Professional Documents

Culture Documents

Market Median

Uploaded by

Rawaa0 ratings0% found this document useful (0 votes)

11 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesMarket Median

Uploaded by

RawaaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

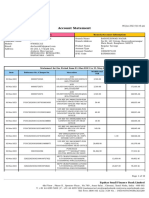

BankFocus - bank report of Bayerische Landesbank

Bayerische Landesbank

Table

Closest 20 national banks according to the Total Assets for the last available year amongst the standard peer

Peer Group:

group (Specialised Gov. Credit Institutions Europe (Excl. Eastern Europe))

Return On Avg Return On Avg

Cons. Nb. of Assets (ROAA) Equity (ROAE) Tier 1 ratio

Bank Name code Ctry Period months % % %

Last available year Rank Rank Rank

Median 0.07 1.35 18.50

KfW Bankengruppe-KfW C2 DE 2019 12 0.28 1 4.43 2 21.30 2

Group

Landesbank Hessen- C2 DE 2019 12 0.26 2 5.59 1 15.30 9

Thueringen Girozentrale -

HELABA

DekaBank Deutsche C2 DE 2019 12 0.21 3 3.83 4 15.70 7

Girozentrale

Bayerische Landesbank C2 DE 2019 12 0.21 4 4.09 3 n.a.

Landesbank Baden- C2 DE 2019 12 0.18 5 3.28 5 16.50 6

Wuerttemberg

LFA Förderbank Bayern U1 DE 2019 12 0.17 6 2.04 6 n.a.

Investitionsbank Berlin C2 DE 2019 12 0.08 7 1.12 9 19.30 4

Landeskreditbank Baden- U1 DE 2019 12 0.07 8 1.36 7 20.06 3

Wuerttemberg -

Förderbank-L-Bank

InvestitionsBank des C2 DE 2019 12 0.07 9 1.34 8 n.a.

Landes Brandenburg

Hamburg Commercial Bank C2 DE 2019 12 0.02 10 0.27 10 18.50 5

AG

Saechsische AufbauBank U1 DE 2019 12 0.01 11 0.10 11 34.57 1

Forderbank

NRW.BANK U1 DE 2019 12 0.01 12 0.04 12 n.a.

Norddeutsche Landesbank C2 DE 2019 12 -0.05 13 -1.49 13 15.33 8

Girozentrale NORD/LB

DEG - Deutsche U1 DE 2019 12 -0.88 14 -2.18 14 n.a.

Investitions-und

Entwicklungsgesellschaft

mbH

BankFocus (Data update 1802 - 29/05/2020) - © BvD 31/05/2020 Page 1

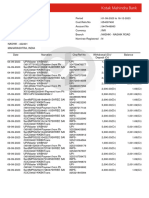

BankFocus - bank report of Bayerische Landesbank

Total capital Loan loss res / Impaired loans /

Cons. Nb. of ratio Impaired loans Gross loans

Bank Name code Ctry Period months % % %

Last available year Rank Rank Rank

Median 21.30 58.68 1.15

KfW Bankengruppe-KfW C2 DE 2019 12 21.30 7 8.24 9 13.40 1

Group

Landesbank Hessen- C2 DE 2019 12 19.00 10 57.81 6 0.42 9

Thueringen Girozentrale -

HELABA

DekaBank Deutsche C2 DE 2019 12 18.10 13 47.96 7 0.76 7

Girozentrale

Bayerische Landesbank C2 DE 2019 12 18.30 12 58.68 5 1.13 6

Landesbank Baden- C2 DE 2019 12 22.90 5 73.08 3 1.15 5

Wuerttemberg

LFA Förderbank Bayern U1 DE 2019 12 25.50 3 n.a. n.a.

Investitionsbank Berlin C2 DE 2019 12 19.30 9 18.18 8 1.21 4

Landeskreditbank Baden- U1 DE 2019 12 22.20 6 199.02 1 0.44 8

Wuerttemberg -

Förderbank-L-Bank

InvestitionsBank des C2 DE 2019 12 n.a. n.a. n.a.

Landes Brandenburg

Hamburg Commercial Bank C2 DE 2019 12 23.50 4 109.09 2 2.11 3

AG

Saechsische AufbauBank U1 DE 2019 12 37.47 2 n.a. n.a.

Forderbank

NRW.BANK U1 DE 2019 12 47.10 1 n.a. n.a.

Norddeutsche Landesbank C2 DE 2019 12 20.76 8 58.77 4 3.30 2

Girozentrale NORD/LB

DEG - Deutsche U1 DE 2019 12 18.40 11 n.a. n.a.

Investitions-und

Entwicklungsgesellschaft

mbH

Liquid assets /

Net loans / Dep Dep & ST Liquid assets /

Cons. Nb. of & ST funding funding Tot dep & bor

Bank Name code Ctry Period months % % %

Last available year Rank Rank Rank

Median 103.33 78.83 36.85

KfW Bankengruppe-KfW C2 DE 2019 12 654.50 1 n.s. 65.87 3

Group

Landesbank Hessen- C2 DE 2019 12 108.43 4 59.20 8 32.94 9

Thueringen Girozentrale -

HELABA

DekaBank Deutsche C2 DE 2019 12 61.64 10 150.40 2 66.74 2

Girozentrale

Bayerische Landesbank C2 DE 2019 12 104.06 5 32.26 9 21.61 11

Landesbank Baden- C2 DE 2019 12 67.32 8 80.46 6 53.90 4

Wuerttemberg

LFA Förderbank Bayern U1 DE 2019 12 22.02 12 123.12 3 70.85 1

Investitionsbank Berlin C2 DE 2019 12 142.65 2 81.24 5 39.30 6

Landeskreditbank Baden- U1 DE 2019 12 62.22 9 78.83 7 40.69 5

Wuerttemberg -

Förderbank-L-Bank

InvestitionsBank des C2 DE 2019 12 51.85 11 22.99 11 22.25 10

Landes Brandenburg

Hamburg Commercial Bank C2 DE 2019 12 103.33 7 26.06 10 19.00 12

AG

Saechsische AufbauBank U1 DE 2019 12 103.52 6 19.72 12 17.46 13

Forderbank

NRW.BANK U1 DE 2019 12 127.43 3 97.13 4 36.85 7

Norddeutsche Landesbank C2 DE 2019 12 n.s. 657.43 1 36.11 8

Girozentrale NORD/LB

DEG - Deutsche U1 DE 2019 12 2.11 13 6.10 13 n.a.

Investitions-und

Entwicklungsgesellschaft

mbH

BankFocus (Data update 1802 - 29/05/2020) - © BvD 31/05/2020 Page 2

BankFocus - bank report of Bayerische Landesbank

Cost to income Net interest

Cons. Nb. of ratio margin

Bank Name code Ctry Period months % %

Last available year Rank Rank

Median 73.75 0.69

KfW Bankengruppe-KfW C2 DE 2019 12 46.42 14 0.50 10

Group

Landesbank Hessen- C2 DE 2019 12 72.00 10 0.69 8

Thueringen Girozentrale -

HELABA

DekaBank Deutsche C2 DE 2019 12 75.69 5 0.18 14

Girozentrale

Bayerische Landesbank C2 DE 2019 12 67.96 12 0.81 3

Landesbank Baden- C2 DE 2019 12 73.08 9 0.74 5

Wuerttemberg

LFA Förderbank Bayern U1 DE 2019 12 87.94 2 0.46 11

Investitionsbank Berlin C2 DE 2019 12 85.78 3 0.78 4

Landeskreditbank Baden- U1 DE 2019 12 70.90 11 0.34 13

Wuerttemberg -

Förderbank-L-Bank

InvestitionsBank des C2 DE 2019 12 84.52 4 0.53 9

Landes Brandenburg

Hamburg Commercial Bank C2 DE 2019 12 73.48 8 0.70 7

AG

Saechsische AufbauBank U1 DE 2019 12 96.88 1 1.34 2

Forderbank

NRW.BANK U1 DE 2019 12 74.02 7 0.45 12

Norddeutsche Landesbank C2 DE 2019 12 74.60 6 0.72 6

Girozentrale NORD/LB

DEG - Deutsche U1 DE 2019 12 50.36 13 3.37 1

Investitions-und

Entwicklungsgesellschaft

mbH

BankFocus (Data update 1802 - 29/05/2020) - © BvD 31/05/2020 Page 3

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ift 2020 Exam FactsheetDocument12 pagesIft 2020 Exam FactsheetRawaaNo ratings yet

- RBI Monetary Policy FinalDocument28 pagesRBI Monetary Policy FinaltejassuraNo ratings yet

- The Money Supply ProcessDocument34 pagesThe Money Supply ProcessLazaros KarapouNo ratings yet

- Solution Manual For Financial Markets and Institutions 7th Edition by MishkinDocument7 pagesSolution Manual For Financial Markets and Institutions 7th Edition by MishkinKatrinaYoungqtoki100% (77)

- Bayerische Landesbank: Global Detailed FormatDocument23 pagesBayerische Landesbank: Global Detailed FormatRawaaNo ratings yet

- Bayerische Landesbank: Global Standard FormatDocument2 pagesBayerische Landesbank: Global Standard FormatRawaaNo ratings yet

- Fra QuizDocument8 pagesFra QuizRawaaNo ratings yet

- Central Banks and Monetary Organisations Website ListDocument20 pagesCentral Banks and Monetary Organisations Website ListholyblackmariaNo ratings yet

- Unit 4 - Central Banking and The Conduct of Monetary Policy Chapter 9 - Central Banks: A Global PerspectiveDocument51 pagesUnit 4 - Central Banking and The Conduct of Monetary Policy Chapter 9 - Central Banks: A Global PerspectiveKaren ReasonNo ratings yet

- TCHE 303 - Tutorial 10Document4 pagesTCHE 303 - Tutorial 10Bách Nguyễn XuânNo ratings yet

- Functions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)Document41 pagesFunctions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)kim byunooNo ratings yet

- European Central BankDocument1 pageEuropean Central BankJustin JangoNo ratings yet

- UNIT - 2 (Demand For Money) by - Mr. Vijay Kumar Dept. of Economics, Mob No. - 7549273042Document9 pagesUNIT - 2 (Demand For Money) by - Mr. Vijay Kumar Dept. of Economics, Mob No. - 7549273042Santosh dhabekarNo ratings yet

- Chapter 15 The Money Supply ProcessDocument35 pagesChapter 15 The Money Supply ProcessDUYEN LE HUYNH MYNo ratings yet

- Hani Purnaya ApplicationDocument2 pagesHani Purnaya ApplicationLiveka PrintersNo ratings yet

- Rbi NotesDocument2 pagesRbi Notes2607982No ratings yet

- Instruments of Moneytary PolicyDocument3 pagesInstruments of Moneytary PolicyJaydeep Paul100% (1)

- Sahaj Arora, 12-C, 12122, Economics Project, Money MultiplierDocument11 pagesSahaj Arora, 12-C, 12122, Economics Project, Money MultiplierSahajNo ratings yet

- Práctica Dirigida 3 2016-IIDocument2 pagesPráctica Dirigida 3 2016-IILeonardo CastilloNo ratings yet

- Fmi - Part 4 - Chap 10 - Conduct of Monetary PolicyDocument65 pagesFmi - Part 4 - Chap 10 - Conduct of Monetary PolicyTouseef Rizvi100% (1)

- Unit 14 Money Creation and Central Banking: 14.0 ObjectivesDocument14 pagesUnit 14 Money Creation and Central Banking: 14.0 ObjectivesSaima JanNo ratings yet

- Peran World Bank (WB) Dalam Hukum Ekonomi InternasionalDocument5 pagesPeran World Bank (WB) Dalam Hukum Ekonomi InternasionalAndrean Darven JustitioNo ratings yet

- In The Balance Sheet Above, The Excess Reserve Ratio of ABC Bank Is - and Its Excess Reserves AreDocument5 pagesIn The Balance Sheet Above, The Excess Reserve Ratio of ABC Bank Is - and Its Excess Reserves AreAnnNo ratings yet

- Cecchetti-5e-Ch18 - Monetary Policy - Stabilizing The Domestic EconomyDocument123 pagesCecchetti-5e-Ch18 - Monetary Policy - Stabilizing The Domestic EconomyammendNo ratings yet

- Chap 016Document16 pagesChap 016yuvrajwilsonNo ratings yet

- Quiz 546Document8 pagesQuiz 546Haris NoonNo ratings yet

- Members and ShareholdersDocument6 pagesMembers and ShareholdersSTEM-G.04 Kiarrah Katrina BotinNo ratings yet

- Chapter 15 Test Bank PDFDocument29 pagesChapter 15 Test Bank PDFCharmaine Cruz100% (1)

- TCHE 303 - Tutorial 10Document5 pagesTCHE 303 - Tutorial 10Bách Nguyễn XuânNo ratings yet

- NiyoX-Statementl-01Mar23 To 31may23 Ep1ct3m8Document10 pagesNiyoX-Statementl-01Mar23 To 31may23 Ep1ct3m8Devharsh ToshniwalNo ratings yet

- A Presentation On: Role of Reserve Bank of India in Indian EconomyDocument25 pagesA Presentation On: Role of Reserve Bank of India in Indian EconomyVimal SinghNo ratings yet

- Principles of Economics: 2nd Edition by Fred M GottheilDocument51 pagesPrinciples of Economics: 2nd Edition by Fred M GottheilAKARESH JOSE EBOOKSNo ratings yet

- DNB Working Paper: No. 475 / June 2015Document35 pagesDNB Working Paper: No. 475 / June 2015Тимур ЯкимовNo ratings yet

- CPSPM 66257312 1702746681Document28 pagesCPSPM 66257312 1702746681BidhinNo ratings yet