Professional Documents

Culture Documents

Involvement of Key Engagement Team Members

Uploaded by

kris mCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Involvement of Key Engagement Team Members

Uploaded by

kris mCopyright:

Available Formats

Considerations in Establishing the Overall Audit Strategy

This appendix provides examples of matters the auditor may consider in establishing the

overall audit strategy. Many of these matters will also influence the auditor’s detailed

audit plan. The examples provided cover a broad range of matters applicable to many

engagements. While some of the matters referred to below may be required by other

PSAs, not all matters are relevant to every audit engagement and the list is not necessarily

complete.

Characteristics of the Engagement

• The financial reporting framework on which the financial information to be

audited has been prepared, including any need for reconciliations to another

financial reporting framework.

• Industry-specific reporting requirements such as reports mandated by industry

regulators.

• The expected audit coverage, including the number and locations of components

to be included.

• The nature of the control relationships between a parent and its components that

determine how the group is to be consolidated.

• The extent to which components are audited by other auditors.

• The nature of the business segments to be audited, including the need for

specialized knowledge.

• The reporting currency to be used, including any need for currency translation for

the financial information audited.

• The need for a statutory audit of standalone financial statements in addition to an

audit for consolidation purposes.

• The availability of the work of internal auditors and the extent of the auditor’s

potential reliance on such work.

• The entity’s use of service organizations and how the auditor may obtain evidence

concerning the design or operation of controls performed by them.

PSA 300 (Redrafted)

13

• The expected use of audit evidence obtained in previous audits, for example, audit

evidence related to risk assessment procedures and tests of controls.

• The effect of information technology on the audit procedures, including the

availability of data and the expected use of computer-assisted audit techniques.

• The coordination of the expected coverage and timing of the audit work with any

reviews of interim financial information and the effect on the audit of the

information obtained during such reviews.

• The availability of client personnel and data.

Reporting Objectives, Timing of the Audit, and Nature of Communications

• The entity's timetable for reporting, such as at interim and final stages.

• The organization of meetings with management and those charged with

governance to discuss the nature, timing and extent of the audit work.

• The discussion with management and those charged with governance regarding

the expected type and timing of reports to be issued and other communications,

both written and oral, including the auditor's report, management letters and

communications to those charged with governance.

• The discussion with management regarding the expected communications on the

status of audit work throughout the engagement.

• Communication with auditors of components regarding the expected types and

timing of reports to be issued and other communications in connection with the

audit of components.

• The expected nature and timing of communications among engagement team

members, including the nature and timing of team meetings and timing of the

review of work performed.

• Whether there are any other expected communications with third parties,

including any statutory or contractual reporting responsibilities arising from the

audit.

You might also like

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- A Study Of Performance Measurement In The Outsourcing DecisionFrom EverandA Study Of Performance Measurement In The Outsourcing DecisionNo ratings yet

- Audit PlanningDocument4 pagesAudit PlanningZvioule Ma FuentesNo ratings yet

- CPA REVIEW SCHOOL PHILIPPINESDocument18 pagesCPA REVIEW SCHOOL PHILIPPINESsanguyo_karenNo ratings yet

- Planning and Risk AssessmentDocument21 pagesPlanning and Risk AssessmentFurqan AhmedNo ratings yet

- 010-109-Audit Strategy ChecklistDocument14 pages010-109-Audit Strategy ChecklistKris Anne SamudioNo ratings yet

- At 5908 - Audit Planning Tapos NaDocument4 pagesAt 5908 - Audit Planning Tapos NaPsc O. AENo ratings yet

- At 5908 Audit PlanningDocument9 pagesAt 5908 Audit PlanningjasfNo ratings yet

- At Quizzer (CPAR) - Audit PlanningDocument9 pagesAt Quizzer (CPAR) - Audit Planningparakaybee100% (3)

- Audit Planning GuideDocument9 pagesAudit Planning GuidegumiNo ratings yet

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Document10 pagesCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Dyte DiamanteNo ratings yet

- Planning an Audit of Financial StatementsDocument8 pagesPlanning an Audit of Financial StatementsVito CorleonNo ratings yet

- Audit Planing and DocumentationDocument4 pagesAudit Planing and DocumentationBharat LalNo ratings yet

- Audit Planning EssentialsDocument29 pagesAudit Planning EssentialsPRINCESS MENDOZANo ratings yet

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Document5 pagesCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Ma Yra YmataNo ratings yet

- A&a L4 EditedDocument5 pagesA&a L4 EditedKimosop Isaac KipngetichNo ratings yet

- At.1609 - Audit Planning - An OverviewDocument6 pagesAt.1609 - Audit Planning - An Overviewnaztig_017No ratings yet

- Audit Planning, Controlling and Recording Audit Planning, Controlling and Recording Planning Refer To ISA 300Document8 pagesAudit Planning, Controlling and Recording Audit Planning, Controlling and Recording Planning Refer To ISA 300hasanuNo ratings yet

- Auditing Theory: Audit Planning: An OverviewDocument31 pagesAuditing Theory: Audit Planning: An OverviewChristine NionesNo ratings yet

- Planning Audit Risk AssessmentDocument8 pagesPlanning Audit Risk AssessmentCiel ArvenNo ratings yet

- مادة مراجعة الفرقة الرابعة شعبة محاضرة 2 بعد الميد تيرم د - احمد مختارDocument25 pagesمادة مراجعة الفرقة الرابعة شعبة محاضرة 2 بعد الميد تيرم د - احمد مختارMahmoud AhmedNo ratings yet

- Engagement Letter and PlanningDocument17 pagesEngagement Letter and PlanningJoseph SimudzirayiNo ratings yet

- Overview of Risk-Based Audit ProcessDocument47 pagesOverview of Risk-Based Audit ProcessAngelika NapolesNo ratings yet

- Planning an Audit of Financial StatementsDocument4 pagesPlanning an Audit of Financial StatementsMd Joinal AbedinNo ratings yet

- Understanding the Entity and Risk AssessmentDocument11 pagesUnderstanding the Entity and Risk AssessmentMa Jessa Kathryl Alar IINo ratings yet

- Audit PlanningDocument15 pagesAudit Planningemc2_mcv75% (4)

- 2018 Audit DocumentationDocument28 pages2018 Audit DocumentationNYAMEKYE ADOMAKONo ratings yet

- Chapter 3Document35 pagesChapter 3maryumarshad2No ratings yet

- Audit PlanningDocument29 pagesAudit PlanningchamalixNo ratings yet

- Chapter No.02Document18 pagesChapter No.02Wais Deen NazariNo ratings yet

- 2 Monitor and Control Project WorkDocument16 pages2 Monitor and Control Project WorkKAMRAN SHEREENNo ratings yet

- Audit Programme and Checklists For Completion of Audit Audit ProgrammeDocument26 pagesAudit Programme and Checklists For Completion of Audit Audit ProgrammejafarNo ratings yet

- Project Financial Management SystemsDocument13 pagesProject Financial Management SystemsSarah Jean TrajanoNo ratings yet

- Chap.3 Audit Plannng, Working Paper and Internal Control-1Document10 pagesChap.3 Audit Plannng, Working Paper and Internal Control-1Himanshu MoreNo ratings yet

- Completing The AuditDocument27 pagesCompleting The AuditAlona Dela CruzNo ratings yet

- 6 - Audit PlanningDocument17 pages6 - Audit PlanningJayson Manalo Gaña100% (1)

- Chapter No.2 OkDocument14 pagesChapter No.2 OkRajshahi BoardNo ratings yet

- Audit of ContractsDocument26 pagesAudit of ContractsSarvesh Khatnani100% (1)

- Review Notes On PSA 2Document9 pagesReview Notes On PSA 2Barbie Saniel RamonesNo ratings yet

- C2 Inter AuditDocument8 pagesC2 Inter Auditbroabhi143No ratings yet

- Audit ProgrammeDocument34 pagesAudit ProgrammesurajNo ratings yet

- Disadvantages of Audit ProgrammeDocument2 pagesDisadvantages of Audit ProgrammezenellebellaNo ratings yet

- IntroductionDocument5 pagesIntroductionJasmine Roberts MatorresNo ratings yet

- Audit ManualDocument80 pagesAudit ManualhaninadiaNo ratings yet

- Importance of Audit PlanningDocument12 pagesImportance of Audit PlanningRahul KadamNo ratings yet

- 3 Audit PlanningDocument16 pages3 Audit PlanningHussain MustunNo ratings yet

- Budgeting and Forecasting 2 DaysDocument5 pagesBudgeting and Forecasting 2 DaysGaurav PahwaNo ratings yet

- Audit Planning & Documentation - Taxguru - inDocument8 pagesAudit Planning & Documentation - Taxguru - inNino NakanoNo ratings yet

- Lesson 4Document34 pagesLesson 4Ramon AlpitcheNo ratings yet

- The Role and Timing of Planning: The Overall Audit StrategyDocument2 pagesThe Role and Timing of Planning: The Overall Audit StrategyTanvir HossainNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Wiley Practitioner's Guide to GAAS 2012: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2012: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Management Accounting: Retrospect and ProspectFrom EverandManagement Accounting: Retrospect and ProspectRating: 4.5 out of 5 stars4.5/5 (5)

- Chapter Exercises 3: Chapter Exercises 3: Taxpayers: TaxpayersDocument24 pagesChapter Exercises 3: Chapter Exercises 3: Taxpayers: TaxpayersKenneth Tupas UrbiztondoNo ratings yet

- AdDocument12 pagesAdMjhayeNo ratings yet

- ReportreportDocument5 pagesReportreportkris mNo ratings yet

- Draft 4 EveryrhingDocument1 pageDraft 4 Everyrhingkris mNo ratings yet

- Chap 1 TAX TheoriesDocument16 pagesChap 1 TAX Theorieskris mNo ratings yet

- AdequancyDocument3 pagesAdequancykris mNo ratings yet

- Intermediate Accounting IFRS Equity ConceptsDocument46 pagesIntermediate Accounting IFRS Equity ConceptsHarvey Ochoa100% (2)

- Advanced Accounting Part II Quiz 1 Home Office and Branch AccountingDocument10 pagesAdvanced Accounting Part II Quiz 1 Home Office and Branch AccountingAzyrah Lyren Seguban UlpindoNo ratings yet

- Taxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's ObjectiveDocument3 pagesTaxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's Objectivekris mNo ratings yet

- Barangay Micro Business EnterpriseDocument3 pagesBarangay Micro Business EnterpriseJenny Rose Castro Fernandez100% (1)

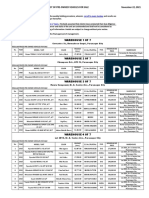

- November 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every SundayDocument3 pagesNovember 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every Sundaykris mNo ratings yet

- Barangay Micro Business EnterpriseDocument3 pagesBarangay Micro Business EnterpriseJenny Rose Castro Fernandez100% (1)

- Obtaining audit evidence about operating effectiveness of controlsDocument3 pagesObtaining audit evidence about operating effectiveness of controlskris mNo ratings yet

- Home Office and Branch Accounting Theories and Problems SolutionsDocument18 pagesHome Office and Branch Accounting Theories and Problems Solutionskris mNo ratings yet

- Risk AssessmentDocument5 pagesRisk Assessmentkris mNo ratings yet

- 12 Capital Budgeting v2Document3 pages12 Capital Budgeting v2kris mNo ratings yet

- Dokumen - Tips - Branch Accounting TestbankDocument6 pagesDokumen - Tips - Branch Accounting Testbankkris mNo ratings yet

- TB Ch08 Capital Budgetting Decisions Part 2Document13 pagesTB Ch08 Capital Budgetting Decisions Part 2kimberly agravante100% (1)

- Psa 315 RedraftedDocument4 pagesPsa 315 Redraftedkris mNo ratings yet

- Construction Contract Notes (Ast)Document1 pageConstruction Contract Notes (Ast)kris mNo ratings yet

- Risks of Material Misstatement at Financial Statement and Assertion LevelsDocument5 pagesRisks of Material Misstatement at Financial Statement and Assertion Levelskris mNo ratings yet

- A60 RedraftedDocument2 pagesA60 Redraftedkris mNo ratings yet

- Responsibility Acctg 2Document5 pagesResponsibility Acctg 2kris mNo ratings yet

- Cost DivisionDocument4 pagesCost Divisionkris mNo ratings yet

- Sample Problems MCQDocument3 pagesSample Problems MCQMary Yvonne AresNo ratings yet

- Responsibility AcctgDocument3 pagesResponsibility Acctgkris mNo ratings yet

- SAP Business One Revenue Cycle GuideDocument9 pagesSAP Business One Revenue Cycle Guidekris mNo ratings yet

- AcceptanceDocument3 pagesAcceptancekris mNo ratings yet

- Def of AudDocument5 pagesDef of Audkris mNo ratings yet

- DiscussionDocument4 pagesDiscussionkris mNo ratings yet

- Economics Class XDocument34 pagesEconomics Class Xbhupenderrana100% (8)

- Encuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénDocument3 pagesEncuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénRobacorazones TkmNo ratings yet

- Engineering Guide-Fans BlowerDocument4 pagesEngineering Guide-Fans BlowershaharyarNo ratings yet

- Medieval IndiaDocument61 pagesMedieval IndiaRahul DohreNo ratings yet

- List of EIC Holder - April 2020Document52 pagesList of EIC Holder - April 2020Luqman HazuanNo ratings yet

- Lost (Andfound?) in Translation:Feminisms InhemisphericdialogueDocument18 pagesLost (Andfound?) in Translation:Feminisms InhemisphericdialogueLucas MacielNo ratings yet

- REBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39Document15 pagesREBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39yhusofiNo ratings yet

- Erich Neumann - Amor and Psyche - TXTDDDocument11 pagesErich Neumann - Amor and Psyche - TXTDDaz09660% (3)

- IpoDocument43 pagesIpoyogeshdhuri22100% (4)

- Pre-Employment Issues: by Group-6Document8 pagesPre-Employment Issues: by Group-6Debabratta PandaNo ratings yet

- IBAs in Timor-Leste Low ResDocument90 pagesIBAs in Timor-Leste Low ResInug WaeNo ratings yet

- Defensa Civil Colombia roles sanitation emergenciesDocument15 pagesDefensa Civil Colombia roles sanitation emergenciesJuanSebastianDiazNo ratings yet

- 2022-02-03 Adidas Global Supplier ListDocument179 pages2022-02-03 Adidas Global Supplier ListTrần Đức Dũng100% (1)

- SPI Firefight Rules (1976)Document20 pagesSPI Firefight Rules (1976)Anonymous OUtcQZleTQNo ratings yet

- Case Brief On R. v. Williams (1998) 1 S.C.R1. 1128Document5 pagesCase Brief On R. v. Williams (1998) 1 S.C.R1. 1128baba toundeNo ratings yet

- Write Your Positive or Negative Thoughts About The Picture.Document6 pagesWrite Your Positive or Negative Thoughts About The Picture.YVONE MAE MAYORNo ratings yet

- Mystical Languages of UnsayingDocument163 pagesMystical Languages of Unsayingninhodesoya100% (2)

- Land II NotesDocument28 pagesLand II NotesYun YiNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Checklist For Construction and Rehabilitation of Small Dams: Social & Environmental Management Unit (Semu)Document10 pagesChecklist For Construction and Rehabilitation of Small Dams: Social & Environmental Management Unit (Semu)Muhammad imran LatifNo ratings yet

- ProCapture-T User Manual V1.1 - 20210903 PDFDocument65 pagesProCapture-T User Manual V1.1 - 20210903 PDFahmad khanNo ratings yet

- Starbucks - Company AnalysisDocument12 pagesStarbucks - Company AnalysisVisakh VigneshNo ratings yet

- Additional Problems (PRESENT ECONOMY)Document2 pagesAdditional Problems (PRESENT ECONOMY)Kristy SalmingoNo ratings yet

- Business Plan Highlights for Salon Beauty VenusDocument20 pagesBusiness Plan Highlights for Salon Beauty VenusEzike Tobe ChriszNo ratings yet

- Electrical MentorDocument3 pagesElectrical Mentoresk1234No ratings yet

- Retailing, Wholesaling and LogisticsDocument31 pagesRetailing, Wholesaling and LogisticsBilal Raja100% (2)

- Bar Graph Unit MonthDocument2 pagesBar Graph Unit MonthsushantinhbiNo ratings yet

- Excess identifiable to net assets consolidationDocument3 pagesExcess identifiable to net assets consolidationRima WahyuNo ratings yet

- Hometown Brochure DesignDocument2 pagesHometown Brochure DesignTiffanymcliu100% (1)

- WJ 2016 07Document158 pagesWJ 2016 07JastenJesusNo ratings yet