Professional Documents

Culture Documents

A Private Placement

Uploaded by

md fahad0 ratings0% found this document useful (0 votes)

10 views2 pagesOriginal Title

A private placement

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesA Private Placement

Uploaded by

md fahadCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

A private placement

A private placement is a sale of stock shares or bonds to pre-selected investors

and institutions rather than on the open market[ CITATION Akh20 \l 1033 ]. Private

placements continue to be issued in the municipal debt market and remain a

topic of interest for municipalities, investors, and regulators. Private placements

are often sold without an underwriter to relatively sophisticated investors and are

typically “buy‐to‐hold” transactions[ CITATION Tim19 \l 1033 ]. A private placement is a

securities issue sold directly to a small group of professional or institutional

investors. A private placement is sold to professional investors and not publicly

advertised, market regulators in many countries have been adopted more flexible

disclosure requirements and selling rules. Since Eurobonds are offered for sale as

private placements, they avoid much of the costly regulatory requirements

associated with public offerings[ CITATION msa \l 1033 ].

The three most important features that would classify a securities issue as a

private placement are:

1. The securities are not publicly offered

2. The securities are not required to be registered with the SEC

3. The investors are limited in number and must be “accredited”

Companies, both public and private, issue in the private placement market for a

variety of reasons, including a desire to access long-term, fixed-rate capital,

diversify financing sources, additional financing capacity beyond existing investors

(banks, private equity, etc.) or, in the case of privately held businesses, to

maintain confidentiality.

Since private placements are offered only to a limited pool of accredited

investors, they are exempt from registering with the Securities and Exchange

Commission (SEC). This affords the issuer the opportunity to avoid certain costs

associated with a public offering as well as allows for more flexibility regarding

structure and terms[ CITATION eco \l 1033 ].

Evaluation of the placements

It is important to acknowledge that different private placements are likely to be

motivated by different considerations. Some corporate control and corporate

finance events may be relatively homogeneous, but private placements of

common stock are not among them. Consequently, there are likely to be factors

that we have not controlled for. There are also likely to be selection biases on the

type of firms that issue private placements. Both factors raise issues of

Endogeneity[ CITATION Mic \l 1033 ] .

Bibliography

economics. (n.d.). Retrieved from prudential private capital: https://www.prudentialprivatecapital.com/

Ganti, A. (2020, march 4). Retrieved from Investopedia: www.Investopedia.com

Michael J.Barclaya, C. G. (n.d.). Retrieved from science direct: https://www.sciencedirect.com/

msande247s. (n.d.). Retrieved from stanford: web.stanford.edu

Tima T. Moldogaziev, R. A. (2019, august 23). Retrieved from Wiley Online Library:

https://doi.org/10.1111/pbaf.12235

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- M&T Bank Statement - 1Document2 pagesM&T Bank Statement - 1Matt DerrickNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Yell FinalDocument10 pagesYell Finalbumz1234100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Budget Analysis and Deficit FinancingDocument2 pagesBudget Analysis and Deficit Financingmd fahadNo ratings yet

- Ratio Analysis: Solutions To Assignment ProblemsDocument16 pagesRatio Analysis: Solutions To Assignment Problemsmd fahadNo ratings yet

- C13 HandoutDocument15 pagesC13 Handoutmd fahadNo ratings yet

- Mobile Banking Operations and Banking Facilities To Rural People in BangladeshDocument17 pagesMobile Banking Operations and Banking Facilities To Rural People in Bangladeshmd fahadNo ratings yet

- Problems and Prospects of Mobile Banking in BangladeshDocument20 pagesProblems and Prospects of Mobile Banking in Bangladeshmd fahadNo ratings yet

- Business Opportunity IdentificationDocument3 pagesBusiness Opportunity Identificationmd fahadNo ratings yet

- Working Capital Management A Measurement Tool For Profitability: A Study On Pharmaceutical Industry in BangladeshDocument10 pagesWorking Capital Management A Measurement Tool For Profitability: A Study On Pharmaceutical Industry in Bangladeshmd fahadNo ratings yet

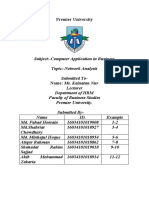

- Premier UniversityDocument7 pagesPremier Universitymd fahadNo ratings yet

- Groups Count Sum Average VarianceDocument5 pagesGroups Count Sum Average Variancemd fahadNo ratings yet

- Premier University: Submitted ToDocument5 pagesPremier University: Submitted Tomd fahadNo ratings yet

- Origin of The Islamic Banking in BangladeshDocument3 pagesOrigin of The Islamic Banking in Bangladeshmd fahadNo ratings yet

- Networking Analysis (Shortest Route Program) : Example 1Document7 pagesNetworking Analysis (Shortest Route Program) : Example 1md fahadNo ratings yet

- BankAsia AIR 2019 FinancialDocument123 pagesBankAsia AIR 2019 Financialmd fahadNo ratings yet

- Rules and Regulation: How To Invest in BondDocument3 pagesRules and Regulation: How To Invest in Bondmd fahadNo ratings yet

- Cover Page of Premier UniversityDocument2 pagesCover Page of Premier Universitymd fahadNo ratings yet

- Zara Case StudyDocument10 pagesZara Case Studymd fahadNo ratings yet

- Project Management in BangladesDocument9 pagesProject Management in Bangladesmd fahadNo ratings yet

- Assignment in Toyota Motor CorporationDocument40 pagesAssignment in Toyota Motor Corporationmd fahadNo ratings yet

- Faculty of Business Studies: Submitted ToDocument10 pagesFaculty of Business Studies: Submitted Tomd fahadNo ratings yet

- Pharmaceutical Industry in BangladeshDocument11 pagesPharmaceutical Industry in Bangladeshmd fahadNo ratings yet

- Insurance and Risk ManagementDocument9 pagesInsurance and Risk Managementmd fahadNo ratings yet

- Gaap Vs IfrsDocument2 pagesGaap Vs IfrsAanchal SinghalNo ratings yet

- Theory of The Firm: Managerial Behavior, Agency Costs and Ownership StructureDocument16 pagesTheory of The Firm: Managerial Behavior, Agency Costs and Ownership StructureWawan Flattron StraerNo ratings yet

- Kodak - Financial AnalysisDocument5 pagesKodak - Financial Analysismcruz18No ratings yet

- ITAU - TecnisaDocument3 pagesITAU - TecnisaAndré FelippeNo ratings yet

- Bilbliography FinalDocument4 pagesBilbliography Finalpoojagopwani3413No ratings yet

- Management of Marketable SecuritiesDocument6 pagesManagement of Marketable Securitiesarchana_anuragi50% (2)

- C 12 LCNRV - Problem SolvingDocument1 pageC 12 LCNRV - Problem Solvingkyle mandaresioNo ratings yet

- Group 15 Merger ProposalDocument41 pagesGroup 15 Merger ProposalJohnny LamNo ratings yet

- FRM Part 1 Study Plan May 2017Document3 pagesFRM Part 1 Study Plan May 2017msreya100% (1)

- Financial Engineering - Futures, Forwards and SwapsDocument114 pagesFinancial Engineering - Futures, Forwards and Swapsqari saibNo ratings yet

- Copy Trading in Pakistan (Instructions)Document4 pagesCopy Trading in Pakistan (Instructions)IRP assignmentsNo ratings yet

- Senior High School: Asia Academic School, IncDocument5 pagesSenior High School: Asia Academic School, IncAbdel-Nasser AbdurayaNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- Earnings Call TranscriptDocument19 pagesEarnings Call TranscriptAniket SabaleNo ratings yet

- Getting Started With The Firstmetrosec Technical Indicators: A Guide For End-UsersDocument4 pagesGetting Started With The Firstmetrosec Technical Indicators: A Guide For End-UsersNestor Jr Rebayla SevenorioNo ratings yet

- CPAR Sale or Exchange of Property (Batch 89) HandoutDocument7 pagesCPAR Sale or Exchange of Property (Batch 89) Handoutjohn paulNo ratings yet

- Q3 2022 - Sequoia Fund LetterDocument2 pagesQ3 2022 - Sequoia Fund LetterjshethNo ratings yet

- Forex QuotationsDocument13 pagesForex QuotationsKamalSoniNo ratings yet

- Termpapermgt517Document3 pagesTermpapermgt517Addydutt SharmaNo ratings yet

- Corporate Finance - KS KimDocument5 pagesCorporate Finance - KS Kim01202750693No ratings yet

- Chapter 10 OutlineDocument13 pagesChapter 10 OutlineAndrew TatisNo ratings yet

- INVENTORIES2Document18 pagesINVENTORIES2Katherine MagpantayNo ratings yet

- CF AssignmentDocument112 pagesCF AssignmentAbhijit DileepNo ratings yet

- Question Paper Introduction To Security Analysis (MB3G1F) : January 2009Document19 pagesQuestion Paper Introduction To Security Analysis (MB3G1F) : January 2009Jatin GoyalNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- EDP)Document2 pagesEDP)02 - CM Ankita AdamNo ratings yet

- The Philippine Financial SystemDocument39 pagesThe Philippine Financial Systemathena100% (1)

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet