Professional Documents

Culture Documents

Imf Intro, Facts & History: The Main Objectives of IMF, As Noted in The Articles of Agreement, Are As Follows

Uploaded by

Devanshi RawatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Imf Intro, Facts & History: The Main Objectives of IMF, As Noted in The Articles of Agreement, Are As Follows

Uploaded by

Devanshi RawatCopyright:

Available Formats

IMF INTRO, FACTS & HISTORY

To promote global economic growth and financial stability, the International Monetary Fund

is based in Washington, D.C. The IMF was established in the year 1945 and is an

organization of 189 countries. It is governed and accountable to the member countries that

contribute to its near-global membership. It is an autonomous organization affiliated to

U.N.O. The IMF has a fundamental mission to ensure the stability of the International

Monetary System.

The IMF was originally established with 30 member countries which later grew to 190 in

1987.

The headquarters of the IMF is located in the country having the highest capital quota of the

Fund.

In the year 1944, the representatives of 44 nations met to figure out a plan for the economic

order after World War II.

The aim was to prevent the repetition of destructive policies that could lead to other conflicts

or issues.

Therefore, the International Monetary Fund was created. It has played a crucial role in

maintaining economic and financial stability globally.

OBJECTIVES

The main objectives of IMF, as noted in the Articles of Agreement, are as follows:

(i)International Monetary Co-Operation:

The most important objective of the Fund is to establish international monetary co-operation

amongst the various member countries through a permanent institution that provides the

machinery for consultation and collaborations in various international monetary problems and

issues.

(ii) Ensure Exchange Stability:

Another important objective of the Fund is to ensure stability in the foreign exchange rates by

maintaining orderly exchange arrangement among members and also to rule out unnecessary

competitive exchange depreciations.

(iii) Balanced Growth of Trade:

IMF has also another important objective to promote international trade so as to achieve its

required expansion and balanced growth. This would ensure development of production

resources and thereby promote and maintain high levels of income and employment among

all its member countries.

(iv) Eliminate Exchange Control:

Another important objective of the Fund is to eliminate or relax exchange controls imposed

by almost each and every country before Second World War as a device to deliberately fix

the exchange rate at a particular level. Such elimination of exchange controls was made so as

to give encouragement to the flow of international trade.

(v) Multilateral Trade and Payments:

To establish a multilateral trade and payment system in respect to current transactions

between members in place of the old system of bilateral trade agreements was another

important objective of IMF.

(vi) Balanced Growth:

Another objective of IMF is to help the member countries, especially the backward countries,

to attain balanced economic growth by exchange the level of employment.

(vii) Correction of BOP Maladjustments:

IMF also helps the member countries in eliminating or reducing the disequilibrium or

maladjustments in balance of payments. Accordingly, it gives confidence to members by

selling or lending Fund’s foreign currency resources to the member nations.

(viii) Promote Investment of Capital:

Finally, the IMF also promotes the flow of capital from richer to poorer or backward

countries so as to help the backward countries to develop their own economic resources for

attaining higher standard of living for its people, in general.

FUNCTIONS

The IMF performs a wide array of functions. The major functions of IMF which are as

follows:-

Attain stability in exchange rates

The IMF functions to maintain stability in exchange rates and discouraging fluctuations in the

rates of exchange.

It is one of the primary functions of the IMF. It makes several arrangements to enforce and

maintain the same.

Eradicate the disequilibrium in Balance of Payment

The fund works to help the member countries in eradicating or minimizing the balance of

payment disequilibrium over a short period or long period by selling or lending foreign

currencies to its members.

Maintain the credit facilities

The IMF maintains various borrowing and credit facilities to help the member countries in

correcting disequilibrium in the balance of payments.

There are several credit facilities such as basic credit facility, compensatory financing

facility, extended fund facility, and more. The fund can charge interest on the credits as well.

Maintain currency demand and supply

One important function of the IMF is to maintain the balance between demand and supply of

currencies.

The fund, as required, can declare a currency as a scare one in case of high demand and can

increase its supply by borrowing from the concerned country or purchasing the currency in

exchange for gold.

Maintaining liquidity of resources

The next important function of the IMF is to maintain the liquidity of its resources. The

member countries can borrow from the IMF by surrendering their currencies in exchange.

Monitoring the monetary and fiscal policies

The IMF has a function of monitoring the fiscal and monetary policies of its member nations.

This is done to determine the impact of the policies on the economy and other nations as well.

Also, it is used for various other analysis purposes as well.

Serve as the bank of Central Banks

The IMF is known as the bank of the Central banks of the member countries. It collects the

resources of the Central banks similar to the country’s central bank.

Impart training

The IMF provides training to the representatives of the member nations and staff. The

training which the IMF provides is to the senior officers of the finance departments and

central banks of the countries.

DIFFERENCE BETWEEN WORLD BANK AND IMF

Basis of

The International Monetary Fund The World Bank

Comparison

It is an international organization It is a global organization

Meaning that maintains the global monetary established to advise and finance

system. the emerging and developing

nations to make them

economically developed.

The World bank consists of five

The IMF is a single organization

organisations. The two major

having four credit lines as follows:

institutions are as follows: The

Organizational Board of DirectorsInternational

International Bank for

Structure Monetary and Financial

Reconstruction and Development

CommitteeExecutive

(IBRD)The International

BoardManaging Director

Development Association (IDA)

The IMF offers technical and The World Bank operates to

Operations advisory assistance to its members facilitate lending to its member

for developing the nations. nations.

To deal with matters that relate to To decrease or eradicate poverty

Objectives macroeconomics and financial levels and to promote economic

sector development

You might also like

- The Web3 Cheat Sheet by Web3 Simplified V2Document13 pagesThe Web3 Cheat Sheet by Web3 Simplified V2Lone SurvivorNo ratings yet

- BTC FMT CodeDocument6 pagesBTC FMT Codeall.service.supt100% (5)

- Role of International Financial InstitutionsDocument26 pagesRole of International Financial InstitutionsSoumendra RoyNo ratings yet

- A Study On Cryptocurrency in IndiaDocument12 pagesA Study On Cryptocurrency in IndiaReetika JainNo ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- What Does International Monetary FundDocument4 pagesWhat Does International Monetary FundSanthosh T KarthickNo ratings yet

- Itl Unit IDocument4 pagesItl Unit IShrabani KarNo ratings yet

- Why The IMF Was Created and How It WorksDocument14 pagesWhy The IMF Was Created and How It Worksnaqash sonuNo ratings yet

- Beyond the World Bank Agenda: An Institutional Approach to DevelopmentFrom EverandBeyond the World Bank Agenda: An Institutional Approach to DevelopmentNo ratings yet

- Top 100 Richest Bitcoin Addresses and Bitcoin DistributionDocument4 pagesTop 100 Richest Bitcoin Addresses and Bitcoin DistributionJordy AssilaNo ratings yet

- International InsititutionDocument23 pagesInternational InsititutionNelsonMoseMNo ratings yet

- Entrepreneurship AssignmentDocument28 pagesEntrepreneurship AssignmentDevanshi Rawat100% (1)

- International Monetary FundDocument5 pagesInternational Monetary FundDolphin sharkNo ratings yet

- International Monetary FundDocument8 pagesInternational Monetary FundNaruChoudharyNo ratings yet

- Supranational InstitutionDocument9 pagesSupranational InstitutionJoseph OkpaNo ratings yet

- Imf 190911Document4 pagesImf 190911Muhammad BilalNo ratings yet

- Formation of IMF: Organization With 190 Member Countries That Aims ToDocument5 pagesFormation of IMF: Organization With 190 Member Countries That Aims Tosuanshu15No ratings yet

- Bbi Institutional SupportDocument13 pagesBbi Institutional SupportChirag KotianNo ratings yet

- PSM 204 Role and Functions of IMFDocument16 pagesPSM 204 Role and Functions of IMFZubair JuttNo ratings yet

- International OrganisationsDocument18 pagesInternational OrganisationsAnjaliPuniaNo ratings yet

- International Monetary FundDocument14 pagesInternational Monetary FundArsaha FatimaNo ratings yet

- International Monetary Fund: JatinDocument18 pagesInternational Monetary Fund: JatinADVENTURE ARASANNo ratings yet

- About The IMFDocument6 pagesAbout The IMFkiranaishaNo ratings yet

- Part 1Document16 pagesPart 1Tanuja PuriNo ratings yet

- Internation Financial Institution G1 052202Document31 pagesInternation Financial Institution G1 052202KaiNo ratings yet

- International Financial InstitutionsDocument10 pagesInternational Financial InstitutionsdrgandhalikhargeNo ratings yet

- Role of International Financial InstitutionsDocument26 pagesRole of International Financial InstitutionsSoumendra RoyNo ratings yet

