Professional Documents

Culture Documents

Importer's Guide To US Customs Clearance of Imported Goods

Uploaded by

yacine ouchiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Importer's Guide To US Customs Clearance of Imported Goods

Uploaded by

yacine ouchiaCopyright:

Available Formats

IMPORTER'S GUIDE TO U.S.

CUSTOMS

CLEARANCE OF IMPORTED GOODS

DANIEL MARK OGDEN

Attorney & Counselor at Law

Licensed Customs Broke

International Trade Consultant

1925 E. Belt Line Rd., Suite 516

Carrollton, Texas 75006

(972) 417–1916 (voice)

(775) 535-1548 (fax)

www.internationaltradeattorney.com

daniel.ogden@internationaltradeattorney.com

© Daniel Mark Ogden, 1993–2008. All Rights Reserved.

The United States Customs Service (part of the Bureau of Customs and Border

Protection) is charged by law to regulate the importation or entry of goods into the Customs

territory of the United States. U.S. Customs territory includes all 50 states, D.C., and Puerto

Rico. The two most important issues for importers to understand regarding the clearance of

imports through U.S. Customs are the entry process for imported goods, and the duty

determination process by which the amount of the import duty (or tariff) is determined.

Additionally, the relief available for importers in response to U.S. Customs actions and rulings is

also an important issue of which importers should be aware.

A. Entry Process

All goods which are imported into U.S. Customs territory must undergo a legal process

called entry in order to be clear Customs and legally be imported into the U.S. Entry of imported

goods into U.S. Customs territory does not legally occur until the import has arrived at the U.S.

port of entry, Customs has authorized the entry of the goods, and any estimated duties owed

on the goods have been paid. Imported goods are said to have cleared Customs when the

goods have been successfully undergone entry.

When imported goods physically arrive within U.S. Customs territory, entry documents

must be filed with U.S. Customs before Customs will release the goods. Once the goods arrive

and are presented for entry, and the goods are either examined by Customs or examination is

waived, Customs will release the goods upon either the filing of certain required entry

documents or the filing of an entry summary, provided that no legal violations pertaining to the

imported goods have occurred. If release is sought on the basis of the filing of the entry

documents only and not the entry summary (which includes a deposit of estimated duties), then

Customs will not release the goods unless a bond sufficient to cover any estimated duties has

been posted by the person making the entry. Note that even after the release of the imported

goods by Customs, however, Customs still has jurisdiction over the goods until the entry of the

goods has been liquidated by Customs.

1. Right to Make An Entry

Imported goods may only be entered by persons who have the legal authority to enter

such goods. There are three types of such persons.

a. Importer of record

The person who has documentary legal title to the goods when they physically arrive in

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 1

U.S. Customs territory. A person has documentary title when they are the person listed on the

bill of lading or the waybill as the consignee. This person could be the U.S. buyer (usually), the

U.S. buyer's agent, the foreign seller, or the foreign seller's agent. A foreign seller is classified

as the importer of record when title to the imported goods does not actually pass from the

foreign seller to a U.S. buyer until after the goods have already arrived within U.S. Customs

territory. In all instances, the importer of record is always liable for the payments of any duties

owed on the imported goods.

b. Ultimate Purchaser

The person who is the ultimate purchaser of the goods after they arrive within U.S.

Customs territory, even if such person is not the importer of record. Usually a person is the

ultimate purchaser but not the importer of record when that person imports goods through an

import agent whose name is listed on the bill of lading as the consignee.

c. Licensed Customs Brokers

Persons who are licensed by the U.S. Customs Service to serves as agents for

importers of record or purchasers by entering and clearing goods through U.S. Customs. While

customs brokers are not legally required to be used in order to enter goods through U.S.

Customs, nevertheless because of their specialized expertise it is desirable in most

circumstances to employ their use. If a customs broker is used to enter imported goods, the

importer must provide the broker with a power of attorney authorizing the broker to engage in

such activity.

2. Forms of Entry

There are several different forms of entry categorized by the intended purpose of the

entry, each having their own requirements.

a. Consumption Entry

The most common form of entry, consumption entries are used whenever imported

goods are to be “consumed” or used by the ultimate purchaser within U.S. Customs territory

b. Transportation Entry

This entry is used when imported goods are transported within the U.S. to another U.S.

port of entry where they will then undergo a consumption entry, or when imported goods are

transported through the U.S. from one country to another (e.g. Canada to Mexico). Although the

goods are physically within U.S. Customs territory, they are not legally entered into U.S.

