Professional Documents

Culture Documents

Assignment A - Law

Uploaded by

Kath Lea Sanchez AbrilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment A - Law

Uploaded by

Kath Lea Sanchez AbrilCopyright:

Available Formats

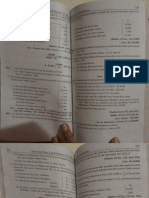

ASSIGNMENT NO.

6-A

Due Monday, 18 October 2021, 5:00 PM

Time remaining: 4 days 23 hours

PLS PROVIDE THE FOLLOWING:

1. Define Corporation

- Corporation is an artificial beng that created by group of people for the certain purposes and acted as a

single entity recognized by the law.

2. What are the characteristic of a corporation

-The characteristics of corporation first is artificial being it is because corporation is acknowledge by law

as a single entity or being which has a different personality to its owners. Next is corporation is created

by operation of law it means that it must be created under the law ang only SEC can grant the license to

operate a corporation. The other one is corporation has the right of succession and it is the passing of

authority of ownership to its successor. Lastly corporation has limited capacity or it has a limited

operation depending of what is granted by the law.

3. What is GOCC or Government-owned or controlled corporation? Explain.

- GOCC is a corporation that is owned by the government or run by the government that "operates

commercial and non-commercial activities". In this form government participate in economics and in

social development. And the examples of GOCC are SSS, Government service insurance system and etc.

which are it received subsidies and dividends to the national government.

4. What is "Piercing the veil of corporate fiction" or " intrumentality or " Alter ego" doctrine?Explain.

- Piercing the veil of corporate fiction is created to treat or protect the rights and duties of corporations

for because it used to perpitrate fraud or exicute something that is related to crime. Instrumentality

means is something that is intended to be used in any manner. And the alter ego doctrine is the law

created in a court for the obligation of the corporation to be treated as of its shareholdersdor the reason

to protect the rights and duties of corporations.

5. What are the elements of piercing the veil of corporate fiction

The elements of piercing the veil of corporate fiction are committing fraud and alter ego.

6. What are the Powers of a corporation?

- According to Accounting Tax in google search engine the powers of a corporation are corporate power

and capacity, power to extend or shorten corporate term, power to deny preemptive right, power to

acquire own shares, power declare dividends, power to enter into a management contract and etc.

7. Define succession under the concept of corporation law.

- Under the concept of corporation law succession is passing the authority to the successor who take

over the company.

8. What the classes of corporation? Discuss each.

- The corporation may be formed by stock or non-stock corporations. Non-stock corporations is a

nonprofitable corporation it doesn't distribute its profit to members. While stock corporation is a

profitable corporation those stock is divided into shares and distributed to its shareholders.

9. What are the other classes of corporation as to:

a) purpose

1. Public - organized for the government with a purpose of general good and welfare.

2. Private - Formed for some private purposes.

3. GOCCs - Corporation that is governed by the government may be nonstock or stock corporation.

4. Quasi-Public - Private corporation that is supported by government of public duties.

b) as to legal rights to corporate existence

1. De jure corporation – exist in fact and in law

2. De facto corporation – exist in fact but not in law

c) as to law of incorporation

1. Domestic - Philippine corporation

2. Foreign - Foreign corporation

d) as to whether they are open to the public or not

1. Close corporation – limited to selected persons

2. Open corporation – open to any person

e) as to relationship of management control

1. Parent - The one that control corporation or it has majority of stocks.

2. Subsidiary - The one that control by a parent.

f) as to number of persons who compose them

1. Corporation aggregate – more than one member

2. Corporation sole – one member or corporator

3. One-person corporation (OPC)

g) as to whether they are religious or not

1. Ecclesiastical corporation - Religious

2. Lay corporation – other than religious purpose. (Either

eleemosynary or civil)

h) as to whether they are for charitable purpose or not

1. Eleemosynary corporation - Charitable

2. Civil corporation – Business of profit

10. What are the components of corporation?

The main components part of corporations are limited liability for investors - Losses are limited to

amount invested. Free transferability of investor interests - Allows for investors to controltheir risk to

sell anytime they want to because they have limited authority. Legal personality (entity-attributable

powers, life span and purpose) -Allow for corporations to live on as long it has capital. Centralized

management - allow company to operate efficiency by allowing only directors to determine direction of

company

11. What are the classification of shares?

According to revised corporation code are nonvoting shares, par value, non-par value, preferred shares,

treasury shares, and etc.

12. Who may classify the shares?

The shares of stock of stock corporations may be divided into classes or series of shares, or both, any of

which classes or series of shares may have such rights, privileges or restrictions as may be stated in the

articles of incorporation: Provided, That no share may be deprived of voting rights except those

classified and issued as "preferred" or "redeemable" shares, unless otherwise provided in this Code:

Provided, further, That there shall always be a class or series of shares which have complete voting

rights. Any or all of the shares or series of shares may have a par value or have no par value as may be

provided for in the articles of incorporation: Provided, however, That banks, trust companies, insurance

companies, public utilities, and building and loan associations shall not be permitted to issue no-par

value shares of stock.

13. Discuss the doctrine of equality of shares

In doctrine of equality of shares all stocks issued by the corporation are presumed equal with the same

privileges and liabilities, provided that the articles of incorporation is silent on such differences.

14. What are redeemable shares?

- Redeemable shares are shares that issued by corporation that is provided by the article of the

incorporation "They are shares which may be purchased by the corporation from the holders of such

shares upon the expiration of a fixed period, regardless of the existence of unrestricted retained

earnings in the books of the corporation, and upon such other terms and conditions stated in the articles

of incorporation and the certificate of stock representing the shares, subject to rules and regulations

issued by the Securities and Exchange Commission (SEC)."

15. What are par value and no pa value shares

A par value for a stock is its per-share value assigned by the company that issues it and is often set at a

very low amount such as one cent. A no-par stock is issued without any designated minimum value.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

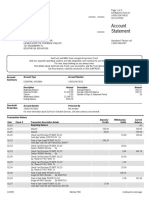

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Charts Amalgamation and WindupDocument25 pagesCharts Amalgamation and WindupPradeep KumarNo ratings yet

- PPPTo-Print THESISDocument17 pagesPPPTo-Print THESISKath Lea Sanchez AbrilNo ratings yet

- Dashboard Final PromiseDocument6 pagesDashboard Final PromiseKath Lea Sanchez AbrilNo ratings yet

- Horizontal Vertical AnalysisDocument12 pagesHorizontal Vertical AnalysisKath Lea Sanchez AbrilNo ratings yet

- The Factors Affecting Students Engagement in Gambling Activities Inside The School Campus of Lamian National High SchoolDocument43 pagesThe Factors Affecting Students Engagement in Gambling Activities Inside The School Campus of Lamian National High SchoolKath Lea Sanchez AbrilNo ratings yet

- Guidelines For Giving Emergency CareDocument5 pagesGuidelines For Giving Emergency CareKath Lea Sanchez AbrilNo ratings yet

- ASSIGNMENT A - LawDocument4 pagesASSIGNMENT A - LawKath Lea Sanchez AbrilNo ratings yet

- Assignment 5-LawDocument4 pagesAssignment 5-LawKath Lea Sanchez AbrilNo ratings yet

- Assignment Law 7Document10 pagesAssignment Law 7Kath Lea Sanchez AbrilNo ratings yet

- Ifos 2 BookDocument15 pagesIfos 2 BookArthi . MNo ratings yet

- AccountingDocument8 pagesAccountingGuiamae GuaroNo ratings yet

- Ind As 8Document9 pagesInd As 8RITZ BROWNNo ratings yet

- Projected Statement of Financial PositionDocument3 pagesProjected Statement of Financial PositionNouman BaigNo ratings yet

- YPF Repsol CaseDocument30 pagesYPF Repsol CaseVijoyShankarRoyNo ratings yet

- Quiz No. 3 - Working Capital Management PDFDocument5 pagesQuiz No. 3 - Working Capital Management PDFNerissa PasambaNo ratings yet

- IFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFDocument3 pagesIFRS 17 - Profit Profiles Under IFRS 4 and IFRS 17 - 20190717 PDFkhedidja attiaNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument26 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- Amalgmation of CompanyDocument83 pagesAmalgmation of CompanySuryaNo ratings yet

- Vertical AnalysisDocument5 pagesVertical AnalysisMica Ann MatinaoNo ratings yet

- Course Week Section Udemy: Course Introduction & How To Take This Course Decide What Financial Analyst Role InterestDocument4 pagesCourse Week Section Udemy: Course Introduction & How To Take This Course Decide What Financial Analyst Role InterestmaniiscribdNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFDocument79 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFYopie ChandraNo ratings yet

- Finance 553 A Capital Investment Planning Spring 2000 Room BLM 304 T & TH 10:30 A - 12:20 PDocument8 pagesFinance 553 A Capital Investment Planning Spring 2000 Room BLM 304 T & TH 10:30 A - 12:20 PHector SalatanNo ratings yet

- PDF 20230403 120901 0000Document12 pagesPDF 20230403 120901 0000Tirta syah putra AlamNo ratings yet

- Surat DataDocument1,063 pagesSurat Datadeltaphi1234No ratings yet

- TUTORIAL Chapter 3Document3 pagesTUTORIAL Chapter 3yhuzaimiNo ratings yet

- Stock ValuationDocument2 pagesStock Valuationxaud qureshiNo ratings yet

- Accounting 2 - Unit 3 - Lesson 1 To 3Document62 pagesAccounting 2 - Unit 3 - Lesson 1 To 3Merdwindelle AllagonesNo ratings yet

- Nama: Nurahma Amalia NIM: 20200070042 Kelas: AK20ADocument4 pagesNama: Nurahma Amalia NIM: 20200070042 Kelas: AK20Aedit andraeNo ratings yet

- Fin201 Assignment by SHAHERZADDocument16 pagesFin201 Assignment by SHAHERZADNayeem Rumman Julhash 1911185642No ratings yet

- Hindustan Unilever: Brand ValuationDocument19 pagesHindustan Unilever: Brand ValuationSultan MahmudNo ratings yet

- 14 Financial Statement Analysis: Chapter SummaryDocument12 pages14 Financial Statement Analysis: Chapter SummaryGeoffrey Rainier CartagenaNo ratings yet

- Average Score: Tex Cycle Technology (M) (Texcycl-Ku)Document11 pagesAverage Score: Tex Cycle Technology (M) (Texcycl-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Trust Tax Return 2019 PDFDocument16 pagesTrust Tax Return 2019 PDFIsabelle Che KimNo ratings yet

- Report 20230321111742Document4 pagesReport 20230321111742Dass AniNo ratings yet

- Delta Corp 2011Document144 pagesDelta Corp 2011RahulSatijaNo ratings yet

- Terbaru 202012 Handout Week 1 Corp Fin Mba Ipmi Intro To Corp Fin TVMDocument99 pagesTerbaru 202012 Handout Week 1 Corp Fin Mba Ipmi Intro To Corp Fin TVMAtika Aziz BalweelNo ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet