Professional Documents

Culture Documents

Abc 2018

Uploaded by

vicent laurianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abc 2018

Uploaded by

vicent laurianCopyright:

Available Formats

Page 1 of 12

PAC FINANCIAL CONSULTANTS

CPA REVIEW CLASSES

INTERMEDIATE & FINAL STAGE

B5: PERFORMANCE MANAGEMENT

TOPIC: ACTIVITY BASED COSTING (ABC)

Absorption Costing - revisited

In order to full understand Activity Based Costing (ABC), we need to remind ourselves about the

principles of traditional absorption costing first of all.

ABSORPTION COSTING

When using absorption costing, we aim to calculate a full production cost per unit. Direct costs such as

materials or labor can clearly be ‘attached’ to each unit of production. Overhead costs are indirect costs

which cannot clearly be charged to individual units of production (for example factory rent and rates).

For overheads we have to adopt a process to estimate an amount of overhead that we can charge to

each cost unit.

Overheads were identified in total and then usually apportioned or shared between cost centers (usually

departments such as assembly or finishing). For example factory rent and rates could be shared

between cost centers on the basis of floor area (square meters).

Once accumulated in a cost center the overheads could then be absorbed into cost units on an hourly

basis – often either labour hours (if the cost centre is labour intensive) or machine hours (if the cost

centre is machine intensive).

Overhead Absorption Rate (OAR) = Total budgeted OHs/Budgeted activity level

The absorption costing per unit can then be used to:

Assess the costs incurred per unit for performance assessment (e.g. variance analysis);

Value inventory for financial accounting purposes;

Calculate sales prices based on a cost-plus basis.

PROBLEMS ASSOCIATED WITH ABSORPTION COSTING

There are problems for modern manufacturing businesses in using absorption costing methods.

1. Increased product complexity.

Laurian, Vicent CPA(T), MSc, Bcom.

Page 2 of 12

Modern manufacturers tend to produce a wide range of products at quite different volumes. There is a

high risk that some products may be charged too much overhead and others too little. This in turn could

lead to inappropriate pricing of products if the business pursues a cost plus pricing methodology.

2. Increasing capital intensity of modern manufacturing techniques

Many modern manufacturers are highly machine intensive. This means that only a small portion of direct

labor is involved in the manufacturing process hence a very small proportion of the overall costs

involved. This can lead to extremely high absorption rates that bear little resemblance to the underlying

overhead and how it is incurred.

EXAMPLE:

Armstrong manufactures small hand held hammers and 12 metre containers used in the transportation

of goods by road, rail and sea. It operates a highly mechanised production system. Overheads are

calculated on a direct labour hour basis.

The following information is available for the manufacture of these products over a period.

Hand held Containers

hammers

Direct material/unit 5/= 300/=

Direct Labour/unit:

0.5 hours @ Tshs.20/hour: 10/=

2 hours @ Tshs.20/hour: 40/=

Budgeted Production (units) 20,000 1,000

Total Factory overhead 960,000/=

REQUIRED:

(a) Calculate the amount of overhead to be absorbed into each product.

(b) Calculate the sales price of each product if the business uses a full cost plus 40% basis.

SOLUTION:

OAR = 960,000/(20,000×0.5) + (1,000×2) = Tshs.80/hr

(a) The standard cost card for each product becomes:

Hand held Containers

hammers

Direct material/unit 5/= 300/=

Direct Labour/unit:

0.5 hours @ Tshs.20/hour: 10/=

2 hours @ Tshs.20/hour: 40/=

Prime cost/unit 15/= 340/=

Overhead/unit:

0.5hrs×Tshs.80/hr 40/=

2hrs×Tshs.80/hr 160/=

Total production cost/unit 55/= 500/=

Laurian, Vicent CPA(T), MSc, Bcom.

Page 3 of 12

(b) The sales price of each product becomes:

Hand held Containers

hammers

Full production cost/unit 55/= 500/=

40% profit mark-up 22/= 200/=

Sales price 77/= 700/=

OBSERVATION:

It appears strange for the case of containers, such a large and bulky product, only 32% of the product’s

cost is made up of overhead. Each container appears relatively ‘cheap’ to make in overhead terms

because of the relatively small amount of direct labour required to make it. Practically the bulk of the

productive input to make the container is machine overhead, yet the absorption rate does not recognize

this.

ACTIVITY BASED COSTING (ABC)

ABC tackles the problems of absorption costing by adopting a much more accurate way of charging

overhead to cost units.

In essence the business carefully considers what the primary activities of the business are. In making

units of production what does the business actually do to be able to make those units?

Traditional absorption costing collects all of the activities together in a cost centre. Any factory

overheads are then apportioned to that cost centre.

Under ABC, overheads are (wherever possible) specifically allocated to a cost pool relating to a

particular activity. Rather than absorbing all overheads from a cost pool under one uniform basis (e.g.

labour hours), ABC then absorbs overhead into cost units by identifying the relevant cost driver (what

cause changes in the cost). This is likely to mean that there will in essence be multiple absorption rates

within a business.

Examples of cost drivers would be: -

Ordering costs – no. of orders

Set-up costs – no. of set-ups

Packing costs – no. of packing orders

NOTE: One of the most important attributes of ABC is that to control costs, the business needs to focus

on reducing the amount of cost drivers.

OVERALL SUMMARY OF ABC

ABC addresses overhead costs only. Direct costs can be specifically calculated and accurately

attributed to each product. In the Armstrong example above, we could accurately identify the

direct material and labour costs attributable to each product;

We are seeking to identify an accurate product cost;

Laurian, Vicent CPA(T), MSc, Bcom.

Page 4 of 12

Under ABC, cost centres are replaced by cost pools. Cost pools reflect an accumulation of

overhead relating to specific activities undertaken by the business;

We replace OARs with cost driver rates. Individual cost driver rates are used to charge activity

overheads to individual cost units on the basis of specific usage.

STEPS IN ESTABLISHING AND APPLYING ABC:

There are 5 main steps in establishing and applying ABC: -

1. Identify activities that consume resources and incur overhead costs.

2. Allocate overhead costs to the activities that incur them.

3. Determine the cost driver for each activity or cost pool.

Each group of costs which are influenced by a particular cost driver is referred to as a 'cost

pool'.

4. Collect data about actual activity for the cost driver in each cost pool

5. Calculate the overhead cost of products or services.

This is done by calculating an overhead cost per unit of the cost driver. Overhead costs are then

charged to products or services on the basis of activities used for each product or service.

The Advantages of ABC

1. More realistic product costs are provided when support overheads are a significant proportion of

total costs.

2. More overheads can be traced to the product. In modern factories there are a growing number

of non-factory floor activities. ABC is concerned with all activities so takes product costing

beyond the traditional factory floor basis.

3. ABC recognizes that it is activities, which cause cost, not products and it is products, which

consume activities.

4. ABC focuses attention on the real nature of cost behaviour and helps in reducing costs and

identifying activities, which do not add value to the product.

5. ABC recognizes the complexity and diversity of modern production by the use of multiple cost

drivers, many of which are transaction based rather than based solely on production volume.

6. ABC provides a reliable indication of long-run variable product cost which is relevant to strategic

decision-making.

Laurian, Vicent CPA(T), MSc, Bcom.

Page 5 of 12

7. ABC is flexible enough to trace costs to processes, customers, areas of managerial

responsibility, as well as product costs.

8. ABC provides useful financial measures (e.g. cost driver rates) and non-financial measures (e.g.

transaction volumes).

9. The principle of using activities to trace costs can be applied across a range of service

industries as well as manufacturing firms.

The Disadvantages of ABC

ABC may not be universally beneficial. There are four major issues to be considered:

1. Cost vs benefit

The need to analyze costs on a radically different basis will require resources, which will lead to

additional costs. Clearly the benefits which will be obtained must exceed these costs.

In general terms, an organization which has little competition, a stable and standardized product

range and for which overheads represent a small proportion of total cost, will not benefit from

the introduction of ABC.

2. Need for informed application

While ABC is likely to provide better information for decision makers, it must still be applied with

care. ABC is not fully understood by many managers and therefore is not fully accepted as a

means of cost control.

3. Difficulty in identifying cost drivers

In a practical context, there are frequently difficulties in identifying the appropriate drivers. ABC

costs are based on assumptions and simplifications. The choice of both activities and cost

drivers might be inappropriate.

4. Lack of appropriate accounting records

ABC needs a new set of accounting records, this is often not immediately available and

therefore resistance to change is common. The setting up of new cost pools is needed which is

time-consuming

Laurian, Vicent CPA(T), MSc, Bcom.

Page 6 of 12

PRACTICE QUESTIONS

QUESTION 1 (NBAA MAY 2018)

Pan African is a reputable law partnership offering a variety of legal services to clients. The managing

partner has recently sought advice in relation to improving the accuracy and efficiency of its billing

system. The advisor, CPA Leo Bulali, suggested the introduction of activity based costing (ABC) to

replace the existing traditional overhead costing method used by Pan African. The current costing

method allocates overhead costs to clients based on total labour hours (for partners, junior clerks and

secretarial support). Clients are billed based on cost plus a markup of 60%. In order to introduce ABC

the managing partner assigned a team, comprising one partner and two junior clerks, to ascertain the

cost and activity relationships, and corresponding cost data, and this is shown below:

Cost activity relationships:

Cost pool Cost driver

Legal search Number of searches conducted

Documentation Number of pages printed/copied

Office administration (telephone, postage, etc.) Secretarial support time spent on case

Cost and activity data: TZS.

Partner salary cost 38,640,000

Junior clerk wages cost 18,320,000

Secretarial support wages cost 5,225,600

Legal search costs 1,818,000

Printing and stationery costs 4,830,000

Office administration costs 3,661,600

Partner labour hours 6,440

Junior clerk labour hours 7,680

Secretarial support labour hours 3,680

Total number of searches conducted 1,212

Total number of document pages printed/copied 1,610,000

Details relating to two legal cases:

Case 1406 Case 2655

Number of searches 5 1

Partner time spent on case 2 hours 1 hour

Junior clerk time spent on case 5 hours 3 hours

Document pages printed/copied 215 pages 86 pages

Secretarial support time spent on case 1 hour 1 1 hour

REQUIRED:

(a) Calculate the total cost of each of the cases noted above using:

(i) The existing costing method;

(ii) Activity based costing. (17 marks)

(b) Comment briefly on your answers at (a) (i) and (ii) above. (3 marks) [Total: 20 Marks]

Laurian, Vicent CPA(T), MSc, Bcom.

Page 7 of 12

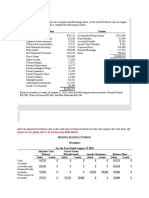

QUESTION 2 (NBAA NOV 2017)

HAPA KAZI Solutions Ltd produces three different products using two production departments. The

company currently uses absorption costing to establish products cost and profitability. The directors

have recently attended a conference on Activity-Based Costing (ABC) and are examining whether ABC

might provide a better system for HAPA KAZI Solutions Ltd.

The following budgeted information for the period ending 31 st December 2018 has been collected for

each of the three products:

Tunda one Tunda two Tunda three

Production and sales 8,750 units 4,000 units 6,000 units

Unit sales price TZS 56 TZS 106 TZS 84

Direct materials 1.5 kg 6 kg 7 kg

Direct labor:

- Machining Dept 1 hour 8 hours 6 hours

- Assembly Dept 4 hours 3 hours 1 hour

Direct expenses TZS 2 TZS 6 TZS 3

Machine Dept (machine hours per unit) 2 hours 5 hours 4 hours

Raw material cost TZS 4 per kilo and the hourly rate for all labor is TZS 5. The direct expenses relate

entirely to specialized packaging which is uniquely designed for each of the products and is therefore

directly attributed to that product alone.

The current costing system absorbs overheads to the Machine and Assembly Departments on the basis

of a recovery rate of TZS 3.50 per machine hour and TZS 1 per labour hour respectively

The following is an analysis of the overheads by department:

Department Overheads in TZS

Purchase Department 22,400

Production Set-up & Design Department 34,500

Customer Service Department 32,600

Machine Department 123,000

Assembly Department 26,500

The Department Managers have provided the following additional information about operations in their

departments:

Tunda one Tunda two Tunda three Total

Number of set-ups 10 10 30 50

Number of customer orders 80 86 160 326

Number of purchase orders 30 32 50 112

The Machine Department is a capital intensive and Assembly Department is labour intensive.

REQUIRED:

(a) Calculate the prime cost of each product. (2 marks)

(b) Calculate profit per unit for each product if overheads are absorbed on the current costing basis

(4 marks)

Laurian, Vicent CPA(T), MSc, Bcom.

Page 8 of 12

(c) Calculate profit per unit for each product if overheads are absorbed using an Activity-Based

Costing approach and identify any cost drivers you assign. (12 marks)

(d) Comment on why there is a difference between the profit/loss shown on an absorption costing

basis and that shown using Activity-Based costing. (2 marks) (Total: 20 marks)

QUESTION 3

Hensau Ltd has a single production process for which the following overhead costs have been estimated

for the period ending 31 December 2010:

Tshs.

Material receipt and inspection costs 15,600

Power costs 19,500

Material handling costs 13,650

Three products - X, Y, and Z are produced by workers who perform a number of operations on material

blanks using hand held electrically powered drills. The workers are paid 4/= per hour.

The following budgeted information has been obtained for the period ending 31 Dec. 2009:

Product X Product Y Product Z

Production quantity (units) 2,000 1,500 800

Batches of Material 10 5 16

Data per product unit:

Direct material (square metres) 4 6 3

Direct material cost (/=) 5 3 6

Direct labour (minutes) 24 40 60

No. of power drill operations 6 3 2

Overhead costs for material receipt and inspection, process power and material handling are presently

each absorbed by product units using rates per direct labour hour.

An activity based costing investigation has revealed that the cost drivers for the overhead costs are as

follows:

Material receipt and inspection: Number of batches of material

Process power: Number of power drill operations

Material handling: Quantity of material (square metres) handled

Required:

(a) Prepare a summary which shows the budgeted product cost per unit for each product of X, Y,

and Z for the period ending 31 December 2010 detailing the unit costs for each cost element

using:

(i) The existing method for the absorption of overhead costs and

(ii) An approach which recognizes the cost drivers revealed in the activity based costing

investigation. (14 marks)

(b) Assuming Hensau ltd operates under a 40% cost-plus pricing strategy, determine sales prices

for each product under both absorption and ABC technique (6 marks) (Total 20 marks)

Laurian, Vicent CPA(T), MSc, Bcom.

Page 9 of 12

QUESTION 4

Pinnacle ltd operates an activity-based costing system and has forecast the following information for

next year.

Cost Pool Cost Cost Driver Number of Drivers

Production set-ups 105,000/= Set-ups 300

Product testing 300,000/= Tests 1,500

Component supply and storage 25,000/= Component orders 500

Customer orders and delivery 112,500/= Customer orders 1,000

General fixed overheads such as lighting and heating, which cannot be linked to any specific activity, are

expected to be 900,000/= and these overheads are absorbed on a direct labour hour basis. Total direct

labour hours for next year are expected to be 300,000 hours.

Pinnacle Co expects orders for the Product next year to be 100 orders of 60 units per order and 60

orders of 50 units per order. The company holds no inventories of the product and will need to produce

the order requirement in production runs of 900 units. One order for components is placed prior to each

production run. Four tests are made during each production run to ensure that quality standards are

maintained. The following additional cost and profit information relates to the product:

Component cost: 1/= per unit

Direct labour: 10 minutes per unit at 7.8/= per hour

Profit mark up: 40% of total unit cost

Required

(a) Calculate the activity-based recovery rates for each cost pool. (4 marks)

(b) Calculate the total unit cost and selling price of Product ZT3. (10 marks)

(c) Discuss the reasons why activity-based costing may be preferred to traditional absorption

costing in the modern manufacturing environment. (6 marks) (20 marks)

QUESTION 5

Triple Limited makes three types of gold watch – the Diva (D), the Classic (C) and the Poser (P). A

traditional product costing system is used at present; although an activity based costing (ABC) system is

being considered.

Details of the three products for a typical period are:

Hours per unit Materials Production

Labor hours Machine hours Cost/unit (/=) Units

Product D 0.5 1.5 20 750

Product C 1.5 1 12 1,250

Product P 1 3 25 7,000

Direct labour costs 6/= per hour and production overheads are absorbed on a machine hour basis. The

overhead absorption rate for the period is 28/= per machine hour.

Total production overheads are 654,500/= and further analysis shows that the total production

overheads can be divided as follows:

Laurian, Vicent CPA(T), MSc, Bcom.

Page 10 of 12

%

Costs relating to set-ups 35

Costs relating to machinery 20

Costs relating to materials handling 15

Costs relating to inspection 30

Total production overhead 100

The following total activity volumes are associated with each product line for the period as a whole:

Number of Number of movements Number of

Set ups of materials inspections

Product D 75 12 150

Product C 115 21 180

Product P 480 87 670

670 120 1,000

REQUIRED:

(a) Calculate the cost per unit for each product using traditional methods, absorbing overheads on

the basis of machine hours. (3 marks)

(b) Calculate the cost per unit for each product using ABC principles (work to two decimal places).

(12 marks)

(c) Explain why costs per unit calculated under ABC are often very different to costs per unit

calculated under more traditional methods. Use the information from Triple Limited to illustrate.

(4 marks)

(d) Discuss the implications of a switch to ABC on pricing and profitability. (6 marks)

(Total 25 marks)

QUESTION 6 (NBAA NOV 2015)

Mwanga Manufacturing Company is a famous Company for manufacturing and distribution of soap

products in all East African countries. The company manufactures two soap brands known as ‘Red

soap’ and ‘Dark soap’.

According to production manager. The company applies overhead on the bases of direct labour hours

throughout the factory and the company anticipate that overhead and direct time for the upcoming

accounting period are TZS. 3,200,000 and 50,000 hours respectively

Information about the company’s products are as follows:

Red Soap Dark Soap

Estimated production volume 3000 units 4000 units

Direct material cost TZS 56/unit TZS 84/unit

Direct labour per unit 6 hours @ TZS 30 per hours 5 hours @TZS 30 per hour

The company overhead cost of TZS. 3,200,000 can be identified with three major activities: order

processing (TZS. 500,000) machine processing (TZS. 2,400,000) and product inspection (TZS.

300,000). These activities are driven by number of orders processed, machine hours worked, and

inspection hours respectively. Data relevant to these activities are as follows:

Laurian, Vicent CPA(T), MSc, Bcom.

Page 11 of 12

Order Processed Machine Hours worked Inspection Hours

Red Soap 640 32,000 8,000

Dark Soap 360 48,000 12,000

Total 1000 80,000 20,000

REQUIRED:

(a) Compute the overhead absorption rates that would be used for order processing, machine

processing, and product inspection in an activity-based costing system. (3 marks).

(b) Assuming use of activity-based costing, compute the unit manufacturing costs of Red soap and

dark soap if the expected manufacturing volume is attained. (6 Marks)

(c) Compute:

(i) How much overhead costs would be applied to a unit of red soap and Dark soap if the

company would have used traditional costing and applied overhead solely on the basis

of direct labour hours?

(ii) Using the answers in (i) above, show which of the two products would be undercosted

or overcosted by this procedure. (6 Marks)

(d) State the major limitations of activity based costing? (5 Marks) (Total 20 Marks)

QUESTION 7 (NBAA MAY 2015 – REVISED)

(a) Explain the key differences between the Traditional costing systems and modern day activity

based costing system (4 Marks)

(b) Explain the necessary steps to be followed when designing an effective Activity based costing

system. (6 Marks)

(c) XY provides accountancy services and has three different categories of client: Currently the

costs are attribute to each client based on the hours spent on preparing accounts and providing

advice.

XY currently charges its clients fees by adding a 20% mark-up to total costs. Currently the

costs are attributed to each client based on the hours spent on preparing accounts and

providing advice.

XY is considering changing to an activity based costing system.

The annual costs and the causes of these costs have been analyzed as follows:

Tshs. ‘000’

Accounting preparation and advice 580,000

Requesting missing information 30,000

Issuing fee payment reminders 15,000

Holding client meeting 60,000

Travelling to meet clients 40,000

Laurian, Vicent CPA(T), MSc, Bcom.

Page 12 of 12

The following details relate to three of XY’s clients and to XY as a whole:

Client XY

A B C

Hours spent on preparing accounts and providing advice 1,000 250 340 18,000

Requests for missing information 4 10 6 250

Payment reminders sent 2 8 10 400

Client meetings held 4 1 2 250

Kilometers travelled to meet clients 150 600 0 10,000

Required:

Make calculations to show the effect to changing to the new costing system on fees charged to each of

these three clients. (10 Marks) (Total = 20 marks)

Laurian, Vicent CPA(T), MSc, Bcom.

You might also like

- P2 Course NotesDocument275 pagesP2 Course NotesMyo TunNo ratings yet

- Activity Based Costing: Topic List Syllabus ReferenceDocument9 pagesActivity Based Costing: Topic List Syllabus ReferenceSyed Attique KazmiNo ratings yet

- Lecture 2 Activity Based CostingDocument6 pagesLecture 2 Activity Based Costingmaharajabby81No ratings yet

- NotesDocument155 pagesNotesZainab Syeda100% (1)

- ACCA F5 Course Notes PDFDocument330 pagesACCA F5 Course Notes PDFAmanda7100% (1)

- ABC Advanced MethodsDocument6 pagesABC Advanced MethodsMicaiah MasangoNo ratings yet

- B01 AbcDocument21 pagesB01 AbcAcca BooksNo ratings yet

- Activity Based Costing Lecture NotesDocument5 pagesActivity Based Costing Lecture NotesskizajNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- Acca F5Document133 pagesAcca F5Andin Lee67% (3)

- Accounting in A Nutshell 10: Activity-Based Costing (ABC)Document3 pagesAccounting in A Nutshell 10: Activity-Based Costing (ABC)Business Expert PressNo ratings yet

- NSJSKSNSJSJSJDDocument5 pagesNSJSKSNSJSJSJDWillen Christia M. MadulidNo ratings yet

- 4thsem CMA II ActivityBasedCosting by SunitaSaha 19apr2020Document9 pages4thsem CMA II ActivityBasedCosting by SunitaSaha 19apr2020bhupNo ratings yet

- Chapter 2 Activity Based Costing: 1. ObjectivesDocument13 pagesChapter 2 Activity Based Costing: 1. ObjectivesNilda CorpuzNo ratings yet

- Performance Management Study NotesDocument167 pagesPerformance Management Study NotesApeksha SubedeeNo ratings yet

- Chapter 5 (Activity-Based Costing) Video: Overhead To Products Based On Direct Labor, With Labor Being A Measure ofDocument8 pagesChapter 5 (Activity-Based Costing) Video: Overhead To Products Based On Direct Labor, With Labor Being A Measure ofMhekai SuarezNo ratings yet

- Activity-Based Costing Relevant To Acca Qualification Paper F5Document9 pagesActivity-Based Costing Relevant To Acca Qualification Paper F5Faizan Ahmed KiyaniNo ratings yet

- ACCA F5 Course NotesDocument273 pagesACCA F5 Course NotesLinkon Peter50% (2)

- Activity-Based CostingDocument7 pagesActivity-Based CostingMasabaku KoteloNo ratings yet

- Chapter 2.4 ABC StudentDocument7 pagesChapter 2.4 ABC StudentnafhahxNo ratings yet

- Iafm Ch05 Fall 2023 NuDocument31 pagesIafm Ch05 Fall 2023 Nugigih satyaNo ratings yet

- Activity Based Costing Questions and NotesDocument11 pagesActivity Based Costing Questions and Notesviettuan9167% (3)

- Activity Based CostingDocument25 pagesActivity Based Costingttongoona3No ratings yet

- Internet Mcqs ABC COSTINGDocument4 pagesInternet Mcqs ABC COSTINGTalhaNo ratings yet

- AFAR 1 - Flexible Learning Module - Midterm Topic 2 - ABC and Variable CostingDocument22 pagesAFAR 1 - Flexible Learning Module - Midterm Topic 2 - ABC and Variable CostingKezNo ratings yet

- Activity-Based Costing: Questions For Writing and DiscussionDocument28 pagesActivity-Based Costing: Questions For Writing and DiscussionSaratull SafriNo ratings yet

- Operation CostingDocument5 pagesOperation CostingAshmanur RhamanNo ratings yet

- Ab CostingDocument6 pagesAb Costingkakalalaa0801No ratings yet

- F5 - Activity Based Costing: Ken GarrettDocument5 pagesF5 - Activity Based Costing: Ken GarrettstukinskoolNo ratings yet

