Professional Documents

Culture Documents

Bongbong Marcos' Tax Conviction Records

Uploaded by

Rappler100%(13)100% found this document useful (13 votes)

119K views17 pagesBongbong Marcos' tax conviction records

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBongbong Marcos' tax conviction records

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(13)100% found this document useful (13 votes)

119K views17 pagesBongbong Marcos' Tax Conviction Records

Uploaded by

RapplerBongbong Marcos' tax conviction records

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 17

® |

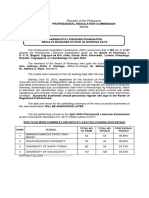

Republic of the Bkilippines =

Supreme Gouct

Manila

First Ditision

Gentlemen:

Quoted hereunder. for voir iiformation. isd resolution. of the First Division of

this Court dared

AUGUST 08, 2001

nG.it. No. 149434 (Ferdinand R. Marcos, JT -

aes people of the Philippines). - The Court Resolves

(a) WOrE and GRANT the manifestation

and urgent motion of petitioner te

withdraw the motion for extension of time

iia a, petition fer review on:

certiorari; and

(b) ors WITHOUT ACTION the said

motion for an extension ‘of thirty (30)

days from duly 4, 2001 within which to

file a petition for review on certiorari

fee sew of the withdrawal of the said

motion.”

Very truly yours,

Clerk of anit ANE 43 20

First Division | Cp h ( baler)

Court of Appeals ()

Manila

(CA-GR, CRNo, 18569)

The Solicitor General (x)

Makati City

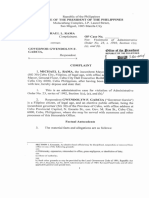

COURT OF APPEALS

Republic of the Philippines EN

oA <4 )

Manila \ (

SPECIAL THIRD DIVISION

THE PEOPLE OF THE CA-G.R. CR No. 18567

PHILIPPINES, ae .

Plaintiff—Appellee, Members:

PARAS, Chairma!

TAYAD-JAGUROS,

— versus — 4AGCADILI, Jd.

Promulgated:

ocr 34 199

| Rerdpnesa: ee

served as. Prova

beginning ‘oO

together

on October Si, 199% that the accused was allowed to

eet font woonee mene on Philippine ae but with

several warrants for his arrest awaiting him.

Pursuant the recommendation of her

Commissioner tnternal Revenue Jose ue Ong

(Commissioner? to. the Secretary feo waetice in a

dated duly 25, 4991, Marcos: dr. was charged

criminally with four” (4) counts eae ch of violation of

Sect ie AS and 50 of she NIRC : amended, for having

is neome tax returns,

taxable years

ding deficiency

oe sone €S, 711.00

for i985,

{Exhibit ©). His annual gross salaries were

as follows: R10, 757-17 (1982), 78,215.85

{1983), P64, 555- 00 (19B4)s #78,780.00

(1985). Per gnvestigation of the team, he

had an income tax deficiency: ineluding

increments, of p2oe.70 for i@a2 (Exh. DD.

Based on the provincial pPayrolis oF Tlecos

Morte (Exhs. 2 to 794) which were signed by

Paula Pastors then Liecos Norte Assistant

Treasurer and officer-in-Charge

9 1985 and submitted to the team by

Jas , Provincial Auditor oF Liocos

hi bas custody oF FP for ten

i acc received

1982 to

Pastor.

received

ca-G-R. CR No. 18569

Moe ee ke Sek OT

City, Perseveranda pimentels

(Senior Record

Information

Io

Siva

Revenue

and Lydia

administrative

Buezon

CA-GR. Cr No. 16569

pec tos 42.8%

dated August

ort

. pee

(Exh. T). Per gga sey Re

ga, agai oF cynth Gat ee EOP

no Markos

‘ Metro

ca-G.R.

D

6

(e!

made, she gave the passbo d oe

Morales. After the deposit wae 8 eafter

passbook was returned to hers heres oe.

she checked whether the deposit mee Ee tax

Based on the payrolls, there oe s

withheld for the ancome

accused from November ©

In the payrolis for }

neome was ie)

Informations in Criminal

and 2916 the amount stated was

ca-G-R. CR Mo, 18569

pre te tte Sh on

ed

Qn duly: 27, aes, Orne: Uther” comet Sense”

Decision, the dispositive Portion thereof stating?

"WHEREFORE, chy Court finds actusrt

Ferdinand Romualdez Marcos II guilty reac

reasonable doubt of the National hs ge 4

Revenue Code of 1977, as amended, a

sentences him as Fol

cA-G-R. GR N

chatahe WING: ieaeg

\

ei hae BOR ee \

notice to hi fi

im was n Pot

ot in derogation Oo

qrution-

and equal prote £ Co

tection clauses of the

nst

Tax colle

‘ chia >

ee ia, di ee of the government gnclude.

(Secti 302, NIRC aoe civil an criminal

eet Lmaiy : : RC, 1977).

. netant cases the BI

en y income taxes due From

his criminal prosecut ion

othe requisite income

a 1985-

ey

taxable y

a

CR NO: 18549

In case 3 Person fails to make and

a return or list at the time Prescribed by

law, oar

Makes, willfully or otherwise. a

false or fraudulent return or

file

: list, the

Commissioner of Internal Revenue shall make

return from his own knowledge and from

obtain through

Or otherwise. In any such case,

the Commissioner

the

such information as he can

ny

be primes

i :

legal

yey s i on

&

was forced by the circumstances. The STAT report,

1c the taxpayer and notices of assessment

epared by the team, were submitted to the

1991 (Exhibit 4). The income

@ prepared by authority of the

1 (Exhi 5 E—, G, I and

‘ to the

the

cR No. 18569 Au

oe eon

pee

from the appellant’s gross income for the years 1985

ta 4985 in the amounts of F5,548.42, F4,542.00 and

po, 416-275 respectively, 45 embodied in Paragraph 2 of

the Request For Stipulation dated April 4, 1794, which

was admitted by the trial court after noting the

comments and qualifications made by the prosecution in

their Comment dated April 14, 1994.

No deficiency assessment for the taxable years

1982 to i985 was made on the part of the government

against the appellant.

It bears emphasis that the duty to withhold taxes

from government employees: including elected officials

Like the provincial qovernor.s has been reposed by law

in the Government (Sections 70 (c)$ 94, NIRC of i977).

Consequently, any deficiency in the taxes sp withheld

is likewise attributable to and/or determinable by the

government and not by the employee concerned (Section

91 tf), 1977 NIRG).

The appellant had 4 right to rely on the

computation and assessment by the BIR for whatever

deficiency income taxes that may be due from him, aA5

after all, it is the government itself which deducts

from his gross income the taxes which he should pay:

over which he has no control. ;

Considering that the income of the appellant for

the years herein involved had already been subjected

to the withholding tax system, Section Si sa} of the

Tax Code, which provides that:

"(a) Payment of Tax-—

1. In general—- The total amount of

tax imposed by this Title shall be paid at

the time the return is filed.”

Sa eke to the case at bench, contrary to

SA tehe ee of the appellee that the tax liability

> ~appellant should have been paid by him at the

time” of fi1i :

Se ~ filing his returns. Deficiency assessment is

CERTIFIED TRUE COP

CA-G.RER/CV/SP inrta

AY\Y DATTA IA

* -REY

roa

(2)

°

Nt EVAN NN \ Ny TIN ONS

GR CR Ne. 18569

re cA. @ 2.0 n

exception to that general rule —.

ine.

-aforequoted Section Si (a) of the Tax Code ~

NIRC. Annotated, Hector 5S. de Leon, i979 Ed.)

The appellee loses sight of abe distinction

between the tae “pf

fe

ge

CR No. 18549

x 4 ge ion

¢

pis obligation. Furthermore, there could be

’ no att t

on his part, for his Failure to file the ae

necessary

income tax returns, to evade and defeat the tax as

has in fact paid his tax obligations For the —

years here-involved und the withholding

Tn one case recer ly

(Commissioner of 1

of Appeals, G.R No

appellant, thi

ry

th at. least a month for the Raret ieee at the

a ess to relay the Notices to axpayer and

‘eight days With respect to ee notices of

ss mt to the appellant, the latter had no ample

tunity to be apprised of and to pay his

taxes before he was held to answer

deficiency Taxes, the

h

he BIR.

ing the appellant to

Pay to the

income taxes due with i

BIk the

Aterest at t

he legaj

appellant to pay a fing

in Criminal Cases Nos. Q-92_

2-29217 for failure tO File

‘Bars 1982, 1983 and 1984;

of

iminal Case No. O-91-

: ta return for 1985,

fudgereatt Forn Se 1 7 \

{ \\ )\)

SS

. LER ie)

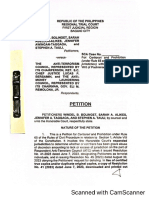

Republic of the Philippines

Manila

FIRSTDIVISION

versus G.R. No. 146434

SEOPLE OF THE PHILIPPINES,

Respondent.

€y

ENTRY OF JUDGMENT

This ts 10 certify that on August 08, 2001 a resolution rendered in the

above-entitled case was filed in this office, the dispositive part of which reads as

follows : ee

I

You might also like

- Civil Engineers Licensure Examination Results April 2024Document134 pagesCivil Engineers Licensure Examination Results April 2024Rappler100% (1)

- April 2023 Pharmacy ResultsDocument5 pagesApril 2023 Pharmacy ResultsRapplerNo ratings yet

- EXECUTIVE ORDER 57 Strengthening PH Maritime Security Amid China's BullyingDocument6 pagesEXECUTIVE ORDER 57 Strengthening PH Maritime Security Amid China's BullyingRapplerNo ratings yet

- April 2024 Real Estate Brokers Licensure Examination ResultsDocument27 pagesApril 2024 Real Estate Brokers Licensure Examination ResultsRapplerNo ratings yet

- April 2024 Electronics Engineers Licensure Examination Performance of SchoolsDocument15 pagesApril 2024 Electronics Engineers Licensure Examination Performance of SchoolsRappler0% (1)

- PHAR0424Document2 pagesPHAR0424Rappler0% (1)

- Roll of Successful Examinees in the REGISTERED ELECTRICAL ENGINEERS LICENSURE EXAMINATIONDocument102 pagesRoll of Successful Examinees in the REGISTERED ELECTRICAL ENGINEERS LICENSURE EXAMINATIONRappler75% (4)

- March 2024 Medical Technologists Licensure Examination ResultsDocument147 pagesMarch 2024 Medical Technologists Licensure Examination ResultsRapplerNo ratings yet

- February 2024 Licensure Examination For Criminologists ResultsDocument314 pagesFebruary 2024 Licensure Examination For Criminologists ResultsRappler70% (10)

- Me0224 Alpha Roll of Successful Examinees in The MECHANICAL ENGINEERS LICENSURE EXAMINATIONDocument92 pagesMe0224 Alpha Roll of Successful Examinees in The MECHANICAL ENGINEERS LICENSURE EXAMINATIONRapplerNo ratings yet

- Cebu Mayor Mike Rama Files Complaint Against Gov Garcia Over BRT StoppageDocument33 pagesCebu Mayor Mike Rama Files Complaint Against Gov Garcia Over BRT StoppageRapplerNo ratings yet

- Mechanical Engineers Licensure Examination Results Released in Three (3) Working DaysDocument3 pagesMechanical Engineers Licensure Examination Results Released in Three (3) Working DaysRapplerNo ratings yet

- Republic Act No. 11985Document12 pagesRepublic Act No. 11985Rappler0% (1)

- February 2024 Master Plumbers Licensure Examination ResultsDocument32 pagesFebruary 2024 Master Plumbers Licensure Examination ResultsRappler100% (1)

- PRC Nurse POSDocument19 pagesPRC Nurse POSRappler100% (1)

- February 2024 Mechanical Engineer Licensure Examination Performance of SchoolsDocument9 pagesFebruary 2024 Mechanical Engineer Licensure Examination Performance of SchoolsRapplerNo ratings yet

- January 2023 Licensure Examination For Architects Performance of SchoolsDocument4 pagesJanuary 2023 Licensure Examination For Architects Performance of SchoolsRapplerNo ratings yet

- January 2023 Licensure Examination For Architects Roll of Successful ExamineesDocument37 pagesJanuary 2023 Licensure Examination For Architects Roll of Successful ExamineesRappler100% (1)

- Ce1123 AlphaDocument124 pagesCe1123 AlphaTheSummitExpress100% (4)

- February 2024 Respiratory Therapists Licensure Examination Results Performance of SchoolsDocument2 pagesFebruary 2024 Respiratory Therapists Licensure Examination Results Performance of SchoolsRapplerNo ratings yet

- Resolution of Both Houses No. 6Document3 pagesResolution of Both Houses No. 6Rappler50% (2)

- PRC Nurse ALPHADocument516 pagesPRC Nurse ALPHARappler84% (19)

- December 2023 Chemists and Chemical Technicians Licensure Examinations ResultsDocument64 pagesDecember 2023 Chemists and Chemical Technicians Licensure Examinations ResultsRappler100% (2)

- Civil Engineers Licensure ExaminationDocument2 pagesCivil Engineers Licensure ExaminationRapplerNo ratings yet

- November 2023 Licensure Examination For Midwives Results POSDocument9 pagesNovember 2023 Licensure Examination For Midwives Results POSRappler100% (1)

- Roll of Successful Examinees in The Pharmacists Licensure ExaminationDocument60 pagesRoll of Successful Examinees in The Pharmacists Licensure ExaminationRappler100% (1)

- Phys1023 AlphaDocument82 pagesPhys1023 AlphaRappler67% (3)

- Petition FullDocument45 pagesPetition FullRapplerNo ratings yet

- November 2023 Licensure Examination For Midwives ResultsDocument56 pagesNovember 2023 Licensure Examination For Midwives ResultsRappler100% (1)

- November 2023 Pharmacists Licensure Examination Performance of SchoolsDocument5 pagesNovember 2023 Pharmacists Licensure Examination Performance of SchoolsRapplerNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)