Professional Documents

Culture Documents

Position Trading

Position Trading

Uploaded by

Lobito SolitarioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Position Trading

Position Trading

Uploaded by

Lobito SolitarioCopyright:

Available Formats

It really is so simple,

So how to get the most of this strategy.

Look at daily chart around 20:00 GMT this is best time to find the entries for this strategy as you

won’t get much more movement on the daily candle, so you are able to plan your trades.

If you are looking to get a better risk to reward, place your limit orders at the 61.8% retracement,

however in doing so, you are less likely for your orders to trigger.

If you're ever unsure about a setup – It isn't a setup. The best setups leap out, much like in the above

examples, and can't be ignored. These are the trades we should aim to take via this strategy.

To conclude:

As ever, we will of course have losing trades. At times, we will have a run of losing trades, just as we

should expect a run of winning trades as our expectancy plays out.

My suggestion would always be to risk 2% or less of your capital. This is a conservative amount of

risk and will allow for the losing run to take place, when it does. Remember we are unable to predict

the future and although predictable at times, the markets are fundamentally random.

You might also like

- Vertex InvestingDocument18 pagesVertex Investingquentin oliverNo ratings yet

- Vertex InvestingDocument18 pagesVertex Investingquentin oliverNo ratings yet

- Top Down AnalysisDocument1 pageTop Down AnalysisWehan NurNo ratings yet

- Vertex Trade StoryDocument15 pagesVertex Trade Storyquentin oliver100% (3)

- Vertex Trade StoryDocument15 pagesVertex Trade Storyquentin oliver100% (3)

- Trading - Level To LevelDocument63 pagesTrading - Level To Levelmandiv100% (1)

- Vertex PlaybookDocument10 pagesVertex PlaybookHODAALE MEDIA100% (2)

- Trade PlanDocument10 pagesTrade Planquentin oliver67% (3)

- Entry Time: Entries 101Document5 pagesEntry Time: Entries 101quentin oliver100% (1)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Daily AnalysisDocument14 pagesDaily AnalysisBarış YENİGELENNo ratings yet

- HTF Framework and StructureDocument2 pagesHTF Framework and StructureOmar Miravete100% (2)

- Vertex Free PlaybookDocument10 pagesVertex Free PlaybookAdil BensellamNo ratings yet

- Market StructureDocument12 pagesMarket StructureHODAALE MEDIANo ratings yet

- Vertex: InvestingDocument12 pagesVertex: InvestingGolconda Mitra100% (2)

- Structure GuideDocument7 pagesStructure Guidequentin oliverNo ratings yet

- Structure GuideDocument7 pagesStructure Guidequentin oliverNo ratings yet

- Inner Circle Trader - 20140311 Yen Day TradeDocument4 pagesInner Circle Trader - 20140311 Yen Day TradeRory BrownNo ratings yet

- Entry Types: Quantum Stone CapitalDocument6 pagesEntry Types: Quantum Stone CapitalThabangNo ratings yet

- This Study Resource Was: Price Action BreakoutDocument7 pagesThis Study Resource Was: Price Action Breakoutquentin oliverNo ratings yet

- Imbalance: Quantum Stone CapitalDocument4 pagesImbalance: Quantum Stone CapitalHiếu LâmNo ratings yet

- 14.highs and LowsDocument4 pages14.highs and LowsHODAALE MEDIANo ratings yet

- Liquidity: Created TagsDocument8 pagesLiquidity: Created TagsSamuel LarryNo ratings yet

- Smart Money FootprintspdfDocument32 pagesSmart Money FootprintspdfNagesh Babu Birur100% (3)

- 1st Week Trading JournalDocument14 pages1st Week Trading JournalWanpaNo ratings yet

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Highs and LowsDocument26 pagesHighs and LowsLeonardo Caverzan0% (1)

- The Markets Ways To TradeDocument8 pagesThe Markets Ways To TradeNassim Alami Messaoudi100% (1)

- Premium and Discount: Quantum Stone CapitalDocument5 pagesPremium and Discount: Quantum Stone CapitalKUNAL PATILNo ratings yet

- Asian Liquidity Sweep V1.3Document8 pagesAsian Liquidity Sweep V1.3AJNo ratings yet

- Fstraders Introduction To Our Trading Strategy Credits To B.MDocument22 pagesFstraders Introduction To Our Trading Strategy Credits To B.MCapRa XuboNo ratings yet

- BOS and Marking Last CandlesDocument13 pagesBOS and Marking Last Candlesvivaldi22100% (1)

- Beginner's Guide To SwingDocument11 pagesBeginner's Guide To SwingSteve Sabang100% (2)

- Trading SessionsDocument22 pagesTrading SessionsAdam SehramNo ratings yet

- CandlesDocument6 pagesCandlesCrypto BitcoinNo ratings yet

- Market Makers Method Order Blocks Englishpdf 3 PDF Free 77 165Document89 pagesMarket Makers Method Order Blocks Englishpdf 3 PDF Free 77 165Tùng Nguyễn100% (1)

- Sndprecision PatternsDocument39 pagesSndprecision PatternsShahzaib hasan100% (4)

- Confluence Technique Be A Trader Road TourDocument163 pagesConfluence Technique Be A Trader Road Toursani_ilpkuantan100% (2)

- Vertex Free PlaybookDocument10 pagesVertex Free PlaybookThero RaseasalaNo ratings yet

- Educational File 2Document7 pagesEducational File 2Phát MinhNo ratings yet

- Market Structure DR - Drew FXDocument83 pagesMarket Structure DR - Drew FXAsaba James Ssekate100% (1)

- POI Case StudyDocument5 pagesPOI Case StudySpeculation Only100% (1)

- Liquidity Hunting Algorithm On 15 MinDocument1 pageLiquidity Hunting Algorithm On 15 MinS WavesurferNo ratings yet

- Scoring Imbalances: QuestionsDocument16 pagesScoring Imbalances: QuestionsMikeNo ratings yet

- Part 3 - ImbalanceDocument4 pagesPart 3 - ImbalanceCrypto BitcoinNo ratings yet

- ICT Trading StrategyDocument21 pagesICT Trading Strategytestxn1aNo ratings yet

- MMXM .ModelDocument7 pagesMMXM .Modeltiajung humtsoeNo ratings yet

- Trade PlanDocument8 pagesTrade PlanSIDOW ADEN100% (1)

- Prediction - Understanding HTF DirectionDocument10 pagesPrediction - Understanding HTF DirectionRui AlmeidaNo ratings yet

- Rules of Trading High Probability TradesDocument1 pageRules of Trading High Probability TradesStephen ShekwonuDuza HoSeaNo ratings yet

- Lesson 7 Market Structure 1Document14 pagesLesson 7 Market Structure 1S WavesurferNo ratings yet

- Entry Time: Entries 101Document5 pagesEntry Time: Entries 101Eric Woon Kim ThakNo ratings yet

- Market Structure and InducementDocument1 pageMarket Structure and InducementS WavesurferNo ratings yet

- Forex LingoDocument6 pagesForex LingoManojkumar NairNo ratings yet

- Tutorial 2: Fixed Range Volume ProfileDocument15 pagesTutorial 2: Fixed Range Volume Profilenguyenhuutan91100% (1)

- A Teen Trader FTR Indicator: DisclosureDocument14 pagesA Teen Trader FTR Indicator: DisclosureMohamad ehteshamNo ratings yet

- Free Order FlowDocument10 pagesFree Order Flowsuraj trader1100% (1)

- Market Structure: The Ict Po3Document4 pagesMarket Structure: The Ict Po3helton celiNo ratings yet

- بلا عنوانDocument13 pagesبلا عنوانsami mohamedNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Basic Candlestick Formations: Indication That Price May Be Heading DownDocument11 pagesBasic Candlestick Formations: Indication That Price May Be Heading Downquentin oliverNo ratings yet

- Breakouts FakeoutsDocument1 pageBreakouts Fakeoutsquentin oliverNo ratings yet

- BrokersDocument1 pageBrokersquentin oliverNo ratings yet

- Lot Sizes Pip CountsDocument1 pageLot Sizes Pip Countsquentin oliverNo ratings yet

- Creating A Trading Plan: GoalsDocument5 pagesCreating A Trading Plan: Goalsquentin oliverNo ratings yet

- Price Action Market StructureDocument3 pagesPrice Action Market Structurequentin oliverNo ratings yet

- Terms and DefinitionsDocument5 pagesTerms and Definitionsquentin oliverNo ratings yet

- The Aha MomentDocument1 pageThe Aha Momentquentin oliverNo ratings yet

- Correlating Currency PairsDocument2 pagesCorrelating Currency Pairsquentin oliver100% (3)

- Pin Bar Forex Trading Strategy 2Document7 pagesPin Bar Forex Trading Strategy 2quentin oliverNo ratings yet

- Tracking Your Trades: ExampleDocument3 pagesTracking Your Trades: Examplequentin oliverNo ratings yet

- Common Mistakes Using Pin Bars 2Document6 pagesCommon Mistakes Using Pin Bars 2quentin oliverNo ratings yet

- EMA Strategy 1Document5 pagesEMA Strategy 1quentin oliver100% (1)

- This Study Resource Was: Amazing Scalping Strategy Using Pin Bar in The 15 Minute Time FrameDocument2 pagesThis Study Resource Was: Amazing Scalping Strategy Using Pin Bar in The 15 Minute Time Framequentin oliverNo ratings yet

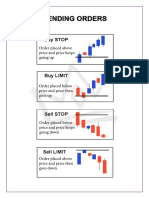

- Buy Limits Stops Sell Limits StopsDocument1 pageBuy Limits Stops Sell Limits Stopsquentin oliverNo ratings yet

- This Study Resource Was: 1. Not Learning To Trade Pin Bars in Trending Markets FirstDocument3 pagesThis Study Resource Was: 1. Not Learning To Trade Pin Bars in Trending Markets Firstquentin oliverNo ratings yet