Professional Documents

Culture Documents

Fim 3B November Examination 2013

Uploaded by

Dolly VongweCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fim 3B November Examination 2013

Uploaded by

Dolly VongweCopyright:

Available Formats

University of Fort Hare

Together in Excellence

NKUHLU DEPARTMENT OF ACCOUNTING

FINANCIAL MANAGEMENT 3B

AFM321E

____________________________________________________________________

EXAMINATION NOVEMBER 2013

ASSESSORS: PROF. W. BROWN PROF. G. BARTLETT

Ms. DENNY EMSLIE

MR MITCHEL DUVENHAGE

MODERATOR: KEVIN FREEMAN (NMMU)

• This paper consists of 12 pages (front page included).

• Silent, non-programmable calculators may be used.

• Clearly show all calculations.

• Answers may NOT be written in pencil. NO tippex may be used.

QUESTION TOPICS COVERED MARKS

1 Investments 60

2 Valuations 25

3 Mergers and Acquisitions 30

4 Financial Statement Analysis 20

5 Sources of Finance 15

TOTAL 150

Financial Management IIIB Examination Page 1

QUESTION 1 60 MARKS

You were recently appointed as the financial manager of Buccaneer Ltd, a listed company and

manufacturer of electronic equipment.

The company is constantly considering capital projects to maintain its position in the market. All

projects that meet the strategic criteria of the company are evaluated using discounted cash

flow techniques.

SECTION A

You establish that the company is using a rate of 15% as its cost of capital. On enquiry you

were told that the rate of 15% was decided upon some seven years ago by management. In

order to establish the reliability of this rate, you are requested by management to calculate the

current weighted average cost of capital.

The most recent Statement of Financial Position of Buccaneer reflects the following:

YEAR ENDING 30 JUNE (R’000) 2013

EQUITY AND LIABILITIES

Capital and reserves 430 000

Issued share capital 100 000

Share premium 50 000

Revaluation reserve 40 000

Accumulated profits 240 000

Non-current liabilities 130 000

Redeemable preference shares 50 000

Redeemable debentures 40 000

Mortgage bond 40 000

Current liabilities 200 000

Bank overdraft 40 000

Bankers acceptance credit facility 80 000

Trade accounts payable 80 000

Total Equity and Liabilities 760 000

Financial Management IIIB Examination Page 2

The following current market information is known:

Return on preference shares 9%

Return on debentures 12%

Return on mortgage bonds 11%

Growth prospects for the electronic manufacturing sector 6%

Buccaneer’s share price cum div R14,25

Reserve Bank repo rate 5%

90 days liquid Bankers’ acceptance rate 6,5%

Buccaneer’s beta 0,9

Rate of return for the market 15%

Yield to maturity on RSA bonds 6%

Note: The bank overdraft rate is generally set at 3.5% above the reserve bank repo rate.

You establish the following:

1. Buccaneer has an authorized share capital of 50 million ordinary shares of R4 each, of

which 25 million have been issued. The annual dividend of R1 per share has recently been

declared.

2. The redeemable preference shares carry a fixed dividend of 10% and are redeemable at

the option of the company, at a premium of 5%, between 30 June 2016 en 30 June 2018.

3. The R1000 redeemable debentures, with a fixed coupon rate of 10,5% per annum, are

redeemable in two equal capital payments on 30 June 2015 and 30 June 2017.

4. The mortgage bond was negotiated at a fixed interest rate of 12,5% and is redeemable in

four equal installments, which includes capital and interest, commencing 1 July 2015.

5. The bank overdraft facility of R50 million is made available at 1,5% above the prime rate.

Management regards 60% of the facility to be of a permanent nature.

6. The rotating bankers’ acceptance credit facility is available with regard to

90 days liquid bankers’ acceptances at an annual commission of 2%. This financing source

is utilized all the time.

7. Buccaneer’s suppliers grant credit of two months on a permanent basis. One

supplier, representing 30% of creditors, offers credit terms of 1/10, 60 net.

Buccaneer does not make use of the discount and also does not include the cash

flow attributable to suppliers in the cash flow projections of projects.

REQUIRED Marks

Calculate the weighted average cost of Buccaneer’s capital by using the market

value of the various capital components as its target capital structure. 40

(Show calculations to the nearest R’000)

Financial Management IIIB Examination Page 3

SECTION B

Buccaneer is currently considering the commissioning of a modern production plant for the

production of electrical circuits.

The project manager have submitted the following projections of the sales, variable cost

of sales and fixed cost of sales for the first year (values stated as at the end of the first

year)

Cash flow End of year 1 values

Sales 300 000

Variable cost of sales -180 000

Fixed cost of sales -70 000

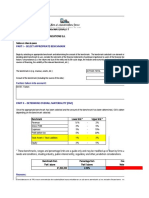

The following annual capacity utilization and annual price increases are expected:

Annual plant capacity utilization

Year 1 2 3 4

80% 100% 100% 100%

Annual price increases

Year 1 2 3 4

Sales 6% 6% 7% 7%

Variable cost of sales 7% 8% 8% 9%

Fixed cost of sales 5% 5% 5% 5%

In calculating of the fixed costs deprecation of the new plant is excluded.

Debtors amount to two months of sales.

The plant carries one month’s inventory of raw material. Sixty percent of variable costs

comprise of raw materials.

The new plant’s cost price is R150 million and has, after an economic life of 4 years, an

estimated remaining value, in real terms, of R20 million. The price index for such capital

equipment is set at 8% per annum. The wear and tear allowance is calculated at 20% per

annum on the original cost and the company tax rate is 28%.

REQUIRED

Marks

Calculate the economic viability of the proposed plant in nominal terms and on the

assumption that Buccaneer’s weighted average nominal cost of capital amounts to 12% per

annum. . 20

Financial Management IIIB Examination Page 4

(Show calculations to the nearest R’000)

Financial Management IIIB Examination Page 5

QUESTION 2 25 MARKS

Constructco (Pty) Ltd, an engineering and construction company is interested in acquiring a

small BEE engineering company called Technoco (Pty) Ltd. Both companies do not have long

term debt and, should Technoco be taken over, it will not result in an increase in finance risk for

Constructco.

The statement of financial position for Technoco (Pty) Ltd as at 31 December 2012 is as follows:

Non current Assets 651 600

Current Assets Inventory 515 900

Receivables 745 000

Bank 158 100

1 419 000

2 070 600

Current liabilities Accounts Payable 753 600

Bank Overdraft 862 900

1 616 500

Capital and Reserves Ordinary Shares of R1 each 50 000

Retained Income 404 100

2 070 600

Technoco's summarised income statements for the last 5 years is as follows:

2008 2009 2010 2011 2012

R R R R R

Profit before abnormal items 30 400 69 000 49 400 48 200 53 200

abnormal items 2 900 (2 200) (6 100) (9 800) (1 000)

profit after abnormal items 33 300 66 800 43 300 38 400 52 200

less: dividends 20 500 22 600 25 000 25 000 25 000

Added to retained income 12 800 44 200 18 300 13 400 27 200

Financial Management IIIB Examination Page 6

Other information available to you:

a. There have been no changes in the issued share capital of Technoco in the past 5

years.

b. The estimated values of Technoco's non-current assets and inventory as at 31 December

2012 are:

Replacement Realisable

cost value

R R

Non-current assets 725 000 450 000

Inventory 550 000 570 000

c. It is expected that 2% of Technoco's receivables as at 31 December 2012 will be

uncollectible.

d. The cost of Capital of Constructco is 9%. The directors of Technoco estimate that the

shareholders of Technoco require a minimum return of 12% on their investment in the

company.

e. The current P/E ratio of Constructco is 12. The industry norm for engineering

companies like Technoco have P/E ratios of around 10, although this is based on much

larger companies.

f. Technoco has a very experienced management team who have been with the company

for a long time. It is noted though, that the Managing Director, Mr Thomas, who has

been with the company for 15 years will be retiring in 2014.

REQUIRED: MARKS

(a) Estimate the value of the total equity of Technoco (Pty) Ltd 12

as on 31 December 2012 using each of the following

bases:

Replacement cost of assets

Realisable value of Assets

The dividend valuation model

(b) Estimate the value of the company using the P/E multiple model. 13

Your answer should include a discussion of the factors affecting

the P/E multiple and any changes that you may wish to make to

derive at maintainable earnings.

(ignore taxation)

Financial Management IIIB Examination Page 7

QUESTION 3 30 MARKS

Club Safari is a Safari tour operator in South Africa. It is wanting to expand its operations into

extreme sport tours in order to capture the ever growing overseas tourist market. Club Safari

has earmarked a small extreme sports company called Extreme SA and the directors feel that

acquiring this company will fit well with their growth strategy. Both companies have the same

level of risk.

Club Safari has decided to offer the shareholders of Extreme SA five shares for every four

shares held. The after tax savings in administrative tasks after the merger would amount to

R2 400 000.

The financial statements for each company are as follows:

Statement of Income for the Year ended 31 December 2012

Club Safari Extreme SA

Rmil Rmil

Sales 182.6 75.2

Operating Profit 43.6 21.4

Interest 12.3 10.2

Net Profit before taxation 31.3 11.2

Taxation 6.3 1.6

Net profit after taxation 25 9.6

Dividends 6 4

Accumulated Profits for the year 19 5.6

Financial Management IIIB Examination Page 8

Statements of Financial Position as at 31 December 2012

Club Safari Extreme SA

Rmil Rmil

Non-current assets 135.4 127.2

Net current assets 65.2 3.2

200.6 130.4

Long term liabilities 120.5 104.8

80.1 25.6

Capital and reserves

R0.5 ordinary shares 20 8

Retained profit 60.1 17.6

80.1 25.6

Price/earnings ratio before the bid 20 15

REQUIRED: 30 MARKS

(a) Calculate the total value of the proposed offer. 10

(b) Calculate the earnings per share of Club Safari if it does acquire 5

Extreme SA and the cost savings are achieved.

(c) Calculate the share price of Club Safari following the acquisition 4

assuming that the savings are achieved and the price earnings

ratio decreases by 5%.

(d) Calculate the effect of the takeover on the wealth of the 9

shareholders of each company (based on C above).

(e) An exchange ratio based on market values might lead to one of 2

the firms experiencing a dilution in earnings per share. Why

might shareholders be prepared to accept a dilution in EPS?

Financial Management IIIB Examination Page 9

QUESTION 4 20 MARKS

Falx Clothes Limited is a clothing retailer that has was incorporated 15 years ago and is now

listed on the JSE. You have been provided with an extract from their financial statements below

(note that all figures are in Rmillions):

STATEMENT OF FINANCIAL POSITION 2013 2012

Assets

Non-current assets 1 197 1 093

Property, plant and equipment 775 724

Goodwill 90 90

Intangible assets 94 77

Derivative financial assets 34 21

Available-for-sale assets 3 1

Loans and receivables 143 141

Deferred tax 58 39

Current assets 5 720 5 131

Inventories 670 530

Trade and other receivables 3 421 3 033

Derivative financial assets 7 28

Prepayments 62 51

Cash and cash equivalents 1 560 1 489

Total assets 6 917 6 224

Equity and liabilities

Total equity 5 981 5 046

Share capital and premium 205 159

Treasury shares -1 274 -1 191

Retained earnings 6 944 6 001

Non-distributable reserves 106 77

Non-current liabilities 97 84

Post-retirement medical benefit obligation 47 41

Cash-settled compensation obligation 12 1

Straight-line operating lease obligation 38 42

Current liabilities 839 1 094

Trade and other payables 598 875

Derivative financial liability - 1

Provisions 73 73

Tax payable 168 145

Total liabilities 936 1 178

Total equity and liabilities 6 917 6 224

Financial Management IIIB Examination Page 10

STATEMENT OF COMPREHENSIVE INCOME 2013 2012

Revenue

Sale of merchandise 8 830 7 858

Cost of sales -3 820 -3 403

Gross profit 5 010 4 455

Other income 208 189

Trading expenses -2 759 -2 421

Depreciation and amortisation -138 -129

Employment costs -890 -828

Occupancy costs -746 -652

Trade receivable costs -533 -390

Other operating costs -452 -422

Trading profit 2 459 2 223

Interest received 728 637

Dividends received 3 -

Profit before tax 3 190 2 860

Tax expense -965 -917

Profit for the period, fully attributable to owners

of the parent 2 225 1 943

Other comprehensive income/(loss)

Movement in effective portion of cash flow hedge 11 -12

Deferred tax on movement in effective portion of cash

flow hedge -3 3

Other comprehensive income/(loss) for the period,

net of tax 8 -9

Total comprehensive income for the period, fully

attributable to owners of the parent 2 233 1 934

Basic earnings per share (cents) 526.3 455.8

weighted average number of shares (millions) 422.8 426.3

Financial Management IIIB Examination Page 11

Industry ratios

Current ratio 5.9 : 1

Acid test ratio 5:1

Stock turnover 11.6

Average collection period 120 days

Total asset turnover 2.9

Debt ratio 25%

Debt / equity ratio 35%

Times interest earned 5 times

Gross profit margin 51%

Net profit margin 16%

Return on assets 25%

Return on equity 30%

Marks

REQUIRED

Based on the information provided, analyse and discuss the financial position and

performance of the company based on the following areas:

- Liquidity 20

- Asset management

- Debt management

- Profitability

Financial Management IIIB Examination Page 12

QUESTION 5 15 MARKS

EL motors has a paid-up ordinary share capital of R4,500,000. This is represented by 6 million

shares. EL motors has no loan capital. Net after tax earnings for the last year were

R3,600,000. The P/E ratio of the company is 15.

The company is wanting to buy and move to bigger premises which will cost R10,500,000 and is

considering financing this through a rights issue at R8 per share.

REQUIRED: 15 MARKS

(a) Calculate the current market price of the ordinary shares 5

(b) Calculate the value of the right. 6

(c) Explain the advantages and disadvantages of a rights issue. 4

Financial Management IIIB Examination Page 13

You might also like

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Solution Manual Advanced Accounting by Guerrero Peralta Chapter 2 PDFDocument24 pagesSolution Manual Advanced Accounting by Guerrero Peralta Chapter 2 PDFAndry John PerialdeNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Economic Inequality Across The WorldDocument33 pagesEconomic Inequality Across The WorldMithun ParamanandanNo ratings yet

- GEF2018 EdEcosystForSocietalTransfDocument132 pagesGEF2018 EdEcosystForSocietalTransfChris PetrieNo ratings yet

- Social Stratification FinalDocument6 pagesSocial Stratification FinalAshfaq KhanNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1Mary Joy CabilNo ratings yet

- Understanding & Analyzing Livelihood InterventionDocument43 pagesUnderstanding & Analyzing Livelihood InterventionS.Rengasamy100% (6)

- Module 010 Financial Statements and The Ratio AnalysisDocument9 pagesModule 010 Financial Statements and The Ratio AnalysisHo Ming LamNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Financial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleDocument11 pagesFinancial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleNadrahNo ratings yet

- Financial AnalysisDocument47 pagesFinancial Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- Lecture 03Document27 pagesLecture 03Anon sonNo ratings yet

- Management Accounting BankDocument23 pagesManagement Accounting BankVaishnavi ChoudharyNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- FINM7312T1a 3Document12 pagesFINM7312T1a 3Phumzile MahlanguNo ratings yet

- Corporate Strategic Financial Decisions 120675525Document17 pagesCorporate Strategic Financial Decisions 120675525Anushka GuptaNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Financial Management End Term Paper - Batch 2020-22Document4 pagesFinancial Management End Term Paper - Batch 2020-22Swastik NayakNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- Mini Case and Summary of BudgetingDocument4 pagesMini Case and Summary of BudgetingKartik TomarNo ratings yet

- Reviewer Financial ManagementDocument7 pagesReviewer Financial Managementldeguzman210000000953No ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- Strategic Finance Mid-Term Examination 1Document6 pagesStrategic Finance Mid-Term Examination 1سردار عطا محمدNo ratings yet

- Fimd Training Unit 1 - Financial AnalysisDocument31 pagesFimd Training Unit 1 - Financial AnalysisErrol ThompsonNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Valuations 1 HreDocument12 pagesValuations 1 HreVictor JonesNo ratings yet

- Practice Paper-June 2020: Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document5 pagesPractice Paper-June 2020: Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- Chapter 14Document13 pagesChapter 14VanessaFaithBiscaynoCalunodNo ratings yet

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Analysis of Financial StatementsDocument17 pagesAnalysis of Financial StatementsRajesh PatilNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Corporate Finance 22vaCRTlVYrpDocument8 pagesCorporate Finance 22vaCRTlVYrpAdityaSinghNo ratings yet

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1trixie maeNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Advanced Audit and Assurance (United Kingdom) : Monday 1 December 2014Document7 pagesAdvanced Audit and Assurance (United Kingdom) : Monday 1 December 2014Vivian Nozhe ZakiNo ratings yet

- Bba Sem Iii QBDocument23 pagesBba Sem Iii QBSaima NishatNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- IV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperDocument2 pagesIV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperAria MazeNo ratings yet

- Suggested CAP II Group I June 2023Document43 pagesSuggested CAP II Group I June 2023pratyushmudbhari340No ratings yet

- Group 1Document53 pagesGroup 1Nishma BaniyaNo ratings yet

- Mas Preweek Handouts - Rodel RoqueDocument10 pagesMas Preweek Handouts - Rodel RoqueElaine Joyce GarciaNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Acquisition & Mergers ValuationDocument18 pagesAcquisition & Mergers ValuationAqeel HanjraNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- Accpro 12 CDocument6 pagesAccpro 12 CShubhamNo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Common Test May2022 QDocument5 pagesCommon Test May2022 QNur Anis AqilahNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- 600 - Materiality AvayaDocument19 pages600 - Materiality AvayaBrayan Nicolás Martínez RomeroNo ratings yet

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196No ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Suggested Solution To Mid Year Test - AFM300 - 2015Document11 pagesSuggested Solution To Mid Year Test - AFM300 - 2015Dolly VongweNo ratings yet

- Solution To Fin 3A Main Exams 2015Document5 pagesSolution To Fin 3A Main Exams 2015Dolly VongweNo ratings yet

- Fim 3A Main June Examination 2014 FinalDocument11 pagesFim 3A Main June Examination 2014 FinalDolly VongweNo ratings yet

- Afm 311 A - 2013Document8 pagesAfm 311 A - 2013Dolly VongweNo ratings yet

- Investment Policy of BankDocument40 pagesInvestment Policy of BankPrakash BhandariNo ratings yet

- Admas University SeminarDocument32 pagesAdmas University SeminarFirezer TeshomeNo ratings yet

- Misreading GorzDocument21 pagesMisreading Gorz5705robinNo ratings yet

- Econ 304 HW 11Document3 pagesEcon 304 HW 11Pulki Mittal100% (1)

- Political Economy of Mass MediaDocument17 pagesPolitical Economy of Mass MediaMusa RashidNo ratings yet

- Personal Finance & Tax Planning For Cost Accountants: Roven PereiraDocument13 pagesPersonal Finance & Tax Planning For Cost Accountants: Roven PereiraK S KamathNo ratings yet

- Excerpt From "America: Imagine A World Without Her" by Dinesh D'Souza.Document4 pagesExcerpt From "America: Imagine A World Without Her" by Dinesh D'Souza.OnPointRadioNo ratings yet

- Profit Maximisation Vs Wealth MaximisationDocument3 pagesProfit Maximisation Vs Wealth MaximisationManasNo ratings yet

- Review On Hasanuzzaman'sDocument12 pagesReview On Hasanuzzaman'sMadison SheenaNo ratings yet

- Fardapaper Perspectives On Mental Accounting An Exploration of Budgeting and InvestingDocument10 pagesFardapaper Perspectives On Mental Accounting An Exploration of Budgeting and Investingvira anandaNo ratings yet

- What Does Economics Have To Do With Running A BusinessDocument13 pagesWhat Does Economics Have To Do With Running A Businesswalsonsanaani3rdNo ratings yet

- Probable Full FileDocument45 pagesProbable Full FileR Rrajesh KoomarrNo ratings yet

- Daniel Gilbert - SurrogatesDocument6 pagesDaniel Gilbert - Surrogatesvikesh_thouraniNo ratings yet

- GENERAL PAYROLL of Employees KolambuganDocument50 pagesGENERAL PAYROLL of Employees KolambuganMercy LazaragaNo ratings yet

- Solution Manual For Financial Accounting 12th Edition by WarrenDocument36 pagesSolution Manual For Financial Accounting 12th Edition by Warrenslugwormarsenic.ci8ri100% (45)

- Academic WordDocument7 pagesAcademic WordNguyễn Cảnh Đông ĐôNo ratings yet

- LS4-7 (3) MARIANO - EditedDocument16 pagesLS4-7 (3) MARIANO - EditedarnelNo ratings yet

- Bcom BeDocument271 pagesBcom BegdbevansNo ratings yet

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewDocument8 pagesTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaNo ratings yet

- Robert Lucas JR - Macroeconomic PrioritiesDocument24 pagesRobert Lucas JR - Macroeconomic PrioritiesDouglas Fabrízzio CamargoNo ratings yet

- Fundamentals of Finance BBA - I SemDocument22 pagesFundamentals of Finance BBA - I SemVishakha AgarwalNo ratings yet

- Lesson 1: What Is Entrepreneurship?Document31 pagesLesson 1: What Is Entrepreneurship?Shammah SagundayNo ratings yet

- Tithe - Percentage Giving ChartDocument1 pageTithe - Percentage Giving ChartRay Anthony Rodriguez0% (1)

- WIKI - The Income StatementDocument2 pagesWIKI - The Income StatementHanna GeguillanNo ratings yet

- Unit 1 HVDTR NotesDocument4 pagesUnit 1 HVDTR NotesSuryansh RantaNo ratings yet