Professional Documents

Culture Documents

SPJ Costing Case Study

SPJ Costing Case Study

Uploaded by

Shubham SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SPJ Costing Case Study

SPJ Costing Case Study

Uploaded by

Shubham SharmaCopyright:

Available Formats

SP JAIN | COST ACCOUNTING | Sept 2021 to December 2021 |

Case study

Copyrights: Dr. Milind Vinod FCA | CPA | MBA (Finance)| MFT | LLB (Gen)

milind_vinod@yahoo.co.in | 00971 50 80735 25 | 0091 882 893 9158

This comprehensive case study introduces you to some basic cost accounting

terminologies, calculations, explains range of costing principles and the fundamental

process of product costing. The idea of this case study is to introduce you to the

process of costing a product. We will build on these concepts in later chapters. (3-9)

In the end you are required to summarise the process and submit an essay which

will count towards your internal assessment.

A1 Garage and Service Centre

Background Information

A1 garage and service centre offers vehicles repairing and routine maintenance

services. The financial accountant produces monthly accounts, but the management

is not happy with the profitability of statements. The customers are billed at a

standardised rate which are at best based on the estimates provided by the

workshop manager for each job. Currently customers are billed @ 400% of the cost

of spare parts and materials. However, the manager feels that this is leading to some

jobs being over charged and some being undercharged. The management has hired

you as a professional cost accountant and has asked you to install a detailed job

costing system at its workshop. You have studied the operations of the garage and

the monthly financial statements and have made the following notes.

Operational information

The workshop has three divisions, namely Finishing division where Denting Painting

jobs are carried out, the Mechanical & Electrical where technical services are offered

and servicing. In addition, there is an administration department and a centralised

store. The broad roles of these departments and the workflow runs as under.

Administration department.

The broad role of this department is to receive vehicles, inspect them and open a job

card indicating the broad nature of the work. It comprises of an insurance surveyor

and accountant and a general manager. The accounts department values the

materials based on stores issue note and bills the customers. The general manager

is involved in procuring the business and for overall supervision of the workshop. 3

people work in this department and draw an average wage of 1200.

Stores Department

The stores department is fully responsible for procurements of all the spares and for

issuing them to the floor manager based on the requisition slips. The storekeeper is

also responsible for inventory and custody of tools and equipment’s used by the

other departments. Lone storekeeper manages the stores and is paid 600 per

month.

Denting Painting Department (Finishing division)

This department is responsible for external refurbishing and carrying out the denting

painting and related jobs. The main item consumed are paint, thinner which accounts

for almost 90% of the consumption value wise. The manpower is mostly unskilled.

There are 5 workers who are paid an average wage of 1500 per month and are

provided staff accommodation. They work for on an average 22 days a month 12

hours a day.

Mechanical and Electrical division

This division comprises of highly skilled technicians and the nature of each job varies

vastly from each other. 4 workers each drawing a wage of 2500 per month, man this

division and all are provided staff accommodation. The average days put in by each

of them are 22 and each day comprises of 12 hours

Servicing

This division sees a steady flow of walk-in customers who mainly opt for car

washing, routine Oil filter change services and comprises of 7 semi-skilled workers.

They draw on an average 1000 per month and are provided with accommodation

too. They put in 25 days a month and work for 15 hours a day.

Financial and other Quantitative information

The following information summarises the overall costs structure of the divisions.

1. All the workmen are insured comprehensively under the group insurance

policy which costs the workshop 12,000 per month.

2. Workshop rental amounts to 60,000, the staff accommodation costs 16,000,

general heating and lighting for workshop amounts to 2500 per month.

3. The stores mainly services the three production departments Finishing,

Technical and Servicing estimated at 20%, 30% and 50 % respectively.

4. The administrative department provides services to all the 3 production

departments and to stores in the ratio of 20% 20% 50% and 10% respectively.

5. The accountant has proposed three different bases for absorption of

overheads on to the jobs namely: % of materials costs for finishing division,

(expected value (M) 97000), number of labour hours (#1096) for the technical

division and number of vehicles (#1000) to be serviced for the servicing

division.

6. Depreciation is on heavy equipment and machinery installed in three sections

and is based on budgeted machine hours. Power consumption is closely

monitored as different rates are prescribed by the local electricity supplier.

7. Cost accountant is proposing a margin of 200% on the total cost of Job.

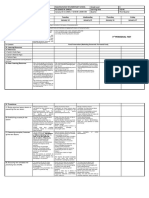

8. The following table summarises the other quantitative and financial

information for each of the 5 departments. (M): Monetary value (#) Units

Departments Finishing Technical Servicing Administrative Stores Total

Expenses

Depreciation (M) 4850 6025 3000 0 0 13875

Rent workshop (M) 60000

Rent 16000

accommodation(M

)

Electrical watt (#) 100 200 400 25 75 800

Unit rate @ (M) 2 2 3 1 1

Printing and

Stationery (M) 600 1200 1800

Administrative (M) 100 100 250 150 200 800

areas occupied (#) 900 1200 1500 300 600 4500

Cost Details Job# 53 Job# 84 Job# 3

Oil filter (M) 24

Spray paint (M) 543

Electrical parts (M) 257

Mechanical parts 753

(M)

Labour hours (#) 8 64 1

Electricity hours 7 25 1

(#)

Exercise (The problem will be solved in the classroom)

A: Produce invoices for jobs #53, #84, and #3, using Accountant’s approach.

B: Produce invoices for jobs #53, #84, and #3, using Cost Accountant’s approach.

Required: (Group assignment for the students)

Using the above data write a critical essay of around 500 words on the approaches

adopted by the two Accountants.

Assignment is due in week:

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Legal Resources - EFT (Electronic - Funds - Transfer) ExplainedDocument9 pagesLegal Resources - EFT (Electronic - Funds - Transfer) ExplainedBrad100% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Earnest Money Receipt and AgreementDocument4 pagesEarnest Money Receipt and Agreementmykel_aaron100% (1)

- UP Urban Planning & Development Act 1973Document43 pagesUP Urban Planning & Development Act 1973somraj100% (2)

- Shopping and Small Value Procurement Requirements Checklist PDFDocument1 pageShopping and Small Value Procurement Requirements Checklist PDFNorman FloresNo ratings yet

- INTRODUCTION TO INTERNATIONAL BUSINESS TRADE InbtDocument2 pagesINTRODUCTION TO INTERNATIONAL BUSINESS TRADE InbtMariaNo ratings yet

- Act121 - 1S 2Q - Set ADocument4 pagesAct121 - 1S 2Q - Set AElena Salvatierra ButiuNo ratings yet

- Fire Code Sec 6Document8 pagesFire Code Sec 6patitay036817No ratings yet

- Philippine Agriculture: Its Path To Modernization: Cristina C. DavidDocument25 pagesPhilippine Agriculture: Its Path To Modernization: Cristina C. DavidJulius CalimagNo ratings yet

- Panera BreadDocument3 pagesPanera BreadMisti Walker67% (3)

- TabelDocument13 pagesTabelDavid SzucsNo ratings yet

- Property OutlineDocument22 pagesProperty Outlinemarksy003No ratings yet

- 2009-04-09 130229 Case 12-4Document5 pages2009-04-09 130229 Case 12-4NadhilaNo ratings yet

- Shantigram Meadows Application FormDocument11 pagesShantigram Meadows Application Formbigdealsin14No ratings yet

- DLL HE Week 10Document4 pagesDLL HE Week 10Eunice GarciaNo ratings yet

- EOS IT Service MGT L5Document47 pagesEOS IT Service MGT L5Habtamu Hailemariam AsfawNo ratings yet

- Ev Standard AnalyticsDocument7 pagesEv Standard AnalyticsDavid ShapiroNo ratings yet

- ENT600 Blueprint FormatDocument20 pagesENT600 Blueprint FormatMujahid Addin100% (1)

- Market Research QuestionnaireDocument3 pagesMarket Research QuestionnaireTania cruzNo ratings yet

- 3 MKG Consumer BehaviorDocument33 pages3 MKG Consumer BehaviorIqra 2000No ratings yet

- G.R. No. 124715 - Lim v. Auto TruckDocument16 pagesG.R. No. 124715 - Lim v. Auto TruckKaren Gina Dupra100% (1)

- ACC349 Week 2 Individual Assignments - E2-9Document2 pagesACC349 Week 2 Individual Assignments - E2-9lovebooks92No ratings yet

- EX PARTE APPLICATION FEDERAL COURT NATIONSTAR MORTGAGE LLC (Billy Earley)Document25 pagesEX PARTE APPLICATION FEDERAL COURT NATIONSTAR MORTGAGE LLC (Billy Earley)Billy EarleyNo ratings yet

- Hollow Sections: European Delivery Programma 2010Document33 pagesHollow Sections: European Delivery Programma 2010Sorin LescaiNo ratings yet

- Economic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesDocument5 pagesEconomic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesAderaw GashayieNo ratings yet

- Sample Position PaperDocument1 pageSample Position PaperJem BobilesNo ratings yet

- OB - Atlas HondaDocument22 pagesOB - Atlas Hondaatique092828886% (7)

- Dark Roast JavaDocument59 pagesDark Roast Javajpauno201250% (2)

- Iso 9001 Interpretation (En) Part.4Document6 pagesIso 9001 Interpretation (En) Part.4jduràn_56No ratings yet

- KFC Feb13-19Document3 pagesKFC Feb13-19Ruby DianaNo ratings yet

- Automatic Creation of Transfer Orders For Outbound DeliveryDocument3 pagesAutomatic Creation of Transfer Orders For Outbound DeliveryKarunGaurNo ratings yet