Professional Documents

Culture Documents

Annual Report: Balance Sheet

Annual Report: Balance Sheet

Uploaded by

Arfa FatimaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report: Balance Sheet

Annual Report: Balance Sheet

Uploaded by

Arfa FatimaCopyright:

Available Formats

Annual Report

Round: 2

Annual Report Erie C131469

Dec. 31, 2023

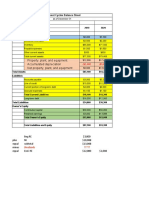

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2023 2022

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $0 0.0% $14,248

current value of your inventory across all products. A zero

Account Receivable $8,892 6.9% $9,646

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $8,107 6.3% $0

Equipment: The current value of your plant. Accum Total Current Assets $16,999 13.1% $23,894

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $160,800 124.0% $136,000

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($48,453) -37.5% ($37,733)

of operations. It includes emergency loans used to keep Total Fixed Assets $112,347 86.9% $98,267

your company solvent should you run out of cash during Total Assets $129,345 100.0% $122,161

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $6,116 4.7% $6,131

instead of paying to shareholders as dividends.

Current Debt $23,741 18.4% $12,000

Long Term Debt $50,750 39.2% $57,700

Total Liabilities $80,607 62.3% $75,831

Common Stock $33,360 25.8% $28,360

Retained Earnings $15,379 11.9% $17,970

Total Equity $48,739 37.7% $46,330

Total Liab. & O. Equity $129,345 100.0% $122,161

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2023 2022

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) ($2,591) ($11,612)

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $10,720 $8,800

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 $450

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable ($15) ($452)

are bad and you find yourself carrying an abundance of excess inventory,

Inventory ($8,107) $8,617

the report would show the increase in inventory as a huge negative cash

Accounts Receivable $754 ($1,338)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $761 $4,465

afloat. Cash Flows from Investing Activities

Plant Improvements ($24,800) ($31,650)

Cash Flows from Financing Activities

Dividends paid $0 $0

Sales of common stock $5,000 $10,000

Purchase of common stock $0 $0

Cash from long term debt $0 $16,000

Retirement of long term debt ($6,950) $0

Change in current debt(net) $11,741 $12,000

Net cash from financing activities $9,791 $38,000

Net change in cash position ($14,248) $10,815

Closing cash position $0 $14,248

Annual Report Page 1

Round: 2

Annual Report Erie C131469

Dec. 31, 2023

2023 Income Statement

2023 Common

(Product Name) Eat Ebb Echo Edge Egg Eno

Total

Size

Sales $30,796 $20,793 $19,556 $19,213 $13,918 $3,911 $0 $0 $108,188 100.0%

Variable Costs:

Direct Labor $5,726 $4,185 $3,488 $3,958 $2,783 $1,383 $0 $0 $21,522 19.9%

Direct Material $11,800 $8,965 $7,920 $8,954 $5,453 $1,686 $0 $0 $44,777 41.4%

Inventory Carry $495 $0 $0 $32 $446 $0 $0 $0 $973 0.9%

Total Variable $18,021 $13,151 $11,407 $12,943 $8,682 $3,069 $0 $0 $67,273 62.2%

Contribution Margin $12,775 $7,643 $8,148 $6,270 $5,236 $842 $0 $0 $40,915 37.8%

Period Costs:

Depreciation $3,640 $3,680 $1,213 $800 $907 $480 $0 $0 $10,720 9.9%

SG&A: R&D $80 $1,000 $749 $453 $641 $850 $0 $0 $3,773 3.5%

Promotions $1,100 $1,500 $1,500 $1,100 $1,100 $200 $0 $0 $6,500 6.0%

Sales $2,500 $2,500 $2,000 $2,900 $2,000 $200 $0 $0 $12,100 11.2%

Admin $486 $328 $309 $303 $220 $62 $0 $0 $1,709 1.6%

Total Period $7,806 $9,008 $5,771 $5,557 $4,867 $1,792 $0 $0 $34,802 32.2%

Net Margin $4,969 ($1,366) $2,377 $713 $369 ($949) $0 $0 $6,113 5.7%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $250 0.2%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $5,863 5.4%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $3,384 3.1%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $6,465 6.0%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes ($1,395) -1.3%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $0 0.0%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit ($2,591) -2.4%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 2

You might also like

- Case 21Document14 pagesCase 21Gabriela LueiroNo ratings yet

- Sunset Boards Case StudyDocument3 pagesSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Case Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, IncDocument3 pagesCase Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, Inchelsamra0% (2)

- Test Bank Auditing and Assurance Services 13e by Arens Chapter 14Document16 pagesTest Bank Auditing and Assurance Services 13e by Arens Chapter 14Yogeswari Sista100% (1)

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Transmittal 2019 New FormDocument3 pagesTransmittal 2019 New FormHge Barangay100% (3)

- 1 Courier C128574 R3 TCK0 ADocument2 pages1 Courier C128574 R3 TCK0 AAgz HrrfNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetdummy GoodluckNo ratings yet

- Annual Report Annual ReportDocument2 pagesAnnual Report Annual ReportsurvisureshNo ratings yet

- Comp XMDocument1 pageComp XMlogeshkounderNo ratings yet

- Balance Sheet: Annual ReportDocument2 pagesBalance Sheet: Annual ReportekanshjiNo ratings yet

- Annual Report - Capstone WebAppDocument2 pagesAnnual Report - Capstone WebAppSaurabh KhopadeNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Assignement 5Document4 pagesAssignement 5Valentin Florin Drezaliu100% (1)

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Handout 1 (B) Ratio Analysis Practice QuestionsDocument5 pagesHandout 1 (B) Ratio Analysis Practice QuestionsMuhammad Asad AliNo ratings yet

- Week1 Answers ChYqDocument5 pagesWeek1 Answers ChYqChintya FransiscaNo ratings yet

- Your Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / KyanDocument6 pagesYour Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / Kyanmohitgaba19No ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Test 2 Financial MGTDocument4 pagesTest 2 Financial MGTBervie RondonuwuNo ratings yet

- Assignment 2Document2 pagesAssignment 2Syed Osama AliNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Review Materials Financial ManagementDocument9 pagesReview Materials Financial ManagementTOBIT JEHAZIEL SILVESTRENo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- hw4 (Answers) R2Document6 pageshw4 (Answers) R2Arslan HafeezNo ratings yet

- Cases ChapterDocument15 pagesCases Chaptermariam.ahmed03No ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Midterm Exam Part 2 - AtikDocument8 pagesMidterm Exam Part 2 - AtikAtik MahbubNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- Ch.17 HW Acc PDFDocument2 pagesCh.17 HW Acc PDFyizhou FengNo ratings yet

- Cyberdragon Cash Flow AnalysisDocument3 pagesCyberdragon Cash Flow AnalysisBablu EscobarNo ratings yet

- CH 3.bDocument4 pagesCH 3.basiaNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- B205B Financial ExamplesDocument6 pagesB205B Financial ExamplesAhmad RahjeNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Ch04solution ProbDocument13 pagesCh04solution ProbdenisNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- Practice Problems Chapter 4 Solutions 2Document19 pagesPractice Problems Chapter 4 Solutions 2Hope Trinity EnriquezNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- FIN254 Assignment# 1Document2 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Chapter 03 - Intro FinDocument39 pagesChapter 03 - Intro FinSivan JacksonNo ratings yet

- Cash Flow - HandoutDocument3 pagesCash Flow - HandoutMichelle ManuelNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- Ch02 P20 Build A Model SolutionDocument6 pagesCh02 P20 Build A Model Solutionsonam agrawalNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Soal Dan Jawaban Tugas Lab 3 - Stock Investment PDFDocument4 pagesSoal Dan Jawaban Tugas Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Chapter 3 - Analysis and Interpretation of Financial StatementsDocument21 pagesChapter 3 - Analysis and Interpretation of Financial StatementsFahad Asghar100% (1)

