Professional Documents

Culture Documents

RMC No. 42-2021 RA No. 11534

RMC No. 42-2021 RA No. 11534

Uploaded by

marie deniega0 ratings0% found this document useful (0 votes)

13 views39 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views39 pagesRMC No. 42-2021 RA No. 11534

RMC No. 42-2021 RA No. 11534

Uploaded by

marie deniegaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 39

H.No. 4187

S.No, 1357

Republic ofthe Philippines

Congress of the Philippines

Micteo Manila

‘Fighteenth Congress

Second Regular Session

gee

Begun and held in Metro Manila, on Monday, the twenty-seventh

day of July, two thousand twenty,

[ RePuBLic Act No. 11534]

AN ACT REFORMING THE CORPORATE INCOME TAX

AND INCENTIVES SYSTEM, AMENDING FOR THE

PURPOSE SECTIONS 20, 22, 25, 27, 28, 29, 34, 40, 57,

109, 116, 204 AND 290 OF THE NATIONAL INTERNAL

REVENUE CODE OF 1997, AS AMENDED, AND

CREATING THEREIN NEW TITLE XIII, AND FOR

OTHER PURPOSES

Be it enacted by the Senate and House of Representatives of the

Philippines in Congress assembled:

SECTION 1. Short Title. - This Act shall be known as

the “Corporate Recovery and Tax Incentives for Enterprises

Act” or “CREATE”.

SEC. 2, Declaration of Policy. ~ Ibis hereby declared the

policy of the State to develop the national economy towards global

‘competitiveness by implementing tax policies instrumental in

2

attracting investments, which will reeult in productivity

enhancement, employment generation, countrywide development,

and a more inclusive economic growth, while at the same

time maintaining fiscal prudence and stability.

‘To achieve these objectives, the State shall:

(@) Improve the equity and efficiency of the corporate tax

system by lowering the rate, widening the tax base, and reducing

tax distortionsand leakages;

(b) Develop, subject to the provisions of this Act, a more

responsive and globally-competitive tax incentives regime that

isperformance-based, targeted, time-bound, and transparent;

© Provide support to busines

unforeseen events such as an out

diseases or a global pandemic, and strengthen the nation's

capability for similar circumstances in the future; and

in their recovery from

ak of communicable

@ Create a more equitable tax incentive system that

will allow for inclusive growth and generation of jobs and

opportunities in all the regions of the country, and ensure

access and ease in the grant of these incentives especially for

applicantsin least developed aress.

SEC. 3. Section 20 of the National Internal Revenue

Code of 1997, as amended, is hereby further amended to read

as follows:

“SBC.20. Submission of Report and Pertinent

Information by the Commissioner.

“@ xxx

“@) Submission of Tax-Related Information

to the Department of Finance. — The Commissioner

shall, upon the order of the Secretaxy of Finance

specifically identifying the needed information and

Justification for such order in relation to the grant of

incentives under Title XIII, furnish the Secretary

3

pertinent information on the entities receiving

incentives under this Code: Provided, however,

‘That the Secretary and the relevant officers handling

‘such specific information shall be covered by the

provisions of Section 270 unless the taxpayer

‘consents in writing to such disclosure.

“© Report to Oversight Committee. - The

Commissioner shall, with reference to Section 204

of this Code, submit to the Oversight Committee -

referred to in Section 290 hereof, through the

Chairpersons of the Committees on Ways and

Means of the Senate and House of Representatives,

a report on the exercise of his powers pursuant to

the said Section, every six (6) months of each

calendar year.”

SEC. 4, Section 22 of the National Internal Revenue

Code of 1997, as amended, ishereby further amended to read

as follows:

“SEO, 22. Definitions. - xxx

“Q) xxx

“®) The term ‘corporation’ shail include one

person corporations, partnerships, no matter how

general professional partnerships and a joint

venture or consortium formed for the purpose of

undertaking construction projects or engaging in

petroleum, coal, geothermal and other energy

operations pursuant to an operating consortium

agreement under a service contract with the

Government. ‘General professional partnerships’

are partnerships formed by persons for the sole

purpose of exercising their common profession,

no part of the income of which is derived from

engaging in any trade orbusiness.

“crx”

‘SO. 5. Section 25 of the National Internal Revenue

Code of 1997, as amended, is hereby further amended to read

asfollows:

“$50.25. Tax on Nonresident Alien

Individual.

