Professional Documents

Culture Documents

Maruti Suzuki India LTD.: Balance Sheet (Standalone)

Uploaded by

Denish Vekariya0 ratings0% found this document useful (0 votes)

53 views5 pagesOriginal Title

Maruti Suzuki India Ltd

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views5 pagesMaruti Suzuki India LTD.: Balance Sheet (Standalone)

Uploaded by

Denish VekariyaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

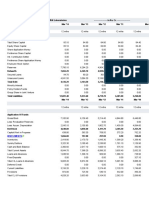

Maruti Suzuki India Ltd.

: Balance Sheet (Standalone)

Standalone Consolidated

(Rs. in Crore)

March ' 10 March ' 09 March ' 08 March ' 07 March ' 06

12 Months 12 Months 12 Months 12 Months 12 Months

SOURCES OF FUNDS

Owner's Fund

Equity Share Capital 144.50 144.50 144.50 144.50 144.50

Share Application Money 0.00 0.00 0.00 0.00 0.00

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves & Surplus 11,690.60 9,200.40 8,270.90 6,709.40 5,308.10

Loan Funds

Secured Loans 26.50 0.10 0.10 63.50 71.70

Unsecured Loans 794.90 698.80 900.10 567.30 0.00

Total 12,656.50 10,043.80 9,315.60 7,484.70 5,524.30

USES OF FUNDS

Fixed Assets

Gross Block 10,406.70 8,720.60 7,285.30 6,146.80 4,954.60

Less : Revaluation Reserve 0.00 0.00 0.00 0.00 0.00

Less : Accumulated Depreciation 5,382.00 4,649.80 3,988.80 3,487.10 3,259.40

Net Block 5,024.70 4,070.80 3,296.50 2,659.70 1,695.20

Capital Work-in-progress 387.60 861.30 736.30 238.90 92.00

Investments 7,176.60 3,173.30 5,180.70 3,409.20 2,051.20

Net Current Assets

Current Assets, Loans & Advances 3,856.00 5,570.00 3,190.50 3,956.00 3,870.70

Less : Current Liabilities & Provisions 3,788.40 3,631.60 3,088.40 2,779.10 2,184.80

Total Net Current Assets 67.60 1,938.40 102.10 1,176.90 1,685.90

Miscellaneous expenses not written 0.00 0.00 0.00 0.00 0.00

Total 12,656.50 10,043.80 9,315.60 7,484.70 5,524.30

Note :

Book Value of Unquoted Investments 11.10 3,162.20 5,169.60 3,398.10 2,040.10

Market Value of Quoted Investments 215.10 108.70 219.50 270.40 289.80

Contingent liabilities 3,657.20 1,901.70 2,734.20 2,094.60 1,289.70

Number of Equity shares outstanding (in Lacs) 2,889.10 2,889.10 2,889.10 2,889.10 2,889.10

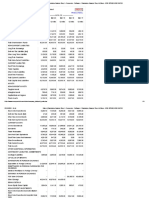

Maruti Suzuki India Ltd. : Income Statement (Standalone)

Standalone Consolidated

(Rs. in Crore)

March ' 10 March ' 09 March ' 08 March ' 07 March ' 06

12 Months 12 Months 12 Months 12 Months 12 Months

Income :

Operating Income 29,317.70 20,729.40 18,066.80 14,806.40 12,197.90

Expenses

Material Consumed 22,435.40 16,339.80 13,622.00 11,063.70 9,223.70

Manufacturing Expenses 1,278.20 909.70 670.60 489.80 359.60

Personnel Expenses 545.60 471.10 356.20 288.40 228.70

Selling Expenses 916.00 738.20 560.20 499.90 356.00

Adminstrative Expenses 404.60 389.20 326.30 274.50 170.60

Expenses Capitalised 0.00 -22.30 -19.80 -14.30 -6.70

Cost Of Sales 25,579.80 18,825.70 15,515.50 12,602.00 10,331.90

Operating Profit 3,737.90 1,903.70 2,551.30 2,204.40 1,866.00

Other Recurring Income 617.70 547.60 456.10 361.10 268.10

Adjusted PBDIT 4,355.60 2,451.30 3,007.40 2,565.50 2,134.10

Financial Expenses 33.50 51.00 59.60 37.60 20.40

Depreciation 825.00 706.50 568.20 271.40 285.40

Other Write offs 0.00 0.00 0.00 0.00 0.00

Adjusted PBT 3,497.10 1,693.80 2,379.60 2,256.50 1,828.30

Tax Charges 1,094.90 457.10 763.30 705.30 560.90

Adjusted PAT 2,402.20 1,236.70 1,616.30 1,551.20 1,267.40

Non Recurring Items 44.30 -55.90 37.90 -23.00 -83.70

Other Non Cash adjustments 51.10 37.90 76.60 33.40 5.40

Reported Net Profit 2,497.60 1,218.70 1,730.80 1,562.00 1,189.10

Earnigs Before Appropriation 10,501.80 8,244.40 7,368.10 5,947.10 4,631.20

Equity Dividend 173.30 101.10 144.50 130.00 101.10

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Dividend Tax 28.80 17.20 24.80 21.90 14.20

Retained Earnings 10,299.70 8,126.10 7,198.80 5,795.20 4,515.90

Maruti Suzuki India Ltd. : Ratio Analysis (Standalone)

Standalone Consolidated

March ' 10 March ' 09 March ' 08 March ' 07 March ' 06

12 Months 12 Months 12 Months 12 Months 12 Months

PER SHARE RATIOS

Adjusted E P S (Rs.) 83.15 42.81 55.94 53.69 43.87

Adjusted Cash EPS (Rs.) 111.70 67.26 75.61 63.09 53.75

Reported EPS (Rs.) 86.45 42.18 59.91 54.07 41.16

Reported Cash EPS (Rs.) 115.00 66.64 79.57 63.46 51.04

Dividend Per Share 6.00 3.50 5.00 4.50 3.50

Operating Profit Per Share (Rs.) 129.38 65.89 88.31 76.30 64.59

Book Value (Excl Rev Res) Per Share (Rs.) 409.52 323.35 291.19 237.16 188.67

Book Value (Incl Rev Res) Per Share (Rs.) 409.52 323.35 291.19 237.16 188.67

Net Operating Income Per Share (Rs.) 1,014.77 717.50 625.34 512.49 422.20

Free Reserves Per Share (Rs.) 403.82 318.45 286.28 231.89 183.18

PROFITABILITY RATIOS

Operating Margin (%) 12.74 9.18 14.12 14.88 15.29

Gross Profit Margin (%) 9.93 5.77 10.97 13.05 12.95

Net Profit Margin (%) 8.34 5.72 9.34 10.29 9.53

Adjusted Cash Margin (%) 10.78 9.13 11.79 12.01 12.45

Adjusted Return On Net Worth (%) 20.29 13.23 19.20 22.63 23.24

Reported Return On Net Worth (%) 21.10 13.04 20.56 22.78 21.80

Return On long Term Funds (%) 28.80 17.48 27.35 30.74 33.47

LEVERAGE RATIOS

Long Term Debt / Equity 0.03 0.06 0.05 0.08 0.01

Total Debt/Equity 0.06 0.07 0.10 0.09 0.01

Owners fund as % of total Source 93.51 93.04 90.33 91.57 98.70

Fixed Assets Turnover Ratio 2.82 2.38 2.48 2.41 2.46

LIQUIDITY RATIOS

Current Ratio 1.02 1.53 1.03 1.42 1.77

Current Ratio (Inc. ST Loans) 0.91 1.51 0.91 1.40 1.77

Quick Ratio 0.67 1.26 0.66 1.13 1.31

Inventory Turnover Ratio 30.47 30.46 22.93 28.76 18.78

PAYOUT RATIOS

Dividend payout Ratio (Net Profit) 8.09 9.70 9.78 9.72 9.69

Dividend payout Ratio (Cash Profit) 6.08 6.14 7.36 8.28 7.81

Earning Retention Ratio 91.59 90.44 89.53 90.21 90.91

Cash Earnings Retention Ratio 93.74 93.92 92.25 91.67 92.58

COVERAGE RATIOS

Adjusted Cash Flow Time Total Debt 0.25 0.35 0.41 0.34 0.04

Financial Charges Coverage Ratio 130.02 48.06 50.46 68.23 104.61

Fin. Charges Cov.Ratio (Post Tax) 100.18 38.75 39.57 49.76 73.28

COMPONENT RATIOS

Material Cost Component(% earnings) 77.21 77.10 77.25 73.36 77.25

Selling Cost Component 3.12 3.56 3.10 3.37 2.91

Exports as percent of Total Sales 15.49 7.24 4.10 3.90 4.78

Import Comp. in Raw Mat. Consumed 12.89 11.70 10.84 12.62 18.75

Long term assets / Total Assets 0.76 0.59 0.74 0.61 0.49

Bonus Component In Equity Capital (%) 0.00 0.00 0.00 0.00 0.00

Dividend Details

Year/Month Dividend (%)

2010/03 120

2009/03 70

2008/03 100

2007/03 90

2006/03 70

2005/03 40

2004/03 30

2003/03 30

2002/03 30

2001/03 0

2000/03 25

1999/03 30

1998/03 30

1997/03 20

1996/03 20

1995/03 15

1994/03 10

You might also like

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Maruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementDocument1 pageMaruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementPriyanka GodhaNo ratings yet

- Wipro Balance Sheet and Financial Statements from 2006-2010Document17 pagesWipro Balance Sheet and Financial Statements from 2006-2010Rekha RaoNo ratings yet

- Company Info - Print Financials 1Document2 pagesCompany Info - Print Financials 1Shown Shaji JosephNo ratings yet

- Balance Sheet of WiproDocument2 pagesBalance Sheet of WiproNabeelur RahmanNo ratings yet

- Maruti Suzuki Bal SheetDocument2 pagesMaruti Suzuki Bal SheetR N Shah0% (1)

- Case Study Mango - QuestionDocument7 pagesCase Study Mango - QuestionVi Phạm Thị HàNo ratings yet

- Maruti Suzuki India standalone balance sheetDocument2 pagesMaruti Suzuki India standalone balance sheetinvinciblesid8950% (2)

- Wipro Consolidated Balance SheetDocument2 pagesWipro Consolidated Balance SheetKarthik KarthikNo ratings yet

- Financial Statements of WiproDocument2 pagesFinancial Statements of WiproPraveen Reddy100% (1)

- Maruti Suzuki's Balance Sheet Shows Application of Key Accounting ConceptsDocument5 pagesMaruti Suzuki's Balance Sheet Shows Application of Key Accounting ConceptsAaditya PokhrelNo ratings yet

- Five Year Balance Sheet and Profit & Loss Data for CompanyDocument20 pagesFive Year Balance Sheet and Profit & Loss Data for Companytanuj_mohantyNo ratings yet

- FSA - Additional HandoutDocument6 pagesFSA - Additional HandoutApoorva SharmaNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsTarun GuptaNo ratings yet

- Ratio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079Document10 pagesRatio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079AbhignaNo ratings yet

- Wipro Standalone Balance SheetDocument2 pagesWipro Standalone Balance SheetSai SunilNo ratings yet

- Data Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesData Moneycontrol - Com - Company Info - Print FinancialsshreyasNo ratings yet

- Tata Motors LTD.: Total LiabilitiesDocument4 pagesTata Motors LTD.: Total LiabilitiesGOURAV SHRIVASTAVA Student, Jaipuria IndoreNo ratings yet

- Tata Steel FinancialsDocument11 pagesTata Steel FinancialsForam SukhadiaNo ratings yet

- Depreciation, Salary, and Tax Expenses for Farm and Solar EquipmentDocument7 pagesDepreciation, Salary, and Tax Expenses for Farm and Solar EquipmentJerica DacanayNo ratings yet

- Bharti Airtel BalsheetDocument2 pagesBharti Airtel BalsheetBrock LoganNo ratings yet

- Bharti Airtel: PrintDocument1 pageBharti Airtel: Printvivek singhNo ratings yet

- Bharti Airtel - Consolidated Balance Sheet Telecommunications - Service Consolidated Balance Sheet of Bharti Airtel - BSE: 532454, NSE: BHARTIARTLDocument2 pagesBharti Airtel - Consolidated Balance Sheet Telecommunications - Service Consolidated Balance Sheet of Bharti Airtel - BSE: 532454, NSE: BHARTIARTLrohansparten01No ratings yet

- Tech Mahindra and Wipro Balance Sheets ComparisonDocument3 pagesTech Mahindra and Wipro Balance Sheets ComparisonPRAVEEN KUMAR M 18MBR070No ratings yet

- Graphite India Ltd. Balance Sheet Summary: Non-Annualised Rs. Million 2012-2021Document4 pagesGraphite India Ltd. Balance Sheet Summary: Non-Annualised Rs. Million 2012-2021Foram SukhadiaNo ratings yet

- Profit & Loss - Maruti Suzuki India LTD.: PrintDocument5 pagesProfit & Loss - Maruti Suzuki India LTD.: PrintPushkar VermaNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsMehak MehrajNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Biocon Standalone Balance Sheet and Profit & Loss SummaryDocument5 pagesBiocon Standalone Balance Sheet and Profit & Loss SummarySweety RoyNo ratings yet

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocument5 pagesFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaNo ratings yet

- Bluestar PNLDocument6 pagesBluestar PNLg23033No ratings yet

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Table A1. JSW Steel Balance Sheet: Source: Dion Global Solutions LimitedDocument12 pagesTable A1. JSW Steel Balance Sheet: Source: Dion Global Solutions Limitedkarunakar vNo ratings yet

- Financial Accounting Company: Tata Consultancy Services LTDDocument13 pagesFinancial Accounting Company: Tata Consultancy Services LTDSanJana NahataNo ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- Balance Sheet of MsDocument2 pagesBalance Sheet of Mspraansuchaudhary713No ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintSamil MusthafaNo ratings yet

- Joneja CaseDocument9 pagesJoneja CaseAbhishek GuptaNo ratings yet

- Balance SheetDocument11 pagesBalance SheetPrachi VermaNo ratings yet

- Balance Sheet - WiproDocument3 pagesBalance Sheet - WiproHarshit AroraNo ratings yet

- BayerDocument2 pagesBayerABHAY KUMAR SINGHNo ratings yet

- Analysis of Financial StatementDocument1 pageAnalysis of Financial StatementvmsharathNo ratings yet

- Tech Mahindra P&L StatmentDocument6 pagesTech Mahindra P&L StatmentBharat RajputNo ratings yet

- Maruti Suzuki Financial Statment NewDocument4 pagesMaruti Suzuki Financial Statment NewMasoud Afzali100% (1)

- Profit and Loss WiproDocument2 pagesProfit and Loss WiproSai SunilNo ratings yet

- Company Info - Print Financials VIDocument2 pagesCompany Info - Print Financials VIMayank BhardwajNo ratings yet

- Infosys Sources of FinanceDocument6 pagesInfosys Sources of FinanceyargyalNo ratings yet

- HCL Technologies Consolidated Balance SheetDocument2 pagesHCL Technologies Consolidated Balance SheetSachin SinghNo ratings yet

- Account Managing .WIPRODocument4 pagesAccount Managing .WIPROshradddhaNo ratings yet

- ITC Business Group BackgroundDocument2 pagesITC Business Group BackgroundPani Bhushan RaodevalaNo ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintSoumya KhatuaNo ratings yet

- Loan Amotization (Bank)Document7 pagesLoan Amotization (Bank)ahmedazaz1011No ratings yet

- Evi13 104949Document2 pagesEvi13 104949Al QadriNo ratings yet

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFutkarsh varshneyNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Financial Planning ToolsDocument50 pagesFinancial Planning ToolsPhill SamonteNo ratings yet

- Akshat Ratio AnanlysisDocument8 pagesAkshat Ratio AnanlysisAshutosh GuptaNo ratings yet

- Fixed Assets and Intangible AssetsDocument73 pagesFixed Assets and Intangible AssetsLay TekchhayNo ratings yet

- Template - TAXN 2200 MIDTERM EXAM 2ND SEM 2020-2021 QUESTIONNAIREDocument17 pagesTemplate - TAXN 2200 MIDTERM EXAM 2ND SEM 2020-2021 QUESTIONNAIREHera AsuncionNo ratings yet

- Chapter 2 - Income TaxDocument30 pagesChapter 2 - Income TaxRochelle ChuaNo ratings yet

- Investment Avenues Available in BangladeshDocument16 pagesInvestment Avenues Available in BangladeshangelNo ratings yet

- Acca f9 Cbe PracticeDocument25 pagesAcca f9 Cbe PracticeSylvia NatashaNo ratings yet

- SBI Internet BankingDocument21 pagesSBI Internet BankingHiteshwar Singh Andotra60% (5)

- Boston Beer Company IPO ValuationDocument6 pagesBoston Beer Company IPO ValuationHridi RahmanNo ratings yet

- Contract of Bailment and PledgeDocument6 pagesContract of Bailment and PledgeAnayta SharmaNo ratings yet

- University of Adelaide Business School Year in Review 2010Document76 pagesUniversity of Adelaide Business School Year in Review 2010Faculty of the ProfessionsNo ratings yet

- Finan MGT DoneDocument22 pagesFinan MGT DonesnehitachatterjeeNo ratings yet

- CHAPTER 2 The IS LM ModelDocument73 pagesCHAPTER 2 The IS LM ModelDương ThùyNo ratings yet

- Global Model Risk ManagementDocument24 pagesGlobal Model Risk ManagementrichdevNo ratings yet

- SBI Project ReportDocument14 pagesSBI Project ReportNick IvanNo ratings yet

- MisDocument3 pagesMisDevanshi AroraNo ratings yet

- LomaDocument4 pagesLomaUshaNo ratings yet

- Role of Tech in Promoting Financial InclusionDocument66 pagesRole of Tech in Promoting Financial InclusionKheang VesalNo ratings yet

- Hire Purchase PDFDocument12 pagesHire Purchase PDFliamNo ratings yet

- Alert Company S Shareholders Equity Prior To Any of The Following PDFDocument1 pageAlert Company S Shareholders Equity Prior To Any of The Following PDFHassan JanNo ratings yet

- Contract of Loan Inter AffiliateDocument3 pagesContract of Loan Inter Affiliatealexandro_novora6396No ratings yet

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidNo ratings yet

- Venture CapitalDocument22 pagesVenture CapitalRiximNo ratings yet

- Cyprus Companies LawDocument298 pagesCyprus Companies LawNikhil MahajanNo ratings yet

- MERS Southeast Legal Seminar (11.10.04) FinalDocument26 pagesMERS Southeast Legal Seminar (11.10.04) FinalgregmanuelNo ratings yet

- Cash ManagementDocument3 pagesCash ManagementPoorna Chandra GaralapatiNo ratings yet

- PT BLUE BIRD TBK 2021 Financial ReportDocument111 pagesPT BLUE BIRD TBK 2021 Financial ReportMayyasya UlaNo ratings yet

- Short Intro To M&ADocument103 pagesShort Intro To M&AShivangi MaheshwariNo ratings yet

- PPFAS Mutual Fund SAI Key DetailsDocument138 pagesPPFAS Mutual Fund SAI Key DetailsRaghu RamanNo ratings yet

- Economics Edexcel A Level: Diagram Practice BookDocument9 pagesEconomics Edexcel A Level: Diagram Practice BookMd SafwatNo ratings yet