Professional Documents

Culture Documents

Equity Method - Case Study 5

Uploaded by

HAO HUYNH MINH GIACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Method - Case Study 5

Uploaded by

HAO HUYNH MINH GIACopyright:

Available Formats

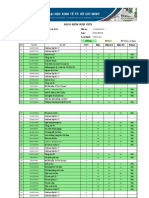

Case study 5

On 1 July 2015, Key Ltd acquired 25% of the shares of Board Ltd for $400 000. The

acquisition of these shares gave Key Ltd significant infulence over Board Ltd. At this date,

the equity of Board Ltd consisted of:

Share capital $660 000

General reserve 100 000

Retained earnings 440 000

At 1 July 2015, all the identifable assets and liabilities of Board Ltd were recorded at

amounts equal to their fair values except for

Carrying amount Fair value

Land $ 1 200 000 $ 1 600 000

Plant (cost $1 200 000) 1 000 000 1 100 000

The plant was considered to have a further useful life of 5 years. The land was revalued in the

records of Board Ltd and the revaluation model applied in the measurement of the land. The

tax rate is 30%.

At 30 June 2017, Board Ltd reported the following information

Profit before tax $ 720 000

Income tax expense (300 000)

Profit after tax 420 000

Retained earnings at 1 July 2016 820 000

Dividend paid (40 000)

Dividends declared (50 000)

Transfer to general reserve (30 000)

Retained earnings at 30 June 2017 1 120 000

Share capital 640 000

General reserve 150 000

Asset revaluation surplus 310 000

Total equity 2 220 000

Board Ltd also reported other comprehensive income relating to gains on revaluation of land

of $15 000.

Required

Prepare the journal entries for inclusion in the consolidation worksheet of Key Ltd at 30 June

2017 for the accounting of Board Ltd.

You might also like

- DuLieuLuanvan Cao Hoc TuanDocument46 pagesDuLieuLuanvan Cao Hoc TuanHAO HUYNH MINH GIANo ratings yet

- /Ӟs +Ӑwrq 0Mvӕ Ĉlӌqwkrҥl: 31181025819 Dh44Ki002 Chính QuyDocument3 pages/Ӟs +Ӑwrq 0Mvӕ Ĉlӌqwkrҥl: 31181025819 Dh44Ki002 Chính QuyHAO HUYNH MINH GIANo ratings yet

- 10.1108@jaee 04 2017 0040Document30 pages10.1108@jaee 04 2017 0040HAO HUYNH MINH GIANo ratings yet

- International Accounting 2: Hoang Trong HiepDocument212 pagesInternational Accounting 2: Hoang Trong HiepHAO HUYNH MINH GIANo ratings yet

- Đề thi thử EY intern 2021Document131 pagesĐề thi thử EY intern 2021HAO HUYNH MINH GIANo ratings yet

- Mini Test - Consolidated Financial StatementsDocument3 pagesMini Test - Consolidated Financial StatementsHAO HUYNH MINH GIANo ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- Equity Method Case StudyDocument3 pagesEquity Method Case StudyHAO HUYNH MINH GIANo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)