Professional Documents

Culture Documents

NATIONAL MONETIZATION PIPELINE Content

Uploaded by

Ketan DedhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NATIONAL MONETIZATION PIPELINE Content

Uploaded by

Ketan DedhaCopyright:

Available Formats

NATIONAL MONETIZATION PIPELINE

On 23 August 2021, India unveiled the Asset Investment Pipeline for government

departments and public sector entities - the 'National Pipeline'. The program aims to

monetize key assets under the central government to the tune of INR 6000 billion over 4

years.

Purpose: -

The NMP is a new initiative to establish a strategic partnership between government and the

private sector and thus generate sustainable infrastructure funding by fundraising brownfield

infrastructure i.e. assets on which operational infrastructure has been built.

How to create an NMP Scheme?

Assets and transactions will be supported by a variety of specific contractual instruments

and financial markets, depending on parameters such as sector, nature of the asset,

transaction time, etc. Appropriate policy and regulatory interventions will be implemented as

required. Work continues to set up a monetization dashboard with real-time monitoring. The

empowerment committee has been set up by the government to implement and monitor the

program - the Core Group of Secretaries on Asset Monetization (CGAM) will be led by the

Cabinet Secretary.

Asset valuation under NMP

Across the sector, NMP monetization is limited to potential assets based on 3 factors-:

1. Potential value of goods

2. Inheritance is considered to make money

3. Number of showcase making money

Methods of estimating monetary value shown by approx.

A. Market Method- In this way, the Display Value is measured from the comparable market

functions of the identified asset classes.

B. Capex Method- In this way, the assets of those categories can be monetized by PPP-

based models that expect the private sector to incur significant costs.

C. Book Price Method - This method is used when CAPEX investment is not available or

classes are based on information about transactions such as a market.

D. Enterprise Value Method- This method is used for assets where existing budget

information is available or can be easily estimated based on assumptions or available data.

Sector-Wise classification of the legacy of the Income-Making Scheme

The assets of the road, rail, and energy sectors account for 66 per cent of the total

identification value and the remainder is owned by telecoms, aviation, etc.

The assets under the national monetary pipeline are:

1. Roads- Total road assets up to 26,700 km, representing 22% of national roads (QL) will

be considered for monetization over the next 4 years. The indicated monetization will be

estimated using the market approach. The government is expected to attract INR 1.6 trillion

(US $ 21.55 billion) by monetizing these road assets through potential models such as Toll

Operate Transfer (Tot) and Infrastructure Investment Trust (InvIT).

2. Trains- The railway sector is set to cash out assets with an indicator value of 152.5 billion

rupees (20.70 billion dollars) over the next four years. Key rail assets identified for revenue

generation include 400 railway stations, 90 passenger trains, 1400 km of tracks on one

route, 741 km of backbone railway, 15 railway stadiums and selected railway colonies, 265

railway-owned product cabins, and 4 hill railways. The cash value of this indicator is

estimated according to the investment method of railway stations, passenger trains, railway

colonies and private cargo terminal facilities, but a book value approach is adopted for the

estimation of the cash value of track infrastructure.

3. Power transfer- Transmission assets that will be considered to generate revenue over

the next four years when combined at 28,608 km, including 400 kilovolt (KV) and Power Grid

Corporation of India Limited (PGCIL).

4. Natural Gas Pipes- Over the four years, the total assets considered for revenue

generation will form approximately 23% of India's total pipeline asset base. In this division,

the COT (CarryOperateTransfer) concession model was conceived as a suitable model in

the pipeline.

5. Petroleum, Petroleum Product Pipelines and other goods- The asset classes

identified for revenue generation in this sector include a 733 km LPG pipeline, a 3196 km

petroleum product pipeline, two hydrogen production plants and ESG assets (wastewater

treatment plant, sulphur recovery equipment, flare gas recovery system).

6. Telecommunications- Investment in telecom assets is expected to reach INR 351 billion

(US $ 4.8 billion). Identification calculations are based on the Capex Approach for Bharatnet

fiber assets and Market Approach for tower assets.

7. Warehousing- The government intends to monetize the assets of state-owned

enterprises, Food Corporation of India (FCI) and Central Warehousing Corporation (CWC),

at an estimated cost of INR 289 billion (US $ 4 billion) and the Capex Approach used for this

measure.

8. Aviation- Government monetizes 25 Indian Airport Authority (AAI) managed airports to

FY25, including Varanasi, Udaipur, Dehradun, Indore, Ranch, Coimbatore, Jodhpur,

Baddara, Part and Vijayawada, Chennai, Nagpur, Babaneshul. These revenue drives are

estimated to raise the equivalent of INR 207.8 billion (US $ 2.8 billion) in response to the

Capex Approach.

9. Shipping- A total of 31 shipping assets worth INR 128 billion ($1.8 billion) will be

generated between Fiscal 22 and Fi 25. The Capex method was used while estimating this

value. The PPP model will probably be used in this area, and it will be implemented by the

Department of Ports, Navigation and Waterways.

Concerns raised by Stakeholders

Expected transfer of assets into the hands of state leaders has been a criticism of

government programs, especially as these have a number of national strategies. It is

reported that in the long run, the nature of these programs will affect the interests of citizens

as it is not yet clear what checks and prices the government will impose on private players.

Concerns have also been expressed that models of equity and the lack of resources that can

be identified in various assets are seen as a challenge to attract various stakeholders, which

undoubtedly increases the number of corrupt interests. In addition, there is no way to resolve

disputes mentioned on a map provided by the government.

The conclusion

The National Pipeline is a project launched by the Central Government on 23 August 2021.

This project is a public-private partnership. There are three main methods for measuring

property classes. The government provides for the segregation of the income-generating

system. Stakeholders raised concerns by discussing the various challenges of the project.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Design of Propulsion Systems For High-Speed CraftDocument17 pagesDesign of Propulsion Systems For High-Speed Craftaeromexpower2009No ratings yet

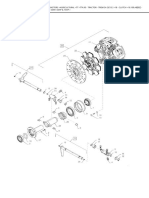

- Transmission Clutch, 55Hp, 65Hp & 75HpDocument3 pagesTransmission Clutch, 55Hp, 65Hp & 75Hpwinston sandovalNo ratings yet

- 4 Geometric Design of HighwayDocument80 pages4 Geometric Design of HighwaySol TirusewNo ratings yet

- Haulotte Optimum 8 Maintenance ManualDocument206 pagesHaulotte Optimum 8 Maintenance Manualraul430No ratings yet

- Returns NoteDocument16 pagesReturns NoteKetan DedhaNo ratings yet

- 02 Charging Section GST Part 2Document14 pages02 Charging Section GST Part 2Ketan DedhaNo ratings yet

- Time of SupplyDocument21 pagesTime of SupplyKetan DedhaNo ratings yet

- About Reliance Jio: Reliance Jio Infocomm Limited Popularly Known As Jio Is India's LargestDocument4 pagesAbout Reliance Jio: Reliance Jio Infocomm Limited Popularly Known As Jio Is India's LargestKetan DedhaNo ratings yet

- Paper - 2: Corporate & Other Laws: © The Institute of Chartered Accountants of IndiaDocument15 pagesPaper - 2: Corporate & Other Laws: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Division Performance MeasurementDocument31 pagesDivision Performance MeasurementKetan DedhaNo ratings yet

- The Institute of Chartered Accountants of India - Admit Card2Document11 pagesThe Institute of Chartered Accountants of India - Admit Card2Ketan DedhaNo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Character CertificateDocument1 pageCharacter CertificateKetan DedhaNo ratings yet

- Ford Next Gen Ranger Brochure NewDocument9 pagesFord Next Gen Ranger Brochure NewDonReilyNo ratings yet

- Mini Escavadeira - 302.7d - CaterpillaDocument636 pagesMini Escavadeira - 302.7d - CaterpillaRaphael OliveiraNo ratings yet

- The Ports As Smart Micro-Grids: Development PerspectivesDocument6 pagesThe Ports As Smart Micro-Grids: Development Perspectivesnkor6574No ratings yet

- Eap Prducts Catalogue-Internal Use 2022 RV1Document62 pagesEap Prducts Catalogue-Internal Use 2022 RV1Alexis AlfingerNo ratings yet

- 3293 P 00 Rev 1 ENDocument2 pages3293 P 00 Rev 1 ENWan Nabilah Farahin WawanpinkNo ratings yet

- Road and ComponentsDocument10 pagesRoad and ComponentsPrakhar patidarNo ratings yet

- MCHW Vol 1 Series 900 - Print v0.2Document89 pagesMCHW Vol 1 Series 900 - Print v0.2Dwijendra ChanumoluNo ratings yet

- Role of Malacca Strait With A Geopolitical and Strategic ApproachDocument24 pagesRole of Malacca Strait With A Geopolitical and Strategic ApproachRr Sri Sulistijowati HNo ratings yet

- Ek Dham 3N - 4D Departure 2023Document11 pagesEk Dham 3N - 4D Departure 2023thestrategicedgeNo ratings yet

- Revision Lecture 7 PDFDocument130 pagesRevision Lecture 7 PDFiit powaiNo ratings yet

- Product Selection Matrix: Approximated and Varies Based Off Option SelectionsDocument1 pageProduct Selection Matrix: Approximated and Varies Based Off Option SelectionsWalter Dario LopezNo ratings yet

- Distance Time Graphs Match UpDocument1 pageDistance Time Graphs Match UpCodamiNo ratings yet

- Commissioning of INLCUDocument1 pageCommissioning of INLCUpukhraj007No ratings yet

- Sham (Price List)Document6 pagesSham (Price List)Wish StazienNo ratings yet

- Cable Ship OverviewDocument30 pagesCable Ship Overviewkaushaltrivedi46No ratings yet

- Škoda Kushaq: The All NewDocument4 pagesŠkoda Kushaq: The All NewAnoop KavirajanNo ratings yet

- Shipping Port CodesDocument21 pagesShipping Port CodesSEAPATH DOCSNo ratings yet

- Rd125lcii RZ125 Ypvs '86 1GL 1ga 2HKDocument49 pagesRd125lcii RZ125 Ypvs '86 1GL 1ga 2HKMohamad SyukhairiNo ratings yet

- LIWEI CatalogeDocument22 pagesLIWEI Cataloge3orwa HajNo ratings yet

- ATL & BTL ActivitiesDocument14 pagesATL & BTL ActivitiesAMITAVA ROYNo ratings yet

- Mirror Glass 2022Document95 pagesMirror Glass 2022Julian GardiNo ratings yet

- RENK Integrated Front-End Power System enDocument8 pagesRENK Integrated Front-End Power System enhumayun121No ratings yet

- CIPET Inspection Call of OFB Tech 14.12.2022Document1 pageCIPET Inspection Call of OFB Tech 14.12.2022GNANA CHARAN GNo ratings yet

- Pipeline Pigging Handbook 8Document1 pagePipeline Pigging Handbook 8Bruno GonçalvesNo ratings yet

- Linde EN Ds n20b n20 25 n20 25hp 1115 en A 0819 ViewDocument6 pagesLinde EN Ds n20b n20 25 n20 25hp 1115 en A 0819 ViewNadeem AhmedNo ratings yet

- Static and Dynamic Analysis of Tee Beam Bridge DeckDocument4 pagesStatic and Dynamic Analysis of Tee Beam Bridge DeckfarrukhNo ratings yet