Professional Documents

Culture Documents

Emedlife Insurance Broking Services Limited: Group Mediclaim Policy

Uploaded by

Yanamandra Radha Phani ShankarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emedlife Insurance Broking Services Limited: Group Mediclaim Policy

Uploaded by

Yanamandra Radha Phani ShankarCopyright:

Available Formats

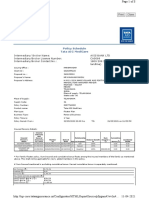

EMEDLIFE INSURANCE BROKING SERVICES LIMITED

GROUP MEDICLAIM POLICY

Proposer Details:

Name of the Client AJ PACKAGING LIMITED

Policy Period 16-SEP-2021 to 15-SEP-2022

Current Insurer Bharti Axa General insurance company limited

TPA Health India

Policy Inception Details for 2020 - 2021:

Number of Employees : 43

Number of Dependents : 106

Total Number of Lives : 149

Family Size: 1+3 (Self+spouse+4 childrens)

Premium paid at inception(Excluding GST) 615,003

Premium paid till date(Excluding GST) 615,003

Claim Ratio 48.78%

Claim MIS Dated 13-Sep-21

Claimed Amount 3,000,000

365 days claims out go 3,033,241

Annualized claims ratio 49.18%

Policy Details for Renewal 2021 - 2022

Number of Employees: 50

Number of Dependents : 119

Total Number of Lives : 169

SL.NO FEATURES TERMS AND CONDITIONS

1 FAMILY DEFINITION (1+3) Self + Spouse + 4 Dependent Children

2 SUM INSURED Family Floater Sum Insured of INR 300,000

3 AGE BRACKET 0-80 Years

4 1ST, 2ND AND 4TH YEAR WAITING PERIOD Waived for all

5 1ST 30 DAYS WAITING PERIOD Waived for all

6 PRE-EXISTING DISEASE WAITING PERIOD Waived for all

7 MATERNITY BENEFITS - LIMITS AND COVERAGES Not Covered

8 NEW BORN BABY COVERAGE FROM DAY 1 NO

2% of SI for Normal Hospitalisation and 4% of SI for ICU Hospitalisation.

9 ROOM RENT OR ROOM TYPE RESTRICTION

Opting for a room of higher category than the eligible category will result in higher cost for all

hospitalization services , which must be borne by the claimant

10 PRE AND POST HOSPITALIZATION COVERAGE 30 days pre-hospitalization and 60 days post-hospitalization respectively.

11 DOMICILIARY HOSPITALIZATION COVER Not Covered

12 CONGENITAL INTERNAL DISEASE Covered for all

13 CORPORATE BUFFER Not Covered

14 DAY CARE PROCEDURES Covered

15 CLAIMS INTIMATION No Claims intimation required for reimbursement claims & Day Care procedure claims

16 RE-IMBURSEMENT CLAIMS REPORTING / SUBMITTING PERIOD Claim reporting /submission period within 30 days from the Date of Discharge

17 LIMIT ON ANY ONE DISEASE OR AILMENT No capping; Cataract Limit restricted to INR 15,000 per eye

LIMIT ON SURGEON CHARGES, ANESTHETIC CHARGES, STENT

18 CHARGES, ETC. No Capping

19 CO-PAY CLAUSE No Copay

20 HOSPITALIZATION / INJURY ARISING OUT TERRORISM Covered

21 PREMIUM CALCULATION Pro rata Basis

22 EMERGENCY AMBULANCE CHARGES Covered upto INR 3000 per hospitalisation

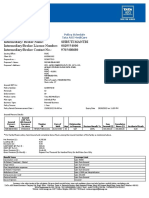

EMEDLIFE INSURANCE BROKING SERVICES LIMITED

GROUP MEDICLAIM POLICY

Proposer Details:

Name of the Client AJ PACKAGING LIMITED

Policy Period 16-SEP-2021 to 15-SEP-2022

Current Insurer Bharti Axa General insurance company limited

TPA Health India

Policy Inception Details for 2020 - 2021:

Number of Employees : 43

Number of Dependents : 106

Total Number of Lives : 149

Family Size: 1+3 (Self+spouse+4 children)

Premium paid at inception(Excluding GST) 615,003

Premium paid till date(Excluding GST) 615,003

Claim Ratio 48.78%

Claim MIS Dated 13-Sep-21

Claimed Amount 300,000

365 days claims out go 302,486

Annualized claims ratio 49.18%

Policy Details for Renewal 2021 - 2022

Number of Employees: 50

Number of Dependents : 119

Total Number of Lives : 169

SL.NO FEATURES TERMS AND CONDITIONS MAGMA HDI

1 FAMILY DEFINITION (1+3) Self + Spouse + 4 Dependent Children YES

2 SUM INSURED Family Floater Sum Insured of INR 300,000 YES

3 AGE BRACKET 0-80 Years YES

4 1ST, 2ND AND 4TH YEAR WAITING PERIOD Waived for all YES

5 1ST 30 DAYS WAITING PERIOD Waived for all YES

6 PRE-EXISTING DISEASE WAITING PERIOD Waived for all YES

7 MATERNITY BENEFITS - LIMITS AND COVERAGES Not Covered YES

8 NEW BORN BABY COVERAGE FROM DAY 1 NO YES

2% of SI for Normal Hospitalisation and 4% of SI for ICU Hospitalisation. YES

9 ROOM RENT OR ROOM TYPE RESTRICTION

Opting for a room of higher category than the eligible category will result in higher cost for all

YES

hospitalization services , which must be borne by the claimant

10 PRE AND POST HOSPITALIZATION COVERAGE 30 days pre-hospitalization and 60 days post-hospitalization respectively. YES

11 DOMICILIARY HOSPITALIZATION COVER Not Covered YES

12 CONGENITAL INTERNAL DISEASE Covered for all YES

13 CORPORATE BUFFER Not Covered YES

14 DAY CARE PROCEDURES Covered YES

15 CLAIMS INTIMATION No Claims intimation required for reimbursement claims & Day Care procedure claims YES

16 RE-IMBURSEMENT CLAIMS REPORTING / SUBMITTING PERIOD Claim reporting /submission period within 30 days from the Date of Discharge YES

17 LIMIT ON ANY ONE DISEASE OR AILMENT No capping; Cataract Limit restricted to INR 15,000 per eye YES

LIMIT ON SURGEON CHARGES, ANESTHETIC CHARGES, STENT

18 No Capping YES

CHARGES, ETC.

19 CO-PAY CLAUSE No Copay YES

20 HOSPITALIZATION / INJURY ARISING OUT TERRORISM Covered YES

21 PREMIUM CALCULATION Pro rata Basis YES

22 EMERGENCY AMBULANCE CHARGES Covered upto INR 3000 per hospitalisation YES

PREMIUM EXCL GST 500,000

PREMIUM PAYABLE GST @ 18% 90,000

PREMIUM INCL GST 590,000

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Emedlife Insurance Broking Services Limited: Sl. No. Coverages Expiring Terms & ConditionsDocument6 pagesEmedlife Insurance Broking Services Limited: Sl. No. Coverages Expiring Terms & ConditionsYanamandra Radha Phani ShankarNo ratings yet

- GMC, Gpa RFQDocument8 pagesGMC, Gpa RFQRushil Gupta100% (1)

- Self Health Insurance 80 DDocument3 pagesSelf Health Insurance 80 Dinstatest3580No ratings yet

- GurbaniDocument4 pagesGurbanimeetu2102No ratings yet

- Insurance SKU158638468362N9SWDocument5 pagesInsurance SKU158638468362N9SWEr Dnyaneshwar PatilNo ratings yet

- 0287764082 (1)Document8 pages0287764082 (1)rmohanNo ratings yet

- ReportDocument5 pagesReportvinaykumar333777No ratings yet

- PDF 17017375 1584486767998 PDFDocument6 pagesPDF 17017375 1584486767998 PDFLucky TraderNo ratings yet

- Star Health and Allied Insurance Company LimitedDocument2 pagesStar Health and Allied Insurance Company LimitedMr. RAJASEKHARNo ratings yet

- Policy Mr. Ullas PalDocument11 pagesPolicy Mr. Ullas Palullaspal30No ratings yet

- Intermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Document3 pagesIntermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Iloo SinghNo ratings yet

- GMC Quotation Q200014904049Document4 pagesGMC Quotation Q200014904049pandeyvashishthaNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- PDF 17145960 1585132385521 PDFDocument7 pagesPDF 17145960 1585132385521 PDFLucky TraderNo ratings yet

- Health Insurance Vish 2 2Document5 pagesHealth Insurance Vish 2 2Naz ParveenNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- Coi 464664335162951Document1 pageCoi 464664335162951Guru PrasadNo ratings yet

- Religare Health Insurance Company LimitedDocument6 pagesReligare Health Insurance Company LimitedLucky TraderNo ratings yet

- Policy CertificateDocument5 pagesPolicy CertificateSITESH SINGHNo ratings yet

- Group Medicare Policy ScheduleDocument7 pagesGroup Medicare Policy Scheduleparas INSURANCENo ratings yet

- ICICI GMC Quote - Baroda Decorators Revised 02.04.2024Document6 pagesICICI GMC Quote - Baroda Decorators Revised 02.04.2024silvershield.generalNo ratings yet

- Agent Name: Insured Persons DetailsDocument14 pagesAgent Name: Insured Persons Detailsravi yadavNo ratings yet

- Policy No. Name Address:: 7000054772-02: MR Arbind Kumar Sinha: F-3,202 Shankeshwar Nagar, Manpad RoadDocument18 pagesPolicy No. Name Address:: 7000054772-02: MR Arbind Kumar Sinha: F-3,202 Shankeshwar Nagar, Manpad Roadbinitasinha100No ratings yet

- Star Health and Allied Insurance Company LimitedDocument2 pagesStar Health and Allied Insurance Company LimitedMr. RAJASEKHARNo ratings yet

- Intermediary Details Name Code Contact Number Union Bank of India 20007540 011-47019045Document4 pagesIntermediary Details Name Code Contact Number Union Bank of India 20007540 011-47019045arghadiproy012No ratings yet

- Screenshot 2024-03-22 at 12.59.42 PMDocument40 pagesScreenshot 2024-03-22 at 12.59.42 PMYash ChaudharyNo ratings yet

- Policy 75532363 02122023Document8 pagesPolicy 75532363 02122023kpandya21No ratings yet

- PDF 16900547 1584487082104 PDFDocument7 pagesPDF 16900547 1584487082104 PDFLucky TraderNo ratings yet

- Zilingo Global PVT LTD - GMC Broking SlipDocument3 pagesZilingo Global PVT LTD - GMC Broking SlipYanamandra Radha Phani ShankarNo ratings yet

- Intermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Document4 pagesIntermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655TambeNo ratings yet

- Policy 73607229 31102023Document8 pagesPolicy 73607229 31102023mohdtanveer550No ratings yet

- Intermediary Details Name Code Contact Number Iifl Insurance Brokers Limited 20024612 9819286666Document4 pagesIntermediary Details Name Code Contact Number Iifl Insurance Brokers Limited 20024612 9819286666Pramila DeviNo ratings yet

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- My Insurance PolicyDocument7 pagesMy Insurance PolicyMuntaj BegumNo ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- Intermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Document4 pagesIntermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Mohd Ahmad100% (1)

- UNITY GMC - RFQ With DataDocument27 pagesUNITY GMC - RFQ With DataBOC ClaimsNo ratings yet

- Intermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Document4 pagesIntermediary Details Name Code Contact Number Care Health Insurance Ltd. Direct 1800-102-6655Mahakaal Digital PointNo ratings yet

- Health InsuranceDocument4 pagesHealth InsuranceInstagram UserNo ratings yet

- Certificate PDFDocument3 pagesCertificate PDFSudeep MeshramNo ratings yet

- 2825100207112402000Document4 pages2825100207112402000bipin012No ratings yet

- TATA AIG General Insurance Company Limited: Your Policy DetailsDocument7 pagesTATA AIG General Insurance Company Limited: Your Policy DetailsSneha BhosaleNo ratings yet

- In-Fork Logistics Solutions Private Limited - With Maternity 200k QuoteDocument2 pagesIn-Fork Logistics Solutions Private Limited - With Maternity 200k Quotesharad patilNo ratings yet

- Meeting Your Life's Money NeedsDocument5 pagesMeeting Your Life's Money NeedsRahulNo ratings yet

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- Employee Benefits Manual - Air India Express GMC 2023-24Document29 pagesEmployee Benefits Manual - Air India Express GMC 2023-24tanyaqthomasNo ratings yet

- Reliance Healthwise Policy ScheduleDocument2 pagesReliance Healthwise Policy ScheduleueraviNo ratings yet

- Insurance Parents Top UpDocument45 pagesInsurance Parents Top UpAbhinav SinhaNo ratings yet

- Group Activ Secure - Certificate of InsuranceDocument4 pagesGroup Activ Secure - Certificate of InsuranceBanu MathyNo ratings yet

- ParentsDocument2 pagesParentssameo13No ratings yet

- Policy 19743223 23012021Document7 pagesPolicy 19743223 23012021Lallu KalluNo ratings yet

- Manipalcigna Prohealth Group Insurance PolicyDocument3 pagesManipalcigna Prohealth Group Insurance PolicykeviletuoNo ratings yet

- InsuranceDocument5 pagesInsurancefyersa1No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyShashank SinghNo ratings yet

- AKPA PolicyDocument10 pagesAKPA PolicyRatheeshkumar Almurshed TravelNo ratings yet

- Intermediary/ Broker Name: Intermediary/Broker License Number: Intermediary/Broker Contact No.: Shruti Mantri 0029554000 9765408680Document12 pagesIntermediary/ Broker Name: Intermediary/Broker License Number: Intermediary/Broker Contact No.: Shruti Mantri 0029554000 9765408680dipesh goudNo ratings yet

- Detailed Insurance Policy 2019-20 VenturaDocument54 pagesDetailed Insurance Policy 2019-20 VenturaPratap ReddyNo ratings yet

- EY Employee Benefits ManualDocument49 pagesEY Employee Benefits ManualVishnu UdayagiriNo ratings yet

- Zilingo Global PVT LTD - GMC Broking SlipDocument3 pagesZilingo Global PVT LTD - GMC Broking SlipYanamandra Radha Phani ShankarNo ratings yet

- Nagaland 2016Document96 pagesNagaland 2016Yanamandra Radha Phani ShankarNo ratings yet

- AJ PACKAGING LIMIT-35113 - MIS - Claim - Details - Till-13 - 09 - 21Document27 pagesAJ PACKAGING LIMIT-35113 - MIS - Claim - Details - Till-13 - 09 - 21Yanamandra Radha Phani ShankarNo ratings yet

- Employee Details (FY 2021 - 2022) 1Document8 pagesEmployee Details (FY 2021 - 2022) 1Yanamandra Radha Phani ShankarNo ratings yet

- Punjab 2016Document4,298 pagesPunjab 2016Yanamandra Radha Phani ShankarNo ratings yet

- Puducherry 2016Document520 pagesPuducherry 2016Yanamandra Radha Phani ShankarNo ratings yet

- Tripura 2016Document63 pagesTripura 2016Yanamandra Radha Phani ShankarNo ratings yet

- Odisha 2016Document3,199 pagesOdisha 2016Yanamandra Radha Phani Shankar0% (1)

- Punjab 2016Document4,298 pagesPunjab 2016Yanamandra Radha Phani ShankarNo ratings yet

- Uttarakhand 2016Document875 pagesUttarakhand 2016Yanamandra Radha Phani ShankarNo ratings yet

- Sikkim 2016Document7 pagesSikkim 2016Yanamandra Radha Phani ShankarNo ratings yet

- Haryana 2016Document2,137 pagesHaryana 2016Sumit SavaraNo ratings yet

- Goa 2016Document1,384 pagesGoa 2016manishaNo ratings yet

- Daman and Diu 2016Document64 pagesDaman and Diu 2016Yanamandra Radha Phani ShankarNo ratings yet

- Arunachal Pradesh 2016Document96 pagesArunachal Pradesh 2016Yanamandra Radha Phani Shankar0% (1)

- Bihar 2016Document3,668 pagesBihar 2016Yanamandra Radha Phani ShankarNo ratings yet

- Bihar 2016Document3,668 pagesBihar 2016Yanamandra Radha Phani ShankarNo ratings yet

- Dadar Nagar Haveli 2016Document88 pagesDadar Nagar Haveli 2016Yanamandra Radha Phani ShankarNo ratings yet

- 1 TDocument1,309 pages1 TAmlan BiswalNo ratings yet

- Arunachal Pradesh 2016Document96 pagesArunachal Pradesh 2016Yanamandra Radha Phani Shankar0% (1)

- Andaman Nicobar Islands 2016Document56 pagesAndaman Nicobar Islands 2016safdgfdNo ratings yet

- Andaman Nicobar Islands 2016Document56 pagesAndaman Nicobar Islands 2016safdgfdNo ratings yet

- Andaman Nicobar Islands 2016Document56 pagesAndaman Nicobar Islands 2016safdgfdNo ratings yet

- Pro Forma Balance Sheet and Income StatementDocument2 pagesPro Forma Balance Sheet and Income StatementMelinda AndrianiNo ratings yet

- Business Model of A Consulting Companyv2Document13 pagesBusiness Model of A Consulting Companyv2Nadya TheodoraNo ratings yet

- 18mel76 CimDocument4 pages18mel76 CimSushant NaikNo ratings yet

- Digital Transformation OF FMCG Supply Chain: Case Presentation (Nitie, Mumbai)Document10 pagesDigital Transformation OF FMCG Supply Chain: Case Presentation (Nitie, Mumbai)snehaarpiNo ratings yet

- Research Methods For Architecture Ebook - Lucas, Ray - Kindle StoreDocument1 pageResearch Methods For Architecture Ebook - Lucas, Ray - Kindle StoreMohammed ShriamNo ratings yet

- AshZjxFuEemP8Qpm209XvA Rewiring-Trade-FinanceDocument5 pagesAshZjxFuEemP8Qpm209XvA Rewiring-Trade-Financezvishavane zvishNo ratings yet

- Epiforce: Protecting Personal InformationDocument4 pagesEpiforce: Protecting Personal InformationLuke TerringtonNo ratings yet

- Fundamentals of Business Law PDFDocument358 pagesFundamentals of Business Law PDFmikiyo90% (10)

- MQ1 1Document1 pageMQ1 1shaira alliah de castroNo ratings yet

- 13 - Project Procurement Management-Online v1Document41 pages13 - Project Procurement Management-Online v1Afrina M.Kom.No ratings yet

- The Challenges of Globalization On The Industrial Sector of BangladeshDocument18 pagesThe Challenges of Globalization On The Industrial Sector of Bangladeshsyed_sazidNo ratings yet

- Principles of Taxation Law 2022 Chapter4Document30 pagesPrinciples of Taxation Law 2022 Chapter4Kaylah NewcombeNo ratings yet

- CV Template 0018Document1 pageCV Template 0018Rahma idahNo ratings yet

- Inquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPDocument10 pagesInquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPNeil GillespieNo ratings yet

- Option Valuation Black ScholesDocument18 pagesOption Valuation Black ScholessanchiNo ratings yet

- AIS Review QuestionnairesDocument4 pagesAIS Review QuestionnairesKesiah FortunaNo ratings yet

- Model LLP AgreementDocument20 pagesModel LLP AgreementSoumitra Chawathe71% (21)

- PretestDocument3 pagesPretestDonise Ronadel SantosNo ratings yet

- E Commerce QuestionsDocument4 pagesE Commerce Questionsbharani100% (1)

- ChatGPT PromptsDocument105 pagesChatGPT PromptsJohn ErichNo ratings yet

- Pacl ScamDocument24 pagesPacl ScamAindrila ChatterjeeNo ratings yet

- Market Segmentation Strategic Analysis and Positioning ToolDocument4 pagesMarket Segmentation Strategic Analysis and Positioning ToolshadrickNo ratings yet

- Certificado EGT 20000 MAX G2Document4 pagesCertificado EGT 20000 MAX G2Diego PionaNo ratings yet

- Day 1 Preparation AssignmentDocument2 pagesDay 1 Preparation AssignmentKevin KimNo ratings yet

- Fact Sheet - ITIL® 4 Specialist - Create, Deliver and Support - ClassroomDocument6 pagesFact Sheet - ITIL® 4 Specialist - Create, Deliver and Support - ClassroomEduardo MucajiNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Roles and Skills of ManagersDocument9 pagesRoles and Skills of Managersarjun SinghNo ratings yet

- Magic Quadrant For G 734654 NDXDocument35 pagesMagic Quadrant For G 734654 NDXm.ankita92No ratings yet

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaNo ratings yet

- Toppan Merrill Technology ListDocument2 pagesToppan Merrill Technology ListKilty ONealNo ratings yet