Professional Documents

Culture Documents

20191394@s.ubaguio - Edu: A. Prepare The Year-End Adjusting Entries

Uploaded by

Jefferson SarmientoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20191394@s.ubaguio - Edu: A. Prepare The Year-End Adjusting Entries

Uploaded by

Jefferson SarmientoCopyright:

Available Formats

Duran, Glaezee Anne C.

September 9, 2021

ACCNTG4 - AAI 20191394@s.ubaguio.edu

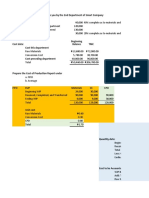

A. Prepare the year-end adjusting entries

1 Bad Debt Expense (50,000*0.02) 1,000

Allowance of Bad Debts 1,000

To record the 2% allowance for bad debts

2 Depreciation Expense 10,000

Accumulated Depreciation Expense 10,000

To record the depreciation expense of the equipment

3 Interest Expense (24,000 x 0.10 x 4/12) 800

Interest Payable 800

To record the accrued interest expense for 4 months

4 Rent Expense 2,000

Rent Payable 2,000

To record the accrued rent expense for the month of December

B. Prepare a 10-column worksheet

Sunray Co.

Worksheet

For the Year Ended December 31, 20x1

Unadjusted Trial

Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Balance

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash ₱ 60,000 ₱ 60,000 ₱ 60,000

Accounts Receivable 50,000 50,000 50,000

Inventory 40,000 40,000 40,000

Equipment 100,000 100,000 100,000

Accumulated Depreciation ₱ 10,000 ₱ 10,000 ₱ 20,000 ₱ 20,000

Accounts Payable 5,000 5,000 5,000

Notes Payable 24,000 24,000 24,000

Sunray, Capital 109,000 109,000 109,000

Service Fees 220,000 220,000 ₱ 220,000

Salaries Expense 96,000 96,000 ₱ 96,000

Rent Expense 22,000 ₱ 2,000 24,000 24,000

Totals ₱ 368,000 ₱ 368,000

Adjustments:

Bad debt Expense 1,000 1,000 1,000

Allowance for bad debts 1,000 1,000 1,000

Depreciation Expense 10,000 10,000 10,000

Interest Expense 800 800 800

Interest Payable 800 800 800

Rent Payable 2,000 2,000 2,000

Totals ₱ 13,800 ₱ 13,800 ₱ 381,800 ₱ 381,800 ₱ 131,800 ₱ 220,000 ₱ 250,000 ₱ 161,800

Net Income 88,200 88,200

Totals ₱ 220,000 ₱ 220,000 ₱ 250,000 ₱ 250,000

You might also like

- CH 13 TifDocument35 pagesCH 13 TifZyroneGlennJeraoSayanaNo ratings yet

- Sop Temporary Very Unsure HahahahaDocument2 pagesSop Temporary Very Unsure HahahahaJefferson SarmientoNo ratings yet

- Activity For September 6 Sarmiento Jefferson DDocument5 pagesActivity For September 6 Sarmiento Jefferson DJefferson SarmientoNo ratings yet

- Document analysis and accounting practice problemsDocument2 pagesDocument analysis and accounting practice problemsJefferson SarmientoNo ratings yet

- CH 13 TifDocument35 pagesCH 13 TifZyroneGlennJeraoSayanaNo ratings yet

- MC Questions: Choose The Best Possible AnswerDocument11 pagesMC Questions: Choose The Best Possible AnswerJefferson SarmientoNo ratings yet

- Summary 0F Scores - PrelimsDocument1 pageSummary 0F Scores - PrelimsJefferson SarmientoNo ratings yet

- 2009-04-25 082332 Grim 3Document5 pages2009-04-25 082332 Grim 3Aiden PatsNo ratings yet

- Accntg6 Ifrs 15 ActivityDocument3 pagesAccntg6 Ifrs 15 ActivityJefferson SarmientoNo ratings yet

- CFASDocument3 pagesCFASJefferson SarmientoNo ratings yet

- CFASDocument3 pagesCFASJefferson SarmientoNo ratings yet

- Lyon's Corporation Financial StatementsDocument3 pagesLyon's Corporation Financial StatementsJefferson SarmientoNo ratings yet

- Cfas - Journal EntriesDocument3 pagesCfas - Journal EntriesJefferson SarmientoNo ratings yet

- Chap 005Document44 pagesChap 005Juan Miguel Kidlawan Alabastro67% (3)

- 1 Q.Document6 pages1 Q.Jefferson SarmientoNo ratings yet

- MeasurementDocument1 pageMeasurementJefferson SarmientoNo ratings yet

- Sarmiento, Jefferson D.Document6 pagesSarmiento, Jefferson D.Jefferson SarmientoNo ratings yet

- Cfas - Journal EntriesDocument3 pagesCfas - Journal EntriesJefferson SarmientoNo ratings yet

- Average Annual Net Income InvestmentDocument2 pagesAverage Annual Net Income InvestmentJefferson SarmientoNo ratings yet

- Chapter 1 Assessement 1Document2 pagesChapter 1 Assessement 1Jefferson SarmientoNo ratings yet

- Chapter 8 FinalDocument17 pagesChapter 8 FinalMichael Hu67% (9)

- Ap L Aaf - Assessment 19Document2 pagesAp L Aaf - Assessment 19Jefferson SarmientoNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- Smart Company - Department Cost of Production Report January 2021Document6 pagesSmart Company - Department Cost of Production Report January 2021Jefferson SarmientoNo ratings yet

- Assessment 17 PDFDocument1 pageAssessment 17 PDFJefferson SarmientoNo ratings yet

- ASSESSMENTS 19 Converted 1 PDFDocument2 pagesASSESSMENTS 19 Converted 1 PDFJefferson SarmientoNo ratings yet

- Study Schedule 1Document1 pageStudy Schedule 1Jefferson SarmientoNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Introduction To Managerial Accounting 7th Edition Test Bank BrewerDocument155 pagesIntroduction To Managerial Accounting 7th Edition Test Bank BrewerJefferson SarmientoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Syllabus - Advanced Corp Fin 2022-2023 SpringDocument3 pagesSyllabus - Advanced Corp Fin 2022-2023 SpringAssiat ZhassaganbergenNo ratings yet

- 3.8 ExercisesDocument8 pages3.8 ExercisesGeorgios Militsis50% (2)

- Worksheet For Financial Acc. IDocument5 pagesWorksheet For Financial Acc. IFantay100% (1)

- TB - Chapter08 Stocks and Their ValuationDocument80 pagesTB - Chapter08 Stocks and Their ValuationMarie Bernadette AranasNo ratings yet

- Ultimate Sample Paper 2Document22 pagesUltimate Sample Paper 2Tûshar ThakúrNo ratings yet

- JP Morgan Greater China FundDocument13 pagesJP Morgan Greater China FundArmstrong CapitalNo ratings yet

- 823 Cost Accounting SQPDocument5 pages823 Cost Accounting SQPSayandip DeyNo ratings yet

- Soon Heng (01.03-15.03.2023) Soa PDFDocument2 pagesSoon Heng (01.03-15.03.2023) Soa PDFSicklyangel LokeNo ratings yet

- Ross: Fundamentals of Corporate Finance 9ce Errata: Annual Depreciation AllowancesDocument2 pagesRoss: Fundamentals of Corporate Finance 9ce Errata: Annual Depreciation AllowancesYuk SimNo ratings yet

- MBA - Full Time (Regular) - Regulation & Syllabus: Bharathiar University: Coimbatore-46Document59 pagesMBA - Full Time (Regular) - Regulation & Syllabus: Bharathiar University: Coimbatore-46RamkumarNo ratings yet

- Adjudication Order in Respect of Shri Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals (India) Ltd.Document9 pagesAdjudication Order in Respect of Shri Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals (India) Ltd.Shyam SunderNo ratings yet

- CH 06Document92 pagesCH 06Noheul KimNo ratings yet

- Results For True/False Quiz: You Correctly Answered 16 Questions For A Score of 100 PercentDocument4 pagesResults For True/False Quiz: You Correctly Answered 16 Questions For A Score of 100 PercentErica Sabado EmanelNo ratings yet

- Modul Finance 2020 PDFDocument96 pagesModul Finance 2020 PDFMutiaraMorentNo ratings yet

- Img 20200707 0003 PDFDocument26 pagesImg 20200707 0003 PDFJade MarieNo ratings yet

- Principles of Corporate Finance 11th Edition Brealey Test BankDocument26 pagesPrinciples of Corporate Finance 11th Edition Brealey Test BankJamesJacksonnqpf100% (44)

- Dividend Policies and Stock SplitsDocument3 pagesDividend Policies and Stock SplitslenakaNo ratings yet

- BBFA2303 Take Home Exam - Eng & BM - Jan20Document10 pagesBBFA2303 Take Home Exam - Eng & BM - Jan20AnnieNo ratings yet

- Test Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve DolvinDocument48 pagesTest Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve Dolvinchrisrasmussenezsinofwdr100% (28)

- AccountingDocument19 pagesAccountinggigigiNo ratings yet

- Accounting Selfstudy 01Document3 pagesAccounting Selfstudy 01Mohammed Al-YagoobNo ratings yet

- ADBM – Full Time Financial Accounting Multiple Choice QuestionsDocument8 pagesADBM – Full Time Financial Accounting Multiple Choice QuestionsAshika JayaweeraNo ratings yet

- 6 AfarDocument24 pages6 AfarJM SonidoNo ratings yet

- Hightech Inc Was A Small Company Started by Four Entrepreneurs PDFDocument1 pageHightech Inc Was A Small Company Started by Four Entrepreneurs PDFhassan taimourNo ratings yet

- FY 2018 LPLI Star+Pacific+TbkDocument72 pagesFY 2018 LPLI Star+Pacific+TbkIman Firmansyah IkaNo ratings yet

- Section 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsDocument15 pagesSection 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsHelloWorldNowNo ratings yet

- AP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYDocument12 pagesAP Long Test 1 - CHANGES&ERROR, CASH ACCRUAL, SINGLE ENTRYjasfNo ratings yet

- 10 IAS 41 AgricultureDocument18 pages10 IAS 41 AgricultureAANo ratings yet

- Biologicalassets PDFDocument135 pagesBiologicalassets PDFCeline GalvezNo ratings yet

- Series 2 2006Document7 pagesSeries 2 2006Apollo YapNo ratings yet