“@) xxx

“@ xxx

"@ Cash and/or Property Dividends from

@ Domestic Corporation or sJoint Stock Company,

or Insurance or Mutual Fund Company or

Regional Operating Headquarter or Multinational

Company, or Share in the Distributable Net

Income of a Partnership (Except a General

Professional Partnership), Joint Account, Joint

Venture Taxable as a Corporation or Association,

Interests, Royalties, Prizes, and Other Winnings. —

Cash and/or property dividends from a domestic

corporation, or from a joint stock company, or from

an insurance or mutual fund company or from a

regional operating headquarter of multinational

company, or the share of a nonresident alien

individual in the distributable net income after tax

of a partnership (except 2 general professional

partnership) of which he is a partner, or the share

of a nonresident alien individual in the net income

after tax of an association, a joint account, or a joint

venture taxable as a corporation of which he is a

member or a co-venturer; interests; royalties

(in any form); and prizes (except prizes amounting

to Ten thousand pesos (P10,000.00) or less which

shall be subject to tax under Subsection (B)(1) of

Section 24) and other winnings (except winnings

amounting to Ten thousand pesos (P10,000.00) or

leas from Philippine Charity Sweepstakes Office

(PCS0) games which shall be exempt); shall be

5

subject to an income tax of twenty percent (20%)

on the total amount thereof: Provided, however,

‘That royalties on books as well as other literary

works, and royalties on musical compositions shall

be subject to a final tax of ten percent (10%) on

the total amount thereof: Provided, further, That

cinematographic films and similar works shall be

subject to the tax provided under Section 28 of

this Code: Provided, furthermore, That interest

income from long-term deposit or investment

in the form of savings, common or individual

trust funds, deposit substitutes, investment

management accounts and other investments

evidenced by certificates in euch form prescribed

by the Bangko Sentral ng Pilipinas (BSP) shall

be exempt from the tax imposed under this

Subsection: Provided, finally, That should the

holder of the certificate pre-terminate the deposit

or investment before the fifth (5") year, a final

tax shall be imposed on the entire income and

shall be deducted and withheld by the depository

bank from the proceeds of the long-term deposit

or investment certificate based on the remaining

maturity thereof:

“Four (4) yearsto less than five (5) years - 5%;

“Three (8) years to less than four (4) years

+ 12%; and

“Less than three (8) years - 20%.

“@ xxx”

SEC. 6. Section 27 of the National Internal Revenue

Code of 1997, as amended, is hereby further amended to read

asfollows:

“SEO. 27. Rates of Income Tax on Domestic

Corporations. ~

“(@) In General. — Except as otherwise

provided in this Code, an income tax rate of

twenty-five percent (25%) effective July 1, 2020,

is hereby imposed upon the taxable income derived

during each taxable year from all sources within

and without the Philippines by every corporation,

as defined in Section 22(B) of this Code and taxable

under this Title as a corporation, organized in,

or existing under the laws of the Philippines.

“Provided, Vaat corporations with net taxable

income not exceeding Five mil

(P5,000,000.00) and with total assets not exceeding

One hundred million pesos (P100,000,000.00),

excluding lend on which the particular business

entity's office, plant, and equipment are situated

during the taxable year for which the tax isimposed,

shall be taxed at twenty percent (20%).

“In tho ease of corporations adopting the

fiscal-year accounting

shall be computed

date when specific sales, purchases and other

transactions occur. Their income and expenses for

the fiscal year shalll be deemed to have been earned

‘and spent equally for each month of the period.

“The corporate income tax rate shall be

applied on the amount computed by multiplying

the number of months covered by the new rate

within the fiscal year by the taxable income of

the corporation for the period, divided by twelve.

“®) Proprietary Educational Institutions

and Hospitals. — Proprietary educational institutions

and hospitals which are nonprofit shall pay a tax

‘the gross income from ‘unrelated trade, business

1

or other activity’ exceeds fifty percent (60%) of the

substantially related to the cecta aryucanta

by such educational institution or hospital of its

primary purpose or function. ‘Proprietary’ means a

private hospitel, or any private school maintained

and administered by private individuals or groups’

with an issued permitio operate from the Department

of Education (DepEd), or the Commission on

Higher Education (CHED), or the Technical

Education and Skills Development Authority

(TESDA), as the case may be, in accordance with

existing laws and regulations.

“(© Government-owned or -C

Corporations, Agencies or Instrumer

‘The provisions of existing special or general

to the contrary notwithstanding, all corporations,

agencies, or instrumentalities owned or controlled

by the Government, except the Government

Service Insurance System (GSIS), the Social Security

System (GSS), the Home Development Mutual Fund

(HDMF), the Philippine Health Insurance

Corporation (PHIC), and the local water districts shall

pay such rate of tax upon their taxable income as are

imposed by this Section upon corporations or

ageociations engaged in a similar business, industry,

or activity.

“@) Rates of Taxon Certain Passive Incomes.

