicle insurance renewal noticeDocument3 pagesRoyal Sundaram vehicle insurance renewal noticePrachi BhosaleNo ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyVijay KumarNo ratings yet

- Aditya Birla Insurance welcome letter for Hyundai motor insuranceDocument3 pagesAditya Birla Insurance welcome letter for Hyundai motor insurancerednetijNo ratings yet

- Wego InsuranceDocument1 pageWego Insuranceuttam patraNo ratings yet

- Policy PDFDocument6 pagesPolicy PDFUMESH KUMAR YadavNo ratings yet

- Sub:Risk Assumption Letter: Insured Vehicles DetailsDocument4 pagesSub:Risk Assumption Letter: Insured Vehicles Detailssumant samuelNo ratings yet

- Swift Insurence FY 2017-18 PDFDocument2 pagesSwift Insurence FY 2017-18 PDFRAJ MVNNo ratings yet

- New India Ashok Layland DostDocument3 pagesNew India Ashok Layland Dostsarath potnuriNo ratings yet

- United India Insurance Private Car Liability PolicyDocument2 pagesUnited India Insurance Private Car Liability PolicySabapathy MurugasanNo ratings yet

- Private Car Insurance Policy DetailsDocument11 pagesPrivate Car Insurance Policy DetailsHimalayan Mountaineering Institute DarjeelingNo ratings yet

- Bike InsuranceDocument3 pagesBike InsuranceJAYAPRAKASH BKNo ratings yet

- Vrpower Equipments PVT LTD BhartiDocument8 pagesVrpower Equipments PVT LTD BhartiMADHUKAR JHANKALNo ratings yet

- Nitin PDFDocument2 pagesNitin PDFAnonymous uHXjXqhvoL100% (1)

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 2570 7201 000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 2570 7201 000Kamal Elumalai100% (4)

- Two Wheeler Insurance Policy SummaryDocument1 pageTwo Wheeler Insurance Policy SummaryGrace Touch Interior and DesignsNo ratings yet

- Smart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleDocument1 pageSmart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleAnonymous KITquh5No ratings yet

- Isrt SD Fs 005 in Pgi Block Auto-Removal v1.1Document4 pagesIsrt SD Fs 005 in Pgi Block Auto-Removal v1.1chetanNo ratings yet

- All The Columns Has To Be Filled Either With Yes / NO, and No Column To Be Left Blank or Mention NADocument2 pagesAll The Columns Has To Be Filled Either With Yes / NO, and No Column To Be Left Blank or Mention NAchetanNo ratings yet

- IncofyraDocument8 pagesIncofyrachetanNo ratings yet

- Interview Letter PDFDocument2 pagesInterview Letter PDFSHREYSRAMNo ratings yet

- Yoga Price List PDFDocument3 pagesYoga Price List PDFchetanNo ratings yet

- Step1: Step 2: B) Reissue Via Phonebanking - Through Any HDFC Bank Branch - You Can Collect An Insta Non Personalized Chip + Pin DebitDocument1 pageStep1: Step 2: B) Reissue Via Phonebanking - Through Any HDFC Bank Branch - You Can Collect An Insta Non Personalized Chip + Pin DebitsathishNo ratings yet

- Yoga Price List PDFDocument3 pagesYoga Price List PDFchetanNo ratings yet

- Questionnaire SDDocument36 pagesQuestionnaire SDapi-378110192% (13)

- HDFC 4W MUMBAI Online AuctionDocument13 pagesHDFC 4W MUMBAI Online AuctionDeep ChoudharyNo ratings yet

- Insurance ItaloDocument3 pagesInsurance ItaloNovais paulaNo ratings yet

- Limited Warranty: Project: HuaweiDocument2 pagesLimited Warranty: Project: HuaweizainahmedscribdNo ratings yet

- Harding Vs Commercial Union Assurance CompanyDocument2 pagesHarding Vs Commercial Union Assurance CompanyCarlota Nicolas VillaromanNo ratings yet

- Iffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017Document3 pagesIffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017vikrant sehgalNo ratings yet

- PolicySchedule 2705003121P103849273Document12 pagesPolicySchedule 2705003121P103849273Abhishek UpadhyayNo ratings yet

- Technician Pay MethodsDocument2 pagesTechnician Pay Methodsjimmy100% (1)

- Liberty Mutual - Auto Insurance QuoteDocument5 pagesLiberty Mutual - Auto Insurance Quoteseshu.nukalaNo ratings yet

- Private Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleAkshat GuptaNo ratings yet

- VWFS Finance Brochure: Finance, Servicing & Insurance OptionsDocument22 pagesVWFS Finance Brochure: Finance, Servicing & Insurance OptionsKornelija PadleckyteNo ratings yet

- Estimate MH05EJ0630Document4 pagesEstimate MH05EJ0630Swapnil DoiphodeNo ratings yet

- VOLVO SAFENET PROGRAMDocument3 pagesVOLVO SAFENET PROGRAMprasadNo ratings yet

- Two Wheeler Insurance Policy SummaryDocument3 pagesTwo Wheeler Insurance Policy SummaryAjit Singh0% (1)

- Policy QuotationDocument1 pagePolicy QuotationGuruNo ratings yet

- Santro Insu 22-23Document3 pagesSantro Insu 22-23Hitendra PatelNo ratings yet

- Damage Refund Insurance SummaryDocument8 pagesDamage Refund Insurance Summarycharlie dineenNo ratings yet

- Diploma in Insurance: The Chartered Insurance InstituteDocument12 pagesDiploma in Insurance: The Chartered Insurance InstituteSultan AlrasheedNo ratings yet

- Two Wheeler Package Policy Product Code: 3005 UIN:IRDAN115P0015V02200708 Certificate Cum Policy ScheduleDocument1 pageTwo Wheeler Package Policy Product Code: 3005 UIN:IRDAN115P0015V02200708 Certificate Cum Policy ScheduleMital PatelNo ratings yet

- United India Insurance Company LimitedDocument9 pagesUnited India Insurance Company LimitedHari25885No ratings yet

- Policy - MC PVC CBC 0012307Document5 pagesPolicy - MC PVC CBC 0012307Joshua CoronelNo ratings yet

- 31 2023 2294 PDFDocument2 pages31 2023 2294 PDFLochan PhogatNo ratings yet

- Srinivasrao Gadili Trac PKGDocument4 pagesSrinivasrao Gadili Trac PKGseshu 2010No ratings yet

- MOTOR POLICY SUMMARYDocument2 pagesMOTOR POLICY SUMMARYNandhini muruganNo ratings yet

- Project Management AgreementDocument26 pagesProject Management AgreementDobromira Mihaleva33% (3)

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)Dushyant SharmaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDSamsung M31sNo ratings yet

- Bike Insurance TvsDocument5 pagesBike Insurance Tvsశివ శూలంNo ratings yet

- Ocean Harbor Casualty Insurance Company: Cancellation RequestDocument3 pagesOcean Harbor Casualty Insurance Company: Cancellation Requestdomingos honorato meiraNo ratings yet

- If Undelivered, Please Return ToDocument1 pageIf Undelivered, Please Return ToSri VasaNo ratings yet

- PGRDeclarationsPage 1 PDFDocument3 pagesPGRDeclarationsPage 1 PDFTim HowellNo ratings yet