Professional Documents

Culture Documents

CamScanner 08-31-2021 23.33.47

CamScanner 08-31-2021 23.33.47

Uploaded by

Md Muneeruddin Ahmed0 ratings0% found this document useful (0 votes)

10 views13 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views13 pagesCamScanner 08-31-2021 23.33.47

CamScanner 08-31-2021 23.33.47

Uploaded by

Md Muneeruddin AhmedCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

“Management Accounting is concerned with accounting information that is useful to

management.”

-R.N. Anthony

“Management Accounting is a system that collects, classifies, summarises, analyses and reports

information that will assist managers in their decision making and control activities”.

~ Robert S. Kaplan

“Management Accounting is the term used to describe accounting methods, systems and

techniques which coupled with special knowledge and ability, assists management in its task of

‘maximising profits or minimising losses. Management Accountancy is the blending together into a

coherent whole, Financial Accounting, cost accountancy and all aspects of financial management.”

Batty

“Management Accounting is a system of collection and presentation of relevant economic

information relating to an enterprise for planning, controlling and decision-making.”

-ICWA of India

“Management Accounting is the provision of information required by management for such

purposes as formulation of policies, planning and controlling the activities of the enterprise,

decision-making on the alternative courses of action, disclosure to those extemal to the entity

(shareholders and others), disclosure to employees and safeguarding of assets.”

-CIMA London

Management Accounting is “the application of appropriate techniques and concepts in processing

historical and projected economic data of an entity to assist management in establishing plans for

reasonable economic objectives and in the making of rational decisions with a view towards these

objectives”,

American Accounting Association

‘Scanned with CamScanner

7 SCOPE OF MANAGEMENT ACCOUNTING

‘The scope of Management Accounting is very vast as Management Accountancy utilizes the

principles and practices of Financial Accounting and Cost Accounting in addition to other

‘management techniques for efficient operations of « company. It widely uses different techniques

from various branches of knowledge like Statisties, Mathematics, Economics, Laws and

Psychology to assist the management in its task of maximizing profits oF minimizing losses. The

‘main thrust in Management Accountancy is towards determining policy and formulating plans to

achieve the desired objectives of management. Management Accountancy makes corporate

planning and strategy effective.

1) Financial Accounting

nancial Accounting provides basic historical data which helps management to forecast and plan

its financial activities for the future period. Thus for an effective and successful Management

Accounting, there should be a proper and well designed Financial Accounting system.

fi) Cost Accounting,

Cost Accounting provides the most sophisticated techniques like marginal costing, budgetary

control, standard costing ete., which enables Management Accounting to provide necessary

information for effective decision making and control.

) Budgetary Control

In order to plan business activities forthe Future, forecasting and budgeting play a very significant

role, Forecasting helps in the preparation of budgets and budgeting helps management accountant

in exercising budgetary contro.

iv) Tax Planning

‘Tax planning is another important area which has a serious impact on the profitability of the

concern, Without proper planning of tax, the profits of the enterprise are hijacked which affects

adversely the business operations. Hence, i is an important activity of Management Accounting

vy) Reporting to Management

‘There should be 2 system of prompt and intelligent reporting to management for effective and

timely decisions. Both routine and special reports are prepared for submission to top management,

‘middle-order management and operating level management depending on their requirements. This

isan essential part of Management Accounting.

‘Scanned with CamScanner,

3.3, OBJECTIVES OF FINANCIAL STATEMENTS

The basic objective of financial statements is to furnish information required for decision making.

Financial statements provide necessary accounting information for decision-making and control.

Financial statements are prepared to serve the following objectives:

i) to provide necessary information to it

strength of the business undertaking.

ii) to present a true and fair view of the state of affairs of the undertaking.

i) to provide reliable financial information about the economic resources and obligation of an

enterprise,

akcholders about the financial performance and

iv) to provide information about changes in net resources of an enterprise that result from the

activities.

‘Scanned with CamScanner,

v) to provide financial information that assists in estimating the eaming potential of the

enterprise.

vi) to provide other relevant information about changes in the economic resources and

obligations; and

vii) to disclose, to the extent possible, other information related to the financial statements

relevant to the users of statements.

‘Scanned with CamScanner,

5.2 MEANING OF A RATIO

In mathematics, a ratio is a relationship between two numbers of the same kind (i.¢., objects,

persons, students, units of whatever identical dimension), usually expressed as “a to b” or a:b or

a/b, sometimes expressed arithmetically as a dimensionless quotient of the two, which explicitly

indicates how many times the first number contains the second. It is a relationship between two

related variables expressed in proportion or percentage or quotient or times.

In business analysis a relationship between two variables of balance sheet or income statement or

‘one variable from balance sheet and other variable from income statement and vice versa, for

example the relationship between gross profit and sales. This is expressed as gross profit divided

by sales. The meaningful inferences are drawn from the established relations.

Ratios can be expressed in the following manner:

Percentage: Let us say the net profit ratio is 10% of net sales. This is the result of dividing net

profit (Rs.10,000) by net sales (Rs.1,00,000) and multiplying by 100.

i s say quick ratio is 1:1. This is calculated by dividing quick assets (Rs. 1,00,000)

by current liabilities (Rs.1,00,000).

Let us express that the net profit is one-fifth of sales. This is calculated by dividing net

profit (Rs.1,000) by sales (Rs.5,000).

‘Times: Let the inventory turnover ratio is 6 times. This is calculated by dividing cost of goods sold

(Rs.3,00,000) by average inventory (Rs. 50,000).

‘Scanned with CamScanner,

5.6 IMPORTANCE OF RATIO ANALYSIS

Financial analysis is performed by both intemal management and external groups. Firms would

perform such an analysis in order to evaluate their overall current performance, identify problem /

opportunity areas, develop budgets and implement strategies for the future. The importance of

ratio analysis ean be summarized for various groups vested with diversified interest as follows:

For Short-term Creditors: The short-term creditors are those creditors who supply credit for a

period of less than one year. They can determine the firm’s ability to meet its current obligations

with the help of liquidity ratios such as current ratio, quick ratio and absolute liquidity ratio,

For Long-term Creditors: The long-term creditors are those creditors who provide funds to the

company for a period more than one year. Debenture or bondholders, financial institutions are part

of long-term creditors. These creditors are interested in the solvency of the firm. Some of the

important solvency ratios are debt-equity ratio, proprietary ratio and interest coverage ratio,

For Management: Management includes the persons who manage the affairs of the business

enterprise. The management can determine the operating efficiency with which the firm is utilizing

its various assets in generating sales revenues with the help of activity ratios such as capital

tumover ratio, stock tumover ratio, debtors’ turnover ratio, ete. The management uses ratio

analysis to know company’s viability as an ongoing concern, adequacy of capital structure and

effectiveness of financial policies.

For Owners and Investors: Owners are those persons who provide funds to the business and

share the business and financial risk. The investors can determine the magnitude and direction of

change in firm’s earnings with the help of profitability ratios such as earnings per share, dividend

per share, return on investment, return on equity, etc. According to these ratios, investors decide

whether to hold or sell and prospective investors can decide whether to buy or not to buy the

particular company shares.

‘Scanned with CamScanner,

6.2 MEANING OF FUNDS

The term ‘Funds’ is a little ambiguous. According to the dictionary meaning, the term ‘funds’

implies “an accumulation or deposit of resources from which supplies are or may be drawn a more

or less permanent store or supply”. It is also defined as the “available pecuniary resources”. But

these are broad in nature and fit the context of macro level planning and control. From the

enterprise point of view, the term ‘funds’ may be used to mean any of the following:

i) Total financial resources or assets

ii) Total current assets

iii) Net current assets or net working capital

iv) Total quick assets

v) Net quick assets

vi) Cash

Of these six concepts of funds, the common tendency is to define funds as being equal to working

capital, cash and financial resources. The ‘Statement of Changes in Financial Position’ or the Funds

Flow Statement is prepared on the basis of working capital concept.

‘Scanned with CamScanner,

6.8 ADVANTAGES OF FUNDS FLOW STATEMENT

‘A funds flow statement is an essentiat tool for the financial analysis and is of primary importance

to the financial management. Now-a-days, it is being widely used by the financial analysts, credit

granting institutions and financial managers. The basic purpose of a funds flow statement is to

reveal the changes in the working capital on the two balance sheet dates. It also describes the

sources from which additional working capital has been financed and the uses to which working

capital has been applied. The advantages of funds flow statement is presented as follows:

i, Acts as. Future Guide: A projected funds flow statement also acts as a guide for future to

the management. The management can come to know the various problems that it is going

to face in near future for want of funds. The firm’s future needs for funds can be projected

well in advance and also the timing of these needs. The firm can arrange to finance these

needs more effectively and avoid future problems.

