Professional Documents

Culture Documents

Introduction To MF

Uploaded by

beena antuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To MF

Uploaded by

beena antuCopyright:

Available Formats

In early 1980’s, the existing banking policies, procedures and systems were not

suited to meet the requirements of poor. For borrowings poor people usually resort

to unorganised sector. NABARD recommended that alternative policies, systems

and procedures should be put in use to save the poor from the clutches

of moneylenders. Thus microfinance was introduced in banking sector.

Microfinance is a programme which includes a broad range of financial services such as

deposits, loans, payment services, money transfers, insurance, savings, micro-credit

etc. to support the poor people and low income individuals. Mohammed Yunus

was awarded the Noble Prize for application of the concept of microfinance, with

setting up of the Grameen Bank in Bangladesh

The concept of microfinance was created by Professor Muhammad

Yunus founder of Grameen bank in Bangladesh and noble price winner in

2006.Microfinance is the provision of a broad range of financial services such as

deposits, loans, payment services, money transfers and insurance to the poor and

low income households and their micro-enterprises. Microfinance is defined as

Financial Services (savings, insurance, fund, credit etc.) provided to poor and low

income clients so as to help them raise their income, thereby improving their

standard of living.The Asian Development Bank (2000) defines microfinance as

the provision of broad range of services such as savings, deposits, loans, payment

services, money transfers and insurance to poor and low income households and

their micro-enterprises. This definition of microfinance is not restricted to

the below poverty line people but it includes low income households also.The task

force on Supportive Policy and Regulatory Framework for Microfinance constituted by

NABARD defined microfinance as “ the provision of thrift, saving,

credit and financial services and products of very small amount to the poor’s in

rural, semi urban and urban areas for enabling them to raise their income level and

improve their standard of living.

Microfinance is a form of financial services for entrepreneurs and small businesses

lacking access to banking and related services. The two main mechanisms for the

delivery of financial services to such clients are: (1) relationship-based banking for

individual entrepreneurs and small businesses; and (2) group-based models, where

several entrepreneurs come together to apply for loans and other services as a

group. For some, microfinance is a movement whose object is a world in which as

many poor and near-poor households as possible have permanent access to an

appropriate range of high quality financial services, including not just credit but

also savings, insurance, and fund transfers. Many of those who promote

microfinance generally believe that such access will help poor people out of

poverty. For others, microfinance is a way to promote economic development,

employment and growth through the support of micro-entrepreneurs and small

businesses. Microfinance is a broad category of services, which includes

microcredit. Microcredit is provision of credit services to poor clients. Microcredit

is one of the aspects of microfinance and the two are often confused. Critics may

attack microcredit while referring to it indiscriminately as either 'microcredit' or

'microfinance'. Due to the broad range of microfinance services, it is difficult to

assess impact, and very few studies have tried to assess its full impact. Proponents

often claim that microfinance lifts people out of poverty, but the evidence is mixed.

What it does do, however, is to enhance financial inclusion.

Definition of Microfinance : Microfinance is the provision of a broad range of

financial services such as – deposits, loans, payment services, money transfers and

insurance products – to the poor and low-income households, for their

microenterprises and small businesses, to enable them to raise their income levels

and improve their living standards.

The term 'microfinance' is often confused with the related term 'microcredit',

so much so, that the two are often treated as synonymous and used

interchangeably.

The term microcredit refers to a small size loan, to be repaid within a short

period of time, used mostly low income households and micro entrepreneurs for

the purpose of income generation and enterprise development. The mobilization of

such credit is restricted to external sources such as banks and moneylenders.

Microfinance on the hand, provides a greater menu of options whereby the

small loan can be garnered not just from the external sources but also through

selfmobilization, by way of saving and sale of assets. Also, in case of microcredit,

due to the definite obligation to repay the loan, a physical collateral may

sometimes be needed. However, the biggest flexibility in the case of microfinance

is the lack of any physical collateral, even in case of loan from the bank. The

options available with microfinance, therefore, are much broader and flexible than

the ones available with microcredit.

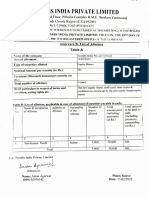

Difference between microfinance and microcredit

Sl.No Characteristics Microfinance Microcredit

1 Size of loan Small Small

2 Repayment of period Short Short

3 Sources of mobilization Both external and External

internal

4 Repayment Obligation if Definite obligation

source external to repay

5 Collateral Not needed May or may not be

needed

6 May or may not be needed Flexible, Mostly fixed,

consumption limited scope for

income generation deviation

7 Scope of operation Mostly group loans Usually individual

trickling down to loans, though

individuals group loans might

be given

Features of Microfinance

1. It is an essential part of rural finance.

2. It deals in small loans.

3. It basically caters to the poor households.

4. It is one of the most effective and warranted Poverty Alleviation Strategies.

5. It supports women participation in electronic activity.

6. It provides an incentive to grab the self employment opportunities.

7. It is more service-oriented and less profit oriented.

8. It is meant to assist small entrepreneur and producers.

9. Poor borrowers are rarely defaulters in repayment of loans as they are simple

and God-fearing.

10. The borrowers are generally from low income backgrounds

11 .Loans availed under microfinance are usually of small amount, i.e., micro

loans

12 The loan tenure is short

13. Microfinance loans do not require any collateral

14.These loans are usually repaid at higher frequencies

15.The purpose of most microfinance loans is income generation

Microfinance is a broad category of services, which includes microcredit.

Microcredit is provision of credit services to poor clients. Micro credit and micro-

finance both are different. Micro credit is a small amount of money, given as a

loan by a bank or any legally registered institution, whereas, Micro-finance

includes multiple services such as loans, savings, insurance, transfer services,

micro credit loans, etc. for poor people.

You might also like

- Banking ServicesDocument5 pagesBanking Servicesbeena antuNo ratings yet

- 3 Module BMFDocument45 pages3 Module BMFbeena antuNo ratings yet

- Types of Retail BankingDocument2 pagesTypes of Retail Bankingbeena antuNo ratings yet

- 2.1. Types of Fire Insurance PoliciesDocument8 pages2.1. Types of Fire Insurance Policiesbeena antuNo ratings yet

- Rights and Obligations of Banker and CustomerDocument12 pagesRights and Obligations of Banker and Customerbeena antu100% (1)

- 2.1. Fire Insurance 2.1.1. Introduction To Fire InsuranceDocument7 pages2.1. Fire Insurance 2.1.1. Introduction To Fire Insurancebeena antuNo ratings yet

- Banker Customer RelationshipDocument11 pagesBanker Customer Relationshipbeena antuNo ratings yet

- A) The Client Agrees To Pay A Premium To The Insurance Company. SuchDocument6 pagesA) The Client Agrees To Pay A Premium To The Insurance Company. Suchbeena antuNo ratings yet

- 1.1. Different Types of General InsuranceDocument3 pages1.1. Different Types of General Insurancebeena antuNo ratings yet

- 2.1.1. Meaning of Fire and Loss or Damage by FireDocument5 pages2.1.1. Meaning of Fire and Loss or Damage by Firebeena antuNo ratings yet

- 1.1. History of General Insurance in India Pre Nationalization EraDocument5 pages1.1. History of General Insurance in India Pre Nationalization Erabeena antuNo ratings yet

- 1.1. Principles of General InsuranceDocument22 pages1.1. Principles of General Insurancebeena antuNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Banking and InsuranceDocument106 pagesBanking and Insurancebeena antuNo ratings yet

- Microfinance Institutions in India:Salient Features: Hemant SinghDocument3 pagesMicrofinance Institutions in India:Salient Features: Hemant Singhbeena antuNo ratings yet

- Top 10 MicrofinanceDocument4 pagesTop 10 Microfinancebeena antuNo ratings yet

- Overview of BFSI DomainDocument5 pagesOverview of BFSI Domainbeena antu100% (2)

- Role of Insurance in Economic DevelopmentDocument4 pagesRole of Insurance in Economic Developmentbeena antu50% (2)

- Overview of Banking IndustryDocument12 pagesOverview of Banking Industrybeena antuNo ratings yet

- Insurance and Social SecurityDocument3 pagesInsurance and Social Securitybeena antuNo ratings yet

- Workers' Compensation: InsuranceDocument4 pagesWorkers' Compensation: Insurancebeena antuNo ratings yet

- Insurance Premium Rate × Number of Exposure Units PurchasedDocument10 pagesInsurance Premium Rate × Number of Exposure Units Purchasedbeena antuNo ratings yet

- Banking Legislation and ReformsDocument22 pagesBanking Legislation and Reformsbeena antuNo ratings yet

- Banking and MicrofinanceDocument33 pagesBanking and Microfinancebeena antuNo ratings yet

- Chapter - 1: Risk ManagementDocument49 pagesChapter - 1: Risk Managementbeena antuNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- List of Cases Selected For Audit Through Computer Ballot - Income TaxDocument49 pagesList of Cases Selected For Audit Through Computer Ballot - Income TaxFahid AslamNo ratings yet

- 11 PDF Original PDFDocument5 pages11 PDF Original PDFMEKTILIA MAPUNDANo ratings yet

- Intermediate To Advance Electronics Troubleshooting (March 2023) IkADocument7 pagesIntermediate To Advance Electronics Troubleshooting (March 2023) IkAArenum MustafaNo ratings yet

- Misamis Oriental Association of Coco Traders, Inc. vs. Department of Finance SecretaryDocument10 pagesMisamis Oriental Association of Coco Traders, Inc. vs. Department of Finance SecretaryXtine CampuPotNo ratings yet

- Week 9 11 Intro To WorldDocument15 pagesWeek 9 11 Intro To WorldDrea TheanaNo ratings yet

- Total Assets: Aktivitas Kas Aset Non Hutang Hut - Dijamin Kas Prioritas PenuhDocument16 pagesTotal Assets: Aktivitas Kas Aset Non Hutang Hut - Dijamin Kas Prioritas PenuhJunjung PrabawaNo ratings yet

- Reference and RevisionDocument6 pagesReference and RevisionRohit kumar SharmaNo ratings yet

- Symbiosis Law School, PuneDocument6 pagesSymbiosis Law School, PuneVarun MenonNo ratings yet

- Improving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesDocument81 pagesImproving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesadjipramNo ratings yet

- Metrobank V Chuy Lu TanDocument1 pageMetrobank V Chuy Lu TanRobert RosalesNo ratings yet

- Disabled Workers in Workplace DiversityDocument39 pagesDisabled Workers in Workplace DiversityAveveve DeteraNo ratings yet

- Icici Declaration - Itm (Online Training)Document2 pagesIcici Declaration - Itm (Online Training)Vivek HubanurNo ratings yet

- Boskalis Position Statement 01072022Document232 pagesBoskalis Position Statement 01072022citybizlist11No ratings yet

- EHDF Module 4 & 5Document5 pagesEHDF Module 4 & 5Faizal KhanNo ratings yet

- Pressure Vessel CertificationDocument3 pagesPressure Vessel CertificationYetkin ErdoğanNo ratings yet

- List of European Countries Via WIKIPEDIA: Ran K State Total Area (KM) Total Area (SQ Mi) NotesDocument3 pagesList of European Countries Via WIKIPEDIA: Ran K State Total Area (KM) Total Area (SQ Mi) NotesAngelie FloraNo ratings yet

- JFK The Final Solution - Red Scares White Power and Blue DeathDocument120 pagesJFK The Final Solution - Red Scares White Power and Blue DeathJohn Bevilaqua100% (3)

- Tutorial 1Document2 pagesTutorial 1Netra PujarNo ratings yet

- Union Govt Apex Body PDFDocument2 pagesUnion Govt Apex Body PDFAjivam AnvesakaNo ratings yet

- Notification West Bengal Forest Department Bana Sahayak PostsDocument4 pagesNotification West Bengal Forest Department Bana Sahayak PostsBlue Eye'sNo ratings yet

- Chapter 17 - Supply Chains (17th Edition)Document23 pagesChapter 17 - Supply Chains (17th Edition)meeshakeNo ratings yet

- Varieties of CapitalismDocument4 pagesVarieties of CapitalismZaira AsakilNo ratings yet

- 15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120Document3 pages15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120MSFT2022100% (1)

- Office of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposerDocument5 pagesOffice of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposermarjNo ratings yet

- DeviceHQ Dev User GuideDocument13 pagesDeviceHQ Dev User GuidekediteheNo ratings yet

- Tectabs Private: IndiaDocument1 pageTectabs Private: IndiaTanya sheetalNo ratings yet

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookDocument26 pages(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroNo ratings yet

- Legal Research BOOKDocument48 pagesLegal Research BOOKJpag100% (1)

- Syllabus Pprm-OnilDocument6 pagesSyllabus Pprm-OnilOnil Shaquel PeteNo ratings yet