Professional Documents

Culture Documents

ACF 103 - Fundamentals of Finance Tutorial 9 - Questions

Uploaded by

Riri FahraniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACF 103 - Fundamentals of Finance Tutorial 9 - Questions

Uploaded by

Riri FahraniCopyright:

Available Formats

ACF 103 – Fundamentals of Finance

Tutorial 9 - Questions

Chapter 15

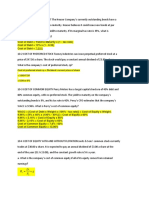

1. The capital structure of Golden Gate Windsurfing, Inc. (given in terms of both

book value and market value) is as follows:

BOOK VALUE MARKET VALUE

Bonds $15,000,000 $13,000,000

Preferred stock 2,000,000 2,500,000

Common stock equity9,000,000 18,500,000

Retained earnings 4,000,000

TOTALS $30,000,000 $34,000,000

In addition: 1) its bonds currently provide a yield to maturity of 10%;

preferred stock is yielding 9%; common stock is yielding 13%; 2) its marginal

tax rate is 40%; and 3) its capital structure is considered optimal. The firm's

weighted average cost of capital is closest to ________.

A. 11.6%

B. 11.2%

C. 10.0%

D. 9.2%

2. The beta coefficient for ZZZ, Inc. is 1.0. If the risk-free rate is 8% and the

required return on stocks in general is 16%, the required return for ZZZ is

closest to ________.

A. 10%

B. 11%

C. 12%

D. 16%

3. The required rate of return on the bonds of the EAP Corporation is 12%. The

firm's beta coefficient is 1.2, the risk-free rate is 8%, and the required rate of

return on stocks in general is 14%. If the firm's marginal tax rate is 40%, and it

will be financing projects with a 50-50 debt to equity mix, find its weighted

average cost of capital.

4. Bay City Enterprises is considering the purchase of equipment costing

$800,000, which promises to generate after-tax cash flows of $150,000

annually for the next 10 years. The firm has a weighted average cost of capital

of 12%. For this project, the financial manager plans to provide $200,000 from

a new bond issue and $300,000 from a new stock issue. The balance of the

financing would come from retaining earnings. The after-tax flotation costs on

the debt issue will be 3% of the amount raised, while the common stock issue

will carry flotation costs of 10%. Should the firm purchase the new piece of

equipment?

5. Text book Ch 15, problem # 1 (p.412). This problem is asking you to develop

the general algebraic formula for calculating the weighted average cost of

capital.

ACF 103 HAUT 2015 Tutorial 9 1

6. Text book Ch 15, problem # 2 (p.412)

Homework problem

7. Text book Ch 15, problem # 3 (p.412)

8. Text book Ch 15, problem # 4 (p.412) (Hint: The answer lies between 12%

and 14%)

ACF 103 HAUT 2015 Tutorial 9 2

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Air Ticket Booking - Book Flight Tickets - Cheap Air Fare - LTC Fare - IRCTC AIRDocument2 pagesAir Ticket Booking - Book Flight Tickets - Cheap Air Fare - LTC Fare - IRCTC AIRMohitSharmaNo ratings yet

- FM11 CH 09 Test BankDocument16 pagesFM11 CH 09 Test BankJohn Brian D. SorianoNo ratings yet

- Corporate Finance and Capital Markets ReviewDocument13 pagesCorporate Finance and Capital Markets ReviewFabio Streitemberger FabroNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalrosdicoNo ratings yet

- BFIN 3321 Final Exam - Louder BackDocument4 pagesBFIN 3321 Final Exam - Louder BackDenounce GovNo ratings yet

- Duoc Dien Duoc Lieu Dai Loan - 3rd - 2019Document639 pagesDuoc Dien Duoc Lieu Dai Loan - 3rd - 2019Hương Nguyễn100% (1)

- Awfpc 2022Document7 pagesAwfpc 2022Jay-p BayonaNo ratings yet

- International Financial Fin Man The FINAL WorksDocument5 pagesInternational Financial Fin Man The FINAL WorksCBM0% (1)

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Soft Course Material Iran 2007 PDFDocument646 pagesSoft Course Material Iran 2007 PDFLa Picarona del Peru100% (1)

- Cost of capital and financial statement questionsDocument34 pagesCost of capital and financial statement questionsJoel Christian MascariñaNo ratings yet

- Study Plan VMware VSphere 6.5Document11 pagesStudy Plan VMware VSphere 6.5Milan PatelNo ratings yet

- DPU30D-N06A1 & DBU20B-N12A1 Distributed Power System Quick Guide PDFDocument10 pagesDPU30D-N06A1 & DBU20B-N12A1 Distributed Power System Quick Guide PDFxolorocha100% (1)

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 9 - Solutions: I F M FDocument3 pagesACF 103 - Fundamentals of Finance Tutorial 9 - Solutions: I F M FRiri FahraniNo ratings yet

- Chapter 7 Risk and The Cost of Capital ReviewDocument6 pagesChapter 7 Risk and The Cost of Capital ReviewThuỷ TiênnNo ratings yet

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbaoNo ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- Cost of Capital CalculationsDocument7 pagesCost of Capital CalculationsUmair Shekhani100% (2)

- Ch9Cost of CapProbset 13ed - MastersDFDocument4 pagesCh9Cost of CapProbset 13ed - MastersDFJaneNo ratings yet

- Risk Analysis, Cost of Capital and Capital BudgetingDocument10 pagesRisk Analysis, Cost of Capital and Capital BudgetingJahid HasanNo ratings yet

- Answers Practice1Document7 pagesAnswers Practice1helal uddinNo ratings yet

- Financing Decisions - Practice Questions PDFDocument3 pagesFinancing Decisions - Practice Questions PDFAbrar0% (1)

- MBA Finance Practice QuestionsDocument3 pagesMBA Finance Practice QuestionsAbrarNo ratings yet

- FM11 CH 09 Test BankDocument15 pagesFM11 CH 09 Test BankFrances Ouano Ponce100% (1)

- Chapter 7 - Risk and The Cost of CapitalDocument3 pagesChapter 7 - Risk and The Cost of CapitalLưu Nguyễn Hà GiangNo ratings yet

- Chapter 7 - Risk and The Cost of CapitalDocument4 pagesChapter 7 - Risk and The Cost of Capital720i0180No ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- Assignment # 5 22 CH 10Document5 pagesAssignment # 5 22 CH 10Ibrahim AbdallahNo ratings yet

- Practicequestions Mt3a 625Document25 pagesPracticequestions Mt3a 625sonkhiemNo ratings yet

- Lahore School of Economics: Final Semester Exam May 2021Document6 pagesLahore School of Economics: Final Semester Exam May 2021Muhammad Ahmad AzizNo ratings yet

- Problem Solving 10Document6 pagesProblem Solving 10Ehab M. Abdel HadyNo ratings yet

- Weighted Average Cost of Capital and Company Valuation: Individual ExerciseDocument13 pagesWeighted Average Cost of Capital and Company Valuation: Individual ExerciseMarilou Olaguir SañoNo ratings yet

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- Practice Questions - Cost of Capital - 2Document11 pagesPractice Questions - Cost of Capital - 2arun babuNo ratings yet

- University of Tunis Tunis Business School: Corporate FinanceDocument3 pagesUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNo ratings yet

- TEST 5 PreparationDocument8 pagesTEST 5 PreparationAna GloriaNo ratings yet

- WineCellars Inc. weighted average cost of capital calculationDocument3 pagesWineCellars Inc. weighted average cost of capital calculationMeghna CmNo ratings yet

- LCI capital structure and project analysisDocument3 pagesLCI capital structure and project analysisLinh Ha Nguyen Khanh100% (1)

- True or False: Cost of Capital Components and WACC CalculationDocument3 pagesTrue or False: Cost of Capital Components and WACC CalculationASUS 14 A416No ratings yet

- WACC 2 qVRkBQB015Document3 pagesWACC 2 qVRkBQB015AravNo ratings yet

- Pilgan Lat UASDocument9 pagesPilgan Lat UASashilahila04No ratings yet

- FIN3004 Tutorial 2 QuestionsDocument2 pagesFIN3004 Tutorial 2 QuestionsLe HuyNo ratings yet

- Final Exam International Business TradeDocument1 pageFinal Exam International Business TradevionysusgoghNo ratings yet

- FinalDocument5 pagesFinalmehdiNo ratings yet

- Calculating Cost of Capital and WACC for Capital Budgeting DecisionsDocument6 pagesCalculating Cost of Capital and WACC for Capital Budgeting DecisionsThị Kim TrầnNo ratings yet

- Chapter 3 Notes Full CompleteDocument17 pagesChapter 3 Notes Full CompleteTakreem AliNo ratings yet

- CH 11 SolDocument9 pagesCH 11 SolCampbell YuNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- 9.1 Overview of The Cost of CapitalDocument21 pages9.1 Overview of The Cost of CapitalTawan VihokratanaNo ratings yet

- Meseleler 100Document9 pagesMeseleler 100Elgun ElgunNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- COST OF CAPITAL Tutorial QuestionsDocument2 pagesCOST OF CAPITAL Tutorial QuestionsBaraka GabrielNo ratings yet

- MAS 2023 Module 10 - Risk Leverage and Cost of CapitalDocument9 pagesMAS 2023 Module 10 - Risk Leverage and Cost of CapitalPurple KidNo ratings yet

- Upload 7Document4 pagesUpload 7Meghna CmNo ratings yet

- Principles of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalDocument5 pagesPrinciples of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalHamza AmmadNo ratings yet

- CH 14Document7 pagesCH 14AnsleyNo ratings yet

- RISK AND COST OF CAPITAL UpdateDocument3 pagesRISK AND COST OF CAPITAL UpdateNguyễn Trần Hoàng YếnNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- Introduction To Banking and Finance: Guy Hargreaves ACE-102Document25 pagesIntroduction To Banking and Finance: Guy Hargreaves ACE-102Riri FahraniNo ratings yet

- Risk and Return: Part IDocument48 pagesRisk and Return: Part IaleknaumoskiNo ratings yet

- Understanding Risk and Return ModelsDocument37 pagesUnderstanding Risk and Return ModelsNeha GargNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument50 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing Riskgonzgd90No ratings yet

- B100 6 Presentations1Document47 pagesB100 6 Presentations1Riri FahraniNo ratings yet

- B100 7 Presentations2Document72 pagesB100 7 Presentations2Riri FahraniNo ratings yet

- B100 6 Presentations1Document47 pagesB100 6 Presentations1Riri FahraniNo ratings yet

- B100 8 Presentations3Document85 pagesB100 8 Presentations3Riri FahraniNo ratings yet

- Chapter 1 Modul Manajemen KeuanganDocument18 pagesChapter 1 Modul Manajemen KeuanganwarsimaNo ratings yet

- B100 6 Presentations1Document47 pagesB100 6 Presentations1Riri FahraniNo ratings yet

- Field of Finance: An Overview Goal of The Firm Agency Problem Business Ethics Forms of Business Organization Globalization ComputerizationDocument16 pagesField of Finance: An Overview Goal of The Firm Agency Problem Business Ethics Forms of Business Organization Globalization ComputerizationShaina Santiago AlejoNo ratings yet

- B100 6 Presentations1Document47 pagesB100 6 Presentations1Riri FahraniNo ratings yet

- Class 1: Introduction, Basic Writing Skills & ReportsDocument64 pagesClass 1: Introduction, Basic Writing Skills & ReportsRiri FahraniNo ratings yet

- Understanding Wealth and Business: An Overview of Financial ManagementDocument32 pagesUnderstanding Wealth and Business: An Overview of Financial ManagementRaf BelzNo ratings yet

- Class 1: Introduction, Basic Writing Skills & ReportsDocument64 pagesClass 1: Introduction, Basic Writing Skills & ReportsRiri FahraniNo ratings yet

- Derivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsDocument13 pagesDerivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsRiri FahraniNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemDocument2 pagesACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemRiri FahraniNo ratings yet

- HAUT 2015 Springl ACE 102 IntroToBankingandFinance MIPDocument6 pagesHAUT 2015 Springl ACE 102 IntroToBankingandFinance MIPRiri FahraniNo ratings yet

- Bangor University Transfer Abroad Undergraduate Programme: Module Implementation PlanDocument6 pagesBangor University Transfer Abroad Undergraduate Programme: Module Implementation PlanRiri FahraniNo ratings yet

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- Im 18Document24 pagesIm 18Daood AbdullahNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemDocument2 pagesACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemRiri FahraniNo ratings yet

- CH 10 PPT Examples Relaxing Credit Standards QnssolnsDocument8 pagesCH 10 PPT Examples Relaxing Credit Standards QnssolnsRiri FahraniNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 10 - Questions: Homework ProblemDocument3 pagesACF 103 - Fundamentals of Finance Tutorial 10 - Questions: Homework ProblemRiri FahraniNo ratings yet

- ACF 103 Tutorial 6 Solns Updated 2015Document18 pagesACF 103 Tutorial 6 Solns Updated 2015Carolina SuNo ratings yet

- ACF 103 Fundamentals of Finance Chapter 16-17 SolutionsDocument9 pagesACF 103 Fundamentals of Finance Chapter 16-17 SolutionsRiri FahraniNo ratings yet

- Some Useful FormulaeDocument1 pageSome Useful FormulaeRiri FahraniNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemDocument2 pagesACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemRiri FahraniNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemDocument2 pagesACF 103 - Fundamentals of Finance Tutorial 8 - Questions: Homework ProblemRiri FahraniNo ratings yet

- A Study of Impact of FMCG Product Packaging On Consumer Behaviour With Reference To Food Items - IOPDocument37 pagesA Study of Impact of FMCG Product Packaging On Consumer Behaviour With Reference To Food Items - IOPvaibhav rajputNo ratings yet

- Male Hijab: Cover in RighteousnessDocument11 pagesMale Hijab: Cover in RighteousnessIbn SadiqNo ratings yet

- School Annual Data For Financial YearDocument3 pagesSchool Annual Data For Financial YearRamesh Singh100% (1)

- Har Rabia Bins Fax Tunisia 2018Document8 pagesHar Rabia Bins Fax Tunisia 2018vacomanoNo ratings yet

- Unit 1Document32 pagesUnit 1Viyat RupaparaNo ratings yet

- Electronics, Furniture, Clothing and Home Stores in KalkaDocument4 pagesElectronics, Furniture, Clothing and Home Stores in KalkaMANSA MARKETINGNo ratings yet

- PP 1Document33 pagesPP 1Vishnu IngleNo ratings yet

- Mercedes 220 AirmaticDocument7 pagesMercedes 220 AirmaticadinxNo ratings yet

- The Columbian Exchange ReadingDocument3 pagesThe Columbian Exchange Readingapi-286657372No ratings yet

- Sakha DictionaryDocument14 pagesSakha DictionarySojeong MinNo ratings yet

- The Teacher and Student Relationship of Haydn and BeethovenDocument10 pagesThe Teacher and Student Relationship of Haydn and BeethovenVinny MuscarellaNo ratings yet

- Selected Questions Revised 20200305 2HRDocument3 pagesSelected Questions Revised 20200305 2HRTimmy LeeNo ratings yet

- Calculating production costs and selling pricesDocument2 pagesCalculating production costs and selling pricesMitch BelmonteNo ratings yet

- Maths English Medium 7 To 10Document13 pagesMaths English Medium 7 To 10TNGTASELVASOLAINo ratings yet

- 2020 FMGT 1013 - Financial Management RevisedDocument9 pages2020 FMGT 1013 - Financial Management RevisedYANIII12345No ratings yet

- PTR 326 Theoretical Lecture 1Document14 pagesPTR 326 Theoretical Lecture 1muhammedariwanNo ratings yet

- MCAS Forces and Equilibrium PracticeDocument51 pagesMCAS Forces and Equilibrium PracticeSyd MalaxosNo ratings yet

- MVC PaperDocument14 pagesMVC PaperManal MkNo ratings yet

- PPF Pumps CatalogDocument112 pagesPPF Pumps Catalogesau hernandezNo ratings yet

- Nouveau Document TexteDocument6 pagesNouveau Document Texteamal mallouliNo ratings yet

- Does Dataset Complexity Matters For Model Explainers?: 1 Jos e Ribeiro 2 Ra Issa Silva 3 Lucas CardosoDocument9 pagesDoes Dataset Complexity Matters For Model Explainers?: 1 Jos e Ribeiro 2 Ra Issa Silva 3 Lucas CardosoJoão PauloNo ratings yet

- Next Best Action in An Omnichannel EnvironmentDocument40 pagesNext Best Action in An Omnichannel EnvironmentMadhu100% (2)

- Present Si̇mple or Present ContinuousDocument3 pagesPresent Si̇mple or Present ContinuousfercordobadelcastilloNo ratings yet

- Effect of land use change on property valuesDocument3 pagesEffect of land use change on property valueseesuola akinyemiNo ratings yet