Professional Documents

Culture Documents

AEC 5211 Practical 1 Balance Sheet

Uploaded by

NIDHIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AEC 5211 Practical 1 Balance Sheet

Uploaded by

NIDHICopyright:

Available Formats

(Write down this in your practical record)

Exercise No-01: To study the Balance Sheet and its test ratio.

The balance sheet is also known as Net worth Statement is a summary of the assets and liabilities,

together with a statement of the owner’s equity at a particular point of time. The owner’s equity is

also commonly referred to as the net worth of the business.

The balance sheet has two characteristics (1) It always refers to a specific date or point of time and

(2) It consist of three aspects namely

(a)The assets or the value of things owned.

(b) The liabilities or amount owed.

(c) The difference between these two which is the owner’s equity or deficit.

Importance of Balance sheet

The balance sheet shows the fundamental soundness of a business. Thus, risk bearing ability is

reflected directly by the balance sheet. Balance sheet is required by a lender or lender’s agent as a

part of every loan application to assess the financial condition of a borrower. Balance sheet may also

be used by the farmers in record keeping and in making income tax reports, if any, and it may also

be used by lenders in interviewing the prospective tenants. Projected balance sheet can be of use in

analyzing rate of growth of a firm and its soundness over time.

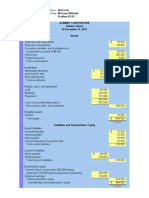

Balance Sheet

Assets Amount (Rs) Liabilities Amount (Rs)

Current Assest Current Liabilities

Cash on hand 10,000 Crop loans to be repaid 8,000

to institutional

agencies

Saving in bank 8,000

Value of grains ready 38,500 Cost of cultivation 6,000

for disposal (excluding loans)

Livestock products 60,000 Other loans 5,000

(eggs,birds, etc.) (unsecured loans due

for immediate

repayment)

Fruits, Vegetable, 8,000 Cost of maintenance of 3,600

fodder and feed ready cattle

for sale

Cost of poultry 25,000

enterprise

Value of bonds and 2,000 Annual instalments 19,000

shares to be realized in

the same year

Sub-total 1,26,500 Sub-total 66,600

Intermediate assets Intermediate liabilities

Dairy cattle 10,000 Livestock loans 8,000

Bullocks 9,000 Machinery loan 15,000

Poultry birds 15,000 Unsecured loans 10,000

Machinery and 15,000

equipment

Tractor 1,75,000

Sub-total 2,24,000 Sub-total 33,000

Long term assets Long term liabilities

Land (book value ) 6,00,000 Tractor loan 1,20,000

Farm buildings 25,000 Orchard loan 25,000

Unsecured loan 10,000

Sub total 6,25,000 Sub-total 1,55,000

Total assets 9,75,500 Total liabilities 2,54,600

Net worth or equity 7,20,900

Gross assets 9,75,500 Gross liabilities 9,75,500

(Calculate the test ratio in practical copy except no 04)

Test Ratio

1.

2.

3.

4.

( )

5.

6. ( )

7.

You might also like

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Problem Based On Ratio Analysis - Part - 2Document1 pageProblem Based On Ratio Analysis - Part - 2Mohd shariqNo ratings yet

- Farm Model of Dairy Unit of 20 Crossbred CowsDocument3 pagesFarm Model of Dairy Unit of 20 Crossbred CowsBhargav KumarNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Common Size/Vertical Analysis: Lecture No. 9Document4 pagesCommon Size/Vertical Analysis: Lecture No. 9naziaNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Fa - 6 Amalgamation & LLPDocument10 pagesFa - 6 Amalgamation & LLPalokchowdhury111No ratings yet

- Financial DataDocument23 pagesFinancial DataGyanendra jhaNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Corporate Acc 6.2.22Document3 pagesCorporate Acc 6.2.22VANSHAJ SHAHNo ratings yet

- Farm Model of Dairy Unit of 20 Crossbred CowsDocument3 pagesFarm Model of Dairy Unit of 20 Crossbred Cowsbosco100% (1)

- Book Value Assets Total Unsecured Realizable ValueDocument9 pagesBook Value Assets Total Unsecured Realizable ValueJPNo ratings yet

- Pas 1, Pas 2, Pas 7Document29 pagesPas 1, Pas 2, Pas 7MPCINo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Financial Accounting QPDocument3 pagesFinancial Accounting QPmallikarjunbpatilNo ratings yet

- Farm Model Project of Dairy Unit of 10 Buffaloes: OwnerDocument4 pagesFarm Model Project of Dairy Unit of 10 Buffaloes: OwnerumashankarsinghNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- Assets Book Value Estimated Realizable ValuesDocument3 pagesAssets Book Value Estimated Realizable ValuesEllyza SerranoNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisRONALD SSEKYANZINo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- DPR 5 MA Prpared by LUVASDocument5 pagesDPR 5 MA Prpared by LUVASRavi TomarNo ratings yet

- Accounting MTP Question Series I 1676966561047406Document9 pagesAccounting MTP Question Series I 1676966561047406Tushar MittalNo ratings yet

