Professional Documents

Culture Documents

Module Iii: Various Statutory and Business Registrations: Answer Key

Uploaded by

ShelendraSinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module Iii: Various Statutory and Business Registrations: Answer Key

Uploaded by

ShelendraSinghCopyright:

Available Formats

MODULE III: VARIOUS STATUTORY AND BUSINESS

REGISTRATIONS

ANSWER KEY

1 : which return form includes Return for a Non-Resident foreign taxable person?

1. GSTR-6

2. GSTR-5

3. GSTR-7

4. none of them

YOUR ANSWER: GSTR-5

CORRECT ANSWER: GSTR-5

DESCRIPTION: GSTR-5 Return for a Non-Resident foreign taxable person

2 : IEC stands for________

1. Income & Expenditure licence

2. Income & Export department

3. Import & Export Licence

4. none of them

YOUR ANSWER: Import & Export Licence

CORRECT ANSWER: Import & Export Licence

DESCRIPTION: IEC stands for Import & Export Licence

3 : If a typical PAN is AFZPK7190K. What does "K" stand for?

1. Individual

2. Company

3. PAN holder's last name/surname.

4. Firm

YOUR ANSWER: PAN holder's last name/surname.

CORRECT ANSWER: PAN holder's last name/surname.

DESCRIPTION: Fifth character i.e. "K" in the above PAN represents first character of the PAN holder's last name/surname.

4 : Form 49B is for ?

1. Application for issuance of new TAN

2. Form for change or correction in TAN data for TAN allotted.

3. both of them

4. none of them

YOUR ANSWER: Application for issuance of new TAN

CORRECT ANSWER: Application for issuance of new TAN

DESCRIPTION: There are two types of TAN applications: • Application for issuance of new TAN(Form 49B) This Application form

should be used when the deductor has never applied for a TAN or does not have a TAN. • Form for change or correction in TAN data

for TAN allotted.

5 : Documents Required for Application for new PAN Card by For Individuals & HUF?

1. Proof of Identity

2. Proof of Address

3. Proof of date of Birth

4. all of them

YOUR ANSWER: all of them

CORRECT ANSWER: all of them

DESCRIPTION: Individual applicants should provide proof of residential address, Proof of Identity, Proof of date of Birth

6 : By which department is the PAN number is issued?

1. GST department

2. Income Tax Department

3. information department

4. commerce department

YOUR ANSWER: Income Tax Department

CORRECT ANSWER: Income Tax Department

DESCRIPTION: Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the

Income Tax Department, to any "person" who applies for it

7 : Full form of ISO?

1. Indian organizationforStandardisation

2. International organizationforStandardisation

3. International orientation for Standardisation

4. International organization for standard

YOUR ANSWER: International organizationforStandardisation

CORRECT ANSWER: International organizationforStandardisation

DESCRIPTION: The International Organization for Standardization (ISO an international standard-setting body composed of

representatives from various national standards organizations.

8 : NIC Code stands for?

1. National Industry Class Code

2. National Indian Classification Code

3. National Industry Classification Code

4. none of them

YOUR ANSWER: National Industry Classification Code

CORRECT ANSWER: National Industry Classification Code

DESCRIPTION: NIC Code stands for National Industry Classification Code.

9 : Under GST, a registered dealer has to file GST returns that include_________

1. Purchases

2. Sales

3. Output GST (On sales)

4. all of them

YOUR ANSWER: all of them

CORRECT ANSWER: all of them

DESCRIPTION: Under GST, a registered dealer has to file GST returns that include: • Purchases • Sales • Output GST (On sales) •

Input tax credit (GST paid on purchases)

10 : how many types of PAN applications are there?

1. 4

2. 3

3. 2

4. 1

YOUR ANSWER: 2

CORRECT ANSWER: 2

DESCRIPTION: There are two types of PAN applications Application for allotment of PAN Application for new PAN Card or/and

Changes or Corrections in PAN Data

You might also like

- Different Types of LoomDocument19 pagesDifferent Types of LoomAhmad Rasheed100% (1)

- UAE Customs Offices Locations by EmirateDocument3 pagesUAE Customs Offices Locations by Emiratesunil kumar100% (1)

- Fedai Daily Quiz Questions Archives - General Queries: Correct Answer: 2 Correct Answer: 2Document44 pagesFedai Daily Quiz Questions Archives - General Queries: Correct Answer: 2 Correct Answer: 2Somdutt Gujjar100% (2)

- Sample Business Plan For Bank Loan PDF594Document32 pagesSample Business Plan For Bank Loan PDF594assefamenelik1No ratings yet

- Biopure's Launch of Animal Blood Substitute OxyglobinDocument6 pagesBiopure's Launch of Animal Blood Substitute OxyglobinNitish BhardwajNo ratings yet

- DTP Msme ProjectDocument22 pagesDTP Msme ProjectGolden Shower தமிழ்No ratings yet

- Report OJT Fire ProtectionDocument33 pagesReport OJT Fire ProtectionFazir AzlanNo ratings yet

- Citizens' Charter Summary for TSNPDCLDocument42 pagesCitizens' Charter Summary for TSNPDCLbharathkumar518518No ratings yet

- Akot Business PlanDocument19 pagesAkot Business PlanBOL AKETCHNo ratings yet

- 8-11... Lobo Service ManualDocument41 pages8-11... Lobo Service ManualRusonegro100% (1)

- Final Internship Report For COLLEGEDocument60 pagesFinal Internship Report For COLLEGEManish SinghNo ratings yet

- Connectivity at Convinence: Aviation Services Pvt. LTDDocument6 pagesConnectivity at Convinence: Aviation Services Pvt. LTDPravin Kamath100% (1)

- Solution Manual For Microeconomics 16th Canadian Edition Christopher T S Ragan Christopher RaganDocument13 pagesSolution Manual For Microeconomics 16th Canadian Edition Christopher T S Ragan Christopher RaganChristopherRamosfgzoNo ratings yet

- Evaluation of The Cash Management & Banking System With A Financial Analysis of Indian Oil Corporation LTDDocument78 pagesEvaluation of The Cash Management & Banking System With A Financial Analysis of Indian Oil Corporation LTDgain.moumitaNo ratings yet

- Module Ii: Starting A New Venture: Answer KeyDocument3 pagesModule Ii: Starting A New Venture: Answer KeyRamesh VankaraNo ratings yet

- Module Vi: Operating The Enterprise: Answer KeyDocument5 pagesModule Vi: Operating The Enterprise: Answer KeyBabu Viswanath MNo ratings yet

- Bergerpaints Selection ProcessDocument6 pagesBergerpaints Selection ProcessBiswanath KunduNo ratings yet

- Batch CostingDocument10 pagesBatch CostingNaveen Prajwalit DangNo ratings yet

- BPCL ProjectDocument50 pagesBPCL ProjectSaurabh Ranjan100% (3)

- Material Requirement PlanningDocument14 pagesMaterial Requirement PlanningPaul Tello RojasNo ratings yet

- Apply for skill development trainingDocument2 pagesApply for skill development trainingSiddNo ratings yet

- Edp 1Document3 pagesEdp 1VRKPRASAD0% (1)

- Customs Act 1962: Key Sections on Vessels, Cargo Unloading & SmugglingDocument18 pagesCustoms Act 1962: Key Sections on Vessels, Cargo Unloading & SmugglingGaurish Salgaocar100% (1)

- Wipro Placement Aptitude Test PaperDocument33 pagesWipro Placement Aptitude Test PapergopalNo ratings yet

- Application Form of Tourist Guide LicenceDocument1 pageApplication Form of Tourist Guide Licencetayyab_mir_4No ratings yet

- IRDA Mock Test 1Document9 pagesIRDA Mock Test 1Venu MadhavNo ratings yet

- Paper Cup MachineDocument5 pagesPaper Cup MachinesNo ratings yet

- Report Intern FinalDocument45 pagesReport Intern FinalAtiqah Nabilah Razali100% (1)

- Application For Renewal of Licence As A Guide - 2 PDFDocument2 pagesApplication For Renewal of Licence As A Guide - 2 PDFrazanymNo ratings yet

- Lenovo Company, Mis AssingmentDocument20 pagesLenovo Company, Mis AssingmentNarendra RaoNo ratings yet

- Sr. No. Topic Page No.: Ins VikrantDocument22 pagesSr. No. Topic Page No.: Ins Vikrantshreyas jadhavNo ratings yet

- FAQ of Insurance Institute of IndiaDocument8 pagesFAQ of Insurance Institute of IndiaSachin KumarNo ratings yet

- Case Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisaDocument5 pagesCase Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisasupriyadhageNo ratings yet

- AssignmentDocument11 pagesAssignmentLaury Phillips100% (1)

- Adv & Disadv of M CommerceDocument10 pagesAdv & Disadv of M CommerceGaurav KumarNo ratings yet

- Internship Report CEATDocument51 pagesInternship Report CEATrogerNo ratings yet

- Internship Report On Noon Sugar Mills BhalwalDocument82 pagesInternship Report On Noon Sugar Mills Bhalwalsyed_ali_37567% (3)

- India Money Supply M2 - 1991-2014 - Data - Chart - Calendar - ForecastDocument5 pagesIndia Money Supply M2 - 1991-2014 - Data - Chart - Calendar - ForecastkrazycapricornNo ratings yet

- Non Fuel Retailing - Report - Arvind DwivediDocument87 pagesNon Fuel Retailing - Report - Arvind Dwivediarvind_dwivedi100% (4)

- REPORTDocument51 pagesREPORTmalik noman0% (1)

- Project Report On Financial AnalysisDocument28 pagesProject Report On Financial Analysisurvashi100% (1)

- Project On RDC ConrectDocument35 pagesProject On RDC ConrectRajkumar koleyNo ratings yet

- Final Research Food Safety Applied in Hotel IndustryDocument62 pagesFinal Research Food Safety Applied in Hotel IndustrySudeep KarkiNo ratings yet

- DARFAPDocument13 pagesDARFAPSamanthaLWildtNo ratings yet

- Project Report On Whipping CreamDocument5 pagesProject Report On Whipping CreamEIRI Board of Consultants and PublishersNo ratings yet

- Sumanth's Total Productivity ModelDocument7 pagesSumanth's Total Productivity ModelSoumya NairNo ratings yet

- LJ 04Document180 pagesLJ 04Dinesh TiwariNo ratings yet

- Register Renewable Energy Devices and Issue I-RECs in 40 CharactersDocument4 pagesRegister Renewable Energy Devices and Issue I-RECs in 40 Charactersluxus100% (1)

- Case Study - Strategy Implementation and EvalDocument6 pagesCase Study - Strategy Implementation and EvalNur Syakira Ismail50% (2)

- Wipro LTD Company DetailsDocument7 pagesWipro LTD Company DetailsLvarsha NihanthNo ratings yet

- Trade Creation and Trade DiversionDocument6 pagesTrade Creation and Trade DiversionHay JirenyaaNo ratings yet

- FZ Employment SummaryDocument13 pagesFZ Employment SummarySavisheshNo ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Myer Contractor Safety Policies SummaryDocument17 pagesMyer Contractor Safety Policies Summaryvhlactaotao0% (1)

- GsdeDocument6 pagesGsdeSurbhi Sofat0% (1)

- DGCA Guidelines - Hot Air Ballooning in IndiaDocument3 pagesDGCA Guidelines - Hot Air Ballooning in IndiaMausam KalraNo ratings yet

- Birhan Final Project11Document51 pagesBirhan Final Project11Tadi Yos100% (2)

- Review of Amcor's Financial StatementsDocument9 pagesReview of Amcor's Financial StatementsZeeshan Ali AnjumNo ratings yet

- Chempolis Asia Business CaseDocument18 pagesChempolis Asia Business CaseIrving Toloache Flores100% (1)

- Acc 201 Introduction To Financial Accounting IDocument73 pagesAcc 201 Introduction To Financial Accounting Igarba shuaibuNo ratings yet

- Iato Aim & ObjectiveDocument2 pagesIato Aim & Objectiveshashanksaurabh1983100% (1)

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Nandish EthirajNo ratings yet

- Lab Project DraftDocument17 pagesLab Project DraftSAURAV KUMAR GUPTANo ratings yet

- Dr Fx Pidiseal Ps 43Document4 pagesDr Fx Pidiseal Ps 43ShelendraSinghNo ratings yet

- Module Ii: Starting A New Venture: Answer KeyDocument3 pagesModule Ii: Starting A New Venture: Answer KeyShelendraSinghNo ratings yet

- Module I: Program Orientation: Answer KeyDocument3 pagesModule I: Program Orientation: Answer KeyShelendraSingh100% (1)

- Microsoft Word - ShaliSeal Primer-IC-207Document1 pageMicrosoft Word - ShaliSeal Primer-IC-207ShelendraSinghNo ratings yet

- Business Name: Solanki Plastic Business Address: 72/2, Khatipura, Near ElectronicDocument3 pagesBusiness Name: Solanki Plastic Business Address: 72/2, Khatipura, Near ElectronicShelendraSinghNo ratings yet

- Engine Cadet CV Seeks PositionDocument1 pageEngine Cadet CV Seeks PositionPatrisNo ratings yet

- LT101A MP Series1 ManualDocument2 pagesLT101A MP Series1 ManualДмитро СелютінNo ratings yet

- Cañon EodDocument58 pagesCañon EodJonatan AlmeidaNo ratings yet

- Method of Statement (Masonry Works-EEC)Document3 pagesMethod of Statement (Masonry Works-EEC)Sa3id HassanNo ratings yet

- Free E-Book: For RBI Gr. B Economic & Social Issues (ESI) PreparationDocument8 pagesFree E-Book: For RBI Gr. B Economic & Social Issues (ESI) PreparationDhairya ChoudharyNo ratings yet

- Architectural Finishes For Retaining WallsDocument3 pagesArchitectural Finishes For Retaining Wallsjackcan501No ratings yet

- JEM Paper Submission Format 2023Document4 pagesJEM Paper Submission Format 2023YudhaNo ratings yet

- Form DGT-New (Per25 THN 2018)Document12 pagesForm DGT-New (Per25 THN 2018)SellyNo ratings yet

- Finishing Construction Specification and Bill of Quantities for Debre Birhan EthiopiaDocument11 pagesFinishing Construction Specification and Bill of Quantities for Debre Birhan EthiopiaMulugeta BezaNo ratings yet

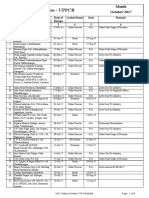

- NOC Status for UPPCB in October 2017Document6 pagesNOC Status for UPPCB in October 2017Jeevan jyoti vnsNo ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Ross12e Chapter05 TBDocument19 pagesRoss12e Chapter05 TBHải YếnNo ratings yet

- Ethiopia Commodity Exchange Rules UpdateDocument107 pagesEthiopia Commodity Exchange Rules UpdateKumera HaileyesusNo ratings yet

- Cryomatrix Series Cryo Freezer User & Service ManualDocument30 pagesCryomatrix Series Cryo Freezer User & Service ManualTrung Hiếu CamNo ratings yet

- Exercise 2Document19 pagesExercise 2Desirre TransonaNo ratings yet

- Assignment 2 BNP 30402 AnswerDocument7 pagesAssignment 2 BNP 30402 AnswerbndrprdnaNo ratings yet

- Voskoboynikov2021 TheRussianEconomy AVeryShortIntroductionDocument4 pagesVoskoboynikov2021 TheRussianEconomy AVeryShortIntroductionnizar.22139No ratings yet

- Iso 4109 1980Document4 pagesIso 4109 1980fruitsok81No ratings yet

- Society and Economy of the Mauryan EmpireDocument2 pagesSociety and Economy of the Mauryan EmpireEkansh DwivediNo ratings yet

- 4 Iw 6GN1 3Document1 page4 Iw 6GN1 3lebanese.intlNo ratings yet

- Manual MaverickDocument39 pagesManual MaverickCristian Orozco ArreolaNo ratings yet

- Purchase order for chemical lab equipmentDocument2 pagesPurchase order for chemical lab equipmentYadnyesh KarkareNo ratings yet

- Lani Nuraini MakmurDocument39 pagesLani Nuraini MakmurIlham PandjuNo ratings yet

- 12 Unit 10 - Closing ActivitiesDocument6 pages12 Unit 10 - Closing ActivitiesJosimar SantosNo ratings yet

- Ageing Debtors 2022 23Document10 pagesAgeing Debtors 2022 23Manojit GamingNo ratings yet

- Ship Chandling Flow ChartDocument3 pagesShip Chandling Flow Chartavon1276No ratings yet

- Form MGT 7 01032021 SignedDocument14 pagesForm MGT 7 01032021 SignedMohak GuptaNo ratings yet