Professional Documents

Culture Documents

Topic 1 Kế toán quốc tế

Uploaded by

Quỳnh Châu0 ratings0% found this document useful (0 votes)

19 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesTopic 1 Kế toán quốc tế

Uploaded by

Quỳnh ChâuCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

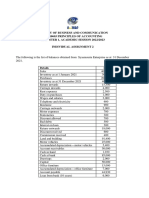

Choose the most correct

answer for each question

below, unless otherwise stated.

1. Which of the bodies listed below is responsible for revewing International Accounting

Standards and issuing guidance on their application?

A. IFRS Intepretation Committee

B. International Accounting Standards Board

C. IFRS Advisory Council

D. IFRS Foundation

2. Which of the following best describes the role of the IFRS Advisory Coucil?

A. To prepare intepretations of International Accounting Standards

B. To provide the IASB with the views of its members on standard setting projects

C. To promote the use of International Accounting Standards amongst its members

D. To select the members of the IASB

3. The conceptual framework for financial reporting lists the qualitative characteristics of

financial statements.

(i) Comparability (iv) Understandability

(ii) Verifiability (v) Relevance

(iii) Timeliness (vi) Faithful representation

Which two of the above are not included in the enhancing qualitative characteristics listed by

the conceptual framework?

A. (i) and (vii)

B. (ii) and (v)

C. (iv) and (v)

D. (v) and (vi)

4. Which of the following measurement base(s) should be used by an entity according to the

conceptual framework for financial reporting?

A. Historical cost

B. Current cost

C. Present value

D. Any of the above

5. Which of the following statements in relation to income is true?

A. Gains are normally reported separately from revenue in the Statement of profit or loss

and other comprehensive income due to the different probabilities attached to that type

of income.

B. The conceptual framework requires that all items of income are reported on a net

basis.

C. Gains and revenue are different in nature and therefore are recognised as separate

elements of the financial statements per the conceptual framework.

D. The conceptual framework defines income as an increase in economic benefits which

results in an increase in equity.

6. Which of the following statements is incorrect in relation to the recognition criteria for

elements of the financial statements?

A. Assets are recognised when it is probable that future economic benefits will flow to

the entity and the asset has a cost or value that can be measured reliably.

B. Because equity is the arithmetic difference between assets and liabilities, a separate

recognition criteria for equity is not needed in the conceptual framework.

C. Liabilities are recognised when it is probable that an outflow of resources embodying

economic benefits will result from the settlement of a present obligation and the

amount at which settlement will take place can be measured reliably.

D. Income is recognised when an increase in future economic benefits related to a

decrease in an asset or an increase in a liability that has arisen can be measured

reliably.

7. Comparability is identified as an enhancing qualitative characteristic in the

IASB's Conceptual Framework for Financial Reporting. Which of the following does NOT

improve

comparability?

A. Restating the financial statements of previous years when there has been a change of

accounting policy

B. Prohibiting changes of accounting policy unless required by an IFRS or to give more

relevant and reliable information

C. Applying an entity's current accounting policy to a transaction which an entity has not

engaged in before

D. Disclosing discontinued operations in financial statements

8. Which one of the following would be classified as a liability?

A. Dexter's business manufactures a product under licence. In 12 months' time the licence

expires and Dexter will have to pay $50,000 for it to be renewed.

B. Reckless purchased an investment 9 months ago for $120,000. The market for these

investments has now fallen and Reckless's investment is valued at $90,000

Bài 2:

C. Carter has estimated the tax charge on its profits for the year just ended as $165,000.

D. Expansion is planning to invest in new machinery and has been quoted a price of

$570,000.

9. Which of the following is a possible advantage of a rules-based system of financial

reporting?

A. It encourages the exercise of professional judgement

B. It prevents a fire-fighting approach to the formulation of standards

C. It offers accountants more protection in the event of litigation

D. It ensures that no standards conflict with each other

10. Faithful representation is a fundamental characteristic of useful information within the

IASB’s Conceptual framework for financial reporting. Which of the following accounting

treatments correctly applies the principle of faithful representation?

A. Reporting a transaction based on its legal status rather than its economic substance

B. Excluding a subsidiary from consolidation because its activities are not compatible

with those of the rest of the group

C. Recording the whole of the net proceeds from the issue of a loan note which is

potentially convertible to equity shares as debt (liability)

D. Allocating part of the sales proceeds of a motor vehicle to interest received even

though it was sold with 0% (interest free) finance

3. A client sued Lampeter to compensate for the consuming negative effects due to the poor product

quality. However, the lawyer said Lampeter has a 60% likelihood of winning the case.

The Conceptual Framework defines a liability as a present obligation of the entity to transfer an

economic resource as a result of past events.

The liability exists when three criteria must all be satisfied:

+ The entity has an obligation: legal obligation.

+ The obligation is to transfer an economic resource: If present obligation is accepted as existing, its

settlement will be transferred an economic resource (cash) by an entity, but the outcome of that

requirement is conditional on the action.

+ The obligation is a present obligation that exists as a result of past events: must have no practical

ability to avoid the future transfer due to the poor product quality and the act of being sued.

The liability recognition criteria is failed, relevant information as it is uncertain whether a liability

exists (40% possibility of occurrence). Therefore, the liability cannot be recognized. And so, lawsuit

need to disclose contingent liability in the financial statements.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tata Steel Financial Statement FY21Document109 pagesTata Steel Financial Statement FY21Surya SuryaNo ratings yet

- Key STQ-6 Valuation Fall 2021Document2 pagesKey STQ-6 Valuation Fall 2021Bilal AfzalNo ratings yet

- HelloDocument2 pagesHelloRyan CalicaNo ratings yet

- Exam On CH 11fswfwrfDocument5 pagesExam On CH 11fswfwrfkareem abozeedNo ratings yet

- Q - Shut Down ReplacementDocument1 pageQ - Shut Down ReplacementIrahq Yarte TorrejosNo ratings yet

- Ferrer vs. Commissioner of Internal RevenueDocument6 pagesFerrer vs. Commissioner of Internal RevenueClaudine Ann ManaloNo ratings yet

- "Azvirt" Limited Liability Company: 25. Construction RevenueDocument1 page"Azvirt" Limited Liability Company: 25. Construction RevenueŞeyxəli ŞəliyevNo ratings yet

- Contoh Review JurnalDocument14 pagesContoh Review JurnalariNo ratings yet

- Auditing and Accounting Mcqs PointDocument9 pagesAuditing and Accounting Mcqs PointMuhammad UsmanNo ratings yet

- Summarizing Buyer Behavior in Excel CleanDocument64 pagesSummarizing Buyer Behavior in Excel CleanK RajeshwaranNo ratings yet

- MODULE 3 Cost Control and QAQCDocument29 pagesMODULE 3 Cost Control and QAQCrandomstalkingwomenNo ratings yet

- Pre Board Class XII AccountancyDocument12 pagesPre Board Class XII AccountancyShubham100% (1)

- AP Preliminary Prospectus 04.19.17 - For Website - 2 PDFDocument557 pagesAP Preliminary Prospectus 04.19.17 - For Website - 2 PDF3 stacksNo ratings yet

- CF Chap002Document37 pagesCF Chap002Anissa Rianti NurinaNo ratings yet

- FINMAN TestBank1 PDFDocument9 pagesFINMAN TestBank1 PDFSteven consueloNo ratings yet

- Dwnload Full Financial and Managerial Accounting 4th Edition Wild Test Bank PDFDocument20 pagesDwnload Full Financial and Managerial Accounting 4th Edition Wild Test Bank PDFlanguor.shete0wkzrt100% (13)

- Chapter 8Document4 pagesChapter 8Coursehero PremiumNo ratings yet

- Update Date: 15/03/2023 Unit: Million Dong: Balance Sheet - GTA 2018 2019 2020 2021Document9 pagesUpdate Date: 15/03/2023 Unit: Million Dong: Balance Sheet - GTA 2018 2019 2020 2021The Meme ReaperNo ratings yet

- Langfield-Smith 7e IRM Ch12-2Document44 pagesLangfield-Smith 7e IRM Ch12-2Nguyễn Mạnh QuânNo ratings yet

- A) Explain Three Different Approaches To Calculate The GDP. Which Approach Should BeDocument2 pagesA) Explain Three Different Approaches To Calculate The GDP. Which Approach Should BeHaris KhanNo ratings yet

- SFM Exam Capsule Question Part Old Syllabus PDFDocument77 pagesSFM Exam Capsule Question Part Old Syllabus PDFKrishna AdhikariNo ratings yet

- FY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Document26 pagesFY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Nyasha MakoreNo ratings yet

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriesIL MareNo ratings yet

- 1902 - BirDocument2 pages1902 - BirLilian Laurel Cariquitan50% (2)

- Cost SheetDocument26 pagesCost SheetPankaj SahaniNo ratings yet

- Adjusting The Accounts: Accounting Principles, 8 EditionDocument44 pagesAdjusting The Accounts: Accounting Principles, 8 EditionSheikh Azizul IslamNo ratings yet

- Waterways Continuous ProblemDocument18 pagesWaterways Continuous ProblemAboi Boboi60% (5)

- Revenue Curves Under Perfect and Imperfect CompetitionDocument32 pagesRevenue Curves Under Perfect and Imperfect CompetitionEsha ChaudharyNo ratings yet

- Far 6 Accounting For Income TaxDocument3 pagesFar 6 Accounting For Income TaxanndyNo ratings yet

- Question IA 2 - Topic 4Document2 pagesQuestion IA 2 - Topic 4YAANESHWARAN A/L CHANDRAN STUDENTNo ratings yet