- Vertical Financial StatementsDocument3 pagesVertical Financial StatementsMANAN MEHTANo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- Conversion or Sale of Partnership Firm Into Limited CompanyDocument24 pagesConversion or Sale of Partnership Firm Into Limited CompanyMadhav TailorNo ratings yet

- 2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80Document4 pages2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80tanmoy sardarNo ratings yet

- Goat-Sheep 101 Hills SC-STDocument5 pagesGoat-Sheep 101 Hills SC-STarvind kadamNo ratings yet

- Ia Vol 3 Valix 2019 Solman 2 PDF FreeDocument105 pagesIa Vol 3 Valix 2019 Solman 2 PDF FreeLJNo ratings yet

- Assignment 5Document1 pageAssignment 5Siva SankariNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Farm Model of Dairy Unit of 10 Crossbred CowsDocument3 pagesFarm Model of Dairy Unit of 10 Crossbred CowsKarthik RamakrishnanNo ratings yet

- PDF RemoverDocument6 pagesPDF RemoversurajNo ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Account Summary: 1-800-427-2200 EnglishDocument2 pagesAccount Summary: 1-800-427-2200 Englishytprem aguNo ratings yet

- EastWest Bank - Credit Cards - (EastWestBankerDocument4 pagesEastWest Bank - Credit Cards - (EastWestBankerLemuel Chin Cantos100% (1)

- Acctg 106 Practice DrillDocument2 pagesAcctg 106 Practice DrillMjhayeNo ratings yet

- Separate Financial Statements: International Accounting Standard 27Document5 pagesSeparate Financial Statements: International Accounting Standard 27Maruf HossainNo ratings yet

- Imran Ul Haq ACMA CGMA MBADocument2 pagesImran Ul Haq ACMA CGMA MBASheza FarooqNo ratings yet

- Question Cpa-00102: Becker Professional Education Registered To: Dominique DantonioDocument111 pagesQuestion Cpa-00102: Becker Professional Education Registered To: Dominique DantonioNhel Alvaro100% (1)

- Dwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFDocument36 pagesDwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFpetrorichelle501100% (15)

- June 15, 2009 - Morning CallDocument3 pagesJune 15, 2009 - Morning Callkkeenan5008475No ratings yet

- Name: Instructor: Accounting Principles Primer On Using Excel in AccountingDocument14 pagesName: Instructor: Accounting Principles Primer On Using Excel in Accountingranim m7mdNo ratings yet

- Chapter 17 - Control AccountsDocument17 pagesChapter 17 - Control Accountsshemida75% (4)

- Bbob Current AffairsDocument28 pagesBbob Current AffairsGangwar AnkitNo ratings yet

- Imports With Letter of Credit in SAP ERPDocument8 pagesImports With Letter of Credit in SAP ERPMohamed QamarNo ratings yet

- Balance StatementDocument5 pagesBalance Statementmichael anthonyNo ratings yet

- SBI Interest Rates - Oct 2010Document2 pagesSBI Interest Rates - Oct 2010Bharani SomasundaraNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- Titan Company Ltd. (India) : SourceDocument6 pagesTitan Company Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Digital Banking & Sales Distribution: Program Kerja 2021Document8 pagesDigital Banking & Sales Distribution: Program Kerja 2021Muhammad Nur Alim Labalo100% (1)

- The Accounting CycleDocument17 pagesThe Accounting Cycleyuvita prasadNo ratings yet

- HDHC Health Insurance PDFDocument5 pagesHDHC Health Insurance PDFNAYAN MEHTA0% (1)

- Exchange Rates Annual Central Bank of Trinidad and TobagoDocument5 pagesExchange Rates Annual Central Bank of Trinidad and TobagoFayeed Ali RassulNo ratings yet

- SOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021Document4 pagesSOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021shreeji metalNo ratings yet

- Medium Sources of Financing: Prepared by Niki Lukviarman (Derived From Various Sources)Document26 pagesMedium Sources of Financing: Prepared by Niki Lukviarman (Derived From Various Sources)Giffari Ibnu ToriqNo ratings yet

- AUD339 (NOTES CP2) - Companies Act 2016Document11 pagesAUD339 (NOTES CP2) - Companies Act 2016pinocchiooNo ratings yet

- 022 1.1.3 B.com BC404 2018-19Document1 page022 1.1.3 B.com BC404 2018-19AankuNo ratings yet

- 2021 M2IAEF Audit Compliance MaterialsDocument53 pages2021 M2IAEF Audit Compliance MaterialsLamis ShalabiNo ratings yet

- Ordinary New - Accounting Paper 1 6143-1 First Proof 13.04.2021Document20 pagesOrdinary New - Accounting Paper 1 6143-1 First Proof 13.04.2021Pantuan SizweNo ratings yet

- Chapter 4 Time Value of MoneyDocument21 pagesChapter 4 Time Value of MoneyLeakhena AnNo ratings yet

- Chapter 20 - AnswerDocument12 pagesChapter 20 - Answerwynellamae100% (3)

- Study of Mutual Funds in IndiaDocument41 pagesStudy of Mutual Funds in IndiaUnnati GuptaNo ratings yet

- Notes On The Overview of Money Market SecuritiesDocument2 pagesNotes On The Overview of Money Market SecuritiesjeanneNo ratings yet