Professional Documents

Culture Documents

1234

Uploaded by

Michael ScofieldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1234

Uploaded by

Michael ScofieldCopyright:

Available Formats

Below is the condensed Statement of Financial Position of Sons, Inc.

, along with estimates of fair

values. Pop, Inc. is planning to acquire Sons by issuing 100,000 shares of its P1 par value ordinary

shares (market value P8/share) in exchange for all the assets and liabilities of Sons. Pop also

guarantees the value of its shares issued. The expected present value of this stock price contingency

is P200,000. Pre-Combination Condensed Statement of Financial Position of Sons, Inc. Book value

Fair value Current assets P 380,000 P 350,000 Plant assets ___740,000 810,000 Total assets

P1,120,000 Liabilities P 500,000 450,000 Ordinary shares 50,000 Share premium 170,000 Retained

earnings ___400,000 Total liabilities and equity P1,120,000 Required: Prepare Pops’

(acquirer/acquiring) entry(ies) to record the acquisition.

35.. Westport Ltd., a supplier of snooker equipment, agreed to acquire the business of a rival firm,

Manukau Ltd. taking over all assets and liabilities as at 1 June 20x4.

The price agreed upon was P40,000, payable P20,000 cash and the balance by the issue to the

selling company of 16,000 fully paid shares in Westport Ltd. these shares having a fair value of P2.50

per share.

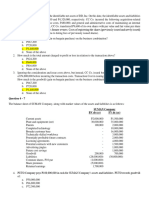

The trial balances of the two companies as at 1 June 20x4 were as follows.

Westport Ltd.

Manukau Ltd.

Dr. Cr. Dr.

Cr.

Share capital P100,000

P 90,000

Retained earnings 12,000 P 24,000

Accounts payable 2,000

20,000

Cash P30,000 -

Plant (net) 50,000 30,000

Inventory 14,000 26,000

Accounts receivable 8,000 20,000

Government bonds 12,000 -

Goodwill - -

.

P114,000 P114,000 P110,000

P110,000

All the identifiable net assets of Manukau Ltd. were recorded by Manukau Ltd. at fair value except for

the inventory which was considered to be worth P28,000. The plant had an expected remaining life of

five years.

The business combination was completed and Manukau Ltd. went into liquidation. Westport Ltd.

incurred incidental costs of P500 in relation to the acquisition costs. Costs of issuing shares in

Westport Ltd. were P400. The amount of goodwill to:

a. Nil or zero

b. P2,500

c. P2,900

d. P3,900

You might also like

- 35Document1 page35Michael ScofieldNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- For Questions 6Document3 pagesFor Questions 6Meghan Kaye LiwenNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- Accounting Ae2020Document3 pagesAccounting Ae2020elsana philipNo ratings yet

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- Problem 1: 105,000 - Correct AnswerDocument1 pageProblem 1: 105,000 - Correct AnswerSophia MilletNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20John Carlos Doringo100% (1)

- Mergers and Inv in SubsDocument4 pagesMergers and Inv in Subsmartinfaith958No ratings yet

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Follow-Up Problem SubsequentDocument4 pagesFollow-Up Problem SubsequentasdasdaNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocument32 pagesPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- Total Assets Stockholders' Equity A. P4,170,000 P2,570,000 B. P4,190,000 P2,590,000 C. P4,562,000 P2,450,000 D. P4,562,000 P2,500,000Document2 pagesTotal Assets Stockholders' Equity A. P4,170,000 P2,570,000 B. P4,190,000 P2,590,000 C. P4,562,000 P2,450,000 D. P4,562,000 P2,500,000Wawex DavisNo ratings yet

- Illustrative Problem 4-2Document5 pagesIllustrative Problem 4-2Nicole Anne Santiago SibuloNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Abc-Problems With SolutionsDocument5 pagesAbc-Problems With SolutionsJohn JackNo ratings yet

- Business Combination by DayagDocument37 pagesBusiness Combination by Dayagkristian Garcia85% (13)

- Midterm HahaDocument33 pagesMidterm HahaCarl Elmo Bernardo MurosNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- 08 Business CombinationDocument9 pages08 Business CombinationtrishaNo ratings yet

- Advance Accounting Book 1Document206 pagesAdvance Accounting Book 1genc22185% (13)

- PREA4Document7 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFdareal laguardiaNo ratings yet

- Business Combination Quiz 1Document5 pagesBusiness Combination Quiz 1Ansherina AquinoNo ratings yet

- P2 Guerrero CH 08 Business CombinationDocument12 pagesP2 Guerrero CH 08 Business CombinationRay Allen PabiteroNo ratings yet

- CHAPTER 1 - Partnership - Basic Considerations and FormationDocument21 pagesCHAPTER 1 - Partnership - Basic Considerations and FormationJamie Rose Aragones100% (1)

