Professional Documents

Culture Documents

Fdi

Uploaded by

Priyanka Agrawal0 ratings0% found this document useful (0 votes)

16 views51 pagesFDI was allowed selectively up to 40% under the 1991 FERA. BJP coalition government was perceived as opposed to FDI, but continued with economic reforms. Many ne w sectors opened to FD I; viz., insurance (26%), integrated townships (100%), mas s rapid transit systems (100%), defence industry (26%), tea plantations (100%), print media (26%).

Original Description:

Original Title

16652685-FDI

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFDI was allowed selectively up to 40% under the 1991 FERA. BJP coalition government was perceived as opposed to FDI, but continued with economic reforms. Many ne w sectors opened to FD I; viz., insurance (26%), integrated townships (100%), mas s rapid transit systems (100%), defence industry (26%), tea plantations (100%), print media (26%).

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views51 pagesFdi

Uploaded by

Priyanka AgrawalFDI was allowed selectively up to 40% under the 1991 FERA. BJP coalition government was perceived as opposed to FDI, but continued with economic reforms. Many ne w sectors opened to FD I; viz., insurance (26%), integrated townships (100%), mas s rapid transit systems (100%), defence industry (26%), tea plantations (100%), print media (26%).

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 51

Foreign Direct Investment in India

Phases of Indian Economy 1947-1980

• Command and Control Economy

– Allocation of resources by the Government (budgetary grants) – Government took act

ive part in setting priorities for the economy – Self-Reliance was the buzz word – N

ationalisation of Banks – Limited scope for private participation

Luthra & Luthra Law Offices 2

Phases of Indian Economy 1991-2000

• Liberalization and Globalization of Indian Economy

– Increased emphasis on private sector participation – Limited extent of FDI partici

pation – Gradual improvement in the enabling environment

Luthra & Luthra Law Offices

3

Phases of Indian Economy post 2000

• Political Coalitions have started providing stable governments • Government to get

out of owning and managing businesses: Disinvestment Policy • Gradual relaxation

in the FDI Policy

Luthra & Luthra Law Offices

4

Progressive Liberalisation

Pre-1991 1991 FDI was allowed selectively up to 40% under FERA This period was d

ominated by the Congress party 35 high priority industry groups were placed on t

he Automatic Route for FDI up to 51% Minority Congress government: Initiated eco

nomic reforms in a big way Automatic Route expanded to 111 high priority industr

y groups up to 100%/ 74%/ 51%/50% United Front Government: Inclusive of ‘left part

ies’, was perceived as traditionally opposed to FDI, but continued with the reform

s. All sectors placed on the Automatic Route for FDI except for a small negative

list BJP coalition government:(coalition of Left and Right wing parties) was tr

aditionally seen as opposed to FDI, but continued with economic reforms. Many ne

w sectors opened to FDI; viz., insurance (26%), integrated townships (100%), mas

s rapid transit systems (100%), defence industry (26%), tea plantations (100%),

print media (26%). Sectoral caps in many other sectors relaxed; BJP coalition go

vernment: pursued reforms vigorously and initiated second generation reforms. Lu

thra & Luthra Law Offices 5

1997

2000

Post 2000

Consensus on Economic Liberalisation

• Change in perception

– Indian Business Houses – Government – Legal Framework: shift from a Positive List to

a Negative List (FERA FEMA)

• Gradually all sectors moving to ‘Choice’ and ‘Competition’ (Multiple Player Model)

Luthra & Luthra Law Offices

6

Current economic situation in india

Present Picture

• India: Fourth largest economy in terms of Purchasing Power Parity • Tenth most ind

ustrialized economy • GDP growth rate of 8.1% - Second highest in the world. • Consi

derable improvement in FDI inflows • FII inflows:

– For the period, July 2003 – Jan 2004 FII inflow has exceeded USD 7 bn, which is mo

re than the cumulative FII inflow in the last five years.

• Still a big gap between India and China

Luthra & Luthra Law Offices 7

Foreign Direct Investment

Foreign direct investment (FDI) is defined as "investment made to acquire lastin

g interest in enterprises operating in the host economy of the investor.“ The FDI

relationship, consists of a parent enterprise and a foreign affiliate which toge

ther form a transnational corporation (TNC). In order to qualify as FDI the inve

stment must afford the parent enterprise control over its foreign affiliate. The

UN defines control in this case as owning 10% or more of the ordinary shares or

voting power of an incorporated firm or its equivalent for an unincorporated fi

rm; lower ownership shares are known as portfolio investment.

Luthra & Luthra Law Offices 8

Foreign Direct Investment

The IMF definition of FDI includes as many as twelve different elements, namely:

equity capital, reinvested earnings of foreign companies, inter-company debt tr

ansactions, short-term and long-term loans, financial leasing, trade credits, gr

ants, bonds, non-cash acquisition of equity, investment made by foreign venture

capital investors, earnings data of indirectly held FDI enterprises and control

premium, non-competition fee, and so on.

Luthra & Luthra Law Offices 9

Foreign Direct Investment

FDI definition in India is restricted mainly to hard cash unlike other countries

which include noncash such as technology and machinery in the FDI flows. It als

o excludes; -reinvested earnings -subordinated debt -overseas commercial borrowi

ngs which are included in other country statistics.

Luthra & Luthra Law Offices 10

Entry Process & Entry Strategies

Luthra & Luthra Law Offices

11

The Industrial Policy

Industrial Licensing

• All Industrial undertakings exempt from obtaining an industrial license to manuf

acture, except for:

– Industries reserved for the Public Sector – Industries retained under compulsory l

icensing – Items of manufacture reserved for the Small Scale Sector – If the proposa

l attracts locational restriction

• Industrial Entrepreneur Memorandum

Luthra & Luthra Law Offices 12

The Industrial Policy

• Industries reserved for the Public Sector: (1) Atomic Energy and (2) Railway Tra

nsport • Compulsory licensing needed in the following industries:

– – – – Distillation and brewing of alcoholic drinks Cigars and cigarettes and manufactu

red tobacco substitutes Electronic aerospace and defence equipment of all types

Industrial explosives including detonating fuses, safety fuses, gun powder, nitr

ocellulose and matches – Certain hazardous chemicals

Luthra & Luthra Law Offices 13

The Industrial Policy

Locational Policy

• Industrial undertakings are free to select the location • Location to be 25 km awa

y from any city with a million strong population – Exceptions:

• When located in an area designated as an “Industrial Area” before the 25th July, 199

1. • Electronics, Computer Software and Printing (and any other industry which may

be notified in future as ‘non polluting industry’).

Luthra & Luthra Law Offices 14

The Industrial Policy

Small Scale Industries

• Suitable for Foreign Investment?

– Cap on Investment in fixed assets (plant and machinery) is Rs. 10 million (appro

x. SGD 3,70,000)

– Not more than 24 per cent of total equity can be held by any industrial undertak

ing either foreign or domestic – Upon such equity exceeding 24% the SSI status is

lost. Carry-on-Business (COB) Licence required.

• Various items reserved exclusively for SSIs.

Luthra & Luthra Law Offices

15

.

The Entry Process

Investing in India

Automatic Route

General rule •Inform RBI within 30 days of inflow/issue of shares • Pricing: FEMA Re

gulations •Unlisted – CCI (Comp Comm of India) •Listed – SEBI • Cap of Rs. 600 Crore

Prior Permission

By exception Approval of Foreign Investment Promotion Board needed. Decision gen

erally within 4-6 weeks

Luthra & Luthra Law Offices

16

The Entry Process: Automatic Route

• All items/activities for FDI investment up to 100% fall under the Automatic Rout

e except the following:

– All proposals that require an Industrial Licence. – All proposals in which the for

eign collaborator has a previous venture/ tie up in India. – All proposals relatin

g to acquisition of existing shares in an existing Indian Company by a foreign i

nvestor. – All proposals falling outside notified sectoral policy/ caps or under s

ectors in which FDI is not permitted.

Luthra & Luthra Law Offices

17

The Entry Process: Government Approval

Foreign Investment Promotion Board (FIPB) Approval

• For all activities, which are not covered under the Automatic Route • Composite ap

provals involving foreign investment/ foreign technical collaboration • Published

Transparent Guidelines vs. Earlier Case by Case Approach • Downstream Investment

Luthra & Luthra Law Offices 18

Acquisition of shares in a Listed Company

Takeover Code

• Acquisition of more than specified equity stakes would entail public offer • Prici

ng: Average of 26 weeks or 2 weeks, whichever is higher • No takeover of managemen

t before completion of Takeover Code formalities

Luthra & Luthra Law Offices

19

Foreign Technology Collaboration

• Foreign technology collaborations are permitted either through the automatic rou

te or by the Government.

Policy for Automatic Approval

• To all industries for foreign technology collaboration agreements, irrespective

of the extent of foreign equity in the shareholding, subject to:

– The lump sum payments not exceeding US $ 2 Million;

Luthra & Luthra Law Offices

20

Foreign Technology Collaboration

Policy for Automatic approval (contd.)

– Royalty payable being limited to 5 per cent for domestic sales and 8 per cent fo

r exports, subject to a total payment of 8 per cent on sales – No restriction on t

he duration of the royalty payments – The aforesaid royalty limits are net of taxe

s and are calculated according to standard conditions.

Luthra & Luthra Law Offices 21

Foreign Technology Collaboration

Policy for Automatic approval (contd.)

– Payment of royalty up to 2% for exports and 1% for domestic sales is allowed und

er automatic route on use of trademarks and brand name of the foreign collaborat

or without technology transfer. – Registration of FC Agreement with RBI.

Luthra & Luthra Law Offices

22

The Entry Strategy

• Forms in which Business can be conducted in India

• • • • Wholly owned subsidiary Joint Venture Company Branch Office Project Office

• India Presence: Liaison Office

Luthra & Luthra Law Offices 23

Exit Issues

• Transfer of shares from non-resident to non-resident does not require RBI approv

al for pricing • Transfer of shares from non-resident to resident does not require

any FIPB Approval, though RBI approval is required for pricing

– Pricing as per FEMA – listed and unlisted securities – RBI permission not required i

f sale through Stock Exchange

• Mauritius Route: Capital Gain Advantage

Luthra & Luthra Law Offices

24

Legal Structures facilitating FDI

Luthra & Luthra Law Offices

25

Facilitating FDI in India

Emergence of Independent Regulators: Electricity, Telecom, Insurance, Capital Ma

rket and Competition Law

• Ensuring level playing field vis-à-vis Government Corporations and inter se privat

e players • Expertise in the subject matter involved • Expeditious resolution of dis

pute

Luthra & Luthra Law Offices 26

Facilitating FDI in India

Emergence of Independent Regulators (Contd.) • Regulators under consideration: Pet

roleum, Railways, Information and Broadcasting • Regulator to curb Anti-Competitiv

e Practices • Government Directives

Luthra & Luthra Law Offices

27

Facilitating FDI in India

Labour laws – a more contractual approach.

• Move towards: hire and fire

• Progressive use of discretionary executive powers

– – – – Permissions granted for closure of unviable units Inspections only upon workers’ g

rievances Voluntary Retirement Schemes EPZs, SEZs etc may be exempted from appli

cation of certain labour laws – Amendment to Industrial Disputes Act under conside

ration – Amendment to Contract Labour (Regulation & Abolition) Act, 1970 under con

sideration.

Luthra & Luthra Law Offices

28

Investment Incentives

Luthra & Luthra Law Offices

29

Incentives for investment in Telecom Sector

Permission for Inter-Circle & Intra-Circle Mergers • Exemplary growth in teledensi

ty, subscriber base etc. • Companies commencing operations before 31st March, 2004

, would enjoy tax benefits:

– 100% deduction for first five years – 30% deduction for next five years

• Exemption from tax on interest income and long term capital gains in certain cas

es • Import duty rates have been reduced for various telecom equipment

Luthra & Luthra Law Offices 30

Investment Incentive for IT Industry

• Software companies have a ten year tax holiday on their export income • In 1998 th

e Government set up a new Ministry of Information Technology • The Information Tec

hnology Act, 2000 was passed to tackle cyber crimes and facilitate ecommerce

Luthra & Luthra Law Offices 31

Incentives for Investment in Power Sector

• New Legal Regime: Electricity Act, 2003 • The Act provides for: Multiple Buyer Mod

el, Independent Regulatory Body, Open Access, Power Trading as an independent bu

siness, delicensing of generation • 100% FDI Automatic Route in:

– Hydro-electric power plants; – Coal/lignite based thermal power plants; – Oil/gas ba

sed thermal power plants.

Luthra & Luthra Law Offices 32

Incentives for Investment in Power Sector

• Other investment incentives:

– New Power Projects eligible for 100% tax holiday in any block of ten years, with

in first fifteen years of operation. – The Deadline for income tax exemption for n

ew power projects extended from 2006 to 2012. – Various indirect tax incentives:

• Concessional rate of import duties • Special project import scheme • Deemed export b

enefit for certain categories of power projects.

Luthra & Luthra Law Offices 33

Reforms in Financial Sector

• FIIs allowed in Capital Market, can invest both in Debt and Equity • FDI cap in pr

ivate sector banks raised to 74%

– 10% cap on voting rights

• The Mutual Fund market is also open now to foreign players. • Equity issue pricing

is market determined

Luthra & Luthra Law Offices 34

FDI in Real Estate: Policy & Issues

• Press Note 4 (2002 Series)

– 100% FDI under Automatic Route PERMITTED FOR Integrated Townships, subject to fo

llowing conditions:

• Foreign company to be registered as Indian company under Companies Act, 1956 • Cor

e Business - Integrated Township Development with a successful track record. • Min

imum area of development: 100 acres as per local bylaws/rules. In absence of suc

h by laws/rules, minimum of 2000 dwelling houses for about 10,000 population to

be developed by the investor.

• Conditions post acceptance of FDI proposal

• • • •

Minimum capitalization norms Upfront payment Minimum lock-in period Time bound c

ompletion of project

Luthra & Luthra Law Offices

35

FDI in Hotel and Tourism:Policy and Issues

• 100% FDI under Automatic Route • “Hotel” includes Restaurant, beach resorts and other

tourist complexes providing accommodation and/or Catering • “Tourism related industr

ies” includes travel agencies, tour operating agencies, units providing facilities

for cultural, adventure and wild life experience to tourists; surface, air and

water transport facilities to tourists; leisure, entertainment, amusement, sport

s and health units for tourists and Convention/ Seminar units and organizations.

• Automatic approval for Technical, Consultancy, Marketing, Publicity, Managerial

services subject to specified limits.

Luthra & Luthra Law Offices 36

Conclusion

• Economics occupies centre stage in various elections • Rising expectations; rising

prosperity • Legal regime: more stable and predictable • Bureaucracy: changing with

the times • The Future beckons

Luthra & Luthra Law Offices

37

FDI IN INDIA: FACTS AND FIGURES

Luthra & Luthra Law Offices

38

FDI IN INDIA: FACTS AND FIGURES

Luthra & Luthra Law Offices

39

FDI IN INDIA: FACTS AND FIGURES

Luthra & Luthra Law Offices

40

LOCATIONAL DETERMINANTS OF FDI

A firm becomes multinational mainly for three reasons. -Ownership advantages, -L

ocation-specific advantages -Internalization. Large market size, proximity to ho

me market, lowcost labor and favorable tax treatment in the host country are all

considered as location advantages

Luthra & Luthra Law Offices 41

LOCATIONAL DETERMINANTS OF FDI

Location-specific advantages are further classified by three types of motives of

FDI. First, market-seeking investment is undertaken to sustain existing markets

or to exploit new markets. For example, due to tariffs and other forms of barri

ers, the firm has to relocate production to the host country where it had previo

usly served by exporting

Luthra & Luthra Law Offices 42

LOCATIONAL DETERMINANTS OF FDI

Second, when firms invest abroad to acquire resources not available in the home

country, the investment is called resource- or asset-seeking. Resources may be n

atural resources, raw materials, or low-cost inputs such as labor.

Luthra & Luthra Law Offices

43

LOCATIONAL DETERMINANTS OF FDI

Third, the investment is rationalized or efficiencyseeking when the firm can gai

n from the common governance of geographically dispersed activities in the prese

nce of economies of scale and scope.

Luthra & Luthra Law Offices

44

The Model

FDI = f (MS, OE/FT, I, DMA, EE, IE) • • • • • • • Where FDI = Foreign direct Investment, MS

Size of domestic market, OE/FT = openness of the economy to foreign trade, I = I

nfrastructure of the host country, DMA = Domestic market Attractiveness, EE = Ex

ternal economic stability, IE = Internal economic stability.

Luthra & Luthra Law Offices 45

The Model

The economic theory suggests that a positive relationship between FDI and size o

f domestic market, openness of the economy to foreign trade, and infrastructure

of the country. While a negative relationship between FDI and External economic

stability, internal economic stability. The larger the market size, the more dem

and for the products or services to be provided by the FDI.

Luthra & Luthra Law Offices 46

Share of Five Top States Attracting FDI Approvals (January 1991 to March 2004)

No. of FDI Approvals Amount of FDI US $ in Bill ion % FDI Approv al

Rank

Name of the State

Total

Technical

Financial

Rs. In Crores

1 2 3 4 5

Maharashtra Delhi Tamil Nadu Karnataka Gujarat

4,816 2,638 2,607 2,467 1,204

1,308 304 613 494 556

3,508 2,334 1,994 1,973 648

51,114.68 13.18 17.48 35,250.74 9.78 25,071.77 6.52 24,138.44 6.15 18,837.30 4.8

1 12.06 8.58 8.26 6.44

47

Source: Economic Survey-2003-04

Luthra & Luthra Law Offices

LOCATIONAL DETERMINANTS OF FDI

Four states namely Karnataka, Maharashtra, Tamilnadu and Gujarat accounted for o

ver one-third of total FDI approvals. The shares of these individual states were

, respectively, 7.6%, 13.7%, 6.7% and 5.3%. The shares of other major states wer

e considerably lower: West Bengal (3.7%), Andhra Pradesh (4.2%), Madhya Pradesh

(4.5%) and Orissa (3.8 %). The shares of Kerala, Haryana, Punjab and Rajasthan w

ere comparatively smaller whereas the flow of FDI into populous states such as B

ihar and Uttar Pradesh has been virtually negligible.

Luthra & Luthra Law Offices 48

Luthra & Luthra Law Offices

49

Conclusion As far as the economic interpretation of the model is concerned, the

size of the domestic market is positively related to foreign direct investment.

The greater the market, the more customers and the more opportunities to invest.

Since FDI is mostly in the form of physical investment, investors would prefer

the markets with better infrastructure.

Luthra & Luthra Law Offices 50

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Exercises For Corporate FinanceDocument13 pagesExercises For Corporate FinanceVioh NguyenNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Bar Exam Study GuideDocument6 pagesBar Exam Study Guideapi-36982600% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Bayala vs. Silang Traffic Co. 73 Phil 557Document5 pagesBayala vs. Silang Traffic Co. 73 Phil 557Rhei BarbaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

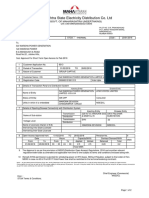

- Maharashtra State Electricity Distribution Co. LTD: (A Govt. of Maharashtra Undertaking)Document2 pagesMaharashtra State Electricity Distribution Co. LTD: (A Govt. of Maharashtra Undertaking)chief engineer CommercialNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- HR Problem at Jet AirwaysDocument39 pagesHR Problem at Jet AirwaysRuchika RawatNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 'Basics of AccountingDocument57 pages'Basics of AccountingPrasanjeet DebNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 4brief Ex 4Document5 pages4brief Ex 4Ervina CorneliaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Nisms05a PDFDocument235 pagesNisms05a PDFAtul SharmaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Terjemahan Bab 5,6,7Document2 pagesTerjemahan Bab 5,6,7Rish DaryantiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Milco Industries CaseDocument5 pagesMilco Industries CaseUpendra SharmaNo ratings yet

- The Ellis Act Gentrification SiegeDocument2 pagesThe Ellis Act Gentrification SiegeTenants Joining Resources (aka 10JR)No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Daf FormDocument5 pagesDaf FormRahul GolchhaNo ratings yet

- Regal Raptor Spyder FrameDocument19 pagesRegal Raptor Spyder FrameNikola Milosev100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- OB - PPT - Vishal Sikka's Ouster From Infosys PDFDocument15 pagesOB - PPT - Vishal Sikka's Ouster From Infosys PDFMayank AgrawalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Infosys CSR ReportDocument27 pagesInfosys CSR ReportSaday Chhabra100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Treasurer CFO Capital Markets in Dallas TX Resume Joseph WilliamsDocument2 pagesTreasurer CFO Capital Markets in Dallas TX Resume Joseph WilliamsJosephWilliamsNo ratings yet

- Intermediate Accounting 1 Key AnswerDocument5 pagesIntermediate Accounting 1 Key AnswerMikhaela TorresNo ratings yet

- AmalgamationDocument35 pagesAmalgamationKaran VyasNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Loan Approval BacatanDocument2 pagesLoan Approval BacatanMario BacatanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Short Term Loan From NDBDocument12 pagesShort Term Loan From NDBHarunNo ratings yet

- Dabur Coke Case AnalysisDocument6 pagesDabur Coke Case AnalysisNiku Thali100% (1)

- List of Companies-2009Document1,194 pagesList of Companies-2009Om PrakashNo ratings yet

- S A 20190625Document4 pagesS A 20190625Mary Ann Gamela IturiagaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Aa Glass en 2007 DoDocument124 pagesAa Glass en 2007 Doapi-3831941No ratings yet

- BIOMEDevice Boston May 15-16-2019Document29 pagesBIOMEDevice Boston May 15-16-2019Keshwa MurthyNo ratings yet

- Peruvian Localization Oracle EBSDocument145 pagesPeruvian Localization Oracle EBSlenardilloNo ratings yet

- The Corporation Under Russian Law, 1800-1917 - A Study in Tsarist Economic PolicyDocument260 pagesThe Corporation Under Russian Law, 1800-1917 - A Study in Tsarist Economic PolicyLivia FrunzaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Katalog Vonsild 2016 300dpiDocument72 pagesKatalog Vonsild 2016 300dpiAleksNo ratings yet

- Boneless & Skinless Chicken Breasts: Get $6.00 OffDocument6 pagesBoneless & Skinless Chicken Breasts: Get $6.00 OffufmarketNo ratings yet

- Parntership CasesDocument52 pagesParntership CasesCamille Denise JavellanaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)