- Dahlia DahliaDocument21 pagesDahlia Dahliaambrosia96No ratings yet

- AFAR 1 Flexible Learning Module Midterm Topic 2 ABC and Variable Costing.Document11 pagesAFAR 1 Flexible Learning Module Midterm Topic 2 ABC and Variable Costing.Jessica IslaNo ratings yet

- Activity Based CostingDocument19 pagesActivity Based CostingthejojoseNo ratings yet

- 08 Accounting Study NotesDocument5 pages08 Accounting Study NotesJonas ScheckNo ratings yet

- AccountingDocument20 pagesAccountingAbdul AyoubNo ratings yet

- Cost M PDFDocument30 pagesCost M PDFabel habtamuNo ratings yet

- Scm.1 - Strategic Management AccountingDocument20 pagesScm.1 - Strategic Management AccountingPrincess BersaminaNo ratings yet

- Costing SystemsDocument33 pagesCosting Systemselizabeth.awaiyeNo ratings yet

- f5 NoteDocument21 pagesf5 NoteAbhiraj RNo ratings yet

- Chapter 2. - Activity Based Costing PPT Dec 2011Document5 pagesChapter 2. - Activity Based Costing PPT Dec 2011shemidaNo ratings yet

- Introduction To Cost Accounting: MeaningDocument11 pagesIntroduction To Cost Accounting: MeaningTejas YeoleNo ratings yet

- MODULE StraCoMaDocument24 pagesMODULE StraCoMaJudy LarozaNo ratings yet

- OverheadsDocument28 pagesOverheadsJawad LatifNo ratings yet

- F5-Abc-1 AccaDocument4 pagesF5-Abc-1 AccaAmna HussainNo ratings yet

- Allocation, Absorption & Ascertainment of CostsDocument20 pagesAllocation, Absorption & Ascertainment of Costssingh_rana@yahoo.comNo ratings yet

- Cma Adnan Rashid Complete NotesDocument541 pagesCma Adnan Rashid Complete NotesHAREEM25% (4)

- Activity Based CostingDocument4 pagesActivity Based CostingSenthilmaniThuvarakanNo ratings yet

- Overhead AbsorptionDocument3 pagesOverhead AbsorptionStar MoonNo ratings yet

- F5 Handout 1 For Dec 2011Document18 pagesF5 Handout 1 For Dec 2011saeed@atcNo ratings yet

- Modul Akuntansi Manajemen (TM7)Document7 pagesModul Akuntansi Manajemen (TM7)Aurelique NatalieNo ratings yet

- Cost and Management Accounting Sem3Document11 pagesCost and Management Accounting Sem3saurabhnanda14No ratings yet

- University of London (LSE) : Activity-Based Costing (ABC) Activity-Based Management (ABM)Document18 pagesUniversity of London (LSE) : Activity-Based Costing (ABC) Activity-Based Management (ABM)Dương DươngNo ratings yet

- Activity Based CostingDocument34 pagesActivity Based CostingJackNo ratings yet

- A Comparison of Traditional & ABC Systems: Cost DriversDocument7 pagesA Comparison of Traditional & ABC Systems: Cost Driverssandesh tamrakarNo ratings yet

- No.2 Activity Based CostingDocument20 pagesNo.2 Activity Based CostinganuradhaNo ratings yet

- Chap 003Document43 pagesChap 003Felix bhieNo ratings yet

- Activity Based CostingDocument2 pagesActivity Based CostingInah SalcedoNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Life Cycle CostingDocument10 pagesLife Cycle Costingvicent laurianNo ratings yet

- Pricing Decisions - Nov. 2017Document10 pagesPricing Decisions - Nov. 2017vicent laurianNo ratings yet

- IFRS 8 Operating Segment-5-7Document3 pagesIFRS 8 Operating Segment-5-7vicent laurianNo ratings yet

- IFRS 11 Joint ArrangementsDocument5 pagesIFRS 11 Joint Arrangementsvicent laurianNo ratings yet

- Performance MeasurementDocument32 pagesPerformance Measurementvicent laurianNo ratings yet

- Activity Based Budgeting Excel TemplateDocument5 pagesActivity Based Budgeting Excel Templatevicent laurianNo ratings yet