- Lecture 2 PDFDocument62 pagesLecture 2 PDFsyingNo ratings yet

- Kelompok 8 - (Wup 9-12) - Week 13 PDFDocument4 pagesKelompok 8 - (Wup 9-12) - Week 13 PDFYefinia OpianaNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Countries Capital, Currencies and SloganDocument5 pagesCountries Capital, Currencies and SloganShiela Marie RizaldoNo ratings yet

- Introduction To Banking Sector & SbiDocument106 pagesIntroduction To Banking Sector & Sbiaparajitha lalasaNo ratings yet

- Accounts Receivable and Inventory ManagementDocument14 pagesAccounts Receivable and Inventory Managementmuhammad sami ullah khanNo ratings yet

- Barter Exchange AgreementDocument2 pagesBarter Exchange Agreementolson134100% (1)

- Cryptocurrency MiningDocument9 pagesCryptocurrency MiningHadrian Mar Elijah Bar IsraelNo ratings yet

- The History of Microfinance PDFDocument8 pagesThe History of Microfinance PDFTheodorah Gaelle MadzyNo ratings yet

- Benefits of Mortgage Refinancing You Must KnowDocument3 pagesBenefits of Mortgage Refinancing You Must KnowriyaNo ratings yet

- May 2023 BoltDocument131 pagesMay 2023 BoltSuman SharmaNo ratings yet

- Steel SecuritiesDocument86 pagesSteel SecuritiesKella PradeepNo ratings yet

- Technology in BankingDocument1 pageTechnology in BankingkaanthikeerthiNo ratings yet

- Asset, Liabilities and Capital Account Titles 2019Document20 pagesAsset, Liabilities and Capital Account Titles 2019Jerome Chester GayNo ratings yet

- Discounted Promissory Notes 4.2Document11 pagesDiscounted Promissory Notes 4.2Brynne UrreraNo ratings yet

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- Bond ListDocument4 pagesBond ListKwok Chung ChuNo ratings yet

- Nicl Exam GK Capsule: 25 March, 2015Document69 pagesNicl Exam GK Capsule: 25 March, 2015Jatin YadavNo ratings yet

- Red Book FY 2014-15 - 20140917050612Document690 pagesRed Book FY 2014-15 - 20140917050612mechanicalNo ratings yet

- Ridad V Filipinas Investment Digest SorianoInigoDocument3 pagesRidad V Filipinas Investment Digest SorianoInigoArifKadatuanNo ratings yet

- Acknowledgement Receipt 20190526 151008Document2 pagesAcknowledgement Receipt 20190526 151008Arman PenalosaNo ratings yet

- ĐCCT - Nguyễn Công Kim Chi lần 1Document26 pagesĐCCT - Nguyễn Công Kim Chi lần 1Nguyễn Minh AnhNo ratings yet

- Premium Credit Card UsersDocument54 pagesPremium Credit Card UserscityNo ratings yet

- Bay' Bithaman Ajil & Bay' SalamDocument3 pagesBay' Bithaman Ajil & Bay' SalamAmeerul MukmininNo ratings yet

- St. Francis School - Icse Koramangala, Bengaluru - 34. School Bus Routes (2017 - 2018) Bus No. Name of The Stops FeesDocument6 pagesSt. Francis School - Icse Koramangala, Bengaluru - 34. School Bus Routes (2017 - 2018) Bus No. Name of The Stops FeesRanjit KumarNo ratings yet

- 2102 Midterm 2 Study GuideDocument13 pages2102 Midterm 2 Study GuideMoses SuhNo ratings yet

- Rene GautreauxDocument19 pagesRene GautreauxAnonymous vRG3cFNjANo ratings yet

- Money MarketDocument22 pagesMoney MarketAnkit PatodiaNo ratings yet

- JudgeMorrisdocket WDocument56 pagesJudgeMorrisdocket WDinSFLANo ratings yet

- An Analytical Study On The Role of Ngos in The Poverty Reduction of IndiaDocument11 pagesAn Analytical Study On The Role of Ngos in The Poverty Reduction of IndiaHimanshu SinghNo ratings yet

- SSRN Id2632911Document21 pagesSSRN Id2632911KUNAL GUPTANo ratings yet