Professional Documents

Culture Documents

Butler Lumber Company Income Statements and Projections 1988-1991

Uploaded by

puspemoltuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Butler Lumber Company Income Statements and Projections 1988-1991

Uploaded by

puspemoltuCopyright:

Available Formats

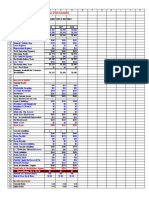

BUTLER LUMBER COMPANY

Income Statement

Operating Statements for Years Ending December 31, 1988-1990, and

for First Quarter 1991 (thousands of dollars)

1st Qtr

1988 1989 1990 1991

Net sales $1,697 $2,013 $2,694 $718

Cost of goods sold:

Beginning inventory $183 $239 $326 $418

Purchases $1,278 $1,524 $2,042 $660

$1,461 $1,763 $2,368 $1,078

Ending inventory $239 $326 $418 $556

Total cost of goods sold $1,222 $1,437 $1,950 $522

Gross Profit $475 $576 $744 $196

Operating expenses $425 $515 $658 $175

Interest expense $13 $20 $33 $10

Net income before income taxes $37 $41 $53 $11

Provision for income taxes $6 $7 $9 $2

Net income $31 $34 $44 $9

BUTLER LUMBER COMPANY

Balnce Sheet

Balance Sheets at December 31, 1988-1990, and March 31, 1991 (thousands of dollars)

1st Qrtr

1988 1989 1990 1991

Cash $58 $49 $41 $31

Accounts receivable, net $171 $222 $317 $345

Inventory $239 $325 $418 $556

Current assets $468 $596 $776 $932

Property, net $126 $140 $157 $162

Total assets $594 $736 $933 $1,094

Notes payable, bank $0 $146 $233 $247

Notes payable, Mr. Stark $105 $0 $0 $0

Notes payable, trade $0 $0 $0 $157

Accounts payable $124 $192 $256 $243

Accrued expenses $24 $30 $39 $36

Long-term debt, current portion $7 $7 $7 $7

Current liabilities $260 $375 $535 $690

Long-term debt $64 $57 $50 $47

Total liabilities $324 $432 $585 $737

Net worth $270 $304 $348 $357

Total liabilities & net worth $594 $736 $933 $1,094

COMMON SIZE STATEMENTS

Percentage of Sales

1988 1989 1990 Average

Purchases 75.3% 75.7% 75.8% 75.6%

Cost of goods sold 72.0% 71.4% 72.4% 71.9%

Operating expenses 25.0% 25.6% 24.4% 25.0%

Cash 3.4% 2.4% 1.5% 2.5%

Accounts receivable 10.1% 11.0% 11.8% 11.0%

Inventory 14.1% 16.1% 15.5% 15.2%

Fixed assets (net) 7.4% 7.0% 5.8% 6.7%

Total assets 35.0% 36.6% 34.6% 35.4%

Accrued Expenses 1.4% 1.5% 1.4% 1.5%

Percentage of Total Assets

1988 1989 1990 Average

Current liabilities 43.8% 51.0% 57.3% 50.7%

Long-term liabilities 10.8% 7.7% 5.4% 8.0%

Equity 45.5% 41.3% 37.3% 41.4%

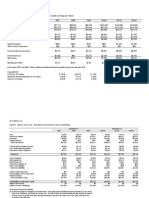

PROJECTIONS FOR YEAR 1991

Projected income statement for 1991 (thousands of dollars)

1991

Net sales $ 3,600

Cost of goods sold:

Beginning inventory $418

Purchases $2,722

$3,140

Ending inventory $550

Total cost of goods sold $2,589

Gross Profit $1,008

Operating expenses $901

Operating Profit $107

Purchase Discounts* $54

Interest expense** $40

Net income before income taxes $122

Provision for income taxes $30

Net income $92

Projected balance sheet for December 31, 1991 (thousands of dollars)

1991

Assets:

Cash $88

Accounts recievable, net (12% of sales) $394

Inventory $550

Current Assets $1,033

Property, net $162

Total Assets $1,195

`

Liabilities:

Accounts payable $76

Accrued expenses $52

Long-term debt, current portion $7

Provision for taxation $30

Bank note payable* $548

Current Liabilities $712

Long-term debt $43

Total Liabilities $755

Net worth $440

Total Liabilities plus net worth $1,195

* Bank note payable = (Total assets- Total liabilities except note payable - Net Worth) $547.75

Assumptions

Value Explanation

$ 3,600 given in case

From Income Statement

75.61% historical % of sales

computed value (beg inv + purch - end inv)

71.93% historical % of sales

25.02% historical % of sales

2% assuming that payments are made within 10 days of purchase

based on the quaterly interest expense ($10*4)

as per given tax slab

2.46% average percent of sales

11% average percent of sales

computed value from above

assuming no other property is purchased after Q1

10 days of purchases

1.45% average % of sales

constant amortization

Balancing figure

repayment of $7000 p.a.

last year's balance plus current net income

WORKING CAPITAL ASSESSMENT

1988 1989 1990 1991(Projected)

Curent Assets 468.00 596.00 776.00 1033.39

Current Liabilities 260.00 375.00 535.00 712.25

Other Current liabilities 253.00 222.00 295.00 157.50

Working Capital Gap (=CA-OCL) 215.00 374.00 481.00 875.89

Current ratio (=CA/CL) 1.80 1.59 1.45 1.45

METHOD I

Margin (= 0.25 of WCG) 53.75 93.50 120.25 218.97

MPBF (= 0.75 of WCG) 161.25 280.50 360.75 656.92

METHOD II

Margin (= 0.25 of Current Assets) 117.00 149.00 194.00 258.35

MPBF [(0.75 of CA)- OCL] 98.00 225.00 287.00 617.55

You might also like

- Sample Tour ContractDocument1 pageSample Tour ContractAdrian Keys79% (19)

- Ch02 P20 Build A ModelDocument6 pagesCh02 P20 Build A ModelLydia PerezNo ratings yet

- Clarkson Lumber SolutionDocument8 pagesClarkson Lumber Solutionpawangadiya1210No ratings yet

- Butler Lumber Case Study Solution: Assess Financial Situation & Loan RequestDocument8 pagesButler Lumber Case Study Solution: Assess Financial Situation & Loan RequestBagus Be WeNo ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- Case Analysis of Butler Lumber Company's Financial PerformanceDocument14 pagesCase Analysis of Butler Lumber Company's Financial PerformanceSangeet SaritaNo ratings yet

- Blake and Scott FS AnalysisDocument38 pagesBlake and Scott FS AnalysisFaker PlaymakerNo ratings yet

- Clarkson Lumber Company Operating ExpensesDocument7 pagesClarkson Lumber Company Operating Expensespawangadiya1210No ratings yet

- Jones Electrical SolutionDocument21 pagesJones Electrical SolutioneduardoNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinNo ratings yet

- Questions of Case 4 - Diageo PLCDocument1 pageQuestions of Case 4 - Diageo PLCYun Clare YangNo ratings yet

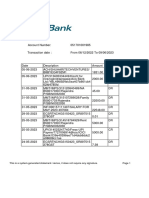

- Bank of Ireland Account StatementDocument5 pagesBank of Ireland Account StatementwinstonnelsonNo ratings yet

- Fne306 Assignment 6 AnsDocument9 pagesFne306 Assignment 6 AnsMichael PironeNo ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- Jones Adapted Student SpreadsheetDocument19 pagesJones Adapted Student SpreadsheetVera Lúcia Batista SantosNo ratings yet

- Operating and Financial Results 2004-2007Document14 pagesOperating and Financial Results 2004-2007Vera Lúcia Batista SantosNo ratings yet

- Sterling Student ManikDocument23 pagesSterling Student ManikManik BajajNo ratings yet

- Financial projections for electronics company 2004-2010Document13 pagesFinancial projections for electronics company 2004-2010Abdullah Ishak KhanNo ratings yet

- Chapter 2. Model For Financial Statements, Cash Flows, and TaxesDocument3 pagesChapter 2. Model For Financial Statements, Cash Flows, and TaxesNaser Fayyaz KhawajaNo ratings yet

- Financial Analysis Model: Income StatementDocument4 pagesFinancial Analysis Model: Income StatementSameer PadhyNo ratings yet

- Operating Statements and Balance Sheets for Cartwright Company 2001-2004Document7 pagesOperating Statements and Balance Sheets for Cartwright Company 2001-2004UMMUSNUR OZCANNo ratings yet

- Flash Memory Income Statements and Balance Sheets 2007-2009Document14 pagesFlash Memory Income Statements and Balance Sheets 2007-2009Pranav TatavarthiNo ratings yet

- ANS #3 Ritik SehgalDocument10 pagesANS #3 Ritik Sehgaljasbir singhNo ratings yet

- Test 3 BRVDocument4 pagesTest 3 BRVBervie RondonuwuNo ratings yet

- Financial Analysis Model: Income StatementDocument3 pagesFinancial Analysis Model: Income StatementAdrian PetcuNo ratings yet

