Professional Documents

Culture Documents

CBCS 4.1 International Business Dynamics (2017)

CBCS 4.1 International Business Dynamics (2017)

Uploaded by

Uma Umamaheswari0 ratings0% found this document useful (0 votes)

3 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesCBCS 4.1 International Business Dynamics (2017)

CBCS 4.1 International Business Dynamics (2017)

Uploaded by

Uma UmamaheswariCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

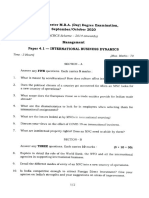

PG -—875

IV Semester M.B.A. Degree Examination, July 2017

(CBCS Scheme)

Management

4.1; INTERNATIONAL BUSINESS DYNAMICS

Time : 3 Hours Max. Marks : 70

Instruction : Answer all Sections,

SECTION-A

Answerany five of the following questions. Each question cartiesfivemarks. (§%5=25)

c

What do you mean by a Tariff Barriers in Intemational Trade ? How these are

different from the Non-Tanif barriers ?

2. Explain "Comparative Advantage” with the support of an example.

. Discuss the scope of WTO. How itis differant fram GATT 2

Define Foreign Direct investment (FDI). Differentiate between FDI and Foreign

Portfolio Investment (FPI)

‘What are Multi-National Enterprises (MNEs) ? Explain the advantages and

disadvantages of MNEs from the point of view of host country.

‘What are the causes of globalization ? Explain

What is cross cultural training ? Discuss its importance.

SECTION-B

Answerany three questions. Each question carriesten marks. (8x10=30)

a

9.

10.

"

Explain the factors influencing the International business environment.

Elucidate the Export— Import procedure and the documents that are important

during this process,

What do you mean by conflicts ? Discuss the role of negotiations in Intemational

business,

Expiain Raymond Vernon's Product Life Cycle theory in International Trade.

Pro.

PG - 875 a

SECTION-C

12, Compulsory Section. (115215)

Case Study : Unfair Protection or valid defence.

“Mexico Widens Anti-Dumping measures .... Steel at the core of US Japan

‘Trade Tensions .... Competitors in other countries are destroying an American

success story... It must be stopped’, scream headlines around the world.

International trade theories argue that nations should open their doors to trade

Conventional free trade wisdom says that by trading with others, a country can

offer its citizens a greater volume and selection ct goods at cheaper prices than

it could in the absence of it. Nevertheless, truly free trade still does not exist

because national govemments intervene. Despite the efforts of WTO and smaller

‘groups of nations, government seems to be crying foul in the trade game now

more than ever before:

We see efforts at protectionism in the rising trends in governments charging

foreign producers for“dumping” their goods on the world market. Worldwids, the

‘number of anti-dumping cases that were initiated stood at about 150 in 2014,

225 in 2018, 230 in 2016, and 300 in 2017,

“Thore is no shortage of similar examples. The US charges Brezil, Japan, anc.

Russia with dumping their products in the US market as a way out of tough

economic times. The US steel industry wants the government fo slap @

200 percent tari on certain types'of steal, But car makers in US are not

complaining, and General Motors even spoke out against the anti-dumping

charges — as it Is enjoying the benefits of low cost steel for the use in its

auloproduction. Canadian steel makers followed the lead of the US and are

pushing for anti-dumpig actions against four nations,

Emerging markets too, are jumping into the fray. Mexico recently expanded.

coverage ofits Automatic Import Advice System. The system requires importers:

(from a selected list of countries) to notify Mexican officials of the amount and

price of the shipment 10 days prior 10 its expected arrivals in Mexico. The ten

day notice gives domestic producers advance warning of incoming low priced

products $0 they can complain of dumping before the product clear customs and

‘onter the market place. India is also getting onboard by setting up a new

government agency to handle anti-dumping cases.

Why dumping is on the rise for the first place ? The WTO has made major

inroads on the use of tarifs, slashing them across every product category in

recent years, Bul the WTO does not have the autherity to punish companies, but

only governments, Thus the WTO does not have the authority to punish

‘companies, but only governments, Thus the WTO cannot pass judgments against

individual companies that ate dumping thelr products in other markets. It can

‘only pass the rulings against the governments of the country that imposes

anti-dumping duty. But the WTO allows countries to retaliate against nations

‘whose producers are suspected of dumping when it can be shown that

1) The alleged offenders are significantly hurting the domestic producers.

ii) The expor price is lower than the cost of production or lower than the home-

market price,

Supporters of anti-dumping tariff claim that they pfevent dumpers from

undercutting the price charged by the producers in a target market and driving

them about of business. Another claim in support of anti-dumping is thatitis an

‘excellent way of retaining some protection against the potential dangers of totally

free trade. Detractors of anti-dumping tariffs charge that once the taritis are

imposed they are rarely removed. They also claim that they cost companies and

governments a great deal of ime and money to file and argue their cases. Itis

argued that the fear of being charged with dumping causes international

‘competitors to keep their price higher in the target market than would have

otherwise be the case. This would allow domestic companies to charge higher

prices and not loose market shares forcing consumers to pay more for their

‘so0ds

Case Questions:

i) Explain the concept of Dumping with suitable examples.

il) What are the major érawoacks of anti-dumping measure for the consumers ?

iil) As we have seen WTO cannot currently get involved in punishing individual

‘companies for dumping. Its action can be only directed towards governments

of countries. Do you think this is @ wise policy ? Why or why not ? Justity

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cat 2018 Slot 1 Solved Question PaperDocument102 pagesCat 2018 Slot 1 Solved Question PaperUma UmamaheswariNo ratings yet

- MBA 2007 TANCET Previous Papers 1Document22 pagesMBA 2007 TANCET Previous Papers 1Uma UmamaheswariNo ratings yet

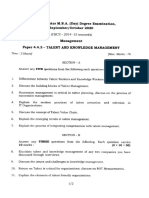

- CBCS 4.4.3 Talent and Knowledge Management 2020Document2 pagesCBCS 4.4.3 Talent and Knowledge Management 2020Uma UmamaheswariNo ratings yet

- BA7107-Legal Aspects of Business Question Bank - EditedDocument6 pagesBA7107-Legal Aspects of Business Question Bank - EditedUma UmamaheswariNo ratings yet

- Management: Paper 4.4.2 International Human Resource ManagementDocument2 pagesManagement: Paper 4.4.2 International Human Resource ManagementUma UmamaheswariNo ratings yet

- CBCS 3.2 Projects and Operation Management (2017)Document3 pagesCBCS 3.2 Projects and Operation Management (2017)Uma UmamaheswariNo ratings yet

- 2014 Onwards) : Q.P. Code: 61341 (Day) Degree ExaminationDocument2 pages2014 Onwards) : Q.P. Code: 61341 (Day) Degree ExaminationUma UmamaheswariNo ratings yet