Professional Documents

Culture Documents

Bus1103 Unit 6 Learning Journal Bus1103 Unit 6 Learning Journal

Uploaded by

Urmila RenetaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bus1103 Unit 6 Learning Journal Bus1103 Unit 6 Learning Journal

Uploaded by

Urmila RenetaCopyright:

Available Formats

lOMoARcPSD|9026029

Bus1103 unit 6 Learning Journal

Microeconomics (University of the People)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Urmila Shamsundar (urmila.reneta@gmail.com)

lOMoARcPSD|9026029

Bus1103 unit 6 Learning Journal

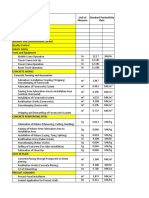

Refer to the Unit 6 Learning Journal Poverty Trap Tables spreadsheet to complete the

assignment.

Susan is a single mother with three children. She is a cashier at a food market earning $7.75 per

hour and works up to 2,000 hours per year. She is eligible for government benefits, so if she does

not earn any income, she will receive a total of $17,050 per year. She can work and still receive

government benefits, but for every $1 of income, her government stipend is $1 less.

The government has decided to change the benefits policy of every $1 of income earned to

reduce the government’s stipend by 60 cents. How will this change Susan's benefits received?

What are her new choices? Complete the Revised Poverty Trap Table to present Susan’s options

and provide answers to the following:

● What are the advantages of Susan working?

● What are the disadvantages of Susan working?

● What are the advantages of Susan receiving government benefits?

● What are the disadvantages of Susan receiving government benefits?

● Based on your findings from the Poverty Trap Table, should Susan continue to work

or only receive government benefits? Why or why not?

● Based on your findings from the Revised Poverty Trap Table, should Susan continue

to work or only receive government benefits? Why or why not?

● What are your recommendations for Susan to progress from the poverty trap?

If the government changes the benefits policy of every $1 of income earned to reduce the

government’s stipend by 60 cents, Susan’s benefits would increase by $1200 (17,050 + 2,000 x

0.60). Her new choices are 2000 hours of leisure for $18,250 and 2000 hours of work for

$15,500.

The advantages of Susan working are that even if the government reduces or seizes the benefits,

she would still have something to fall back on. Therefore working gives her some form of

stability and security. Also, working gives a sense of identity as well as an intellectual challenge.

It is beneficial to her mental health to spend time with people within her age group to share ideas

and learn new things. Susan gets the benefit of upgrading her skills and learning new ones

timeously. Working women are generally believed to have self-confidence and independence.

The disadvantages of Susan working are that she would incur extra expenses. She would spend

more money on transport and work clothes. She would also have to consider committing her kids

to the nursery or childcare. She would miss out on seeing her children grow, and she would not

have much time to spend with her kids as she would be most probably too tired when she knocks

Downloaded by Urmila Shamsundar (urmila.reneta@gmail.com)

lOMoARcPSD|9026029

off from work.

The advantages of Susan receiving government benefits are that she would be able to provide for

her children’s basic human needs. Her children get to have a healthy lifestyle whether their

mother is working or not. Government benefits give Susan the flexibility of working or caring

for her children on a full-time basis.

The disadvantages of Susan receiving government benefits are that she might not have an

incentive to work. Government benefits hinder self-reliance and cause dependence. Receiving

government benefits would also make Susan economically inefficient.

Based on my findings from the poverty trap table, Susan has no incentive to work. She should

spend time looking after her children because whether she works or not, she still receives the

same amount. Staying home to look after her children would benefit the children as well as cut

the costs she would otherwise incur on childcare, transport and the like. Working does not

provide her with any financial gain.

Based on the revised poverty trap table, Susan should continue to work because the more she

works, the more money she would receive. She has an incentive to work. Working would provide

more financial gain for her.

I would recommend that Susan consider investing in online learning in order to acquire

education and new skills. She could also cut cost by doing some backyard vegetable gardening,

as well as save and start a small business. These may seem small, but they can help her progress

from the poverty trap.

References

1. Chen, J. (2020). Economics: Poverty Trap. Retrieved from

https://www.investopedia.com/terms/p/poverty-trap.asp

2. Greenlaw, S. A. & Shapiro, D. (2018). Principles of microeconomics, 2e. Open Stax Rice

University. Retrieved from https://d3bxy9euw4e147.cloudfront.net/oscms-

prodcms/media/documents/Microeconomics2e-OP.pdf

Downloaded by Urmila Shamsundar (urmila.reneta@gmail.com)

You might also like

- Refer To The Unit 4 Learning Journal Marginal Utility SpreadsheetDocument3 pagesRefer To The Unit 4 Learning Journal Marginal Utility SpreadsheetDouglas ArisiNo ratings yet

- BUS 1103 Learning Journal Unit 7Document5 pagesBUS 1103 Learning Journal Unit 7Julius OwuondaNo ratings yet

- Maternity Benefit ProjectDocument16 pagesMaternity Benefit ProjectS1626100% (1)

- Kaba Simplex Catalog and Price ListDocument72 pagesKaba Simplex Catalog and Price ListSecurity Lock DistributorsNo ratings yet

- U 6 LJ Poverty Trap TableDocument12 pagesU 6 LJ Poverty Trap TableJaphet ZilaNo ratings yet

- Bus 1103 Learning Journal Unit 3Document2 pagesBus 1103 Learning Journal Unit 3Mailu Shirl100% (1)

- BUS 1103 Discussion Forum Unit 5Document2 pagesBUS 1103 Discussion Forum Unit 5Julius OwuondaNo ratings yet

- BUS 1103 Written Assignment Unit 4Document4 pagesBUS 1103 Written Assignment Unit 4Julius OwuondaNo ratings yet

- Module Home Business Break-Even AnalysisDocument6 pagesModule Home Business Break-Even AnalysisJude KCNo ratings yet

- Bus 1102 Discussion Forum Init 8Document1 pageBus 1102 Discussion Forum Init 8janice100% (1)

- Learning Journal Unit 4 15-07-2021Document3 pagesLearning Journal Unit 4 15-07-2021Winnerton GeochiNo ratings yet

- Calculating real GDP and limitations of GDPDocument2 pagesCalculating real GDP and limitations of GDPFirew AberaNo ratings yet

- BUS 1103 Written Assignment Unit 5Document5 pagesBUS 1103 Written Assignment Unit 5Julius OwuondaNo ratings yet

- How immigration impacts global economic growthDocument2 pagesHow immigration impacts global economic growthJulius OwuondaNo ratings yet

- Finance Final ExamDocument3 pagesFinance Final Exambips99No ratings yet

- Running Head: Poverty Impact Analysis 1Document8 pagesRunning Head: Poverty Impact Analysis 1Charles Bishop OgollaNo ratings yet

- Community Programs Assignment Amanda McelvanyDocument7 pagesCommunity Programs Assignment Amanda Mcelvanyapi-308562428No ratings yet

- Should women choose between family and career or combine bothDocument3 pagesShould women choose between family and career or combine bothЖеня КрасниковаNo ratings yet

- Read to Me Talk to Me Listen to Me: Your Child's First Three YearsFrom EverandRead to Me Talk to Me Listen to Me: Your Child's First Three YearsRating: 3 out of 5 stars3/5 (2)

- 7. LUYỆN VIẾT ĐOẠN VĂN TIẾNG ANH - ON CHILD LABOURDocument3 pages7. LUYỆN VIẾT ĐOẠN VĂN TIẾNG ANH - ON CHILD LABOURVũ TuấnNo ratings yet

- MCRPDocument5 pagesMCRPapi-336860248No ratings yet

- Letter To A Person in ChargeDocument2 pagesLetter To A Person in Chargeapi-707123850No ratings yet

- Povertysimulationstudents 3Document8 pagesPovertysimulationstudents 3api-327711832No ratings yet

- Ending Child Labor Through Education and ProtectionDocument2 pagesEnding Child Labor Through Education and ProtectionVania0% (1)

- II. Summarised Note (P18 - P24) - Human Capital - Education - Child LabourDocument7 pagesII. Summarised Note (P18 - P24) - Human Capital - Education - Child LabourRishav SahuNo ratings yet

- Senate Hearing, 112TH Congress - Beyond Mother's Day: Helping The Middle Class Balance Work and FamilyDocument66 pagesSenate Hearing, 112TH Congress - Beyond Mother's Day: Helping The Middle Class Balance Work and FamilyScribd Government DocsNo ratings yet

- Report On Replacing Welfare Programs With A Universal Basic IncomeDocument6 pagesReport On Replacing Welfare Programs With A Universal Basic IncomeCongressman Dave Brat100% (1)

- "Concerns of Working Muslim Women and Impact of Various Factors On Employment of Working Muslim Women in India" PDFDocument7 pages"Concerns of Working Muslim Women and Impact of Various Factors On Employment of Working Muslim Women in India" PDFarcherselevatorsNo ratings yet

- Final DraftDocument9 pagesFinal Draftapi-242487403No ratings yet

- Dissertation Presentation 1Document10 pagesDissertation Presentation 1Manisha HirawatNo ratings yet

- SP Essay FDDocument11 pagesSP Essay FDapi-660384791No ratings yet

- One Child PolicyDocument2 pagesOne Child PolicyShruthimaniNo ratings yet

- Creating Opportunity Requiring ResponsibilityDocument18 pagesCreating Opportunity Requiring ResponsibilityAustralianLaborNo ratings yet

- The Effects of Paid Family and Medical Leave On Employment Stability and Economic SecurityDocument30 pagesThe Effects of Paid Family and Medical Leave On Employment Stability and Economic SecurityCenter for American ProgressNo ratings yet

- Child Labor in IndiaDocument4 pagesChild Labor in Indiahirak jyoti nathNo ratings yet

- Worklife Balance of Women WorkersDocument8 pagesWorklife Balance of Women WorkerskarthinathanNo ratings yet

- Policy Memo On Familias en Accion in ColombiaDocument11 pagesPolicy Memo On Familias en Accion in ColombiaJuliana NeiraNo ratings yet

- Health and Social Care Coursework A LevelDocument4 pagesHealth and Social Care Coursework A Leveliafafzhfg100% (2)

- Child Labor - The Snag and Way OutDocument1 pageChild Labor - The Snag and Way OutReyvennNo ratings yet

- Child LabourDocument1 pageChild Laboursongspk100No ratings yet

- GD Assignment 2Document8 pagesGD Assignment 2munira rangwalaNo ratings yet

- Research Essay - Olivia Dao 10Document15 pagesResearch Essay - Olivia Dao 10api-609496312No ratings yet

- BCS Activity-The Invisible WomanDocument3 pagesBCS Activity-The Invisible WomanpankhuriNo ratings yet

- Financial Assistance For Single Mothers May Just Be What You NeedDocument5 pagesFinancial Assistance For Single Mothers May Just Be What You NeedSingleNo ratings yet

- TY BMM Students Presentation on Causes and Effects of Child LabourTITLEDocument15 pagesTY BMM Students Presentation on Causes and Effects of Child LabourTITLEChetanKambleNo ratings yet

- Child LabourDocument2 pagesChild LabourMunish DograNo ratings yet

- Head Start of Lane County: Creative BriefDocument6 pagesHead Start of Lane County: Creative BriefZackNo ratings yet

- Soc Prj. Working WomenDocument4 pagesSoc Prj. Working Womenarti shahNo ratings yet

- Armstrong Breastfeeding 5Document14 pagesArmstrong Breastfeeding 5api-518977758No ratings yet

- The Importance of Preschool and Child Care For Working MothersDocument7 pagesThe Importance of Preschool and Child Care For Working MothersCenter for American Progress100% (2)

- SW 4710Document12 pagesSW 4710api-242944449No ratings yet

- Research Essay On Unemployment 1Document11 pagesResearch Essay On Unemployment 1api-582527005No ratings yet

- Graduation Project SpeechDocument6 pagesGraduation Project Speechapi-337648403No ratings yet

- Laura'S Employment Data: A Case Study: BackgroundDocument2 pagesLaura'S Employment Data: A Case Study: Backgroundmarjorie ballesterosNo ratings yet

- High Cost of Money in India Leading To Poverty.Document5 pagesHigh Cost of Money in India Leading To Poverty.Abhijeet BeniwalNo ratings yet

- Fact Sheet: Child CareDocument4 pagesFact Sheet: Child CareCenter for American ProgressNo ratings yet

- HW 410 Final Project HeatherstmyerDocument10 pagesHW 410 Final Project Heatherstmyerapi-625376854No ratings yet

- Child Labour Laws in India Explained in 40 CharactersDocument21 pagesChild Labour Laws in India Explained in 40 Characterssusanleniya100% (1)

- INTRO TO CHILD LABOUR ISSUESDocument12 pagesINTRO TO CHILD LABOUR ISSUESBlazeNo ratings yet

- ASSIGMENT Bbgo4103Document15 pagesASSIGMENT Bbgo4103vaishnaviNo ratings yet

- A. Poverty Trap Table: Number of Work Hours Earnings From Work Government BenefitsDocument2 pagesA. Poverty Trap Table: Number of Work Hours Earnings From Work Government BenefitsUrmila RenetaNo ratings yet

- A SelfDocument2 pagesA SelfUrmila RenetaNo ratings yet

- Written Assignment Week 2 JFFFFDocument3 pagesWritten Assignment Week 2 JFFFFUrmila RenetaNo ratings yet

- UNIV 1001 Unit 2 - Sample Peer Review RubricdsDocument4 pagesUNIV 1001 Unit 2 - Sample Peer Review RubricdsUrmila RenetaNo ratings yet

- Written Assignment Unit 2Document4 pagesWritten Assignment Unit 2Urmila RenetaNo ratings yet

- Unit 2 - Fictitous Student AssignmentDocument2 pagesUnit 2 - Fictitous Student AssignmentKatiuska KtskNo ratings yet

- Peer AssessmentDocument5 pagesPeer AssessmentUrmila RenetaNo ratings yet

- Written Assignment Week 2 JFFFFDocument3 pagesWritten Assignment Week 2 JFFFFUrmila RenetaNo ratings yet

- Written Assignment Week 2 JFFFFDocument3 pagesWritten Assignment Week 2 JFFFFUrmila RenetaNo ratings yet

- 250kLD STP STR Design FinalDocument64 pages250kLD STP STR Design Finalraghu kiranNo ratings yet

- Food Products in KeralaDocument5 pagesFood Products in KeralaAvijitSinharoyNo ratings yet

- International Economics 11th Edition Salvatore Solutions ManualDocument17 pagesInternational Economics 11th Edition Salvatore Solutions Manualsaintcuc9jymi8100% (23)

- Kingfisher Airlines Failure: Financial Mismanagement and Inconsistent DecisionsDocument14 pagesKingfisher Airlines Failure: Financial Mismanagement and Inconsistent DecisionsAnwesa PaulNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Pakistan's Early Industrialization and Economic GrowthDocument13 pagesPakistan's Early Industrialization and Economic GrowthTyped FYNo ratings yet

- ITP-FW For Civil & Building WorksDocument18 pagesITP-FW For Civil & Building WorksjoaoNo ratings yet

- Cartas de ReclamoDocument9 pagesCartas de ReclamoLourdes Sucely Pirir ToxcónNo ratings yet

- Chapter 2 - Opportunities and RewardDocument31 pagesChapter 2 - Opportunities and RewardBui Le Thuy Trang (FE FIC HN)No ratings yet

- Explosion-proof fluorescent lighting fittingsDocument6 pagesExplosion-proof fluorescent lighting fittingsDandi ZulkarnainNo ratings yet

- Mohite Suzuki Kolhapur and Star Local Mart Kolhapur Travling Sheet 16-11-2023 To 21-11-2023Document3 pagesMohite Suzuki Kolhapur and Star Local Mart Kolhapur Travling Sheet 16-11-2023 To 21-11-2023phamberkarNo ratings yet

- Elements of Financial Statements: AssetsDocument39 pagesElements of Financial Statements: AssetsEdna MingNo ratings yet

- Annex 30 - BRSDocument1 pageAnnex 30 - BRSLikey PromiseNo ratings yet

- Contract Equipment BillingDocument2 pagesContract Equipment BillingCollins Allen IversonNo ratings yet

- Flipkart Labels 30 Mar 2017 11 14 PDFDocument1 pageFlipkart Labels 30 Mar 2017 11 14 PDFbalkar singhNo ratings yet

- Ekoko 55Document11 pagesEkoko 55QS OH OladosuNo ratings yet

- Productivity RateDocument5 pagesProductivity RateSarah TolineroNo ratings yet

- Etiket Lion AirDocument4 pagesEtiket Lion AirVirama KalimantanNo ratings yet

- AA Chap 14Document28 pagesAA Chap 14Thu NguyenNo ratings yet

- Pre Seen Case Study For BM Paper 1 (HL & SL)Document5 pagesPre Seen Case Study For BM Paper 1 (HL & SL)Siddhant MaheshwariNo ratings yet

- Reinforced Concrete Bridge Deck DesignDocument11 pagesReinforced Concrete Bridge Deck DesignAhmad AlamNo ratings yet

- Pr-Smarthouse Collapsible Container HouseDocument3 pagesPr-Smarthouse Collapsible Container HouseMabs BalatbatNo ratings yet

- Escorts MumbaiDocument1 pageEscorts MumbaiRiya RoyNo ratings yet

- Demand Letter - FRIASDocument1 pageDemand Letter - FRIASPenguin 37No ratings yet

- Rubber Statistical News: The TrendDocument4 pagesRubber Statistical News: The TrendSayantan ChoudhuryNo ratings yet

- Main Chowk Bhilwadi Dist-Sangli State Name:Maharashtra, Code: 27 Place of Supply:MaharashtraDocument1 pageMain Chowk Bhilwadi Dist-Sangli State Name:Maharashtra, Code: 27 Place of Supply:Maharashtrastamboli9No ratings yet

- Business 2008 PDFDocument24 pagesBusiness 2008 PDFAndrew ArahaNo ratings yet

- Mohammed Yanus LessonsDocument6 pagesMohammed Yanus LessonsEduardo EisenhutNo ratings yet