- Seatwork On Business Combination Stock AcquisitionDocument2 pagesSeatwork On Business Combination Stock AcquisitionceistNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Bus Com 13Document4 pagesBus Com 13Chabelita MijaresNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- Accounting For Special Transaction 1Document9 pagesAccounting For Special Transaction 1Timon CarandangNo ratings yet

- Business CombDocument2 pagesBusiness CombMichael ScofieldNo ratings yet

- Fees Are P100Document1 pageFees Are P100Michael ScofieldNo ratings yet

- Business CombDocument2 pagesBusiness CombMichael ScofieldNo ratings yet

- Business CombDocument2 pagesBusiness CombMichael ScofieldNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Below Is The Condensed Statement of Financial Position of SonsDocument1 pageBelow Is The Condensed Statement of Financial Position of SonsMichael ScofieldNo ratings yet

- The Communicsation Flow ChartDocument2 pagesThe Communicsation Flow ChartMichael ScofieldNo ratings yet

- The Communicsation Flow ChartDocument2 pagesThe Communicsation Flow ChartMichael ScofieldNo ratings yet

- The Communicsation Flow ChartDocument2 pagesThe Communicsation Flow ChartMichael ScofieldNo ratings yet

- The Communicsation Flow ChartDocument2 pagesThe Communicsation Flow ChartMichael ScofieldNo ratings yet

- The Communicsation Flow ChartDocument2 pagesThe Communicsation Flow ChartMichael ScofieldNo ratings yet

- Fundamentals of Economics - Chapter 9Document13 pagesFundamentals of Economics - Chapter 9Alya SyakirahNo ratings yet

- Private Sector Banks Set 1Document5 pagesPrivate Sector Banks Set 1bharat.chauhan7717No ratings yet

- MKT 730fundamentals of MarketingDocument252 pagesMKT 730fundamentals of Marketingjoseph emmanuelNo ratings yet

- Euro ComissionDocument168 pagesEuro ComissionForkLogNo ratings yet

- 5.6.1 Unintended Consequences of Rent Control in The Philippines - 0Document30 pages5.6.1 Unintended Consequences of Rent Control in The Philippines - 0Maisie SuyatNo ratings yet

- Chapter 40 IFRIC InterpretationsDocument5 pagesChapter 40 IFRIC InterpretationsEllen MaskariñoNo ratings yet

- 3.earnings Per ShareDocument13 pages3.earnings Per ShareTsekeNo ratings yet

- Business Management LatestDocument16 pagesBusiness Management LatestNathaniel T. GuanzonNo ratings yet

- Meet The Multibagger Expert Manish GoyalDocument4 pagesMeet The Multibagger Expert Manish GoyalhukaNo ratings yet

- Exercise No. 3Document2 pagesExercise No. 3Quenny RasNo ratings yet

- 124.J & P Services Pty Limited ABNDocument2 pages124.J & P Services Pty Limited ABNFlinders TrusteesNo ratings yet

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- International Marketing Module 6 - Global Competitors Global Firms vs. Global FirmsDocument3 pagesInternational Marketing Module 6 - Global Competitors Global Firms vs. Global FirmsRenato GayaniloNo ratings yet

- Quiz 2.docx Afar 2Document2 pagesQuiz 2.docx Afar 2Ella Turato100% (1)

- Fabiz II Standard CostingDocument1 pageFabiz II Standard Costingrux_l_andraNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana - Claim Form: (To Be Completed by The Claimant & Bank)Document2 pagesPradhan Mantri Jeevan Jyoti Bima Yojana - Claim Form: (To Be Completed by The Claimant & Bank)srajan sahu100% (2)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- 05 Activity 1 BusinessTaxDocument2 pages05 Activity 1 BusinessTaxJoannie Cercado RabiaNo ratings yet

- Dates Fresh and Dried Sector 2021Document13 pagesDates Fresh and Dried Sector 2021FileuploaderNo ratings yet

- Iqcert International LTD.: Documents Checklist For Grs & RcsDocument3 pagesIqcert International LTD.: Documents Checklist For Grs & RcsMd. Samirul Islam100% (2)

- Captive Insurance Times-12.02.21Document26 pagesCaptive Insurance Times-12.02.21kidamanNo ratings yet

- Solutions To Marginal Costing PDFDocument5 pagesSolutions To Marginal Costing PDFkota surya chandraNo ratings yet

- Cost Acc Chapter 7Document14 pagesCost Acc Chapter 7ElleNo ratings yet

- B Ethiopia Commercial LawDocument165 pagesB Ethiopia Commercial Lawesayasserbesa60No ratings yet

- Tugas ForumDocument4 pagesTugas Forumarif budi hermansahNo ratings yet

- Vinastraws Competitive StrategyDocument12 pagesVinastraws Competitive StrategyNguyễn Việt NgaNo ratings yet

- Managerial Economics, 5th Edition PDFDocument427 pagesManagerial Economics, 5th Edition PDFAzoooNo ratings yet

- Market Risk Management: Eymen Errais, PHD, FRMDocument17 pagesMarket Risk Management: Eymen Errais, PHD, FRMMalek OueriemmiNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet