Professional Documents

Culture Documents

Sujit - Tiwari - Vs - State - of - Gujarat - 10102018 - GUJHC (FN - 35) J.P-8.15

Uploaded by

Rahul kumar0 ratings0% found this document useful (0 votes)

25 views38 pagesOriginal Title

Sujit_Tiwari_vs_State_of_Gujarat_10102018__GUJHC [FN- 35] J.P-8.15

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views38 pagesSujit - Tiwari - Vs - State - of - Gujarat - 10102018 - GUJHC (FN - 35) J.P-8.15

Uploaded by

Rahul kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 38

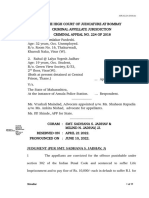

MANU/GJ/1748/2018

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

R/Special Criminal Application No. 1691 of 2018

Decided On: 10.10.2018

Appellants: Sujit Tiwari

Vs.

Respondent: State of Gujarat

Hon'ble Judges/Coram:

S.G. Gokani, J.

Counsels:

For Appellant/Petitioner/Plaintiff: Virat G. Popat and Adityasinh J. Jadeja

For Respondents/Defendant: Kartik Pandya, Devang Vyas and H.S. Soni, Public

Prosecutor

Case Note:

Criminal - Bail - Sections 37 of the Narcotics Drugs and Psychotropic

Substances Act, 1985 - Petitioner had preferred application for grant of

bailon ground that his detention in connection with criminal case pending

before court below was illegal - Whether Petitioner entitled for relief on

ground that his detention was illegal - Held, it appeared from record that

there were prima facie, overwhelming evidence against present Petitioner

in form of CDRs so also Whatsapp conversation with other accusedso also

his own brother - Considering huge quantity of contraband, which was

seized from vessel MV Henry by NCB with help of Indian Coast Guard, court

was of opinion that Petitioner release, at this stage, especially when, case

was at very crucial stage and vital evidences were to come on record yet,

would have tendency of thwarting course of justice - Moreover, section 37

of Act also would not permit court to hold, at this stage, from evidence,

which have come on record and there were no reasonable grounds for

believing that Petitioner was not guilty of such offence and that grant of

liberty was not likely to thwart course of justice - Thus, this petition did not

deserve to be entertained and same was dismissed - However, considering

young age of Petitioner, he should be permitted to approach court once

again after period of expiry of six months, if, trial did not proceed

substantially - Petition dismissed. [6],[7]

JUDGMENT

S.G. Gokani, J.

Rule. Learned APP waives service of rule for the respondent-State, whereas, the

learned standing Counsel, Mr. Pandya, appearing with Mr. Vyas waives service of rule

for respondent No. 2.

1 . The petitioner has preferred this application under Articles 21 and 226 of the

Constitution of India along with Sections 167, 482 and Section 439 of the Code of

Criminal Procedure, 1973 ('the Code', in brief), on the ground that his detention in

connection with NDPS File No. NCB/AZU/CR-7/2017, numbered as Special Case No.

12-10-2021 (Page 1 of 38) www.manupatra.com Central University of South Bihar

1/2017, pending before the Court of the learned Special Judge, Porbandar, which is

filed by the Intelligence Officer of the Narcotics Control Bureau, Ahmedabad Zonal

Unit, Ahmedabad (for short, 'NCB') under Sections 8C, 21C, 23C, 25 and 29 of the

Narcotics Drugs and Psychotropic Substances Act, 1985 ('NDPS Act' in short), is

illegal.

2. It is the say of the applicant that under Section 200 of the Code, the office of the

NCB has lodged a complaint, however, he has not produced any authorization to file

the said complaint, and therefore, custody of the applicant continues to be illegal.

The complainant is the Intelligence Officer in NCB, Ahmedabad. It is the say of the

complainant in the complaint that that the Indian Coast Guard is a Central

Government Agency, which has been empowered under Section 53 of the NDPS Act of

search, seizure and calling for the information, as is available to the Police Officer in

charge of a police station. It also has powers, under Section 49 of the very Act, to

stop and search conveyances including the vessels, as defined under Section 2(viii)

of the said Act. A specific information was received from Indian Coast Guard by NCB

on 29.07.2017 that a vessel, namely OSV MV Henry, is being escorted to Porbandar

and as the movement of the said vessel is suspicious, a request was made to send a

team for conducting the joint investigation and the arrival of the said vessel was

likely to be on 30.07.2017. This was when submitted to the Additional Director, NCB,

he directed the Investigating Officer, one Mr. Rakesh Datania, to form a team and

visit Porbandar.

2.1. On visiting the Head Quarter of the Indian Coast Guard at Porbandar, it was

realized by the IO, Mr. Datania that the vessel, OSV MV Henry, was under detention

of the Indian Coast Guard at Porbandar. They also had seized the huge quantity of

the contraband, i.e. heroin, along with its eight crew members. The vessel was

already in the Indian waters. The NCB team reached Saurashtra Cement Limited Jetty,

where, the information was extracted and a request was made to NCB to take over

the case for further proceedings. Accordingly, the District Collector, Porbandar, was

requested in writing to depute two officials to remain present as independent witness.

The Executive Magistrate also was deputed to remain present along with NCB team.

3. It is the case of the NCB that huge quantity of the contraband has been recovered

from different cavities of the said vessel. The total weight of the said contraband is

1445 kgs. approximately. The eight crew members, including the Captain of the

vessel, who were found on the said vessel, have also been named in the complaint.

One of them was the Captain of the vessel, namely Suprit Tiwari, who happens to be

the brother of the present applicant. The complainant had summoned the present

applicant for recording his statement on 01.08.2017. However, he had requested to

appear on 04.08.2017, and therefore, his statement came to be recorded on

04.08.2017, which revealed the following details:

"...

In his voluntarily statement Sujit Tiwari s/o. A N Tiwari, told that Suprit

Tiwari is his brother. His brother Suprit Tiwari joined merchant navy in

January, 2011 at Dubai. Then, he visited home during his holidays and he

was at home till April, 2017. In May, 2017, his brother Suprit Tiwari went to

Iran. Suprit used to call him from the satellite phone on his ship and would

inform him about his work and situation. One day, his brother Suprit called

him on phone and informed that his ship was halting at Karachi and that

goods are being loaded on it. He also informed him that he was going to

12-10-2021 (Page 2 of 38) www.manupatra.com Central University of South Bihar

make a deal of Rs. 400 crores in which he was going to get Rs. 50 crores

towards his commission. He said that as and when he would get Rs. 50

crores towards the commission, he would send the money to Kolkata by

route of Hawala. He sent the numbers of two persons named Irfan and Vishal

through WhatsApp and asked him to be in contact with these persons. His

brother had informed that after delivery of the goods these persons would

come to Kolkata along with Rs. 50 crores of Hawala. Thereafter, time and

again he remained in contact with both these persons and had a conversation

with them. Before bringing his ship to India, Suprit had sent the crew list to

Sujit on WhatsApp and had asked him to hand over this crew list to Irfan and

Vishal. The said crew list contained the names of four Iranians and one

person named Esthekhar Alam also and he was required to hand over the

said crew list to Vishal and Irfan. Thereafter, as told by Suprit, Sujit deleted

the names of four Iranians and Esthekhar Alam and handed over the crew list

of the remaining persons to Vishal and Irfan through whatsapp. Suprit had

told him that after delivery of goods in Gujarat, the ship will be converted

into trash at Alang. Vishal sent Sujit a voice message on WhatsApp that there

was a person named Saud who is contact with his brother Suprit through

postpaid connection and he had worked out a plan for unloading the heroin

from the ship at Gujarat instead of Mumbai. In July last week Suprit called

his on phone and informed that he was about to reach India along with his

ship and after unloading heroin in Gujarat his people would hand over Rs. 50

crores to him at Kolkata.

Sujit further stated that his mobile number is 9804412393 and he used a

black colored mobile phone of Motorola Nexus. Sujit also stated that Suprit

used to call him from satellite phone having number +8821621280227 and

another mobile number of Suprit Tiwari was +971569633590. Suprit also

told that Vishal's mobile number was 9789435606 and Irfan mobile number

was 9768437860.

..."

3.1. It is, further, the case of NCB that Suprit Tiwari in his statement recorded on

02.08.2017 had stated that the other seven crew members found on the said vessel

were Vinay, Munish, Manish, Devesh, Anurag, Dinesh and Sanjay. He, further, had

stated that he was introduced to one Seyed Ali Moniri @ Seyed Mahmoud, who is an

Iranian national, by one Amin Lalla, who was known to him from his earlier work

days in UAE. He worked in the company of said Seyed Ali Moniri as Captain with the

monthly salary of 3,000 U.S. Dollars. He along with three other persons, who were

known to him from his days of childhood, joined the vessel known as Prince-2 on

22.05.2017 and the other persons were also working on this vessel, which was

owned by Ali Moniri. The cavities were already made in the said vessel and the same

were being made to conceal the contraband article, i.e. heroin. They were all asked to

carry out his directions by Ali Moniri and in return, he offered to the Captain of the

vessel 20,000 AED and other crew members were offered 5000 AED. Those of them,

who were disagreeable departed from Prince-2 to another vessel. It is his case that

after that Ali Moniri came along with four Iranians, namely Ebrahim, Mustafa,

Mohamad, Rassol and they joined them on the trip with the other persons. Then, they

started towards Sharjah and on reaching there the Captain of the vessel, i.e. the

brother of the present applicant, purchased a cellphone bearing no. +971569633590

at Free Zone, Sharjah. He was, then, introduced to Devendra, a resident of Bareilly,

Uttar Pradesh and they both conspired to steal the entire load of the contraband of Ali

12-10-2021 (Page 3 of 38) www.manupatra.com Central University of South Bihar

Moniri. They also planned to defraud Ali Moniri and to earn the huge profits.

Devendra provided cellphone number being +919897215944 of Vishal, who also hail

from Uttar Pradesh and Vishal provided the cellphone number being (i) 9768437860

and (ii) 8850390034 of Irfan to him. Both Vishal and Irfan agreed to purchase the

entire consignment of contraband.

3.2. It is, further, the case of the prosecution that Suprit was directed by the Ali

Moniri to station the vessel Prince-II at about 70 NM from Gwadar Port, Pakistan, and

thereafter, the small boats containing the contraband, weighing, in all, 1445 Kgs.

approximately, came to be loaded in the said vessel and concealed in the different

cavities of the said vessel. The welding of the said cavities was also done. This work

was carried out by the four Iranians and one Pakistani, namely Khalid Mohammad,

had also joined them on the trip. Although, the vessel initially started towards Red

Sea on 24.07.2017, as per the crew members' plan they turned the said vessel

towards India on 26.07.2017. It is also alleged that two of the persons, who were on

the vessel, were thrown in the sea with an intention of cheating Ali Moniri and

stealing the entire load of contraband weight around 1445 kgs., valued at Rs. 4500/-

crore in the international market. From 26.07.2017, the Captain of the vessel and the

brother of the present applicant was in constant touch with Irfan and Vishal and both

of them had assured the Captain of the vessel and other crew members to purchase

the entire load of the contraband. It is also the case of the prosecution that the

Vessel Prince-II repainted mid-sea and was renamed as M.V. Henry. Therefore, a

detailed complaint, came to be lodged by the Intelligence Officer on 21.12.2017.

3.3. The present petitioner is the brother of the Captain of the said vessel, namely

Suprit, who is arrested by the NCB on the basis of the details culled out on the basis

of the record of satellite phone. The petitioner has emphasized that there is not an

iota of evidence to indicate that he was aware of the criminal conspiracy with regard

to either the contraband or of any other details, which have been provided in the

complaint, itself. It is, further, his say that merely because, he happens to be the

brother of the Captain of the said vessel and he spoke to his brother over the satellite

phone, since, that was the only mode of communication available, he cannot be

arraigned as an accused. Moreover, it is urged that the statements of Vishal and Irfan

would reveal that the present applicant would have no connection with this entire

incident. CDRs is sought to be relied upon to urge that the phone calls made to the

co-accused, who happens to be his brother, would not make him liable for any act.

3.4. It is, further, the case of the petitioner that his arrest has been made in wake of

the complaint filed by the NCB. There is no charge-sheet so far filed. Therefore, his

present custody cannot be termed as a legal custody. It is, further, his case that the

complaint is filed without obtaining necessary sanction, and therefore, the complaint

is bad in law. It is, therefore, urged that the petitioner be granted regular bail, as the

chances of his conviction are very bleak. An application being Criminal Misc.

Application No. 61 of 2018 was also preferred by the petitioner before the learned

Special Judge, Porbandar, seeking regular bail and questioning his custody. However,

the same is rejected by the learned Special Judge, Porbandar, vide his order dated

06.02.2018.

3.5. It is the case of the petitioner that he is 25 years old and has just completed his

engineering. He also has got various job offers and his continuous custody would

ruin his entire life. It is prayed that, since, he has no criminal antecedents, he be

enlarged on regular bail. If, he is kept behind the bars, he shall have to suffer the

damage, which cannot be compensated in terms of money. Thus, with two fold

12-10-2021 (Page 4 of 38) www.manupatra.com Central University of South Bihar

prayers, i.e. (i) seeking a declaration that his custody is illegal and (ii) seeking his

release on regular bail, he is before this Court.

4 . Affidavit-in-reply for and on behalf of respondent No. 2-NCB is filed, where, the

contention has been raised that the complaint has been filed under Section 200 of the

Code. Actually, the complaint is filed under Section 36A(d)(4) of the NDPS Act and

the officers of the Revenue Intelligence have been vested with the powers of Officer

in charge of a police station under Section 53 of the NDPS Act. They are not police

officers within the meaning of Section 25 of the Indian Evidence Act, 1872, and their

powers are akin to the powers vested in the officers under the Customs Act. Two

decisions also have been pressed into service, viz. (1) 'RAM SING VS. CENTRAL

BUREAU OF INVESTIGATION', MANU/SC/0629/2011 : (2011) 11 SCC 347 and (2)

'STATE THROUGH NARCOTICS CONTROL BUREAU VS. KULVANTSINH',

MANU/SC/0108/2003 : (2003) 9 SCC 193, where, the Apex Court has held that

Central Government constituted an authority Narcotics Control Bureau by way of a

notification, empowering the officers of the NCB above the rank of inspector to

exercise the powers under Section 41(2), 41(1), 67 and 53 of the Act and the NCB is

authorized to carry search and seizure and their powers can be enlarged by the

notification empowering the officers to exercise the powers under Section 36A, 41,

42 and 67 of the Act.

4.1. On merits, it is urged that the present petitioner was in constant touch with the

other co-accused. His Whatsapp conversation is also indicative that he was fully

conscious, as to what was going on and from the statement made under Section 67

of the NDPS Act, his prima facie involvement is established on record. The statement

given by the present petitioner and the other co-accused are voluntary statements,

which were recorded by the officers prior to the lodgment of the complaint.

Moreover, non-compliance of Sections 41 and 42 of the Act would not vitiate the trial

even if, eventually, it is proved that the there had been non-compliance.

4.2. The summons under Section 67 of the Act, according to the respondent, had

been issued to the present petitioner for recording his statement on 02.08.2017 and

he had appeared on 04.08.2017, at 16:00 hours. The entire procedure was duly

followed. It is, further, urged that the complainant's case is filed under 36A(d)(4) of

the NDPS Act. This provides that the Special Court may, upon perusal of police report

of the facts constituting an offence under this Act or upon a complaint made by an

officer of the Central or State Government, authorized in this behalf, take cognizance

of that offence without the accused being committed to it for trial. The complaint is

filed within the stipulated period of 180 days and the same is registered as NDPS

Case No. 01/2017. There is no procedure to lodge FIR in NCB.

4.3. So far as the request of the petitioner for grant of regular bail is concerned, it is

urged that the quantity of the contraband seized in this case is commercial quantity,

as defined under Section 37 of the NDPS Act and it would not fall under Section 439

of the Code. It is also the say of the respondent that the kind of evidence that has

emerged against the present petitioner, it is not a case for this Court to consider his

case for regular bail. Specifically, it has been pointed out that, in his statement, he

has agreed that his brother had called him over the phone to say that his ship was

halting at Karachi and the goods were being loaded and he was going to make a deal

of about Rs. 400/- crore, for which he was going to get Rs. 50/- crore towards

commission and whenever he completes the said deal, he would send the said

amount to Kolkata by way of Hawala. His brother had also asked the present

petitioner to remain in constant touch with Vishal and Irfan through Whatsapp. After

12-10-2021 (Page 5 of 38) www.manupatra.com Central University of South Bihar

the delivery of the goods, these persons would come to Kolkata along with Rs. 50/-

crore through Hawala route and thereafter, the petitioner remained in contact with

Irfan and Vishal and he also had conversation with them.

4.4. The petitioner also had sent Crew List on Whatsapp and was asked to handover

the same to Irfan and Vishal. This list contained the names of the four Iranian

nationals and one person named, Khalid Mohammad, who was a Pakistani national.

Thereafter, the petitioner was told to delete the names of four Iranian nationals and

of Pakistani national and to hand over the names of the remaining crew members to

Vishal and Irfan through Whatsapp. The petitioner also was conveyed that after the

delivery of the goods in Gujarat, the ship shall be converted into trash at Alang..

Vishal also had conveyed to the present petitioner that he has worked out a plan for

unloading the heroin in Gujarat instead of Mumbai. All the details, including the

details of the cellphone, have been provided by the petitioner in his statement.

5 . This Court has heard extensively, learned Advocate, Mr. Popat, with learned

Advocate, Mr. Jadeja, for the petitioner, learned Advocate, Mr. Pandya with Mr. Vyas

for respondent No. 2-NCB so also the learned APP for the respondent-State.

6 . Taking firstly the issue of question of arrest and custody of the petitioner, the

challenge is made to the arrest of the petitioner, after his statement was recorded

under Section 67 of the NDPS Act on 04.08.2017. He was, then, produced before the

Magistrate on the very same day and was sent into custody. It is to be noted that the

complaint in this case is filed under Section 36 A(d)(4) of the NDPS Act, which is

numbered as NDPS Case No. 1/2017. The Intelligence Officer of the NCB is

authorized to investigate under Section 53 and Section 36 A(d)4 of the NDPS Act

empowers the Special Court to take cognizance of the offence, when the accused is

committed to it and upon perusal of the police paper, discloses an offence under the

Act or upon a complaint made by an officer of the central or state government and

authorized in this behalf.

6.1. In case of 'DIRECTORATE OF ENFORCEMENT VS. DEEPAK MAHAJAN AND

ANOTHER', MANU/SC/0422/1994 : 1994 (2) GLH 603, the Apex Court held that it is

not an indispensable prerequisite condition that in all circumstances, the arrest

should have been effected only by a police officer and none else and that there must

necessarily be records of entries of a case diary. Therefore, it necessarily follows that

a mere production of an arrestee before a competent Magistrate by an authorized

officer or an officer empowered to arrest (notwithstanding the fact that he is not a

police officer in its stricto sensu) on a reasonable belief that the arrestee "has been

guilty of an offence punishable" under the provisions of the special Act is sufficient

for the Magistrate to take that person into his custody on his being satisfied of the

three preliminary conditions, namely, (1) the arresting officer is legally Competent to

make the arrest, (2) that the particulars of the offence or the accusation for which the

person is arrested or other grounds for such arrest do exist and are well-founded,

and (3) that the provisions of the special Act in regard to the arrest of the persons

and the production of the arrestee serve the purpose of Section 167(1) of the Code.

6.2. The Apex Court, in that case, was considering Section 104(1) of the Customs

Act, 1962, Section 35(1) and 35(2) of the Foreign Exchange Regulation Act, 1973,

and Section 167(2) of the Code and the Apex Court observed and held as under:

"102. From the foregoing discussion, it is clear that the word 'accused' or

'accused person' is used only in a generic sense in Section 167(1) and (2)

12-10-2021 (Page 6 of 38) www.manupatra.com Central University of South Bihar

denoting the "person" whose liberty is actually restrained on his arrest by a

competent authority on well founded information or formal accusation or

indictment. Therefore, the word 'accused' limited to the scope of Section

167(1) and (2) -particularly in the light of Explanation to Section 273 of the

Code includes 'any person arrested'. The inevitable consequence that follows

is that 'any person is arrested' occurring in the first limb of Section 167(1) of

the Code takes within its ambit 'every person arrested' under Section 35 of

FERA or S. 104 of the Customs Act also as the case may be and the 'person

arrested' can be detained by the Magistrate in exercise of his power under

Section 167(2) of the Code. In other words, the 'person arrested' under FERA

or Customs Act is assimilated with the characteristics of an 'accused' within

the range of Section 167(1) and as such liable to be detained under Section

167(2) by a Magistrate when produced before him.

103. In fact, Justice Yogeshwar Dayal speaking for the majority in Union of

India v. O.P. Gupta, (1990) 2 DL 23 (FB) has rightly observed thus:

"The expression 'accused' used in Section 167(2) of the Code is not

in the sense of accused under Article 20(3) of the Constitution

and/or Section 25 of the Indian Evidence Act with which the

Supreme Court was concerned in the cases of Ramesh Chander

Mehta and/or Illias. The word, "accused" in Section 167(2) of the

Code is merely used in the sense of defining a person who has been

arrested, detained and produced before a Magistrate and not in the

sense of accused person under the Customs Act and/or Foreign

Exchange Regulation Act since that person has been defined in the

aforesaid two judgments as only that person against whom

cognizance has been taken by the Magistrate on a complaint being

filed. Therefore, the judgment of the Supreme Court in the case of

Ramesh Chander Mehta or Illias referred to above do not stand in the

way of applicability of Section 167(2) of the Code to the person

detained and produced by competent officer before the Magistrate in

pursuance of Section 104(2) of the Customs Act or Section 35(2) of

the Foreign Exchange Regulation Act."

1 0 4 . Further, in the later part of his judgment the learned Judge has

observed;

"The word accused is to be construed in its widest connotations. It

means the one who is arrested and detained."

105. After having observed as above, it has been concluded by the learned

Judge thus:

"Section 167(1) of the Code is already replaced by Section 104(2) of

the Customs Act and S. 35(2) of the Foreign Exchange Regulation

Act. What is to be done to a person who is so produced before the

Magistrate is dealt with only under Section 167(2) and not under

Section 167(1) of the Code." 103. Agreeing with the majority

judgment in O.P. Gupta ((1990) 2 DL 23 (FB)) and with the view of

the High Court of Kerala in C.I.U. Cochin v. P.K. Ummerkutty,

MANU/KE/0083/1983 : 1983 Cri L J 1860 and N.K. Ayoob v. The

Superintendent, C.I.W., Cochin, MANU/KE/0118/1983 : 1984 Cri L J

12-10-2021 (Page 7 of 38) www.manupatra.com Central University of South Bihar

949 as well as of the Gujarat High Court in N.H. Dave v. Mohamed

Akhtar, MANU/GJ/0009/1982 : 1984 (15) ELT 353, Arunachalam, J.

of the Madras High Court in his well-reasoned judgment in Senior

Intelligence Officer v. M.K.S. Abu Bucker, MANU/TN/0031/1989 :

1989 LW (Cri) 325: (1990 Cri L J 704) has observed as follows (at

Pp. 710 to 713 of 1990 Cri L J): "Obviously in relation to a person

arrested under the Customs Act, Section 167(1), Cr.P.C., is covered

suitably by S. 104(1) and (2) of the Customs Act. In that event, the

application of S. 167(2) of the Code can pose no difficulty, except

the consideration of the words 'accused person' used in that

subsection.

***

If we construe the words "an accused person" in S. 167(2) of the

Code, it will be clear that the words would take in, the person who is

arrested or detained in custody by the Customs Officer who had

reason to believe that such person was guilty of an offence

punishable under S. 135 of the Act.

***

Looked at in this background, the word 'accused' in Section 167(2),

Cr.P.C., will have to be construed in its widest connotation meaning

"one who has been arrested and detained" which will include even a

person suspected of having committed an offence.

***

I hold that the Magistrate has the power to remand a person

produced before him in accordance with S. 104 of the Customs Act

by virtue of the powers of remand under S. 167(2) and (3) of the

Code and could further exercise the powers under S. 437 of the

Code."

106. In our considered opinion, the view taken in O.P. Gupta ((1990) 2 DL

23 (FB)). and M.K.S. Abu Bucker (MANU/TN/0031/1989 : 1990 Cri. L J 704

(Mad)) and also of the Kerala High Court and Gujarat High Court is the

logical and correct. View and we approve the same for the reasons we have

given in the preceding part of this judgment. We, indeed, see no

imponderability in construing Section 35(2) of FERA and 104(2) of Customs

Act that the said provisions replace Section 167(1) and serve as a substitute

thereof substantially satisfying all the required basic conditions contained

therein and that consequent upon such replacement of sub-section (1) of

Section 167, the arrested person under those special Acts would be an

accused person to be detained by the Magistrate under subsection (2) of

Section 167. In passing, it may be stated that there is no expression 'police

officer' deployed in Section 167(1) nor does it appear in any part of Section

167(2). The authority for detaining a person as contemplated under Section

167(2) is in aid of investigation to be carried on by any prosecuting agency

who is invested with the power of investigation.

1 0 7 . We next proceed to consider the second question whether the

authorised or empowered officer under FERA or Customs Act exercises all or

12-10-2021 (Page 8 of 38) www.manupatra.com Central University of South Bihar

any of the powers of a police officer outlined under Chapter XII of the Code

and conducts any investigation within the meaning of Section 2(h) of the

Code.

108. The word 'Investigation' is defined under Section 2(h) of the present

Code (which is an exact reproduction of Section 4(1)(1) of the old Code)

which is an inclusive definition as including all the proceedings under the

Code for the collection of evidence conducted by a police officer or any

person (other than a Magistrate) who is authorised by a Magistrate in this

behalf. The said word 'investigation' runs through the entire fabric of the

Code. There is a long course of decisions of this Court as well as of the

various High Courts explaining in detail, what the word 'investigation' means

and is? It is not necessary for the purpose of this case to recapitulate all

those decisions except the one in H.N. Rishbud v. State of Delhi,

MANU/SC/0049/1954 : 1955 (1) SCR 1150: (AIR 1955 SC 196). In that

decision, it has been held that "under the Code investigation consists

generally of the following steps: (1) Proceeding to the spot, (2)

Ascertainment of the facts and circumstances of the case, (3) Discovery and

arrest of the suspected offender, (4) Collection of evidence relating to the

commission of the offence which may consist of (a) the commission of

various persons (including the accused) and the reduction of their statement

into writing, if the officer thinks fit, (b) the search of places or seizure of

things considered necessary for the investigation and to be produced at the

trial, and (5) formation of the opinion as to whether on the material collected

there is a case to place the accused before a Magistrate for trial and if so

taking the necessary steps for the same by the filing of a charge-sheet under

Section 173."

The steps involved in the course of investigation, as pointed out in Rishbud's

case (MANU/SC/0049/1954 : AIR 1955 SC 196) have been reiterated in State

of M.P. v. Mubarak Ali.

109. No doubt, it is true that there is a series of decisions holding the view

that an officer of enforcement or a customs officer is not a police officer

though such officers are vested with the powers of arrest and other

analogous powers. Vide Ramesh Chandra v. The State of West Bengal, and

Illias v. Collector of Customs, Madras. In the above decisions, this Court has

held that the above officers under the special Acts are not vested with the

powers of a police officer qua investigation of an offence under Chapter XII

of the Code including the power to forward a report under Section 173 of the

Code. See also State of Punjab v. Barkat Ram, and Badaku Jyoti Savant v.

State of Mysore."

6.3. It would not be out of context to mention that the emphasis on the part of the

learned Advocate, Mr. Popat, is that a person not being a police officer or any

authorized officer, investigation is caused to be carried out under the directions of

the Magistrate, whereas, in the instant case from the date of the filing of the

complaint till lodging of the FIR, this aspect is missing. He also sought to rely on the

decision of the Apex Court in the case of 'TOFAN SINGH VS. STATE OF TAMIL NADU',

MANU/SC/1031/2013 : AIR 2014 SC (Supp) 1534, where, the question before the

Apex Court was as to whether, such a statement made under Section 67 of the NDPS

Act can be made the sole basis by construing the same as substantial evidence to

record the conviction.

12-10-2021 (Page 9 of 38) www.manupatra.com Central University of South Bihar

6.4. The appellant, therein, was listed as Accused No. 3 in the trial for the offences

under Sections 8(c), 21(c), 8(c) read with Section 29 of the NDPS Act. The trial,

conducted by the Special Judge, Additional Special Court, under the NDPS Act,

Chennai, which resulted in the conviction of the appellant, holding him guilty of the

offences under the aforesaid provisions of the Act. As a consequence of the said

judgment dated 18.12.2009 convicting him under the provisions of the NDPS Act, the

learned Special Judge sentenced the appellant to undergo 10 years rigorous

imprisonment and to pay a fine of Rs. 1/- lakh and in default to undergo further

rigorous imprisonment for a period of one year. Identical sentences were also

imposed for the offences under Section 8(c) read with Sections 21 and 29 of the

NDPS Act with the direction that both the sentences had to be undergone by the

appellant concurrently. The appeal filed by the appellant against the order of the

Special Judge, Addl. Special Court, came to be dismissed by the High Court of Madras

vide judgment and order dated 18.06.2012 and thereby, maintaining the conviction

as well as the sentence awarded by the Special Judge, Addl. Special Court under

NDPS Act, Chennai.

6.5. When the challenge was taken to the Apex Court by way of Special Leave

Petition, though, the leave was granted on 18.01.2013. However, at the same time,

bail application preferred by the appellant was rejected and appeal was posted for

hearing. The relevant observations read thus:

38. In our view the aforesaid discussion necessitates a re-look into the ratio

of Kanhaiyalal Case (MANU/SC/7047/2008 : AIR 2008 SC 1044: 2008 AIR

SCW 627). It is more so when this Court has already doubted the dicta in

Kanhaiyalal (supra) in the case of Nirmal Singh Pehalwan

MANU/SC/0957/2011 : (2011) 12 SCC 298: (2011 AIR SCW 5697) wherein

after noticing both Kanhiyalal as well as Noor Aga, this Court observed thus:

"15. We also see that the Division Bench in Kanhaiyalal case;

MANU/SC/7047/2008 : 2008 (4) SCC 668; (2008) 2 SCC (Crl) 474:

(AIR 2008 SC 1044: 2008 AIR SCW 627), had not examined the

principles and the concepts underlying Section 25 of the Evidence

Act vis.-a-vis. Section 108 of the Customs Act the powers of Custom

Officer who could investigate and bring for trial an accused in a

narcotic matter. The said case relied exclusively on the judgment in

Raj Kumar's case (MANU/SC/0014/1991 : AIR 1991 SC 45) (supra).

The latest judgment in point of time is Noor Aga's case

(MANU/SC/2913/2008 : AIR 2009 SC (Supp) 852 : 2008 AIR SCW

5964) which has dealt very elaborately with this matter. We thus feel

it would be proper for us to follow the ratio of the judgment in Noor

Aga's case particularly as the provisions of Section 50 of the Act

which are mandatory have also not been complied with."

39. For the aforesaid reasons, we are of the view that the matter needs to be

referred to a larger Bench for reconsideration of the issue as to whether the

officer investigating the matter under NDPS Act would qualify as police

officer or not.

4 0 . In this context, the other related issue viz. whether the statement

recorded by the investigating officer under Section 67 of the Act can be

treated as confessional statement or not, even if the officer is not treated as

police officer also needs to be referred to the larger Bench, inasmuch as it is

12-10-2021 (Page 10 of 38) www.manupatra.com Central University of South Bihar

intermixed with a facet of the 1st issue as to whether such a statement is to

be treated as statement under Section 161 of the Code or it partakes the

character of statement under Section 164 of the Code.

41. As far as this second related issue is concerned we would also like to

point out that Mr. Jain argued that provisions of Section 67 of the Act cannot

be interpreted in the manner in which the provisions of Section 108 of the

Customs Act or Section 14 of the Excise Act had been interpreted by number

of judgments and there is a qualitative difference between the two sets of

provisions. Insofar as Section 108 of the Customs Act is concerned, it gives

power to the custom officer to summon persons "to give evidence" and

produce documents. Identical power is conferred upon the Central Excise

Officer under Section 14 of the Act. However, the wording to Section 67 of

the NDPS Act is altogether different. This difference has been pointed out by

Andhra Pradesh High Court in the Case of Shahid Khan v. Director of Revenue

Intelligence; MANU/AP/0972/2001 : 2001 (Criminal Law Journal) 3183.

6.6. This matter was then referred to the larger Bench to decide the aforesaid specific

issue so also the other related issues.

6.7. In 'HIRA SINGH VS. UNION OF INDIA', MANU/SC/0761/2017 : (2017) 8 SCC

162, the appellant and others approached the Apex Court seeking quashment of the

notification issued by the Central Government bearing No. S.O. 2941(E) dated

18.11.2009, amending Notification No. S.O. 1055(E) : MANU/REVU/0009/2001 dated

19.10.2001 and thereby inserting Note 4 (four) Signature Not Verified Digitally

signed by CHETAN KUMAR in the table at the end of Note 3 (three). The appellants

had challenged the judgment and order of the High Court of Delhi and of the High

Court of Punjab and Haryana respectively, rejecting the challenge to the impugned

notification being ultra vires. Therefore, the said notification was assailed on the

ground that the NDPS Act does not confer any power upon the Central Government to

vary the parameters of the quantification of the drugs. It was urged that the offence

defined in the Act is specific to narcotic drugs or the psychotropic substances and no

punishment is provided for or can be given in respect of non-narcotic drugs or the

non psychotropic substances. It was, therefore, urged that the something that cannot

be done directly, it cannot be achieved indirectly, much less by issuance of a

notification, where, the Apex Court observed and held as under:

"9. The respondents have rightly pointed out that the expression "neutral"

substance has not been defined in the Act. That obviously has been coined by

the Court to describe the other component of the mixture or preparation

(other than the specified narcotic drug or psychotropic substance). We are

also in agreement with the respondents that, the said decision nowhere

makes reference to Note 2 (two) of the notification dated 19.10.2001 and

that the same may have some bearing on the issue under consideration. This

decision also does not refer to entry no. 239 and the interplay between the

various provisions alluded to earlier while noting the argument of the

respondents. That may have some bearing on the issue that has been finally

answered. The judgment, however, after quoting the notification dated

19.10.2001 took note of the purpose for which Amendment Act of 2001 was

brought into force and then proceeded to hold that to achieve the said

purpose of rationalisation of the sentence structure, the purity of the narcotic

drug from the recovery or seizure made from the offender would be a

decisive factor. In other words, the actual content or weight of the narcotic

12-10-2021 (Page 11 of 38) www.manupatra.com Central University of South Bihar

drug or psychotropic substance alone should be reckoned. For taking that

view support was drawn from the observations made in another two Judges

Bench decision in the case of Ouseph @ Thankachan Vs. State of Kerala

which, however, has also not elaborately dealt with the issue finally

answered in E. Micheal Raj (supra).

10. It was possible to examine the wider issues raised by the respondents

upon accepting their argument that the decision in E. Micheal Raj (supra) is

per incuriam. However, in our view, that decision has interpreted Section 21

of the Act. That interpretation would bind us. Moreover, that decision has

been subsequently noted in other decisions of this Court in the case of Harjit

Singh Vs. State of Punjab MANU/SC/0269/2011 : (2011) 4 SCC 441,

Kashmiri Lal Vs. State of Haryana, State Through Intelligence Officer, and

Narcotics Control Bureau Vs. Mushtaq Ahmad and Others 6-followed or

distinguished. In Amarsingh Ramjibhai Barot vs. State of Gujarat, quantity of

entire mixture was reckoned and not limited to the pure drug content therein.

Significantly, in none of these decisions, was the Court called upon to

examine the issues now raised by the respondents. Further, all these

decisions are of two Judges Bench.

1 1 . Thus, considering the significance of the issues raised by the

respondents and the grounds of challenge of the appellants/petitioners

concerning the impugned notification, to observe judicial rectitude and in

deference to the aforementioned decisions we direct that these matters be

placed before at least a three Judges Bench for an authoritative

pronouncement on the matters in issue, which we think are of seminal public

importance.

1 2 . The three Judges Bench may have to consider, amongst others, the

following questions:

(a) Whether the decision of this Court in E. Micheal Raj (supra)

requires reconsideration having omitted to take note of entry no. 239

and Note 2 (two) of the notification dated 19.10.2001 as also the

interplay of the other provisions of the Act with Section 21?

(b) Does the impugned notification issued by the Central

Government entail in redefining the parameters for constituting an

offence and more particularly for awarding punishment?

(c) Does the Act permit the Central Government to resort to such

dispensation?

(d) Does the Act envisage that the mixture of narcotic drug and

seized material/substance should be considered as a preparation in

totality or on the basis of the actual drug content of the specified

narcotic drug?

(e) Whether Section 21 of the Act is a stand alone provision or

intrinsically linked to the other provisions dealing with

"manufactured drug" and "preparation" containing any manufactured

drug?"

6.8. It is given to understand to this Court that till date, the reference made to the

12-10-2021 (Page 12 of 38) www.manupatra.com Central University of South Bihar

larger Bench to determine the aforesaid issues is pending.

6.9. Apt also would be to refer to 'E. MICHEAL RAJ VS. INTELLIGENCE OFFICER,

NARCOTIC CONTROL BUREAU', MANU/SC/7405/2008 : (2008) 5 SCC 161. It was a

case, where, the Apex Court was considering the determination of small or

commercial quantity in relation to narcotic drugs or psychotropic substances in a

mixture with one or more neutral substances. It was while considering the relevant

weight of offending drug in the mixture, it held and observed that in the mixture of

narcotic drug or psychotropic substance with one or more neutral substances, the

quantity of neutral substance is not be taken into consideration while determining the

small or commercial quantity of the narcotic drug or psychotropic substance and only

actual content by weight of the offending drug which is relevant for the purpose of

determining, whether, it would constitute small quantity or commercial quantity,

where, the Apex Court has held that in the mixture of narcotic drug or psychotropic

substance with one or more neutral substances, the quantity of neutral substance is

not to be taken into consideration, while determining the small or commercial

quantity of the narcotic drug or psychotropic substance.

6.10. The Apex Court, further, noted that the rate of purity of the drug is decisive for

determining the quantum of sentence for small, intermediary or commercial quantity.

The punishment must be based on the volume or content of the offending drug in the

mixture and not on the aggregate weight of the mixture as such. In other words, the

quantity of the neutral substance is not to be taken into consideration. While

determining the small quantity or commercial quantity of a narcotic drug or

psychotropic substance. It is only the actual content by weight of the narcotic drug,

which is relevant for the purpose of determining the quantity with reference to the

quantum of punishment. The Court also noted that the expression 'neutral substance'

has not been defined in the Act and that obviously has been coined by the Court to

describe the other components of the mixture or preparation, other than the specified

narcotic drug or psychotropic substance. The Apex Court, further, held and observed

as under:

"11. Thus, considering the significance of the issues raised by the

respondents and the grounds of challenge of the appellants/petitioners

concerning the impugned notification, to observe judicial rectitude and in

deference to the aforementioned decisions we direct that these matters be

placed before atleast a three Judges Bench for an authoritative

pronouncement on the matters in issue, which we think are of seminal public

importance.

1 2 . The three Judges Bench may have to consider, amongst others, the

following questions:

12.1 Whether the decision of this Court in E. Micheal Raj (supra)

requires reconsideration having omitted to take note of entry no. 239

and Note 2 (two) of the notification dated 19.10.2001 as also the

interplay of the other provisions of the Act with Section 21?

1 2 . 2 Does the impugned notification issued by the Central

Government entail in redefining the parameters for constituting an

offence and more particularly for awarding punishment?

12.3 Does the Act permit the Central Government to resort to such

dispensation?

12-10-2021 (Page 13 of 38) www.manupatra.com Central University of South Bihar

12.4 Does the Act envisage that the mixture of narcotic drug and

seized material/substance should be considered as a preparation in

totality or on the basis of the actual drug content of the specified

narcotic drug?

12.5 Whether Section 21 of the Act is a stand alone provision or

intrinsically linked to the other provisions dealing with

"manufactured drug" and "preparation" containing any manufactured

drug?

13. It will be open to the parties to persuade the larger Bench to reformulate

the aforementioned questions or frame additional question(s), if they so

desire."

6.11. In 'UMARBHAI YUSUFBHAI CHINIWALA VS. UNION OF INDIA AND ANOTHER',

Criminal Misc. Application No. 1941 of 2018, this Court was posed with the very

question, where, this Court observed and held as under:

8. Having heard the learned Advocates on both the sides, it can be noticed

that the muddamal articles, which is said to have been containing Opium,

which is a contraband, article was found in the bottles labeled as 'Kamini

Vidravan Rus', which is known as Ayurvedic Viagra, which is duly available in

the market. It was on a tip off that the NCB carried out a raid and found from

the office of the courier services, the packets, which were to be received,

initially, by A-1 and thereafter by A-3. It is the case of the prosecution that at

the behest of A-2, A-3 was to receive those parcels. The question, therefore,

that arises is as to whether, there is prima facie any admissible evidence

under the law or there is any cogent reason for this Court to deny bail to the

present applicant.

8.1 Before this Court considers the statements under Section 67 of the NDPS

Act for which much debate took place during the course of submissions,

particularly, because the Apex Court, itself, has referred the matter to the

larger Bench in 'TOFAN SINGH VS. STATE OF TAMIL NADU ' (Supra), what

this Court needs to consider at this stage is as to whether, this is a

widespread racket of sending the narcotic drugs under the pretext of

Ayurvedic product outside the Country.

8.2 It is on a tip off that the NCB had carried out a raid at the office of Shree

Mahabali Express Pvt. Ltd., whereupon, it was found that the parcels were in

the name of A-1, who had presented himself at the office to collect the same.

Undoubtedly, in regard to the two parcels, which had been seized initially, and

thereafter, the other parcels seized from the residence of A-1, the panchnama

had been carried out, later on, at Circuit House.

THE CONTENT/PERCENTAGE OF CONTRABAND ARTICLE:

The emphasis on the part of the learned Sr. Advocate, Mr. Raju, is that the

samples, which were drawn, were representative in nature, whereas, the

panchnama prima facie reveal that all the packets were emptied in a

container, and thereafter, the samples were drawn. These samples were when

sent to the CRCL, New Delhi, they were found to be containing 'Opium'. The

total contents of the packets containing Opium weighed 6.723 kgs..

Undoubtedly, there are four such samples and out of the total number of

12-10-2021 (Page 14 of 38) www.manupatra.com Central University of South Bihar

parcels seized, from each parcel, representative sample had been drawn, after

emptying all those bottles of a particular packet.

8.3 In that view of the matter to say that these were reference samples and

hence, would not reflect the clear picture of contraband article does not weigh

with this Court.

8.4 So far as the total content of opium is concerned, it is argued that the

content of Morphin found to be was 2.89%, 3.39%, 3.30% and 2.73%

respectively, as per the complaint. As can be culled out from the report of

CRCL dated 26.05.2017, which is the result of chemical analysis of all the four

samples.

8.5 As mentioned herein above, the emphasis on the part of the applicant is

that they should be construed as 0.232 gms. and not as 6.723 kgs.

8.6 Reliance in that regard is placed on the decision of the Apex Court

rendered in case of 'E. MICHEAL RAJ VS. INTELLIGENCE OFFICER,

NARCOTIC CONTROL BUREAU'(Supra). It was a case, where, the Apex

Court was considering the determination of small or commercial quantity in

relation to narcotic drugs or psychotropic substances in a mixture with one or

more neutral substances. It was while considering the relevant weight of

offending drug in the mixture, it held and observed that in the mixture of

narcotic drug or psychotropic substance with one or more neutral substances,

the quantity of neutral substance is not be taken into consideration while

determining the small or commercial quantity of the narcotic drug or

psychotropic substance and only actual content by weight of the offending

drug which is relevant for the purpose of determining, whether, it would

constitute small quantity of commercial quantity.

8.7 At this stage, relevant it would be to refer to the Notification dated

18.11.2009, issued by the Ministry of Finance (Department of Revenue), New

Delhi, which read as under:

"...

S.O. 2941(E).- IN exercise of the powers conferred by clause (vii a)

and (xxiii a) of section 2 of the Narcotic Drugs and Psychotropic

Substances Act, 1985 (61 of 1985) the Central Government, hereby

makes the following amendment in the Notification S.O. 1055(E)

dated 19th October, 2001, namely:-In the Table at the end after Note

3, the following Note shall be inserted, namely:-

"(4) The quantities shown in Column and column 6 of the

Table relating to the respective drugs shown in column 2

shall apply to the entire mixture or any solution or any one or

more narcotic drugs or psychotropic substances of that

particular drug in dosage form or isomers, esters, ethers and

salts of those drugs, including salts of esters, ethers and

isomers, wherever existence of such substance is possible

and not just its pure drug content."

8.8 Thus, it is clear from the above notification that, as per the requirement of

considering the existence of the substance, its entire mixture shall have to be

12-10-2021 (Page 15 of 38) www.manupatra.com Central University of South Bihar

considered, while considering the quantity shown in column 5 and column 6

of the table of the respective drugs shown in Column 2. Bearing in mind that

this a notification to possibly nullify effect of the earlier decision of the Apex

Court the reference made in 'HIRA SINGH AND ANOTHER VS. UNION OF

INDIA AND ANOTHER' (Supra) would need discussion hereunder.

8.9 The Apex Court while considering this decision of 'E. MICHEAL RAJ VS.

INTELLIGENCE OFFICER, NARCOTIC CONTROL BUREAU ' (Supra), noted

that the principle stated in the said decision is that the rate of purity of the

drug is decisive for determining the quantum of sentence for small,

intermediary or commercial quantity. The punishment must be based on the

volume or content of the offending drug in the mixture and not on the

aggregate weight of the mixture as such. In other words, the quantity of the

neutral substance is not to be taken into consideration. while determining the

small quantity or commercial quantity of a narcotic drug or psychotropic

substance. It is only the actual content by weight of the narcotic drug, which

is relevant for the purpose of determining the quantity with reference to the

quantum of punishment. The Court also noted that the expression 'neutral

substance' has not been defined in the Act and that obviously has been coined

by the Court to describe the other components of the mixture or preparation,

other than the specified narcotic drug or psychotropic substance.

Therefore, on the detailed discussion on this issue and considering the

significance of the issues raised by the parties and the grounds of challenge,

concerning the notification, while observing judicial rectitude and in deference

of the decisions discussed, therein, the Apex Court in 'E. MICHEAL RAJ'

(Supra), directed the matter to be placed at least before a three Judge Bench

with an authoritative pronouncement on the matters in issue, which the Apex

Court thought of seminal public importance. The relevant observations read

thus:

"8. We have heard Shri Manoj Swarup, Shri R.K. Kapoor, Shri

Sangram S. Saron and Shri R.B. Singhal for the appellants/petitioners

and Shri Ranjit Kumar Solicitor General assisted by Ms. Binu Tamta

for the respondents-Union of India. Before we embark upon the

course to be adopted, we deem it apposite to advert to the relevant

portion of the exposition of this Court in E. Micheal Raj (supra). This

is a decision of two Judges Bench. In paragraph 15 of the reported

judgment, the Court observed thus: (SCC pp. 168-69)

"15. It appears from the Statement of Objects and Reasons

of the amending Act of 2001 that the intention of the

legislature was to rationalize the sentence structure so as to

ensure that while drug traffickers who traffic in significant

quantities of drugs are punished with deterrent sentence, the

addicts and those who commit less serious offences are

sentenced to less severe punishment. Under the rationalised

sentence structure, the punishment would vary depending

upon the quantity of offending material. Thus, we find it

difficult to accept the argument advanced on behalf of the

respondent that the rate of purity is irrelevant since any

preparation which is more than the commercial quantity of

250 gm and contains 0.2% of heroin or more would be

12-10-2021 (Page 16 of 38) www.manupatra.com Central University of South Bihar

punishable under Section 21(c) of the NDPS Act, because the

intention of the legislature as it appears to us is to levy

punishment based on the content of the offending drug in

the mixture and not on the weight of the mixture as such.

This may be tested on the following rationale. Supposing 4

gm of heroin is recovered from an accused, it would amount

to a small quantity, but when the same 4 gm is mixed with

50 kg of powdered sugar, it would be quantified as a

commercial quantity. In the mixture of a narcotic drug or a

psychotropic substance with one or more neutral

substance(s), the quantity of the neutral substance(s) is not

to be taken into consideration while determining the small

quantity or commercial quantity of a narcotic drug or

psychotropic substance. It is only the actual content by

weight of the narcotic drug which is relevant for the purposes

of determining whether it would constitute small quantity or

commercial quantity. The intention of the legislature for

introduction of the amendment as it appears to us is to

punish the people who commit less serious offences with less

severe punishment and those who commit grave crimes,

such as trafficking in significant quantities, with more severe

punishment."

(emphasis supplied)

The principle stated in this decision is that the rate of purity of the

drug is decisive for determining the quantum of sentence-for "small",

"intermediary" or "commercial" quantity. The punishment must be

based on the volume or content of the offending drug in the mixture

and not on the aggregate weight of the mixture as such. In other

words, the quantity of the neutral substance is not to be taken into

consideration while determining the small quantity or commercial

quantity of a narcotic drug or psychotropic substance. It is only the

actual content by weight of the narcotic drug, which is relevant for

the purpose of determining the quantity with reference to the

quantum of punishment.

9 . The respondents have rightly pointed out that the expression

"neutral" substance has not been defined in the Act. That obviously

has been coined by the Court to describe the other component of the

mixture or preparation (other than the specified narcotic drug or

psychotropic substance). We are also in agreement with the

respondents that, the said decision nowhere makes reference to Note

2 (two) of the notification dated 19.10.2001 and that the same may

have some bearing on the issue under consideration. This decision

also does not refer to entry no. 239 and the interplay between the

various provisions alluded to earlier while noting the argument of the

respondents. That may have some bearing on the issue that has been

finally answered. The judgment, however, after quoting the

notification dated 19.10.2001 took note of the purpose for which

Amendment Act of 2001 was brought into force and then proceeded

to hold that to achieve the said purpose of rationalisation of the

sentence structure, the purity of the narcotic drug from the recovery

12-10-2021 (Page 17 of 38) www.manupatra.com Central University of South Bihar

or seizure made from the offender would be a decisive factor. In

other words, the actual content or weight of the narcotic drug or

psychotropic substance alone should be reckoned. For taking that

view support was drawn from the observations made in another two

Judges Bench decision in the case of Ouseph @ Thankachan Vs.

State of Kerala MANU/SC/1672/2001 : (2004) 4 SCC 446 which,

however, has also not elaborately dealt with the issue finally

answered in E. Micheal Raj (supra).

1 0 . It was possible to examine the wider issues raised by the

respondents upon accepting their argument that the decision in E.

Micheal Raj (supra) is per incuriam. However, in our view, that

decision has interpreted Section 21 of the Act. That interpretation

would bind us. Moreover, that decision has been subsequently noted

in other decisions of this Court in the case of Harjit Singh Vs. State

of Punjab 4, Kashmiri Lal Vs. State of Haryana, State Through

Intelligence Officer, and Narcotics Control Bureau Vs. Mushtaq

Ahmad and Others - followed or distinguished. In Amarsingh

Ramjibhai Barot vs. State of Gujarat, quantity of entire mixture was

reckoned and not limited to the pure drug content therein.

Significantly, in none of these decisions, was the Court called upon

to examine the issues now raised by the respondents. Further, all

these decisions are of two Judges Bench.

1 1 . Thus, considering the significance of the issues raised by the

respondents and the grounds of challenge of the

appellants/petitioners concerning the impugned notification, to

observe judicial rectitude and in deference to the aforementioned

decisions we direct that these matters be placed before atleast a

three Judges Bench for an authoritative pronouncement on the

matters in issue, which we think are of seminal public importance.

12. The three Judges Bench may have to consider, amongst others,

the following questions:

12.1 Whether the decision of this Court in E. Micheal Raj

(supra) requires reconsideration having omitted to take note

of entry no. 239 and Note 2 (two) of the notification dated

19.10.2001 as also the interplay of the other provisions of

the Act with Section 21?

12.2 Does the impugned notification issued by the Central

Government entail in redefining the parameters for

constituting an offence and more particularly for awarding

punishment?

12.3 Does the Act permit the Central Government to resort

to such dispensation?

12.4 Does the Act envisage that the mixture of narcotic drug

and seized material/substance should be considered as a

preparation in totality or on the basis of the actual drug

content of the specified narcotic drug?

12-10-2021 (Page 18 of 38) www.manupatra.com Central University of South Bihar

1 2 . 5 Whether Section 21 of the Act is a stand alone

provision or intrinsically linked to the other provisions

dealing with "manufactured drug" and "preparation"

containing any manufactured drug?

13. It will be open to the parties to persuade the larger Bench to

reformulate the aforementioned questions or frame additional

question(s), if they so desire."

8.10 It is quite clear from the said decision in the case of 'HIRA SINGH AND

ANOTHER'(Supra) that reference to the Larger Bench by the Apex Court is,

bearing in mind the importance it has on every matter which is being tried

under the provisions of the NDPS Act. This Court cannot be oblivious of the

fact that the decision of 'E. MICHEAL RAJ' (Supra), it has not been held per in

curium, however, by the Apex Court. Although, this aspect is to be mainly

and essentially seen at the time of punishing a person, where the contraband

article seized falls under the small, commercial or intermediary category, at

the stage of grant of regular bail also, it would assume importance. Even

being alive to the reference to the three judges Bench on the issue of

contraband article, according to the prosecution, the same is 0.232 gms.,

going by the decision of the Apex Court in 'E. MICHEAL RAJ' (Supra).

PANCHNAMA:

8.11 This will take this Court to the challenge with regard to change of

venue of panchnama from the residence of A-1 to Circuit House and also

challenge to the procedure adopted by the NCB, while carrying out the same.

In this regard, profitable it would be to refer to the decision of the Apex

Court in 'ABDUL SALIM ABDUL MUNAF SHAIKH @ SALIMBHAI & ANOTHER

VS. NARCOTICS CONTROL BUREAU AND ANOTHER', 2010 (4) GLR 2985,

wherein, it is observed that the standing instructions by NCB require that

weighing, taking of samples, packing and sealing of samples etc. should be

done at the place of seizure. However, the Apex Court held that not doing of

said tasks at the place of seizure would not render seizure doubtful and

deviation from standing instructions, for justifiable and valid reasons, is

permissible. Since, it is for the Court concerned to look into the validity of

those reasons. It is, therefore, premature for this Court to conclude on that

aspect, while deciding the application for regular bail.

8 .1 2 This Court is conscious that it is neither deciding appeal nor is it

deciding revision and it is at the stage of pending trial that the applicant is

before this Court for regular bail. This is an application for regular bail qua

the serious offence under the NDPS Act, the applicant is charged with and the

trial is not likely to begin in the near future. It is a well laid down law as to

when the regular bail can be granted. Moreover, Section 37 of the NDPS Act

is also to be regarded, while considering this request, where, this Court

needs to consider existence of prima facie case and those broad principles,

which have been laid down by the Apex Court in catena of decisions and

particularly, as concised in 'SANJAY CHANDRA' (Supra). Neitherit is required

to appreciate any evidence nor to conclude on any of the aspects. The broad

possibility of prima facie involvement is if considered, it is revealed from the

record that four packets were seized, i.e. two from the office of Shree

Mahabali Express Pvt. Ltd. and other two from the residence of A-1. Further,

12-10-2021 (Page 19 of 38) www.manupatra.com Central University of South Bihar

the identification of A-3 is through the photograph by the personnel of the

courier company, which is a procedure, as rightly pointed out by the learned

Sr. Counsel, Mr. Raju, it is not acceptable under the procedural law. So far as

the supply to the courier company at Mumbai and its sending of the articles

abroad are the questions to be determined by the Court concerned, at the

relevant point of time, after permitting the prosecution to adduce evidence

and to appreciate the same, as is necessary under the law.

8.13 Suffice to hold, at this stage, that the case of the NCB is of continuous

export of the contraband to the foreign countries through the courier

company based at Mumbai and New Delhi. It is, further, revealed from the

record that the investigation qua those courier companies is under progress.

Therefore, the limited case qua the present applicant will have to be

considered under Section 67 of the NDPS Act.

8.14 This takes this Court to the question of involvement with the aid of

statements recorded under Section 68 of the NDPS Act.

8.15 It is not in dispute that prior to the arrest of all the three accused,

these statements have been recorded by the NCB. Firstly, the statement of A-

1 came to be recorded on 28.03.2017, who revealed the names of A-3 and A-

2, i.e. the present applicant. Therefore, both A-2 and A-3 were called and

their statements under Section 67 of the NDPS Act came to be recorded,

which subsequently led to their arrest. The details with regard to the supply

of the contraband abroad, is prima facie also revealed in their statements. As

can be noticed, in all matters under the NDPS Act, the heavy reliance is

placed on the statements recorded under Section 67 of the NDPS Act.

8.16 If, one looks at the details provided by each of the accused in their

respective statement, recorded under Section 67 of the NDPS Act, they reveal

as to how extensively and hos systematically, the supply of drugs to USA and

Canada continued. The regular contact based at USA and Canada and sending

of them of the bottles of 'Kamini Vidravan Rus' on regular basis. It is also the

revelation of sending of consignment for about seven times, consisting 650

bottles per consignment and earning of huge amounts by the accused.

8 .1 7 In the case of 'UNION OF INDIA VS. BAL MUKUND AND OTHERS'

(Supra), the conviction was solely based on confessional statement of the

co-accused, where, the Apex Court held that the conviction should not be

based solely on the basis of statement of the co-accused, without

independent corroboration, especially when retracted. The Court, further,

held that holistic approach needs to be taken by weighing evidentiary value

of the confessional statement to see the ground realities, since, the

authorities under the NDPS Act can always show that the accused was not

arrested before such statement was recorded.

8.18 In the case of 'TOFAN SINGH VS. STATE OF TAMIL NADU' (Supra), the

statement under Section 67 of the NDPS Act was recorded by the NDPS

Officer, who was allegedly the investigating officer, as provided under

Section 53, and who also had made the seizure and arrest under Section 42

of the NDPS Act. The question before the Apex Court was whether, such a

statement can be made a sole basis, by construing the same as substantial

evidence, to record conviction. Considering the fact that such a confession

12-10-2021 (Page 20 of 38) www.manupatra.com Central University of South Bihar

was retracted, the Apex Court referred the matter to the larger Bench to

decide the specific issue and the related issues with the same. It would be

vital, at this stage, to reproduce relevant observations, which read thus:

"16. A perusal of the impugned judgment reveals that as many as six

arguments were advanced before the High Court, attacking the

findings of the learned trial Court. Taking note of these grounds of

appeal, the High Court framed the questions in para 12 of the

judgment. We reproduce herein below those six questions

formulated by the High Court which reflected the nature defence:

(i) Whether Section 50 of the NDPS Actis complied with or

not?

(ii) Whether the provisions of Section 42 of the NDPS Act is

complied with or not?

(iii) Whether non-examination of drivers and non-seizure of

vehicle/car are fatal to the case of the prosecution?

(iv) Whether Section 67 statements of the accused is

reliable?

(v) Whether accused 2 is entitled to invoke Section 30 of the

NDPS Act?

(vi) Whether conviction and sentence passed by the trial

Court is sustainable?

17. Obviously, all these questions have been answered by the High

Court against the appellant herein as the outcome of the appeals has

gone against the appellant. However, it is not necessary to mention

the reasons/rationale given by the High Court in support of its

conclusion in respect of each and every issue. We say so because of

the reason that all the aforesaid contentions were not canvassed

before us in the present appeal. Thus, eschewing the discussion

which is not relevant for these appeals, we would be narrating the

reasons contained in the impugned judgment only in respect of those

grounds which are argued by Mr. Sushil Kumar Jain, learned Counsel

appearing for the appellant, that too while taking note of and dealing

with those arguments.

THE ARGUMENTS:

18. After giving brief description of the prosecution case, in so far as

the alleged involvement of the appellant is concerned. Mr. Sushil

Kumar Jain drew our attention to the following aspects as per the

prosecution case itself:

(a) In the present case in the prior secret information with

the police, there was no prior information with regard to the

appellant herein. The secret information (Ex. P-72) does not

disclose the name of the appellant at all.

(b) On the date of incident also, the appellant was found

12-10-2021 (Page 21 of 38) www.manupatra.com Central University of South Bihar

sitting on the front seat alongwith the two drivers who have

been let off by the investigating agency itself and the

ambassador car from which the recoveries had been effected

has also not been seized. The said drivers could have been

the best witnesses but they have not been examined by the

prosecution.

(c) The recovery of the narcotic substance was made at the

instance of A1 and A2 (and not the appellant herein), who

while sitting on the back seat took out a green colour bag

from beneath their seat and handed it over to PW. 7. The

appellant cannot be said to be in conscious possession of

the narcotic substance.

(d) In the search conducted of the appellant herein, the

raiding party found Indian currency of Rs. 680/- (vide Ex. P-

11) which is M.O. 15 and two second class train tickets from

Shamgarh to Chennai. Thus no incriminating material has

been recovered from the appellant. Further there is also no

recovery of any mobile phone from the appellant herein

which could link the appellant with the other co- accused.

(e) The prosecution case hinges solely upon the confessional

statement of the appellant herein (Ex. P-9), which was

recorded by PW. 2-R. Murugan under Section 67 of the Act,

and the same person acted as the investigating officer in the

present case.

1 9 . From the above, Mr. Jain argued that there was no evidence

worth the name implicating the appellant except the purported

confessional statement of the appellant recorded under Section 67 of

the NDPS Act. After drawing the aforesaid sketch, Mr. Jain

endeavoured to fill therein the colours of innocence in so far as the

appellant is concerned with the following legal submissions:-

(I) It was argued that the conviction of the appellant is

based upon a purported confessional statement (Ex. P-9]

recorded by PW. 2 R. Murugan under the provisions of

Section 67 of the NDPS Act, which did not have any

evidentiary value. Mr. Jain submitted in this behalf that:

(a) There is no power under Section 67 of the NDPS Act to

either record confessions or substantive evidence which can

form basis for conviction of an accused, in as much as:

(i) The scheme of the Act does not confer any power upon

an officer empowered under Section 42 to record

confessions since neither a specific power to record

confession has been conferred as was provided under

Section 15 of the Terrorist and Disruptive Activities

(Prevention) Act, 1987 (TADA) or under Section 32 of the

Prevention of Terrorism Act, 2002 (POTA) nor the power

under Section 67 is a power to record substantive "evidence"

as in Section 108 of the Customs Act or Section 14 of the

12-10-2021 (Page 22 of 38) www.manupatra.com Central University of South Bihar

Central Excise Act which are deemed to be judicial

proceedings as specifically provided under Section 108(4) of

the Customs Act or Section 14(3) of the Central Excise Act.

(ii) The powers under Section 67 has been conferred upon

an officer under Section 42 so that such officer can

effectively perform his functions. The power under Section

67 is incidental to and intended to enable an officer under