Professional Documents

Culture Documents

Eligible Bank List: Pbank - Name Pbank - Name

Uploaded by

Muralidharan Krishnamoorthy0 ratings0% found this document useful (0 votes)

26 views1 pageisip banks

Original Title

ISIP Banks

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentisip banks

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views1 pageEligible Bank List: Pbank - Name Pbank - Name

Uploaded by

Muralidharan Krishnamoorthyisip banks

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

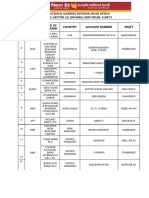

ELIGIBLE BANK LIST

S.No. PBANK_NAME S.No. PBANK_NAME

1 ICICI BANK LIMITED 14 INDIAN OVERSEAS BANK

2 IDBI BANK 15 INDUSIND BANK

3 HDFC BANK 16 JAMMU AND KASHMIR BANK LIMITED

4 AXIS BANK 17 KARNATAKA BANK LIMITED

5 BANDHAN BANK LIMITED 18 KARUR VYSYA BANK

6 BANK OF BARODA 19 KOTAK MAHINDRA BANK LIMITED

7 BANK OF MAHARASHTRA 20 PUNJAB NATIONAL BANK

8 CITY UNION BANK LIMITED 21 SARASWAT COOPERATIVE BANK LIMITED

9 CORPORATION BANK 22 SOUTH INDIAN BANK

10 FEDERAL BANK 23 STATE BANK OF INDIA

11 IDFC BANK LIMITED 24 UCO BANK

12 INDIAN BANK 25 UNION BANK OF INDIA

13 YES BANK 26 EQUITAS SMALL FINANCE BANK

FAQs

Q. Do I need to follow SIP necessarily or can I purchase units of a certain mutual fund as per my desire and

financial capacity. Why one should take the course of SIP and what are the benefits of following SIP?

It is not mandatory to do an SIP. You can also invest in different time periods as per your knowledge and

convenience. However, SIP provides the much needed Rupee Cost Averaging benefit which helps you make

disciplined investment instead of trying to time the market.

Q. What is URN and how to register it in bank account?

URN or Unique Registration Number is generated for every SIP. This would need to be entered during the biller

registration process in the bank account which is as follows:

- Login to your net banking account

- Click on Bills/Biller/Bills and Pay

- Register New biller

- Select business category as Mutual Funds

- Select the mutual fund AMC used for investment

- Enter the URN number received in your email and mobile number in the empty text box

- Tick "Auto Pay" option and enter an appropriate amount below which amount will be automatically debited

every month

- Enter your user id and transaction password, click on add to complete the process

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ABSLI Capped Nifty Index FundDocument1 pageABSLI Capped Nifty Index FundMuralidharan KrishnamoorthyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Demo Cursive Handwriting Practice Set 23159175Document1 pageDemo Cursive Handwriting Practice Set 23159175Muralidharan KrishnamoorthyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Cursive Handwriting FreebieDocument10 pagesCursive Handwriting FreebieMuralidharan KrishnamoorthyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grade 1 Maths Revision Ppt-19 FebDocument7 pagesGrade 1 Maths Revision Ppt-19 FebMuralidharan KrishnamoorthyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- 1671515247nit - Chenab Valley Power Projects (P) Limited (CVPPPL) - Tender Id Cvpppl22-23et1 - Electro-Mechanical (E&m) Works Package (Lot-III) of Kwar He Project 540 MW - Due Date 25.01.2023Document21 pages1671515247nit - Chenab Valley Power Projects (P) Limited (CVPPPL) - Tender Id Cvpppl22-23et1 - Electro-Mechanical (E&m) Works Package (Lot-III) of Kwar He Project 540 MW - Due Date 25.01.2023Muralidharan KrishnamoorthyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Pragati Millets Booklet 25.10Document136 pagesPragati Millets Booklet 25.10Muralidharan KrishnamoorthyNo ratings yet

- GTC On GeM 3.0 v1.12Document40 pagesGTC On GeM 3.0 v1.12govind tiwariNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Open Book Assessment - English Comprehension and Creative WritingDocument5 pagesOpen Book Assessment - English Comprehension and Creative WritingMuralidharan KrishnamoorthyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Joankaylor Com Thank You For Being A StudentDocument1 pageJoankaylor Com Thank You For Being A StudentMuralidharan KrishnamoorthyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hindu Baby Girl Names in Kerala PDF Hindu Baby Girl Names in Kerala PDFDocument3 pagesHindu Baby Girl Names in Kerala PDF Hindu Baby Girl Names in Kerala PDFMuralidharan KrishnamoorthyNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Ratnam-Ball Pens-2019-2Document2 pagesRatnam-Ball Pens-2019-2Muralidharan KrishnamoorthyNo ratings yet

- Giri Book Isbn List 08.12.17Document43 pagesGiri Book Isbn List 08.12.17Muralidharan KrishnamoorthyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Readers Digest Feb 2020 PDFDocument148 pagesReaders Digest Feb 2020 PDFMuralidharan KrishnamoorthyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Indian Hindu Baby Names GuideDocument113 pagesIndian Hindu Baby Names Guidevenkateshsj100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Uom Ug2017Document122 pagesUom Ug2017GOWTHAMNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Science&TechnologyDocument31 pagesScience&TechnologyMuralidharan KrishnamoorthyNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Muslim Male Names ListDocument6 pagesMuslim Male Names ListBilal KhanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Grade 1 EVS Answer Key Worksheet 1 - Chapter 2Document2 pagesGrade 1 EVS Answer Key Worksheet 1 - Chapter 2Muralidharan KrishnamoorthyNo ratings yet

- RTGS Mandate FormDocument1 pageRTGS Mandate Formsaravananji665No ratings yet

- Verb To Be - Verb To Be 3Document3 pagesVerb To Be - Verb To Be 3Muralidharan KrishnamoorthyNo ratings yet

- Install Component Guide - For Chrome, Mozilla PDFDocument10 pagesInstall Component Guide - For Chrome, Mozilla PDFMuralidharan KrishnamoorthyNo ratings yet

- Install Component Guide - For Chrome, Mozilla PDFDocument10 pagesInstall Component Guide - For Chrome, Mozilla PDFMuralidharan KrishnamoorthyNo ratings yet

- 4test: Free Valid Test Questions and Dumps PDF For Certification Test PrepDocument7 pages4test: Free Valid Test Questions and Dumps PDF For Certification Test PrepMuralidharan KrishnamoorthyNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Government Clarifies Preference for Posting Physically Handicapped Employees Near Native PlacesDocument3 pagesGovernment Clarifies Preference for Posting Physically Handicapped Employees Near Native PlacesMuralidharan KrishnamoorthyNo ratings yet

- Grade 1 EVS Worksheet 1 - Chapter 2Document2 pagesGrade 1 EVS Worksheet 1 - Chapter 2Muralidharan Krishnamoorthy100% (1)

- Prep4Sure: Real Exam & Prep4Sureexam Is For Well Preparation of It ExamDocument7 pagesPrep4Sure: Real Exam & Prep4Sureexam Is For Well Preparation of It ExamMuralidharan KrishnamoorthyNo ratings yet

- Grade 1 EVS Parts of a Plant ActivityDocument1 pageGrade 1 EVS Parts of a Plant ActivityMuralidharan KrishnamoorthyNo ratings yet

- Answer The Following Questions:: Class: I Worksheet 4 Name: Subject: EVS Chapter 3: Parts of A PlantDocument2 pagesAnswer The Following Questions:: Class: I Worksheet 4 Name: Subject: EVS Chapter 3: Parts of A PlantMuralidharan KrishnamoorthyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Thank You For Installing Bullzip PDF Printer: Like Us?Document2 pagesThank You For Installing Bullzip PDF Printer: Like Us?Muralidharan KrishnamoorthyNo ratings yet

- List of Banks in IndiaDocument3 pagesList of Banks in IndiaAtul krishna PatraNo ratings yet

- IPEM21 2020attendees PDFDocument39 pagesIPEM21 2020attendees PDFKadri UgandNo ratings yet

- List of RTGS BanksDocument1,787 pagesList of RTGS Banksapi-385197650% (2)

- BSR CodesDocument38 pagesBSR CodesnitinNo ratings yet

- Ssi PNBDocument3 pagesSsi PNBKumar KalyanNo ratings yet

- From 01-01-2020 To 12-03-2021Document31 pagesFrom 01-01-2020 To 12-03-2021parvesh kumarNo ratings yet

- KM23315567 StatementDocument9 pagesKM23315567 StatementPrashant RajNo ratings yet

- Banks Enabled For Customer Payment Through RTGSDocument5,262 pagesBanks Enabled For Customer Payment Through RTGSkenshai1No ratings yet

- List of BankDocument20 pagesList of BankFarzana SharminNo ratings yet

- Natwarlal & CompanyDocument17 pagesNatwarlal & Companysunil jadhavNo ratings yet

- 4375.201.125 Fy 22-23Document99 pages4375.201.125 Fy 22-23Star ColourparkNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Ine That We NeedDocument8 pagesThe Ine That We NeedTyrion LannisterNo ratings yet

- Civrev2 2019 Case TitlesDocument3 pagesCivrev2 2019 Case TitlesAnne VallaritNo ratings yet

- 1572000811776Document16 pages1572000811776Bhanu ViswanathNo ratings yet

- LSF 555 Enterprise 2 JLN Silat Goyang 16 BNDR Selesa Jaya 81300 Johor BahruDocument5 pagesLSF 555 Enterprise 2 JLN Silat Goyang 16 BNDR Selesa Jaya 81300 Johor Bahru小林No ratings yet

- Acct Statement - XX9665 - 17082022Document53 pagesAcct Statement - XX9665 - 17082022nosNo ratings yet

- Bhopal Circle and BranchesDocument117 pagesBhopal Circle and BranchesPranav BhargavNo ratings yet

- Extras de Cont - 20230716 - 142843Document6 pagesExtras de Cont - 20230716 - 142843aura popescu bucurNo ratings yet

- Hotels, Hospitals, Shopping and Services in Jamnagar CityDocument182 pagesHotels, Hospitals, Shopping and Services in Jamnagar CityKamlesh SanghaviNo ratings yet

- Sources of Obligation (Art 1157 - 1162)Document9 pagesSources of Obligation (Art 1157 - 1162)Mariz EreseNo ratings yet

- CANHoldingReport 10.01.19Document10 pagesCANHoldingReport 10.01.19anilNo ratings yet

- PDFDocument8 pagesPDFSriram BudampatiNo ratings yet

- Extensive Bin ListDocument64 pagesExtensive Bin ListMajor Minor60% (5)

- Acct Statement XX7000 13032023Document10 pagesAcct Statement XX7000 13032023v prakashNo ratings yet

- No VBVDocument2 pagesNo VBVJuan C Garzn89% (9)

- Invest Hedge September 2010 - Billion Dollar ClubDocument6 pagesInvest Hedge September 2010 - Billion Dollar ClubEden Rock Capital ManagementNo ratings yet

- Statement MAR2021 125323533 (1)Document9 pagesStatement MAR2021 125323533 (1)Bakibillah MollaNo ratings yet

- RBI Approved BankDocument1 pageRBI Approved BankVįňäý Ğøwđã VįñîNo ratings yet

- Card Confirmation PDFDocument1 pageCard Confirmation PDFCamili AlinNo ratings yet

- Banks HR ContactsDocument2 pagesBanks HR ContactsPrasang Singh Parihar100% (1)