Professional Documents

Culture Documents

Individual Tax - Problems

Uploaded by

Julienne Julio100%(1)100% found this document useful (1 vote)

2K views5 pagesKathlyn, a Norwegian lecturer, earned P320,000 in professional fees and P140,000 from book sales during a four-week lecture series in the Philippines. She incurred P120,000 in travel expenses and P100,000 in food and accommodation costs. Her Philippine income tax due is P115,000, calculated as 25% of her gross income of P460,000.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentKathlyn, a Norwegian lecturer, earned P320,000 in professional fees and P140,000 from book sales during a four-week lecture series in the Philippines. She incurred P120,000 in travel expenses and P100,000 in food and accommodation costs. Her Philippine income tax due is P115,000, calculated as 25% of her gross income of P460,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

2K views5 pagesIndividual Tax - Problems

Uploaded by

Julienne JulioKathlyn, a Norwegian lecturer, earned P320,000 in professional fees and P140,000 from book sales during a four-week lecture series in the Philippines. She incurred P120,000 in travel expenses and P100,000 in food and accommodation costs. Her Philippine income tax due is P115,000, calculated as 25% of her gross income of P460,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

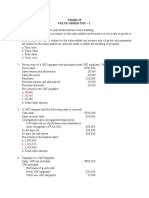

Situational Problem No.

1:

Kathlyn, of Norwegian parentage went to the Philippines for a short lecture series wherein she

lectured about how to avoid bullying. The lecture series lasted for four weeks. The following

details pertain to Kathlyn’s lecture series in the Philippines:

Professional fees for lecture (P80,000 a week) P 320,000

Income from onsite bookselling 140,000

Travel expenses incurred, with receipts 120,000

Food and accommodation expenses incurred, with receipts 100,000

How much is Kathlyn’s Philippine income tax due?

ANSWER:

Professional fees for lecture (P80,000 a week) 320,000

Income from onsite bookselling 140,000

Gross Income 460,000

Tax rate 25%

Income Tax Due 115,000

*KAPAG NRA-NETB - isusugal sa 25%

Industrious as he is known, Arthur, a non-VAT registered resident citizen, works as a

government employee at daytime and accepts clients for accounting work after office hours. At

the same time, Arthur maintains a t-shirt printing shop to earn more. For the taxable year ending

December 31, 2021, Arthur earned the following amounts:

Taxable compensation income P 850,000

Gross receipts from accounting work 1,500,000

T-shirt printing shop

Gross sales 1,400,000

Cost of sales (800,000)

Gross income P 600,000

Operating expenses (400,000)

Net income P 200,000_

1. Assuming that the availment of the 8% income tax option is proper, how much is

Arthur’s income tax due?

2. How much is Arthur’s percentage tax due?

ANSWER:

1. Taxable Compensation Income 850,000 kapag mixed income earner

First 800,000 130,000

On the excess (850,000-800,000) * 30% 15,000

Income Tax on Compensation 145,000

Gross receipts from accounting work 1,500,000

Gross sales 1,400,000

Total Gross Receipts/Sales 2,900,000

Tax rate 8%

Income Tax on Businesses 232,000

Income Tax Due 377,000

2. 0

INCOME FROM BUSINESS/PROFESSIONAL 8%

MIXED INCOME EARNERS Hindi na magleless ng 250,000

kapag mixed income earner, hiwalay ang compensation income

hindi na magbabayad ng percentage tax due kapag subject na sa 8%

NOW: Percentage tax due is 1%

ANSWER:

1. Taxable Income - Philippine Cheetah 300,000

Taxable Income - Philippine Dolphin 200,000

Total Taxable Income 500,000

First 400,000 30,000

On excess (500,000 - 400,000) * 25% 25,000

Income Tax Due 55,000

2. 0

3. Gross receipts - Philippine Cheetah 4,000,000

Gross receipts - Philippine Dolphin 2,000,000

Total Gross receipts 6,000,000

Tax rate 3%

Percentage Tax Due 180,000

kapag non-vat, papalo ka sa OPT

PASSIVE INCOME

within the Philippines - FWT

outside - basic tax

You might also like

- Warehouse Management Software WMS System Selection RFP Template 2013Document217 pagesWarehouse Management Software WMS System Selection RFP Template 2013SusanLK100% (1)

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Taxation and VAT ConceptsDocument6 pagesTaxation and VAT ConceptselmerNo ratings yet

- Acc 202 Ast ReviewerDocument193 pagesAcc 202 Ast ReviewerMA. CHRISTINA BUSAINGNo ratings yet

- Quiz On OPTDocument9 pagesQuiz On OPTJustine Maureen Andal100% (1)

- Other Percentage TaxespdfDocument5 pagesOther Percentage TaxespdfAngeilyn RodaNo ratings yet

- Higher Education Department: Maryhill College, IncDocument4 pagesHigher Education Department: Maryhill College, Incpat patNo ratings yet

- GeneralPrinciples Incometax Tabag 51 224Document28 pagesGeneralPrinciples Incometax Tabag 51 224John Carlo Dela CruzNo ratings yet

- Capital Gains Tax Quiz AnswersDocument2 pagesCapital Gains Tax Quiz AnswersJimbo Manalastas50% (2)

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- Chap. 13A 15BDocument72 pagesChap. 13A 15B2vpsrsmg7jNo ratings yet

- Comprehensive Exam Case Analysis Lester Limheya FinalDocument36 pagesComprehensive Exam Case Analysis Lester Limheya FinalXXXXXXXXXXXXXXXXXXNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Compensation Income: Bacc8 TaxationDocument30 pagesCompensation Income: Bacc8 TaxationsoonsNo ratings yet

- Calculate fringe benefit tax on condo, car, rental housing benefitsDocument6 pagesCalculate fringe benefit tax on condo, car, rental housing benefitsRonald SaludesNo ratings yet

- Post Test Regular Income Taxation For PartnershipsDocument6 pagesPost Test Regular Income Taxation For Partnershipslena cpaNo ratings yet

- Chapter 3 Percentage Taxes - UpdatedDocument13 pagesChapter 3 Percentage Taxes - UpdatedDudz Matienzo100% (1)

- Answer Key To QuizzersDocument52 pagesAnswer Key To QuizzersQueen ValleNo ratings yet

- Benzon A. Ondovilla - 2. Assignment-VAT On Sale of Goods or PropertiesDocument4 pagesBenzon A. Ondovilla - 2. Assignment-VAT On Sale of Goods or PropertiesBenzon Agojo OndovillaNo ratings yet

- Parfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandDocument21 pagesParfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandrheaNo ratings yet

- Yna CCCCDocument2 pagesYna CCCCIsabelle CandelariaNo ratings yet

- ULOa Answer KeyDocument2 pagesULOa Answer KeyAyah LaysonNo ratings yet

- For Upload MAS 1 Short-Term Budgeting, Forecasting and ControlDocument13 pagesFor Upload MAS 1 Short-Term Budgeting, Forecasting and ControlABBIE GRACE DELA CRUZNo ratings yet

- 2.1.1 Quiz 2 - Answer KeyDocument7 pages2.1.1 Quiz 2 - Answer KeyMark Emil BaritNo ratings yet

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- This Study Resource Was: Midterm Quiz 1 - Business Registration and VAT ExemptDocument6 pagesThis Study Resource Was: Midterm Quiz 1 - Business Registration and VAT ExemptJosephine CastilloNo ratings yet

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Tax1 Quiz 3 Fringe Benefit TaxDocument17 pagesTax1 Quiz 3 Fringe Benefit TaxJan Mark2No ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- PrefinalDocument7 pagesPrefinalLeisleiRagoNo ratings yet

- Tax 1 Activity (Soriano Book)Document18 pagesTax 1 Activity (Soriano Book)Sara Andrea SantiagoNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- 1st PB TAX AnsDocument24 pages1st PB TAX AnsDin Rose Gonzales50% (2)

- Chapter 11 Multiple Choice 2Document3 pagesChapter 11 Multiple Choice 2Mary DenizeNo ratings yet

- TAX (1ST Quiz)Document8 pagesTAX (1ST Quiz)Mon RamNo ratings yet

- TAX-10-INSTALLMENT-DEFERRED-PAYMENT-METHOD-OF-REPORTING-INCOME (With Answers)Document4 pagesTAX-10-INSTALLMENT-DEFERRED-PAYMENT-METHOD-OF-REPORTING-INCOME (With Answers)Kendrew SujideNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Makati Haberdashery, Inc. vs. NLRCDocument3 pagesMakati Haberdashery, Inc. vs. NLRCXryn MortelNo ratings yet

- Excise Tax Rules and Regulations ExplainedDocument252 pagesExcise Tax Rules and Regulations ExplainedMary DenizeNo ratings yet

- 15 Responsibility Accounting andDocument17 pages15 Responsibility Accounting andmaria ronoraNo ratings yet

- Taxation Final Preboard CPAR 92 PDFDocument17 pagesTaxation Final Preboard CPAR 92 PDFomer 2 gerdNo ratings yet

- W7-Module Concept of Income-Part 2Document21 pagesW7-Module Concept of Income-Part 2Danica VetuzNo ratings yet

- Assignment PDFDocument11 pagesAssignment PDFJanine Lerum100% (1)

- Astral Records LTDDocument16 pagesAstral Records LTDMbavhalelo100% (2)

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- StratCost CVP 1Document65 pagesStratCost CVP 1Vrix Ace MangilitNo ratings yet

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- HOMEWORK 5 Exclusion From Gross IncomeDocument3 pagesHOMEWORK 5 Exclusion From Gross Incomefitz garlitos100% (1)

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- TAX 1.docx KeyDocument94 pagesTAX 1.docx Keymario1962No ratings yet

- Hetutua, Therese Janine D. Oct. 3, 2020 Bsac 2B: Problem 1Document7 pagesHetutua, Therese Janine D. Oct. 3, 2020 Bsac 2B: Problem 1Tristan Arthur BernalesNo ratings yet

- Individual Taxpayers Classified and Taxed DifferentlyDocument95 pagesIndividual Taxpayers Classified and Taxed DifferentlyRoronoa Zoro67% (3)

- Examination About Investment 5Document3 pagesExamination About Investment 5BLACKPINKLisaRoseJisooJennieNo ratings yet

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- 8% Income Tax OptionDocument14 pages8% Income Tax OptionZaaavnn VannnnnNo ratings yet

- Tax 3216Document5 pagesTax 3216Rich William PagaduanNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- CPA Review School of the Philippines Final Pre-board Examination ProblemsDocument17 pagesCPA Review School of the Philippines Final Pre-board Examination ProblemsMichael Brian TorresNo ratings yet

- Estate Tax Computation and DeductionsDocument14 pagesEstate Tax Computation and DeductionsHaidee Flavier SabidoNo ratings yet

- Chapter 15 Regular Income Taxation CorporationsDocument9 pagesChapter 15 Regular Income Taxation CorporationsMary Jane PabroaNo ratings yet

- CTDI Tax Formatting QuestionsDocument13 pagesCTDI Tax Formatting QuestionsMaryane AngelaNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- Taxation CompressDocument3 pagesTaxation CompressJulie BagaresNo ratings yet

- Accomplishment Report. KrizDocument7 pagesAccomplishment Report. KrizHazel Seguerra BicadaNo ratings yet

- Chapter 9 Assigned Question SOLUTIONSDocument31 pagesChapter 9 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- SYZ Mining Audit Problem AnalysisDocument26 pagesSYZ Mining Audit Problem AnalysisKate NuevaNo ratings yet

- Tyco fraud investigation timelineDocument12 pagesTyco fraud investigation timelineSumit Sharma100% (1)

- Job Application Letter Internal Vacancy SampleDocument8 pagesJob Application Letter Internal Vacancy Sampleafdlxeqbk100% (1)

- Contractor's taxable gross receipts include salaries, SSS contributionsDocument3 pagesContractor's taxable gross receipts include salaries, SSS contributionsSuzanne Pagaduan CruzNo ratings yet

- Semi Formal ExamplesDocument3 pagesSemi Formal ExamplesDjshh oiNo ratings yet

- Service Design Package ContentsDocument10 pagesService Design Package ContentsAlberto AlvaradoNo ratings yet

- Journal Homepage: - : IntroductionDocument9 pagesJournal Homepage: - : IntroductionNikhita KrishnaiahNo ratings yet

- 5.a Study On Utilization and Convenient of Credit CardDocument11 pages5.a Study On Utilization and Convenient of Credit CardbsshankarraviNo ratings yet

- Principles of Engineering EconomyDocument14 pagesPrinciples of Engineering Economyabhilash gowdaNo ratings yet

- Arts3 q1 Mod1 Aralin1-4 v5Document27 pagesArts3 q1 Mod1 Aralin1-4 v5Edward TarucNo ratings yet

- Girish KSDocument3 pagesGirish KSSudha PrintersNo ratings yet

- Exercise 1 Key PDF Cost of Goods Sold InvenDocument1 pageExercise 1 Key PDF Cost of Goods Sold InvenAl BertNo ratings yet

- Marketing CommunicationsDocument19 pagesMarketing CommunicationsGracezel Evangelista GarciaNo ratings yet

- Batangas State University Managerial Economics Article Site Author Date PublishedDocument3 pagesBatangas State University Managerial Economics Article Site Author Date PublishedBen TorejaNo ratings yet

- Dupont 5704 DielectricDocument2 pagesDupont 5704 DielectricdigiarkanandNo ratings yet

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersDocument21 pagesAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- Increase Google Reviews Using G Popcard and Must Know The BenefitsDocument3 pagesIncrease Google Reviews Using G Popcard and Must Know The Benefitsgpopcard.seoNo ratings yet

- Aral Pan 9 EquationDocument5 pagesAral Pan 9 EquationRashiel Jane Paronia CelizNo ratings yet

- Accounting Handout Chapter 8Document5 pagesAccounting Handout Chapter 8EdrielleNo ratings yet

- Company Profile: Inside Look at Leading Jacket ManufacturerDocument41 pagesCompany Profile: Inside Look at Leading Jacket ManufacturerVanika SharmaNo ratings yet

- NPTEL Assign 3 Jan23 Behavioral and Personal FinanceDocument5 pagesNPTEL Assign 3 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet