Professional Documents

Culture Documents

Unit II: Banking Products and Services (Credit Facility)

Uploaded by

darshan lamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit II: Banking Products and Services (Credit Facility)

Uploaded by

darshan lamaCopyright:

Available Formats

Unit II: Banking Products and Services

(Credit Facility)

Syllabus Coverage:

Meaning of Credit, Types of Lending, Principles of Lending, Process & Documentation of Lending, Primary

and Secondary Collateral Securities, Modes of Creating Charges on Securities, Hypothecation, Pledge, Lien

and Assignment, Credit Cards, Consortium & Syndication, Micro Finance, Documentary Credit (Bank

Guarantee & Letter of Credit), Financing Export and Imports.

Introduction

Historically banks have preferred to make short-term loans to businesses for non-permanent additions to

their working capital. These loans usually were used to finance the inventory-raw material or finished goods

to sell. Such loans take advantage of the normal cash cycle in a business firm. While banks today make a

far wider array of business loans than just simple liquidating credits, the short-term loan- frequently displaying

many of the features of self-liquidation- continues to account for over half of bank loans to business firms.

The extension of credit is one of the major functions of banking business. Major source of income for the

bank and financial institution comes from their Loans and Advances. Credit management is the management

of loans and advances. Success of banking business depends on the efficient and effective management of

credit. Poor credit management has proved to be one of the major causes of bank failures throughout the

world. Loan uncollectible due to mismanagement, illegal manipulation of loan, misguided lending policies or

unexpected economic downturn are main reasons for a bank getting into serious problems.

Credit can be offered in a variety of types/categories as per the need of the potential market. Credit

management is always a challenging task in the banking business because there are several environmental

influences and risks associated with the credit operation and administration. Credit Risk is that risk which

arises where the borrower fails to meet the obligation on agreed terms. The volume and impact of credit risk

is very high among the various types of risk associated in the banking business (See detail in Risk

Management chapter).

Lending function is significant for every bank as it yields substantial income by means of interest on loan &

advances and fees on non-fund based credit activities. Bank lending facilitates the economic development

of a country by extending financial support to industry, agriculture, trade, commerce and other sectors. Banks

also invest a certain part of their loan in social development in the form of deprived sector lending. Banks

lending activities are generally governed by certain principles since the lending activities involve depositors'

money which is repayable on demand or on specified maturities. Bank adheres to the principle of liquidity,

safety and profitability in their lending policies and standard guidelines for operations. Nepal Rastra Bank has

also stipulated mandatory maintenance of Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) to

reinforce liquidity and safety principles. Banks also diversify their loan portfolio across a spectrum of

borrowers industries, sectors, securities as per the prudential norms and also follow other risk management

practices.

Definitions

Credit (function) can be defined as the channelization of the fund from the people/entities that have excess

funds to the people/entities that have a deficit (of funds).

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 1

"Credit is a contractual agreement in which a borrower receives something of a value with the explicit

agreement to repay the lender at some date in future. The borrower pays interest as compensation (to the

lender) for allowing the use of funds.

“Credit management is the management of the credit portfolio of the bankers and financial institutions. The

expression credit refers to short term loans and advances as well as medium/long term loans and off balance

sheet transactions. Management includes within its preview pre-sanction appraisal, sanction, documentation,

disbursement and post lending supervision and control.”

- O.P. Agrawal “Principles of Banking”, (Macmillan).

A specified sum of money lent by a bank to customers usually for a specified time at specified rate of interest.

In most cases banks require some form of security for loans especially if the loan is to a commercial

enterprise.

- Oxford Dictionary of Business, second edition

From the above definitions and explanation, we can say that credit is one of the major functions of the banking

business. There are several risks inherent in the credit process. Credit management deals with minimizing

those risks which are directly or indirectly involved in a project. Credit management is no longer a "rule of

thumb" game. In a highly competitive and deregulated environment, Banks and Financial Institutions have to

evolve better systems and procedures to manage the credit needs of highly demanding customers,

particularly in the corporate and retail sectors. Credit management includes all the activities related with credit

such as; credit processing, credit marketing, portfolio management, concentration risk monitoring, risk

hedging, capital required for the risks and credit reporting etc. This chapter presents the principles and

practices in credit operation and administration.

Types of Credit

Credit can be classified on several bases. The credit products may differ as per the financing requirement of

any business. These products can be developed on the basis of terms and conditions demanded by the credit

agreement between bank and the borrower. Furthermore the credit products are determined on the basis of

borrowing cause of the customer.

For simplicity in learning, it can be classified as;

Fund Utilization: Funded or Non-funded

Tenure: Fixed Term or Working Capital

Target Customer: Retail/Consumer or Corporate

Funded or Non-Funded

Funded

Funded loan refers to the loan which is disbursed in the forms cash or any other payments made on behalf

of customers. Whenever a bank disburses a loan and cash goes out of the bank immediately, then it is

classified as funded loan. Funded loans are recorded in the books of accounts and appear in the balance

sheet under the heading of loan and advances.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 2

Some examples of funded loans are;

Overdraft/ Cash Credit/Hypothecation Loan

Importers' Loan/ Trust Receipt Loans

Exporters' Loan/ Packing Credit Loan

Short Term Loan/ Demand Loan

Long Term Loan

Home Loan/Hire Purchase/ Consumer/ Mortgage Loan/ Auto

Loan

Credit Cards

Bills purchase

Non Funded

Bank's commitment for the future payment or any other conditional payment on behalf of its customer is

known as a non-funded facility. In non-funded facilities banks don't have to pay cash but need to commit a

conditional payment. Non funded facility involves the issuing bank's commitment to honor certain promises

as per the letter of credit or guarantee or similar documents favoring a third party, without requiring any

immediate outlay of funds by the bank at the time of making a commitment. However outlay of the may take

place in the event of development of commitment on the issuing bank. These commitments do not appear in

the banks on the balance sheet. It is presented as contingent liabilities outside the balance sheet hence they

are also known as off balance sheet items.

Some examples of non funded loans are;

Letter of Credit

Guarantee (Bid bond, Performance bond, Advance payment,

Retention etc.)

Acceptance and endorsement

Commitments

Fixed Term or Working Capital

The loans which are granted for the creation of longer term assets (Capital Expenditure) are known as fixed

term loans. These types of loans are generally for more than one year and repaid on fixed installments over

the loan tenor. These loans are secured mortgaging the specific fixed assets financed or the entire block of

fixed assets of a particular project.

Examples are;

Project loan

Home/house

Hire purchase

Other term loans

Business requires working capital for its day to day operation. Working capital loans are granted to finance

the working capital requirement of the business. The working capital requirement relates to processing,

production, sale of goods and services which are granted for bridging the financial gaps in the production

cycle of the business. Banks sanction a specified credit limit to the borrower against the security of stock,

book debts or any other assets acceptable to banks which are pledged /hypothecated. Some examples are;

Pledge

Hypothecation

Overdraft

Demand Loan

Cash Credit

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 3

Retail/Consumer or Corporate

Retail/Consumer loans are the loans which are granted for the consumption purpose. These loans are based

on the security and the future cash flow (disposable income) of the borrower. Some examples are;

House/Home loan

Vehicle loan/ Auto

Education loan

Personal loan/Management loan

Corporate loans are the loans which are granted for big business houses. The corporate loans are appraised

on the basis of detailed analysis of the borrowers past performance, projected balance sheet, profit and loss

account, cash flow statements etc. to determine financial viability of the capacity. The technical, managerial,

commercial viabilities of the project is also critically examined by the banker before granting these loans. For

example; all the loans disbursed to the corporate sector.

Principles of Lending

Banks have to follow the basic principle of lending for minimizing risk associated. There are various

fundamental norms and principles for making good quality of loan which helps banks in honoring

commitments to the depositors and earning some profit from their lending situation.

1. Principle of Safety and Security:

The safety of funds lent is another principle of lending. Safety means that the borrower should be able to

repay the loan and interest in time at regular intervals without default. The repayment of the loan depends

upon the nature of security, the character of the borrower, his capacity to repay and his financial standing.

This principle is based on the assumptions that the bankers should lend their fund in such an area where

there are least probabilities of default. To follow this principle banks should develop an appropriate

mechanism of credit appraisal system and good credit policy. While granting a loan, the bank carefully

examines the economic financial and commercial viability of the business, quality of its management

(integrity, honesty, willingness to pay, reputation in market etc.) and the past track record. Banks should give

priority to have possession or control over a cashable security for future precaution in adverse situations.

Like other investments, bank investments involve risk. But the degree of risk varies with the type of security.

Securities of the central government are safer than those of the state governments and local bodies. And the

securities of state government and local bodies are safer than those of the industrial concerns. This is

because the resources of the central government are much higher than the state and local governments and

of the latter higher than the industrial concerns.

In fact, the share and debentures of industrial concerns are tied to their earnings which may fluctuate with

the business activity in the country. The bank should also take into consideration the debt repaying ability of

the governments while investing in their securities. Political stability and peace and security are the

prerequisites for this.

It is very safe to invest in the securities of a government having large tax revenue and high borrowing capacity.

The same is the case with the securities of a rich municipality or local body and state government of a

prosperous region. So in making investments the bank should choose securities, shares and debentures of

such governments, local bodies and industrial concerns which satisfy the principle of safety

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 4

Thus from the bank’s viewpoint, the nature of security is the most important consideration while giving a loan.

Even then, it has to take into consideration the creditworthiness of the borrower which is governed by his

character, capacity to repay, and his financial standing. Above all, the safety of bank funds depends upon

the technical feasibility and economic viability of the project for which the loan is advanced.

2 Principle of Liquidity: The banks should have the best mechanism to manage the assets and liabilities in

a sound manner. Banks have various sources of funds for conducting its lending business. During the course,

it has to attune the maturities of its assets (loan) with the maturities of liabilities (deposit). Bank should not

delay or default in making payment to its depositors or other liabilities, as this would result in loss of trust and

faith of customers. Banks must comply with various regulatory requirements regarding liquidity like CRR

(Cash reserve ratio), SLR (Statutory Liquidity ratio).

Liquidity is an important principle of bank lending. Bank lend for short periods only because they lend public

money which can be withdrawn at any time by depositors. They, therefore, advance loans on the security of

such assets which are easily marketable and convertible into cash at a short notice.

A bank chooses such securities in its investment portfolio which possess sufficient liquidity. It is essential

because if the bank needs cash to meet the urgent requirements of its customers, it should be in a position

to sell some of the securities at a very short notice without disturbing their market prices much. There are

certain securities such as central, state and local government bonds which are easily saleable without

affecting their market prices.

The shares and debentures of large industrial concerns also fall in this category. But the shares and

debentures of ordinary firms are not easily marketable without bringing down their market prices. So the

banks should make investments in government securities and shares and debentures of reputed industrial

houses.

3. Principle of Risk Diversification: There are various risks involved in lending business and banks can be

away from such risk. This principle focuses on better credit risk management through tolerable credit limits

in different sectors and parties.

This principle is based on the proverb "Do not put all eggs in a single basket". So concentration risk should

be monitored and managed through credit diversification. The credit risk can be minimized through

diversification of credit portfolio that means prevention from excessive concentration of loans into few

borrowers/industries/sectors.

In choosing its investment portfolio, a commercial bank should follow the principle of diversity. It should not

invest its surplus funds in a particular type of security but in different types of securities. It should choose the

shares and debentures of different types of industries situated in different regions of the country. The same

principle should be followed in the case of state governments and local bodies. Diversification aims at

minimising risk of the investment portfolio of a bank.

The principle of diversity also applies to the advancing of loans to varied types of firms, industries, businesses

and trades. A bank should follow the maxim: “Do not keep all eggs in one basket.” It should spread it risks

by giving loans to various trades and industries in different parts of the country.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 5

4. Principle of Profitability:

This is the cardinal principle for making investment by a bank. It must earn sufficient profits. It should,

therefore, invest in such securities which was sure a fair and stable return on the funds invested. The earning

capacity of securities and shares depends upon the interest rate and the dividend rate and the tax benefits

they carry.

Banks are commercial organizations and profit making is their main objective. Profit is necessary for the

bank's sustainability and growth. They need to pay an adequate return to their shareholders. Banks take risk

for securing the reasonable level of return. This principle advocates that maximum possible return should be

considered while a lending decision is made.

It is largely the government securities of the centre, state and local bodies that largely carry the exemption of

their interest from taxes. The bank should invest more in such securities rather than in the shares of new

companies which also carry tax exemption. This is because shares of new companies are not safe

investments.

5. Principle of loan purpose: Banks always need to be careful about the purpose and objective of the loan.

Analysis of the borrowing cause is a very important aspect in credit analysis. If the disbursed loan from the

bank is misutilized, there will be less chances of repayment by the borrower. Lending activities should be

guided by banks' own credit policy and remain within the boundaries of the legal framework. Banks need to

be careful to prevent lending in money laundering, terrorist activities, conducting illegal business etc.

6. Principle of Stability:

Another important principle of a bank’s investment policy should be to invest in those stocks and securities

which possess a high degree of stability in their prices. The bank cannot afford any loss on the value of its

securities. It should, therefore, invest it funds in the shares of reputed companies where the possibility of

decline in their prices is remote.

Government bonds and debentures of companies carry fixed rates of interest. Their value changes with

changes in the market rate of interest. But the bank is forced to liquidate a portion of them to meet its

requirements of cash in cash of financial crisis. Otherwise, they run to their full term of 10 years or more and

changes in the market rate of interest do not affect them much. Thus bank investments in debentures and

bonds are more stable than in the shares of companies.

Credit Process

Banks and financial institutions have to pass through a predetermined process of granting loans. Well defined

processes help to minimize credit risk as well as other potential complexities of the future. In general following

steps are taken as credit processes;

Credit appraisal;

Credit approval;

Credit Documentation;

Disbursement;

Credit monitoring;

Credit recovery and restructuring

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 6

Credit Appraisal

Credit Appraisal is the process whereby the risks relating to the repayment of a loan are evaluated. It is the

first step in the credit process which involves analysis of the borrower's capacity to repay the loan. Good

credit appraisal may be a milestone in maintaining a good credit portfolio in the banking business. Better

credit quality may be regarded as the outcome of the better credit appraisal technique. Every lending situation

may vary from case to case. Proper credit appraisal involves the assessment of three main aspects: the

applicant, the purpose, and the security. The banks should also assess the applicant's character and capital

position (or financial capacity to repay). The Banks should also assess the economic and industry conditions

and the borrower's need for funds, including the feasibility of any proposed venture, the amount of funds

required, and the cash flow expected to liquidate the credit facility. Banks should assess the marketability

and price stability of the security offered. Moreover in case of business borrowers, financial statements and

project progress reports are normally good indicators of the state of their businesses.

A credit appraisal is generally standardized presentation demonstrating the detailed analysis of a particular

lending situation. The conclusion drawn on the analysis helps in decision making for lending. Before making

the credit appraisal it is must for the credit analyst to understand the situation of the macro environment and

the industry a firm operates in. The detail procedure and analysis technique are discussed under Credit

Appraisal Chapter.

Credit approval

The loan is approved by competent authority after completion of the credit appraisal on the basis of the

recommendation of credit analyst as well as credit risk officer. Approving authority may enquire and make

addition in terms and conditions of the credit agreement during the stage of approval. Principally the approval

process needs to be started after completion of the documentation process. But in practice, the competitive

market has developed the trend of collecting initial documents in the first stage for approval of loans. Final

and original documentation are obtained only before disbursement of loan. Approval of credit facilities should

be done only by the authorized officers of the bank within their respective authorized limits.

In practice, "Principally agreed" type of pre-approval is also granted to the borrower subject to the condition

of providing necessary documents (securities) before disbursement of loan.

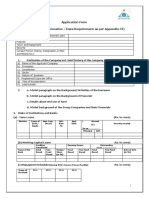

Credit Documentation

Credit documentation means obtaining and executing necessary legal documents in order to protect the

interest of the Bank. As discussed earlier, credit is an agreement between the bank and the borrower. The

borrower must present the documents before being availed of the loan as specified in the agreement.

Documentation means the execution of credit documents in the proper form as required by bank's internal

policies as well prevailing legal provisions. It establishes the contractual relationship between lending bankers

and the borrowers. Documents are essential to avoid ambiguities and settlement of future disputes.

Once the approval of the credit facility is received, the job of loan documentation starts. Normally there are

two units within the credit department namely business development unit and Credit Administration unit.

Business development unit is responsible for bringing business and relationship banking. They generally

focus on marketing related jobs, making necessary credit appraisals and forwarding it to the competent

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 7

authority for approval. Credit administration unit is responsible for documentation, monitoring, follow-ups,

supervision and control of the loans and advances.

The necessity of credit documents depends on the type of loan product. There are several credit documents

which are required. Some of the documents may be compulsorily required as per bank's credit policy

guideline while others may be needed to minimize credit risk. In general, following documents are used by

banks and financial institutions.

Major Credit Documents

1. Personal Information of Borrower (Individual borrower and guarantors)

Citizenship or other valid identification document issued by government

Location Verification Documents

Background, Experience, Engagements

2. Information of Borrower (Institutional)

Registration documents

Ownership documents

Income tax documents (PAN)

Financial statements

3. Income Source Documents

Document verification of income i.e. salary, wage, rental, pension, remittance etc.,

Financial Statements (if possible audited),

4. Collateral Security Documents

(Ownership) Legal documents of collateral i.e. registration and/or certification

Valuation document of collateral (if required)

5. Other legal documents (before disbursement executing at FI)

Offer letter/Sanction letter

Mortgage deed with all necessary legal documents.

Loan deed

Personal guarantee/cross guarantee/ corporate guarantee

Promissory notes

Hypothecation of stocks & supplementary agreement to hypothecation

Hypothecation of book debts & power of attorney

Insurance documents

Transfer of ownership of vehicle

Subordinate agreement from other creditors

Hire purchase agreement etc.

Approved Credit Appraisal (Memo) / Approved Credit Facility

Request (CFR)

Offer letter/Sanction letter

Evidence of Income Sources & Financial Statements

Evidence of Identification and Business Incorporation Certificates & Tax Registration Certificate

Mortgage deed with all necessary legal documents.

Loan deed

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 8

Personal guarantee/cross guarantee/ corporate guarantee

Promissory notes

Hypothecation of stocks & supplementary agreement to hypothecation

Hypothecation of book debts & power of attorney

Insurance documents

Transfer of ownership of vehicle

Subordinate agreement from other creditors

Hire purchase agreement etc.

Loan and security documentation refers to the possession and possible use of legal documents to validate

the claim of the Bank against the borrower. The credit analyst prescribes the document to be obtained while

obtaining the approval for various facilities provided to the borrower and it is the responsibility of the Credit

Administration Division (CAD) to get the documents executed in conformity with the approval. Credit

Administration Department prepares the checklist based on terms of approval so as to confirm that all

required security documents are obtained.

After approval of the various credit facilities, CAD prepares offer letter and property valuation letter from

registered valuation of Bank. The offer letter should cover the approved credit facility, interest rate/cash

margin, commission, management fee, purpose, maturity, security arrangement and other terms and

conditions. CAD must ensure that those documents received from the customer are duly signed/stamped by

the concerned authorities.

Disbursement

After ensuring that all the documents have been obtained from the borrower, banks disburse the approved

loan limits. The disbursement may be in full or in partial amount as per the approved terms and conditions.

In case of revolving credit banks provide limit to the borrower.

Credit Recovery and Restructuring

All the borrowers may not serve interest as well as principal on time according to the agreed term and

conditions. Some of them become delinquent in payment. In such cases banks need to take recovery action.

When a borrower fails to meet obligation, banks take recovery action as per the recovery policy of the bank.

The actions regarding recovery are; issue reminder notice, 7/15/35 days notice as per prevailing laws. The

bank may go for recovery of its dues through selling of the mortgaged/ pledged/lien assets when there is no

chance of repayment by the borrower.

Sometimes borrowers may request for the continuation of credit agreement by restructuring the terms and

conditions. In such a case, if the bank is assured that the loan will be repaid once the loan is

restructured/rescheduled, a new agreement can be established which is known as restructuring of loans.

Primary and Secondary Collateral Securities

Collateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used

as a way to obtain a loan, acting as a protection against potential loss for the lender should the

borrower default in his payments. In such an event, the collateral becomes the property of the lender to

compensate for the unreturned borrowed money.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 9

For example, if a person wants to take out a loan from the bank, he may use his car or the title of a piece of

property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two

parties’ agreement. If the borrower has finished paying back his loan, then the collateral is returned to his

possession.

Collateral vs. Security

Collateral and security are two terms that often confuse people who think the terms are completely

synonymous. In fact, the two concepts are different. The differences are explained below:

Collateral is any property or asset that is given by a borrower to a lender in order to secure a loan. It

serves as an assurance that the lender will not suffer a significant loss. Securities, on the other hand,

refer specifically to financial assets (such as stock shares) that are used as collateral. Using

securities when taking out a loan is called securities-based lending.

Collateral can be the title of a parcel of land, a car, or a house and lot, while securities are things

such as bonds, futures, swaps, options, and stocks.

Collateral, or at least the ownership title to it, stays with the lender throughout the time the borrower

is paying the loan. Securities, on the other hand, allow the borrower to benefit from both the loan and

the securities portfolio even while the loan is still being paid back because the securities portfolio

remains under the borrower’s control. However, the lender assumes a greater risk because the value

of the securities may fluctuate substantially.

Primary Collateral

Primary collateral is the main, or first, asset pledged to secure a loan. Sometimes a loan has secondary

collateral -- for instance, when one mortgage covers multiple pieces of real estate, as in a blanket mortgage.

When an asset acquired by the borrower under a loan is offered to the lender as security for the financed

amount then that asset is called Primary Security. In simple terms, it is the thing that is being financed.

Example: A person takes a housing loan of Rs. 50 lakh from the bank and purchases a residential loan. That

flat will be mortgaged to the bank as primary security.

Primary Collateral means all property (whether real or personal) with respect to which any security interests

have been granted (or purported to be granted) pursuant to any Primary Security Document, including,

without limitation, all Pledge Agreement Collateral, all Earnings and Insurance Collateral, all Primary

Collateral Vessels and all cash and Cash Equivalents at any time delivered as collateral thereunder or

hereunder.

Credit Facility Type Primary Collateral

Housing Loan Land & Building (Financed by Housing Loan)

Hire Purchase Loan Vehicle (Financed by Hire Purchase Loan)

Business Working Capital Loan Stock & Debtors (Financed by WC Loan)

Features of Primary Collaterals:

Credit facility is granted to finance primary collateral and drawing power (% of lending limit calculated

based on value of collateral offered) is calculated based on it,

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 10

This is the first collateral offered by borrower to lender,

It can be physical property (movable & immovable) and / or personal guarantee etc.

Value of primary collateral may or may not cover the value of credit facility,

Secondary Collateral Security

All other collateral securities offered other than primary collateral is secondary collateral. Sometime, primary

collateral value may not be adequate to cover the total credit limit or lender (bank) may feel required to add

additional collaterals or nature of credit may demand other collaterals, then secondary collaterals are offered.

Bank creates charge over secondary collateral basically to secure the credit facility.

Features of Secondary Collateral Security:

It is other than primary collateral,

It can be physical property (movable & immovable) and / or personal guarantee etc.

Credit facility is not granted to finance secondary collateral and drawing power (% of lending limit

calculated based on value of collateral offered) is not calculated based on it,

Modes of Creating Charge over Collateral Securities:

In order to be useful to a banker as an enforceable security for an advance, it is necessary that the security,

in addition to having the qualities as discussed, should also be charged to a banker in a legal and a perfect

manner. The mode by which various assets are made available as securities to a banker for advance granted

is called charging of securities. In case the mode of charging is defective, a banker will not be in a position

to enforce his security in case of default by the borrower. By charging a security, the borrower does not

transfer ownership of asset to a banker but transfers certain rights and interest in the property to the banker:

In order to safeguard his interest, a banker must understand various modes of charges. The following are

modes of charges, which are very important for a bank:

Pledge

Hypothecation

Mortgage

Assignment

Lien

Pledge

It is the bailment of goods as security for payment of a debt or performance of a promise. Bailment of goods

is the delivery of the goods by one person to another for some purpose, under a contract that the goods

shall, when the purpose is served, be returned or otherwise disposed of, according to the directions of the

person delivering them.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 11

The person who delivers the goods are delivered is called the pledger or pawner (borrower of the bank) and

the person to whom the goods are delivered is called the pledgee or bank or Pawnee. Legal delivery- actual

or constructive- is an essential part of a contract of pledge. The contract or pledge may not be expressed in

writing. A banker, however, takes precautions in addition to taking possession of goods and securities, and

also binds the borrower by a deed of pledge, embodying the terms of agreement. Of all the methods of

charging a security, a pledge is considered to be most satisfactory by the banker, it is perfectly legal.

Documents to the title of goods and paper security, like fixed deposit receipts and stock exchange securities,

also can be pledged to a banker as security.

Pledge is a kind of bailment having the following essential elements:

o Goods must be delivered by the pledger to the pledgee. The delivery to the pledgee may be actual or

constructive. Delivery of the key of the warehouse where the pledged goods are stored is a constructive

delivery and is sufficient to create a pledge. A pledge involves a transfer of possession of the goods

pledged and not of title. The ownership of the of goods pledged remains with the pledger.

o Pledge can be made only of movable properties. Money cannot be pledged.

o A contract of pledge must be supported by a valid consideration. The goods should be offered as security

for the payment of a debt or the performance of promise.

Hypothecation

Hart describes hypothecation charge against property for an amount of debt where neither ownership nor

possession is passed to the creditor.

Hypothecation is a mode of securing a loan by creating a charge on movable goods without the surrender of

possession or ownership. It may be described as a transaction whereby money is borrowed by the debtor on

the security of the movable property without transferring either the ownership or the possession to the

creditor. It is a well settled law that mortgage of movable property unaccompanied by transfer of ownership

or possession is called hypothecation. Thus, the borrower continues to be the owner of the property by

hypothecated as in the case of pledge. But the possession is not transferred to the creditor or lender.

In hypothecation, the charge created is equitable. Under this arrangement, the movable property remains in

the possession of the borrower who undertakes to give the possession to the creditor when the latter requires

him to do so. Thus, charge of hypothecation can be converted into a pledge by the lender at any time. In

such a case, the lender will enjoy all the rights of a pledgee.

Hypothecation is a device to create a charge over movable property and is the most suitable arrangement in

circumstances where the transfer of possession of the goods is either inconvenient or impracticable. For

instance, where an industrialist provides the security of raw materials or work-in-progress for a loan, transfer

of possession will hamper the production. This difficulty can be removed by hypothecating the assets with

the bank. This will enable the borrower to utilise the raw materials or work-in-progress in the ordinary course

of his business. Now-a-days, banks also lend against hypothecation of automobiles like three wheelers, vans,

tampos and trucks. This enables the borrower to use the vehicle and earn money. Thus, hypothecation is a

floating charge on the borrower's assets, present and future. It is crystallised when the borrower makes

default in making the payment and the lender takes steps to enforce his security.

Some of the important characteristics of a charge by hypothecation are given below:

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 12

A document called hypothecation deed is executed by the borrower, which contains a

clause that when the banker demands, the borrower agrees to convert the hypothecation

charge into a pledge by giving possession of the goods to the banker. If peaceful

possession is not given when demanded, the banker has no alternative but to file a suit for

appointment of a receiver.

Only movable goods and commodities, movable machinery and book debts can be

hypothecated.

It is an equitable charge to a banker, where possession as well as ownership of the property

is with the borrower.

It is advantageous to a banker also as he is not saddled with responsibility of storing the

goods and taking care of goods' protection and preservation.

It is advantageous to the borrower, who is in a position to retain possession and sell the

goods, and also can convert the raw material into semi-finished goods and then finished

goods. He can also sell the finished goods to realise cash or create book debts, which can

also be hypothecated with his banker.

Possibility of double financing in case of hypothecated goods is real. A banker should be

careful in this regard. The bank's Board should be prominently displayed at the place of the

borrower to give notice to other bankers. A Board of the bank should also be affixed on the

hypothecated machinery. The borrower must bank only with one banker to avoid the

possibility of double financing.

As the advance against security of hypothecation is a risky advance, a banker should give

this facility only to first class parties, after proper verification of their credentials. A borrower

has got every opportunity to dispose of the goods in his possession without bothering about

repayment.

A borrower has to submit stock statements of the goods or book debts to the bank either

monthly or quarterly. Such statements should be signed by authorized officials of the borrowing

unit and should be accompanied by a certificate that the quantity, quality and price quoted are

proper and the goods and commodities are paid for by the borrower.

Mortgage

A borrower may offer immovable property as a security for a loan to be granted by the creditor or

banker. When a borrower offers his immovable property like building, land, factory premises, etc. for

a loan, a charge thereon is created by means of a mortgage.

Advance against immovable property are secured by way of charge of mortgage. A mortgage is the

transfer of an interest in specific immovable property for the purpose of securing payments of money

advanced by way of loan, existing or future debts or performance of an engagement, which may

give, rise to a pecuniary liability. The transferor is called a mortgage, the transferee or mortgagee

and the principal money and interest of which the payment is secured are called the mortgage money

and the instruments (if any) by which the transfer is effected is called a mortgage deed. The

essentials of a charge of mortgage can be summarized as under: -

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 13

Mortgage property must be specific and identifiable.

Ownership and possession of the property remain with the mortgagor; only some interest

in the property is transferred to the mortgage.

Immovable property, like land and buildings, plant and embedded machinery, should be

taken by way of mortgage.

Mortgage creates transfer of interest in property by the mortgagor to the mortgagee.

Mortgage can be created for present as well as future debt.

Assignment

Assignment means transfer of an existing or future right, property or debt by one person to another person.

The transferor is known as the assignor and the transferee as assignee. Actionable claims are assigned by

way of security for advance. An actionable claim means a claim to any debt other than a debt security by

mortgage of immovable property or by hypothecation or pledge of movable property or to any beneficial

interest in movable property not in the possession, either actual or constructive or beneficial interest be

existent, accuring conditional or contingent. In simple words, an actionable claim is a claim for which an

action can lie in the court of law if it is not met on due date. Some of the actionable claims to be noted are

interest in the insurance policy, book debts, shares, debentures and even term deposits.

Types of Assignment:

Legal Assignment:

A legal assignment of an actionable claim must be in writing and signed by the assignor. It must be

absolute and not by way of charge only. In practice, the banker to whom debt has been assigned sends

prompt notice in writing to the debtor of the borrower.

Equitable Assignment:

When due, procedure in case of legal assignment is not followed, it is called equitable assignment. In

case of legal assignment, the assignee can sue in his name, but it is not so if it is an equitable

assignment. A legal assignee can also give a good discharge for the debt without the concurrence of

the assignor. Value of assignment will depend not only on the integrity of the borrower, who is the

assignor, but also on the integrity of the borrower’s debtors, who ultimately has to make the payment.

Lien:

A Lien is the right of a creditor to retain the properties belonging to the debtor until the debt due to him is

repaid. Lien gives a person only a right to retain the possession of the goods and not the power to sell them.

A banker’s lien is a general lien which tantamount to an implied pledge. It confers upon the banker the right

to sell the securities after serving reasonable notice to the borrower.

Lien is the right of a creditor to hold possession of the goods of the debtor till he discharges his debt. Right

of lien entitles the creditor to retain the security or goods belonging to the debtor till the payment of debt. Lien

can be either (i) a general lien, or (ii) a particular lien.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 14

- General lien entitles the creditor in possession to retain the goods till all his claims against the owner

of the goods have been met. This is applicable in respect of all amounts due from the debtor to the

creditor.

- But a particular lien is a specific lien which confers a right to retain those goods for which the amount

is to be paid.

Difference between Pledge and Lien

Following are the points of difference between a pledge and a lien:

Pledge is always created by a contract, whereas no contract is necessary for a right of licn. In most of

the cases, lien is createdd by law.

Though in both the cases the possession of the goods is transferred to the creditor, yet in case of a lien,

the party in possession of the goods does not have in general any right to sell the goods. In case of

pledge, the creditor or the pledgee has right to sell the goods in his possession on the default by the

debtor.

Right of lien is lost with the loss of the possession of the goods. But pledge is not necessarily terminated

by return of goods to the owner. The goods pledged may be redelivered to the pledger for a limited

purpose.

Lien is purely a passive right. Lien-holder can only hold the goods till the payment is made. Lien holder

can not enforce its claim through a court of law. But a pledge enjoys the right to sue, right of sale and the

right of lien.

Difference between Mortgage and Pledge

The main difference between a mortgage and a pledge is that in case of a pledge, the possession is

transferred to the creditor, while it remains with the mortgagor in case of a mortgage unless otherwise stated

in the mortgage deed. Delivery of possession is essential in a pledge, but the pledgee has only a special

interest in the property and the general interest remains with the pledger.

Goods must be movable in case of a pledge, but mortgage is possible only in the case of specific immovable

property. Further, a mortgagee has the right of foreclosure in certain cases which is not available to the

pledgee in any case.

Credit Cards

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay

a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to

pay them for the amounts plus the other agreed charges). The card issuer (usually a bank) creates

a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money

for payment to a merchant or as a cash advance.

A credit card is different from a charge card, which requires the balance to be repaid in full each month or at

the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance

of debt, subject to interest being charged. A credit card also differs from a cash card, which can be used like

currency by the owner of the card. A credit card differs from a charge card also in that a credit card typically

involves a third-party entity that pays the seller and is reimbursed by the buyer, whereas a charge card simply

defers payment by the buyer until a later date.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 15

Interest charges

Credit card issuers usually waive interest charges if the balance is paid in full each month, but typically will

charge full interest on the entire outstanding balance from the date of each purchase if the total balance is

not paid.

For example, if a user had a Rs. 1,000 transaction and repaid it in full within this grace period, there would

be no interest charged. If, however, even Rs. 1.00 of the total amount remained unpaid, interest would be

charged on the Rs. 1,000 from the date of purchase until the payment is received.

The precise manner in which interest is charged is usually detailed in a cardholder agreement which may be

summarized on the back of the monthly statement. The general calculation formula most financial institutions

use to determine the amount of interest to be charged is (APR/100 x ADB)/365 x number of days revolved.

Take the annual percentage rate (APR) and divide by 100 then multiply to the amount of the average daily

balance (ADB). Divide the result by 365 and then take this total and multiply by the total number of days the

amount revolved before payment was made on the account. Financial institutions refer to interest charged

back to the original time of the transaction and up to the time a payment was made, if not in full, as a residual

retail finance charge (RRFC). Thus after an amount has revolved and a payment has been made, the user

of the card will still receive interest charges on their statement after paying the next statement in full (in fact

the statement may only have a charge for interest that collected up until the date the full balance was paid,

i.e. when the balance stopped revolving).

The credit card may simply serve as a form of revolving credit, or it may become a complicated financial

instrument with multiple balance segments each at a different interest rate, possibly with a single umbrella

credit limit, or with separate credit limits applicable to the various balance segments. Usually this

compartmentalization is the result of special incentive offers from the issuing bank, to encourage balance

transfers from cards of other issuers. In the event that several interest rates apply to various balance

segments, payment allocation is generally at the discretion of the issuing bank, and payments will therefore

usually be allocated towards the lowest rate balances until paid in full before any money is paid towards

higher rate balances. Interest rates can vary considerably from card to card, and the interest rate on a

particular card may jump dramatically if the card user is late with a payment on that card or any other credit

instrument, or even if the issuing bank decides to raise its revenue.

Parties involved

Cardholder: The holder of the card used to make a purchase; the consumer.

Card-issuing bank: The financial institution or other organization that issued the credit card to the

cardholder. This bank bills the consumer for repayment and bears the risk that the card is used

fraudulently. American Express and Discover were previously the only card-issuing banks for their

respective brands, but as of 2007, this is no longer the case. Cards issued by banks to cardholders in a

different country are known as offshore credit cards.

Merchant: The individual or business accepting credit card payments for products or services sold to the

cardholder.

Acquiring bank: The financial institution accepting payment for the products or services on behalf of the

merchant.

Independent sales organization: Re-sellers (to merchants) of the services of the acquiring bank.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 16

Merchant account: This could refer to the acquiring bank or the independent sales organization, but in

general is the organization that the merchant deals with.

Card association: An association of card-issuing banks such as Discover, Visa, MasterCard, American

Express, etc. that set transaction terms for merchants, card-issuing banks, and acquiring banks.

Transaction network: The system that implements the mechanics of the electronic transactions. May be

operated by an independent company, and one company may operate multiple networks.

Affinity partner: Some institutions lend their names to an issuer to attract customers that have a strong

relationship with that institution, and get paid a fee or a percentage of the balance for each card issued

using their name. Examples of typical affinity partners are sports teams, universities, charities,

professional organizations, and major retailers.

Insurance providers: Insurers underwriting various insurance protections offered as credit card perks, for

example, Car Rental Insurance, Purchase Security, Hotel Burglary Insurance, Travel Medical Protection

etc.

Credit Card Issue Process

Credit cards have become a part and parcel of our financial routine. They not only bring in convenience but

also help tide over short-term crunches.

How do you apply for a credit card?

There are multiple ways to apply for a credit card. You can apply for one online or by visiting the nearest

branch. Often, they can be applied through many promotional stalls set up at various events or through the

field service officers of the bank. If you submit an online application, a representative of the bank will visit you

to collect your documents.

What are the documents needed to apply for a credit card?

The documents you would need to submit with a filled-up application form are:

Identity Proof

Address Proof

A copy of your PAN card

Income/ Employment proof

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 17

The Processing and Verification of your Application

Once you have submitted all the necessary documents, the bank starts the process of verifying the

authenticity of your documents. They will check all the documents and may also call and talk to the references

provided in your application. Your employer may also be approached to check for the correctness

of the details that you have provided. Also, the verification may be expatiated if you operate a salary or loan

account of a fixed deposit with that bank.

Credit Score Check

Credit Score is an important determinant for your application getting accepted or rejected. A credit card is an

unsecured credit, so the issuer of your card would want to be doubly sure about your creditworthiness before

your application is accepted. The only way to do this is through your credit score. A good credit

score indicates that you behave responsibly towards credit and that makes you eligible for further credit.

The Final check

After the credit score and the initial documents check, a final check of all documents is carried out before

taking a call on either accepting or rejecting the application. If the application is accepted, the issuing bank

sets your credit limit based on your income and other deciding criteria like your credit score, etc. The

individual is intimated about the acceptance of the application. The approved credit card is then sent with

all the relevant documentation regarding the terms and conditions to the applicant.

Time taken for the approval

Generally, the entire process from submission to approval may take about 10-15 days depending upon the

kind of card you have applied, and the documents submitted.

Consortium & Syndication

Loan Syndication

A loan syndication usually occurs when multiple banks lend money to a borrower all at the same time and for

the same purpose. In a very general sense, a consortium is any group of individuals or entities that decide to

pool resources toward a given objective. A consortium is usually governed by a legal contract that delegates

responsibilities among its members. In the financial world, a consortium refers to several lending institutions

that group together to jointly finance a single borrower.

These multiple banking arrangements are very similar to a loan syndication, although there are structural and

operational differences between the two.

Loan syndications are generally reserved for loans involving international transactions, different

currencies, and necessary banking cooperation.

A consortium is usually governed by a legal contract that delegates responsibilities among its

members.

Consortium financing occurs for transactions that might not take place with a single lender.

While a loan syndication also involves multiple lenders and a single borrower, the term is generally reserved

for loans involving international transactions, different currencies, and a necessary banking cooperation to

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 18

guarantee payments and reduce exposure. A loan syndication is headed by a managing bank that is

approached by the borrower to arrange credit. The managing bank is generally responsible for negotiating

conditions and arranging the syndicate. In return, the borrower generally pays the bank a fee.

Loan syndication is the most common way for European and American corporations to seek financing from

banks and other lenders. In Europe, loan syndication is primarily driven by private equity sponsors, while in

the U.S., corporate borrowers and private equity sponsors drive the loan syndication market in equal

measures.

The managing bank in a loan syndication is not necessarily the majority lender, or "lead" bank. Any of the

participating banks may act as lead or assume the responsibilities of the managing bank depending on how

the credit agreement is drawn up.

A loan syndication is similar to a consortium, although there are structural and operational differences

between the two.

Consortium

Like a loan syndication, consortium financing occurs for transactions that might not take place with a single

lender. Several banks agree to jointly supervise a single borrower with a common appraisal, documentation,

and follow-up and own equal shares in the transaction. Unlike in a loan syndication, there is not one lead

bank that manages the financing project; all of the banks play an equal role in managing the project.

Consortiums are not built to handle international transactions such as a syndication loan. Instead, a

consortium may arise because the size of the project at hand is simply too large or too risky for any single

lender to assume. While loan syndications typically work across borders and may handle financing in different

currencies, consortiums typically occur within the boundaries of a given nation.

Sometimes the participating banks form a new consortium bank that functions by leveraging assets from

each institution and disbands after the project is complete. By allowing all of the members to pool their assets,

consortiums allow smaller banks to tackle larger projects.

In consortium lending system, two or more lenders join together to finance a single borrower. The lending

banks formally join together, by way of an inter-se agreement to meet the credit needs of a borrower. Here,

the sanction of limits to a borrower is completed with common appraisal, common documentation and

monitoring the advance with joint supervision and follow-up exercises.

The borrower company gives a mandate to a bank to lead the consortium, which is commonly referred as a

consortium lead (leader) bank. The consortium leader will be responsible for holding common loan/advance

documents executed by the borrower company on behalf of consortium. The “Pari-Passu” Charge will be

created on securities offered by the borrower company against the total credit extend to the company by all

the lending institutions of consortium. “Pari Passu” charge means that when Borrower entity goes into

dissolution or the security is sold or otherwise disposed –off by the consortium, the assets over which the

charge has been created will be distributed in proportion to the creditors’ (lenders) respective holdings.

Thus, the system of consortium lending offers scope and opportunity to share risk amongst banks. The

system is considered to be mutually beneficial to the banks as well as customers.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 19

In consortium advance, the levy of commitment charge is not mandatory and it is left to the discretion of the

financing banks/ consortium/syndicate. Accordingly, banks are free to evolve their own guidelines in regard

to commitment charge for ensuring credit discipline.

Micro Finance

Micro Finance in Nepal

The microfinance sector was served by cooperatives (1950-1960s) and normal banks (1970-1980s) until

1980, when a number of pilot projects and initiatives were implemented to introduce the financial and banking

services to help poor and women. However, few groups of poor people were benefited, but at the end these

service were found ineffective.

During the 1990s and early 2000s, the government moved further to strengthen the Microfinance Institutions

to provide financial service to poor and women, with the formation of five Regional Development Banks

(RDBs) in each Development region based of Grameen model with the sole objective to provide micro-credit

services to the poor and women. Eventually these Regional Development Banks transformed to

Microfinance Development Banks (MFDBs) after privatization and licensed as class 'D' financial Institutions.

Soon after in early 2000s, a number of private microfinance and NGOs came into existence with microfinance

programs. Under Grameen Model, NGOs such as Nirdhan Utthan Bank, Center for Self-help Development

(CDF) successfully implemented microfinance program and later transformed to Microfinance Development

Banks. Similarly other Microfinance Development Banks, Chhimek Bikas Bank Ltd. (CBB), Deprosc Bikas

Bank (DBB) and Nerude Microfinance Development Bank Ltd. (NMDB), were also formed.

During early 2000s, NGOs which were involved in community based financial activities were also legalized

and licensed by Nepal Rastra Bank (NRB) to formalize micro financing services, as a result Financial

Intermediary NGOs (FINGOs) were formed. Wholesale funding institutions were also formed during the early

2000s period. Nepal Rastra Bank formed Rural Self-Reliance Fund (RSRF) in the year 1991 to provide

financial assistance to NGOs and Cooperatives. Rural Microfinance Development Center (RMDC) is the one

such wholesale organization that was formed in 1998 under the Public Private Partnership (PPP) Program,

where Nepal Rastra Bank has 26% stake and remaining stakes hold by 13 commercial banks. Sana Kisan

Bikas Bank Ltd. (SKBBL) was formed in 2001 with the objective to finance Small Farmer Cooperatives Ltd.

(SFCLs) and the National Cooperative Development Bank (NCDB) was formed in 2003 to support and

finance the Cooperative organizations in the country. Nepal Rastra Bank, the central bank of the country

regulates the Microfinance Development Banks (MFDBs) and Financial Intermediary NGOs (FINGOs) while

the Small Farmer Cooperatives Ltd. (SFCL) and Savings and Credit Cooperatives (SACCOs) are governed

by Cooperative Laws.

All types of Microfinance services in the country are provided by Microfinance Institutions (MFIs) working as

regulated MFDBs, FINGOs, SFCL, and SACCOs.

Nirdhan Utthan Bank Ltd., Chhimek Bikas Bank Ltd., and Swabalamban Bikas Bank are the top three

Microfinance Institutions in the country.

Of the total borrowers under Microfinance Institutions, government Regional Development Banks serves

almost quarter of the total borrowers, Microfinance Development Banks (MFDBs) servers almost the half of

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 20

the borrowers and the remaining borrowers are serviced by FINGOs and Cooperatives.

There are various organizations in Nepal that regulates and supervises Microfinance Institutions, which are

listed below:

Microfinance—also called microcredit—is a way to provide small business owners and entrepreneurs access

to capital. Often these small and individual businesses don’t have access to traditional financial resources

from major institutions. This means it is harder to access loans, insurance, and investments that will help

grow their business.

Essentially, microfinance is providing loans, credit, access to savings accounts—even insurance policies and

money transfers––to the small business owner and entrepreneur. There are many such enterprises in the

developing world.

How Microfinancing Works

Microfinance, pioneered by the Nobel-Prize winner Muhammad Yunus, helps the financially marginalized by

providing them with the necessary capital to start a business and work toward financial independence. These

loans are significant because they are given even though the borrower has no collateral. However, the

interest rates for these microloans are often very high due to the risk of default.

The term microfinance encompasses microloans, micro-savings, and microinsurance. Microfinance

institutions provide small loans and other resources to business owners and entrepreneurs to help them get

their businesses off the ground. Many of the recipients are in developing countries, and could otherwise not

obtain a traditional loan.

Micro-savings accounts are also under the microfinance umbrella. They allow entrepreneurs to have a

savings account with no minimum balance. And microinsurance provides these borrowers with insurance, at

a lower rate, and with lesser premiums.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 21

Financial Literacy

Sometimes, those who receive microloans are required to take training courses. These courses include book-

keeping, cash flow management, and other relevant skills.

Access to cell phones and wireless internet around the world has also lent itself to the prevalence of

microfinance since potential borrowers can use their cell phones as banking channels.

Why Is It Important?

Microfinance is important because it provides resources and access to capital to the financially underserved,

such as those who are unable to get checking accounts, lines of credit, or loans from traditional banks.

Without microfinance, these groups may have to resort to using loans or payday advances with extremely

high-interest rates or even borrow money from family and friends. Microfinance helps them invest in their

businesses, and as a result, invest in themselves.

Who Benefits from Microfinancing?

While microfinance can certainly benefit those stateside, it can also serve as an important resource for those

in the developing world. For example, cell phones are being used as a way to bring financial services such

as microlending to those living in Kenya.

It’s also made headway in the United States, where burgeoning entrepreneurs with no collateral are able to

take out loans of less than $50,000 to jump-start their business ventures.8

Microfinance can also help women break the cycle of poverty. Often, these loans can be as small as $60.

For example, a young single mother from Paraguay took this small investment of $60 to start an empanada

and snack stand. She continued building her business, repaying this loan and taking out larger loans to buy

a building for her stand, complete with a refrigerator and attached home for her family. This is microfinance

at its best.

In fact, women are major microfinance borrowers, making up 80% of loans in 2018, according to the 2019

Microfinance Barometer. Around 65% of total borrowers live in rural areas, which means that a large number

of female microfinance borrowers live in rural areas with limited resources.

The microfinance industry is also growing rapidly. In 2018, there were 139.9 million microfinance borrowers,

for a total of $124 billion in loans. India accounted for most of these borrows, followed by Bangladesh, and

Vietnam.

Does It Actually Work?

While some have lauded microfinance as a way to end the cycle of poverty, decrease unemployment,

increase earning power, and aid the financially marginalized, some experts say that it may not work as well

as it should, even going so far as to say it’s lost its mission.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 22

Others argue that microfinance simply makes poverty worse since many borrowers use microloans to pay

for basic necessities, or their businesses fail, which only plunges them further into debt.

For example, in South Africa, 94% of all microfinance loans are used for consumption, meaning, the funds

are used to pay for basic necessities. This means borrowers aren’t generating new income with the initial

loan, which means they have to take out another loan to pay off that loan, and so forth and so forth. This

translates into a lot more debt.

However, other experts say that microfinance can serve as a valuable tool for the financially underserved

when used properly. They also cite the industry’s high repayment rate as proof of its effectiveness. Either

way, microfinance is an important topic in the financial realm, and if done correctly, could be a powerful tool

for many.

Documentary Credit (Bank Guarantee & Letter of Credit)

Letter of Credit (LC)

A letter of credit, or "credit letter" is a letter from a bank guaranteeing that a buyer's payment to a seller will

be received on time and for the correct amount. In the event that the buyer is unable to make a payment on

the purchase, the bank will be required to cover the full or remaining amount of the purchase. It may be

offered as a facility.

Due to the nature of international dealings, including factors such as distance, differing laws in each country,

and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect

of international trade.

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will

receive a buyer's payment on time and for the full amount.

Letters of credit are often used within the international trade industry.

There are many different letters of credit including one called a revolving letter of credit.

Banks collect a fee for issuing a letter of credit.

Because a letter of credit is typically a negotiable instrument, the issuing bank pays the beneficiary or any

bank nominated by the beneficiary. If a letter of credit is transferable, the beneficiary may assign another

entity, such as a corporate parent or a third party, the right to draw.

Banks also collect a fee for service, typically a percentage of the size of the letter of credit. The International

Chamber of Commerce Uniform Customs and Practice for Documentary Credits oversees letters of credit

used in international transactions. There are several types of letters of credit available.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of

undertaking (LoU), is a payment mechanism used in international trade to provide an

economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively

in the financing of international trade, where the reliability of contracting parties cannot be readily and easily

determined. Its economic effect is to introduce a bank as an underwriter, where it assumes the counterparty

risk of the buyer paying the seller for goods.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 23

A letter of credit is a document from a bank that guarantees payment. There are several types of letters of

credit, and they can provide security when buying and selling products or services.

Seller protection: If a buyer fails to pay a seller, the bank that issued a letter of credit must pay the

seller as long as the seller meets all of the requirements in the letter. This provides security when

the buyer and seller are in different countries.

Buyer protection: Letters of credit can also protect buyers. If you pay somebody to provide a

product or service and they fail to deliver, you might be able to get paid using a standby letter of

credit. That payment can be a penalty to the company that was unable to perform, and it’s similar to

a refund. With the money you receive, you can pay somebody else to provide the product or service

needed.

Example

A manufacturer receives an order from a new customer overseas. The manufacturer has no way of

knowing if this customer can (or will) pay for the goods after producing and shipping the products.

To manage risk, the seller uses an agreement that requires the buyer to pay with a letter of credit as

soon as shipment is made.

To move forward, the buyer needs to apply for a letter of credit at a bank in their home country. The

buyer may need to have funds on hand at that bank or get approval for financing from the bank.

The bank will only release funds to the seller after the seller proves that the shipment happened. To

do so, the seller typically provides documents showing how goods were shipped (with details like the

exact dates, destination, and contents). In some ways, the buyer also enjoys protection under a letter

of credit: Buyers might prefer to pay a bank with a big legal department rather than send the money

directly to an unknown seller.

If the buyer is concerned about a dishonest seller, there are additional options available for the

buyer’s protection. For example, somebody can inspect the shipment before the payment is

released.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 24

To better understand letters of credit, it helps to know the terminology.

Applicant: The party who requests the letter of credit. This is the person or organization that will pay

the beneficiary. The applicant is often (but not always) an importer or buyer who uses the letter of

credit to make a purchase.

Beneficiary: The party who receives payment. This is usually a seller or exporter who has requested

that the applicant use a letter of credit (because the beneficiary wants more security).

Issuing bank: The bank that creates or issues the letter of credit at the applicant’s request. It is

typically a bank where the applicant already does business (in the applicant’s home country, where

the applicant has an account or a line of credit).

Negotiating bank: The bank that works with the beneficiary. This bank is often located in the

beneficiary’s home country, and it may be a bank where the beneficiary is already a customer. The

beneficiary submits documents to the negotiating bank, and the negotiating bank acts as a liaison

between the beneficiary and the other banks involved.

Confirming bank: A bank that “guarantees” payment to the beneficiary as long as the requirements

in the letter of credit are satisfied. The issuing bank already guarantees payment, but the beneficiary

may prefer a guarantee from a bank in their home country (with which they are more familiar). This

may be the same bank as the negotiating bank.

Advising bank: The bank that receives the letter of credit from the issuing bank and notifies the

beneficiary that the letter is available. This bank is also known as the notifying bank, and may be the

same bank as the negotiating bank and the confirming bank.

Intermediary: A company that connects buyers and sellers, and which sometimes uses letters of

credit to facilitate transactions. Intermediaries often use back-to-back letters of credit (or transferable

letters of credit).

Freight forwarder: A company that assists with international shipping. Freight forwarders often

provide the documents exporters need to provide in order to get paid.

Shipper: The company that transports goods from place to place.

Legal counsel: A firm that advises applicants and beneficiaries on how to use letters of credit. It’s

essential to get help from an expert who is familiar with these transactions.

Several categories of LC's exist which seek to operate in different markets and solve different issues. An

example of these include:

Import/export(Commercial): — The same credit can be termed an import or export letter of credit

depending on whose perspective is considered. For the importer it is termed an Import LC and for the

exporter of goods, an Export LC.

Revocable/ Irrevocable: — Whether a LC is revocable or irrevocable determines whether the buyer

and the issuing bank are able to manipulate the LC or make corrections without informing or getting

permissions from the seller. According to UCP 600, all LCs are irrevocable, hence in practice the

revocable type of LC is increasingly obsolete. Any changes (amendment) or cancellation of the LC

(except when expired) is done by the applicant (buyer) through the issuing bank. It must be authenticated

and approved by the beneficiary (seller).

Confirmed/Unconfirmed: — An LC is said to be confirmed when a second bank adds its confirmation

(or guarantee) to honor a complying presentation at the request or authorization of the issuing bank.

UJJWAL MARAHATTA | PRESIDENCY COLLEGE 25