- ImfDocument2 pagesImfMarinellaNo ratings yet

- L-32, International Monetary Fund (IMF)Document17 pagesL-32, International Monetary Fund (IMF)Surya BhardwajNo ratings yet

- The Role of IMF in Public Policy MakingDocument4 pagesThe Role of IMF in Public Policy Makingantara nodiNo ratings yet

- About IMFDocument17 pagesAbout IMFvinay sainiNo ratings yet

- In Unit 5Document16 pagesIn Unit 5RoomNo ratings yet

- Uni. Ref Book - Page Nos - 123/136 (M3)Document9 pagesUni. Ref Book - Page Nos - 123/136 (M3)emmanuel JohnyNo ratings yet

- Lesson 3 IMF&World BankDocument7 pagesLesson 3 IMF&World BankDave Mariano BataraNo ratings yet

- Difference Between IMF and World BankDocument2 pagesDifference Between IMF and World BankMomal JavedNo ratings yet

- The International Monetary Fund (IMF)Document3 pagesThe International Monetary Fund (IMF)basit ubasitNo ratings yet

- International Business Assignment (IMF)Document13 pagesInternational Business Assignment (IMF)Siddharth AgarwalNo ratings yet

- International Monetary Fund (IMF) : Name: Eesha Arshad Class and Semester: MDDS-II Course: International OrganizationDocument7 pagesInternational Monetary Fund (IMF) : Name: Eesha Arshad Class and Semester: MDDS-II Course: International Organizationayesha amirNo ratings yet

- FIN 004 Module 2 PPT Part 1Document2 pagesFIN 004 Module 2 PPT Part 1lianna marieNo ratings yet

- Presentation On IMF and Its Working: Presented by Sandhya Roll No-1430220025 M.A. Eco (Final) Govt. COLLEGE BhiwaniDocument18 pagesPresentation On IMF and Its Working: Presented by Sandhya Roll No-1430220025 M.A. Eco (Final) Govt. COLLEGE Bhiwanidhruv hansNo ratings yet

- International Monetary FundDocument6 pagesInternational Monetary FundHarsh PanchalNo ratings yet

- Week Three - International Financial InstitutionsDocument22 pagesWeek Three - International Financial InstitutionsFestus MuriukiNo ratings yet

- Imf ProjectDocument17 pagesImf ProjectkitkomalNo ratings yet

- Unit-2 - International Financial Institutions Markets - Lecture Note - ConsolidatedDocument30 pagesUnit-2 - International Financial Institutions Markets - Lecture Note - ConsolidatedNeerajNo ratings yet

- DocumentDocument3 pagesDocumentNirbhay SinghNo ratings yet

- World Bank and IMFDocument14 pagesWorld Bank and IMFaditya saiNo ratings yet

- Financial Administration and Development Aid: E8: Contemporary Administrative SystemsDocument40 pagesFinancial Administration and Development Aid: E8: Contemporary Administrative SystemsprabodhNo ratings yet

- ImfDocument24 pagesImfKethavath Poolsing100% (2)

- S.K School of Business ManagementDocument16 pagesS.K School of Business ManagementchthakorNo ratings yet

- What Is The OriginDocument7 pagesWhat Is The Originabdullah al mamunNo ratings yet

- Bus 685 Group AssignmentDocument18 pagesBus 685 Group AssignmentAnnoor Ayesha Siddika 1411306042No ratings yet

- Role of IMF in International Monetary System - 2 - 2Document18 pagesRole of IMF in International Monetary System - 2 - 2Sushma VegesnaNo ratings yet

- International BusinessDocument21 pagesInternational BusinessBhavana JainNo ratings yet

- Contemporary - IMF and WBDocument11 pagesContemporary - IMF and WBShanlane CoronelNo ratings yet

- Sanya Gupta Pol SC PDFDocument15 pagesSanya Gupta Pol SC PDFsanyagupta966No ratings yet

- Module 21 International Trade & OrganizationsDocument33 pagesModule 21 International Trade & Organizationsg.prasanna saiNo ratings yet

- International Monetary Fund (Imf) : Read OnDocument3 pagesInternational Monetary Fund (Imf) : Read OnBabamu Kalmoni JaatoNo ratings yet

- Imf and World BankDocument3 pagesImf and World BankSHAMAPRASAD H P SDM College(Autonomous), UjireNo ratings yet

- Market IntegrationDocument19 pagesMarket Integrationangelnicole.arceloNo ratings yet

- International Monetary FundDocument13 pagesInternational Monetary FundHIMANSHU PATHAKNo ratings yet

- Post WW II Economic OrderDocument62 pagesPost WW II Economic OrderrahmadNo ratings yet

- International Financial InstitutionsDocument37 pagesInternational Financial InstitutionsYash AgarwalNo ratings yet

- India’s Relations With The International Monetary Fund (IMF): 25 Years In Perspective 1991-2016From EverandIndia’s Relations With The International Monetary Fund (IMF): 25 Years In Perspective 1991-2016No ratings yet

- International Finance Regulation: The Quest for Financial StabilityFrom EverandInternational Finance Regulation: The Quest for Financial StabilityNo ratings yet

- FCFMDocument11 pagesFCFMDevanshi RawatNo ratings yet

- Gen Z'S Perception of Fashion Rentals222Document42 pagesGen Z'S Perception of Fashion Rentals222Devanshi RawatNo ratings yet

- Fashion Material Management & Quality: Assignment - 1 Fabric AnalysisDocument35 pagesFashion Material Management & Quality: Assignment - 1 Fabric AnalysisDevanshi RawatNo ratings yet

- Sologenic OnepagerDocument1 pageSologenic OnepagerzhullkhadriansyaNo ratings yet

- Chapter 1 Eco561Document32 pagesChapter 1 Eco561norshaheeraNo ratings yet

- Chap12 PDFDocument38 pagesChap12 PDFBelindaNo ratings yet

- Standard Fireworks Sivakasi Wholesale Pricelist 2016Document10 pagesStandard Fireworks Sivakasi Wholesale Pricelist 2016Preemnath KatareNo ratings yet

- IBF301 Ch006 2020Document38 pagesIBF301 Ch006 2020Giang PhanNo ratings yet

- Interest Rate ParityDocument2 pagesInterest Rate ParityPradeepNo ratings yet

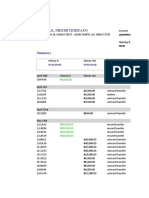

- Customer StatementDocument20 pagesCustomer StatementDonaldNo ratings yet

- Estimation and Roonding of Numbers GR 4Document16 pagesEstimation and Roonding of Numbers GR 4MaghrifahAkriyaniFiftiNo ratings yet

- Cryptoscam Floki Imu WhitepaperDocument14 pagesCryptoscam Floki Imu WhitepaperWhatNo ratings yet

- A Contrary View On Indian Economic Crisis of 1991: AbstractDocument11 pagesA Contrary View On Indian Economic Crisis of 1991: AbstractSujay MudagalNo ratings yet

- Solidus FinanceDocument11 pagesSolidus Finance4242424No ratings yet

- Customer Satisfaction in Forex PDFDocument41 pagesCustomer Satisfaction in Forex PDFRajkumar VrNo ratings yet

- Unit B PDFDocument25 pagesUnit B PDFsanjuNo ratings yet

- Gold As A Strategic Asset - 2024 EditionDocument18 pagesGold As A Strategic Asset - 2024 EditionNointingNo ratings yet

- Star Net ClientDocument8 pagesStar Net ClientXyz YxzNo ratings yet

- Fedai RulesDocument36 pagesFedai RulesManipal SinghNo ratings yet

- Introduction To DerivativesDocument38 pagesIntroduction To DerivativesDhawal RajNo ratings yet

- "A Comprehensive Study of Currency Market in India.": A Dissertation Report ONDocument64 pages"A Comprehensive Study of Currency Market in India.": A Dissertation Report ONBerkshire Hathway coldNo ratings yet

- 23 4Document5 pages23 42103010030No ratings yet

- The Bretton Woods SystemDocument21 pagesThe Bretton Woods SystemSatesh RauNo ratings yet

- Zeropay Airdrop #1 WinnersDocument22 pagesZeropay Airdrop #1 Winnersmuhafira hifaNo ratings yet

- Chapter 3Document22 pagesChapter 3Feriel El IlmiNo ratings yet

- Test Bank For International Economics 13th Edition Dominick SalvatoreDocument4 pagesTest Bank For International Economics 13th Edition Dominick Salvatorerillefroweyt4mNo ratings yet

- Currency Recognition System Using Image Processing: Libyan Banknote As A Case StudyDocument5 pagesCurrency Recognition System Using Image Processing: Libyan Banknote As A Case StudyVelumani sNo ratings yet

- Suggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdDocument12 pagesSuggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdkinikinayyNo ratings yet