Customs territory and therefore may not be “consumed” without undergoing a consumption

entry. The goods must be sealed in the transportation carrier by Customs and may not be

unsealed before undergoing a consumption entry.

c. Temporary Importation Under Bond Entry (TIB)

This form of entry is used when goods are imported temporarily into the U.S. under

bond. Only certain goods are eligible for this entry. TIB entries are valid for one year after which

the goods must undergo a consumption entry, be re-exported from U.S. Customs territory, or

be destroyed. A failure to perform one of the foregoing will result in forfeiture of the bond (which

generally is around twice the estimated dutiable value of the goods).

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 2

d. Warehouse Entry

This form of entry is used when goods are imported into a Customs approved bonded

warehouse. The goods may reside in the bonded warehouse for up to five years after which the

goods must undergo a consumption entry, be re-exported from U.S. Customs territory, or be

destroyed. If the goods physically leave the bonded warehouse before this five year period

expires, they must then undergo a consumption entry, a transportation entry, or be re-exported

from U.S. Customs territory.

e. Foreign Trade Zone Entry (FTZ)

This form of entry is used when goods are imported into a foreign trade zone. The

goods may reside in the FTZ indefinitely. If the goods leave the FTZ, however, they must

undergo a consumption entry, a transportation entry, a warehouse entry, or be re-exported from

U.S. Customs territory.

f. Drawback Entry

This form of entry is used when a duty drawback is claimed on goods that are imported

into U.S. Customs territory and then are re-exported from U.S. Customs territory. A drawback

entry must be filed within three years of the date of exportation.

g. Appraisement Entry

This form of entry is used for certain specialized categories of goods that are imported

into U.S. Customs territory.

h. Mail Entry

This form of entry is used when items such as parcels, letters, packages, boxes, or

similar articles are imported into U.S. Customs territory through U.S. mail. These entries may

either be formal or informal entries.

i. Informal Entry

This last form of entry has less stringent requirements than formal entries (which include

all of the above forms of entry). Imported goods may be entered informally when (1) they have

a dutiable value of less than $2500, (2) they are of a certain class of goods which are entitled to

entry free of duty, (3) they are certain other classes of goods, or (4) they are goods of U.S.

origin that were originally exported from U.S. Customs territory and are being re-imported back

into U.S. Customs territory solely for the purposes of repair or alteration prior to a re-

exportation.

3. Documents Required to be Filed For Entry

The process of entry requires that certain documents be filed with U.S. Customs. Some

of the most important of these documents include the following:

a. Evidence of Right to Make Entry

One of the two following documents must be filed with U.S. Customs evidencing that the

person making the entry has a legal right to make such an entry–

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 3

1) a bill of lading showing the importer of record as the consignee; or

2) a carrier's certificate that is used when the bill of lading is not used or available and

is a certification by the carrier that the person making the entry has documentary

title to the goods or is authorized by such person as an agent to make the entry.

This document must be filed with U.S. Customs within five days of date of arrival of the

imported goods into U.S. Customs territory.

b. Invoice

U.S. Customs uses invoices primarily to determine the duty to be assessed on the

imported goods. One of two types of invoices must be filed–

1) a commercial invoice, which has specific requirements as to certain

information which must be included such as the port of entry, the names and

addresses of seller and buyer, a detailed description of the imported goods,

the country of origin, the charges for the goods, the currency of sale, and

other pertinent information; or

2) a proforma invoice, which may be used only when a commercial invoice can

not be produced at time of entry. If a proforma invoice is filed, then a

commercial invoice must be filed not later than 120 days from the date of

entry.

This document must also be filed with U.S. Customs within five days of date of arrival of

the imported goods into U.S. Customs territory.

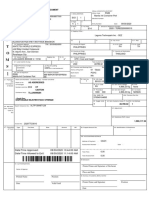

c. Entry Summary

This document, Customs Form 7501, must be filed within ten days of Customs' release

of the imported goods, along with a deposit of the estimated duties on the goods. Other

documents required to be filed at the same time as the entry summary are the entry package

returned by U.S. Customs to the person making the entry after Customs releases the goods,

and any other documentation necessary to prove that any Customs requirements have been

satisfied.

d. Immediate Delivery

In certain unique circumstances, the usual entry process may be circumvented by filing

Customs Form 3461, which is a Special Permit for Immediate Delivery. This document should

be filed prior to the arrival of the goods into U.S. Customs territory. If Customs approves the

filing, then the imported goods are released shortly after their arrival. Note, however, that the

entry summary along with a deposit of the estimated duties owed must still be filed within ten

days of release.

4. Entry Liquidation

Entries of imported goods into U.S. Customs territory are liquidated when Customs has

issued final approval of the entry documentation, the classification of the imported

merchandise, the duty rate on the imported merchandise and the amount of duty actually paid.

Quite often, liquidation occurs upon the filing of the entry summary and all required

documentation. Notice of liquidated entries is provided by the posting by Customs of a public

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 4

notice at the local Customs' office. If Customs does not approve of the filed entry summary,

however, due to such matters as an incorrect classification or an insufficient incorrect deposit of

duties, then the importer of record will receive a notice from Customs detailing the problem. If

this notice is not responded to by the importer, then the entry is liquidated and the importer

billed for any extra duty owed. Following the liquidation of an entry, if the importer of record is

dissatisfied with some aspect of the liquidation, the importer has ninety days to file a protest

with either the local Customs port director of the local Customs district director, or to request an

administrative ruling by Customs headquarters in Washington, D.C. Once the time for any

protest or administrative ruling request has expired, or if a timely filed protest or administrative

ruling request has been finally denied, liquidation is final. Customs must liquidate entries within

one year of the date of entry unless Customs extends the period, which can not be more than

four years from the entry date.

B. Duty Determination Process

All imported goods that are entered into U.S. Customs territory must undergo a process

of duty determination, even if ultimately no duty is imposed. Duty determination in all cases is a

two step process– the classification of the imported goods to determine the duty rate of the

goods, and the appraisement of the goods to determine their monetary value. Once the goods

are classified and appraised, then the duty that is owed by the importer is calculated by

multiplying the duty rate times the appraised value. While the importer has the obligation to

make the proper duty determination and disclose that determination in the entry summary, the

Customs Service has the final say as to the duty owed, unless the importer is able to reverse a

Customs' duty ruling through a protest.

1. Classification of Imported Goods

The process of classification of imported goods is used to determine the good's duty

rate. This duty rate is ascertained by classifying the goods as to their country of origin, and

then, based upon that country of origin classification as well as the essential character of the

goods, selecting the proper category under the Harmonized Tariff Schedules of the United

States (HTSUS).

a. General Country of Origin Rule

In most instances, an imported good's country of origin is that country in which the good

last underwent a “significant transformation” of the good's “essential character.” Nearly all

imported goods are required to be marked as to their country of origin. A failure to properly

mark such goods can lead to their seizure by Customs. Those goods that are exempt from

marking are specified in what is called the J List.

b. NAFTA Country of Origin Rules

There are special Rules of Origin to determine whether to not an imported good is

entitled to NAFTA treatment.

c. HTSUS

The Harmonized Tariff Schedule (HTS) is the result of an attempt to internationally

harmonize the tariff (or duty) structure and classification of imported goods. The HTSUS,

enacted in 1989, is the U.S. implementation of the HTS. All goods are classified in the HTSUS

by a eight digit number (for example, leather cross-country ski gloves are classified as

4203.21.55). Goods are generally classified by their essential character; however, certain

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 5

goods are classified by their use.

d. HTSUS Duty-Rate Categories

The HTSUS has two main duty-rate categories–

1) Most-Favored Nation (MFN) Status– is given to imports from countries who

have been granted MFN status pursuant to their membership in the GATT.

This rate is used for imports from most countries who are not communist or

otherwise embargoed. It is a greatly reduced rate from the statutory rate of

the Tariff Act of 1930 (the infamous Smoot-Hawley tariff).

2) Smoot-Hawley Tariff– the duty rate that, in essence, is the default rate if the

import is from a country that has not been granted MFN status or does not

otherwise qualify for any special duty-rate categories.

e. Special Duty-Rate Classifications

In addition to the above two categories, some imported goods receive special duty-rates

when they fall under one of the following categories. Note that country of origin rules vary from

category to category and therefore are very critical in determining whether an imported good is

eligible for a particular special duty-rate classification.

1) Generalized System of Preferences (GSP)–applies to imports from countries

who have been granted GSP status by UNCTAD and grants free duty on

imports from GSP countries except for certain specified goods.

2) Caribbean Basin Initiative (CBI)–applies to imports from countries who are

CBI members and grants free duty on imports from CBI members except for

certain specified goods.

3) U.S.-Israel Free Trade Area Agreement–applies to imports of Israeli origin.

4) NAFTA–applies to imports of Canadian and Mexican origin.

g. Special Duty Assessments

1) Antidumping duties– is an extra duty assessed after the U.S. determines that

a foreign-produced product is being “dumped” in the U.S. market.

2) Countervailing duties– is an extra duty assessed after the U.S. determines

that a foreign-produced product imported into the U.S. is being produced with

subsidies from the producer's government.

2. Appraisement of Imported Goods

The following methods are to be used, in descending order, to determine the value of

and imported good. Only if one method can not produce a value under that method is the next

method to be used.

a. Transaction value of actual imported goods

This method of valuation seeks to determine the actual price paid or payable for the

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 6

imported goods. If certain items such as importer packing costs or selling commissions or seller

assists or not reflected in the price shown on the commercial invoice, then such

items must be added to that price to determine transaction value.

b. Transaction value of similar goods

If the transaction value of the actual imported goods can not be determined, then the

proper valuation method is to determine the transaction value of goods similar to those actually

imported. Factors that are used in determining this value include the actual exportation date of

the goods and the quantity of the goods sold.

c. Deductive value

If the transaction value of the actual imported goods or goods similar to those actually

imported can not be determined, then the deductive value of the imported goods must be

determined unless the person making the entry has designated the computed value as the

preferred valuation method. Deductive value is the resale price in the U.S. of the imported

goods, minus certain deductions.

d. Computed value

The computed valuation method is used if valuation of the imported goods can not be

determined by either transaction valuation method or the deductive valuation method, or if the

person making the entry has elected to choose this method. Computed value consists of the

sum of the materials and processing costs of the imported goods, the general expenses and

profit on the goods, the value of any seller assists for the goods, and the packing costs of

goods.

C. Importer Relief

The failure by an importer to properly follow the above procedures for clearance of

imported goods by U.S. Customs can result in a denial of entry, seizure and/or forfeiture of the

imported goods, and other various penalties and fines. Additionally, an importer, while fully

complying with required Customs procedures, nevertheless may also be damaged by what it

considers to be an incorrect Custom ruling on such matters as classification, appraisement and

the like.

Fortunately, there are several different avenues of relief that are available to importers

who believe that they have been damaged by a Customs Service action or ruling or would like

to request a Customs ruling on a particular matter. It is important to note that each one of these

forms of relief is uniquely related to a particular kind of Customs ruling. Quite often these forms

of relief are confused with one another. Choosing an improper form of relief can result in an

importer being denied the opportunity to challenge a particular Customs ruling. Therefore, it is

vital that the proper type of relief be chosen in order for the party requesting the relief to

preserve its right to challenge a particular ruling.

1. Petitions for Relief

Petitions for Relief are used by importers to request relief when Customs has engaged

in a punitive action such as seizing imported goods or imposing a penalty against an importer.

Petitions for Relief must be filed with the District Director for the Customs District where the

seizure occurred or where the penalty was imposed within 30 days of the mailing of the notice

of the seizure or penalty to the importer.

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 7

2. Protests

Protests are used by an importer to protest Customs rulings regarding classification,

appraisement, exclusion, liquidation of duties and drawback refusals. Protests may be filed by

an importer, an importer's surety or any other party who has paid any duties on the particular

imported goods. Protests must be filed within 90 days following the issuance or notice of such

ruling with the District Director for the District in which the ruling is made or with the Port

Director if entry is made at a port other than the District headquarters port.

3. Administrative Rulings Requests

Requests for Administrative Rulings are used by importers to request that Customs

issue a ruling in regard to Customs laws and regulations as applied to a specific import

transaction over which Customs has jurisdiction. Administrative Rulings can be requested in

relation to specific prospective transactions, current transactions, or completed transactions.

Administrative Rulings Requests are filed either with the appropriate Customs office having

jurisdiction over the particular issue being raised, or with Customs headquarters in Washington.

4. Administrative Review

Administrative Review is used by an importer to request a review of Customs rulings

regarding reliquidations of duties, mistakes of fact or clerical errors. Requests for Administrative

Review must be filed with the District Director for the District in which the ruling was made

within one year of the issuance of the ruling.

5. Domestic Interested Party Petitions

Domestic Interested Party Petitions are used by importers as well as others such as

producers, manufacturers or associations to request a Customs ruling as to classification or

appraisement of certain types of imported goods. These Petitions must be submitted to the

Commissioner of Customs for review.

6. U.S. Court of International Trade

The U.S. Court of International Trade (CIT) has jurisdiction over all appeals of U.S.

Customs rulings and decisions that are eligible for review by law. In certain cases, a Customs

ruling or decision must first be appealed to the Secretary of the Treasury and then ruled upon

before the Court of International Trade will review it.

7. U.S. International Trade Commission

The U.S. International Trade Commission has jurisdiction over the final assessment of

antidumping and countervailing duties, and makes rulings on other unfair import trade

practices.

IMPORTER’S GUIDE TO U.S. CUSTOMS CLEARANCE OF IMPORTED GOODS– Page 8

You might also like

- USCustoms 1 TopostDocument31 pagesUSCustoms 1 Topostapi-522706No ratings yet

- DIB 02 - 202 International Trade and Finance - 02Document13 pagesDIB 02 - 202 International Trade and Finance - 02farhadcse30No ratings yet

- Shipping DocumentsDocument41 pagesShipping DocumentsEdward JohnNo ratings yet

- Import Procedure: Prof. C. K. SreedharanDocument68 pagesImport Procedure: Prof. C. K. Sreedharanamiit_pandey3503No ratings yet

- Import Export DocumentsDocument32 pagesImport Export DocumentsPriya Shah100% (1)

- How The Shipping Process Works Step by SDocument10 pagesHow The Shipping Process Works Step by SPablo Godoy OssesNo ratings yet

- Export ManagementDocument18 pagesExport Managementrash4ever2uNo ratings yet

- Document For ExportingDocument2 pagesDocument For ExportingLijofrancisNo ratings yet

- When Does Importation Begin?: Chloe Jane B. Macabalos CA-201 Assignment 3 - Border Control & SecurityDocument2 pagesWhen Does Importation Begin?: Chloe Jane B. Macabalos CA-201 Assignment 3 - Border Control & SecurityChloe Jane MacabalosNo ratings yet

- IB0013Document8 pagesIB0013ManishShersiaNo ratings yet

- The Quick and Dirty Guide To ImportingDocument18 pagesThe Quick and Dirty Guide To ImportingcharlesgooberNo ratings yet

- Sea Shipment StepsDocument65 pagesSea Shipment StepsF. M. Zahidul KarimNo ratings yet

- Common Export DocumentsDocument3 pagesCommon Export DocumentsSaihuNo ratings yet

- Ups Export ManualDocument25 pagesUps Export Manuals.srinivas36No ratings yet

- What Articles Are Subject To Duty?Document1 pageWhat Articles Are Subject To Duty?sapphdarecaNo ratings yet

- EXIM ProcedureDocument5 pagesEXIM ProcedureSandeep GoleNo ratings yet

- I) Trade InterrogationDocument5 pagesI) Trade InterrogationMd Hasibul Karim 1811766630No ratings yet

- Trade Terms and AbbreviationsDocument26 pagesTrade Terms and AbbreviationsJem EstradaNo ratings yet

- Export ProceduresDocument10 pagesExport ProceduresGenious GeniousNo ratings yet

- Topic 4 - Export Marketing 2Document10 pagesTopic 4 - Export Marketing 2arrowphoto10943438andrewNo ratings yet

- Procedure For Import and ExportDocument3 pagesProcedure For Import and ExportPooja GujarathiNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Goods Documents Required Customs Prescriptions RemarksDocument6 pagesGoods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- How To Manage Transport DocumentationDocument10 pagesHow To Manage Transport DocumentationRavikrishna NagarajanNo ratings yet

- Bill of LadingDocument6 pagesBill of LadingChris LahotiNo ratings yet

- E&I MNGT Presentation Pradnya 06Document24 pagesE&I MNGT Presentation Pradnya 06Vaishali KakadeNo ratings yet

- Step I: Answer-Various Steps Involved in Processing of An Export Order Are Discussed BelowDocument6 pagesStep I: Answer-Various Steps Involved in Processing of An Export Order Are Discussed BelowTusharr AhujaNo ratings yet

- Chapter 12 - Customs Act 1962Document6 pagesChapter 12 - Customs Act 1962Abhay Sharma100% (1)

- Infographic HSVDocument1 pageInfographic HSVANGIE DANIELA CORREA GOMEZNo ratings yet

- ADL 85 Export, Import Procedures & Documentation V2Document23 pagesADL 85 Export, Import Procedures & Documentation V2ajay_aju212000No ratings yet

- Transportation DocumentsDocument11 pagesTransportation Documentsdeepakarora201188No ratings yet

- Custom Clearance ProcessDocument16 pagesCustom Clearance ProcessZariq ShahNo ratings yet

- International Business Notes CompillationDocument38 pagesInternational Business Notes Compillationhigh deeNo ratings yet

- FX 2Document4 pagesFX 2Hanisha RaviNo ratings yet

- InfomercialDocument5 pagesInfomercialJao ObispoNo ratings yet

- FROM Chapter 98Document11 pagesFROM Chapter 98Gaby FernandezNo ratings yet

- Logistics For Baklava From Turkey To IndiaDocument7 pagesLogistics For Baklava From Turkey To IndiaMeghna SivakumarNo ratings yet

- Import ProcedureDocument6 pagesImport ProcedureAnand VermaNo ratings yet

- Export DocumentationDocument8 pagesExport Documentationtranlamtuyen1911No ratings yet

- E3 AnswersDocument12 pagesE3 Answersashish1981No ratings yet

- Law of Taxation AssignmnetDocument13 pagesLaw of Taxation Assignmnetsohan h m sohan h mNo ratings yet

- Exports - Glossary2Document2 pagesExports - Glossary2Ajay NandiwdekarNo ratings yet

- Documents Used in Foreign Trade TransactionsDocument5 pagesDocuments Used in Foreign Trade TransactionsANILN1988No ratings yet

- Trade InfosDocument4 pagesTrade InfosJao ObispoNo ratings yet

- INTERCHAP7Document4 pagesINTERCHAP7laureanoayraNo ratings yet

- Apr Manual V 3Document175 pagesApr Manual V 3rohit guptNo ratings yet

- (B.1) Are Importations Made by The Government Taxable?: PartnerDocument7 pages(B.1) Are Importations Made by The Government Taxable?: Partnerkath magsNo ratings yet

- Custom Clerarance: Area of Operations and AuthorityDocument4 pagesCustom Clerarance: Area of Operations and AuthorityRajeev VyasNo ratings yet

- Procedure and Steps Involved in Import of GoodsDocument13 pagesProcedure and Steps Involved in Import of GoodsDevNo ratings yet

- Documentation Related To ExportDocument5 pagesDocumentation Related To ExportLijofrancisNo ratings yet

- Export Import DocumentationDocument16 pagesExport Import Documentationprosen141No ratings yet

- Temporary Importation Under BondDocument5 pagesTemporary Importation Under BondMskagiri GiriNo ratings yet

- Mamta BhushanDocument26 pagesMamta BhushanDinesh HegdeNo ratings yet

- Session 2 Global Sourcing and TradeDocument34 pagesSession 2 Global Sourcing and TradeErnesto AndradeNo ratings yet

- Ba Core 6 Emodule 11Document4 pagesBa Core 6 Emodule 11Francheska LarozaNo ratings yet

- UntitledDocument5 pagesUntitledHIMANSHU PALNo ratings yet

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- Strategic Knowledge Management in Multinational Organizations 9781599046303Document428 pagesStrategic Knowledge Management in Multinational Organizations 9781599046303yacine ouchiaNo ratings yet

- Export Procedure & PracticeDocument18 pagesExport Procedure & Practiceyacine ouchiaNo ratings yet

- Supply Chain Management - Impact of Distributor Roi Towards Sales Enhancement in FMCG SectorDocument10 pagesSupply Chain Management - Impact of Distributor Roi Towards Sales Enhancement in FMCG Sectoryacine ouchiaNo ratings yet

- Sales Force and Channel ManagementDocument5 pagesSales Force and Channel Managementyacine ouchiaNo ratings yet

- Executive Guide: To Managing Global Brand Performance Throughout ChangeDocument2 pagesExecutive Guide: To Managing Global Brand Performance Throughout Changeyacine ouchiaNo ratings yet

- Stripe Tax Invoice WJYU6FTN-2022-01Document1 pageStripe Tax Invoice WJYU6FTN-2022-01Stagg Cory louisNo ratings yet

- Import and Warehouse ChargesDocument1 pageImport and Warehouse ChargesNatsu DeAcnologiaNo ratings yet

- GSTDocument195 pagesGSTNitesh VyasNo ratings yet

- RA - PrE 418 - EXERCISE IIDocument3 pagesRA - PrE 418 - EXERCISE IIEnnajieee QtNo ratings yet

- GSRTCDocument1 pageGSRTCSohum PatelNo ratings yet

- SAMDS012136Document1 pageSAMDS012136amitNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- Terumo - Tllu6099284 - EdDocument2 pagesTerumo - Tllu6099284 - EdmnmusorNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- Revision Notes Unit 1Document9 pagesRevision Notes Unit 1mamdhoohaNo ratings yet

- Notification 11 2021Document2 pagesNotification 11 2021sudhagar palaniNo ratings yet

- Islamabad Electric Supply Company: PM Relief For Covid 19 at Rs. 2631 DeferredDocument1 pageIslamabad Electric Supply Company: PM Relief For Covid 19 at Rs. 2631 Deferredadilshahzad2001No ratings yet

- Tax1-Cir Vs Campos RuedaDocument3 pagesTax1-Cir Vs Campos RuedaSuiNo ratings yet

- The Impact of GST On IndiaDocument8 pagesThe Impact of GST On Indiasahil khanNo ratings yet

- ME-SABIQ Manula EN31Document24 pagesME-SABIQ Manula EN31Manish AgrawalNo ratings yet

- Chartered Accountants Program Course FeesDocument2 pagesChartered Accountants Program Course FeesPeper12345No ratings yet

- CRN6623054990Document3 pagesCRN6623054990assgxNo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument4 pagesFiber Monthly Statement: This Month's Summaryavinash kumarNo ratings yet

- GETCO Public Notice - EnglishDocument1 pageGETCO Public Notice - EnglishVala VinodNo ratings yet

- Concept Map GlobalizationDocument1 pageConcept Map GlobalizationAlexis CastilloNo ratings yet

- Downloadbill?sinumber 03346017318&invoicenumber HT2319I001213204&lob FIXED LINE&billingAccountNumber 7041451704Document4 pagesDownloadbill?sinumber 03346017318&invoicenumber HT2319I001213204&lob FIXED LINE&billingAccountNumber 7041451704amit ghoshNo ratings yet

- Monthly Statement: This Month's SummaryDocument3 pagesMonthly Statement: This Month's SummaryabcdNo ratings yet

- Excel Invoice TemplateDocument2 pagesExcel Invoice TemplateGolamMostafa100% (1)

- Tally Prime Record BookDocument19 pagesTally Prime Record Bookmuneest19No ratings yet

- AirBnB April InvoiceDocument1 pageAirBnB April InvoiceMelanie SingletonNo ratings yet

- Invoice: Company's GST: 201115736M Company's ECC No: 0Document1 pageInvoice: Company's GST: 201115736M Company's ECC No: 0CP KrunalNo ratings yet

- Gexa Eco Choice 24Document2 pagesGexa Eco Choice 24fNo ratings yet

- PayslipDocument1 pagePayslipprathmeshNo ratings yet

- Airtel Bill DLF Capital PDFDocument4 pagesAirtel Bill DLF Capital PDFSonia SainiNo ratings yet

- INDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Tanjung Emas Export Processing Zone) PDFDocument2 pagesINDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Tanjung Emas Export Processing Zone) PDFGinnyNo ratings yet