0% found this document useful (1 vote)

184 views9 pagesIISY Grade IX Accounting Exam 2021

1) The document is an exam for a Grade 9 Accounting class given by Indonesian International School Yangon.

2) It contains instructions for the exam, which has 4 questions and lasts 60 minutes.

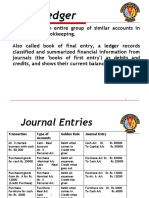

3) The questions cover topics like double entry accounting, preparing a trial balance, journalizing transactions, and more.

Uploaded by

Arkar.myanmar 2018Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (1 vote)

184 views9 pagesIISY Grade IX Accounting Exam 2021

1) The document is an exam for a Grade 9 Accounting class given by Indonesian International School Yangon.

2) It contains instructions for the exam, which has 4 questions and lasts 60 minutes.

3) The questions cover topics like double entry accounting, preparing a trial balance, journalizing transactions, and more.

Uploaded by

Arkar.myanmar 2018Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd