Professional Documents

Culture Documents

Is Shareholder Wealth Maximization A Worldwide Goal

Is Shareholder Wealth Maximization A Worldwide Goal

Uploaded by

Shakeel IqbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is Shareholder Wealth Maximization A Worldwide Goal

Is Shareholder Wealth Maximization A Worldwide Goal

Uploaded by

Shakeel IqbalCopyright:

Available Formats

Is Shareholder Wealth Maximization a Worldwide

Goal?

Most academics agree that shareholder wealth maximization should be a firm’s

primary goal, at least in the United States; however, it’s not clear that people really

know how to implement it. Pricewaterhouse- Coopers (PWC), a global consulting

firm, conducted a survey of 82 Singapore companies to test their understanding

and implementation of shareholder value concepts. Ninety percent of the

respondents said their firm’s primary goal was to enhance shareholder value, but

only 44 percent had taken steps to achieve this goal. Moreover, almost half of the

respondents who had shareholder value programs in place said they were

dissatisfied with the results achieved thus far. Even so, respondents who focused

on shareholder value were more likely to believe that their stock was fairly valued

than those with other focuses, and 50 percent of those without a specific program

said they wanted to learn more and would probably adopt one eventually.

The study found that firms measure performance primarily with accounting-based

measures such as the returns on assets, on equity, or on invested capital. These

measures are easy to understand and thus to implement, even though they might

not be the best conceptually. Compensation was tied to shareholder value, but only

for mid-level managers and above.

It is unclear how closely these results correspond to U.S. firms, but firms from the

United States and Singapore would certainly agree on one thing: It is easier to set

the goal of shareholder wealth maximization than it is to figure out how to achieve

it.

Source: Kalpana Rashiwala, “Low Adoption of Shareholder Value Concepts Here,” The Business Times

(Singapore), February 14, 2002.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Solutions Discussion Questions Lecture 1 SFDocument3 pagesSolutions Discussion Questions Lecture 1 SFShakeel IqbalNo ratings yet

- Information System and System SecurityDocument31 pagesInformation System and System SecurityShakeel IqbalNo ratings yet

- Sukuk As An Alternative Source of Funds For The Nigerian GovernmentDocument11 pagesSukuk As An Alternative Source of Funds For The Nigerian GovernmentShakeel IqbalNo ratings yet

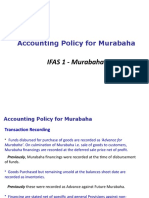

- Murabaha AccountingDocument15 pagesMurabaha AccountingShakeel IqbalNo ratings yet

- Internet and World Wide WebDocument46 pagesInternet and World Wide WebShakeel IqbalNo ratings yet

- ADDITIONAL READINGS Lecture 3Document3 pagesADDITIONAL READINGS Lecture 3Shakeel IqbalNo ratings yet

- Afs - Practice Question SolutionsDocument3 pagesAfs - Practice Question SolutionsShakeel IqbalNo ratings yet

- Analysis of Financial Statements - Practice QuesitonsDocument3 pagesAnalysis of Financial Statements - Practice QuesitonsShakeel IqbalNo ratings yet

- Measuring The Market: A Stock Index Is Designed To Show The Performance of The Stock Market. TheDocument2 pagesMeasuring The Market: A Stock Index Is Designed To Show The Performance of The Stock Market. TheShakeel IqbalNo ratings yet

- Looking For Warning Signs Within The Financial StatementsDocument4 pagesLooking For Warning Signs Within The Financial StatementsShakeel IqbalNo ratings yet

- Accounting:: Information For Decision MakingDocument21 pagesAccounting:: Information For Decision MakingShakeel IqbalNo ratings yet

- Striking The Right BalanceDocument2 pagesStriking The Right BalanceShakeel IqbalNo ratings yet