Professional Documents

Culture Documents

Accounting - Reversing Entries - Sample Problem

Accounting - Reversing Entries - Sample Problem

Uploaded by

MaDine 190 ratings0% found this document useful (0 votes)

16 views2 pagesAccounting in Chapter 8 - Reversing Entries - Sample Problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting in Chapter 8 - Reversing Entries - Sample Problem

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesAccounting - Reversing Entries - Sample Problem

Accounting - Reversing Entries - Sample Problem

Uploaded by

MaDine 19Accounting in Chapter 8 - Reversing Entries - Sample Problem

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

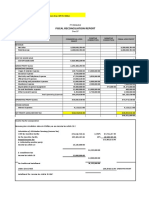

Chapter 8 - Closing Entries (Net Loss)

Acct. Account Title Debit Credit

No.

101 Cash 28,450.00

102 Accounts Receivable 65,000.00

102-A Allow. for Bad Debts 1,500.00

103 Prepaid Insurance 120,000.00

104 Supplies 12,500.00

120 Equipment 120,000.00

120-A Accumulated Depreciation – Equipment 5,000.00

121 Furniture & Fixtures 85,000.00

121-A Accumulated Depreciation - Furniture 8,750.00

201 Accounts Payable 137,600.00

202 Notes Payable -12% 60,000.00

301 Miley, Capital 252,570.00

302 Mile, Personal 5,000.00

401 Service Fees Revenue 204,755.00

501 Salaries Expense 75,000.00

502 Utilities Expense 55,725.00

503 Gasoline and oil 5,600.00

504 Rent Expense 77,000.00

505 Interest Expense 900.00

TOTAL 670,175.00 670,175.00

Step 1: To record closing entry of income accounts:

31-Dec Service Fees Revenue 204,755

Income Summary 204,755

Step 2: To record closing entry of expense accounts:

31-Dec Income Summary 204,755

Salaries Expense 75,000

Utilities Expense 55,725

Gasoline and Oil 5,600

Rent Expense 77,000

Interest Expense 900

My Note: Kung ano yung total ng expense yun yung ilalagay sa Income Summary

Step 3: To record closing entry of the Income Summary Account:

INCOME SUMMARY

CE2 214,225 204,775 CE1

9,479

9,470 CE3

- End. Bal.

31-Dec Miley, Capital 9,470 = Capital is DECREASED

Income Salary 9,470

My Note: Pag yung total ay nasa DEBIT side ibig sabihin ay NET LOSS

Chapter 8 - Closing Entries (Net Income)

Income Accounts 150,000.00 credit

Expense Accounts 125,000.00 debit

Not Income (Loss) 25,000.00

Drawing Account 10,000.00

Step 1: To record closing entry of Income Account:

31-Dec Income Accounts 150,000

Income Summary 150,000

Step 2: To record closing entry of Expense Account:

31-Dec Income Summary 125,000

Expense Accounts 125,000

Step 3: To record closing entry of the Income Summary Account:

INCOME SUMMARY

CE2 125,000 150,000 CE1

25,000

CE3 25,000.00

End. Bal. -

31-Dec Income Summary 25,000

Owner, Capital 25,000 = Capital is DECREASED

My Note: Pag yung total ay nasa CREDIT side ang ibig sabihin ay NET INCOME

Step 4: To record closing entry of the Drawing / Withdrawal Account:

31-Dec Owner, Capital 10,000 = Capital is DECREASED

Owner, Drawing 10,000

TIPS:

If the Income Summary Account has a DEBIT = NET LOSS Based on T-

balance before closing it against the capital account, Account

then the result of the operation is?

If the Income Summary Account is CREDITED = NET LOSS Based on the

against the capital account, then the result of the Closing Entry

operation is?

If the Income Summary Account has a CREDIT = NET Based on T-

balance before closing it against the capital account, INCOME Account

then the result of the operation is?

If the Income Summary Account is DEBITED against = NET Based on the

the capital account, then the result of the operation INCOME Closing Entry

is?

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Solution Manual For Intermediate Accounting 17th by KiesoDocument36 pagesSolution Manual For Intermediate Accounting 17th by Kiesozirconic.dzeron.8oyy100% (47)

- GA1 - Syndicate 10 - 29118149Document8 pagesGA1 - Syndicate 10 - 29118149devanmadeNo ratings yet

- Personal Finance Turning Money Into Wealth 6th Edition Keown Test BankDocument35 pagesPersonal Finance Turning Money Into Wealth 6th Edition Keown Test Bankjovialtybowbentqjkz88100% (20)

- Adjusting Entry - LectureDocument9 pagesAdjusting Entry - LectureMaDine 19100% (2)

- Corporate Bylaws of Brizee Heating & Air Conditioning, IncDocument13 pagesCorporate Bylaws of Brizee Heating & Air Conditioning, IncJenniferNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Financial Feasibility of Product ADocument4 pagesFinancial Feasibility of Product AMuhammad AsadNo ratings yet

- HW - Task - 7. Royal WessanentDocument5 pagesHW - Task - 7. Royal Wessanentbernadetta paradintya utamiNo ratings yet

- Company Law II ProjectDocument21 pagesCompany Law II ProjectBhawna JoshiNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Tugas 20.445cs4Document8 pagesTugas 20.445cs4ina aktNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Homework Chapter 12Document28 pagesHomework Chapter 12Trung Kiên NguyễnNo ratings yet

- PCPPI - Petition For Voluntary Delisting and Annexes (Execution Copy 2020-09-15)Document204 pagesPCPPI - Petition For Voluntary Delisting and Annexes (Execution Copy 2020-09-15)Flash RoyalNo ratings yet

- Organizational Behavior - Chapter 11 LectureDocument20 pagesOrganizational Behavior - Chapter 11 LectureMaDine 19No ratings yet

- Income Statement, Oener's Equity, PositionDocument4 pagesIncome Statement, Oener's Equity, PositionMaDine 19No ratings yet

- Fabm Group 4. Closing EntriesDocument11 pagesFabm Group 4. Closing Entriesjoel phillip GranadaNo ratings yet

- Feasib - Fin. State.Document28 pagesFeasib - Fin. State.aldric taclanNo ratings yet

- Ej 2 Cap 3 Mayers CanvasDocument2 pagesEj 2 Cap 3 Mayers CanvasAlvaro LopezNo ratings yet

- Chapter 6 Completing The Accounting CycleDocument14 pagesChapter 6 Completing The Accounting CycleAyesha Eunice SalvaleonNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- ACT110.Worksheet ActivityDocument1 pageACT110.Worksheet ActivityAra JeanNo ratings yet

- Module 4Document16 pagesModule 4Ma Leah TañezaNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Caecilia FahiraDocument6 pagesCaecilia FahiraMuhammad Fajar Al AminNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Exercise 6 25Document8 pagesExercise 6 25junjunNo ratings yet

- Test 3, Montolalu, Wahyu YohanesDocument7 pagesTest 3, Montolalu, Wahyu YohanesDimas LimpongNo ratings yet

- CLOSING ENTRIES (Merchandising)Document28 pagesCLOSING ENTRIES (Merchandising)issachar barezNo ratings yet

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofDocument11 pagesProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunNo ratings yet

- Leray Business SolutionsDocument5 pagesLeray Business SolutionsKyla Andrea GammadNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- Tugas Kelompok Ke-1 Week 3/ Sesi 4: EssayDocument5 pagesTugas Kelompok Ke-1 Week 3/ Sesi 4: Essayadelia zahraNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument7 pagesFundamentals of Accountancy Business and ManagementJayNo ratings yet

- Copies Express Inc - by Cherryl ValmoresDocument7 pagesCopies Express Inc - by Cherryl ValmoresCHERRYL VALMORESNo ratings yet

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Closing EntriesDocument6 pagesClosing Entriesspam.ml2023No ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- ACT110.Worksheet Activity - IllustrateDocument1 pageACT110.Worksheet Activity - IllustrateAra JeanNo ratings yet

- Mike Owjai Finance Income Statements For The Year Ended December 31, 2020Document6 pagesMike Owjai Finance Income Statements For The Year Ended December 31, 2020Alvaro LopezNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- FABM1 11 Quarter 4 Week 2 Las 2Document1 pageFABM1 11 Quarter 4 Week 2 Las 2Janna PleteNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- AccountingDocument5 pagesAccountingAndrea Joy PekNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Start Here: Click ConsultingDocument14 pagesStart Here: Click ConsultingNyasha MakoreNo ratings yet

- AkuntansuDocument36 pagesAkuntansusuryati hungNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Learning Activity 5 - Financial PlanDocument6 pagesLearning Activity 5 - Financial PlanGeryca CarranzaNo ratings yet

- HP Service Company TransactionsDocument18 pagesHP Service Company TransactionsAndrew Sy ScottNo ratings yet

- Statement of Comprehensive Income (Merchandising)Document3 pagesStatement of Comprehensive Income (Merchandising)hhgfNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- IA3 Act2Document20 pagesIA3 Act2Denise DejitoNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Assignment 2 (DEF Company)Document8 pagesAssignment 2 (DEF Company)Bea LadaoNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- Fundamental of Accounting - Chapter 2 LessonDocument5 pagesFundamental of Accounting - Chapter 2 LessonMaDine 19No ratings yet

- CHAPTER 10, 9 and 6Document18 pagesCHAPTER 10, 9 and 6MaDine 19No ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- Letter of Offer WiproDocument52 pagesLetter of Offer WiproSauvik BhattacharyaNo ratings yet

- Payback Schedule Year Beginning Unrecovered Investment Cash InflowDocument4 pagesPayback Schedule Year Beginning Unrecovered Investment Cash InflowMaisamNo ratings yet

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- Mridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMDocument4 pagesMridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMekta agarwalNo ratings yet

- Manajemen Keuangan Laporan Keuangan Dan Analisi RasioDocument8 pagesManajemen Keuangan Laporan Keuangan Dan Analisi RasioDeslia AnggraeniNo ratings yet

- SEIU 2021 Financial DisclosuresDocument294 pagesSEIU 2021 Financial DisclosuresLaborUnionNews.comNo ratings yet

- Balance Sheet of Havells IndiaDocument5 pagesBalance Sheet of Havells IndiaMalarNo ratings yet

- For Other Uses, See High-Net-Worth IndividualDocument3 pagesFor Other Uses, See High-Net-Worth IndividualChitraNo ratings yet

- 110 WarmupDay1Document25 pages110 WarmupDay1shiieeNo ratings yet

- Home Office and Branch Accounting Special ProceduresDocument17 pagesHome Office and Branch Accounting Special ProceduresOrnica BalesNo ratings yet

- PT CahayaDocument45 pagesPT CahayaSylviaNo ratings yet

- Company Law.Document40 pagesCompany Law.Keerat singhNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Lopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument4 pagesLopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionKaname KuranNo ratings yet

- Solution Aud589 - Jun 2015Document7 pagesSolution Aud589 - Jun 2015LANGITBIRUNo ratings yet

- NIFTY Option ChainDocument2 pagesNIFTY Option Chainbharat singh koteriNo ratings yet

- Fas 141 R PDFDocument2 pagesFas 141 R PDFToniaNo ratings yet

- Essay Question:: UNAPPROPRIATED RETAINED EARNINGS Represent That Portion Which Is Free and Can BeDocument11 pagesEssay Question:: UNAPPROPRIATED RETAINED EARNINGS Represent That Portion Which Is Free and Can BeAramina Cabigting BocNo ratings yet

- CH 1: The Nature and Objectives of Financial AccountingDocument12 pagesCH 1: The Nature and Objectives of Financial AccountingroopmaniNo ratings yet

- HW 1 SolutionsDocument7 pagesHW 1 Solutionsjinny6061No ratings yet