Professional Documents

Culture Documents

Partnership Workbook 2019

Uploaded by

Miki TYOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Workbook 2019

Uploaded by

Miki TYCopyright:

Available Formats

A Conceptual Approach to Partnership Accounting

Why A Conceptual Approach?

It has been noticed that one of the hindrances in learning accounting is that students fail

to see the process as a whole system and the relationship of its components.

With this in mind, the author prepared an instructional material that would address the

barrier. A conceptual approach was developed that utilizes flowchart as primary tool to provide

logic in analyzing partnership transactions. The flowchart also presents when or how a

particular concept is applied or used in the process. This is further enhanced by narrative

procedure to strengthen understanding.

It is only hoped that this humble contribution can facilitate learning, and eventually, full

grasp of the subject matter.

Enrico D. Flores Page 1

A Conceptual Approach to Partnership Accounting

The Conceptual Framework of Partnership Accounting

The conceptual framework of partnership accounting presents the major topics for discussion,

which includes:

1. Partnership environment

2. Partnership formation

3. Partnership operation

4. Partnership liquidation

5. Changes in partnership relation

These major topics are enclosed in a double lined box. The framework also presents the sub-

topics under each major agenda.

It could be noticed that bold solid lines connect the first four major topics. This represents usual

life cycle of a partnership, that is, from conception to termination. However, changes in the relationship

among partners may occur which require re-formation (dissolution) of the partnership to address the

present needs. The event does not call for liquidation (termination) of the partnership and

discontinuance of the business. This is connected to the main line by bold broken line to emphasize

that, although a reality, this event does not always take place.

Another item for discussion is Admission of New Partner. This is usually tackled separately. For

illustration purposes, this is enclosed in solid bold box connected both to Changes in Partnership

Relation and Partnership Formation as factor for dissolution and re-formation respectively.

Enrico D. Flores Page 2

A Conceptual Approach to Partnership Accounting

Fig. 1: CONCEPTUAL FRAMEWORK OF PARTNERSHIP ACCOUNTING

Nature of partnership PARTNERSHIP

• Characteristics ENVIRONMENT

• Advantages & Disadvantages

• Kinds of Partnerships Two or more persons

• Types of Partners contributing cash,

property or services

for the first time

Admission of

new partner by: PARTNERSHIP

• Investment FORMATION

• Purchase1

Two or more persons,

one or more is

already engaged in

CHANGES IN PARTNERSHIP business

RELATION

(DISSOLUTION)

Distribution of Profit

or Loss

PARTNERSHIP

Partnership may

OPERATION

continue:

• Retirement of

Financial Statements

partner1

• Death, incapacity

or insolvency Methods and

Statement of

Liquidation

Partnership cease to

PARTNERSHIP

continue

LIQUIDATION

• Sale of Partnership

• Incorporation

• Liquidation Partner’s Debit

Balances

Enrico D. Flores Page 3

A Conceptual Approach to Partnership Accounting

ACCOUNTING FOR PARTNERSHIP FORMATION

A partnership maybe formed by any of the following:

1. Individuals and individuals

2. Individuals and sole proprietor

3. Sole proprietor and sole proprietor

The first consideration in partnership formation is whether the partners’ business venture is a

new one or not. If NOT (already existing), then it could be considered as admission of new partner. In

which case, follow the procedure in admission of new partner.

In case of new business venture (YES), the next consideration is the form of contribution to the

partnership which can be any of the following:

1. Cash (or any of its form);

2. Services/Industry;

3. Non-cash (i.e., equipment or property); and/or

4. Existing business

Recording of contribution is as follows:

1. Cash – recorded at face value

2. Services/Industry – memorandum entry to recognize admission and its terms

3. Non-cash – recorded at agreed value which is normally its fair market value. In case of

any outstanding obligation attending to the contribution, capital credit must be net of

obligation.

4. If an existing business will be contributed, the following must be undertaken:

a. Revaluation (adjustment) of accounts

b. Close the books of the business

c. The new partnership may opt to continue to use the existing books of account of

the business or set-up a new one.

d. Capital credit of the owner of the existing business to the new partnership is net of

any obligations (payables) of the business.

Enrico D. Flores Page 4

A Conceptual Approach to Partnership Accounting

Fig. 2: CONCEPTUAL FLOWCHART OF PARTNERSHIP FORMATION

Start

Partners

N Y

Admission of New Business? Contribution

New Partner

Y

Cash Face Value

Follow procedure in

admission of new Y

Services Memorandum

partner

Y Agreed Value

Non-cash

(Market Value)

Existing Business Revaluation

Closing Entries

N

New Books?

Set-up New Books

Journal Entries

Stop

Enrico D. Flores Page 5

A Conceptual Approach to Partnership Accounting

Problems and Exercises

Give the entries for the following independent cases:

1. X and Y decided to form a partnership. X contributed P20,000.00 while Y P30,000.00 cash.

2. A and B formed the AB Trading. A invested cash of P30,000.00 and B invested P10,000.00 cash

plus his delivery vehicle costing P100,000.00 but with a market value of P50,000.00.

3. M was invited to join the partnership of O and P. He will contribute only his services for a 15%

share in profit.

4. JR joined the partnership of VC by investing cash of P20,000.00 and his accounts receivable of

P50,000.00. Only 50% of the account is collectible.

5. JV joined the partnership of XYZ by investing his delivery equipment amounting to P50,000.00

with accumulated depreciation of P20,000.00

Enrico D. Flores Page 6

A Conceptual Approach to Partnership Accounting

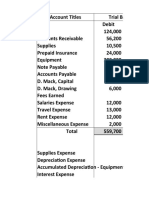

The post-closing trial balance of AG appears below:

Debit Credit

Cash 20,000.00

Accounts Receivable 8,000.00

Allowance for Bad Debts 1,500.00

Merchandise Inventory 15,000.00

Delivery Equipment 30,000.00

Accumulated Depreciation 10,000.00

Accounts Payable 20,000.00

AG, Capital 41,500.00

Totals 73,000.00 73,000.00

AG invited E to join her and become partners under the name of AGE Enterprises. E will invest

P50,000.00 cash only. No adjustments will be made in the books of AG.

Required:

Prepare the journal entries in the new partnership books to record the investment of E and

transfer the business of AG to the partnership.

Enrico D. Flores Page 7

A Conceptual Approach to Partnership Accounting

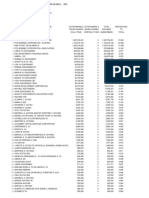

Sole proprietors Alvis and Ancheta established a partnership on December 31, 2010. They agreed that

each would make the following contributions:

Alvis Ancheta

Cash 50,000.00 750,000.00

Land 375,000.00

Building 1,200,000.00

Furniture and Fixture 675,000.00

Accounts Payable of Alvis totaling P250,000.00 are to be assumed by the partnership.

Instruction: Prepare the entries on December 31, 2010 to record the investment in the

partnership by Alvis and Ancheta under each of the following independent assumptions:

1. Each partner is credited for the full amount of the net assets invested.

2. Each partner initially should have an equal interest in the partnership capital

Enrico D. Flores Page 8

A Conceptual Approach to Partnership Accounting

Zyron and Dale decided to combine their businesses. The following accounts appeared in their books:

Zyron Dale

Cash 20,000.00 Cash 30,000.00

Merchandise 10,000.00 Merchandise 5,000.00

Equipment 20,000.00 Furniture 10,000.00

Acc. Depreciation 5,000.00 Acc. Depreciation 2,000.00

The fair market value of non-cash assets is:

Cost FMV

Zyron

Merchandise 10,00.00 8,000.00

Euipment 20,000.00 15,000.00

Dale

Merchandise 5,000.00 6,000.00

Furniture 10,000.00 8,000.00

Required: Record the investments of Zyron and Dale in the partnership books.

Enrico D. Flores Page 9

A Conceptual Approach to Partnership Accounting

On May 1, 2010, the business accounts of Ablan and Amias appear below:

Ablan Amias

Cash 55,000.00 111,770.00

Accounts Receivable 1,172,680.00 2,839,450.00

Merchandise Inventory 600,175.00 1,300,510.00

Land 3,015,000.00 -

Buildings - 2,141,335.00

Furniture and Fixture 251,725.00 173,945.00

Other Assets 10,000.00 18,000.00

Accounts Payable 894,700.00 1,218,250.00

Notes Payable 1,000,000.00 1,725,000.00

Ablan, Capital 3,209,880.00

Amias, Capital 3,641,760.00

Ablan and Amias agreed to form a partnership contributing their respective assets and liabilities

subject to the following adjustments.

a. Accounts receivable of P50,000.00 in Ablan’s books and P75,000.00 in Amias’ books

are uncollectible.

b. Inventories of P27,500.00 and P33,500.00 are worthless in Ablan’s and Amias’

respective books.

c. Other assets of P10,000.00 and P18,000.00 in Ablan’s and Amias’ books are to be

written off.

Required:

1. Prepare journal entries to the new books of the partnership.

Enrico D. Flores Page 10

A Conceptual Approach to Partnership Accounting

ACCOUNTING FOR PARTNERSHIP OPERATION

Partnership operation refers to division or distribution of profit/loss (result of business

operation) of the business during the period.

The first criterion is whether the partner is a capitalist or industrial partner.

For capitalist partner, the following steps must be taken:

1. Determine the result of business operation for the period.

2. If there is profit, refer to Profit Agreement as basis for distribution. If there is none, use

the capital contribution ratio as basis for distribution.

3. In case of a loss, use Profit and Loss Agreement as basis of allocation. If there is none,

use the Profit Agreement, else, use the capital contribution ratio.

For industrial partner, the following steps apply:

1. Determine the result of business operation for the period.

2. If there is a profit, refer to Profit Agreement as basis of share in the profit. If there is

none, determine equitable share in the profit.

3. In case of a loss, use the Profit and Loss Agreement as basis of computing the share in

loss. Else, the industrial partner does not share in any loss as provided by law.

Distribution or division of profit (loss) can be based on:

1. As stipulated in the Articles of Partnership:

a. Equally

b. Agreed (Arbitrary) Ratio

c. Ratio of capital contribution

• Initial contribution

• Beginning balance

• Average balance

• Ending balance

d. Provision of either /or combination of: interest on capital contribution, salary

and bonus to partner and the balance equally or in agreed proportion.

e. Or, combination of any of the above condition

2. In absence of stipulation, use ratio of initial capital contribution.

Enrico D. Flores Page 11

A Conceptual Approach to Partnership Accounting

Fig. 3: CONCEPTUAL FLOWCHART OF PARTNERSHIP OPERATION

(Division of Profit /Loss)

Start

Partner

Y

Result of

Capitalist

Operation

N P&L N Profit N

Profit?

Agreement Agreement

Y

Y Y

Profit Y

Use Capital

Agreement Agreement Contribution

Capital

Contribution

Y Y

Industrial Result of

Profit? Profit Agreement

Partner Operation

N

Agreement?

N

Equitable

share in profit

Y

P & L Agreement?

Compute share in

No share

result of operation

in loss

Distribute Partner’s

Stop share

Enrico D. Flores Page 12

A Conceptual Approach to Partnership Accounting

Problems and Exercises

The following are the capital accounts of Epoy and Junior for the year 2017. The business realizes a net

income from operation of P60,000.00 for the year.

Epoy, Capital

Debit Credit

Feb 1 5,000.00 Jan 1 45,000.00

May 1 9,000.00 Mar 1 12,000.00

Sept 1 2,000.00 Dec 1 30,000.00

Junior, Capital

Debit Credit

Feb 1 5,000.00 Jan 1 60,000.00

May 1 2,000.00 Apr 1 15,000.00

Nov 1 2,000.00 Sept 1 10,000.00

Divide the net income by using each of the following bases:

a. Average capital ratio

b. Beginning capital ratio

c. Ending capital ratio

d. Equally

e. Epoy, 60%, Junior, 40%

Enrico D. Flores Page 13

A Conceptual Approach to Partnership Accounting

Zyron and Des, partners of DZ Co., with investments of P300,000.00 and P400,000.00 respectively,

realized an income of P150,000.00. Prepare the journal entries to divide the income under the following

independent assumptions:

1. No stipulation on the division of income was made.

2. Capital ratio

3. Interest of 18% will be allowed on the ending capital and the balance equally

4. Salary allowance of P1,000.00 a month to Zyron and the remainder to be divided equally

Enrico D. Flores Page 14

A Conceptual Approach to Partnership Accounting

Ramos and Santos are business partners with capital investments of P150,000.00 and P250,000.00

respectively, suffered a net loss of P70,000.00 during the period. Prepare the journal entries to divide

the loss under the following independent assumptions.

1. Interest of 14% will be allowed on capital and the remainder equally.

2. Salary of P10,000.00 will be allowed to Ramos being the managing partner and the remainder

will be divided on the capital ratio.

3. Interest of 14% on the capital and salary allowance of P10,000.00 to Ramos and the

remainder equally.

Enrico D. Flores Page 15

A Conceptual Approach to Partnership Accounting

The partnership of Benito and Bunye has the following provisions in the partnership agreement:

1. A partner earns 10% interest on the excess of his average capital over the other partner.

2. Benito and Bunye are allowed annual salaries of P500,000.00 and P300,000.00 respectively

3. Any remaining profit or loss is to be divided in the ratio of 70:30

The average capital of Benito is P1,000,000.00 and that of Bunye is P600,000.00

Instruction: Prepare a profit distribution schedule assuming the profit of the partnership is:

a. P900,000.00

b. P700,000.00

Enrico D. Flores Page 16

A Conceptual Approach to Partnership Accounting

Blanco and Banda formed a partnership by investing P120,000.00 and P150,000.00 respectively. At the

end of its first year of operations, the partnership has realized a profit of P120,000.00. Determine the

distribution of profit under each of the following independent assumptions.

1. The partnership agreement does not mention profit sharing

2. Profit is divided in the ratio of the original investments

3. Interest at 8% is to be allowed on the original capital investments and the balance is to be

divided equally

4. Salaries of P54,000.00 and P45,000.00 respectively and the balance to be divided equally.

5. Interest at 10% is to be allowed on the original capital investments, salaries of P50,000.00

andP75,000.00 to partners, respectively and the balance to be divided in the ratio 2:3. In case of

insufficient net income, however, this has to be distributed in the salary ratio. While if there is a

net loss, then it has to be distributed equally.

Enrico D. Flores Page 17

A Conceptual Approach to Partnership Accounting

Bueno and Beran have capital balances at the beginning of the year of P1,200,000.00 and

P1,350,000.00, respectively. They share profit as follows:

1. Interest of 8% on beginning capital balances

2. Salary allowances of P450,000.00 to Bueno and P225,000.00 to Beran

3. Balance in the ratio of 3:2

The partnership realized a profit of P750,000.00 during the current year before interest and

salary allowances to partners.

Instructions:

1. Show how the profit of P750,000.00 should be divided between Bueno and Bernan.

2. Assuming that Bueno and Beran simply agree to share profit in a 3:2 ratio with a

minimum of P320,000.00 guaranteed to Beran, show how the profit of P750,000.00 be

divided.

Enrico D. Flores Page 18

A Conceptual Approach to Partnership Accounting

The partners of BBB Partnership are Bilbao, Bertol and Borja. During the current year, their average

capital balances are as follows:

Bilbao 560,000.00

Bertol 400,000.00

Borja 240,000.00

The partnership agreement provides that partners shall receive:

1. Annual allowance of 6% of their average capital balances

2. Salary allowances as follows: Bertol - P96,000.00, Borja – P80,000.00

3. Bertol, who manages the business, is to receive a bonus of 25% of profit in excess of

P144,000.00 after partners’ interest and salary allowances.

4. Residual profit will be divided in the ratio of 5:3:2

Instructions: Prepare separate schedules showing how profit or loss will be divided among the

three partners under each of the following independent cases.

1. P50,000.00 loss

2. P120,000.00 profit

3. P500,000.00 profit

Enrico D. Flores Page 19

A Conceptual Approach to Partnership Accounting

ACCOUNTING FOR ADMISSION OF NEW PARTNER

Admission of a new partner is a change in partners’ relationship wherein a third party is

admitted to the partnership. An incoming partner maybe admitted to the partnership through purchase

of interest of old (existing) partner or direct investment to the partnership.

If admission is through purchase of interest (share) of the old partner:

1. Record transfer of interest from OLD partner to NEW partner regardless of amount received

by or paid to old partner. This is a personal transaction between the individual partners and

the partnership was not involved in the cash (or any consideration) used by the parties.

If admission is through investment, the following steps must be taken:

1. Prepare schedule of capital structure with PARTNERS, CONTRIBUTED CAPITAL (CC), AGREED

CAPITAL CREDIT (ACC) and DIFFERENCE as heading for columns.

2. Determine the TOTAL CONTRIBUTED CAPITAL (TCC) and TOTAL AGREED CAPITAL CREDIT

(TACC).

3. If invested capital of new partner is equal to his ACC and there is no change between TCC

and TACC, then record the investment as actual capital credit.

However, if there is a change between TCC and TACC, then asset revaluation took place and

the difference is goodwill to OLD partners

In case that the CC and ACC of the new partner is not equal (in all probability, greater ACC

and the ACCs of old partners remain the same), then, a goodwill to NEW partner occurred.

4. If invested capital of new partner is not equal to his ACC and there is no change between

TCC and TACC, then a transfer (bonus) in capital credit occurred.

If the new partner’s investment is less than his ACC, then, bonus is granted to new partner,

else, bonus is granted to the old partners.

Enrico D. Flores Page 20

A Conceptual Approach to Partnership Accounting

Fig. 4: CONCEPTUAL FLOWCHART OF ADMISSION OF NEW PARTNER

Start

Incoming

Partner

Mode of

Admission

N Y Transfer interest

Investment Sale/Purchase regardless of

of interest amount received

Y

or paid

Y

Prepare schedule of

capital structure

Investment of

new partner

N Investment Y

=

Cap. Credit

Y

N N

Change in total Change

Y in total Actual

Bonus

agreed capital agreed capital Investment

N

Investment Y Y Y

N

<

Cap. Credit = =

Y Goodwill to Y

Credit new Y Credit

Goodwill to old

Y Y Y

Bonus to old Bonus to new Determine Goodwill

and Capital Credit

Determine Bonus

and Capital Credit

Journal Entries

Stop

Enrico D. Flores Page 21

A Conceptual Approach to Partnership Accounting

Problems and Exercises

Angie and Cecile are partners in selling RTW dresses. Their capital balances are as follows: Angie –

P150,000.00 and Cecile – P200,000.00. They share profits and losses in the ration of 40% and 60%,

respectively. Prepare the journal entries to record the admission of Tessie in each of the following

independent cases.

1. Tessie bought one-half of the interest of Cecile for P120,000.00

2. Angie sold 75% of her interest to Tessie for P115,000.00

3. Tessie bought one-half of the interest of Angie at book value.

4. Cecile sold one-third of her interest at P50,000.00

5. Angie and Cecile sold one-half of their interest to Tessie at book value

6. Tessie bought 50% of Angie’s interest by giving her car worth P100,000.00

7. Cecile received Tessie’s new stocks of RTW dresses worth P150,000.00 in exchange for her

50% interest in the partnership.

8. Tessie bought 40% of Angie’s interest for P60,000.00 and 50% interest of Cecile for

P150,000.00

9. Angie received Tessie’s brand new furniture costing P75,000.00 in exchange for her two-

fifths interest in the partnership.

10. Tessie bought 50% of the interest of Angie and Cecile for P175,000.00

Enrico D. Flores Page 22

A Conceptual Approach to Partnership Accounting

A and B share profits and losses based on their capital balances. Their capital accounts show P40,000.00

and P60,000.00 respectively. Prepare the journal entries for the admission of C under the following

independent cases:

1. C buys 50% of A’s interest and 60% interest of B for P40,000.00

2. A sells 2/5 of his interest to C for P20,000.00 in exchange of merchandise

3. C will invest P20,000.00 for a ¼ interest in a capital of P120,000.00

4. C will invest P16,000.00 for 1/6 interest in the new agreed capital of P116,000.00

5. C purchases one-half of the equity of A and B in the partnership

Enrico D. Flores Page 23

A Conceptual Approach to Partnership Accounting

X and Y are partners with capital balances of P30,000.00 and P40,000.00 respectively. Give the entry to

record the admission of Z under each of the following independent cases.

1. Z buys ¼ of the interest of X and Y for P9,000.00

2. X sells ½ of his interest to Z for P17,000.00

3. Y sells 40% of his interest to Z at book value

4. Z makes and investment of P20,000.00 for a 1/6 interest in the firm whose agreed

capitalization is P90,000.00

5. Z s required to make a P20,000.00 investment for a 1/5 interest in the total net assets of

P100,000.00

6. Z will make an investment of P30,000.00 for a 30% interest in the new partnership

7. Z will invest P28,000.00 for a 1/3 interest in the agreed capital of P105,000.00

8. Z was invited to invest P10,000.00 for a 1/5 interest in the new firm’s total capital of

P80,000.00

Enrico D. Flores Page 24

A Conceptual Approach to Partnership Accounting

Prepare the journal entries in the books of the partnership under each of the following independent

cases:

1. Partners A and B have capitals of P60,000.00 and P90,000.00 respectively. They share

profits and losses equally. They agree to admit C into the partnership. C is to contribute

P24,000.00 in cash but he will receive a capital credit of P30,000.00 for a 1/6 interest in the

firm.

2. M and N are partners with capitals of P75,000.00 and P60,000.00 respectively. They share

profits and losses as follows: M, 60%; and N, 40%. They agree to admit O to the

partnership. O will contribute P60,000.00 cash and will receive a credit for the same

amount representing ¼ interest in the capital of the firm.

3. X and Y have capitals of P40,000.00 and P60,000.00 respectively. They share profit and

losses equally. They agree to admit Z to the partnership. Z is to contribute P16,000.00 in

cash for a 1/6 interest in the new agreed capital of P116,000.00

4. C and D have capitals of P25,000.00 and P20,000.00 respectively. They share profit and

losses as follows: C, 3/5; D, 2/5. They agree to admit E to the partnership. E is to invest

P20,000.00 in cash for a 25% interest in the total capital of P65,000.00.

5. A and B are partners with capital investments of P20,000.00 and P30,000.00 respectively.

They share profits and losses equally. B with the consent of A sells to C one-half of his

interest in the firm for P18,000.00. The original partnership agreement between A and B is

terminated and a new partnership agreement is executed among A, B and C.

Enrico D. Flores Page 25

A Conceptual Approach to Partnership Accounting

Camus and Cuenco are partners who have capital balances of P90,000.00 and P60,000.00 and who share

profits 75% and 25% respectively. They agree to admit Cerda as a partner upon his payment of

P90,000.00.

Instruction: Give the journal entries to record each of the following independent

assumptions:

1. One-third of the capital balances of the old partners are transferred to the new partner,

Camus and Cuenco dividing the cash between themselves.

2. One-third of the capital balances of the old partners are transferred to the new partner,

Camus and Cuenco dividing the cash between themselves. However, before recording the

admission of Cerda, asset revaluation is undertaken on the firm books so that Cerda’s capital

may be equal to the amount paid for the interest.

3. The cash is invested in the business and Cerda is credited with a ¼ interest in the firm, the

bonus method being used in recording his investment.

4. The cash is invested in the business and Cerda is credited with the full amount of his

investment which is to be 25% of the new firm capital.

5. The cash is invested in the business and Cerda is credited for P120,000.00 which includes a

bonus from Camus and Cuenco.

Enrico D. Flores Page 26

A Conceptual Approach to Partnership Accounting

Carlos and Cruz, partners have capital balances of P200,000.00 and P300,000.00 respectively. They

admit Caparas and Carpio into the partnership. Caparas purchases one-fourth of Carlos’ interest for

P36,000.00 and one-third of Cruz’s interest for P72,000.00. Carpio is admitted to the partnership with

an investment of P120,000.00 for which he is to received an ownership equity of P120,000.00.

Instructions:

1. Present the entries in general journal form to record the admission into the partnership of

(a) Caparas, and (b) Carpio.

2. What are the capital balances of each partner after the admission of Caparas and Carpio?

Enrico D. Flores Page 27

A Conceptual Approach to Partnership Accounting

Coral and Corpuz are partners with capital balances of P180,000.00 and P120,000.00 respectively. They

share profits and losses in the ratio of 60:40. They agree to admit Calma to the partnership.

Instructions: Journalize the admission of Calma to the partnership for each of the following

independent assumptions:

1. Calma is admitted to a one-third interest capital with a contribution of P150,000.00

2. Calma is admitted to a one-fourth interest in capital with a contribution of P120,000.00.

Total capital of the partnership is to be P420,000.00.

3. Calma is admitted to a one-fourth interest in capital upon contributing P60,000.00. The

total capital of the new partnership is to be P360,000.00.

4. Calma is admitted to a one-fourth interest in capital by the purchases of one-fourth of the

interest of Coral and Corpuz for P82,500.00. Total capital of the new partnership is to be

P300,000.00.

5. Same conditions as in number 4, except that the new partnership capital is to be

P330,000.00 due to the asset revaluation undertaken prior to the admission of Calma.

6. Calma is admitted to a one-fifth interest in capital upon contributing P90,000.00. Total

capital of the new partnership is to be P450,000.00.

Enrico D. Flores Page 28

A Conceptual Approach to Partnership Accounting

In 2007, Castillo and Cordova established a partnership. Their operations have been very successful.

Since Castillo devotes full-time to the business and Cordova part-time, they share profits and losses in

the ratio of 8:2 respectively. At the beginning of 2010, Coloma expressed his interest of joining the

partnership. The capital balances of Castillo and Cordova on this date are P560,000.00 and P840,000.00

respectively.

Instructions:

1. Prepare the entries to record the admission of Coloma into the partnership under each of

the following independent assumptions:

a. Coloma invests P350,000.00 cash for a one-fifth interest in the partnership.

b. Coloma interest P500,000.00 cash for a one-fourth interest in net assets; the bonus

method is used.

c. Coloma invests P700,000.00 for a one-fourth interest, the asset revaluation method

is to be used.

d. Coloma pays Castillo and Cordova a total of P550,000.00 for one-fourth of their

respective capital interest.

e. Coloma pays Castillo and Cordova a total of P350,000.00 for one-fifth of their

respective capital interest, no asset revaluation is undertaken prior to the admission

of Coloma.

2. Assuming Coloma paid a total of P600,000.00 to Castillo and Cordova for two-fifths of their

respective capital balances, prepare a schedule determining the amount of cash to be

transferred to Castillo and Cordova.

Enrico D. Flores Page 29

A Conceptual Approach to Partnership Accounting

ACCOUNTING FOR CHANGES IN CAPITAL STRUCTURE (Dissolution)

Change in capital structure (dissolution) occurs on the following occasions:

1. Retirement/withdrawal of partner

2. Death, incapacity or insolvency

3. Admission of new partner

4. Incorporation

5. Sale of Partnership

This particular section only deals with retirement and death of partner since other topics are

covered separately.

For retirement of partner, the following applies:

1. The retiring partner has the option to sell his interest to the remaining/continuing

partners or to the partnership.

2. If he sells his interest to remaining partners, only journal entry to effect transfer of

interest is required as this is a personal transaction of the parties.

3. However, if he sells his interest to the partnership, the following is required before

settlement of partner’s capital account

a. result of business operation during the period

b. closing the books

c. preparation of post-closing trial balance or financial statements

d. determination of asset revaluation or bonus

In case of death, Items 3a to 3d above is required before settlement of the deceased partner’s

capital account. Proceeds shall form part of the deceased’s estate.

Enrico D. Flores Page 30

A Conceptual Approach to Partnership Accounting

Fig. 5: CONCEPTUAL FLOWCHART OF CHANGES IN CAPITAL STRUCTURE

(DISSOLUTION)

Start

Partner

Y

Retirement

N

N N

Incorporation Admit new

partner Death

Y

Y Y

Compute result Sold to

of operation Partnership

Admission of

new partner Close books Sold to

remaining

partner

Prepare Post-

closing Trial

Journal Entry to

Balance

Follow procedure in Follow procedure in effect transfer of

formation of corporation admission of new partner interest

Y

Asset

Revaluation

Y

Compute

Y

N

Revaluation

Y

Compute Bonus

Bonus

Y N

Y Settlement of

Partners’ Capital

Accounts

Stop

Enrico D. Flores Page 31

A Conceptual Approach to Partnership Accounting

Problems and Exercises

The partners of 3D Partnership agreed to the withdrawal of Dolor. Prior to the withdrawal, the partners

had the following capital balances: Damian – P32,000.00; Damaso – P48,000.00; Dolor – P40,000.00.

The partners shared profits and losses equally.

Instructions: Prepare the journal entry or entries necessary to record the withdrawal of Dolor

from the partnership under each of the following independent assumptions:

1. Each of the remaining partners will purchase 50% of interest of Dolor for P25,000.00.

2. The partnership will purchase the interest of Dolor for P32,000.00; the bonus method is

used.

3. The partnership will purchase the interest of Dolor for P46,000.00; asset revaluation prior to

retirement of Dolor being recognized.

