Professional Documents

Culture Documents

Module 01 - Auditing, Attestation and Assurance

Uploaded by

MAG MAGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 01 - Auditing, Attestation and Assurance

Uploaded by

MAG MAGCopyright:

Available Formats

MODULE 1: AUDIT, ATTESTATION AND ASSURANCE – AN OVERVIEW

I. Description

This module discusses Assurance and Audit Engagement and their relationship. It discusses

its definition, the different types of audit and auditors and their roles in an organization. This

also gives an overview on the independent audit of financial statements.

II. Objectives

After completing the module, the students are expected to:

Understand the nature and objective an assurance engagement.

Identify and explain the types of assurance engagements.

Know and explain the non-assurance services.

Understand the auditor’s responsibilities and approach on engagements involving

review of financial statements.

Describe the responsibilities and approach on engagements involving review of

financial statements.

Understand and perform engagements involving compilation of financial statements

Understand and perform engagements involving compilation of financial statements

III. Duration

Start: Week 2

End: Week 2

IV. Learning Contents

PART 1: Auditing, Attestation and Assurance

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding

assertions about economic actions and events to ascertain the degree of correspondence

between the assertions and established criteria and communicating the results to interested

users.

By: American Accounting Association committee on basic auditing concepts.

Assurance Services

Although auditing refers specifically to expressing an opinion on financial statements and

attestation refers more generally to expressing an opinion on any type of information or

subject matter that is the responsibility of another party (such as sustainability measures),

assurance services includes an even broader set of information, including nonfinancial

information.

Assurance means confidence. In an assurance engagement, an assurance firm is engaged

by one party to give an opinion on a piece of information that has been prepared by another

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 1

Desiree D. Cemefrania, CPA

party. The opinion is an expression of assurance about the information that has been

reviewed. It gives assurance to the party that hired the assurance firm that the information

can be relied on.

1. Reasonable Assurance - the auditor provides a high level of assurance regarding

their works by performing very thorough procedures and obtaining sufficient

appropriate evidence to be able to draw reasonable conclusions.

2. Limited Assurance - the auditor only provides a moderate or a low level of

assurance regarding their work since only a fewer procedures are followed in

obtaining sufficient appropriate evidence to draw limited conclusions.

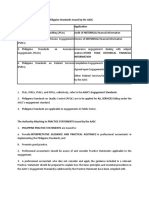

Elements of an Assurance Engagement

1. Three Party Relationship

a. Practitioner

b. Responsible party

c. Intended users

2. Appropriate Subject Matter

3. Suitable Criteria

4. Sufficient appropriate evidence

5. Conclusion

Attestation Engagement - An engagement in which a practitioner is engaged to issue a

report on subject matter or an assertion about subject matter that is the responsibility of

another party.

1. Audit of Financial Statements

2. Review of Financial Statements (See Part 2)

3. Internal Control Over Financial Reporting

4. Others

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 2

Desiree D. Cemefrania, CPA

In short, auditing is a type of attestation engagement, and all attestation engagements are a

type of assurance service. An audit lends credibility to a company's financial statements.

Attestation lends credibility to any assertions made a company's management. This

includes, but is not limited to, a company's financial statements.

PART 2: REVIEW OF FINANCIAL STATEMENTS

Philippine Standards on Review Engagements (PSREs)

OBJECTIVE

The objective of a review of financial statements is to enable an auditor to state whether, on

the basis of procedures which do not provide all the evidence that would be required in an

audit, anything has come to the auditor's attention that causes the auditor to believe that the

financial statements are not prepared, in all material respects, in accordance with generally

accepted accounting principles in the Philippines (negative assurance).

GENERAL PRINCIPLE OF A REVIEW ENGAGEMENT

1. Independence;

2. Integrity;

3. Objectivity;

4. Professional competence and due care;

5. Confidentiality;

6. Professional behavior; and

7. Technical standards.

The auditor should conduct a review in accordance with this PSRE.

The auditor should plan and perform the review with an attitude of professional skepticism

recognizing that circumstances may exist which cause the financial statements to be

materially misstated.

For the purpose of expressing negative assurance in the review report, the auditor should

obtain sufficient appropriate evidence primarily through inquiry and analytical procedures to

be able to draw conclusions.

SCOPE OF A REVIEW

The procedures required to conduct a review of financial statements should be determined

by the auditor having regard to the requirements of this PSA, relevant professional bodies,

legislation, regulation and, where appropriate, the terms of the review engagement and

reporting requirements.

MODERATE ASSURANCE

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 3

Desiree D. Cemefrania, CPA

A review engagement provides a moderate level of assurance that the information subject to

review is free of material misstatement, this is expressed in the form of negative assurance.

Negative assurance is a determination by an auditor that a particular set

of facts is believed to be accurate since no contrary evidence has been

found to dispute them.

TERMS OF ENGAGMENT

The auditor and the client should agree on the terms of the engagement. The agreed terms

would be recorded in an engagement letter or other suitable form such as a contract.

The objective of the service being performed.

Management's responsibility for the financial statements.

The scope of the review, including reference to this Philippine Standard on Auditing.

Unrestricted access to whatever records, documentation and other information

requested in connection with the review.

A sample of the report expected to be rendered.

The fact that the engagement cannot be relied upon to disclose errors, illegal acts or

other irregularities, for example, fraud or defalcations that may exist.

A statement that an audit is not being performed and that an audit opinion will not be

expressed. To emphasize this point and to avoid confusion, the auditor may also

consider pointing out that a review engagement will not satisfy any statutory or third

party requirements for an audit.

PLANNING

The auditor should plan the work so that an effective engagement will be performed. In

planning a review of financial statements, the auditor should obtain or update the knowledge

of the business including consideration of the entity's organization, accounting systems,

operating characteristics and the nature of its assets, liabilities, revenues and expenses.

DOCUMENTATION

The auditor should document matters which are important in providing evidence to support

the review report, and evidence that the review was carried out in accordance with this PSA.

PROCEDURES AND EVIDENCE

The auditor should apply judgment in determining the specific nature, timing and extent of

review procedures.

The auditor should apply the same materiality considerations as would be applied if an audit

opinion on the financial statements were being given.

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 4

Desiree D. Cemefrania, CPA

Procedures may be performed through:

Inquiries and analysis

Analytical procedures

Recomputation, comparison and other clerical accuracy checks.

Observation

Inspection

Obtaining confirmations

CONCLUSIONS AND REPORTING

The review report should contain a clear written expression of negative assurance. The

auditor should review and assess the conclusions drawn from the evidence obtained as the

basis for the expression of negative assurance

The report on a review of financial statements should contain the following basic elements,

ordinarily in the following layout:

1. Title

2. Addressee

3. opening or introductory paragraph

a. identification of the financial statements on which the review has been

performed; and

b. a statement of the responsibility of the entity's management and the

responsibility of the auditor;

4. scope paragraph, describing the nature of a review

5. statement of negative assurance;

6. date of the report;

7. auditor's address; and

8. auditor's signature

PART 3: AGREED-UPON PROCEDURES

Philippine Standards on Related Services 4400

OBJECTIVES

The objective of an agreed-upon procedures engagement is for the auditor to carry out

procedures of an audit nature to which the auditor and the entity and any appropriate third

parties have agreed and to report on factual findings.

As the auditor simply provides a report of the factual findings of agreed-upon procedures, no

assurance is expressed. Instead, users of the report assess for themselves the procedures

and findings reported by the auditor and draw their own conclusions from the auditor’s work.

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 5

Desiree D. Cemefrania, CPA

The report is restricted to those parties that have agreed to the procedures to be performed

since others, unaware of the reasons for the procedures, may misinterpret the results.

GENERAL PRINCIPLES OF AGREED-UPON PROCEDURES

1. The report is restricted to those parties that have agreed to the procedures to be

performed since others, unaware of the reasons for the procedures, may misinterpret

the results.

a. Independence;

b. Integrity;

c. Objectivity;

d. Professional competence and due care;

e. Confidentiality;

f. Professional behavior; and

g. Technical standards.

2. The auditor should conduct an agreed-upon procedures engagement in accordance

with this PSA and the terms of the engagement.

PROCEDURES

Procedures may be performed through:

Inquiries and analysis

Analytical procedures

Recomputation, comparison and other clerical accuracy checks.

Observation

Inspection

Obtaining confirmations

PART 4: COMPILATION ENGAGEMENT

Philippine Standards on Related Services 4410

OBJECTIVES

The objective of a compilation engagement is for the accountant to use accounting

expertise, as opposed to auditing expertise, to collect, classify and summarize financial

information.

This ordinarily entails reducing detailed data to a manageable and understandable form

without a requirement to test the assertions underlying that information. The procedures

employed are not designed and do not enable the accountant to express any assurance on

the financial information. However, users of the compiled financial information derive some

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 6

Desiree D. Cemefrania, CPA

benefit as a result of the accountant's involvement because the service has been performed

with professional competence and due care.

A compilation engagement would ordinarily include the preparation of financial statements

(which may or may not be a complete set of financial statements) but may also include the

collection, classification and summarization of other financial information.

V. References

Auditing Theory by J. Salosagcol, Tiu and Hermosilla

Philippine Standards on Related Services-4410-previously-PSA-930

Philippine Standards on Review Engagements-2400 Review Engagement

Philippine Standards on Related Services-4400-previously-PSA-920

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 7

Desiree D. Cemefrania, CPA

You might also like

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- Auditing Theory Cpa ReviewDocument53 pagesAuditing Theory Cpa ReviewIvy Michelle Habagat100% (1)

- Audit Practice and Assurance Services - A1.4 PDFDocument94 pagesAudit Practice and Assurance Services - A1.4 PDFFRANCOIS NKUNDIMANANo ratings yet

- Chapter 12 - Assurance & Other Related ServicesDocument5 pagesChapter 12 - Assurance & Other Related ServicesellieNo ratings yet

- Topic 1 AaaDocument5 pagesTopic 1 AaaIsaac OsoroNo ratings yet

- Notes - Professional ServicesDocument10 pagesNotes - Professional ServicesARIEL NACIONNo ratings yet

- Module 2 - Audit, An OverviewDocument8 pagesModule 2 - Audit, An OverviewMAG MAGNo ratings yet

- AT 02 Intro To AuditingDocument5 pagesAT 02 Intro To AuditingPrincess Mary Joy LadagaNo ratings yet

- Assurance Engagements and Related ServicesDocument45 pagesAssurance Engagements and Related ServicesJohn AceNo ratings yet

- Auditing TheoryDocument63 pagesAuditing TheoryJohn Laurence LoplopNo ratings yet

- Aaa Topic 1Document8 pagesAaa Topic 1Cindy ClollyNo ratings yet

- Auditing Theory CPARDocument57 pagesAuditing Theory CPARCarla ZanteNo ratings yet

- Aud1 & Aud12Document7 pagesAud1 & Aud12Lyka CastroNo ratings yet

- Module 3 - AuditingDocument22 pagesModule 3 - AuditingSophia Grace NiduazaNo ratings yet

- Summary and MCQs PDFDocument6 pagesSummary and MCQs PDFJeffrey GuminNo ratings yet

- Activity Sheet - Module 7Document10 pagesActivity Sheet - Module 7Chris JacksonNo ratings yet

- Chapter 12 Assurance and Non Assurance EngagementsDocument14 pagesChapter 12 Assurance and Non Assurance EngagementsFranz Gales TorcuatorNo ratings yet

- Lesson 1 - Overview of The Risk-Based Audit ProcessDocument7 pagesLesson 1 - Overview of The Risk-Based Audit ProcessYANIII12345No ratings yet

- AuditingDocument13 pagesAuditingRamos JovelNo ratings yet

- Audit 0 Investigation Presentation Module 1 To 3Document72 pagesAudit 0 Investigation Presentation Module 1 To 3Bashiir GelleNo ratings yet

- Assurance EngagementDocument6 pagesAssurance EngagementEmmaNo ratings yet

- Audit Problem (Aaconapps2 - Cash and ReceivablesDocument261 pagesAudit Problem (Aaconapps2 - Cash and ReceivablesDawson Dela CruzNo ratings yet

- IM-01 Overview of Audit and Other Assurance ServicesDocument7 pagesIM-01 Overview of Audit and Other Assurance Servicesharley_quinn11No ratings yet

- Philippine Standards Authority and Assurance EngagementsDocument26 pagesPhilippine Standards Authority and Assurance EngagementsLana sereneNo ratings yet

- Steps in Audit Engagement CDocument5 pagesSteps in Audit Engagement CReland CastroNo ratings yet

- HeheDocument17 pagesHehen56xdmnmmxNo ratings yet

- Review and Audit AssuranceDocument6 pagesReview and Audit AssuranceReg DungcaNo ratings yet

- 02 JournalDocument5 pages02 JournalJohn CPANo ratings yet

- PSA 120 and Audit Definition SummaryDocument4 pagesPSA 120 and Audit Definition SummaryAbraham Chin100% (1)

- Accepting An EngagementDocument4 pagesAccepting An EngagementRalph Ean BrazaNo ratings yet

- Audit Process Overview Module PosttestDocument3 pagesAudit Process Overview Module PosttestPaul Fajardo CanoyNo ratings yet

- A-332 Mercado, Marie Angelica Dv. Internal Auditing (Auditing and Assurance)Document3 pagesA-332 Mercado, Marie Angelica Dv. Internal Auditing (Auditing and Assurance)acilegna mercadoNo ratings yet

- Audit and Assurance f8.Document96 pagesAudit and Assurance f8.ALEKSBANDANo ratings yet

- Audit EvidenceDocument18 pagesAudit EvidenceAslam HossainNo ratings yet

- At 1 Theory Palang With Questions 1Document12 pagesAt 1 Theory Palang With Questions 1Sharmaine JoyceNo ratings yet

- Sabid - MC Neill - Bsma - 4 - I Am Lost! I Know I UnderstandDocument11 pagesSabid - MC Neill - Bsma - 4 - I Am Lost! I Know I UnderstandMC NEILL SABIDNo ratings yet

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaNo ratings yet

- PSA 120, PSA 200, AND Attestation Audit ACCTG 4110: Agreed Upon-ProceduresDocument12 pagesPSA 120, PSA 200, AND Attestation Audit ACCTG 4110: Agreed Upon-ProceduresMC NEILL SABIDNo ratings yet

- Group 4 The Audit ProcessDocument31 pagesGroup 4 The Audit ProcessYonica Salonga De BelenNo ratings yet

- Apiag Audit Theory Reviewer DraftDocument70 pagesApiag Audit Theory Reviewer DraftDanilo ApiagNo ratings yet

- CH 1 Audit Assurance EngagmentsDocument5 pagesCH 1 Audit Assurance EngagmentsDimpal Rabadia100% (1)

- 01 KBAT HandoutDocument10 pages01 KBAT HandoutFor AcadsNo ratings yet

- Module 1 Introduction To Assurance EngagementsDocument70 pagesModule 1 Introduction To Assurance EngagementsAngelica PostreNo ratings yet

- Chapter - 04, Process of Assurance - Evidence and ReportingDocument5 pagesChapter - 04, Process of Assurance - Evidence and Reportingmahbub khanNo ratings yet

- Ass CH04Document18 pagesAss CH04shah newazNo ratings yet

- PrE7 01 IntroductionDocument4 pagesPrE7 01 IntroductionBeelze BalilisNo ratings yet

- Chapter 1-Overview To AuditingDocument43 pagesChapter 1-Overview To Auditingselman AregaNo ratings yet

- Chapter 1 Introduction To Assurance Engagements - PPT 1704069091Document70 pagesChapter 1 Introduction To Assurance Engagements - PPT 1704069091Clar Aaron Bautista100% (1)

- PSBA - Introduction To Assurance and Related ServicesDocument6 pagesPSBA - Introduction To Assurance and Related ServicesephraimNo ratings yet

- DYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFDocument10 pagesDYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFJonnafe Almendralejo IntanoNo ratings yet

- Audit 2Document5 pagesAudit 2Naomi PerezNo ratings yet

- General Types of AuditDocument39 pagesGeneral Types of AuditRyzeNo ratings yet

- (Midterm) Aap - Module 4 Psa-200 - 210 - 240Document7 pages(Midterm) Aap - Module 4 Psa-200 - 210 - 24025 CUNTAPAY, FRENCHIE VENICE B.No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Home Office & Branch AccountingDocument13 pagesHome Office & Branch AccountingGround ZeroNo ratings yet

- Chap 13Document78 pagesChap 13MAG MAG100% (1)

- Objectives: Measures of Correlation and Regression AnalysisDocument16 pagesObjectives: Measures of Correlation and Regression AnalysisMAG MAGNo ratings yet

- Chapter 2 - Pre1Document21 pagesChapter 2 - Pre1MAG MAGNo ratings yet

- Independe NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsDocument23 pagesIndepende NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsMAG MAGNo ratings yet

- Module 7 - Internal ControlDocument22 pagesModule 7 - Internal ControlMAG MAGNo ratings yet

- Audit Sampling TechniquesDocument17 pagesAudit Sampling TechniquesMAG MAGNo ratings yet

- Module 7 - Internal ControlDocument22 pagesModule 7 - Internal ControlMAG MAGNo ratings yet

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- Auditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsDocument9 pagesAuditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsJane Michelle EmanNo ratings yet

- MCQ - Assurance ServicesDocument13 pagesMCQ - Assurance Servicesemc2_mcv67% (30)

- MCQ - Assurance ServicesDocument13 pagesMCQ - Assurance Servicesemc2_mcv67% (30)

- Auditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsDocument9 pagesAuditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsJane Michelle EmanNo ratings yet

- 11 Home Office and BranchDocument3 pages11 Home Office and BranchabcdefgNo ratings yet

- Business Ethics Lesson on Principles, Morality and Social ResponsibilityDocument5 pagesBusiness Ethics Lesson on Principles, Morality and Social ResponsibilityMAG MAGNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersLayla MainNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- PAS 23 - Borrowing Cost PDFDocument16 pagesPAS 23 - Borrowing Cost PDFGeoff MacarateNo ratings yet

- Questionnaire PRACTICAL ACCOUNTINGDocument8 pagesQuestionnaire PRACTICAL ACCOUNTINGJusthine RofuliNo ratings yet

- Business LawDocument51 pagesBusiness LawjacobpulikodenNo ratings yet

- Midterm Exam Review: Property, Plant and Equipment CalculationsDocument11 pagesMidterm Exam Review: Property, Plant and Equipment CalculationsMAG MAGNo ratings yet

- Basic Principles of TaxationDocument45 pagesBasic Principles of TaxationHyviBaculiSaynoNo ratings yet

- Lesson 3Document7 pagesLesson 3Shane Audrey MercadoNo ratings yet

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Document21 pagesProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)

- Chapter - 2Document5 pagesChapter - 2MAG MAGNo ratings yet

- Prevent Fraud at ABC Inc1. L2. B 3. G4. G5. I 6. B7. D8. I9. C10. O11. K 12. P13. P14. O15. MDocument2 pagesPrevent Fraud at ABC Inc1. L2. B 3. G4. G5. I 6. B7. D8. I9. C10. O11. K 12. P13. P14. O15. MMAG MAGNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Acctg16a Midterm ExamDocument6 pagesAcctg16a Midterm ExamRannah Raymundo100% (1)

- FR&A Course OverviewDocument4 pagesFR&A Course OverviewNilesh kumarNo ratings yet

- Accounting Standard Question Bank by CA P.S. BeniwalDocument84 pagesAccounting Standard Question Bank by CA P.S. BeniwalUday TomarNo ratings yet

- Bản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)Document30 pagesBản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)HẬU TRẦN TOÀN XUÂNNo ratings yet

- IFRS S2sDocument46 pagesIFRS S2sComunicarSe-ArchivoNo ratings yet

- Financial Accounting 6Th Edition Weygandt Test Bank Full Chapter PDFDocument36 pagesFinancial Accounting 6Th Edition Weygandt Test Bank Full Chapter PDFphyllis.horan125100% (11)

- Why Standardization in Accounting?Document5 pagesWhy Standardization in Accounting?nrpcsNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- DIALOG2014 FinancialDocument141 pagesDIALOG2014 FinancialFarah ismailNo ratings yet

- Financial AnalyticsDocument8 pagesFinancial AnalyticsSanjana Gowda B NNo ratings yet

- Audit Cash Investments TitleDocument7 pagesAudit Cash Investments TitleIulia BurtoiuNo ratings yet

- ACC 312 Semestral OutputDocument11 pagesACC 312 Semestral Outputgelyncastromero25No ratings yet

- IBM Consol Final PDFDocument236 pagesIBM Consol Final PDFsunNo ratings yet

- PROJECT REPORT ON AViva LIFE INSURANCEDocument62 pagesPROJECT REPORT ON AViva LIFE INSURANCEMayank100% (12)

- Haas UG Courses For CPA Licensure 1Document4 pagesHaas UG Courses For CPA Licensure 1asim riazNo ratings yet

- Apuntes ContabilidadDocument206 pagesApuntes ContabilidadclaudiazdeandresNo ratings yet

- Summer Training Report Textile IndustryDocument80 pagesSummer Training Report Textile IndustryDARSHAN RANPARIYANo ratings yet

- MY Bank LTDDocument83 pagesMY Bank LTDAiza RizviNo ratings yet

- Annual Report PDFDocument316 pagesAnnual Report PDFMohammad Tahir KheridNo ratings yet

- AFM 291 Chapter 2 NotesDocument6 pagesAFM 291 Chapter 2 NoteszoeyNo ratings yet

- Modern Institute of Technology & Research Centre Alwar (Raj.)Document21 pagesModern Institute of Technology & Research Centre Alwar (Raj.)Pushpendra KumarNo ratings yet

- Sec-A.T1-100. AnswerDocument83 pagesSec-A.T1-100. AnswermmranaduNo ratings yet

- Chapter 1 Wps OfficeDocument19 pagesChapter 1 Wps OfficeYashas KumarNo ratings yet

- Access The Financial Statements of Deutsche Lufthansa Ag For The PDFDocument1 pageAccess The Financial Statements of Deutsche Lufthansa Ag For The PDFLet's Talk With HassanNo ratings yet

- Consolidated Scale of Fines for CorporationsDocument124 pagesConsolidated Scale of Fines for CorporationsKevin AmpuanNo ratings yet

- TNB Annual Report 2019Document143 pagesTNB Annual Report 2019Muhd Nu'man HNo ratings yet

- Notes For MBA 2Document254 pagesNotes For MBA 2Pramod Vasudev100% (1)

- At Preweek (Part 2) FinalDocument17 pagesAt Preweek (Part 2) FinalJane Michelle EmanNo ratings yet

- Pathfinder NOV 2015 Professional LevelDocument165 pagesPathfinder NOV 2015 Professional LevelALIU HADINo ratings yet

- 2005 Unilever Annual Review and Summary Financial StatementDocument41 pages2005 Unilever Annual Review and Summary Financial StatementAditya ArfanNo ratings yet