~ xxx

“xx

“@)_Intercorporate Dividends. ~ Dividends

received by a domestic corporation shall not be

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

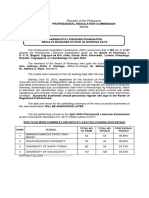

- Licensure Examination For Professional Teachers - ElementaryDocument418 pagesLicensure Examination For Professional Teachers - ElementaryRappler83% (6)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Roll of Successful Examinees in The REGISTERED ELECTRICAL ENGINEERS LICENSURE EXAMINATIONDocument102 pagesRoll of Successful Examinees in The REGISTERED ELECTRICAL ENGINEERS LICENSURE EXAMINATIONRappler75% (4)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- PRC Nurse ALPHADocument516 pagesPRC Nurse ALPHARappler84% (19)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Cebu Mayor Mike Rama Files Complaint Against Gov Garcia Over BRT StoppageDocument33 pagesCebu Mayor Mike Rama Files Complaint Against Gov Garcia Over BRT StoppageRapplerNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Republic Act No. 11985Document12 pagesRepublic Act No. 11985Rappler0% (1)

- February 2024 Licensure Examination For Criminologists ResultsDocument314 pagesFebruary 2024 Licensure Examination For Criminologists ResultsRappler70% (10)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Me0224 Alpha Roll of Successful Examinees in The MECHANICAL ENGINEERS LICENSURE EXAMINATIONDocument92 pagesMe0224 Alpha Roll of Successful Examinees in The MECHANICAL ENGINEERS LICENSURE EXAMINATIONRapplerNo ratings yet

- Resolution of Both Houses No. 6Document3 pagesResolution of Both Houses No. 6Rappler50% (2)

- PRC Nurse POSDocument19 pagesPRC Nurse POSRappler100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Roll of Successful Examinees in the OCCUPATIONAL THERAPISTS LICENSURE EXAMINATIONDocument3 pagesRoll of Successful Examinees in the OCCUPATIONAL THERAPISTS LICENSURE EXAMINATIONRapplerNo ratings yet

- JUNE 2024 OCCUPATIONAL THERAPISTS LICENSURE EXAMINATIONDocument1 pageJUNE 2024 OCCUPATIONAL THERAPISTS LICENSURE EXAMINATIONRapplerNo ratings yet

- Roll of Successful Examinees in The CHEMICAL ENGINEERS LICENSURE EXAMINATIONDocument13 pagesRoll of Successful Examinees in The CHEMICAL ENGINEERS LICENSURE EXAMINATIONRapplerNo ratings yet

- Chemical Engineers Licensure Examination ResultsDocument2 pagesChemical Engineers Licensure Examination ResultsRapplerNo ratings yet

- May 2024 Chemical Engineers Licensure Examination Performance of SchoolsDocument2 pagesMay 2024 Chemical Engineers Licensure Examination Performance of SchoolsRapplerNo ratings yet

- Civil Engineers Licensure Examination Results April 2024Document134 pagesCivil Engineers Licensure Examination Results April 2024Rappler100% (1)

- April 2023 Pharmacy ResultsDocument5 pagesApril 2023 Pharmacy ResultsRapplerNo ratings yet

- PHAR0424Document2 pagesPHAR0424Rappler0% (1)

- April 2024 Real Estate Brokers Licensure Examination ResultsDocument27 pagesApril 2024 Real Estate Brokers Licensure Examination ResultsRapplerNo ratings yet

- January 2023 Licensure Examination For Architects Performance of SchoolsDocument4 pagesJanuary 2023 Licensure Examination For Architects Performance of SchoolsRapplerNo ratings yet

- April 2024 Electronics Engineers Licensure Examination Performance of SchoolsDocument15 pagesApril 2024 Electronics Engineers Licensure Examination Performance of SchoolsRappler0% (1)

- EXECUTIVE ORDER 57 Strengthening PH Maritime Security Amid China's BullyingDocument6 pagesEXECUTIVE ORDER 57 Strengthening PH Maritime Security Amid China's BullyingRapplerNo ratings yet

- March 2024 Medical Technologists Licensure Examination ResultsDocument147 pagesMarch 2024 Medical Technologists Licensure Examination ResultsRapplerNo ratings yet

- Mechanical Engineers Licensure Examination Results Released in Three (3) Working DaysDocument3 pagesMechanical Engineers Licensure Examination Results Released in Three (3) Working DaysRapplerNo ratings yet

- February 2024 Mechanical Engineer Licensure Examination Performance of SchoolsDocument9 pagesFebruary 2024 Mechanical Engineer Licensure Examination Performance of SchoolsRapplerNo ratings yet

- February 2024 Master Plumbers Licensure Examination ResultsDocument32 pagesFebruary 2024 Master Plumbers Licensure Examination ResultsRappler100% (1)

- February 2024 Respiratory Therapists Licensure Examination Results Performance of SchoolsDocument2 pagesFebruary 2024 Respiratory Therapists Licensure Examination Results Performance of SchoolsRapplerNo ratings yet

- December 2023 Chemists and Chemical Technicians Licensure Examinations ResultsDocument64 pagesDecember 2023 Chemists and Chemical Technicians Licensure Examinations ResultsRappler100% (2)

- Civil Engineers Licensure ExaminationDocument2 pagesCivil Engineers Licensure ExaminationRapplerNo ratings yet

- January 2023 Licensure Examination For Architects Roll of Successful ExamineesDocument37 pagesJanuary 2023 Licensure Examination For Architects Roll of Successful ExamineesRappler100% (1)

- Aero1223 PosDocument1 pageAero1223 PosRapplerNo ratings yet