Enrico D. Flores Page 32

A Conceptual Approach to Partnership Accounting

Dayrit, Dayap and Diesta are partners in the Triple B Partnership. Their capital balance on October 1,

2010 are as follows: Dayrit – P100,000.00; Dayap – P60,000.00; Diesta – P80,000.00. They share profits

and losses in the ratio of 3:1:1. Diesta is retiring from the partnership on this date.

Instructions: Prepare journal entries to record Diesta’s withdrawal according to each of the

following independent assumptions:

1. Diesta is paid P96,000.00 and no asset revaluation is recorded.

2. Diesta is paid P90,000.00 and asset revaluation is recorded.

Enrico D. Flores Page 33

A Conceptual Approach to Partnership Accounting

Dimla and Distor wish to purchase the partnership interest of their partner Daza at June 30, 2011.

Partnership assets are to be used to purchase Daza’s partnership interest. The partners share earnings

in the ratio of 3:2:1. The statement of financial position for the partnership on this date show the

following:

Assets Liabilities and Capital

Cash 21,600.00 Liabilities 18,000.00

Receivables (net) 14,400.00 Dimla, Capital 48,000.00

Inventory 12,000.00 Distor, Capital 24,000.00

Equipment (net) 54,000.00 Daza, Capital 12,000.00

102,000.00 102,000.00

Instructions: Prepare the entry to record the retirement of Daza under each of the following

independent assumptions.

1. Daza is paid P13,200.00 and the excess payment is viewed as bonus to him.

2. Daza is paid P10,800.00 and the difference is viewed as bonus to Dimla and Distor.

Enrico D. Flores Page 34

A Conceptual Approach to Partnership Accounting

Dantes, Dungca and Dee are partners sharing profits in the ratio of 3:2:1 respectively. Capital accounts

are P50,000.00, P30,000.00 and P20,000.00 on December 31, 2011 when Dee decided to withdraw. The

partnership paid Dee P30,000.00 for his interest. Profits after the retirement of Dee are to be shared

equally.

Instructions:

1. Give two possible entries to record Dee’s retirement.

Enrico D. Flores Page 35

A Conceptual Approach to Partnership Accounting

ACCOUNTING FOR

REALIZATION OF NON-CASH ASSETS AND PARTNERSHIP LIQUIDATION

(Lump-sum Liquidation)

Liquidation refers to winding-up of the business and termination of the partnership while

realization is the conversion (sale) of non-cash assets.

The following is the procedure for partnership liquidation:

1. Consider the Profit (and Loss) Agreement or in its absence, the capital contribution

ratio.

2. Prepare statement of liquidation with the following column headings:

a. Cash

b. Non-cash assets

c. Liabilities

d. Due to partners

e. Capital accounts

3. Compute gain or loss in the sale of non-cash assets.

In case of gain, distribute the gain to partners’ capital account according to profit (and

loss) ratio.

If the sale resulted to loss, deduct the loss from partners’ capital account according to

profit (and loss) ratio. Should this result to deficit in capital account of any partner,

determine if there is any due to the particular partner and off-set this to his capital

account, if insufficient to cover his capital deficit, determine if he is solvent (capable of

paying his deficiency). If he is, he must invest additional cash to cover his deficiency,

else, the remaining partners must absorb the deficiency according to their profit (and

loss) ratio (note: do not consider the part of the deficient partner).

4. When everything is satisfied, distribute the cash account according to order of priority

or as required by the problem.

Enrico D. Flores Page 36

A Conceptual Approach to Partnership Accounting

Fig. 6: CONCEPTUAL FLOWCHART OF

REALIZATION OF NON-CASH ASSETS AND PARTNERSHIP LIQUIDATION

(Lump-sum Liquidation)

Start

P & L Agreement

Prepare Statement

of Liquidation

Sale of Non-Cash

Assets

Distribute loss N Y Distribute gain

according to profit Gain according to profit

and loss agreement and loss agreement

N

Result to deficit

Y N

Offset against

Due to partner Negative capital

due to partner

N Y

N Other partners

Partner is

to absorb deficit

solvent

Distribute cash

Partner to invest according to

additional cash order of priority

to cover deficit or as required by

the problem

Stop

Enrico D. Flores Page 37

A Conceptual Approach to Partnership Accounting

Problems and Exercises

The partners of Elias, Enrico and Ener Partnership have agreed to liquidate their partnership as of

December 31, 2011. The partnership has cash of P80,000.00, non-cash assets of P810,000.00 and

liabilities of P270,000.00. The capital accounts of the partners are: Elias, P60,000.00; Enrico,

P290,000.00; and Ener, P270,000.00. The partners share profits and losses in the ratio of 3:3:2

respectively. The partnership was able to sell all the non-cash assets for P634,000.00 and paid

P20,000.00 for liquidation expenses.

Instructions:

1. Prepare a statement of liquidation assuming all partners are solvent.

2. Prepare a statement of liquidation assuming the liabilities of P270,000.00 include a P70,000.00

note payable to Elias. All partners are solvent.

3. Prepare a statement of liquidation assuming the non-cash assets of P810,000.00 include a note

receivable from Enrico in the amount of P110,000.00. The liabilities include a P70,000.00 note

payable to Elias.

Enrico D. Flores Page 38

A Conceptual Approach to Partnership Accounting

On June 1, 2011, Encabo and Elorde, partners of E2 Partnership, decided to liquidate their partnership.

At the time of liquidation, the statement of financial position accounts consisted of: cash, P25,000.00;

non-cash assets, P600,000.00; liabilities, P125,000.00; Encabo, Capital, P225,000.00; Elorde, Capital,

P275,000.00. Encabo and Elorde share profits and losses in the capital ratio. Encabo is personally

insolvent. Non-cash assets were sold for P350,000.00.

Instructions: Prepare a statement of liquidation.

Enrico D. Flores Page 39

A Conceptual Approach to Partnership Accounting

The balance sheet of Abby and Gale Merchandising appeared as follows:

Assets Liabilities and Capital

Cash 87,500.00 Accounts Payable 350,000.00

Non-Cash 700,000.00 Loan Payable to Abby 35,000.00

Loan Payable to Gale 52,500.00

Abby, Capital 175,000.00

______.__ Gale, Capital 175,000.00

787,500.00 787,500.00

Profit and loss sharing ratios are equally. All partners are solvent.

Prepare statement of liquidation and journal entries under the following independent cases:

1. The non-cash assets were sold for P500,000.00

2. The non-cash assets were sold for P350,000.00

3. The non-cash assets were sold for P262,500.00

4. The non-cash assets were sold for P210,000.00

Enrico D. Flores Page 40

A Conceptual Approach to Partnership Accounting

The post-closing trial balance of XYZ is given below:

Account Title Debit Credit

Cash 20,000.00

Account Receivable 60,000.00

Allowance for bad debts 6,000.00

Merchandise Inventory 30,000.00

Store Equipment 50,000.00

Accumulated Depreciation 25,000.00

Accounts Payable 10,000.00

X, Loan Payable 10,000.00

X, Capital 20,000.00

Y, Capital 35,000.00

Z, Capital ______.__ 54,000.00

160,000.00 160,000.00

Their profit and loss sharing ratio: X, 20%; Y, 30%; Z, 50%. XYZ decided to liquidate. The assets

except cash realized a lump-sum price of P100,000.00

Required

1. Prepare statement of liquidation

2. Prepare the journal entries for the liquidation.

Enrico D. Flores Page 41

A Conceptual Approach to Partnership Accounting

The CARAMEL Enterprises owned by Cara, Rally and Mely is facing financial crises and decided to

liquidate their partnership. Their ledger showed the following accounts below:

Account Title Debit Credit

Cash 45,000.00

Non-Cash 350,000.00

Accounts Payable 200,000.00

Loan due to Mely 10,000.00

Cara, Capital 60,000.00

Rally, Capital 58,000.00

Mely, Capital ______.__ 67,000.00

395,000.00 395,000.00

They share profits and losses as follows: Cara, 35%; Rally, 25%; Mely, 40%

Requirements:

1. Prepare the journal entries and the statement of liquidation assuming the non-cash assets were

sold for P200,000.00.

2. Prepare the statement of liquidation assuming the non-cash assets were sold for P150,000.00

and the deficient partners are solvent.

3. Prepare the statement of liquidation is the non-cash assets were sold for P100,000.00. The

deficient partner/s is/are insolvent.

Enrico D. Flores Page 42

A Conceptual Approach to Partnership Accounting

LIST OF REFERENCES

Books:

Ballada, Win Lu, (1999), Basic Accounting, Quezon City, Educational Series

Ballada, Win Lu, (2002), Partnership and Corporation Accounting, Quezon City, Educational Series

Boynton, Lewis D., et.al., (1972), Century 21 Accounting, Cincinnati, Ohio, South-Western Publishing Co.

Domingo, James Cristopher D. (2010) Bentahan, Basic Accounting, A Kindergarten Approach, Vol. 2

Domingo, James Cristopher D. (2010) Hairy Potter, Basic Accounting, A Kindergarten Approach, Vol. 1

Feldman, Matan, et.al., (2007), Crash Course in Accounting and Financial Statement Analysis 3rd Ed.,

John Wiley & Sons, Inc., Hoboken, New Jersey

Herrero, Carmen C., et.al., (2007), Accounting Principles 3, Textbook/Workbook, 4th ed., Mandaluyong

City, National Bookstore

Hugo-Macapilit, Cecilia, (2010), Partnership and Corporation Accounting and Their Legal Bases, Manila,

Rex Book Store

Lim, Juan D., et.al., (1997), Introduction to Accounting, Principles and Procedures, Valenzuela City, Tru-

Copy Publishing House, Inc.

Manuel, Zenaida Vera Cruz, (2011), Accounting Process, Basic Concepts and Procedures, Quezon City,

Raintree Trading & Publishing, Inc.

Meigs, Robert T., et.al., (1993), Accounting, The Basis for Business Decisions, USA, McGraw-Hill, Inc.

Passion, Doroteo S., et.al., (1994), Introductory Accounting, Part 2, Quezon City, Phoenix Publishing

House, Inc.

Passion, Doroteo S., et.al., (1995), Introductory Accounting, Part 1, Quezon City, Phoenix Publishing

House, Inc.

Pefianco, Erlinda C., et.al., Accounting Process, Principles and Problems, 2nd Edition, Makati City,

Goodwill Bookstores

Stice, Earl K., (2008), Accounting Concepts, USA, SouthWestern, Cengage Learning

Others:

Bulletin of Information, College of Liberal Arts, TUP, Manila

Civil Code of the Philippines

Corporation Code of the Philippines

Enrico D. Flores Page 43

A Conceptual Approach to Partnership Accounting

COURSE CONTENT/OUTLINE

This course contains the following sub-topics:

B. Review of accounting process

1. Steps in accounting process

C. Nature of partnership E. Partnership operations/Division of profit

4. Characteristics 1. Methods and rules in dividing profits

5. Advantages and disadvantages and losses

6. Kinds and classes of partnership a. Arbitrary ratio

7. Types of Partners • Equally

8. Books of accounts of a • Fractional basis

partnership • Percentage

9. Partnership accounts b. Capital ratio

• Original capital

D. Formation of partnership • Beginning capital

1. Accounting for initial investment • Ending capital

(Opening the Books of Partnership) • Average capital

a. Investment of cash only by the c. With provision of interest on

partners partner’s capital, balance on agreed

b. Investment of cash and non-cash ratio

assets d. With salaries to partners, balance

• Industrial partner on agreed ratio

c. Investment of non-cash by the e. Salaries and interest to partners,

partner, the partnership assuming balance on agreed ratio

the outstanding balance (liability) 2. The Drawing Account (why not closed

d. Investment of a partner with an to Capital Account)

existing business 3. Statement of Changes in Partners’

• Revaluation of assets Equity

• Adjusting entries 4. Net income is less than salary and

• Closing the books interest

• Transfer of assets and liabilities 5. The business operation resulted to net

to partnership (existing book; loss

new book) 6. Share of industrial partner to income or

e. Two existing businesses forming a loss

partnership

• Revaluation of assets

• Adjusting entries

• Closing the books

• Transfer of assets and liabilities

to partnership (existing book;

new book)

Enrico D. Flores Page 44

A Conceptual Approach to Partnership Accounting

F. Partnership dissolution (Admission of new H. Partnership liquidation

partner) 1. Types of liquidation

1. Causes of dissolution a. Lump-sum liquidation

2. Admission of a new partner by transfer b. Installment liquidation

of equity (sale of interest) of old partner 2. Steps in lump-sum liquidation

to new partner a. Sale of assets and recording the

a. Adjustment of books to determine gain or loss

book value of equity b. Distribution of gain or loss

b. Selling price is at book value c. Payment of liabilities to outside

c. Selling price is above book value creditors

d. Selling price is below book value d. Payment of loans to partners

3. Goodwill and Bonus e. Distribution of the remaining cash

a. Reasons for goodwill/bonus to the partners in their capital

4. Admission by investment balances

a. No goodwill, no bonus

b. Goodwill to new partner I. Organization and formation of a

c. Goodwill to old partner corporation

d. Goodwill to new and old partners 2. Characteristics, advantages and

e. Implied goodwill disadvantages

f. Bonus to new 3. Classes of shares

g. Bonus to old 4. Issuance of share capital

h. Goodwill and bonus

J. Operations of corporation

G. Changes in capital structure 1. Dividends

1. Retirement or withdrawal 2. Book value per share

a. Withdrawal of a partner by sale of 3. Earnings per share

equity to the remaining partners

b. Withdrawal of a partner by sale of

equity to a new partner

c. Withdrawal of a partner by sale of

equity to the partnership

2. Death, insolvency or incapacity

Enrico D. Flores Page 45

A Conceptual Approach to Partnership Accounting

INDIVIDUAL ASSIGNMENT

IN THE FOLLOWING PAGES, answer the following in HANDWRITTEN and FOR SUBMISSION one (1)

week after first meeting.

Part I: Answer the following questions. Refer to accounting books.

A. PARTNERSHIP ACCOUNTING

INTRODUCTION

1. Define partnership

2. Define corporation

3. What are the attributes of a corporation?

4. What are the classes of corporation?

5. What is the legal basis of partnership? Corporation?

6. What are the advantages and disadvantages of a partnership?

7. What are the advantages and disadvantages of a corporation?

8. What are the characteristics of a partnership?

9. Distinguish partnership and corporation as to:

a. Creation g. Right of succession

b. Number of incorporators h. Extent of liability to third

c. Commencement of juridical persons/parties

personality i. Term of existence (Life span)

d. Powers j. Firm name

e. Management k. Dissolution

f. Effect of mismanagement l. Governing law

10. Classification of partners as to:

a. Nature of contribution f. Continuation of the business affairs

b. Liability to third persons/parties after dissolution

c. Management g. Value of contribution

d. Exposure to public perception h. Nature of membership

e. Membership i. State of survivorship

j. Expulsion

11. Distinguish a capitalist from industrial partner as to:

a. Contribution

b. Prohibition to engage in other business

c. Profit sharing

d. Losses

Enrico D. Flores Page 46

A Conceptual Approach to Partnership Accounting

12. Classification of partnership as to:

a. Object of partnership d. Legality of existence

b. Liabilities or obligations to third e. Representation to others

persons f. Publicity

c. Duration g. Purpose

13. What are the contents of Articles of Co-partnership?

14. What are the requirements and procedure in partnership registration?

PARTNERSHIP FORMATION

15. What are the resources that partners may contribute into a partnership? How are their values

determined and recorded?

PARTNERSHIP OPERATION/DIVISION OF PROFIT

16. What are the rules in dividing profit and losses?

17. What is meant by “equitable share” in profit?

18. What are the methods of distributing profits (losses) based on partners’ agreement?

19. What is “order of priority” of division of profit?

PARTNERSHIP DISSOLUTION

20. What is partnership dissolution?

21. What are the causes of partnership dissolution?

22. What are the causes in change of capital structure?

23. How and to whom can a partner’s interest be transferred?

24. What is partnership dissolution with liquidation?

PARTNERSHIP LIQUIDATION

25. What are the causes of partnership dissolution with liquidation?

26. What are the steps in lump-sum liquidation?

27. What are the types of liquidation?

28. What is Statement of Liquidation?

29. As applied to partnership liquidation, what does the following terms mean?

a. Realization

b. Right of offset

30. Who is a “deficient partner”?

31. Who is an “insolvent partner”?

Enrico D. Flores Page 47

A Conceptual Approach to Partnership Accounting

B. CORPORATION ACCOUNTING

32. What are the classes of stocks under Section 6 of the Corporation Code of the Phils.?

33. What is “par-value” of stock?

34. What is “book value” of stock? How do you compute for the book value of stock?

35. What is “earnings per share” of stock? How do you compute for the earning per share of stock?

36. What are the rights of a stockholder?

Part II: Copy the following Articles pertaining to partnership from the Civil Code of the

Philippines

1. Article 1767 – Partnership defined

2. Article 1768 – Juridical Personality

3. Article 1771 – Constitution of a partnership

4. Article 1772 – Contract of Partnership with P3,000.00 Capital

5. Article 1776 – Kinds of Partnership

6. Article 1784 – When Partnership Begins

7. Article 1789 – Industrial Partner

8. Article 1790 – Equal Shares

9. Article 1797 – Distribution of Profits

10. Article 1810 – Property Rights of a Partner

11. Article 1828 – Dissolution of a Partnership

12. Article 1829 – Winding Up the Partnership

13. Article 1830 – Causes of Dissolution

14. Article 1831 – Application for Dissolution

15. Article 1839 – Settlement of Accounts

Part III: Copy the following Sections pertaining to corporation from the Corporation

Code of the Philippines

1. Section 2 – Corporation defined

2. Section 3 – Classes of Corporation

3. Section 5 – Corporators and Incorporators

4. Section 10 – Incorporation of a Private Corporation

5. Section 11 – Corporate Term

6. Section 14 – Contents of Articles of Incorporation

7. Section 15 – Form of Articles of Incorporation

8. Section 18 – Corporate Name

9. Section 23 – Corporate Powers

10. Section 47 – Contents of By-Laws

11. Section 62 – Consideration for Stocks

Enrico D. Flores Page 48

A Conceptual Approach to Partnership Accounting

Course Outline from:

ACCOUNTING PRINCIPLES 3, Textbook/Workbook, 4th edition

Carmen C. Herrero and Amelia M. Arganda (Bernardo G. Del Rosario, Coordinator)

2007, National Bookstore, Mandaluyong City

I. Ways of forming partnership

A. Two or more persons may form a partnership for the first time. In this type of formation, the

partners may contribute cash, property or services.

B. Two or more persons may form a partnership where one of them is already engaged in

business:

a. New set of books may be opened for the partnership

b. One of the old books to be continued as the partnership books

C. Admission of a new partner in an existing partnership

a. By purchase of a certain fraction of interest of one of the partners or both

b. By investment or by contributing cash or other tangible assets to the firm

II. Partnership operations

A. Division of Profit (Loss)

1. Equally

2. Arbitrary ratio

3. Capital ratio

4. Allowing interest; balance equally or in agreed ratios

5. Allowing salaries and interest; balance equally or in agreed ratios

6. Allowing salaries, interest and bonus; balance equally or in agreed ratios

B. Financial Statements

1. Changes in partners’ equity

III. Dissolution of partnership

A. Causes of dissolution

1. Sale of partner’s interest (Retirement/Withdrawal)

a. To existing partner

b. To new partner

c. To partnership

2. Sale of partnership business

3. Death, insolvency or incapacity of a partner

4. Admission of a new partner

a. Purchase of equity

b. Investment of new partner

i. Bonus

ii. Goodwill

5. Liquidation of a partnership

6. Incorporation

IV. Liquidation

A. Methods of Liquidation (Lump-sum/Installment)

B. Partner’s debit balances

Enrico D. Flores Page 49

You might also like

- PROBLEM 11-1 Accrual of Income, Prepayments-Asset Method, Precollection-Liability MethodDocument2 pagesPROBLEM 11-1 Accrual of Income, Prepayments-Asset Method, Precollection-Liability MethodJesseca JosafatNo ratings yet

- Chapter 4 DCFDocument107 pagesChapter 4 DCFVienne MaceNo ratings yet

- 9410 - Job Order CostingDocument7 pages9410 - Job Order CostingMarshmallowNo ratings yet

- Short Case ActivitiesDocument2 pagesShort Case ActivitiesRaff LesiaaNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Answer Sheet PerpetualDocument16 pagesAnswer Sheet PerpetualMICHELLE DE LOS REYESNo ratings yet

- Chapter 1 Introduction To Cost AccountingDocument9 pagesChapter 1 Introduction To Cost AccountingSteffany RoqueNo ratings yet

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- Module 4 Adjusting Entries PDFDocument21 pagesModule 4 Adjusting Entries PDFMax Dela TorreNo ratings yet

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDocument2 pagesJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNo ratings yet

- Module Part I Preface To UNIT I PDFDocument43 pagesModule Part I Preface To UNIT I PDFsvpsNo ratings yet

- Accounting For Business Organization: Partnership FormationDocument14 pagesAccounting For Business Organization: Partnership FormationKate Jezel SantoniaNo ratings yet

- Partnership Formation: AssignmentDocument6 pagesPartnership Formation: AssignmentLee SuarezNo ratings yet

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- Castro-Merchandising 20211124 0001Document2 pagesCastro-Merchandising 20211124 0001Chelsea TengcoNo ratings yet

- CF04 Part 3 - Petty Cash FundDocument51 pagesCF04 Part 3 - Petty Cash FundABMAYALADANO ,ErvinNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Problem ADocument5 pagesProblem AKim TaehyungNo ratings yet

- Chapter 2 SummaryDocument3 pagesChapter 2 SummaryXiaoyu KensameNo ratings yet

- Ayala Land, Inc. Back GroundDocument3 pagesAyala Land, Inc. Back GroundAndrea Noreen Pascua NardoNo ratings yet

- 01 Activity 2Document4 pages01 Activity 2Laisan SantosNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- BA 118.1 SME Exercise Set 5Document1 pageBA 118.1 SME Exercise Set 5Ian De DiosNo ratings yet

- Case StudyDocument2 pagesCase StudyMargielyn Umbao0% (1)

- CMPC 131 4-Partnership LiquidationDocument9 pagesCMPC 131 4-Partnership LiquidationGab Ignacio100% (1)

- Module 2 - Topic 4Document8 pagesModule 2 - Topic 4Moon LightNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Accountants in The Academe: Embracing The Changing and Challenging TimesDocument12 pagesAccountants in The Academe: Embracing The Changing and Challenging TimesLorie Anne ValleNo ratings yet

- 2 Partnership Dissolution 0 Liquidation 2022Document16 pages2 Partnership Dissolution 0 Liquidation 2022Kimberly IgnacioNo ratings yet

- Bank Recon and Poc SolutionDocument4 pagesBank Recon and Poc SolutionJanine IgdalinoNo ratings yet

- FAR Chapter 1 Problem 2Document1 pageFAR Chapter 1 Problem 2jelou ubagNo ratings yet

- CFAS.100 - Diagnostic Test Part 1Document4 pagesCFAS.100 - Diagnostic Test Part 1Mika MolinaNo ratings yet

- Bcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)Document5 pagesBcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)nickoloco100% (1)

- SW-16 UTB Merchandising AsDocument4 pagesSW-16 UTB Merchandising AsAlexis Marie Balagot100% (1)

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Quiz On The Accounting EquationDocument5 pagesQuiz On The Accounting EquationCeejay MancillaNo ratings yet

- Mathpiechart and BargraphDocument4 pagesMathpiechart and BargraphJasmine Arnejo AmadorNo ratings yet

- The DualisticDocument6 pagesThe DualisticFlorence LapinigNo ratings yet

- Week 5 - AEC 201 - Activities-PrelimDocument7 pagesWeek 5 - AEC 201 - Activities-PrelimNathalie HeartNo ratings yet

- Chart of Accounts Assets: LiabilitiesDocument50 pagesChart of Accounts Assets: LiabilitiesDiana Rose Orlina100% (1)

- HOBA - General Procedures-DLSAUDocument25 pagesHOBA - General Procedures-DLSAUJasmine LimNo ratings yet

- FS ActivityDocument4 pagesFS ActivityJace LavaNo ratings yet

- CFAS - Lec. 5 PAS 7, PAS8, PAS10Document28 pagesCFAS - Lec. 5 PAS 7, PAS8, PAS10latte aeriNo ratings yet

- Cce Prob DiscussionDocument6 pagesCce Prob DiscussionTrazy Jam BagsicNo ratings yet

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeDocument44 pagesChart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeJireh RiveraNo ratings yet

- Worksheet 1Document8 pagesWorksheet 1Kevin Espiritu100% (1)

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- Partnership Operation - ProblemDocument1 pagePartnership Operation - ProblemIñego Begdorf100% (2)

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Classification of PartnersDocument2 pagesClassification of Partnersarnel barawedNo ratings yet

- St. Paul University Surigao Surigao City, Philippines: The Problem and Its BackgroundDocument7 pagesSt. Paul University Surigao Surigao City, Philippines: The Problem and Its BackgroundivyNo ratings yet

- SolMan (Advanced Accounting)Document190 pagesSolMan (Advanced Accounting)Jinx Cyrus RodilloNo ratings yet

- AFAR Partnership FormationDocument4 pagesAFAR Partnership FormationCleofe Mae Piñero AseñasNo ratings yet

- Dey'S - Sample PDF - Accountancy-XII Exam Handbook 2021-22 (Term-I)Document73 pagesDey'S - Sample PDF - Accountancy-XII Exam Handbook 2021-22 (Term-I)icarus falls57% (7)

- 19 Admission of A Partner PDFDocument40 pages19 Admission of A Partner PDFabdanNo ratings yet

- Parcor ActgDocument7 pagesParcor Actgoneddd439No ratings yet

- Chapter 6 BFMDocument59 pagesChapter 6 BFMrifat AlamNo ratings yet

- Anita CakeDocument1 pageAnita CakeYoshita SubramaniamNo ratings yet

- internship-report-OIB YIRGUDocument28 pagesinternship-report-OIB YIRGUSISAYNo ratings yet

- Uti Mutual Fund Project 2022Document45 pagesUti Mutual Fund Project 2022Anuja DekateNo ratings yet

- Schoolchildren FinDocument32 pagesSchoolchildren FinRajesh BoppisettiNo ratings yet

- Accounting and Finance For Non-SpecialistsDocument4 pagesAccounting and Finance For Non-SpecialistsDaniel Bogisch100% (1)

- Investment Portfolio Template 1Document2 pagesInvestment Portfolio Template 1NikHil SharmaNo ratings yet

- Quiz No. 2 SolutionsDocument3 pagesQuiz No. 2 SolutionsCiel ArvenNo ratings yet

- CMA FAR ExamDocument30 pagesCMA FAR ExamAbd-Ullah AtefNo ratings yet

- Basking AnswerDocument2 pagesBasking AnswerAjith GeorgeNo ratings yet

- Wells Fargo Statement - Oct 2022Document6 pagesWells Fargo Statement - Oct 2022pradeep yadavNo ratings yet

- Auditing Quizzer 3Document4 pagesAuditing Quizzer 3KathleenNo ratings yet

- Funding and Listing Numerical Questions: S.no. TopicDocument22 pagesFunding and Listing Numerical Questions: S.no. Topicvarad dongreNo ratings yet

- Spring '21 North South University Hhq1 School of Business, BbaDocument4 pagesSpring '21 North South University Hhq1 School of Business, BbaMushfiqur RahmanNo ratings yet

- Internal Audit ManualDocument11 pagesInternal Audit ManualAnudeep ReddyNo ratings yet

- Advanced Audit and Assurance (International) : Tuesday 3 June 2008Document8 pagesAdvanced Audit and Assurance (International) : Tuesday 3 June 2008usamaNo ratings yet

- JGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020Document6 pagesJGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020ADFAfsNo ratings yet

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- Partnership Liquidation Do It YourselfDocument3 pagesPartnership Liquidation Do It YourselfBC qpLAN CrOwNo ratings yet

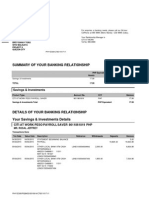

- Summary of Your Banking Relationship: Savings & InvestmentsDocument3 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- Final Exam Accounting 2 Fin AcountingDocument5 pagesFinal Exam Accounting 2 Fin Acountingloida aquinoNo ratings yet

- Iapm PDFDocument25 pagesIapm PDFtejas malokarNo ratings yet

- Regulatory Framework of Merchant BankingDocument12 pagesRegulatory Framework of Merchant BankingKirti Khattar60% (5)

- Tutorial Questions - Capital Budgeting 2023-1Document16 pagesTutorial Questions - Capital Budgeting 2023-1Richie Ric JuniorNo ratings yet

- CAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Document3 pagesCAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Darkness DarknessNo ratings yet

- Collateral ManagersDocument3 pagesCollateral ManagersZerohedgeNo ratings yet

- Pro-Forma Journal EntriesDocument4 pagesPro-Forma Journal EntriesAdam CuencaNo ratings yet

- Examination 7Document6 pagesExamination 7Lopez, Azzia M.No ratings yet

- A Project On Capital MarketDocument4 pagesA Project On Capital MarketYadav JayNo ratings yet

- Approach For Safety of Loans Follow Up and Monitoring Process Q3Document6 pagesApproach For Safety of Loans Follow Up and Monitoring Process Q3maunilshahNo ratings yet