Professional Documents

Culture Documents

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

Uploaded by

Mimi OlshopeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

Uploaded by

Mimi OlshopeCopyright:

Available Formats

Module 3

FACTORS WHICH CONTRIBUTE TO LOW QUALITY FINANCIAL REPORTS

Learning Objectives:

At the end of this chapter students shall be able to:

1. Know the factors that contribute to low quality reports.

2. Discuss the motivation behind a company manager’s action to issue low

quality financial reports.

3. Discuss the spectrum for assessing financial reporting quality.

The main motivation behind company manager’s action to issue low

quality reports includes: Hiding poor performance, such as loss of market share

or low profitability. This usually arises from:

a desire to meet or beat market expectations as reflected in analyses forecast

or management’s own forecasts which usually lead to an increase in stock price and

management compensation that linked to stock or earnings performance.

Concern over career and incentive compensation. For example, a manager

may be worried that a poorly performing company may limit his future career

opportunities or that he may not receive a bonus based on exceeding an earning

target.

Avoiding debt covenant violations. This can lead to manager’s inflating

earnings and this is particularly important for highly leverage and unprofitable

companies.

CONDITIONS CONDUCIVE TO ISSUING LOW QUALITY FINANCIAL REPORTS

OPPORTUNITY

This may be presented by conditions that are either internal or external to a

company. Internal conditions include poor internal control or an ineffective board of

directors.

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

External conditions include the accounting standards which provide scope for

divergent choices or minor consequences for making inappropriate choices.

MOTIVATION

This can result from a manager feeling pressured to meet certain criteria in order

for personal gratification such as receiving a bonus, or for corporate reasons,

such as concern about future financing.

RATIONALIZATION

When concerned about whether or not a choice is correct, an individual will

use rationalization as she needs to be able to justify the choice to herself.

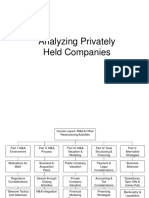

QUALITY SPECTRUM OF FINANCIAL REPORTING

FINANCIAL REPORTING QUALITY

High Low High

High financial reports

Earnings quality enable assessment High

Quality earning s quality

Low financial reporting

quality impedes increases company value

assessment of earnings

and impedes valuation

Low

High financial reporting quality

enables assessment Low

earnings quality

decreases company value

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

Quality of financial reports can vary. High quality financial reporting provides

information that is useful to analysts in assessing a company’s performance and

prospects. Low quality financial reporting contains inaccurate, misleading or

incomplete information

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

Activity 2

Discussion Questions :

1. What does low quality financial report means?

2. What are the factors that contribute to low quality reports?

3. What is the motivation behind company manager’s action to issue low quality

reports?

4. Give an example of misreporting a financial report.

RUBRIC FOR ACTIVITY 2

Excellent Good Satisfactory Need

9-10 points 7-8 points 5-6 points Improvement

0-4 points

Ideas Thoroughly Ideas Ideas Little or no

Explanatio explained explained somewhat explanation of ideas

n

ideas explained

Coherency Extremely Coherent Somewhat Lacks

coherent writing coherent coherency

Grammar Few errors Some Many Many errors

errors errors

that difficult to

understand

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

Resources:

http://www.ifrsbox.com

https://www.youtube.com/user/IFRSbox

URS-IM-AA-CI-0050 Rev 00 Effective Date: August 24, 2020

You might also like

- Making Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationFrom EverandMaking Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationRating: 3 out of 5 stars3/5 (2)

- R25 Financial Reporting Quality IFT NotesDocument20 pagesR25 Financial Reporting Quality IFT Notesmd mehmoodNo ratings yet

- Assignment 1Document4 pagesAssignment 1Stanford LibaNo ratings yet

- Perceived Benefits of Vat and Its Impact To The Corporate Taxpayers in The Lone District of BinanDocument10 pagesPerceived Benefits of Vat and Its Impact To The Corporate Taxpayers in The Lone District of BinanJohn Kayle BorjaNo ratings yet

- LM10 Financial Reporting Quality IFT NotesDocument16 pagesLM10 Financial Reporting Quality IFT NotesjagjitbhaimbbsNo ratings yet

- Application of Responsibility AccountingDocument28 pagesApplication of Responsibility AccountingMahfuzulNo ratings yet

- Accounting Ethics - NotesDocument41 pagesAccounting Ethics - NotesAlice FiedelersNo ratings yet

- Financial Statement Analysis and InterpretationDocument37 pagesFinancial Statement Analysis and InterpretationVikãsh MishrâNo ratings yet

- Risk Based AuditsDocument78 pagesRisk Based AuditsAlie Dys100% (1)

- Knowledge AAA p7Document15 pagesKnowledge AAA p7PfuhadNo ratings yet

- DocxDocument7 pagesDocxHeni OktaviantiNo ratings yet

- Audit Case StudyDocument3 pagesAudit Case StudyTaha AhmedNo ratings yet

- Fraud and ErrorDocument3 pagesFraud and ErrorLevi AckermannNo ratings yet

- A Consultative Approach To AuditingDocument24 pagesA Consultative Approach To AuditingWafaa Safaei TolamiNo ratings yet

- CHAPTER 5 Managing The Internal Audit FunctionDocument31 pagesCHAPTER 5 Managing The Internal Audit FunctionHanis ZahiraNo ratings yet

- Skip To Primary Navigation BuchiDocument11 pagesSkip To Primary Navigation Buchigetachewhabtamu361No ratings yet

- Audit Opinion HWDocument2 pagesAudit Opinion HWErnesto Sokolova KacianovNo ratings yet

- Planning An AuditDocument4 pagesPlanning An Auditkalpanashah.1961No ratings yet

- A Forensic Accountants Take On MaterialityDocument3 pagesA Forensic Accountants Take On MaterialityAbdifatah AbdilahiNo ratings yet

- MK7040 Marketing Strategy and CSR ReportDocument6 pagesMK7040 Marketing Strategy and CSR Reportpriyanka mangukiyaNo ratings yet

- F8 Audit and AssuranceDocument72 pagesF8 Audit and Assuranceramona_007grlNo ratings yet

- Discussion Questions - Conceptual Framework Semester 1 20202021Document3 pagesDiscussion Questions - Conceptual Framework Semester 1 20202021athirah jamaludinNo ratings yet

- Managing Fraud and Audit RiskDocument39 pagesManaging Fraud and Audit RiskLouiseNo ratings yet

- IIA, CobiT, and Professional Internal Audit Standards ExplainedDocument29 pagesIIA, CobiT, and Professional Internal Audit Standards Explainedlely2014100% (2)

- Module 2Document13 pagesModule 2Mimi OlshopeNo ratings yet

- Module 2Document13 pagesModule 2Mimi OlshopeNo ratings yet

- Mock ExamDocument4 pagesMock ExamSophie ChopraNo ratings yet

- Merger Acquisition Chapter 10Document26 pagesMerger Acquisition Chapter 10rayhanrabbiNo ratings yet

- May 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeDocument18 pagesMay 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeMahediNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument55 pagesAuditing and Assurance Services: Seventeenth Edition, Global EditionSin TungNo ratings yet

- Krisis Akuntansi Dan Membangun Kembali Kepercayaan PublikDocument32 pagesKrisis Akuntansi Dan Membangun Kembali Kepercayaan PublikMuhammad Muhammad Ichsan KamilNo ratings yet

- Management AuditDocument14 pagesManagement AuditManic TafilNo ratings yet

- Task 2Document12 pagesTask 2Erika EludoNo ratings yet

- Rajan Madaan - Resume - For CA Industrial TraineeDocument1 pageRajan Madaan - Resume - For CA Industrial TraineeSuprateek BoseNo ratings yet

- CPA in IndiaDocument44 pagesCPA in IndiaAnisha GogoiNo ratings yet

- Accepting An Audit AppointmentDocument24 pagesAccepting An Audit AppointmentXarmina GullNo ratings yet

- Compensation ManagementDocument3 pagesCompensation ManagementAdi Syuhaidi Abu Bakar0% (1)

- Ch3 Audit As Management Control System ToolDocument35 pagesCh3 Audit As Management Control System ToolCabdixakiim-Tiyari Cabdillaahi AadenNo ratings yet

- Cats 20112 Bowden 1Document16 pagesCats 20112 Bowden 1ShantamNo ratings yet

- Acc205 Fsa1Document48 pagesAcc205 Fsa1Abhijeet BhardwajNo ratings yet

- Chapter 7 NotesDocument7 pagesChapter 7 NotesSavy DhillonNo ratings yet

- Shahid SiddiqueDocument4 pagesShahid SiddiqueNafees TaimoorNo ratings yet

- Audit and Assurance Answers: Professional Level Examination JUNE 2016 Mock Exam 1Document20 pagesAudit and Assurance Answers: Professional Level Examination JUNE 2016 Mock Exam 1Madalitso MbeweNo ratings yet

- Exam TechniqueDocument6 pagesExam TechniqueJaskaran SinghNo ratings yet

- HRM Compensation Design for MNCsDocument5 pagesHRM Compensation Design for MNCsCH NAIRNo ratings yet

- Audit Reports: CPA Alfred LagatDocument41 pagesAudit Reports: CPA Alfred LagatRasheed ZedanNo ratings yet

- Week 4: Other Public Accounting Services and Reports ACCT 322Document24 pagesWeek 4: Other Public Accounting Services and Reports ACCT 322Dhruvi MaiyaniNo ratings yet

- Credit Risk Assessment ReportDocument9 pagesCredit Risk Assessment ReportAli RanaNo ratings yet

- P7 Audit and Assurance SummaryDocument31 pagesP7 Audit and Assurance SummaryJunaedur Rahman Jesun80% (5)

- TheBenefits of Effective Financial Operational BenchmarkingDocument25 pagesTheBenefits of Effective Financial Operational BenchmarkingsambaviNo ratings yet

- NYIF Williams Credit Risk Analysis IV 2018Document95 pagesNYIF Williams Credit Risk Analysis IV 2018jojozieNo ratings yet

- Auditing Industry Concentration RisksDocument3 pagesAuditing Industry Concentration RisksYun Jin100% (2)

- Company Specific Financial PerformanceDocument22 pagesCompany Specific Financial PerformanceJorge NANo ratings yet

- Honda (Pakistan) : Individual Report On Audit ProcessDocument11 pagesHonda (Pakistan) : Individual Report On Audit ProcesssadiaNo ratings yet

- Lecture 5Document34 pagesLecture 5Maham AhsanNo ratings yet

- Corporate FailuresDocument4 pagesCorporate FailuresaditiNo ratings yet

- Audit Committee Effectiveness Executive SummaryDocument4 pagesAudit Committee Effectiveness Executive Summarypresentasi1No ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument182 pagesF8 Workbook Questions & Solutions 1.1 PDFViembre Tr33% (3)

- Module 2Document13 pagesModule 2Mimi OlshopeNo ratings yet

- Consumer Rights and ResponsibilitiesDocument51 pagesConsumer Rights and ResponsibilitiesMimi OlshopeNo ratings yet

- Barangay Budget Preparation andDocument13 pagesBarangay Budget Preparation andMimi OlshopeNo ratings yet

- Module 2Document13 pagesModule 2Mimi OlshopeNo ratings yet

- Module 1-: Financial Analysis and Reporting Learning ModulesDocument11 pagesModule 1-: Financial Analysis and Reporting Learning ModulesMimi OlshopeNo ratings yet

- Salvador, Gem D. FM 2-5 Activity 1 and SAQDocument2 pagesSalvador, Gem D. FM 2-5 Activity 1 and SAQMimi OlshopeNo ratings yet

- Module 1-: Financial Analysis and Reporting Learning ModulesDocument11 pagesModule 1-: Financial Analysis and Reporting Learning ModulesMimi OlshopeNo ratings yet

- Module 1-: Financial Analysis and Reporting Learning ModulesDocument11 pagesModule 1-: Financial Analysis and Reporting Learning ModulesMimi OlshopeNo ratings yet

- Salvador, Gem D. Module 2 Activity & SAQDocument2 pagesSalvador, Gem D. Module 2 Activity & SAQMimi OlshopeNo ratings yet

- Salvador, Gem D. Assignment #2Document2 pagesSalvador, Gem D. Assignment #2Mimi OlshopeNo ratings yet

- Salvador, Gem D. Assignment #2Document2 pagesSalvador, Gem D. Assignment #2Mimi OlshopeNo ratings yet

- Salvador, Gem D. Assignment #1Document1 pageSalvador, Gem D. Assignment #1Mimi OlshopeNo ratings yet

- ACTIVITY 1 and 2 Salvador, Gem D.Document2 pagesACTIVITY 1 and 2 Salvador, Gem D.Mimi OlshopeNo ratings yet

- Salvador, Gem D. Assignment #2Document2 pagesSalvador, Gem D. Assignment #2Mimi OlshopeNo ratings yet

- Salvador, Gem D. Assignment #1Document1 pageSalvador, Gem D. Assignment #1Mimi OlshopeNo ratings yet

- Salvador, Gem D. FM 2-5 Activity 1 and SAQDocument2 pagesSalvador, Gem D. FM 2-5 Activity 1 and SAQMimi OlshopeNo ratings yet

- RizalDocument2 pagesRizalMimi OlshopeNo ratings yet

- 5 Basic Model of PorterDocument6 pages5 Basic Model of PorterJahanvi PandyaNo ratings yet

- C Programming JNTU PDFDocument171 pagesC Programming JNTU PDFfakeNo ratings yet

- 4 - ASR9K XR Intro Routing and RPL PDFDocument42 pages4 - ASR9K XR Intro Routing and RPL PDFhem777No ratings yet

- Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingDocument8 pagesSafety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingFerry Dela RochaNo ratings yet

- Order From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedDocument9 pagesOrder From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedBeau YarbroughNo ratings yet

- Internship ReportDocument171 pagesInternship ReportShahrukh MunirNo ratings yet

- Chapter 4 Earth WorkDocument39 pagesChapter 4 Earth WorkYitbarek BayieseNo ratings yet

- Nov 2018 Pathfinder SkillsDocument162 pagesNov 2018 Pathfinder SkillsWaidi AdebayoNo ratings yet

- Dialogic DSI Signaling Servers: SIU Mode User ManualDocument304 pagesDialogic DSI Signaling Servers: SIU Mode User ManualAdiansyah Rama67% (3)

- Carpenter Company MarketingDocument14 pagesCarpenter Company Marketingsladex17No ratings yet

- Truespace For DarkBASIC ProfessionalDocument13 pagesTruespace For DarkBASIC ProfessionalclaudefrancisNo ratings yet

- Standards in Nursing Education ProgrammeDocument13 pagesStandards in Nursing Education ProgrammeSupriya chhetryNo ratings yet

- Pangilinan, Zobel de Ayala, Sy Sr., Dangote, Rupert, Jameel - Power and influence of business leaders in Asia and AfricaDocument20 pagesPangilinan, Zobel de Ayala, Sy Sr., Dangote, Rupert, Jameel - Power and influence of business leaders in Asia and AfricaGwenNo ratings yet

- Lb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDocument2 pagesLb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDaniel Oliveira Freitas RochaNo ratings yet

- CIMA Introduction To NLPDocument4 pagesCIMA Introduction To NLPsambrefoNo ratings yet

- Application For Transmission of Shares / DebenturesDocument2 pagesApplication For Transmission of Shares / DebenturesCS VIJAY THAKURNo ratings yet

- PE6705 Water Flooding and Enhanced Oil Recovery L T P C 3 0 0 3 Objective: Unit I 9Document6 pagesPE6705 Water Flooding and Enhanced Oil Recovery L T P C 3 0 0 3 Objective: Unit I 9Prince ImmanuelNo ratings yet

- JohnsonJohnson 2006 PDFDocument84 pagesJohnsonJohnson 2006 PDFakfar b417No ratings yet

- ANGCOS - The Challenge and The Future For OrganizationsDocument28 pagesANGCOS - The Challenge and The Future For Organizationshoney beeNo ratings yet

- Metsec Purlin Technical ManualDocument88 pagesMetsec Purlin Technical ManualAnbalaganV100% (2)

- IsotopesDocument35 pagesIsotopesAddisu Amare Zena 18BML0104No ratings yet

- Moisture Control Guidance For Building Design, Construction and Maintenance (2013)Document144 pagesMoisture Control Guidance For Building Design, Construction and Maintenance (2013)Schreiber_Dieses100% (1)

- Challenging Cognitive Distortions HealthyPsych - ComDocument1 pageChallenging Cognitive Distortions HealthyPsych - ComLeila MargaridaNo ratings yet

- Sample Administrative Disicplinary CasesDocument13 pagesSample Administrative Disicplinary CasesWen DyNo ratings yet

- Segilola Gold ProjectDocument11 pagesSegilola Gold ProjectaishaNo ratings yet

- Juno Gi BrochureDocument2 pagesJuno Gi BrochureJerry VagilidadNo ratings yet

- Document - University Admission SystemDocument100 pagesDocument - University Admission SystemNaresh SharmaNo ratings yet

- The Difficult Patient' As Perceived by Family Physicians: Dov Steinmetz and Hava TabenkinDocument6 pagesThe Difficult Patient' As Perceived by Family Physicians: Dov Steinmetz and Hava TabenkinRomulo Vincent PerezNo ratings yet

- Maputo Port Approach Passage PlanDocument1 pageMaputo Port Approach Passage PlanRitesh ChandraNo ratings yet

- F404-15 Standard Consumer Safety Specification For High ChairsDocument19 pagesF404-15 Standard Consumer Safety Specification For High ChairsAhmed AlzubaidiNo ratings yet