Professional Documents

Culture Documents

Prudhvi Pokuru RBI

Uploaded by

Gramoday FruitsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prudhvi Pokuru RBI

Uploaded by

Gramoday FruitsCopyright:

Available Formats

Assignment

By: Prudhvi Pokuru

PGDM ABM (2021-23)

1. What is RBI?

Reserve Bank Of India is India’s central bank and regulatory body which comes under Ministry

of Finance, GOI. It was established on April 1, 1935, under RBI act 1934. Initially the central

office was located at Kolkata. It was shifted to Mumbai in 1937. RBI was nationalised with

effect from 1stJanuary 1949based on Reserve Bank of India (Transfer to public ownership) Act

1948.

2. What are the main functions of RBI?

Monetary Authority:

Formulates implements and monitors the monetary policy.

Objective: maintaining price stability while keeping in mind the objective of growth.

Regulator and supervisor of the financial system:

Prescribes broad parameters of banking operations within which the country's banking

and financial system functions.

Objective: maintain public confidence in the system, protect depositors' interest and

provide cost-effective banking services to the public.

Manager of Foreign Exchange

Manages the Foreign Exchange Management Act, 1999.

Objective: to facilitate external trade and payment and promote orderly development and

maintenance of foreign exchange market in India.

Issuer of currency:

Issues and exchanges or destroys currency and coins not fit for circulation.

Objective: to give the public adequate quantities of supplies of currency notes and coins

and in good quality.

Developmental role:

Performs a wide range of promotional functions to support national objectives.

3. Establishment of RBI, Act of establishment and year of nationalization of RBI

The Reserve Bank of India was established on April 1, 1935 in accordance with the

provisions of the Reserve Bank of India Act, 1934

Though originally privately owned, since nationalisation in 1949, the Reserve Bank is

fully owned by the Government of India.

4. Governor of RBI

Governor of RBI is Shri Shaktikanta Das. He is a retired 1980 batch Indian Administrative

Service officer of Tamil Nadu cadre. Currently he is serving as 25th governor of RBI. He was

earlier a member of the Fifteenth Finance Commission.

5. Repo Rate:

Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case

of India) lends money to commercial banks in the event of any shortfall of funds. Repo

rate is used by monetary authorities to control inflation.

As of April 2021, RBI’s repo rate stands at 4%, repo rate was reduced by 40 basis points

from 4.4% to 4%.

6. Reverse Repo Rate:

Reverse repo rate is the rate at which the central bank of a country (Reserve Bank of

India in case of India) borrows money from commercial banks within the country. It is a

monetary policy instrument which can be used to control the money supply in the

country.

As of April 2021, RBI’s Reverse repo rate stands at 3.35%.

7. Cash Reserve Ratio:

The Reserve Bank of India or RBI mandates that banks store a proportion of their

deposits in the form of cash so that the same can be given to the bank’s customers if the

need arises. The percentage of cash required to be kept in reserves, vis-a-vis a bank’s

total deposits, is called the Cash Reserve Ratio. The cash reserve is either stored in the

bank’s vault or is sent to the RBI. Banks do not get any interest on the money that is with

the RBI under the CRR requirements.

8. SLR:

Statutory Liquidity Ratio or SLR is a minimum percentage of deposits that a

commercial bank has to maintain in the form of liquid cash, gold or other securities. It is

basically the reserve requirement that banks are expected to keep before offering credit to

customers

RBI in 2020 has fixed a SLR ratio of 18%.

9. NPA:

An asset, including a leased asset, becomes non-performing when it ceases to generate

income for the bank. A 'non-performing asset' (NPA) was defined as a credit facility in

respect of which the interest and/ or installment of principal has remained 'past due' for a

specified period of time.

Indian public sector banks collectively owned approximately 6.17 trillion Indian rupees

in non-performing assets in fiscal year 2021. This value was much higher, at around 7.5

trillion rupees in the 2019 fiscal year, indicating a slow but slight relief for India's

economy in terms of non-paying assets at public banks.

10. Bank Rate:

Bank rate is the rate charged by the central bank for lending funds to commercial banks.

Base rate is the minimum rate set by the Reserve Bank of India below which banks are

not allowed to lend to its customers.

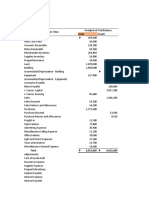

11. Difference between RTGS and NEFT

Parameters NEFT RTGS

Expansion National Electronics Funds Real Time Gross Settlement

Transfer

Minimum transfer value Re 1 Rs 2 lakhs

Maximum transfer value No limit No limit

Payment options Online and offline Online and offline

Settlement type Takes time because of batch Real time transaction

wise transaction

You might also like

- The Reserve Bank of India: Central BankingDocument5 pagesThe Reserve Bank of India: Central BankingSUNIL DUGANWANo ratings yet

- Krishna Singh RBI AssignmentDocument8 pagesKrishna Singh RBI AssignmentJNU BSCAGNo ratings yet

- Questions and Answers Related To RBIDocument3 pagesQuestions and Answers Related To RBIRahul PrasadNo ratings yet

- RBI Functions: 1. Monopoly of Note IssueDocument5 pagesRBI Functions: 1. Monopoly of Note Issueshivam shandilyaNo ratings yet

- RbiDocument3 pagesRbimishelNo ratings yet

- Banking Awareness: Topic 1: Reserve Bank of India & Its FunctionsDocument37 pagesBanking Awareness: Topic 1: Reserve Bank of India & Its FunctionsExplore LifeNo ratings yet

- Submitted By: Bachkaniwala Priyanka Bavda Nikita Lalwani Sonam Submitted To: Mr. Paresh Dave S. R. Luthra Institute of ManagementDocument31 pagesSubmitted By: Bachkaniwala Priyanka Bavda Nikita Lalwani Sonam Submitted To: Mr. Paresh Dave S. R. Luthra Institute of ManagementMuana Lal Thla JAfNo ratings yet

- Features and Objectives of Money MarketDocument23 pagesFeatures and Objectives of Money MarketYashaswini Gowda100% (1)

- Rbi PDFDocument4 pagesRbi PDFUmar AbdullahNo ratings yet

- Gobs Fa CapsuleDocument118 pagesGobs Fa CapsuleAbhishek Choudhary100% (1)

- Chapter 2 - Rbi, Sebi, IrdaDocument66 pagesChapter 2 - Rbi, Sebi, IrdasejalNo ratings yet

- m1-2 Regulation, Rbi, Func, PolicyDocument15 pagesm1-2 Regulation, Rbi, Func, PolicyMEENUNo ratings yet

- About Reserve Bank of India (RBI)Document3 pagesAbout Reserve Bank of India (RBI)Newton KumamNo ratings yet

- CHAPTER 3 RBI and Monetary PolicyDocument27 pagesCHAPTER 3 RBI and Monetary PolicyPraveen KumarNo ratings yet

- RBI and Its FunctionDocument5 pagesRBI and Its FunctionSweta PandeyNo ratings yet

- 1.bankers Adda Banking CapsuleDocument17 pages1.bankers Adda Banking CapsulePavan TejaNo ratings yet

- Role and Functions of Reserve Bank of India (RBI)Document17 pagesRole and Functions of Reserve Bank of India (RBI)ankita100% (1)

- Role of RBI Under Banking Regulation Act, 1949Document5 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- RBI and Functions YKKDocument30 pagesRBI and Functions YKKMALKANI DISHA DEEPAKNo ratings yet

- Role of Central Bank: by Dr. Manmeet KaurDocument18 pagesRole of Central Bank: by Dr. Manmeet KaurHey broNo ratings yet

- A Presentation On: Role of Reserve Bank of India in Indian EconomyDocument25 pagesA Presentation On: Role of Reserve Bank of India in Indian EconomyVimal SinghNo ratings yet

- FIM-Module II-Banking InstitutionsDocument11 pagesFIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- Digital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceDocument9 pagesDigital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceSwethaNo ratings yet

- 2.FIM-Module II-Banking InstitutionsDocument11 pages2.FIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- Reserve Bank of India - Prathyusha PDFDocument5 pagesReserve Bank of India - Prathyusha PDFPolamada PrathyushaNo ratings yet

- RBI Rules and RegulationDocument30 pagesRBI Rules and Regulationsyed imranNo ratings yet

- General Banking Awareness For All Promotional Exams 1Document9 pagesGeneral Banking Awareness For All Promotional Exams 1Javed QasimNo ratings yet

- Financial Regulatory Bodies in IndiaDocument6 pagesFinancial Regulatory Bodies in IndiaRaman SrivastavaNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- Special Entities Accounting and Innovation Accounting: Project ConceptDocument21 pagesSpecial Entities Accounting and Innovation Accounting: Project ConceptSanket AgarwalNo ratings yet

- Functions of RBIDocument6 pagesFunctions of RBISumantra BhattacharyaNo ratings yet

- Unit - II - Banking RegulationDocument14 pagesUnit - II - Banking RegulationShreya PushkarnaNo ratings yet

- Assignement BAnkingDocument13 pagesAssignement BAnkingbhudavid075237No ratings yet

- RBI and Its FunctionsDocument14 pagesRBI and Its FunctionsSuchandra SarkarNo ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document11 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- RRB Po Clerk Capsule 2015Document59 pagesRRB Po Clerk Capsule 2015Abhishek GeraNo ratings yet

- Financial Management Assignment-1Document8 pagesFinancial Management Assignment-1surajNo ratings yet

- RRB Po GK Power CapsuleDocument59 pagesRRB Po GK Power CapsuleDetective ArunNo ratings yet

- Module 4 Eco Sem 3Document18 pagesModule 4 Eco Sem 3sruthikadug22No ratings yet

- Banking WELCOME50Document24 pagesBanking WELCOME50Mahi MaheshNo ratings yet

- Roles & Functions of Reserve Bank of India: Useful LinksDocument7 pagesRoles & Functions of Reserve Bank of India: Useful LinksJaldeep MangawaNo ratings yet

- Cash Reserve RatioDocument7 pagesCash Reserve Ratioratheesh1981No ratings yet

- General Awareness 2015 For All Upcoming ExamsDocument59 pagesGeneral Awareness 2015 For All Upcoming ExamsJagannath JagguNo ratings yet

- Central Bank Edit-1Document3 pagesCentral Bank Edit-1Vanlalbiakdiki ChhangteNo ratings yet

- RBI FunctionsDocument11 pagesRBI Functionsredarrow05No ratings yet

- Banking Awareness Notes 2Document15 pagesBanking Awareness Notes 2adithyavardhanmNo ratings yet

- Role of Rbi in Indian EconomyDocument20 pagesRole of Rbi in Indian EconomySophiya KhanamNo ratings yet

- Chapter 3. Lecture 3.1 RBI, 1934Document4 pagesChapter 3. Lecture 3.1 RBI, 1934vibhuNo ratings yet

- Traditional Functions B. Monopoly of Note IssueDocument10 pagesTraditional Functions B. Monopoly of Note IssueSaishankar SanaboinaNo ratings yet

- 4 MP Reddy SirDocument26 pages4 MP Reddy SirTanay BansalNo ratings yet

- 18.04 - RBI - Role & Functions, Monetary PolicyDocument13 pages18.04 - RBI - Role & Functions, Monetary PolicyramixudinNo ratings yet

- Reserve Bank of India: By. Asutosh RaiDocument19 pagesReserve Bank of India: By. Asutosh Raiashutosh raiNo ratings yet

- Reserve Bank of India: Central BoardDocument25 pagesReserve Bank of India: Central Boardganesh_280988No ratings yet

- A Project Report of Indian Financial System On Role of Rbi in Indian EconomyDocument14 pagesA Project Report of Indian Financial System On Role of Rbi in Indian EconomyAjay Gupta67% (3)

- PPT of Role of Rbi Policies Functions and ProhibitoryDocument17 pagesPPT of Role of Rbi Policies Functions and Prohibitoryr.vani75% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Prudhvi PokuruDocument1 pagePrudhvi PokuruGramoday FruitsNo ratings yet

- Prudhvi Pokuru - Accounting For ManagersDocument5 pagesPrudhvi Pokuru - Accounting For ManagersGramoday FruitsNo ratings yet

- ABM 507 MergedDocument78 pagesABM 507 MergedGramoday FruitsNo ratings yet

- Vajrapu Lakshmi Priya - Accountng For ManagersDocument7 pagesVajrapu Lakshmi Priya - Accountng For ManagersGramoday FruitsNo ratings yet

- Functions of Channel Members: Submitted By: Rachna Priyadarshini Radhika KumariDocument32 pagesFunctions of Channel Members: Submitted By: Rachna Priyadarshini Radhika KumariGramoday FruitsNo ratings yet

- Classification of Product (Garima Singh)Document15 pagesClassification of Product (Garima Singh)Gramoday FruitsNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Asynchronous ActivityDocument4 pagesAsynchronous ActivityJohn Francis RosasNo ratings yet

- Times NIE Web Ed FEB 3Document4 pagesTimes NIE Web Ed FEB 3W PremsonNo ratings yet

- Psaf Revision Day 4Document7 pagesPsaf Revision Day 4Esther AkpanNo ratings yet

- Module Configuration Template - General ConfigDocument16 pagesModule Configuration Template - General ConfigPavan HurukadliNo ratings yet

- Policy On Bank DepositDocument32 pagesPolicy On Bank DepositNK PKNo ratings yet

- Quiz 4 Fa ReviewerDocument3 pagesQuiz 4 Fa ReviewerKristine Jewel PacursaNo ratings yet

- Profit MGT & InflationDocument21 pagesProfit MGT & InflationParkhi AgarwalNo ratings yet

- Asset Classes and Financial InstrumentsDocument33 pagesAsset Classes and Financial Instrumentskaylakshmi8314No ratings yet

- Triple - M-Trading - SARAYDocument10 pagesTriple - M-Trading - SARAYLaiza Cristella SarayNo ratings yet

- Salome Kirimi CVDocument3 pagesSalome Kirimi CVsalome kirimiNo ratings yet

- Questionnaire of UlipDocument8 pagesQuestionnaire of UlipPankaj Vashist50% (2)

- Accounting For Foreign Currency Transactions1Document17 pagesAccounting For Foreign Currency Transactions1eliyas mohammedNo ratings yet

- Category 1 MessagesDocument17 pagesCategory 1 MessagesSun City TVNo ratings yet

- Finace ProjectDocument31 pagesFinace ProjectRahul NishadNo ratings yet

- Property HeroesDocument18 pagesProperty HeroesAnonymous KUGdwwb4iXNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971NEELESH GARGNo ratings yet

- Continental Carriers IncDocument7 pagesContinental Carriers IncYetunde JamesNo ratings yet

- Gaurav Gharat ResumeDocument2 pagesGaurav Gharat Resumegaurav gharatNo ratings yet

- M & ADocument6 pagesM & AiluaggarwalNo ratings yet

- Multiple Choice Questions On Financial Accounting V2Document6 pagesMultiple Choice Questions On Financial Accounting V2Kate FernandezNo ratings yet

- National Income AccountingDocument25 pagesNational Income AccountingAnuska ThapaNo ratings yet

- Email TemplatesDocument8 pagesEmail TemplatesVictor S. Suratos Jr.No ratings yet

- G-1 RTP Compiled MAY 2024 - WDocument99 pagesG-1 RTP Compiled MAY 2024 - WSairamNo ratings yet

- Balance Sheet Break-Even Analysis: SBA Guaranteed LoansDocument6 pagesBalance Sheet Break-Even Analysis: SBA Guaranteed Loansr.jeyashankar9550No ratings yet

- Financial Education Workbook-VII - ComprDocument44 pagesFinancial Education Workbook-VII - ComprShubh JainNo ratings yet

- ADJUSTING ENTRIES PPT Examples and ActivityDocument14 pagesADJUSTING ENTRIES PPT Examples and Activitytamorromeo908No ratings yet

- Tekumatla SupriyaDocument11 pagesTekumatla SupriyamubeenuddinNo ratings yet

- Examination Question and Answers, Set B (Multiple Choice), Chapter 7 - CashDocument2 pagesExamination Question and Answers, Set B (Multiple Choice), Chapter 7 - CashJohn Carlos DoringoNo ratings yet

- Mba f09 01 Security Analysis Portfolio Management Syllabus PDFDocument3 pagesMba f09 01 Security Analysis Portfolio Management Syllabus PDFPrabhjot KaurNo ratings yet