‘Scanned with CamScanner,

ii, Analysis of Financial Operations: The financial statements reveal the net effect of

various transactions on the operational and financial position of a concern. The balance

sheet gives a static view of the resources of a business and the uses to which these resources

have been put ata certain point of time. But it does not disclose the causes for changes in

the assets and liabilities between two different points of time. The funds flow statement

explains causes for such changes and also the effect of these changes on the liquidity

position of the company.

iii, Changes in Working Capital Position: A Funds Flow Statement presents either the

increase in Working Capital or Decrease in Working Capital with the help of ‘A Statement

‘of Changes in Working Capital’- which helps us to know from which sources the additional

Capital has been procured, or the application of such funds.

iv. Formulation of a Realistic Dividend Policy: Sometimes a firm has sufficient profit

available for distribution as dividend but yet it may not be advisable to distribute dividend

or eash resources. In such eases, a funds flow statement helps in the

formulation of a realistic dividend policy.

vy. Fund Generating Capacity: Funds Flow Statement helps to understand the fund

‘generating capacity of the firm which, ultimately, provides valuable information to the

‘management for taking future courses of action.

vi. Overall Creditworthiness of a Firm: The financial institutions and banks such as State

Financial Institutions, Industrial Development Corporations, Industrial Finance

Corporation of India, Industrial Development Bank of India, etc, all ask for funds flow

statement constructed for a number of years before granting loans to know the ereditwor

thiness and paying eapacity of the firm. Hence, a firm secking financial assistance from

these institutions has no alternative but to prepare funds flow statements.

vii, Projected Funds Flow Statement: A firm can prepare its expected inflows and outflows of

ceash for future with the help of a Projected Funds Flow Statement.

viii, Proper Allocation of Resources: The resources of a concem are always limited and it

‘wants to make the best usc of these resources. A projected funds flow statement constructed

forthe future helps in making managerial decisions. The firm ean plan the deployment of

its resources and allocate them among various applications.

ix. Throws Light on Many Confusing Questions: Such as (a) Why were the net current

assets lesser in spite of higher profits and vice-versa? (b) Why more dividends could not be

declared in spite of available profits? (c) How was it possible to distribute more dividends

than the present eamings? (4) What happened to the net profit? Where did they go?

(©) What happened to the proveeds of sale of fixed assets or issue of shares, debentures,

ctc.? (f) What are the sources of the repayment of debt? (g) How was the increase in

working capital financed and how will it be financed in future?

‘Scanned with CamScanner,

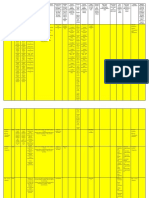

Mlustration-17: Trading Profit & Loss Account of Harshitha Limited for the year ending 31 si

December, 2019

Dr. cr.

Particulars Rs. | Particulars Rs.

[To Opening Stock 75,000 | By Sales Tess returns T0,00,000

To Purchases less returns 5,75,000_| By Closing Stock of

To Wages 40,000 | Finished Goods 50,000

To Carriage Inward 10,000

To Gross Profit e/d. 4,00,000 Li

10,50,000 10,50,000

By Gross Profit bid, 4,00,000

‘ToSelling Expenses By Intereston Investments 2,000

ToDiscount Allowed 154 choo

To Bad Debis 34

To Interest Paid 25,000

ToNet Profit Before Tax 2,17,000

4,52,000 4,52,000

‘aleulate gross profit ratio.

‘olution

3ross Profit Ratio= [Gross Profit] / [Net Sales] X 100

3iven: Gross Profit = Rs.4,00,000 and Net Sales = Rs. 10,00,000

ross Profit Ratio = [Rs.4,00,000 / Rs, 10,00,000]100 = 40%

‘Scanned with CamScanner,

Mlustration-18

Trading and Profit & Loss Account of Avinash Limited for the year ending 31-12-2019

Dr. Cr.

Particulars Rs. Particulars Rs.

‘To Opening Stock 2,00,000 | By Sales 32,00,000

To Purchases 16,00,000 | ByClosing Stock | 4,00,000

To Gross Profit e/d. 18,00,000

36,00,000 36,00,000

4,00,000 | By Gross Profit b/d. | 18,00,000

To Selling & Distribution Exp. 200,000 | By Profit on

To Other Expenses 40,000 Sale of Land 0,000

To Loss on Sale of Investments 10,000

To Net Profit 12,00,000

18,50,000 18,50,000

Calculate Operating Profit Ratio.

Sol

Operating Profit =

Operating Expenses

ross Profit - Operating Expenses

Office & Administrative Exp. + Selling & Dist. Exp. + Other Exp.

= Rs.4,00,000 + Rs.2,00,000 + Rs.40,000 = Rs.6,40,000

‘Scanned with CamScanner,

Mustration-19

‘Trading and Profit & Loss Account of Kalyan Limited for the year ending 31-12-2019

Dr. cr.

Particulars Rs, Particulars Rs.

To Opening Stock 50,000 | By Sales 8,00,000

To Purchases 4,00,000 | By Closing Stock 50,000

To Manufacturing Expenses 20,000

To Gross Profit c/d. 3,80,000

8,50,000, 8,50,000

To Office & Administrative Exp. 70,000 ByGross Profitb/d. | 3,80,000

To Selling & Distribution Exp. 65,000 | ByProfiton Sale

To Finance Expenses 20,000 of Investments 10,000

To Loss on Sale of Building 12,000. | By Interest received

To Tax 50,000 on Investments 10,000

To Net Profit afier Tax 183,000

4,00,000 4,00,000]

Calculate net profit ratio.

Solution

Net profit after tax = Rs.1,83,000 and Net sales = Rs.8,00,000

‘Net profit ratio = Net profit after tax / Net sales = [Rs-1,83,000 / Rs.8,00,000] 100 = 22.875%

‘Scanned with CamScanner

LIMITATIONS OF FUNDS FLOW STATEMENT.

ome of the notable limitations or disadvantages of funds flow statement can be hi

ollows:

ighted as

i. Ignores the Non-fund Transactions: Funds flow statement ignores the non-fund t

ransactions i.e, it does not take into consideration those transactions which do not affect

the working capital. For example, funds flow statement does not record the purchase of

fixed assets by the issue of shares or debentures.

Secondary Information: Funds flow statement is based on secondary data. In other words,

1

funds flow statement is based on income statement and balance sheet.

ii. Historical in Nature: Funds flow statement is historical in nature because it isprepared on

the basis of historical financial statements i.c., balance sheet and income statement.

v. Not Original:

statement. So, funds flow statement is not original as

1. No Cash Position: Funds flow statement does not disclose the cash pos

which cash flow statement should be prepared separately.

tis only the rearrangement of financial data of balance sheet and income

cannot be prepared alone.

jon of the firm, for

No Future Indication: It discloses past financial situation of the firm which may not be

suitable for future purpose.

‘ii, Working Capital Changes: It shows only either increase in working capital or decreas

working capital. But, the effect of transactions between current assets and current liabilities

are not included in the funds flow statement.

‘Scanned with CamScanner

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- TEN Measures of Arabic VerbsDocument1 pageTEN Measures of Arabic VerbsMd Muneeruddin AhmedNo ratings yet

- Day 2 To 37 - 28-11-2020Document120 pagesDay 2 To 37 - 28-11-2020Md Muneeruddin AhmedNo ratings yet

- Press Information Bureau Government of India Press Note Result of The Civil Services (Preliminary) Examination, 2021 Dated: 29 October, 2021Document22 pagesPress Information Bureau Government of India Press Note Result of The Civil Services (Preliminary) Examination, 2021 Dated: 29 October, 2021Md Muneeruddin AhmedNo ratings yet

- Count vs. MassDocument1 pageCount vs. MassMd Muneeruddin AhmedNo ratings yet

- Grade VII Revision WorksheetDocument3 pagesGrade VII Revision WorksheetMd Muneeruddin AhmedNo ratings yet

- Telangana TourismDocument3 pagesTelangana TourismMd Muneeruddin AhmedNo ratings yet

- Shri S.K. Dev Verman Addl. Secretary (Admin, Skills, Coord.)Document1 pageShri S.K. Dev Verman Addl. Secretary (Admin, Skills, Coord.)Md Muneeruddin AhmedNo ratings yet

- 67a741a6 b20d 4951 9f16 99506d3ed520Document1 page67a741a6 b20d 4951 9f16 99506d3ed520Md Muneeruddin AhmedNo ratings yet

- Introduction To Public Administration AB PDFDocument17 pagesIntroduction To Public Administration AB PDFMd Muneeruddin AhmedNo ratings yet

- India Political Map - GifDocument1 pageIndia Political Map - GifMd Muneeruddin AhmedNo ratings yet

- Princely State of HydDocument1 pagePrincely State of HydMd Muneeruddin AhmedNo ratings yet

- Mrunal Pillar 6 Lecture 60-65 @ PDFDocument41 pagesMrunal Pillar 6 Lecture 60-65 @ PDFMd Muneeruddin AhmedNo ratings yet

- Report 24 Voters TurnoutDocument29 pagesReport 24 Voters TurnoutMd Muneeruddin AhmedNo ratings yet

- Test - I Results: Name Marks TotalDocument1 pageTest - I Results: Name Marks TotalMd Muneeruddin AhmedNo ratings yet

- (Bitul - In) BS 15.4.19 PDFDocument16 pages(Bitul - In) BS 15.4.19 PDFMd Muneeruddin AhmedNo ratings yet

- 032113CB14762 PDFDocument1 page032113CB14762 PDFMd Muneeruddin AhmedNo ratings yet

- Notes From "Indian Polity"Document8 pagesNotes From "Indian Polity"Md Muneeruddin AhmedNo ratings yet