0% found this document useful (0 votes)

2K views3 pagesIncome Tax Assessment Notice Details

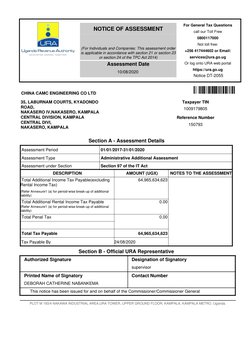

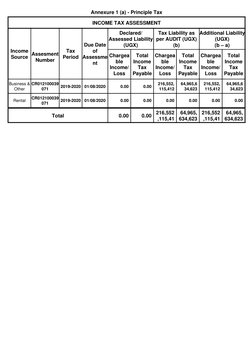

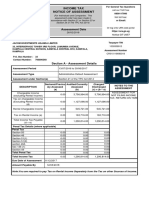

This document is a Notice of Assessment from the Uganda Revenue Authority (URA) to China CAMC Engineering Co LTD regarding an administrative additional income tax assessment for the period of January 1st, 2017 to January 31st, 2020. The total additional income tax payable according to the audit is UGX 64,965,634,623. The taxpayer has 45 days from receipt of the notice to lodge an objection in writing with the Commissioner if they are dissatisfied with the assessment. Payment of the outstanding tax liability is due by August 24th, 2020 and any amount outstanding after this date will accrue interest of 2% per month.

Uploaded by

kailong wangCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views3 pagesIncome Tax Assessment Notice Details

This document is a Notice of Assessment from the Uganda Revenue Authority (URA) to China CAMC Engineering Co LTD regarding an administrative additional income tax assessment for the period of January 1st, 2017 to January 31st, 2020. The total additional income tax payable according to the audit is UGX 64,965,634,623. The taxpayer has 45 days from receipt of the notice to lodge an objection in writing with the Commissioner if they are dissatisfied with the assessment. Payment of the outstanding tax liability is due by August 24th, 2020 and any amount outstanding after this date will accrue interest of 2% per month.

Uploaded by

kailong wangCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Notice of Assessment

- Income Tax Assessment Table

- Tax Information and Objections