Professional Documents

Culture Documents

5 6066671456270418700

5 6066671456270418700

Uploaded by

Rohin GuleriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 6066671456270418700

5 6066671456270418700

Uploaded by

Rohin GuleriaCopyright:

Available Formats

+91 9953301150 use code “NIMISHA” to get Maximum discount on unacademy fees Nimisha Bansal

Q1. What is the cost of filing a complaint with the NBFC Ombudsman ?

(a) No charge

(b) Rs. 100

(c) Rs. 500

(d) Rs. 1000

(e) May vary accordingly

Ans: a

Solution: The Ombudsman Scheme for Non-Banking Financial Companies, 2018 (the Scheme), is an expeditious and

cost free apex level mechanism for resolution of complaints of customers of NBFCs, relating to certain services rendered

by NBFCs.

Q2. In which country the South Asian Association for Regional Cooperation (SAARC) was established with the

signing of the SAARC Charter on 8 December 1985 ?

(a) Afghanistan

(b) Bhutan

(c) India

(d) Bangladesh

(e) Maldives

Ans: b

Solution: The first summit was held in Dhaka, Bangladesh on 7–8 December 1985 and was attended by the Government

representative and president of Bangladesh, Maldives, Pakistan and Sri Lanka, the kings of Bhutan and Nepal, and the

prime minister of India.

Q3. What are the processing charges that an NBFC-MFI can levy on its customers ?

(a) No Charge

(b) 1%

(c) 3%

(d) 5%

English with Nimisha Bansal

+91 9953301150 use code “NIMISHA” to get Maximum discount on unacademy fees Nimisha Bansal

(e) 10%

Ans: b

Solution: Processing charges by NBFC-MFIs shall not be more than 1% of gross loan amount. Processing fee are the

charges levied on the borrower by the bank to provide the services or initiate the process be it a loan or credit card

transaction. This fee is non-refundable even if the loan doesn't get sanctioned. In some cases, this fee can be waived off by

the lender on special requests.

Q4. In context to NBFC-MFI, what does SRO stands for ?

(a) Social Responsibility Organisation

(b) Socio-Economic Regulatory Organisation

(c) Self-Regulatory Organisation

(d) Subordinate Referendum Order

(e) None of these

Ans: c

Solution: A self-regulatory organization (SRO) is an organization that exercises some degree of regulatory authority

over an industry or profession. The regulatory authority could exist in place of government regulation, or applied in

addition to government regulation.

Q5. Which of the following is true regarding NBFC ?

(a) NBFC cannot accept demand deposits.

(b) NBFCs do not form part of the payment and settlement system

(c) NBFC cannot issue cheques drawn on itself

(d) Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs

(e) All are true

Ans: d

Solution: NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few

differences as given below :

i. NBFC cannot accept demand deposits ;

ii. NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself ;

English with Nimisha Bansal

+91 9953301150 use code “NIMISHA” to get Maximum discount on unacademy fees Nimisha Bansal

iii. Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors

of NBFCs, unlike in case of banks.

Q6. As defined in the section 45-IA of the RBI Act, 1934, no Non-Banking Financial company can commence or carry on

business without having a Net Owned Funds of -

(a) Rs. 10 lakhs

(b) Rs. 25 lakhs

(c) Rs. 50 lakhs

(d) Rs. 75 lakhs

(e) Rs. 1 Crore

Ans: b

Solution: In terms of Section 45-IA of the RBI Act, 1934 it is mandatory for a company to obtain Certificate of

Registration (CoR) from Reserve Bank of India (RBI) before commencing or to carry on business of a non-banking

financial institution. And the net value is 25 lakhs.

Q7. What is the asset size required for a NBFC to consider it as a Systemically Important NBFC ?

(a) 50 crore

(b) 100 Crore

(c) 250 Crore

(d) 500 Crore

(e) 1000 crore

Ans: d

Solution: NBFCs whose asset size is of 500 cr or more as per last audited balance sheet are considered as systemically

important NBFCs. The rationale for such classification is that the activities of such NBFCs will have a bearing on the

financial stability of the overall economy.

Q8. What does R stand for in the abbreviation RNBC ?

(a) Residuary

(b) Regional

English with Nimisha Bansal

+91 9953301150 use code “NIMISHA” to get Maximum discount on unacademy fees Nimisha Bansal

(c) Regulatory

(d) Ramification

(e) None of these.

Ans: a

Solution: Residuary Non-Banking Company is a class of NBFC which is a company and has as its principal business

the receiving of deposits, under any scheme or arrangement or in any other manner and not being investment, asset

financing, loan company. These companies are required to maintain investments as per directions of RBI, in addition to

liquid assets. The functioning of these companies is different from those of NBFCs in terms of method of mobilisation of

deposits and requirement of deployment of depositors' funds. However, Prudential Norms Directions are applicable to

these companies also.

Q9. What does C stand for in the abbreviation POCSO ?

(a) Children

(b) Crime

(c) Credit

(d) Company

(e) Child

Ans: e

Solution: The Protection of Children from Sexual Offences (POCSO) Act, 2012 was enacted to provide a robust legal

framework for the protection of children from offences of sexual assault, sexual harassment and pornography, while

safeguarding the interest of the child at every stage of the judicial process.

Q10. What is the threshold limit of assets upto which a Core Investment Company is exempted from registration in terms

of section 45NC of the RBI Act 1934 ?

(a) Rs. 100 Crore

(b) Rs. 200 Crore

(c) Rs. 500 Crore

(d) Rs. 1000 Crore

(e) No such limit is defined

Ans: a

English with Nimisha Bansal

+91 9953301150 use code “NIMISHA” to get Maximum discount on unacademy fees Nimisha Bansal

Solution: Power of Bank to exempt.—The Bank, on being satisfied that it is necessary so to do, may declare by

notification in the Official Gazette that any or all of the provisions of this Chapter shall not apply to a non-banking

institution or a class of non-banking institutions or a non-banking financial company or to any class or non-banking

financial companies either generally or for such period as may be specified, subject to such conditions, limitations or

restrictions as it may think fit to impose. Existing CICs which were exempted from registration in the past and have an

asset size of less than Rs 100 crore are exempted from registration in terms of section 45NC of the RBI Act 1934, as

stated in Notification No. DNBS.

English with Nimisha Bansal

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Transportation Law ReviewerDocument40 pagesTransportation Law ReviewerJannus YodicoNo ratings yet

- Sexless MarriageDocument6 pagesSexless MarriageMircea Enache0% (1)

- Apple Inc. Swot Analysis 2017Document28 pagesApple Inc. Swot Analysis 2017Augusto Teixeira Modesto100% (1)

- Rule 68 - Danao Vs CADocument1 pageRule 68 - Danao Vs CAMiles50% (2)

- Counter Affidavit.1Document15 pagesCounter Affidavit.1Denzel Edward CariagaNo ratings yet

- Ace Hotel Teaser BrochureDocument16 pagesAce Hotel Teaser BrochureSky YimNo ratings yet

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Table A1. JSW Steel Balance Sheet: Source: Dion Global Solutions LimitedDocument12 pagesTable A1. JSW Steel Balance Sheet: Source: Dion Global Solutions Limitedkarunakar vNo ratings yet

- 320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsDocument8 pages320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsPrateek KhandelwalNo ratings yet

- ERDT Scholarship Application Form 2019Document6 pagesERDT Scholarship Application Form 2019Reynaldo YlananNo ratings yet

- Imm5818e PDFDocument8 pagesImm5818e PDFblanknoizNo ratings yet

- Lagrangian Dynamics Problem SolvingDocument5 pagesLagrangian Dynamics Problem Solvingvivekrajbhilai5850No ratings yet

- People Vs SaylanDocument6 pagesPeople Vs SaylanAnne Camille SongNo ratings yet

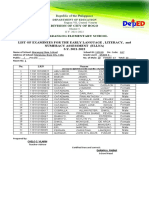

- List of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022Document2 pagesList of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022April Catadman QuitonNo ratings yet

- CHAPTER II. CICM in The WorldDocument9 pagesCHAPTER II. CICM in The WorldJocelyn TabudlongNo ratings yet

- SPAMILTON Deal Sheet 21-22 - 50 50 SplitDocument1 pageSPAMILTON Deal Sheet 21-22 - 50 50 SplitJeremy Joseph EhlingerNo ratings yet

- Banking and Finance Bangalore UniversityDocument103 pagesBanking and Finance Bangalore UniversityABHIJIT SHAWNo ratings yet

- Keac 211Document38 pagesKeac 211vichmegaNo ratings yet

- Gadadhar Abhyudaya PrakalpaDocument2 pagesGadadhar Abhyudaya PrakalpaAGNo ratings yet

- Financing Card Based On Murabahah Contract: The Legal Implications On A Credit CardDocument15 pagesFinancing Card Based On Murabahah Contract: The Legal Implications On A Credit CardIJELS Research JournalNo ratings yet

- Proosed Revised Version of Development Project ProformaDocument2 pagesProosed Revised Version of Development Project Proformascribd1No ratings yet

- In The Supreme Court of Bangladesh (High Court Division) : Equiv Alent Citation: 55 DLR (2003) 130Document9 pagesIn The Supreme Court of Bangladesh (High Court Division) : Equiv Alent Citation: 55 DLR (2003) 130Imran HossenNo ratings yet

- Ibm Totalstorage San140M: Designed For Easy-To-Manage, Highly Scalable, High-Performance Enterprise San SolutionsDocument8 pagesIbm Totalstorage San140M: Designed For Easy-To-Manage, Highly Scalable, High-Performance Enterprise San SolutionsrakeshNo ratings yet

- Sibick LetterDocument40 pagesSibick LetterWGRZ-TVNo ratings yet

- Recognition and Extinction of StatesDocument4 pagesRecognition and Extinction of StatesCristy C. BangayanNo ratings yet

- Tour and Travel 3Document49 pagesTour and Travel 3Danica Joy ArcegonoNo ratings yet

- Unit 1 Book Keeping, Accounting, AS & IFRS PDFDocument49 pagesUnit 1 Book Keeping, Accounting, AS & IFRS PDFShreyash Pardeshi100% (1)

- 8 Land - Bank - of - The - Phils. - v. - Perez PDFDocument10 pages8 Land - Bank - of - The - Phils. - v. - Perez PDFEffy SantosNo ratings yet

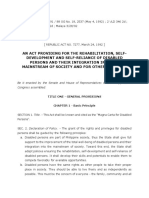

- 05 Ra 7277Document22 pages05 Ra 7277Dan Christian Dingcong CagnanNo ratings yet

- Proposal Tax Payer EducationDocument22 pagesProposal Tax Payer EducationDenis Robert Mfugale100% (1)