Professional Documents

Culture Documents

Ministry of Finance

Uploaded by

Yến Hoàng LêOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ministry of Finance

Uploaded by

Yến Hoàng LêCopyright:

Available Formats

MINISTRY OF FINANCE Final Assessment 2

ACADEMY OF FINANCE Subject: Accounting for Trading- Services Enterprises

Code: 04.05/2021 Duration: 1 day

PART A:

1 On April 2, Cion Co. purchased merchandise from Jose Co. for 210.000 (exclusive VAT

10%), terms 2/10, n/30 FOB shipping point. On April 12, paid the amount due to Jose Co. in

full. Dion Co used perpetual inventory system.

a. Prepare the journal entries to record the transaction on April 2 in Cion Co.

b. Prepare the journal entries to record the transaction on April 12 in Cion Co.

c. Assume that Cion Co. paid the balance due to Jose Co. on April 20 instead of April

12. Prepare the journal entry to record this payment.

2 Luci Co. imported goods, price of goods in invoice $8.000, the import tax 20%, The special

consumption tax 30%, the VAT tax 10%, the customs rate of exchange: $1= VND 23, the

approximate exchange rate: $1= VND 23,1, the customs value of goods is the same as the

the value of goods in invoice.

a. Determine the cost of goods imported.

b. Determine the import tax

c. Determine the special consumption tax

3 a/“The primary source of revenue for a merchandising company results from performing

services for customers”.True or false?

b/“Trade company does not carry out a production process for goods solds”. True or false?

c/If beginning inventory is 60.000, cost of goods sold is 380.000, and ending inventory is

50.000, cost of goods purchased is___________

d/A situation in which a company sells its products directly to customers in another country

without using another person or organization to make arrangement for them is called _____

e/ What will result if gross profit are greater than operating expenses?

a/The average-cost method in a periodic inventory system is called__________

b/Which inventory system that company keeps detailed inventory records of the each

4 inventory purchase and sale?

c/ “The freight costs incurred by the buyer are operating expenses”. True or false?

d/ That company that buys products and resell them with a large quantities is__________

Pan Company purchased 500(exclusive VAT 10%) of merchandise from Lan company, FOB

destination, freight cost: 20(exclusive VAT 10%) was paid by cash in bank(VND:1.000.000)

5 a. Which company paid freight cost?

b. Which accounts were used for freight cost transaction of Lan company.

c. Prepare entries for freight cost transaction for Lan company.

Dash Co. received export entrustment fees from Smath Co. by VND in bank of 110.000

(inclusive of VAT 10%).(VND: 1.000).

6

a. Which company is export truster?

b. Make entries for this transaction in export truster.

PART B

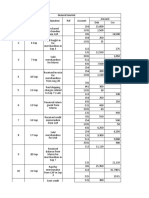

Question 7: Lith Co. began operation on July 1, using a perpetual inventory system. During

July, the company had the following purchases and sales:

Date Quantity Unit cost Unit sale

July 1 5 122

July 6, sale 2 Y1

July 11, purchase 7 136

July 14, sale 6 Y2

July 21, purchase 8 147

July 27, sale 8 Y3

Require:

- Give Y1,Y2,Y3 by yourself

- Determine cost of goods sold, the ending inventory, gross profit under perpectual and

periodic inventory system using FIFO, average cost method.

Question 8

Dutch Co, a Vietnamese company, uses a perpetual inventory system and tax deduction

method. During March, 2020, the following transactions occurred (VND: 1.000)

Mar.2 Purchased merchandise from Tuan Company for 22.000 (exclusive of VAT 10%) under

credit terms of 1/20, n/30, invoice dated Mar 2. Freight charges 2.200 (exclusive of VAT

10%) paid cash in bank.

4. Prepaid $5.000 by cash in bank for import entrustment contract to Lux to open L/C. The

accounting book exchange rate: $ 1= VND 22,9

5. Sold merchandise to T&T Corp for 52.800 (inclusive of VAT 10%) under credit terms of

1/20, n/60, invoice dated Mar 5. The merchandise had cost 30.000.

12. Paid 8.000 (exclusive of VAT 10%) by cash in bank for shipping charges related to the Mar

5 sale to T&T Corp.

13. Received import entrustment goods with total value of $X1 delivered by Lux (import

trustee). The imported good was put into the warehouse, the import tax 30%, the VAT tax

10%. The Customs rates of exchange $1= VND 23,1. The customs value of the goods =

value of good in invoice. Lux paid on behalf of the import truster all kind of tax payable to

the government budget by VND in bank. The import entrustment fee accounts for 1% on the

contract value.

15. T&T returned merchandise from the Mar 5 sale that had cost 500 and been sold for 770

(inclusive of VAT 10%). The merchandise was restored to inventory.

17. The import entrustment fee to Lux was credited on account.

18. After negotiations with Tuan Corporation concerning problems with the merchandise

purchased on Mar 2, received a credit memorandum from Tuan granting a price reduction of

800 (exclusive of VAT 10%)

22. Paid the amount due Tuan Corporation for the Mar 2 purchase less the price reduction

granted.

25. Received balance due from T&T Corp. for the Mar 5 sale less the return on Mar 15.

28. Received the notice about the consigment goods that had been sold from the AA Agent with

costing of VND 25.000 for 40.000 (exclusive of VAT 10%), commission fee 4.000

(exclusive of VAT 10%).

29. Paid import entrustment fee and tax for Lux by VND in bank.

30. Received the balance due from AA Agent for the consigment goods less the commisson fee

30. Paid the rest of the payment for Lux by USD in bank on Mar 13, the accounting book

exchange rate $1= 23,1. Lux paid to the exporter by L/C and Cash in bank.

30. Accrued salary for administration component X2 and selling component X3

Require:

A. In Dutch Co

1. Give the opening balance of accounts at 1st, Mar, 2020 and X1,X2,X3 by yourself.

2. Journalize above transactions (including closing entries)

3. Prepare T accounts

4. Prepare trial balance for March, 2020

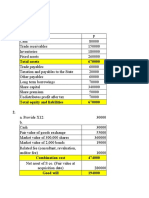

5. Prepare Statement of Financial Position as at 31st, March, 2020.

6. Prepare Statement of Profit or Loss for the period ended 31st, March, 2020.

B. Make the entries the transactions of Lux (import trustee)

(The approximate exchange rate: $ 1= VND 23)

Part C: Identify the differences between the merchandising company and manufacturing

company?

You might also like

- BT Chương 1-3Document23 pagesBT Chương 1-3Hà Chi NguyễnNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Exercises - Accounting For Merchandising Business Part 2Document10 pagesExercises - Accounting For Merchandising Business Part 2Yzmael Klyde BorjaNo ratings yet

- Tax 2 - Final Quiz 2Document5 pagesTax 2 - Final Quiz 2Uy SamuelNo ratings yet

- VAT Problems - SolvedDocument7 pagesVAT Problems - SolvedRamez AhmedNo ratings yet

- Case Study - Chapter 1 2 3 4 - 2Document5 pagesCase Study - Chapter 1 2 3 4 - 2Lê Ngọc Vân NhiNo ratings yet

- Exam On Foreign Currency Transaction 40Document6 pagesExam On Foreign Currency Transaction 40nigusNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Lecturer. 8.. Income Tax Article .22Document5 pagesLecturer. 8.. Income Tax Article .22AlisyaNo ratings yet

- Lesson 6 Accounting For Merchandising Business Part 2 ExercisesDocument9 pagesLesson 6 Accounting For Merchandising Business Part 2 ExercisesTalented Kim SunooNo ratings yet

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosNo ratings yet

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationRena Rose Malunes11% (9)

- Buscom 2Document5 pagesBuscom 2Janice AbonalesNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- SV Exercises FA1Document13 pagesSV Exercises FA1Nguyễn Văn AnNo ratings yet

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- VAT MathDocument3 pagesVAT Mathtisha10rahman50% (4)

- ICAB Last Year Question (Knowledge Level)Document5 pagesICAB Last Year Question (Knowledge Level)Fatema KanizNo ratings yet

- IA Chapters 4 9 ProblemsDocument6 pagesIA Chapters 4 9 ProblemsNica PasionaNo ratings yet

- Assignment HBDocument3 pagesAssignment HBJhay Sy LynNo ratings yet

- Accounting 2Document28 pagesAccounting 2cherryannNo ratings yet

- Act184 Quiz 3Document4 pagesAct184 Quiz 3Cardo DalisayNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Midterm Quiz No 2Document2 pagesMidterm Quiz No 2mariejoyceaggabaoNo ratings yet

- Public Finance & TaxationDocument4 pagesPublic Finance & Taxationfikremaryam hiwiNo ratings yet

- Test 1Document3 pagesTest 1Tram AnhhNo ratings yet

- Name: - Date: - Midterm Examination - Accounting 1 Set A Problem IDocument3 pagesName: - Date: - Midterm Examination - Accounting 1 Set A Problem ITrixie VasquezNo ratings yet

- Task 1 Accounting RačunovodstvoDocument21 pagesTask 1 Accounting RačunovodstvoDario JahNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- Mock Test 1Document7 pagesMock Test 1Toàn ĐứcNo ratings yet

- Basic Accounting ReviewerDocument35 pagesBasic Accounting ReviewerJhane MarieNo ratings yet

- SF Comprehensive Quiz 1Document10 pagesSF Comprehensive Quiz 1Francis Raagas40% (5)

- ABC Co LTD - Case Study Test - RevisedDocument2 pagesABC Co LTD - Case Study Test - Revisedroman marian89No ratings yet

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoNo ratings yet

- Accounting CycleDocument17 pagesAccounting CycleAnonymous 1P4Me8680% (1)

- Ocean Atlantic Co Is A Merchandising Business The Account BalaDocument2 pagesOcean Atlantic Co Is A Merchandising Business The Account BalaM Bilal SaleemNo ratings yet

- Bai Tap Thue Gian ThuDocument8 pagesBai Tap Thue Gian ThuTrân VõNo ratings yet

- Set A Review Quiz QuestionsDocument7 pagesSet A Review Quiz QuestionsJan Allyson BiagNo ratings yet

- Final Exam POA 1-Haj-SentDocument3 pagesFinal Exam POA 1-Haj-SentSteven NehemiaNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- 1st Exam Chapter 11Document9 pages1st Exam Chapter 11Imma Therese YuNo ratings yet

- Question Chapter1 Final 1Document11 pagesQuestion Chapter1 Final 1Mạnh Đỗ ĐứcNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Mid ThúeeDocument4 pagesMid Thúeetuanminhyl56No ratings yet

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- IFRS 15 Revenue MathsDocument2 pagesIFRS 15 Revenue MathsTanvir PrantoNo ratings yet

- Exercises Chapter 15Document3 pagesExercises Chapter 15DƯƠNG PHẠM THÙYNo ratings yet

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- QuizDocument5 pagesQuizRomaica Ella AmbidaNo ratings yet

- MT - Assignment 01 StudentsDocument2 pagesMT - Assignment 01 Studentspatburner1108No ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Nfjpia Mockboard 2011 p1 - With AnswersDocument12 pagesNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonNo ratings yet

- MID THUẾDocument9 pagesMID THUẾtuanminhyl56No ratings yet

- Financial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryDocument16 pagesFinancial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryKinomoto Sakura33% (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 13 - Nguyeexn Thu Huowngq57-21.01CLDocument9 pages13 - Nguyeexn Thu Huowngq57-21.01CLYến Hoàng LêNo ratings yet

- Question 3Document13 pagesQuestion 3Yến Hoàng LêNo ratings yet

- mua mọi tập đoànDocument16 pagesmua mọi tập đoànYến Hoàng LêNo ratings yet

- Book 1Document7 pagesBook 1Yến Hoàng LêNo ratings yet

- Đáp án đề minh họaDocument2 pagesĐáp án đề minh họaYến Hoàng LêNo ratings yet

- Đáp án đề minh họaDocument2 pagesĐáp án đề minh họaYến Hoàng LêNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Demand ForecastingDocument30 pagesDemand Forecastingsnehashish gaurNo ratings yet

- 190523 2018 Hyundai Oilbank AR 영문 FinalDocument76 pages190523 2018 Hyundai Oilbank AR 영문 FinalHashaira AlimNo ratings yet

- ITC Covered Call Option Strategy - 24112020-1606213764Document3 pagesITC Covered Call Option Strategy - 24112020-1606213764Bobby TNo ratings yet

- MCQs BPEMDocument13 pagesMCQs BPEMhridyansh kainNo ratings yet

- ObjectivesDocument2 pagesObjectivesAdiza BaduaNo ratings yet

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelAdeenaNo ratings yet

- Market Entry StrategiesDocument24 pagesMarket Entry StrategiesMurat NalcıNo ratings yet

- Target CustomersDocument1 pageTarget CustomersThiird RacelisNo ratings yet

- TATA Motors EVDocument24 pagesTATA Motors EVKarthick FerruccioNo ratings yet

- Maru BattingDocument28 pagesMaru BattingRealChiefNo ratings yet

- TALF Annual Report 2018Document197 pagesTALF Annual Report 2018Doni WarganegaraNo ratings yet

- Greater Visakhapatnam Smart City Corporation Limited (GVSCCL)Document22 pagesGreater Visakhapatnam Smart City Corporation Limited (GVSCCL)Tarun KumarNo ratings yet

- KK PillarDocument30 pagesKK PillarshaktiNo ratings yet

- Resume by Shannon Jocson July 2022Document5 pagesResume by Shannon Jocson July 2022Shannon JocsonNo ratings yet

- Dragon Palace Hotel by Amazing Reservation DetailsDocument3 pagesDragon Palace Hotel by Amazing Reservation DetailsOgaia Hotel TernateNo ratings yet

- Pulman Steel Guide PDFDocument29 pagesPulman Steel Guide PDFNaveenNo ratings yet

- Vita ReporttDocument84 pagesVita ReporttTamanna GoyalNo ratings yet

- 6 The Sixth Meeting Is Organization Part 2 PDFDocument4 pages6 The Sixth Meeting Is Organization Part 2 PDFRiko AryantoNo ratings yet

- Business Plan FOR: AppendixDocument23 pagesBusiness Plan FOR: AppendixNOUN UPDATENo ratings yet

- Course Name: Master of Business Administration: Computation of Weighted Average Cost of CapitalDocument8 pagesCourse Name: Master of Business Administration: Computation of Weighted Average Cost of CapitalshriyaNo ratings yet

- CHAPTER5Document16 pagesCHAPTER5Bisag Asa88% (8)

- Literature Review On Consumer AttitudeDocument8 pagesLiterature Review On Consumer Attitudeaflspyogf100% (1)

- Top 10 Roles of A Manager in OrganizationDocument5 pagesTop 10 Roles of A Manager in OrganizationANUPAM KAPTINo ratings yet

- Tata Steel Ir 2022 23Document18 pagesTata Steel Ir 2022 23harshita girdharNo ratings yet

- The Effectiveness of Instagram Social Media As Interactive Marketing For System Provider CompaniesDocument6 pagesThe Effectiveness of Instagram Social Media As Interactive Marketing For System Provider CompaniesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Coca Cola (KO) Financial RatiosDocument4 pagesCoca Cola (KO) Financial RatiosKhmao SrosNo ratings yet

- Webinar On How To Deal With Open Cases in The BirDocument25 pagesWebinar On How To Deal With Open Cases in The BirkirkoNo ratings yet

- China Pharmaceutical Sector Stay in The Sweet Spot As The Industry Differentiates - 20170417Document38 pagesChina Pharmaceutical Sector Stay in The Sweet Spot As The Industry Differentiates - 20170417/jncjdncjdnNo ratings yet

- Additional Funds Needed - Exercises - QuestionsDocument2 pagesAdditional Funds Needed - Exercises - QuestionsDANE MATTHEW PILAPILNo ratings yet