Professional Documents

Culture Documents

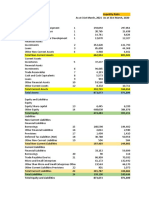

Balance Sheet Assets DEC. 31, 2007 DEC. 31, 2006

Uploaded by

Linh Kelly0 ratings0% found this document useful (0 votes)

10 views4 pages1. The bank's total assets increased from $183.77 million in 2006 to $205.97 million in 2007, with net loans and leases increasing from $81.86 million to $90.10 million over the same period.

2. Total deposits increased from $167.26 million in 2006 to $188.30 million in 2007, accounting for most of the growth in liabilities.

3. The bank's net income increased slightly from $2.49 million in 2006 to $2.52 million in 2007, with its return on equity remaining steady at approximately 18%.

Original Description:

Your document was successfully uploaded!

Original Title

balance sheet bma

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The bank's total assets increased from $183.77 million in 2006 to $205.97 million in 2007, with net loans and leases increasing from $81.86 million to $90.10 million over the same period.

2. Total deposits increased from $167.26 million in 2006 to $188.30 million in 2007, accounting for most of the growth in liabilities.

3. The bank's net income increased slightly from $2.49 million in 2006 to $2.52 million in 2007, with its return on equity remaining steady at approximately 18%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesBalance Sheet Assets DEC. 31, 2007 DEC. 31, 2006

Uploaded by

Linh Kelly1. The bank's total assets increased from $183.77 million in 2006 to $205.97 million in 2007, with net loans and leases increasing from $81.86 million to $90.10 million over the same period.

2. Total deposits increased from $167.26 million in 2006 to $188.30 million in 2007, accounting for most of the growth in liabilities.

3. The bank's net income increased slightly from $2.49 million in 2006 to $2.52 million in 2007, with its return on equity remaining steady at approximately 18%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

Balance Sheet FMT - Hanoi University

ASSETS DEC. 31, 2007 DEC. 31, 2006

1 Cash & due from dep. Instit. 9,039 10,522

Investment securities

Interest bearing bank balances 0 1,000

U.S. Treasury and agency securities 54,082 44,848

Municipal securities 32,789 34,616

Investment securities 86,871 80,464

Trading account assets 0 0

Fed Funds Sold 10,500 1,500

2 Securities Holdings 97,371 81,964

Loans and leases

Real estate loans 50,393 38,975

Commercial loans 9,615 11,381

Individual loans 8,824 10,640

Agricultural loans 20,680 19,654

Other loans and leases-domestic 3,684 4,025

Gross loans and leases 93,196 84,675

Less: unearned income reserves -89 -282

Allowance for loan and lease losses -3,006 -2,536

3 Net loans and leases 90,101 81,857

Premises, fixed assets, and capitalized

leases 2,229 2,398

Other real estate 2,282 3,012

Other assets 4,951 4,014

4 Miscellaneous assets 9,462 9,424

Total assets 205,973 183,767

LIABILITIES & CAPITAL

Demand deposits 23,063 22,528

All NOW accounts 6,021 5,322

MMDA accounts 41,402 49,797

Other savings deposits 3,097 2,992

Time deposits<100K 31,707 28,954

Time deposits>100K 83,009 57,665

1 Total deposits 188,299 167,258

Nondeposit funds

Fed funds purchased 0 0

Other borrowings 0 0

Bankers’ acceptance and other liabilitie 3,546 3,101

2 Total nondeposit funds 3,546 3,101

Total liabilities 191,845 170,359

Subordinated notes and debentures 0 0

3 All common and preferred equity 14,128 13,408

Total liabilities and capital 205,973 183,767

TB Page 96 of 97

Income statement FMT - Hanoi University

Revenues and Expenses December 31, 2007 December 31, 2006

Income from loans and lease financing 0 0

Fully taxable $8,880 9,032

Tax-exempt $51 50

Interest and fees on loans and leases $8,931 9,082

Estimated tax benefit 38 21

Total income on loans and leases 8969 9,103

Investment interest income

U.S. Treasury and agency securities 3735 3,571

income

Muni securities income 3097 3,025

Estimated tax benefit 1882 2,103

Other securities income 13 0

Total investment interest income 8727 8,699

Interest on federal funds sold 192 194

Interest due from banks 27 5

Total interest income 17915 18,001

Interest expense

Interest on CDs > 100K 3248 2,924

Interest on other deposits 6757 7,167

Interest on Fed Funds bought and repos 16 59

Interest on borrowed money 0 50

Interest on mortgages and leases 0 0

Interest on subordinated debt 0 0

Total interest expense 10021 10,200

Net interest income 7894 7,801

Non-interest income 571 577

Adjusted operating income 8465 8,378

Overhead expense 3624 3,876

Provision for loan and lease loss 1294 3,208

Pre-tax operating income 3547 1,294

Securities gains/(losses) 1240 3,331

Pre-tax net operating income 4787 4,625

Applicable income taxes 2267 2,133

Net operating income before extraodinary items 2520 2,492

Net extraordinary items 0 0

Net income 2520 2,492

Fomula Result

ROE net income/total equity 17.84%

(Net income/total asset) x (Total asset/Equity Capital)

Income statement FMT - Hanoi University

Revenues and Expenses December 31, 2007 December 31, 2006

Income from loans and lease financing $0 $0

Fully taxable $8,880 $9,032

Tax-exempt $51 $50

Interest and fees on loans and leases $8,931 $9,082

Estimated tax benefit $38 $21

Total income on loans and leases $8,969 $9,103

Investment interest income

U.S. Treasury and agency securities $3,735 $3,571

income

Muni securities income $3,097 $3,025

Estimated tax benefit $1,882 $2,103

Other securities income $13 $0

Total investment interest income $8,727 $8,699

Interest on federal funds sold $192 $194

Interest due from banks $27 $5

Total interest income $17,915 $18,001

Interest expense

Interest on CDs > $100K $3,248 $2,924

Interest on other deposits $6,757 $7,167

Interest on Fed Funds bought and repos $16 $59

Interest on borrowed money $0 $50

Interest on mortgages and leases $0 $0

Interest on subordinated debt $0 $0

Total interest expense $10,021 $10,200

Net interest income $7,894 $7,801

Non-interest income $571 $577

Adjusted operating income $8,465 $8,378

Overhead expense $3,624 $3,876

Provision for loan and lease loss $1,294 $3,208

Pre-tax operating income $3,547 $1,294

Securities gains/(losses) $1,240 $3,331

Pre-tax net operating income $4,787 $4,625

Applicable income taxes $2,267 $2,133

Net operating income before $2,520 $2,492

extraordinary items

Net extraordinary items $0 $0

Net income $2,520 $2,492

TB Page 97 of 97

You might also like

- Ia Vol 3 Valix 2019 SolmanDocument105 pagesIa Vol 3 Valix 2019 Solmanxeth agas86% (7)

- Strategic Management Concepts and Cases David 13th Edition Solutions ManualDocument14 pagesStrategic Management Concepts and Cases David 13th Edition Solutions ManualJoannFreemanwnpd100% (39)

- Farag HWCH 3Document8 pagesFarag HWCH 3drenghalaNo ratings yet

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- Coffee Shop Business Plan Example PDFDocument31 pagesCoffee Shop Business Plan Example PDFiNSTANT EquityNo ratings yet

- MOD Technical Proposal 1.0Document23 pagesMOD Technical Proposal 1.0Scott TigerNo ratings yet

- Camel VCB 2021Document36 pagesCamel VCB 2021phượng nguyễn thị minhNo ratings yet

- Arini Mutmainnah PA ADocument7 pagesArini Mutmainnah PA AArini MutmainnahNo ratings yet

- CF - Example1Document8 pagesCF - Example1BSHELTON8No ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Business ForecastingDocument6 pagesBusiness ForecastingRahat Mahmud ShoebNo ratings yet

- R&D AmortizationDocument22 pagesR&D AmortizationFakeNo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- Libro 1Document1 pageLibro 1Constanta CobusceanNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- BSIS Tesla 2017 2021Document10 pagesBSIS Tesla 2017 2021Minh PhuongNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- MFI NCC Bank XL ReportsDocument27 pagesMFI NCC Bank XL ReportsSaid Ur RahmanNo ratings yet

- Wassim Zhani Texas Roadhouse Financial Statements 2006-2009Document14 pagesWassim Zhani Texas Roadhouse Financial Statements 2006-2009wassim zhaniNo ratings yet

- Income Statement and Balance Sheet (LV & Parda)Document30 pagesIncome Statement and Balance Sheet (LV & Parda)Pallavi KalraNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Reformuation of FS ProblemDocument7 pagesReformuation of FS ProblemRohitNo ratings yet

- Section A (Group 11)Document14 pagesSection A (Group 11)V PrasantNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Fauji Fertilizer Company Limited 20 21Document5 pagesFauji Fertilizer Company Limited 20 21Aliza IshraNo ratings yet

- The Group AssetsDocument46 pagesThe Group Assetsit4728No ratings yet

- Bank 2 CitigroupDocument42 pagesBank 2 CitigroupEnock RutoNo ratings yet

- Bdo BalancesheetDocument6 pagesBdo BalancesheetroilesatheaNo ratings yet

- Tutorial 5 Part 1 Ratio CalculationsDocument14 pagesTutorial 5 Part 1 Ratio CalculationsNISHA BANSALNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- MDT (Medtronic PLC.) (10-Q) 2023-08-31Document154 pagesMDT (Medtronic PLC.) (10-Q) 2023-08-31Asim MalikNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- Leverage RatioDocument3 pagesLeverage RatioRahul PrasadNo ratings yet

- A3 6Document3 pagesA3 6David Rolando García OpazoNo ratings yet

- Vertical Analysis of Sopl For The Year 2020Document3 pagesVertical Analysis of Sopl For The Year 2020Shubashini RajanNo ratings yet

- Practice Set 2 Pfizer HM SolvedDocument17 pagesPractice Set 2 Pfizer HM SolvedNISHA BANSALNo ratings yet

- Liquidity RatioDocument2 pagesLiquidity RatioRahul PrasadNo ratings yet

- Group Assignemnt Finance ManagementDocument5 pagesGroup Assignemnt Finance ManagementEaindray OoNo ratings yet

- 3 - CokeDocument30 pages3 - CokePranali SanasNo ratings yet

- Balance Sheets (In Millions) June 30 2003Document6 pagesBalance Sheets (In Millions) June 30 2003vdkvaibhavNo ratings yet

- Horizontal Analysis: AssetsDocument13 pagesHorizontal Analysis: AssetsMonica ReyesNo ratings yet

- Shiksha: Non-Current AssetsDocument4 pagesShiksha: Non-Current AssetsdebojyotiNo ratings yet

- Lopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument4 pagesLopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionKaname KuranNo ratings yet

- Asset Based ValuationDocument11 pagesAsset Based ValuationShubham ThakurNo ratings yet

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- Income Statement: in ThousandsDocument29 pagesIncome Statement: in ThousandsDaviti LabadzeNo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- Veda Co - Financial StatementsDocument2 pagesVeda Co - Financial StatementsTalib KhanNo ratings yet

- Acc319 - Take-Home Act - Financial ModelDocument24 pagesAcc319 - Take-Home Act - Financial Modeljpalisoc204No ratings yet

- Company X Dated December 31Document3 pagesCompany X Dated December 31Bui AnNo ratings yet

- SerwerDocument22 pagesSerwerSahand LaliNo ratings yet

- Kit Valoración Cementos ArgosDocument19 pagesKit Valoración Cementos ArgosLEIDY DAYANA PARRA CARONo ratings yet

- Aeg EnterpriseDocument7 pagesAeg EnterpriseMuzammil ImranNo ratings yet

- HOndaDocument8 pagesHOndaRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Understanding Financial StatementsDocument30 pagesUnderstanding Financial StatementsCalvin GadiweNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Financial Position of The STCDocument13 pagesFinancial Position of The STCSalwa AlbalawiNo ratings yet

- Consolidated Financial Statements June 30, 2017 and 2016 (With Independent Auditors' Report Thereon)Document63 pagesConsolidated Financial Statements June 30, 2017 and 2016 (With Independent Auditors' Report Thereon)Nadie LrdNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskFrom EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskNo ratings yet

- Wages and Salary Administration: Project Report OnDocument58 pagesWages and Salary Administration: Project Report OnNiranjan WarakeNo ratings yet

- Exploring Corporate Strategy Johnson and Scholes PDFDocument2 pagesExploring Corporate Strategy Johnson and Scholes PDFTodd100% (1)

- Consumer Loans, Credit Cards and Real Estate Lending: Prepared By: Banking Department Faculty of Finance and BankingDocument93 pagesConsumer Loans, Credit Cards and Real Estate Lending: Prepared By: Banking Department Faculty of Finance and BankingPhương NguyễnNo ratings yet

- NPP Best Practices Instructions FAU I SPG 5410 en 01Document2 pagesNPP Best Practices Instructions FAU I SPG 5410 en 01HammamiSalahNo ratings yet

- Capital Markets - Final Exam (María Redondo)Document2 pagesCapital Markets - Final Exam (María Redondo)María Mercedes RedondoNo ratings yet

- Waghbakri PPT 2Document12 pagesWaghbakri PPT 2NIKNISHNo ratings yet

- Module 6: 4M'S of Production and Business ModelDocument43 pagesModule 6: 4M'S of Production and Business ModelSou MeiNo ratings yet

- Resume Lokesh Chawla PDFDocument3 pagesResume Lokesh Chawla PDFvaibhav.manchester9372No ratings yet

- BSBRSK501 Task 2 - UnlockedDocument6 pagesBSBRSK501 Task 2 - UnlockedCristhianNo ratings yet

- Loan Recommendation For Loan ApprovalDocument6 pagesLoan Recommendation For Loan ApprovalPlace2790% (1)

- My ReportDocument48 pagesMy ReportSaik Sadat Ibna IslamNo ratings yet

- ProfileDocument2 pagesProfileJaviier Arellano BravoNo ratings yet

- Chap 013Document60 pagesChap 013zeidNo ratings yet

- Teaser On E-Commerce Final PDFDocument3 pagesTeaser On E-Commerce Final PDFRiazboniNo ratings yet

- Corporate Brochure 2019: Mitsui & Co., LTDDocument12 pagesCorporate Brochure 2019: Mitsui & Co., LTDjason6686pNo ratings yet

- Phantom Share PlanDocument2 pagesPhantom Share PlanFibriaRINo ratings yet

- Airport Urbanism Max HirshDocument4 pagesAirport Urbanism Max HirshMukesh WaranNo ratings yet

- AFAR 1.4 - Installment SalesDocument7 pagesAFAR 1.4 - Installment SalesKile Rien MonsadaNo ratings yet

- Syeda Samia Ali - Case Study - National Mayonnaise - CBDocument6 pagesSyeda Samia Ali - Case Study - National Mayonnaise - CBSyédà Sámiá AlìNo ratings yet

- Chapter 13 - Weighing Net Present Value and Other Capital Budgeting Criteria QuestionsDocument21 pagesChapter 13 - Weighing Net Present Value and Other Capital Budgeting Criteria QuestionsAhmad RahhalNo ratings yet

- Unit 1.3 Building Customer Satisfaction, Value, and RetentionDocument23 pagesUnit 1.3 Building Customer Satisfaction, Value, and Retentionsunny_gladiator100% (3)

- HRM Case Study 1Document2 pagesHRM Case Study 1Shubham sainiNo ratings yet

- Tapping Into Global Markets: Marketing Management, 13 EdDocument9 pagesTapping Into Global Markets: Marketing Management, 13 EdFarabiTsmNo ratings yet

- CT SS For Student Oct2018Document5 pagesCT SS For Student Oct2018Nabila RosmizaNo ratings yet

- Special Economic Zone - WikipediaDocument8 pagesSpecial Economic Zone - WikipediaDishaNo ratings yet

- Final Project LEAP Batch 4Document7 pagesFinal Project LEAP Batch 4fildzarohma123No ratings yet

- HRMS BrochureDocument4 pagesHRMS Brochureapi-3801793No ratings yet