- Abc ActivityDocument1 pageAbc Activityvicent laurianNo ratings yet

- Module 5 - Factory Overhead VarianceDocument73 pagesModule 5 - Factory Overhead VarianceCristineNo ratings yet

- Faculty Name: Rabia SharifDocument7 pagesFaculty Name: Rabia SharifHercules EdenNo ratings yet

- 01.PROJECT REPORT - Cold Processed OilDocument10 pages01.PROJECT REPORT - Cold Processed Oiluma91% (11)

- Mid Term 2ndDocument16 pagesMid Term 2ndMinh Thư Nguyễn ThịNo ratings yet

- Coffee Bean IncDocument5 pagesCoffee Bean Inctiff556No ratings yet

- Chapter 4 Spoilage & ReworkDocument11 pagesChapter 4 Spoilage & ReworkyebegashetNo ratings yet

- Modul Lab - Akuntansi Manajemen 1 P22.23-1Document31 pagesModul Lab - Akuntansi Manajemen 1 P22.23-1Bena BustikaNo ratings yet

- Cost Accounting Matz & Usry 7 EditionDocument24 pagesCost Accounting Matz & Usry 7 Editionsaira22pafNo ratings yet

- Production Losses in Job OrderDocument4 pagesProduction Losses in Job OrderJoshua CabinasNo ratings yet

- Comprehensive Exam in Cost Accounting and Control 2022Document8 pagesComprehensive Exam in Cost Accounting and Control 2022Maui EquizaNo ratings yet

- PROBLEM 4-38 Service Industry, Job Costing, Two Direct-And Indirect-Cost Categories, Law Firm (Continuation of 4-37)Document8 pagesPROBLEM 4-38 Service Industry, Job Costing, Two Direct-And Indirect-Cost Categories, Law Firm (Continuation of 4-37)Von Andrei MedinaNo ratings yet

- Visvesvaraya Technological University: Assignment - 1Document12 pagesVisvesvaraya Technological University: Assignment - 1vinayNo ratings yet

- Types of Decision Making - StudentsDocument82 pagesTypes of Decision Making - Studentssujithra mathivananNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Decision Making Through Marginal CostingDocument33 pagesDecision Making Through Marginal CostingKanika Chhabra100% (2)

- Manufacturing Accounts - Extra Questions - A LevelDocument6 pagesManufacturing Accounts - Extra Questions - A LevelMUSTHARI KHANNo ratings yet

- Standard Costing ReportDocument35 pagesStandard Costing ReportApril Rose AlagosNo ratings yet

- Accounting Notes ALL at MBADocument43 pagesAccounting Notes ALL at MBABabasab Patil (Karrisatte)No ratings yet

- SamHoustonState Fy 2020Document79 pagesSamHoustonState Fy 2020Matt BrownNo ratings yet

- Finals Quiz CostDocument42 pagesFinals Quiz CostIsabelle Candelaria0% (1)

- IA 3 ReviewDocument34 pagesIA 3 ReviewHell LuciNo ratings yet

- Oracle LCM Process FlowDocument3 pagesOracle LCM Process FlowMuhammad Faysal100% (1)

- 04 x04 Cost-Volume-Profit RelationshipsDocument11 pages04 x04 Cost-Volume-Profit RelationshipscassandraNo ratings yet

- AA025 Chapter AT5Document2 pagesAA025 Chapter AT5norismah isaNo ratings yet

- Answer c20Document7 pagesAnswer c20Võ Huỳnh BăngNo ratings yet

- January 2005 6-1 6-101: Local Governments, and Non-Profit OrganizationsDocument31 pagesJanuary 2005 6-1 6-101: Local Governments, and Non-Profit OrganizationsDoxCak3No ratings yet

- CH 14 Wiley Kimmel Homework QuizDocument16 pagesCH 14 Wiley Kimmel Homework QuizmkiNo ratings yet

- Financial Feasibility StudyDocument13 pagesFinancial Feasibility Studyecclesasates erdachewNo ratings yet

- Marginal & Absorption Costing ST Academy With SolutionDocument14 pagesMarginal & Absorption Costing ST Academy With SolutionFaisal KhanNo ratings yet

- Ch3 Process CostingDocument4 pagesCh3 Process CostingmahendrabpatelNo ratings yet