Professional Documents

Culture Documents

Tugas Performance Evaluation

Tugas Performance Evaluation

Uploaded by

Rangga Dhia Majduddin0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pagesTugas Performance Evaluation

Tugas Performance Evaluation

Uploaded by

Rangga Dhia MajduddinCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

F Gis peste tacreincs vance

[vie Piliaitene tn)ormation fy

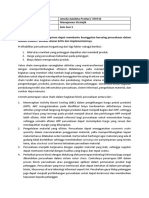

eterithingon Company ha

Division. The following inform

Net (afte

Total capital employed

| Washingron actual cost of capital was

Exercise 11-31 Economic Value Added OF

Refer to the information for Washington Company above

Required:

1. Calculate the EVA for the Adams Division.

2. Calculate the EVA for the Jefferson Division.

3, CONCEPTUAL CONNECTION Is each division creating or destroying wealth?

4, CONCEPTUAL CONNECTION Describe generally the types of actions that Washington's

management team could take to increase Jefferson Division’s EVA?

Exercise 11-32 Residual Income c

Referto the information for Washington Company above. In addition, Washington Company's

top management has set a minimum acceptable rate of return equal to 8%.

Required:

1. Calculate the residual income for the Adams Division.

2. Calculate the residual income for the Jefferson Division.

Problem 11-41 Return on Investment, Margin, Turnover ol

Ready Electronics is facing stiff competition fi

BE ining se a ; petition from imported goods. Its operating income margin

ec ig steadily for the past several years. The company has been forced to k

Beeeeeee ) pany has been forced to lower

prices in its market share. The operating results for the past 3 years are as

follows:

Year 1 Year2 Year 3

Sales $10,000,000 $ 9,500,000 $ 9,000,000

Operating income 1,200,000 1,045,000 945,000

Average assets 15,000,000 15,000,000 15,000,000

For the coming year, Ready’s president plans to installa JIT purchasing and manufacturing

| She estimates that inventories will be reduced by 70% during the first year of operations,

ing a 20% reduction in the average operating assets of the company, which would remain

“without the JIT system. She also estimates that sales and operating income will be

(Continued)

ling

restored to Year I levels because of simultaneous reductions in operating

prices. Lower selling prices will allow Ready to expand its marker share. (.\ =

bers to two decimal places.)

Required:

1. Compute the ROI, margin, and turnover for Years 1, 2, and 3.

2. CONCEPTUAL CONNECTION Suppose that in Year 4 the sales and operating income

were achieved as expected, but inventories remained at the same level as in Year 3.

Compute the expected ROI, margin, and turnover. Explain why the ROI increased over

the Year 3 level.

CONCEPTUAL CONNECTION Suppose that the sales and net operating income for Year

4 remained the same as in Year 3 but inventory reductions were achieved as projected.

Compute the ROI, margin, and eurnover. Explain why the ROI exceeded the Year 3 level

CONCEPTUAL CONNECTION Assume that all expectations for Year 4 were realized.

Compute the expected ROI, margin, and turnover. Explain why the ROI increased over

the Year 3 level.

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Tugas CH 7 - Amelia Zulaikha PDocument3 pagesTugas CH 7 - Amelia Zulaikha Pamelia zulaikha100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Chapter 2 The Public Accounting ProfessionDocument3 pagesChapter 2 The Public Accounting Professionamelia zulaikhaNo ratings yet

- CH 3 Audit Report & CH 4 Professional Ethics - Amelia Zulaikha P - MAKSI43BDocument4 pagesCH 3 Audit Report & CH 4 Professional Ethics - Amelia Zulaikha P - MAKSI43Bamelia zulaikhaNo ratings yet

- CH 6 Audit Responsibilities and ObjectivesDocument2 pagesCH 6 Audit Responsibilities and Objectivesamelia zulaikhaNo ratings yet

- Problem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43BDocument4 pagesProblem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43Bamelia zulaikhaNo ratings yet

- Amelia ZP - Resume Ch.4Document2 pagesAmelia ZP - Resume Ch.4amelia zulaikhaNo ratings yet

- CHAPTER 6 - Kelompok 1 FixDocument30 pagesCHAPTER 6 - Kelompok 1 Fixamelia zulaikhaNo ratings yet

- Tugas Akpri Week 14Document4 pagesTugas Akpri Week 14amelia zulaikhaNo ratings yet

- TUGAS RINGKASAN CASES #1 KEL 4 FixDocument3 pagesTUGAS RINGKASAN CASES #1 KEL 4 Fixamelia zulaikhaNo ratings yet

- Multinational OrganizationDocument22 pagesMultinational Organizationamelia zulaikhaNo ratings yet

- Amelia ZP - Tugas W3Document2 pagesAmelia ZP - Tugas W3amelia zulaikhaNo ratings yet

- Pertanyaan Kuis 3Document1 pagePertanyaan Kuis 3amelia zulaikhaNo ratings yet

- CAMPBELL SOUP - Grup 2Document4 pagesCAMPBELL SOUP - Grup 2amelia zulaikhaNo ratings yet

- Problem 5-5 - Grup 2 ALKDocument4 pagesProblem 5-5 - Grup 2 ALKamelia zulaikhaNo ratings yet

- Columbia Pictures - Grup 2 ALKDocument3 pagesColumbia Pictures - Grup 2 ALKamelia zulaikhaNo ratings yet