Professional Documents

Culture Documents

Departmental Interpretation and Practice Notes No. 4 (Revised)

Uploaded by

Difanny KooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Departmental Interpretation and Practice Notes No. 4 (Revised)

Uploaded by

Difanny KooCopyright:

Available Formats

Inland Revenue Department

The Government of the Hong Kong Special Administrative Region

of the People's Republic of China

DEPARTMENTAL INTERPRETATION AND PRACTICE NOTES

NO. 4 (REVISED)

LEASE PREMIUMS / NON-RETURNABLE DEPOSITS /

KEY OR TEA MONEY / CONSTRUCTION FEES ETC.

These notes are issued for the information of taxpayers and their tax

representatives. They contain the Department’s interpretation and practices in

relation to the law as it stood at the date of publication. Taxpayers are reminded

that their right of objection against the assessment and their right of appeal to the

Commissioner, the Board of Review or the Court are not affected by the

application of these notes.

These notes replace those issued in July 2005.

LAU MAK Yee-ming, Alice

Commissioner of Inland Revenue

February 2006

Our web site : http://www.ird.gov.hk

DEPARTMENTAL INTERPRETATION AND PRACTICE NOTES

NO. 4 (REVISED)

CONTENT

Paragraph

Assessability of Lease Premiums 1

Interaction with Property Tax 7

Examples 8

ASSESSABILITY OF LEASE PREMIUMS

Premiums on leases are frequently referred to as non-returnable

deposits, key or tea money, construction fees, tenancy rights or other terms.

Sometimes, taxpayers or their representatives are inclined to assume that

receipts of lease premiums or of moneys of a similar nature are capital receipts,

and consequently fail to show them separately in their accounts or

computations. Such an assumption should not be made, because these receipts,

by virtue of the nature of the trade or business carried on by the recipient, can

often be, and more frequently are, revenue receipts. Moreover, the fact that

premium under a lease or tenancy agreement is being regarded as capital

expenditure by the payer does not necessarily turn it into a capital receipt in the

hands of the recipient.

2. By the definition of “business” in section 2 of the Inland Revenue

Ordinance (the Ordinance), corporations letting property are carrying on a

business, and so are other persons sub-letting property held by them under a

lease other than from the Government. Persons dealing in property are

carrying on a trade. It is therefore important that all persons carrying on a

property letting or dealing business should give full information concerning

such receipts in their accounts supporting the tax returns filed with the

Department.

3. Taxpayers or their representatives, if they claim the captioned

receipts to be capital receipts, have to ascertain and report the precise facts and

the exact legal relationship between the parties occasioned by any agreement to

receive or pay such items.

4. In a property letting or dealing business, a lease premium is part of a

payment for the use of the property and therefore is an income of a revenue

nature. This view is supported by the Court of Appeal decision in the East

African Tax Case No. 37 - A.L. et al v. The Commissioner of Income Tax

[E.A.T.C. Vol. 2 at page 148] which held that the premiums in that case were

received for the use of a capital asset and not for its realization and that they

were therefore income receipts and taxable.

5. The editors of Halsbury’s Laws of Hong Kong, at paragraph 370.174

of Vol. 24, expressed a similar view –

“Where a person dealing in land may be considered carrying on a

business (and therefore subject to profits tax), the receipt of rent,

lease premiums, construction fees and other miscellaneous sums

arising from dealings with land should also be included as trading

receipts irrespective of the possible capital nature from the viewpoint

of the payee.”

6. Generally accepted accounting practice 1 requires that premium

receipts be spread over the term of the lease for the purpose of recognizing

them as income. If the accounts are prepared on such basis, the premium

receipts will be assessed to profits tax accordingly.

INTERACTION WITH PROPERTY TAX

7. Under section 5B(4) of the Ordinance, a lease premium is deemed

for property tax purposes to be payable in equal monthly instalments during the

period of the right of use of the property subject to a maximum period of 3

years. Accordingly, property tax may be charged on such a basis.

Nevertheless, any property tax so paid is available for set-off against the profits

tax payable by the owner of the property under section 25 of the Ordinance.

Any excess property tax paid will be refunded. Furthermore, where the owner

is a corporation, the exemption from property tax provided under section 5(2)(a)

may also be available.

EXAMPLES

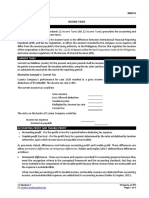

8. The following examples illustrate the operation of paragraphs 6

and 7 above.

Example 1

Company H carries on a property letting business. While retaining

substantially all the risks and rewards incidental to its ownership, it leases one

of its properties for a term of 2 years at a premium of $1,200,000. Assume

that it closes its accounts on 31 March each year.

1

Hong Kong Accounting Standard 17 – Leases, issued by the Hong Kong Institute of Certified Public

Accountants.

According to Hong Kong Accounting Standard 17 (paragraphs 4 and 8), the

lease will be an operating lease and hence the lease premium “shall be

recognised in income on a straight line basis over the lease term” (paragraph

50), i.e. over the 2-year period. Therefore, half of the premium will be

assessed to profits tax in Year 1 and half in Year 2.

Property tax assessments may be issued to Company H. Pursuant to section

5B(4), half of the premium will be charged to property tax in Year 1 and half in

Year 2. Company H is entitled to set off the property taxes paid against its

profits taxes payable on the premium for these 2 years and have the balance

refunded, if any (section 25).

Alternatively, Company H can apply for property tax exemption under section

5(2)(a) of the Ordinance, leaving the premium to be assessed to profits tax.

Example 2

Same scenario as in Example 1 except that the lease is for a term of 6 years.

According to Hong Kong Accounting Standard 17 (paragraph 50), the lease

premium will be recognised in income on a straight line basis over the 6-year

period. Therefore, 1/6 of the premium (or $200,000) will be assessed to

profits tax in each of the years from Year 1 to Year 6.

Property tax assessments may be issued to Company H. Pursuant to section

5B(4), the premium will be deemed to be payable and hence assessed over a

maximum period of 3 years. Hence, 1/3 of the premium (or $400,000) will be

charged to property tax in each of the Years 1, 2 and 3. Company H is entitled

to set off the property taxes paid against its profits taxes payable for these 3

years respectively and have the balance refunded, if any (section 25). No

question of set-off/refund will arise starting from Year 4.

The computation of taxes payable for the 6 years is as follows–

Year 1 (2005-06) Property Tax paid: Profits Tax assessment*:

$400,000 x 80% x 16% $200,000 x 17.5% = $35,000

= $51,200 Less: Property tax paid $51,200

Tax refund ($16,200)

Year 2 (2006-07) Property Tax paid: Profits Tax assessment*:

$400,000 x 80% x 16% $200,000 x 17.5% = $35,000

= $51,200 Less: Property tax paid $51,200

Tax refund ($16,200)

Year 3 (2007-08) Property Tax paid: Profits Tax assessment*:

$400,000 x 80% x 16% $200,000 x 17.5% = $35,000

= $51,200 Less: Property tax paid $51,200

Tax refund ($16,200)

Year 4 (2008-09) Property Tax paid: Profits Tax assessment*:

NIL $200,000 x 17.5% = $35,000

Less: Property tax paid Nil

Tax payable $35,000

Year 5 (2009-10) Property Tax paid: Profits Tax assessment*:

NIL $200,000 x 17.5% = $35,000

Less: Property tax paid Nil

Tax payable $35,000

Year 6 (2010-11) Property Tax paid: Profits Tax assessment*:

NIL $200,000 x 17.5% = $35,000

Less: Property tax paid Nil

Tax payable $35,000

Total tax paid Property Tax paid: $153,600 Net Profits Tax paid: $56,400

Grand Total of $210,000 (or 17.5% on premium, representing the total Profits Tax

Tax Paid: charged)

NB: * Assuming no other income chargeable to profits tax and no expenses claim.

Similarly, Company H can also apply for property tax exemption under section

5(2)(a) of the Ordinance.

You might also like

- Remedies For Breach of ContractDocument6 pagesRemedies For Breach of Contract'Sånjîdå KåBîr'No ratings yet

- Torts and Damages Case DigestDocument40 pagesTorts and Damages Case DigestJean Pango89% (9)

- Buckwold 21e - CH 7 Selected SolutionsDocument41 pagesBuckwold 21e - CH 7 Selected SolutionsLucy100% (1)

- Briefcase On Contract Law - NodrmDocument314 pagesBriefcase On Contract Law - NodrmSarah DarkoNo ratings yet

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Vita vs. MontananoDocument3 pagesVita vs. MontananoRICKY ALEGARBESNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- Obligations and Contracts NotesDocument72 pagesObligations and Contracts NotesShantalle KimNo ratings yet

- 2019 Bar Qs TaxDocument9 pages2019 Bar Qs Taxzealous9carrotNo ratings yet

- Taxation (Income Tax) - Pp41-60Document37 pagesTaxation (Income Tax) - Pp41-60Iya PadernaNo ratings yet

- ESSAY Suggested AnswersDocument5 pagesESSAY Suggested AnswersAe-cha Nae GukNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument11 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Consultancy Agreement For Business (Sample)Document18 pagesConsultancy Agreement For Business (Sample)Faisal RafiqNo ratings yet

- Tax Compre 1 PDFDocument20 pagesTax Compre 1 PDFJaneNo ratings yet

- 15 Withholding TaxDocument14 pages15 Withholding TaxHaRry PeregrinoNo ratings yet

- Topic 5 Deferred TaxDocument45 pagesTopic 5 Deferred TaxFuchoin Reiko100% (1)

- Topic 5 - Final Income TaxationDocument12 pagesTopic 5 - Final Income TaxationNicol Jay Duriguez100% (3)

- RR 13-2000Document4 pagesRR 13-2000doraemoan100% (1)

- 2019 Form Mag FeedDocument9 pages2019 Form Mag FeedJosephine Kawayo100% (1)

- RIT IndividualDocument77 pagesRIT IndividualAngelica Pagaduan100% (1)

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaDocument22 pagesIndian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Ryan RemsDocument56 pagesRyan Remsmimi supasNo ratings yet

- Taxation Mid TermDocument6 pagesTaxation Mid TermMuhammad AlfarrabieNo ratings yet

- Chapter 3 - Deferred TaxDocument61 pagesChapter 3 - Deferred Taxansath193No ratings yet

- ACC708 Lecture 2Document26 pagesACC708 Lecture 2Emjes Giano100% (1)

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income From PropertyDocument8 pagesPrinciples of Taxation M. Khalid Petiwala: Income From PropertyosamaNo ratings yet

- Lesson 1 Tax Administration Tutorial NotesDocument8 pagesLesson 1 Tax Administration Tutorial Notes4mggxj68cyNo ratings yet

- SCS 0975 - Module 1 SMB2018Document13 pagesSCS 0975 - Module 1 SMB2018Deion BalakumarNo ratings yet

- Final Income TaxDocument27 pagesFinal Income TaxKai Son-MyoiNo ratings yet

- Chapter 8 - Income TaxesDocument6 pagesChapter 8 - Income TaxesHaddy GayeNo ratings yet

- Accounting For Income TaxDocument18 pagesAccounting For Income TaxChirag PatelNo ratings yet

- Digested (Income Tax)Document8 pagesDigested (Income Tax)DutchsMoin MohammadNo ratings yet

- Module 11 - Fringe Benefit TaxDocument18 pagesModule 11 - Fringe Benefit TaxJANELLE NUEZNo ratings yet

- I. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Document8 pagesI. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Scribd Government DocsNo ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- 11 Handout 1Document4 pages11 Handout 1Jeffer Jay GubalaneNo ratings yet

- 05 Handout 1 PDFDocument5 pages05 Handout 1 PDFjhomar benavidezNo ratings yet

- Determination of Income Tax Due and Payable If There Is A Given Creditable Withholding TaxDocument12 pagesDetermination of Income Tax Due and Payable If There Is A Given Creditable Withholding Taxgellie mare flores100% (1)

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Corporate Taxpayer Source of Income Tax Base Tax Rate Effectivity DateDocument6 pagesCorporate Taxpayer Source of Income Tax Base Tax Rate Effectivity DateZaaavnn VannnnnNo ratings yet

- Q-2. IFRS 16 Compared To IAS-17Document4 pagesQ-2. IFRS 16 Compared To IAS-17shohag mahmudNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- T 4 - Co-Ownership Estate TrustDocument21 pagesT 4 - Co-Ownership Estate TrustKristine Aubrey AlvarezNo ratings yet

- Held. The Supreme Court of The United States Affirmed The Lower Court and Holding That The Taxes Paid Were Income To Wood - TheDocument3 pagesHeld. The Supreme Court of The United States Affirmed The Lower Court and Holding That The Taxes Paid Were Income To Wood - TheDudzLajaratoNo ratings yet