- Test 3 PinkyDocument2 pagesTest 3 PinkyBervie RondonuwuNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Financial Planning and ForecastingDocument20 pagesFinancial Planning and ForecastingSyedMaazNo ratings yet

- Tire City ExhibitsDocument7 pagesTire City ExhibitsAyushi GuptaNo ratings yet

- Toy World Inc Pro Forma Income StatementDocument3 pagesToy World Inc Pro Forma Income StatementAkshay WahalNo ratings yet

- Clarkson Lumber Co. Operating Expenses 1993-1996Document3 pagesClarkson Lumber Co. Operating Expenses 1993-1996Joan MaduNo ratings yet

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaNo ratings yet

- ButlerLumberCompany Session4 Group9Document5 pagesButlerLumberCompany Session4 Group9IEUveNo ratings yet

- P&G 3 Statement ModelDocument20 pagesP&G 3 Statement ModelRabia HashimNo ratings yet

- Solucion Caso PacificDocument7 pagesSolucion Caso PacificPaulina EsparzaNo ratings yet

- Historical Income Statement and Balance Sheets For Vitex Corp. Income Statement ($ Million)Document4 pagesHistorical Income Statement and Balance Sheets For Vitex Corp. Income Statement ($ Million)ShilpaNo ratings yet

- Condensed Income and Balance Sheet Data 1991-1993Document18 pagesCondensed Income and Balance Sheet Data 1991-1993Lu Cheng50% (2)

- Hasnon Ski ProdkDocument4 pagesHasnon Ski ProdkMonika SindyNo ratings yet

- Toy World - Working FileDocument30 pagesToy World - Working Filepiyush aroraNo ratings yet

- Cash Flows at Warf Computer, Inc.: Input AreaDocument6 pagesCash Flows at Warf Computer, Inc.: Input AreaHelen LiNo ratings yet

- Lecture 3 FMDocument14 pagesLecture 3 FMHassan ElbayyaNo ratings yet

- Ch02 P20 Build A Model SolutionDocument6 pagesCh02 P20 Build A Model Solutionsonam agrawalNo ratings yet

- Forecasted Is & BS (Modified)Document6 pagesForecasted Is & BS (Modified)Md. Mehedi HasanNo ratings yet

- FM and Dupont of GenpactDocument11 pagesFM and Dupont of GenpactKunal GarudNo ratings yet

- Proforma Balance SheetDocument1 pageProforma Balance SheetStanly AlamaresNo ratings yet

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Session 7 - Financial Statements and RatiosDocument23 pagesSession 7 - Financial Statements and Ratiosalanablues1No ratings yet

- Mba AceDocument4 pagesMba AceJitesh ThakurNo ratings yet

- Assignment 01 2018 Financial Analysis HotelDocument6 pagesAssignment 01 2018 Financial Analysis HotelEllie NguyenNo ratings yet

- Robertson Tool Company Financial AnalysisDocument17 pagesRobertson Tool Company Financial AnalysisWasp_007_007No ratings yet

- Assignment 2Document3 pagesAssignment 2leorezendNo ratings yet

- The Balance Sheet: Assets Liabilities and Stockholder's Equity 2012 2011 2012 2011Document23 pagesThe Balance Sheet: Assets Liabilities and Stockholder's Equity 2012 2011 2012 2011Phạm Ngô Diễm QuỳnhNo ratings yet

- Chap 2 Market Value RatiosDocument22 pagesChap 2 Market Value Ratiosyemsrachhailu8No ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- CH 22062017 1Document9 pagesCH 22062017 1MohitNo ratings yet

- Ind - Ass.CF I ProblemsDocument3 pagesInd - Ass.CF I ProblemsNop SopheaNo ratings yet

- ABC Company Balance Sheet and Income Statement AnalysisDocument8 pagesABC Company Balance Sheet and Income Statement AnalysisMinh Van NguyenNo ratings yet

- Build Cumberland Industries 2004 Income StatementDocument4 pagesBuild Cumberland Industries 2004 Income StatementAngel L Rolon TorresNo ratings yet

- Student Workbook Flash Amended Final PDFDocument21 pagesStudent Workbook Flash Amended Final PDFGaryNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Your Income Should Increase Every Year 2: Financial Freedom, #151From EverandYour Income Should Increase Every Year 2: Financial Freedom, #151No ratings yet

- Qdoc - Tips Butler Lumber CaseDocument7 pagesQdoc - Tips Butler Lumber CasepuspemoltuNo ratings yet

- Suggestion As Butler's Financial AdvisorDocument2 pagesSuggestion As Butler's Financial AdvisorpuspemoltuNo ratings yet

- Multiple Choice Questions: Eecs 183 Fall 2014 Exam 2Document12 pagesMultiple Choice Questions: Eecs 183 Fall 2014 Exam 2Madhu CkNo ratings yet

- Multiple Choice Questions: Eecs 183 Fall 2014 Exam 2Document12 pagesMultiple Choice Questions: Eecs 183 Fall 2014 Exam 2Madhu CkNo ratings yet

- Multiple Choice Questions: Eecs 183 Fall 2014 Exam 2Document12 pagesMultiple Choice Questions: Eecs 183 Fall 2014 Exam 2Madhu CkNo ratings yet

- Multiple Choice Questions: Eecs 183 Fall 2014 Exam 2Document12 pagesMultiple Choice Questions: Eecs 183 Fall 2014 Exam 2Madhu CkNo ratings yet

- Multiple Choice Questions: Eecs 183 Fall 2014 Exam 2Document12 pagesMultiple Choice Questions: Eecs 183 Fall 2014 Exam 2Madhu CkNo ratings yet

- Impact of The UKVFTA On The Export of Vietnam's Textile and Garment To The UKDocument37 pagesImpact of The UKVFTA On The Export of Vietnam's Textile and Garment To The UKThu Hai LeNo ratings yet

- List of Participating Organization For Campus Sept-Oct, 2021Document5 pagesList of Participating Organization For Campus Sept-Oct, 2021Siva KrishnaNo ratings yet

- National Income Accounting: Unit HighlightsDocument37 pagesNational Income Accounting: Unit HighlightskalehiwotkoneNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- The correct answer is B. During a recession, consumer incomes fall which means that the demand for normal goods like new cars will decrease and the demand curve will shift leftDocument15 pagesThe correct answer is B. During a recession, consumer incomes fall which means that the demand for normal goods like new cars will decrease and the demand curve will shift leftDaisy Ann Cariaga SaccuanNo ratings yet

- Characteristics Social StratificationDocument14 pagesCharacteristics Social Stratificationmarissa casareno almueteNo ratings yet

- Gujarat Post Office DetailsDocument188 pagesGujarat Post Office DetailsRishi WadhwaniNo ratings yet

- Contemporary World MODULE 1Document24 pagesContemporary World MODULE 1Tracy Mae Estefanio100% (2)

- New Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test BankDocument15 pagesNew Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test Banknathanmelanie53f18f100% (27)

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- PDM YumbeDocument18 pagesPDM YumbeAkimu sijaliNo ratings yet

- I PlanetDocument1 pageI PlanetAbib SeckNo ratings yet

- Knox Local Food SurveyDocument3 pagesKnox Local Food SurveyMadhu BalaNo ratings yet

- Catalog Pricol MeterDocument44 pagesCatalog Pricol MeterTaher MotorwalaNo ratings yet

- Art of Being MinimalistDocument70 pagesArt of Being MinimalistbluexizorNo ratings yet

- 158461465384vhhDocument8 pages158461465384vhhAjit RaoNo ratings yet

- Rural Banking & Financial Institutions in India: Free E-BookDocument8 pagesRural Banking & Financial Institutions in India: Free E-BookPrasun KumarNo ratings yet

- Statement 1686304717558Document14 pagesStatement 1686304717558Education HubNo ratings yet

- Gold Operations - PresentationDocument79 pagesGold Operations - PresentationChristian TewodrosNo ratings yet

- Vellikallu Culvert Revised Working EstimateDocument33 pagesVellikallu Culvert Revised Working EstimateRA1511001010329 229510No ratings yet

- Potensi Pengembangan Rute Bandara PaluDocument12 pagesPotensi Pengembangan Rute Bandara PaluErie TambnNo ratings yet

- Employee payroll data from multiple banksDocument4 pagesEmployee payroll data from multiple banksMuhamad YandihNo ratings yet

- Islamic Participative Financial Intermediation and Economic GrowthDocument17 pagesIslamic Participative Financial Intermediation and Economic GrowthAmNo ratings yet

- SFM Theory With SolutionsDocument64 pagesSFM Theory With SolutionsNisen ShresthaNo ratings yet

- Textile Exchange Preferred Fiber and Materials Market Report 2021Document118 pagesTextile Exchange Preferred Fiber and Materials Market Report 2021TARKAOUI OussamaNo ratings yet

- AutoSave To 77C07B0FIBM Lauren Chennai - First Cut Attendee List - 25th May 16Document22 pagesAutoSave To 77C07B0FIBM Lauren Chennai - First Cut Attendee List - 25th May 16Vicky SinhaNo ratings yet