Professional Documents

Culture Documents

Accounting - Journal Entries Overview

Uploaded by

Amara Rehman0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageAccounting - Journal Entries Overview

Uploaded by

Amara RehmanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

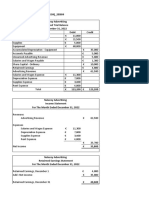

Accounting - Journal Entries Overview

Remember A.L.O.R.E. Debits = Credits for every journal entry.

Debit Credit

Asset + -

Liability - +

Owner’s/Stockholder Equity - +

Revenue - +

Expenses + -

Basic Entries

Buying Items (e.g. supplies, land, etc.) Doing Job for Advance Payment

Items Unearned Revenue

Cash Revenue

Buying Items on Account Recording Depreciation

Items Depreciation Expense

Accounts Payable Accumulated Depreciation

Paying off Items bought on Accounts Invoicing Client

Accounts Payable Accounts Receivables

Cash Fees Earned

Using Items (e.g. supplies) Client pay Invoice

Supplies Expense Cash

Supplies Accounts Receivables

Paying Dividends Closing Entries

Dividends Moving Revenue to Income Summary

Cash Revenue (Sales, Rents etc.)

Income Summary

Adjusting Entries

Prepaid Expense (e.g. rent, insurance etc.) Closing Expenses

Prepaid Income Summary

Cash all Expenses

Using Prepaid Moving Income to Retained Earnings

Expense Income Summary

Cash Retained Earnings

Client Pays Fees in Advance Removing Dividends

Cash Retained Earnings

Unearned Revenue Dividends

C-21 281-478-2779

Lee Davis Library Director: dawn.shedd@sjcd.edu

Student Success Center - Central

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Spelling PBDocument200 pagesSpelling PBAmara Rehman100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Asymmetrical NecklaceDocument7 pagesAsymmetrical NecklaceAmara Rehman100% (1)

- Advance Accounting 2 by GuerreroDocument13 pagesAdvance Accounting 2 by Guerreromarycayton100% (7)

- Cash BudgetDocument28 pagesCash BudgetLerrad GutierrezNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Cost of Capital and Capital Structure DecisionsDocument21 pagesCost of Capital and Capital Structure DecisionsGregory MakaliNo ratings yet

- TB21Document33 pagesTB21Aiden Pats100% (1)

- DepletionDocument25 pagesDepletionRachelle Deleña100% (1)

- Learning Possibilities: Text: Donaldson, J 2001, Room On The BroomDocument1 pageLearning Possibilities: Text: Donaldson, J 2001, Room On The BroomAmara RehmanNo ratings yet

- Achievement TestDocument19 pagesAchievement TestAmara RehmanNo ratings yet

- Summary 1Document8 pagesSummary 1Amara RehmanNo ratings yet

- Money To Be Paid by Reliance Infra-: Reliance Can Go ForDocument5 pagesMoney To Be Paid by Reliance Infra-: Reliance Can Go ForAbhishekKumarNo ratings yet

- Charts of AccountsDocument2 pagesCharts of AccountsNur ika PratiwiNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- Chapter24 Cashflowstatements2008Document21 pagesChapter24 Cashflowstatements2008Marium Rafiq100% (2)

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- FARI Daisy 2021 Mock ExamDocument17 pagesFARI Daisy 2021 Mock ExamLauren McMahonNo ratings yet

- The Reporting Entity and Consolidation of Less-than-Wholly-Owned Subsidiaries With No DifferentialDocument93 pagesThe Reporting Entity and Consolidation of Less-than-Wholly-Owned Subsidiaries With No DifferentialZahra Zafirah AmaliaNo ratings yet

- Chapter 04Document101 pagesChapter 04Ha100% (1)

- Facebook IPO 2012 Prospectus S1 PDFDocument198 pagesFacebook IPO 2012 Prospectus S1 PDFoObly.com100% (1)

- P1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Document2 pagesP1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Patrick Kyle Agraviador0% (1)

- ACC2007 - Seminar 9 - Complex Group StructuresDocument47 pagesACC2007 - Seminar 9 - Complex Group StructuresCeline LowNo ratings yet

- ExerciseDocument5 pagesExerciseICS TEAMNo ratings yet

- Divina-QandA-Finals-CoverageDocument37 pagesDivina-QandA-Finals-CoverageGaille IvyNo ratings yet

- Advance Accounting Materials 2Document4 pagesAdvance Accounting Materials 2Andrea Lyn Salonga CacayNo ratings yet

- Cfas (Pas 16)Document7 pagesCfas (Pas 16)Niña Mae VerzosaNo ratings yet

- Accounting Practice QuestionDocument2 pagesAccounting Practice Questionchacha_420No ratings yet

- Consolidation Question PaperDocument42 pagesConsolidation Question PaperNick VincikNo ratings yet

- PT AGIS Tbk.sDocument4 pagesPT AGIS Tbk.sRizka FurqorinaNo ratings yet

- Part 2 Chapter 5Document3 pagesPart 2 Chapter 5Keay ParadoNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- Assignment For Final Assesment: Submitted By: Subitted To: Subject: Course Name: Course Code: DateDocument13 pagesAssignment For Final Assesment: Submitted By: Subitted To: Subject: Course Name: Course Code: DateNeel ManushNo ratings yet

- FAR 38MC PFRS For SMEsDocument2 pagesFAR 38MC PFRS For SMEsMark Leo Opo RetuertoNo ratings yet

- Devina Yulia 20221539 2EB09 AKM TM#3Document3 pagesDevina Yulia 20221539 2EB09 AKM TM#3rully movizarNo ratings yet

- Translation ActivityDocument1 pageTranslation ActivityJon Dumagil Inocentes, CPANo ratings yet