- Income Taxation 1: Holding PeriodDocument4 pagesIncome Taxation 1: Holding PeriodKarl John Jay ValderamaNo ratings yet

- Maximizing Returns - Exploring Property Income Taxation For ACCA UK-TX FA2021Document5 pagesMaximizing Returns - Exploring Property Income Taxation For ACCA UK-TX FA2021Gaziyah BenthamNo ratings yet

- Rental - English 2022-23Document4 pagesRental - English 2022-23Crispus SaviaNo ratings yet

- IAS 12 Income Taxes (2021)Document18 pagesIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertNo ratings yet

- HI5020: Corporate Accounting Lecture 6cDocument22 pagesHI5020: Corporate Accounting Lecture 6cFeku RamNo ratings yet

- Accounting Standards For Deferred TaxDocument17 pagesAccounting Standards For Deferred TaxRishi AgnihotriNo ratings yet

- 06 Actvity 1 1Document4 pages06 Actvity 1 14mpspxd5msNo ratings yet

- Chapter 4 v4Document18 pagesChapter 4 v4Sheilamae Sernadilla GregorioNo ratings yet

- 2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFDocument18 pages2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFtendaicrosby100% (1)

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document14 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaNo ratings yet

- ACCT320 CHP 19 Part 1Document60 pagesACCT320 CHP 19 Part 1Huzaifa AhmedNo ratings yet

- TA U2 Property1 PDFDocument5 pagesTA U2 Property1 PDFRafaelKwongNo ratings yet

- Withholding Tax: Bar Examination Questions and Answers in TaxationDocument14 pagesWithholding Tax: Bar Examination Questions and Answers in TaxationSophia OñateNo ratings yet

- Colombia Tax ReformDocument6 pagesColombia Tax ReformshadiafeNo ratings yet

- DT RTP NovDocument52 pagesDT RTP NovKeshav KhandelwalNo ratings yet

- Buckwold12e Solutions Ch07Document41 pagesBuckwold12e Solutions Ch07awerweasd100% (1)

- Session 11 Income TaxesDocument13 pagesSession 11 Income TaxesNhânNo ratings yet

- Bustax 4Document117 pagesBustax 4Frances AgustinNo ratings yet

- Chamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryDocument10 pagesChamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryLemUyNo ratings yet

- Departmental Interpretation and Practice Notes No. 33 (Revised)Document21 pagesDepartmental Interpretation and Practice Notes No. 33 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 34 (Revised)Document14 pagesDepartmental Interpretation and Practice Notes No. 34 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes NO. 32 (Revised)Document51 pagesDepartmental Interpretation and Practice Notes NO. 32 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 28 (Revised)Document5 pagesDepartmental Interpretation and Practice Notes No. 28 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 30 (Revised)Document13 pagesDepartmental Interpretation and Practice Notes No. 30 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes NO. 29Document7 pagesDepartmental Interpretation and Practice Notes NO. 29Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 31 (Revised) Advance RulingsDocument44 pagesDepartmental Interpretation and Practice Notes No. 31 (Revised) Advance RulingsDifanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 25 (Revised)Document34 pagesDepartmental Interpretation and Practice Notes No. 25 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice NotesDocument19 pagesDepartmental Interpretation and Practice NotesDifanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 27 (Revised)Document15 pagesDepartmental Interpretation and Practice Notes No. 27 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 24 (Revised)Document17 pagesDepartmental Interpretation and Practice Notes No. 24 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 20 (Revised)Document11 pagesDepartmental Interpretation and Practice Notes No. 20 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 26 (Revised)Document5 pagesDepartmental Interpretation and Practice Notes No. 26 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice NotesDocument41 pagesDepartmental Interpretation and Practice NotesDifanny KooNo ratings yet

- Departmental Interpretation and Practice Notes NO. 13ADocument25 pagesDepartmental Interpretation and Practice Notes NO. 13ADifanny KooNo ratings yet

- Departmental Interpretation and Practice NotesDocument14 pagesDepartmental Interpretation and Practice NotesDifanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 6 (Revised)Document23 pagesDepartmental Interpretation and Practice Notes No. 6 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 14 (Revised)Document16 pagesDepartmental Interpretation and Practice Notes No. 14 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 11 (Revised)Document46 pagesDepartmental Interpretation and Practice Notes No. 11 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 17 (Revised)Document8 pagesDepartmental Interpretation and Practice Notes No. 17 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 20 (Revised)Document11 pagesDepartmental Interpretation and Practice Notes No. 20 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 21 (Revised)Document33 pagesDepartmental Interpretation and Practice Notes No. 21 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes NO. 19Document10 pagesDepartmental Interpretation and Practice Notes NO. 19Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes NO. 15 (REVISED)Document39 pagesDepartmental Interpretation and Practice Notes NO. 15 (REVISED)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 16 (Revised)Document12 pagesDepartmental Interpretation and Practice Notes No. 16 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 18 (Revised)Document29 pagesDepartmental Interpretation and Practice Notes No. 18 (Revised)Difanny KooNo ratings yet

- Departmental Interpretation and Practice Notes No. 13 (Revised)Document7 pagesDepartmental Interpretation and Practice Notes No. 13 (Revised)Difanny KooNo ratings yet

- Company Law Module 2Document37 pagesCompany Law Module 2SAMRIDHINo ratings yet

- NDB 15usd 1Document6 pagesNDB 15usd 1Jon SeoNo ratings yet

- What Is Sectional CompletionDocument3 pagesWhat Is Sectional CompletionWork OfficeNo ratings yet

- Refrigerator FAQs1Document1 pageRefrigerator FAQs1Kamaldeep NainwalNo ratings yet

- Conveyancing Summary Notes - NB Print 1Document43 pagesConveyancing Summary Notes - NB Print 1Phatheka MgingqizanaNo ratings yet

- Based From The Syllabus of Atty. Jazzie M. Sarona-LozareDocument1 pageBased From The Syllabus of Atty. Jazzie M. Sarona-LozareShivaNo ratings yet

- 76 CIR v. CA, 267 SCRA 576Document2 pages76 CIR v. CA, 267 SCRA 576Raymond MedinaNo ratings yet

- NBFC Compliance and Return - Taxguru - inDocument7 pagesNBFC Compliance and Return - Taxguru - incaaashishupadhyay9579No ratings yet

- Bus Pass FormDocument4 pagesBus Pass Formshivchaudhary20954No ratings yet

- CHAPTER 4 Limited PartnershipDocument8 pagesCHAPTER 4 Limited Partnershipjacelshyene.payotNo ratings yet

- Addendum For Property in A Propane Gas System Service Area (TREC No. 47-0)Document1 pageAddendum For Property in A Propane Gas System Service Area (TREC No. 47-0)Matt SimonNo ratings yet

- 12 CFR 1002.6Document2 pages12 CFR 1002.6Ma NuNo ratings yet

- Legal NoticeDocument2 pagesLegal Noticeadityawategaonkar632No ratings yet

- Memorandum of Agreement: Pro Se Plaintiffs in Cases: 1) Case 19-cv-03289, Plaintiffs Motion ForDocument3 pagesMemorandum of Agreement: Pro Se Plaintiffs in Cases: 1) Case 19-cv-03289, Plaintiffs Motion ForConney CerdenaNo ratings yet

- Donation Agreement - TemplateDocument1 pageDonation Agreement - TemplateBogdan NitulescuNo ratings yet

- Bailment and ContractDocument11 pagesBailment and ContractManju NadgerNo ratings yet

- Obli EditedDocument147 pagesObli EditedMary Ann MasangcayNo ratings yet

- Annex J: Sanggunian Resolution Approving AccreditationDocument2 pagesAnnex J: Sanggunian Resolution Approving AccreditationDILG Labrador Municipal OfficeNo ratings yet

- TESTATE ESTATE OF THE LATE ALIPIO ABADA VS. ABAJA G.R. NO. 147145.digestDocument2 pagesTESTATE ESTATE OF THE LATE ALIPIO ABADA VS. ABAJA G.R. NO. 147145.digestJaynos FlojoNo ratings yet

- Housing Allowance GuidelinesDocument4 pagesHousing Allowance GuidelinesAshutosh kotnalaNo ratings yet

- Haryana Cinemas (Regulation) Act, 1952Document7 pagesHaryana Cinemas (Regulation) Act, 1952Vivek GeraNo ratings yet