Professional Documents

Culture Documents

Discussions On Chapter 4

Uploaded by

Norren Thea VlogsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discussions On Chapter 4

Uploaded by

Norren Thea VlogsCopyright:

Available Formats

ART.

1843 - DEFINITION OF LIMITED PARTNERSHIP

1) One or more general partners and one or more limited partners.

2) Limited partners are not subsidiarily liable or not liable beyond their

capital contribution.

3) Limited partners do not participate in the management.

4) Comply (mandatory) with statutory requirements in its formation.

WHAT IS SUBSIDIARY LIABILITY?

The partner is liable beyond his capital contribution or after all assets of the

partnership is exhausted, the partner pays the partnership liabilities from his

personal funds.

ART. 1844 – STATUTORY REQUIREMENTS

1) Certificate or Articles of Limited Partnership

2) File the certificate or articles at the SEC.

3) Important contents or the certificate or articles:

a) Add the word “Limited” in the partnership name.

b) Name, address, contribution of limited partner

ART. 1845 – CONTRIBUTIONS OF A LIMITED PARTNER

1) Cash or property

2) Services is not allowed

ART. 1846 – EFFECT IF SURNAME OF LIMITED PARTNER IS INCLUDED IN THE

PARTNERSHIP NAME

1) Surname of limited partner shall not appear in the partnership name

UNLESS also a surname of general partner or surname appeared prior to

becoming a limited partner

2) Violation – limited partner is liable as a general partner or subsidiarily

liable to partnership creditors.

ART. 1847 – LIABILITY FOR FALSITY IN CERTIFICATE OR ARTICLES OF LIMITED

PARTNERSHIP

1. Not liable as a general partner; merely a statutory penalty

ART. 1848 – EFFECT OF PARTICIPATION IN THE MANAGEMENT

1) Limited partner becomes liable as a general partner; subsidiarily liable.

2) Provision contemplates existing limited partnership. If participation is

during liquidation, not liable as a general partner.

ART. 1849 – ADMISSION OF ADDITIONAL LIMITED PARTNERS

1) File an amendment to the original certificate or articles of limited

partnership.

ART. 1850 – ACTS WHICH REQUIRES CONSENT OR RATIFICATION OF LIMITED

PARTNERS.

1) Contravention of the certificate i.e. any other business

2) Make impossible to carry the ordinary business

3) Confess a judgment

4) Possess partnership property or assign SPP

5) Admit a general partner

6) Admit a limited partner

7) Continue the business on the death, retirement, insanity, civil

interdiction or insolvency of a general partner.

ART. 1838 – RIGHTS OF A LIMITED PARTNER

1) Inspect and copy partnership books

2) Demand true and full information of all things affecting the partnership.

3) Ask for dissolution and winding up by decree of court.

4) Receive a share of the profits or other compensation by way of income

5) Return of his contribution (Art. 1856 & 1857)

ART. 1852 – STATUS OF PERSONS IN CASE OF FAILURE TO CREATE A LIMITED

PARTNERSHIP

1. Not liable as a general partner provided:

a) Renounces his interest in the profits or other compensation by

way of income before partnership becomes liable to third persons

b) Surname does not appear in the partnership name

c) Does not participate in the management

ART. 1853 – EFFECT OF BEING A GENERAL AND LIMITED PARTNER AT THE SAME

TIME

1) Has rights and powers of a general partner.

2) Subsidiarily liable to creditors

3) With respect to his contribution as limited partner, has rights of a

limited partner insofar as other partners are concerned (Art. 1855-

1858)

ART. 1854 – ALLOWABLE AND PROHIBITED BUSINESS TRANSACTIONS WITH

LIMITED PARTNERS.

1) ALLOWABLE TRANSACTIONS

a. Grant loans to the partnership

b. Other business transactions

c. Receive a pro rata share of the partnership assets except if also a

general partner

2) PROHIBITED TRANSACTIONS

a. Receiving or holding as collateral security any partnership property

b. Receiving any payment, conveyance, release from liability if it will

prejudice third persons

3) Any violation of the prohibition is presume to defraud partnership

creditors

4) Third persons enjoy preferential rights to the partnership property over

limited partners

ART. 1855 – PREFERRED LIMITED PARTNERS

1) Preference over other limited partners

a) Return of contribution

b) Compensation by way of income

c) Any other matter

2) Preference must be stated in the certificate or articles otherwise equal

footing.

ART. 1856 – CONDITIONS WHEN A LIMITED PARTNER CAN RECEIVED

COMPENSATION BY WAY OF INCOME OR SHARE IN THE

PROFITS

1) Excess of partnership assets over partnership liabilities after payment

2) Liabilities to limited partners are not included in no. 1 (only liabilities to

third persons)

ART. 1857 – REQUISITES FOR RETURN OF CONTRIBUTION

1. REQUISITES

a) All liabilities have been paid or assets are sufficient to pay such liabilities

b) Consent of all partners (general and limited) except when matter of right

c) Certificate is cancelled or amended.

2. When return of contribution is a matter of right:

a) Dissolution

b) On the date specified in the articles or certificate

c) After expiration of six months’ notice in writing given to the partners

if no time is fixed.

3. Return of contribution shall be cash only even if property is contributed

EXCEPT:

a) Agreement

b) Consent of all partners (general or limited)

4. Grounds for dissolution by a limited partner (court decree):

a) Demand for the return of contribution is denied even if he has a right

b) Return of contribution is a matter of right but assets are not

sufficient to pay liabilities.

c) Judicial dissolution only if other partners are not willing to dissolve

extrajudicially.

ART. 1858 – LIABILITY OF LIMITED PARTNER TO PARTNERSHIP

1) Not to the partnership creditors EXCEPT for false statement (art. 1847)

2) For unpaid contribution

3) As trustee for property not contributed or wrongfully returned to

him, money and other property wrongfully paid or conveyed to him

on account of his contribution

4) Requisites for waiver or compromise of liability of limited partner

a) Consent of all partners

b) Does not prejudice partnership creditors.

5) Liability for return of contribution lawfully received – to pay creditors

who extended credit before such return.

ART. 1859 – ASSIGNMENT OF LIMITED PARTNER’S INTEREST

1) No dissolution is effected.

2) Rights of assignee:

a) Receive the share of the profits of the assignor

b) No right to accounting except when he becomes a substituted

limited partner.

3) When assignee becomes a substituted limited partner:

a) Consent of all partners

b) Amendment of certificate or articles

c) Amendment must be registered with SEC

4) Liability of substituted limited partner (SLP) and assignor

a) SLP is liable for all liabilities of the assignor

b) Assignor is released from liability EXCEPT when there is false

statement in the certificate and liability arose before the

substitution

ART. 1860 – EFFECT OF RETIREMENT, DEATH, INSOLVENCY, INSANITY OR CIVIL

INTERDICTION OF A GENERAL PARTNER

1) Partnership is dissolved unless business is continued by the remaining

general partners:

a) Remaining general partners have a right to continue business

b) Consent of all partners

2) If it involves a limited partner, no dissolution takes place

ART. 1861 – RIGHT OF EXECUTOR ON DEATH OF A LIMITED PARTNER

1) Settle the affairs of the limited partner.

2) Act as a substituted limited partner

ART. 1862 – RIGHTS OF CREDITORS OF LIMITED PARTNER

1) Ask the court for charging order for the payment of claims

2) Interest charged may be redeemed by the separate property of any

general partner

3) Interest charged may be redeemed by SPP with consent of all partners

ART. 1863 – PRIORITY IN THE DISTRIBUTION OF PARTNERSHIP ASSETS.

1) Due to creditors (including limited partners)

2) Due to limited partners – profits

3) Due to limited partners – contribution

4) Due to general partners – liability

5) Due to general partners – profits

6) Due to general partners – contribution

ART. 1864 – CERTIFICATE OR ARTICLES IS CANCELLED

1) Dissolution

2) No more limited partners

3) All other cases requires only amendment

ART. 1865 – REQUIREMENTS FOR AMENDMENT/CANCELLATION OF

CERTIFICATE OR ARTICLES

1) In writing

2) Signed and sworn

3) Filed before the SEC

ART. 1866 – A MERE CONTRIBUTOR

1) Limited partner is not included in the suit except to enforce a limited

partner’s liability

2) No right of action against third persons involving partnership affairs

except to enforce a limited partner’s right.

ART. 1867 – PROVISIONS FOR EXITING LIMITED PARTNERSHIP (NOT

APPLICABLE ANYMORE AT THE PRESENT)

You might also like

- CHAPTER 4 Limited PartnershipDocument5 pagesCHAPTER 4 Limited PartnershipWuwu Wuswewu100% (1)

- Difference Between A General Partnership and Limited PartnershipDocument7 pagesDifference Between A General Partnership and Limited PartnershipBasriJayNo ratings yet

- 1040-V Template 10-03-08Document1 page1040-V Template 10-03-08Justin Vance100% (6)

- Law NotesDocument15 pagesLaw Notessweet ecstacyNo ratings yet

- (Outline) LAW LimitedPartnershipDocument7 pages(Outline) LAW LimitedPartnershipPearl Allyssa JimlanNo ratings yet

- Article 1843-1867 Limited Partnership CastañedaDocument6 pagesArticle 1843-1867 Limited Partnership CastañedaAbigail BantilloNo ratings yet

- Group 6 Report HandoutsDocument13 pagesGroup 6 Report HandoutsAlia Arnz-DragonNo ratings yet

- Limited Partnership - Grp. 4Document29 pagesLimited Partnership - Grp. 4Steven Kyle PeregrinoNo ratings yet

- BLR PC4Document9 pagesBLR PC4Kyang WynnNo ratings yet

- Limited Partnership - PH Civil LawDocument13 pagesLimited Partnership - PH Civil LawtransitxyzNo ratings yet

- Notes On Limited PartnershipDocument15 pagesNotes On Limited Partnershipattyaarongocpa9645No ratings yet

- Characteristics: Limited PartnershipDocument4 pagesCharacteristics: Limited PartnershipYvonne Mae TeopeNo ratings yet

- There Are Two Essential Requisites in The Formation of A Limited PartnershipDocument5 pagesThere Are Two Essential Requisites in The Formation of A Limited PartnershipAlan Nageena Arumpac MamutukNo ratings yet

- Partnership ReviewerDocument19 pagesPartnership ReviewerRenarah YeshmeerNo ratings yet

- Chapter 4 - Limited PartnershipDocument5 pagesChapter 4 - Limited PartnershipRica Meryl OcsinNo ratings yet

- CHAPTER 4 Limited PartnershipDocument8 pagesCHAPTER 4 Limited Partnershipjacelshyene.payotNo ratings yet

- LIMITED PARTNERSHIP Summary of Limited PartnershipDocument9 pagesLIMITED PARTNERSHIP Summary of Limited PartnershipAlia Arnz-DragonNo ratings yet

- 6chapter 4Document86 pages6chapter 4Harold B. LacabaNo ratings yet

- Trust, Partnership & AgencyDocument20 pagesTrust, Partnership & AgencyAejay Villaruz BariasNo ratings yet

- Online Lecture On Law On Partnerships (Chapter 4, Limited Partnership) (Articles 1843 - 1867)Document28 pagesOnline Lecture On Law On Partnerships (Chapter 4, Limited Partnership) (Articles 1843 - 1867)Sehyuk LimNo ratings yet

- Law Compilation NotesDocument234 pagesLaw Compilation NotesJyNo ratings yet

- Module 22 - Limited PartnershipsDocument11 pagesModule 22 - Limited PartnershipsNathan Kurt LeeNo ratings yet

- Partnership Notes Chapter4 - JBTDocument4 pagesPartnership Notes Chapter4 - JBTGlenzo Jaye Pigao Daroy100% (1)

- Chapter 4 LTD PTNDocument6 pagesChapter 4 LTD PTNJessica HernandezNo ratings yet

- Answers 5Document5 pagesAnswers 5Xiv NixNo ratings yet

- Partnership Session 9 Limited PDocument5 pagesPartnership Session 9 Limited PmerryNo ratings yet

- Chapter 4 Ltd. PartnershipDocument10 pagesChapter 4 Ltd. PartnershipJave MagsaNo ratings yet

- Coblaw2 Q4Document5 pagesCoblaw2 Q4Al ChuaNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument10 pagesChapter 3 Dissolution and Winding UpNoel Diamos Allanaraiz100% (1)

- Notes in PartnershipDocument7 pagesNotes in Partnershipmakichanzenin01No ratings yet

- Law On Partnership and Corporation Study Guide de LeonDocument9 pagesLaw On Partnership and Corporation Study Guide de LeonLhorene Hope Dueñas0% (2)

- Limited Partnership DiscussionDocument46 pagesLimited Partnership DiscussionJui ProvidoNo ratings yet

- Limited Part QuizDocument14 pagesLimited Part QuizronaldNo ratings yet

- Limited PartnershipDocument46 pagesLimited PartnershipGrace EnriquezNo ratings yet

- Group 4 - ReportingDocument88 pagesGroup 4 - ReportingRence MarcoNo ratings yet

- CHAPTER 4 (Partnership) Part 1Document3 pagesCHAPTER 4 (Partnership) Part 1Maria AlegriaNo ratings yet

- Excerpt From PartnershipDocument2 pagesExcerpt From PartnershipCindy KateNo ratings yet

- Chapter 3 - BusLawDocument4 pagesChapter 3 - BusLawVIRAY, CRISTIAN JAY V.No ratings yet

- ARTICLE 1857 One of The Characteristics of Limited PartnershipsDocument6 pagesARTICLE 1857 One of The Characteristics of Limited PartnershipsJovelyn OrdoniaNo ratings yet

- Limited PartnershipDocument3 pagesLimited Partnershipiam McKoyNo ratings yet

- BL ReportingDocument35 pagesBL ReportingCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Limited Partnership CodalDocument5 pagesLimited Partnership Codaljeanvaljean999No ratings yet

- Notes - Partnership MIDTERM 1Document4 pagesNotes - Partnership MIDTERM 1Alvin Ryan KipliNo ratings yet

- ART 1843 1867 QuizDocument7 pagesART 1843 1867 QuizZatsumono YamamotoNo ratings yet

- Partnership: The Civil Code of The Philippines Articles 1767-1867Document29 pagesPartnership: The Civil Code of The Philippines Articles 1767-1867MyunimintNo ratings yet

- Liability of Substituted Partner and AssignorDocument3 pagesLiability of Substituted Partner and AssignorMaan ElagoNo ratings yet

- Partnership Report Art. 1839-1850Document5 pagesPartnership Report Art. 1839-1850Nehemiah MontecilloNo ratings yet

- PartnershipDocument5 pagesPartnershiponthecribNo ratings yet

- Partnerships DissolutionDocument8 pagesPartnerships DissolutionDEVELANo ratings yet

- Article 1831. On Application by or For A Partner The Court Shall Decree A DissolutionDocument6 pagesArticle 1831. On Application by or For A Partner The Court Shall Decree A DissolutionCyrus DaitNo ratings yet

- Agency, Trust & Partnership Reviewer - 1837-1886 (Cambri Notes)Document5 pagesAgency, Trust & Partnership Reviewer - 1837-1886 (Cambri Notes)Arvin FigueroaNo ratings yet

- Limited PartnershipDocument11 pagesLimited PartnershiparmeruNo ratings yet

- Limited Partnership Nos 1-5Document2 pagesLimited Partnership Nos 1-5Bryan Bab BacongolNo ratings yet

- Effects of Dissolution: InsanityDocument3 pagesEffects of Dissolution: InsanityEunice NavarroNo ratings yet

- Waiver or Compromise of Limited Partner's Liability in No. 3 and 4Document2 pagesWaiver or Compromise of Limited Partner's Liability in No. 3 and 4Gray JavierNo ratings yet

- LAWS Limited PartnershipDocument6 pagesLAWS Limited PartnershipAiwon Zeihane FloresNo ratings yet

- Art 1848-1852Document4 pagesArt 1848-1852Rea Jane B. MalcampoNo ratings yet

- Partnership NotesDocument8 pagesPartnership NotesWhensly Ann Heraña EspirituNo ratings yet

- Atp 1860-1863Document3 pagesAtp 1860-1863Charmaine Key AureaNo ratings yet

- Art 1846 - 1850Document10 pagesArt 1846 - 1850Dianne Kay EscobarNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Discussions On Cooperatives Discussion Part 1Document2 pagesDiscussions On Cooperatives Discussion Part 1Norren Thea VlogsNo ratings yet

- Discussios On Cooperatives Discussion Part 2Document4 pagesDiscussios On Cooperatives Discussion Part 2Norren Thea VlogsNo ratings yet

- Discussions On Chapter 2 Section 1Document7 pagesDiscussions On Chapter 2 Section 1Norren Thea VlogsNo ratings yet

- Discussions On Chapter 2Document13 pagesDiscussions On Chapter 2Norren Thea VlogsNo ratings yet

- Articles 1199 1206Document1 pageArticles 1199 1206Norren Thea VlogsNo ratings yet

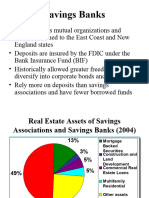

- Savings BanksDocument7 pagesSavings BanksLara KhanNo ratings yet

- Yveth Lumabi 1 C-BSOADocument8 pagesYveth Lumabi 1 C-BSOAYveth LumabiNo ratings yet

- Movies DatabaseDocument40 pagesMovies DatabasevatsonwizzluvNo ratings yet

- William WiseDocument1 pageWilliam Wiseanon_34046597No ratings yet

- Public Finance Solved MCQs (Set-1)Document8 pagesPublic Finance Solved MCQs (Set-1)Kiran Takale50% (2)

- Name Change Request Form: Folio NoDocument2 pagesName Change Request Form: Folio NoMohan PvdvrNo ratings yet

- accounting-theory-POSTULATES, PRINCIPLES, AND CONCEPTSDocument26 pagesaccounting-theory-POSTULATES, PRINCIPLES, AND CONCEPTSJhonNo ratings yet

- Renaissance School, Bulandshahr Renaissance School, BulandshahrDocument1 pageRenaissance School, Bulandshahr Renaissance School, BulandshahrTushar PaliwalNo ratings yet

- VC Associate Program CurriculumDocument4 pagesVC Associate Program CurriculumMochamad Arifin ZainulNo ratings yet

- ASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheDocument5 pagesASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheJiaXinLimNo ratings yet

- Acharya Nagarjuna University: Centre For Distance EducationDocument1 pageAcharya Nagarjuna University: Centre For Distance EducationprembiharisaranNo ratings yet

- Receipt 5Document2 pagesReceipt 5Monique Dos Passos RodriguesNo ratings yet

- Notes On Letter of CreditDocument6 pagesNotes On Letter of Creditsandeepgawade100% (1)

- Chapter 3Document55 pagesChapter 3Ahmed hassanNo ratings yet

- Fakulti Ekonomi Dan Pengurusan Eppd1033 Prinsip Perakaunan Tutorial 6 Topic: MerchandisingDocument4 pagesFakulti Ekonomi Dan Pengurusan Eppd1033 Prinsip Perakaunan Tutorial 6 Topic: MerchandisingHani Syazani B. Kamarudin ArifinNo ratings yet

- Electronic Fund Transfer SystemDocument7 pagesElectronic Fund Transfer SystemJatin BhatiaNo ratings yet

- TINCHODocument2 pagesTINCHOluna germallony gomez abrilNo ratings yet

- Public Notice - Empanelment of Valuers AHMEDABADDocument15 pagesPublic Notice - Empanelment of Valuers AHMEDABADDhruv AgrawalNo ratings yet

- Business Cycles & Theories of Business CyclesDocument7 pagesBusiness Cycles & Theories of Business CyclesAppan Kandala VasudevacharyNo ratings yet

- John Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsDocument6 pagesJohn Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsjohnrollNo ratings yet

- Ans MC1 - SchemaDocument11 pagesAns MC1 - SchemaXue Yin LewNo ratings yet

- Ar2018e 2Document287 pagesAr2018e 2rmarea77No ratings yet

- Cost Chargeable To LandDocument13 pagesCost Chargeable To LandAbegail AdoraNo ratings yet

- Explained Risk AppetiteDocument30 pagesExplained Risk Appetiteeftychidis100% (3)

- Accsys Group Annual Report 2017Document116 pagesAccsys Group Annual Report 2017sharkl123No ratings yet

- PPSC Comerece Lecture Past PaperDocument1 pagePPSC Comerece Lecture Past PaperSalman AliNo ratings yet

- Abyip 2023 Ibuan FinalDocument1 pageAbyip 2023 Ibuan FinalDexter OndaNo ratings yet

- Simple InterestDocument12 pagesSimple InterestyonesNo ratings yet

- Exchange Rate 31 May 2023Document2 pagesExchange Rate 31 May 2023BRTA SCSNo ratings yet